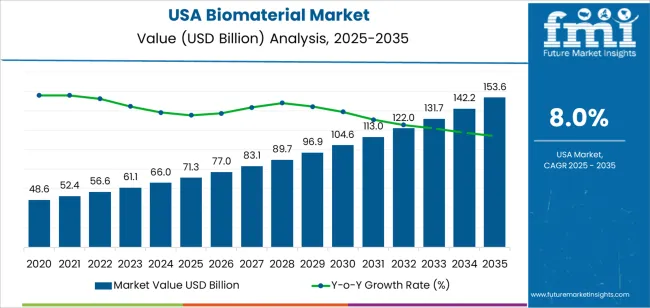

The USA biomaterial demand is valued at USD 71.3 billion in 2025 and is expected to reach USD 153.6 billion by 2035, reflecting a CAGR of 8.0%. Demand is shaped by expanding use of engineered materials in orthopaedics, cardiovascular treatments, wound management, dental reconstruction, and implantable medical devices. Growth is supported by broader adoption of biologically compatible materials in regulated clinical settings, increased surgical volumes, and continued integration of advanced polymers, metals, ceramics, and composites into device manufacturing. Rising utilization of biomaterials in regenerative medicine, tissue repair, and drug-delivery platforms also contributes to steady uptake across healthcare networks.

Ceramic biomaterials lead the segment. Their dominance reflects established application in orthopaedic implants, dental restorations, and spinal procedures, where wear resistance, chemical stability, and predictable biomechanical performance are essential. Calcium-phosphate ceramics, alumina, and zirconia remain widely used due to their compatibility with bone tissue and suitability for long-term implantation. Manufacturers apply ceramic biomaterials across joint reconstruction, dental implants, and load-bearing components requiring controlled porosity and high structural strength.

West USA, South USA, and Northeast USA record the highest utilization levels because these regions host large hospital networks, specialized surgical centers, and medical-device manufacturing hubs. These areas also maintain strong procurement channels for implantable devices and regenerative-medicine products supplied to orthopaedic, dental, and cardiovascular practices. Key suppliers include Medtronic plc, Johnson & Johnson, Stryker Corporation, Zimmer Biomet Holdings Inc., and Evonik Industries AG. These companies provide ceramic, metallic, polymeric, and composite biomaterials used in implants, tissue-engineering scaffolds, fixation devices, and therapeutic medical technologies deployed across the USA healthcare system.

Year-on-year growth analysis shows a consistently rising pattern supported by stable utilization in orthopaedics, cardiovascular implants, advanced wound care, dental reconstruction, and tissue-engineering applications. Between 2025 and 2029, YoY gains remain strong as hospitals and device manufacturers expand use of biocompatible polymers, ceramics, alloys, and regenerative biomaterials. Growth during these years is driven by steady procedure volumes, wider use of minimally invasive implants, and ongoing product upgrades in structural performance and biologic integration.

From 2030 to 2035, YoY growth remains positive but becomes more structured as demand aligns with predictable clinical workflows and established device-replacement cycles. Annual gains are reinforced by incremental advances in bioresorbable materials, high-purity hydrogels, and next-generation scaffold composites used in tissue repair. Expanded adoption of personalized implants and digital-design tools contributes to steady YoY improvements without introducing high volatility. The YoY profile reflects a mature, technology-supported category where consistent medical-procedure demand and continuous material refinement produce a stable, mid-range annual expansion across the United States.

| Metric | Value |

|---|---|

| USA Biomaterial Sales Value (2025) | USD 71.3 billion |

| USA Biomaterial Forecast Value (2035) | USD 153.6 billion |

| USA Biomaterial Forecast CAGR (2025-2035) | 8.0% |

Demand for biomaterials in the USA is increasing as healthcare providers, medical device manufacturers and research organizations seek advanced materials that support tissue engineering, regenerative medicine and bioresorbable implants. Biomaterials that support cell growth, controlled degradation and biocompatibility are increasingly used in orthopaedics, cardiovascular devices and wound-care applications. Growth is driven by rising healthcare expenditure, ageing populations and innovations in personalized medicine that rely on biomaterial solutions.

Regulatory reform and public-private research funding in the USA encourage development of new biomaterial formulations for advanced medical applications. Materials science advances such as bio-active polymers, composite scaffolds and 3D-printed biomaterials expand the range of clinical use-cases. Constraints include high development and regulatory-approval costs, long R&D timelines, and the need for specialized manufacturing processes and supply-chain validation. Some smaller firms may postpone adoption until clinical evidence and commercial scale-up are established.

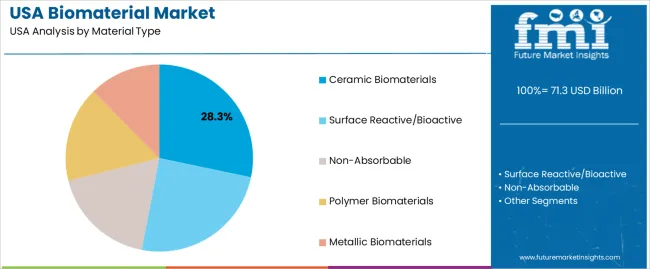

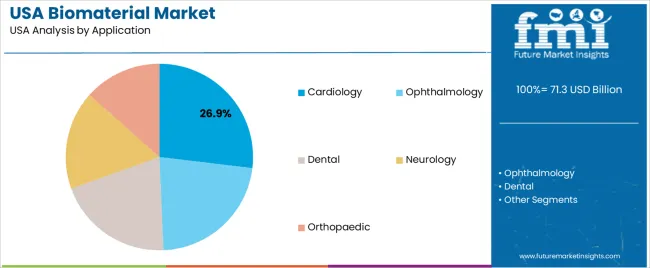

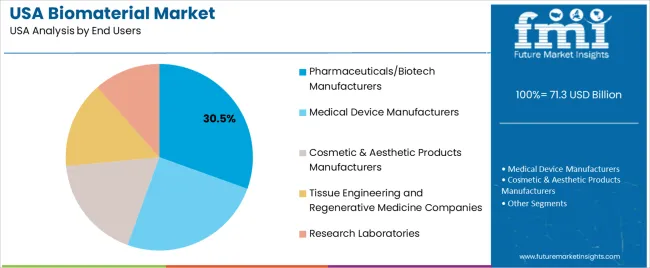

Demand for biomaterials in the United States reflects their role in medical devices, tissue-repair products, regenerative therapies, and specialized surgical applications. Material-type preferences relate to compatibility, durability, and required biological responses. Application patterns correspond to the varied clinical uses of biomaterials across cardiology, ophthalmology, dentistry, neurology, and orthopaedics. End-user distribution shows how pharmaceutical companies, medical-device manufacturers, and research-focused organizations integrate biomaterials to support therapeutic development and product innovation.

Ceramic biomaterials hold 28.3% of national demand and represent the leading material category. Their mechanical strength, chemical stability, and bioactivity support applications in bone repair, dental implants, and load-bearing structures. Surface reactive and bioactive materials account for 24.7%, enabling integration with tissue through controlled surface interactions. Non-absorbable materials represent 18.1%, serving long-term implant needs requiring structural permanence.

Polymer biomaterials hold 16.5%, supporting flexible, biocompatible applications across soft-tissue environments. Metallic biomaterials account for 12.4%, providing high-strength solutions for orthopaedic and dental fixation. Material-type distribution reflects functional requirements, tissue-contact behaviour, and performance characteristics used across USA medical and industrial settings.

Key drivers and attributes:

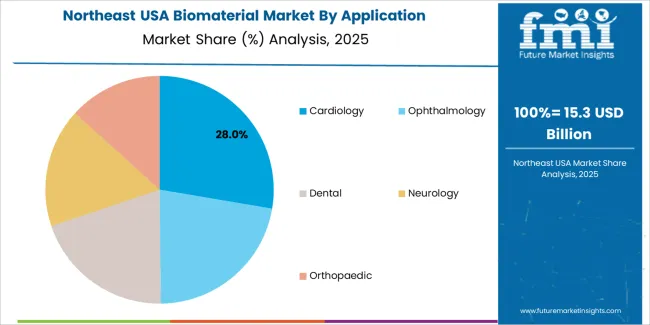

Cardiology holds 26.9% of national demand and represents the leading application category. Biomaterials are used in stents, vascular grafts, and implantable devices requiring durability, hemocompatibility, and controlled interaction with cardiovascular tissues. Ophthalmology follows with 22.4%, using biomaterials for lens implants, corneal substitutes, and ocular surgical tools requiring transparency and biocompatibility. Dental applications account for 20.2%, supporting implants, fillings, and bone-regeneration products. Neurology represents 17.1%, involving biomaterials for neural interfaces and repair scaffolds. Orthopaedic applications hold 13.4%, covering fixation devices and joint components. Application distribution reflects clinical complexity, device requirements, and material-response patterns across USA healthcare settings.

Key drivers and attributes:

Pharmaceutical and biotech manufacturers hold 30.5% of national demand and represent the leading end-user group. These organizations incorporate biomaterials into drug-delivery systems, regenerative-medicine platforms, and biologically active formulations. Medical device manufacturers account for 25.0%, using biomaterials in implants, prosthetics, and diagnostic tools requiring precision and regulatory compliance.

Cosmetic and aesthetic-product manufacturers represent 18.0%, applying biomaterials in fillers and skin-repair formulations. Tissue-engineering and regenerative-medicine companies hold 15.0%, while research laboratories account for 11.5%, supporting experimental studies and early-stage development. End-user distribution reflects product pipelines, clinical-application intensity, and manufacturing infrastructure across USA biomedical sectors.

Key drivers and attributes:

Expansion of regenerative medicine approvals, rising reimbursement support for bioplastics in USA states, and strong university-industry translational research are driving demand.

In the United States, biomaterials are seeing increased demand because the Food and Drug Administration (FDA) continues to clear novel materials for tissue engineering, including scaffolds and 3D implants used in orthopaedics and wound healing. Several USA states have enacted legislation that supports use of biobased plastics and materials in government procurement, which encourages manufacturers to adopt bio-derived polymers instead of conventional petrochemicals. Large academic hubs such as Boston, San Francisco and Research Triangle Park foster collaborations between universities, startups and industry, accelerating commercialization of biomaterials for medical, packaging and industrial applications.

Complex regulatory pathways, high cost of clinical translation and competition from established synthetic materials restrain growth.

Biomaterials intended for human implantation or contact must meet stringent FDA requirements for biocompatibility, sterilization and long-term safety, which raises development cost and extends time to industry. Some companies hesitate to invest because the return on investment is uncertain relative to conventional materials already in use. In industrial uses, bio-derived materials often struggle to match the performance, cost or supply stability of well-established synthetic polymers, which limits adoption in large-volume applications.

Growth of customized 3D-printed biomaterial implants, rising use of bio-based polymers in packaging and expansion of contract manufacturing of biomaterial technologies define USA trends.

In the USA, implant manufacturers increasingly use 3D printing combined with advanced biomaterials that enable patient-specific anatomy and rapid prototyping of scaffolds. On the packaging side, bio-based polymers derived from plant or microbial sources are gaining traction among brands that seek USA consumer appeal for sustainability and "made in USA" credentials. Contract manufacturing organizations with bioreactor and formulation capabilities are scaling biomaterial production, reducing barrier to entry for startups and enabling faster industry access. These developments support broader uptake of biomaterials across medical, industrial and packaging sectors in the United States.

Demand for biomaterials in the USA is increasing through 2035 as healthcare networks, medical-device manufacturers, and research institutions expand the use of advanced materials for implants, tissue engineering, wound-care products, and regenerative-medicine applications. Hospitals adopt biomaterial-based solutions for orthopedic, dental, cardiovascular, and reconstructive procedures, while device manufacturers integrate polymers, ceramics, and bioactive composites into next-generation implants.

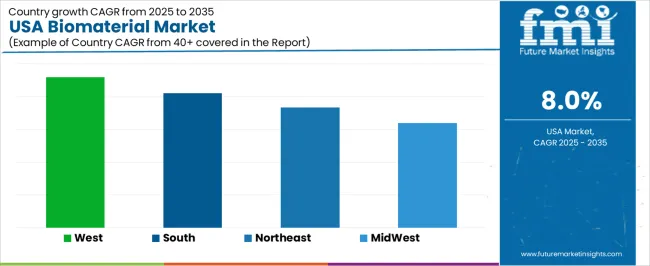

Growth is reinforced by rising surgical volumes, expanded insurance coverage, and continued development of personalized medical treatments. Regional variation reflects healthcare-infrastructure density, concentration of biomedical firms, and state-level investment in life-science research. West USA leads with 9.2%, followed by South USA (8.2%), Northeast USA (7.3%), and Midwest USA (6.4%).

| Region | CAGR (2025-2035) |

|---|---|

| West USA | 9.2% |

| South USA | 8.2% |

| Northeast USA | 7.3% |

| Midwest USA | 6.4% |

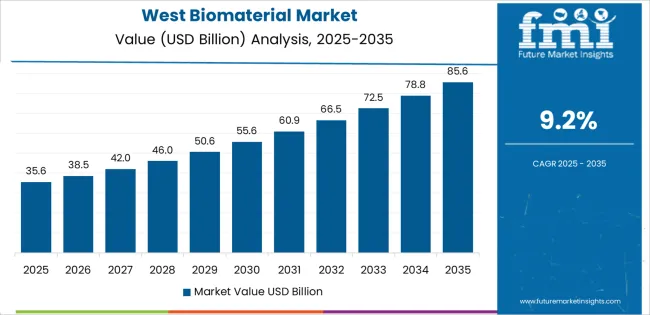

West USA grows at 9.2% CAGR, supported by large biomedical clusters, strong academic research output, and extensive adoption of advanced implants across California, Washington, Oregon, Colorado, Utah, and Arizona. Medical centers in California and Washington expand procedures involving orthopedic implants, dental restoratives, and soft-tissue grafts made from bioactive materials. Biotechnology firms located in the West integrate biomaterials into regenerative-medicine platforms, including scaffolds for tissue repair and absorbable polymers for controlled drug release. Device manufacturers in the region continue developing ceramic and composite implant components for musculoskeletal and cardiovascular applications. Research hospitals collaborate with universities on biomaterial testing, accelerating clinical translation.

South USA grows at 8.2% CAGR, driven by a rapidly expanding healthcare system, strong medical-device production, and growing adoption of biomaterial-based solutions across Texas, Florida, Georgia, North Carolina, Tennessee, and Alabama. Regional hospitals increase orthopedic, cardiovascular, and dental procedures that rely on polymers, ceramics, and bioengineered graft materials. Medical-device firms in Texas and North Carolina integrate biomaterials into joint-replacement components, spinal implants, and soft-tissue reinforcement systems. Population growth in major Southern metropolitan areas increases demand for surgical interventions requiring biocompatible materials. Research institutions in the region expand biomaterial testing and validation programs linked to clinical trials.

Northeast USA grows at 7.3% CAGR, shaped by dense hospital networks, leading research universities, and strong presence of medical-device and biotech firms across Massachusetts, New York, Pennsylvania, New Jersey, and Connecticut. Hospitals expand the use of bioactive ceramics, collagen-based scaffolds, and polymer implants for reconstructive and orthopedic surgeries. Research institutions advance the development of engineered tissues and biocompatible polymers used in regenerative-medicine applications. Device manufacturers integrate biomaterials into cardiovascular stents, dental implants, and neurosurgical devices. Clinical adoption is supported by high regional procedure rates and strong funding for biomedical research.

Midwest USA grows at 6.4% CAGR, supported by a strong medical-device manufacturing base, established hospital systems, and continuous adoption of biocompatible materials across Illinois, Ohio, Michigan, Minnesota, Wisconsin, and Indiana. Regional device producers use biomaterials to manufacture orthopedic implants, surgical meshes, and cardiovascular components. Hospitals expand use of absorbable sutures, polymer-based wound-care materials, and bone-graft substitutes. University-linked medical research centers in Minnesota, Ohio, and Michigan advance material testing, especially in orthopedic and neuromuscular applications. Local manufacturing capabilities strengthen domestic production of bioactive ceramics and specialty polymers.

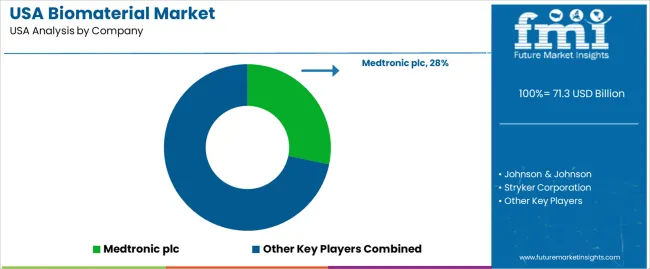

Demand for biomaterials in the USA is shaped by a group of medical-device and specialty-materials manufacturers supplying orthopedics, cardiovascular implants, dental systems, wound care, and regenerative-medicine applications. Medtronic plc holds the leading position with an estimated 28.2% share, supported by controlled production of polymeric, metallic, and bioactive materials used in spinal implants, cardiovascular devices, and soft-tissue repair. Its position is reinforced by stable performance data and long-standing integration with USA surgical networks.

Johnson & Johnson maintains a significant footprint through DePuy Synthes and Ethicon, supplying orthopedic biomaterials, suture technologies, and bioresorbable components with consistent mechanical and biological behaviour. Stryker Corporation contributes strong volume across orthobiologics and bone-regeneration materials, offering controlled osteoconductive and osteoinductive properties used widely in USA trauma and joint-reconstruction procedures.

Zimmer Biomet Holdings, Inc. supports demand with structural and regenerative biomaterials aligned with joint reconstruction, spine, and dental applications, emphasizing predictable handling characteristics and verified biocompatibility. Evonik Industries AG adds depth as a key supplier of medical-grade polymers, including resorbable materials and speciality polymers used by USA device manufacturers requiring controlled degradation profiles and stable long-term performance.

Competition across this segment centers on biocompatibility verification, mechanical reliability, degradation-rate control, regulatory conformity, and integration with established surgical systems. Demand continues to expand as USA healthcare providers adopt bioactive, regenerative, and high-performance implant materials designed to support predictable healing and long-term clinical outcomes across orthopedic, soft-tissue, and cardiovascular applications.

| Items | Values |

|---|---|

| Quantitative Units | USD billion |

| Material Type | Ceramic Biomaterials, Surface Reactive/Bioactive, Non-Absorbable, Polymer Biomaterials, Metallic Biomaterials |

| Application | Cardiology, Ophthalmology, Dental, Neurology, Orthopaedic |

| End Users | Pharmaceuticals/Biotech Manufacturers, Medical Device Manufacturers, Cosmetic & Aesthetic Products Manufacturers, Tissue Engineering and Regenerative Medicine Companies, Research Laboratories |

| Regions Covered | West USA, South USA, Northeast USA, Midwest USA |

| Key Companies Profiled | Medtronic plc, Johnson & Johnson, Stryker Corporation, Zimmer Biomet Holdings, Inc., Evonik Industries AG |

| Additional Attributes | Dollar sales by biomaterial type, clinical application, and end-user categories; regional adoption trends across West USA, South USA, Northeast USA, and Midwest USA; competitive landscape of biomaterial producers and medical technology companies; developments in regenerative biomaterials, bioactive coatings, polymer-metal hybrid materials, and implant-grade ceramics; integration with medical device manufacturing, regenerative medicine, pharmaceutical innovation, and aesthetic applications across the USA. |

The demand for biomaterial in usa is estimated to be valued at USD 71.3 billion in 2025.

The market size for the biomaterial in usa is projected to reach USD 153.6 billion by 2035.

The demand for biomaterial in usa is expected to grow at a 8.0% CAGR between 2025 and 2035.

The key product types in biomaterial in usa are ceramic biomaterials, surface reactive/bioactive, non-absorbable, polymer biomaterials and metallic biomaterials.

In terms of application, cardiology segment is expected to command 26.9% share in the biomaterial in usa in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Biomaterial Tester Market Size and Share Forecast Outlook 2025 to 2035

USA Medical Coding Market Size and Share Forecast Outlook 2025 to 2035

Biomaterial In Surgical Mesh Market Size and Share Forecast Outlook 2025 to 2035

USA Labels Market Size and Share Forecast Outlook 2025 to 2035

USA Plant-based Creamers Market Size and Share Forecast Outlook 2025 to 2035

USA Barrier Coated Paper Market Size and Share Forecast Outlook 2025 to 2035

USA Electronic Health Records (EHR) Market Size and Share Forecast Outlook 2025 to 2035

USA Animal Model Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Packer Bottle Market Size and Share Forecast Outlook 2025 to 2035

USA Stretch Hood Films Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Fence Screen Market Size and Share Forecast Outlook 2025 to 2035

USA Lubricant Contaminated HDPE Container Waste Market Size and Share Forecast Outlook 2025 to 2035

USA Commercial Walk-In Refrigeration Market Size and Share Forecast Outlook 2025 to 2035

USA & Canada Pre-painted Steel Roofing and Cladding Market Size and Share Forecast Outlook 2025 to 2035

USA Residential Cotton Candy Maker Market Size and Share Forecast Outlook 2025 to 2035

USA Faith Based Tourism Market Size and Share Forecast Outlook 2025 to 2035

United States NFC Lemon Juice Market Analysis - Size, Growth and Forecast 2025 to 2035

USA and Canada Copper Market Insights - Demand, Size & Industry Trends 2025 to 2035

USA Ground and Precipitated Calcium Carbonate Market Growth by Product Type, Application, End-Use, and Region in 2025 to 2035

United States Animal Feed Additives Market Report – Trends, Growth & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA