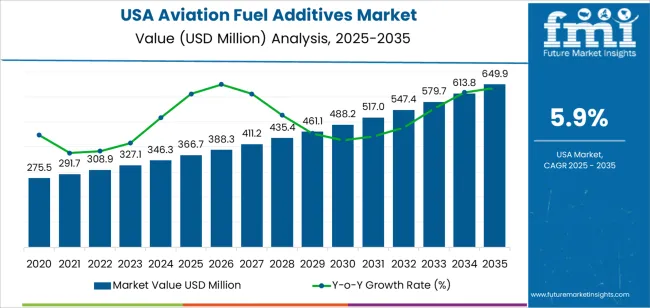

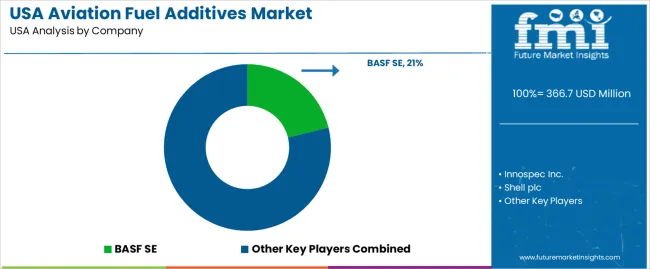

The demand for aviation fuel additives in the USA is expected to grow from USD 366.7 million in 2025 to USD 649.9 million by 2035, reflecting a compound annual growth rate (CAGR) of 5.9%. These additives are crucial in enhancing the performance and safety of aviation fuels, improving fuel efficiency, and preventing issues such as corrosion, ice formation, and microbial growth. As the aviation industry continues to recover and expand, the demand for aviation fuel additives is expected to rise in line with increased air travel and advancements in fuel technology, as well as stricter regulatory standards on fuel quality and performance.

The year-over-year (Y-o-Y) growth is steady, with the market starting at USD 366.7 million in 2025, increasing to USD 388.3 million in 2026, and continuing to grow consistently each year. By 2029, the demand for aviation fuel additives is expected to reach USD 461.1 million, and by 2035, it will reach USD 649.9 million. This growth reflects the ongoing investment in fuel technology, environmental regulations, and the push for more efficient, safer aviation practices across the industry.

The aviation fuel additives market in the USA is expected to continue its steady growth, with an increase from USD 366.7 million in 2025 to USD 388.3 million in 2026, representing a consistent rate of growth. By 2027, the market will grow to USD 411.2 million, and by 2028, it will reach USD 435.4 million. The rate of growth will remain stable through the first half of the forecast period, with a steady increase in demand each year. By 2035, the market is expected to reach USD 649.9 million, reflecting sustained growth driven by regulatory pressure and the growing need for high-performance additives in aviation fuel.

The market share erosion or gain analysis for aviation fuel additives reveals a steady growth pattern without significant erosion of market share from one segment to another. The consistent demand for these additives is supported by their essential role in maintaining fuel quality and performance standards. While there is no dramatic shift in market share, the continuous improvement in fuel additive technologies and regulatory compliance helps secure the market position of key suppliers. The industry is expected to maintain steady gains as technological advancements and environmental considerations push the demand for high-quality aviation fuel additives in the coming years.

| Metric | Value |

|---|---|

| Industry Sales Value (2025) | USD 366.7 million |

| Industry Forecast Value (2035) | USD 649.9 million |

| Industry Forecast CAGR (2025-2035) | 5.9% |

The demand for aviation fuel additives in the USA is rising as air travel and aircraft operations increase. Many airlines and operators require additives to maintain fuel stability, improve combustion efficiency, and protect fuel systems from corrosion or icing. Additives such as antioxidants, anti icing agents, corrosion inhibitors, dispersants, and metal deactivators help prevent engine deposits, manage cold weather effects, and ensure reliable performance under varying flight conditions. As commercial aviation expands, and military and private fleets remain substantial, the overall volume of jet fuel used in the country continues to rise. This growth in fuel consumption naturally boosts the need for additives that preserve fuel quality, support engine health, and safeguard safety.

In addition, stricter environmental standards and a shift toward lower emission or sustainable aviation fuels (SAF) contribute to growing demand for aviation fuel additives. New fuel formulations often require specialized additive packages to ensure compatibility, maintain fuel performance, and prevent issues like microbial growth or instability. The increasing complexity of modern jet engines and the need for fuel efficiency and emissions reduction strengthen the case for advanced additives. Additive suppliers are developing multifunctional products that address several fuel related issues in a single package. As airlines and fuel providers strive to meet regulatory requirements and environmental commitments while ensuring safety and performance, demand for aviation fuel additives in the USA is expected to continue its upward trajectory over the next decade.

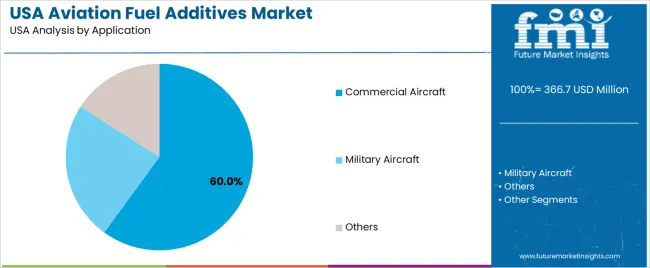

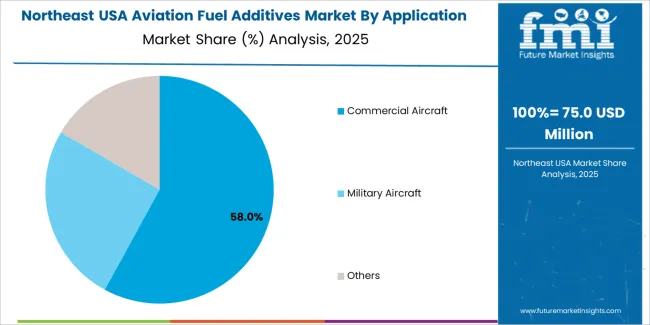

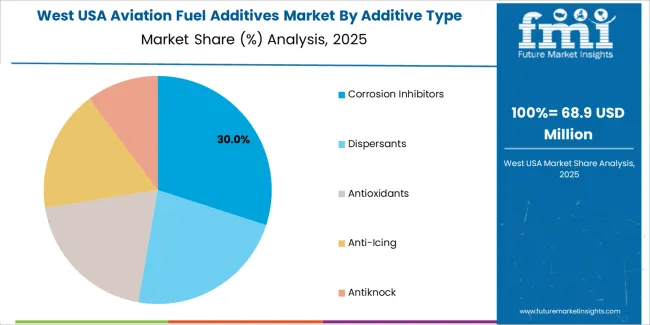

The demand for aviation fuel additives in the USA is driven by additive type and application. The leading additive type is corrosion inhibitors, which capture 30% of the market share, while commercial aircraft dominate the application segment, accounting for 60% of the demand. Aviation fuel additives are essential for enhancing the performance of aviation fuels by improving their stability, protecting engine components, and ensuring safety and efficiency in various flight conditions.

Corrosion inhibitors lead the demand for aviation fuel additives in the USA, holding 30% of the market share. These additives are critical for preventing corrosion in the fuel system of aircraft engines, especially in the presence of moisture, which can cause severe damage to metal components. Corrosion inhibitors work by forming a protective film on metal surfaces, reducing the risk of corrosion and extending the lifespan of fuel system components.

The demand for corrosion inhibitors is driven by the need to protect expensive and vital engine components from the damaging effects of rust and corrosion. Aircraft, particularly those flying in varying weather conditions, are exposed to moisture, which can lead to engine malfunctions if left unaddressed. Corrosion inhibitors ensure that the fuel remains effective over time, providing protection during long flights and reducing maintenance costs. With growing concerns about engine reliability and operational costs, the demand for corrosion inhibitors is expected to remain strong in the USA’s aviation sector.

Commercial aircraft lead the application demand for aviation fuel additives in the USA, capturing 60% of the market share. The commercial aviation sector requires high-performance fuels and additives to ensure the safe and efficient operation of aircraft over long distances. Aviation fuel additives play a key role in enhancing fuel stability, preventing engine issues, and improving fuel efficiency, all of which are essential in commercial aviation operations.

The demand from commercial aircraft is driven by the large volume of air traffic and the critical need for operational efficiency, safety, and performance. As the aviation industry continues to prioritize fuel economy and reduce the environmental impact of air travel, additives that improve fuel quality and engine performance remain in high demand. The widespread use of aviation fuel additives in commercial aircraft ensures continued market growth, with additives like anti-icing agents, antioxidants, and corrosion inhibitors playing vital roles in maintaining engine health and operational efficiency. As the global commercial air travel market expands, the demand for these additives will continue to rise.

The demand for aviation fuel additives in the USA has expanded in line with growth in air travel, larger commercial airline fleets, and increased use in military and private aviation. These additives are used to enhance fuel performance, protect engines, prevent fuel-system issues such as corrosion or icing, and ensure consistent combustion quality. As jet fuel consumption rises, reliance on additive treated fuel increases to maintain safety, reliability, and engine longevity. The growing variety of additive types - anti icing agents, corrosion inhibitors, antioxidants, dispersants, and metal deactivators - supports demand across jet fuel and aviation gasoline segments. The role of additives becomes more important as fuel specifications tighten and older aircraft and defense fleets continue operation. Overall, demand is rising steadily and is expected to grow further as USAge of fuel treated jet fuel increases across commercial, military and private aviation in the USA.

What are the Drivers of Demand for Aviation Fuel Additives in USA?

One key driver is increased air travel and expansion of commercial airline operations in the USA. As the number of flights and fleet size grow, larger volumes of jet fuel are consumed, raising the requirement for additives that ensure fuel stability, prevent deposits, and protect engine components. Another driver is the performance demands placed on modern jet engines, which require fuel that meets strict standards for combustion efficiency, clean burning, and minimal contamination; fuel additives help meet these standards. Additives also support safety and reliability by preventing problems such as fuel icing, corrosion of storage and fuel system components, and oxidative degradation over time. Military aviation demand also contributes because defense aircraft often operate under harsh conditions, requiring fuel formulations with robust additive packages to maintain reliability. In addition, growing interest in alternative aviation fuels, including biofuels or fuel blends, increases demand for specialized additives to ensure proper performance and compatibility with existing engines and fuel systems. These factors collectively reinforce demand for aviation fuel additives across multiple user segments in the USA.

What are the Restraints on Demand for Aviation Fuel Additives in USA?

Demand for aviation fuel additives is constrained by factors including volatility in crude oil and fuel prices. High oil prices can pressure airlines and operators to cut costs; in such cases they may limit USAge of non essential or premium additives to manage fuel expenses. Also, regulatory and environmental pressures on additive composition can restrict use of certain chemical additives if they pose environmental or health risks. The shift toward alternative fuels and fuel efficiency regulations may reduce dependence on some additive types, especially if new fuel formulations require fewer conventional additives. Costs associated with development and certification of additive packages suitable for newer or blended fuels may increase operational and compliance burdens. In addition, maintenance of fuel handling infrastructure and logistic complexity - especially for smaller operators or private aircraft - may limit adoption of additive treated fuel despite potential benefits. These restraints may limit growth of additive consumption even as overall fuel demand rises.

What are the Key Trends Influencing Demand for Aviation Fuel Additives in USA?

A prominent trend is growing adoption of advanced, multifunctional additive packages that combine anti icing, corrosion inhibition, deposit control, and fuel stability in a single treatment, allowing greater efficiency and simplified fuel management. Another trend is rising use of jet fuel blends or alternative aviation fuels, which often require specially tailored additive formulations to ensure compatibility and reliable performance; this drives demand for new additive chemistries. Demand for additives in military and defense aviation remains steady, especially where operations require fuel stability under extreme conditions. Increased focus on fuel system integrity, including measures against microbial contamination and metal induced deposits, supports demand for biocides and metal deactivators. Finally, as regulators and industry stakeholders emphasize fuel safety and quality standards, consistent use of additive treated jet fuel becomes more common across commercial airlines, cargo carriers, private jets and defense fleets - supporting long term demand growth.

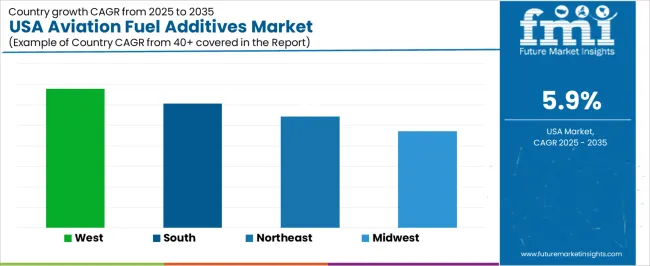

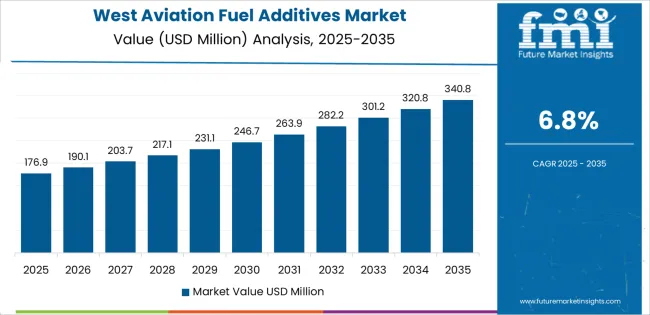

The demand for aviation fuel additives in the USA shows steady growth across regions, with the West leading at a CAGR of 6.8%. The South follows with a CAGR of 6.1%, driven by a strong aviation industry and the region’s major hubs for commercial and military aviation. The Northeast shows moderate growth at 5.4%, supported by its large airports and aerospace sectors. The Midwest has the lowest growth rate at 4.7%, reflecting a more stable demand for aviation fuel additives. These regional differences reflect varying levels of aviation activity, infrastructure, and demand for fuel performance optimization across the USA.

| Region | CAGR (%) |

|---|---|

| West | 6.8 |

| South | 6.1 |

| Northeast | 5.4 |

| Midwest | 4.7 |

The demand for aviation fuel additives in the West is projected to grow at a CAGR of 6.8%, driven by the region’s significant aviation industry. The West, particularly states like California, is home to major airports, commercial airlines, and military bases, all of which require high-quality fuel additives to enhance the performance and efficiency of aviation fuel. The increasing focus on fuel efficiency, engine performance, and environmental standards is pushing the demand for specialized additives. The region’s strong aerospace sector, combined with regulatory pressures aimed at reducing emissions and improving fuel efficiency, ensures that demand for aviation fuel additives remains robust. As the region continues to innovate in aviation technology, the need for fuel additives that optimize engine performance and meet environmental standards will drive further market growth.

In the South, the demand for aviation fuel additives is expected to grow at a CAGR of 6.1%, supported by the region’s strong aviation sector, including both commercial and military aviation. The South is home to major airports, aircraft manufacturers, and military bases, all of which rely on fuel additives to maintain optimal performance in aviation engines. The growing demand for air travel, coupled with efforts to improve fuel efficiency and reduce operating costs, is driving airlines and aviation operators in the region to use high-quality fuel additives. Additionally, the region’s military aviation sector, which requires specialized fuel additives to meet specific operational needs, contributes to the strong demand. As the South continues to be a key hub for aviation activity, demand for aviation fuel additives is expected to remain strong.

In the Northeast, the demand for aviation fuel additives is projected to grow at a CAGR of 5.4%, supported by the region’s large airports, aerospace industries, and significant volume of air traffic. The Northeast is home to some of the busiest airports in the USA, including New York’s JFK and Boston Logan, where fuel additives are essential to maintain the performance and safety of aircraft. Additionally, the region has a strong aerospace sector that is increasingly focused on optimizing fuel performance and meeting stringent environmental regulations. The demand for additives in this region is also influenced by the growing need for improved fuel efficiency and lower emissions in both commercial and private aviation. Although growth is somewhat slower than in other regions, the Northeast’s extensive aviation infrastructure ensures steady demand for aviation fuel additives.

The demand for aviation fuel additives in the Midwest is expected to grow at a CAGR of 4.7%, reflecting moderate and steady growth. The Midwest has a well-established aviation industry, but compared to regions like the West and South, it experiences slower growth due to a relatively smaller volume of air traffic and fewer aviation hubs. However, the region is home to a significant number of smaller airports and private aviation operators who require fuel additives for optimal engine performance, particularly in terms of efficiency and reliability. As airlines and operators in the region seek to improve fuel economy and meet environmental standards, demand for aviation fuel additives is expected to grow, albeit at a slower pace compared to more aviation-dense regions. Nonetheless, the Midwest’s steady demand for fuel additives will continue as part of the broader efforts to optimize aviation fuel performance.

Demand for aviation fuel additives in the United States remains strong as airlines, cargo operators, and private aviation firms seek to ensure fuel stability, engine performance, and compliance with rigorous safety and environmental standards. Key suppliers in this market include BASF SE (holding approximately 21.2% share), Innospec Inc., Shell plc, and Chevron Oronite Company LLC. These companies supply additive packages that enhance fuel lubricity, prevent microbial growth in fuel tanks, maintain fuel stability during storage, and protect engines from corrosion and deposits under a variety of operating conditions.

Competition in this industry centers on additive performance, certification compliance, and supply chain reliability. Suppliers prioritize formulations that meet standards set by aviation authorities for jet and aviation turbine fuels. Another important factor is the ability to provide additives that function across a broad range of climates-from extreme cold at high-altitude airports to humid, high-temperature conditions in hangars or fuel storage areas. Firms that support batch control, traceability, and robust quality assurance tend to be preferred by fuel suppliers and aircraft operators. Marketing materials often emphasize additive effectiveness, compatibility with different fuel types, regulatory certification status, and long-term stability. By aligning their products with the operational and regulatory needs of USA aviation stakeholders, these companies aim to maintain or expand their presence in the aviation fuel additives market.

| Items | Details |

|---|---|

| Quantitative Units | USD Million |

| Regions Covered | USA |

| Additive Type | Corrosion Inhibitors, Dispersants, Antioxidants, Anti-Icing, Antiknock |

| Application | Commercial Aircraft, Military Aircraft, Others |

| Key Companies Profiled | BASF SE, Innospec Inc., Shell plc, Chevron Oronite Company LLC |

| Additional Attributes | The market analysis includes dollar sales by additive type, application, and company categories. It also covers regional demand trends in the USA, driven by the increasing adoption of aviation fuel additives in both commercial and military aircraft. The competitive landscape highlights key manufacturers focusing on innovations in fuel additives to enhance engine performance, reduce emissions, and improve fuel efficiency. Trends in the growing demand for high-performance and environmentally friendly aviation fuel additives are explored, along with advancements in additive formulations for improved aircraft safety and operational efficiency. |

The demand for aviation fuel additives in USA is estimated to be valued at USD 366.7 million in 2025.

The market size for the aviation fuel additives in USA is projected to reach USD 649.9 million by 2035.

The demand for aviation fuel additives in USA is expected to grow at a 5.9% CAGR between 2025 and 2035.

The key product types in aviation fuel additives in USA are corrosion inhibitors, dispersants, antioxidants, anti-icing and antiknock.

In terms of application, commercial aircraft segment is expected to command 60.0% share in the aviation fuel additives in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Aviation Fuel Additives Market Growth 2025 to 2035

Fuel Additives Market Segmentation based on Type, Application, and Region: Forecast for 2025 and 2035

Aviation Biofuel Market

USA Aqua Feed Additives Market Trends – Growth, Demand & Forecast 2025–2035

United States Animal Feed Additives Market Report – Trends, Growth & Forecast 2025–2035

Marine Fuel Additives Market

Refinery fuel additives Market Size and Share Forecast Outlook 2025 to 2035

Specialty Fuel Additives Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Aviation Fuels Market

Sustainable Aviation Fuel Market Growth – Trends & Forecast 2025 to 2035

Demand for Gas & Dual-Fuel Injection Systems in USA Size and Share Forecast Outlook 2025 to 2035

Fuel rail for CNG Systems Market Size and Share Forecast Outlook 2025 to 2035

Fuel Storage Tank Market Size and Share Forecast Outlook 2025 to 2035

Fuel Capacitance Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Aviation Life Rafts Market Size and Share Forecast Outlook 2025 to 2035

Fuel Gas Heater Market Size and Share Forecast Outlook 2025 to 2035

Aviation Power Supply Market Size and Share Forecast Outlook 2025 to 2035

USA Medical Coding Market Size and Share Forecast Outlook 2025 to 2035

Fuel Management Software Market Size and Share Forecast Outlook 2025 to 2035

Additives for Metalworking Fluids Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA