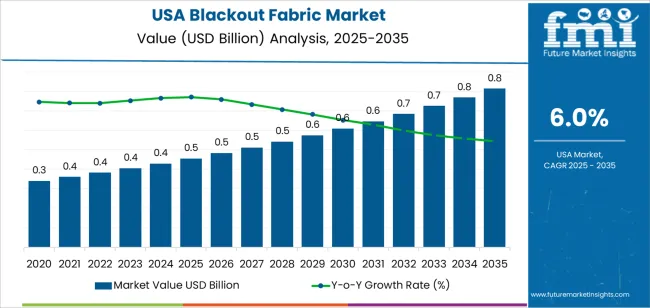

The USA blackout fabric demand is valued at USD 0.5 billion in 2025 and is forecasted to reach USD 0.8 billion by 2035, reflecting a CAGR of 6.0%. Demand is supported by increased utilization of light-blocking textiles across commercial, industrial, and residential settings. Facilities that require controlled illumination, such as manufacturing units, laboratories, and audiovisual environments, continue to adopt blackout materials for operational efficiency. Hotels, healthcare centers, and institutional buildings also contribute to stable procurement as these environments prioritize privacy, temperature control, and glare reduction. Growth in multi-family housing and refurbishment activity strengthens usage within residential interiors.

Industrial-use blackout fabrics lead the segment. These materials are selected for durability, dimensional stability, and consistent light-blocking performance in settings where controlled lighting is essential. Industrial buyers rely on coated polyester and specialized PVC-backed constructions for their resistance to humidity, abrasion, and prolonged exposure to artificial lighting. The segment also benefits from the expanded use of blackout textiles in equipment enclosures, projection rooms, and noise-sensitive workspaces.

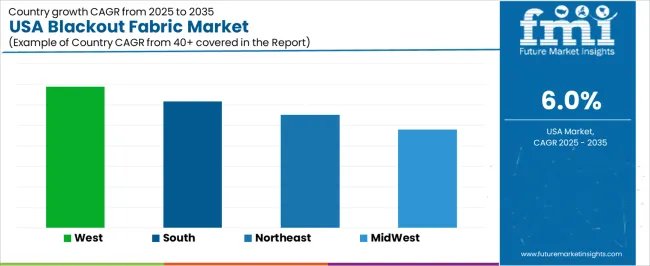

West USA, South USA, and Northeast USA record the highest utilization levels. These regions maintain significant commercial construction activity, extensive hospitality infrastructure, and strong participation from window-treatment distributors and contract suppliers. Demand is further supported by institutional buyers seeking standardized blackout solutions for energy management and interior-environment control. Key suppliers include Hunter Douglas, Springs Window Fashions, Louvolite, and Mermet Corporation. These companies provide coated fabrics, woven polyester blackout materials, and multi-layer technical textiles used across industrial installations, commercial interiors, and residential window-treatment applications.

Breakpoint analysis indicates two inflection periods shaped by residential renovation patterns, institutional procurement, and energy-efficiency requirements. The first breakpoint emerges between 2026 and 2028, when adoption rises as households and hospitality facilities expand use of multilayer and foam-coated blackout fabrics for light control and thermal insulation. Growth in this phase is supported by steady refurbishment cycles, wider retail availability, and increased integration of blackout materials in privacy-oriented room designs. This creates a defined early uplift anchored in practical residential and commercial needs.

A second breakpoint appears between 2030 and 2032 as demand transitions toward a more stable utilization range. By this period, most large commercial users, including hotels, healthcare facilities, and educational institutions, will have completed scheduled upgrades, and procurement follows predictable replacement intervals. Late-period expansion is influenced by incremental improvements in fabric durability, flame resistance, and compatibility with automated shading systems rather than broad new adoption. The breakpoint pattern reflects an early phase driven by renovation and energy considerations, followed by a mature operational phase defined by regular replacement cycles and consistent functional use across USA residential and commercial interiors.

| Metric | Value |

|---|---|

| USA Blackout Fabric Sales Value (2025) | USD 0.5 billion |

| USA Blackout Fabric Forecast Value (2035) | USD 0.8 billion |

| USA Blackout Fabric Forecast CAGR (2025-2035) | 6.0% |

The demand for blackout fabric in the USA is increasing because residential, commercial and hospitality sectors seek textiles that block light, regulate temperature and enhance privacy. Home-improvement activity, especially for bedrooms, media rooms and rental properties, supports purchase of blackout curtains, drapes and roller shades. Commercial use in hotels, hospitals, offices and higher-education facilities also drives demand for higher-performance fabrics that meet noise, light-control and energy-efficiency standards.

Advances in textile coatings, multilayer fabrics and motorized shading systems integrate blackout materials into smart-home and smart-building ecosystems, which boosts adoption in retrofit and new-build projects. Sustainability and energy-conservation goals encourage selection of fabrics with insulating and UV-blocking performance. Constraints include higher cost of premium blackout fabrics compared with standard textile options, the need for custom sizing or specification in commercial applications and supply-chain pressure on raw materials or coatings. Some buyers may delay selection until budgets allow or until integrated smart-shading systems are specified.

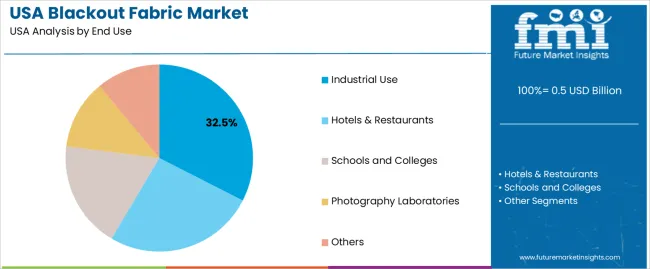

Demand for blackout fabric in the United States reflects its use across commercial interiors, institutional facilities, industrial environments, and photography settings requiring controlled light exclusion. End-use preferences relate to installation scale, privacy needs, and thermal-insulation expectations. Thickness selection corresponds to opacity performance, durability requirements, and fabric-handling needs across varied applications.

Industrial use holds 32.5% of national demand and represents the leading end-use category. Facilities adopt blackout fabric for glare control, thermal regulation, and light-exclusion needs in manufacturing zones, storage rooms, and controlled environments. Hotels and restaurants account for 26.0%, relying on blackout fabric for guest-room privacy and ambient-light management. Schools and colleges represent 18.5%, using blackout materials in classrooms, auditoriums, and testing halls. Photography laboratories hold 12.0%, requiring controlled illumination for film handling and specialty imaging. Other uses represent 11.0%, including residential installations and event spaces. End-use distribution reflects operational requirements, lighting standards, and energy-management needs across USA facilities.

Key drivers and attributes:

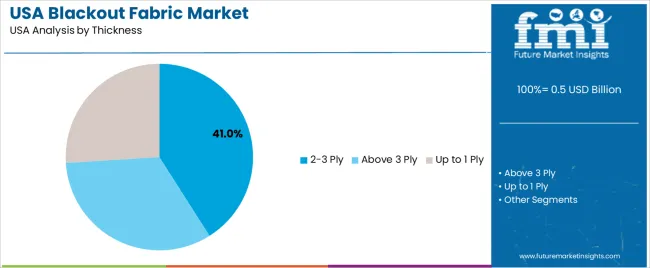

Blackout fabrics in the 2-3 ply range hold 41.0% of national demand and represent the dominant thickness category. These fabrics balance opacity, durability, and handling ease, supporting installations in hotels, industrial spaces, and educational facilities. Thickness above 3 ply accounts for 33.0%, serving environments requiring higher thermal insulation, noise dampening, or intense light-blocking capability. Fabrics up to 1 ply represent 26.0%, supporting applications that prioritize lightweight installation, basic glare reduction, or decorative layering. Thickness distribution reflects the need to balance installation cost, opacity level, structural rigidity, and maintenance requirements across USA users selecting blackout materials for controlled lighting.

Key drivers and attributes:

Urban high-rise living, USA energy-code updates and growth of hospitality refurbishments are driving demand.

In major USA cities such as New York, Los Angeles and Chicago, the growth of high-rise apartments and condos with large windows facing bright city lights has increased the need for fabrics that can block light and provide privacy. New editions of USA building energy codes (e.g., IECC updates) are pushing for better thermal insulation in window treatments, which favour blackout fabrics that reduce heating and cooling load. The hotel and resort sector in the USA is also undergoing renovation to improve guest comfort and sound/light control, boosting purchases of premium blackout fabric for drapes, blinds and automated window coverings.

Material cost pressures, competition from alternate shading systems and slower residential renovation cycles restrain growth.

Blackout fabrics often involve heavier weight coatings, multi-ply layering and special finishes, which raise production cost. Some USA buyers prefer alternative shading or glazing solutions such as tinted glass, motorized shades or smart film systems which can reduce reliance on fabrics. The residential renovation industry in the United States has faced softening in certain regions, which slows demand for new window-treatment installations and therefore limits surge in fabric volumes.

Integration with smart-home motorized systems, rise of eco-friendly recycled-content blackout fabrics and increased use in commercial/healthcare acoustic-and-light-control applications define key trends.

Manufacturers are offering blackout fabrics compatible with motorized rollers and app-controlled systems in the USA, reflecting the smart-home adoption trend. Eco-friendly versions of blackout fabric made with recycled polyester or low-VOC coatings are gaining traction among sustainability-oriented consumers and commercial specifiers. In commercial settings (such as hospitals, offices, cinemas) where light control, glare reduction and acoustic management are important, blackout fabric is increasingly specified not just for aesthetics but for functional performance and interior-environment control.

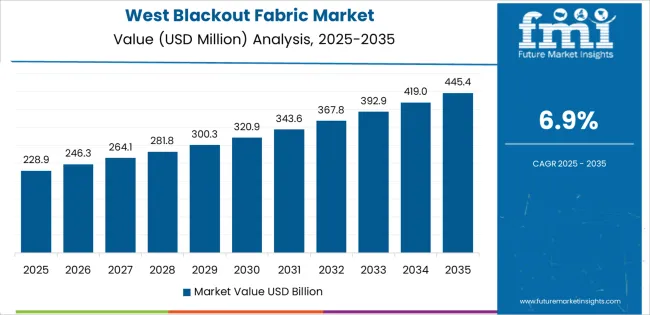

Demand for blackout fabric in the USA is increasing through 2035 as households, commercial buildings, hospitality operators, and institutional facilities expand the use of light-blocking materials for thermal control, privacy, glare reduction, and energy-efficiency improvement. USA consumers adopt blackout fabrics in curtains, roller shades, and window panels to reduce sunlight exposure, stabilize indoor temperatures, and support remote-work environments requiring controlled lighting. Hotels, healthcare facilities, and educational campuses integrate blackout materials into room-darkening systems to support occupant comfort. Regional variation reflects climate patterns, construction activity, hospitality density, and home-renovation trends. West USA leads with 6.9%, followed by South USA (6.2%), Northeast USA (5.5%), and Midwest USA (4.8%).

| Region | CAGR (2025-2035) |

|---|---|

| West USA | 6.9% |

| South USA | 6.2% |

| Northeast USA | 5.5% |

| Midwest USA | 4.8% |

West USA grows at 6.9% CAGR, supported by high solar exposure, strong home-renovation activity, and widespread adoption of thermal-control solutions across California, Arizona, Nevada, Washington, Oregon, and Colorado. Homes in sun-intensive states such as California and Arizona use blackout fabrics to reduce heat gain and limit air-conditioning loads. Multifamily housing developers incorporate blackout curtains and roller shades in new construction to meet energy-performance expectations. Hospitality properties in tourism centers rely on blackout systems to enhance guest comfort. Remote-work households adopt blackout panels to create controlled lighting conditions for screen-based tasks. Retailers across the West expand product options including triple-weave fabrics, insulated blackout linings, and eco-friendly fiber blends.

South USA grows at 6.2% CAGR, driven by high temperatures, extended cooling seasons, and rapid residential construction across Texas, Florida, Georgia, North Carolina, Tennessee, and Alabama. Homes and apartments adopt blackout fabrics to reduce indoor heat, limit glare, and manage HVAC costs. Large suburban housing developments use blackout window treatments as part of energy-efficiency upgrades. Hospitals and senior-care facilities incorporate blackout curtains to improve patient rest and light control. Hotels in Southern tourism corridors use blackout materials to meet guest comfort requirements. Retailers expand availability of moisture-resistant and UV-blocking blackout fabrics suited to humid climates.

Northeast USA grows at 5.5% CAGR, shaped by dense urban living, strong apartment-rental industries, and sustained interest in privacy-oriented home products across New York, Massachusetts, Pennsylvania, New Jersey, and Connecticut. High-density housing encourages adoption of blackout curtains and shades for privacy and noise-associated light control. Older housing stock undergoing renovation incorporates blackout fabrics to improve insulation and reduce drafts. Hotels and business-travel centers in major cities rely on blackout installations to support consistent room standards. Retailers promote insulated blackout fabrics for winter energy savings in colder states.

Midwest USA grows at 4.8% CAGR, supported by stable residential demand, widespread home-renovation activity, and strong interest in insulated window treatments across Illinois, Ohio, Michigan, Minnesota, Wisconsin, and Iowa. Consumers adopt blackout fabrics to reduce glare in home-offices and living spaces. Cold winters encourage the use of thermal-backed blackout curtains to limit heat loss. Hotels along transportation corridors use blackout materials for consistent guest comfort. Retailers promote durable polyester and triple-weave blackout options targeted at budget-conscious homeowners.

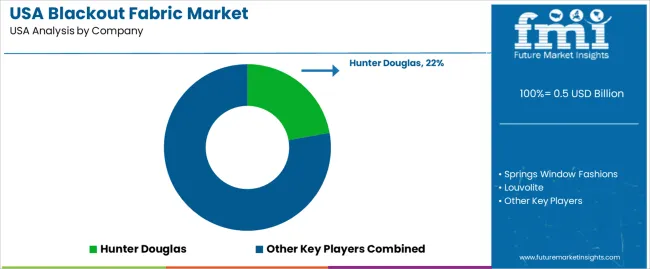

Demand for blackout fabric in the USA is shaped by a group of window-covering and performance-textile producers supplying residential blinds, commercial shading systems, hospitality projects, and light-control applications. Hunter Douglas holds the leading position with an estimated 22.2% share, supported by controlled fabric-lamination processes, consistent opacity performance, and strong integration with USA dealers and contract installers. Its position is reinforced by reliable light-blocking characteristics and stable dimensional behaviour across roller, panel, and cellular systems.

Springs Window Fashions follows as a major participant through its Bali and Graber product lines. The company supplies blackout textiles with dependable coating uniformity, predictable colourfastness, and strong availability across large retail and professional-installation channels. The firm’s USA distribution depth supports consistent adoption in both residential and commercial projects. Louvolite, operating in the USA through authorized distributors and shading partners, contributes specialized blackout fabrics characterized by controlled weave structure and stable reflective backings. Its offerings support mid-scale installers seeking flexible pattern and colour ranges with verified opacity performance.

Mermet Corporation maintains a significant presence as a USA manufacturer of performance shading textiles, including coated blackout fabrics used in commercial buildings, schools, and hospitality interiors. Its products emphasize controlled thermal behaviour, flame-resistance compliance, and stable mechanical properties. Competition across this segment centres on opacity consistency, coating durability, dimensional stability, UV resistance, thermal performance, and availability across customized shading formats. Demand continues to rise as USA homeowners, builders, and commercial designers prioritise light control, energy efficiency, glare reduction, and privacy-focused window systems requiring dependable blackout-fabric performance.

| Items | Values |

|---|---|

| Quantitative Units | USD billion |

| End Use | Industrial Use, Hotels & Restaurants, Schools and Colleges, Photography Laboratories, Others |

| Thickness | 2-3 Ply, Above 3 Ply, Up to 1 Ply |

| Regions Covered | West USA, South USA, Northeast USA, Midwest USA |

| Key Companies Profiled | Hunter Douglas, Springs Window Fashions, Louvolite, Mermet Corporation |

| Additional Attributes | Dollar sales by thickness type and end-use categories; regional adoption trends across West USA, South USA, Northeast USA, and Midwest USA; competitive landscape of blackout fabric producers; developments in multilayer thermal-blocking textiles, flame-retardant coatings, and high-opacity woven/knitted fabrics; integration with hospitality furnishing, commercial interiors, industrial laboratories, and educational infrastructure across the USA. |

The demand for blackout fabric in usa is estimated to be valued at USD 0.5 billion in 2025.

The market size for the blackout fabric in usa is projected to reach USD 0.8 billion by 2035.

The demand for blackout fabric in usa is expected to grow at a 6.0% CAGR between 2025 and 2035.

The key product types in blackout fabric in usa are industrial use, hotels & restaurants, schools and colleges, photography laboratories and others.

In terms of thickness, 2-3 ply segment is expected to command 41.0% share in the blackout fabric in usa in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Blackout Fabric Laminate Market Size and Share Forecast Outlook 2025 to 2035

Blackout Fabric Market Analysis – Trends, Growth & Forecast 2025 to 2035

Demand for Blackout Fabric in Japan Size and Share Forecast Outlook 2025 to 2035

Fabric Spreading Machine Market Forecast Outlook 2025 to 2035

Fabric Freshener Market Forecast and Outlook 2025 to 2035

Fabric Inspection Machine Market Size and Share Forecast Outlook 2025 to 2035

Fabric Cutting Machine Market Size and Share Forecast Outlook 2025 to 2035

USA Medical Coding Market Size and Share Forecast Outlook 2025 to 2035

Fabric Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

USA Labels Market Size and Share Forecast Outlook 2025 to 2035

USA Plant-based Creamers Market Size and Share Forecast Outlook 2025 to 2035

USA Barrier Coated Paper Market Size and Share Forecast Outlook 2025 to 2035

USA Electronic Health Records (EHR) Market Size and Share Forecast Outlook 2025 to 2035

USA Animal Model Market Size and Share Forecast Outlook 2025 to 2035

Fabric Toys Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Packer Bottle Market Size and Share Forecast Outlook 2025 to 2035

USA Stretch Hood Films Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Fence Screen Market Size and Share Forecast Outlook 2025 to 2035

USA Lubricant Contaminated HDPE Container Waste Market Size and Share Forecast Outlook 2025 to 2035

USA Commercial Walk-In Refrigeration Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA