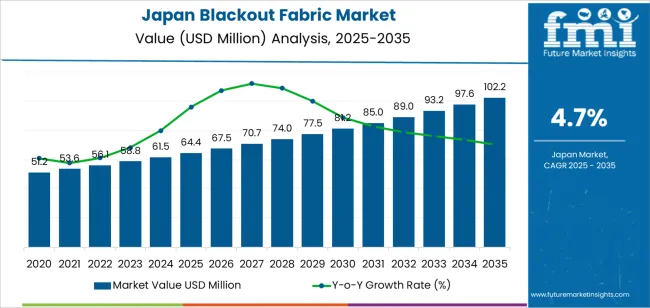

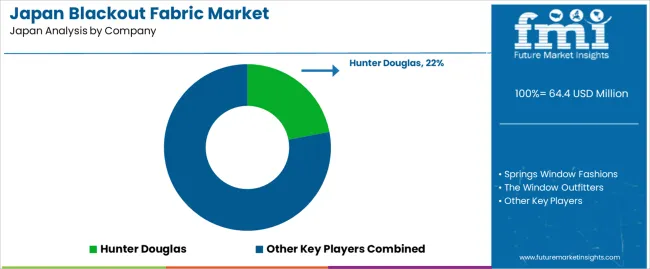

The demand for blackout fabric in Japan is projected to grow from USD 64.4 million in 2025 to USD 102.2 million by 2035, reflecting a CAGR of 4.7%. Blackout fabric, commonly used in window coverings, curtains, and blinds, is increasingly popular for its ability to block out light and provide privacy. This growing demand is driven by factors such as increased construction of residential and commercial buildings, rising interest in home decor, and greater awareness of the benefits of light control. Additionally, the growing trend of energy efficiency and light pollution control is contributing to the adoption of blackout fabrics in both home and office environments.

The market will be further driven by innovations in fabric technology, including the development of more durable, eco-friendly, and lightweight materials. The premiumization trend in interior decor, where consumers seek high-quality, aesthetic, and functional products, will continue to drive demand for stylish blackout fabric options. Furthermore, customization in terms of color, texture, and patterns will expand the appeal of blackout fabrics, catering to diverse consumer preferences in both residential and commercial sectors.

From 2025 to 2030, the demand for blackout fabric in Japan will grow from USD 64.4 million to USD 81.2 million, contributing USD 16.8 million in value. This phase will witness a steady rise in demand driven by rising urbanization, increased construction, and growing interest in home improvement projects. During this period, blackout fabric will gain traction among homeowners and commercial property owners who are prioritizing both privacy and energy efficiency. As more consumers opt for high-quality window treatments and focus on creating comfortable indoor environments, the demand for blackout fabrics will see a strong, steady uptick.

From 2030 to 2035, the market will grow from USD 81.2 million to USD 102.2 million, adding USD 21 million in value. During this period, the market will continue to expand, albeit at a slower rate as it approaches maturity. The increasing integration of energy-efficient materials in building projects will continue to drive the demand for blackout fabrics, especially in the commercial sector. The introduction of smart fabrics and the continued trend towards sustainability will further contribute to growth in this phase. As the market matures, premiumization and customization will become key differentiators, ensuring the continued adoption of blackout fabrics for both practical and aesthetic purposes.

| Metric | Value |

|---|---|

| Industry Sales Value (2025) | USD 64.4 million |

| Industry Forecast Value (2035) | USD 102.2 million |

| Industry Forecast CAGR (2025-2035) | 4.7% |

Demand for blackout fabric in Japan is increasing as property owners and commercial developers focus on indoor comfort, energy efficiency and light control requirements. The market value is estimated at USD 64.4 million and is projected to reach USD 102.2 million, corresponding to a compound annual growth rate (CAGR) of approximately 4.7%. Blackout fabrics are typically installed in hotels, hospitals, executive residences and broadcast studios where complete light exclusion and thermal insulation are critical.

Another factor supporting demand is the expansion of upgrades and renovations in Japan’s built environment, including the hotel and hospitality sector and subtropical regions that face strong sunlight. Architects and interior designers specify blackout fabrics combined with smart automated systems to meet aesthetic and functional demands. The constraints include higher price of technical fabrics compared to standard window treatments and the need for skilled installation to produce the desired effect. Given these structural trends in construction, indoor environmental control and international tourism, the demand for blackout fabric in Japan is expected to grow steadily.

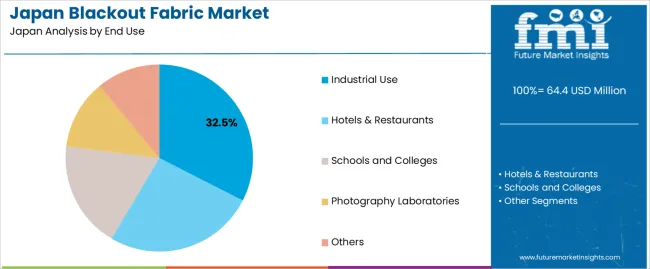

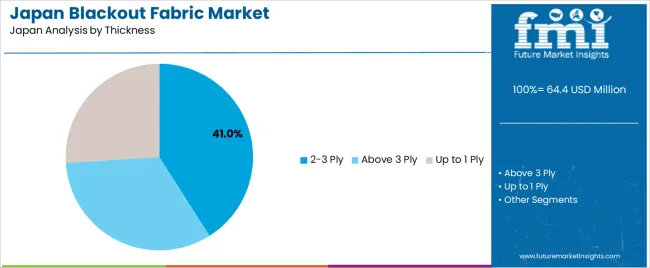

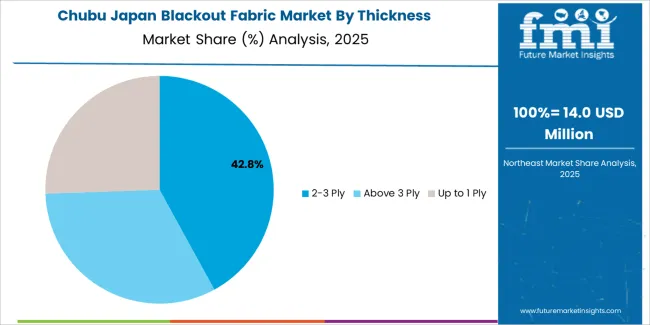

The demand for blackout fabric in Japan is primarily driven by end-use and thickness. The leading end-use segment is industrial use, accounting for 33% of the market share, while 2-3 ply fabrics dominate the thickness category, capturing 41% of the demand. Blackout fabric is widely used for its light-blocking properties in various applications, including curtains, screens, and protective covers, and its demand continues to grow as industries and consumers seek enhanced privacy, light control, and energy efficiency.

Industrial use leads the demand for blackout fabric in Japan, holding 33% of the market share. Industrial applications for blackout fabric include its use in factories, warehouses, and other commercial spaces, where it is essential for controlling light levels, temperature, and visibility. Blackout fabric is used for creating controlled environments for machinery, storage areas, and specific production lines where light or environmental conditions must be managed for optimal performance and safety.

The demand for blackout fabric in industrial settings is driven by the increasing need for energy-efficient solutions and enhanced privacy. Blackout fabric helps to maintain consistent internal conditions by preventing excessive sunlight from entering buildings, thus reducing the need for artificial lighting and improving temperature control. Additionally, blackout fabrics are used in specific industrial applications such as machinery covers, which require protection from light and environmental factors. As industrial operations continue to prioritize efficiency and cost savings, the demand for blackout fabric in this segment is expected to grow.

2-3 ply fabrics dominate the demand for blackout fabric in Japan, accounting for 41% of the market share. These multi-layered fabrics offer enhanced light-blocking properties and better insulation compared to thinner fabrics. The 2-3 ply configuration is particularly effective in providing superior light blockage, which is essential for applications in both residential and industrial settings, where total darkness or privacy is required.

The popularity of 2-3 ply blackout fabric is driven by its increased durability and versatility. In addition to blocking light, these fabrics also provide added insulation, helping to regulate room temperature and improve energy efficiency. As demand for energy-saving solutions and privacy options continues to grow, the 2-3 ply blackout fabric will remain the preferred choice for consumers and businesses in Japan. Its ability to meet both practical and aesthetic needs ensures that it will continue to lead the market.

Demand for blackout fabric in Japan is being driven by increasing urbanization, higher density living spaces, and greater emphasis on energy efficiency in both residential and commercial sectors. As more high rise apartments and mixed use buildings are built, requirements for light control, privacy and thermal insulation grow. At the same time, cost pressures in construction and the mature level of adoption in some segments moderate expansion. Together these factors shape how the blackout fabric market is evolving in Japan.

What Are the Primary Growth Drivers for Blackout Fabric Demand in Japan?

Several factors support growth. First, the push for energy efficient building design in Japan encourages materials that improve insulation, reduce heating and cooling requirements, and thus favor blackout fabrics. Second, rising consumer interest in sleep quality and privacy in urban apartment living drives demand for fabrics that block external light and reduce noise. Third, growth in the hotel, hospitality and commercial property sectors in major Japanese cities creates new demand for blackout solutions in guest rooms and offices. Fourth, the increasing availability of smart home and motorized window treatments enhances the appeal of blackout fabrics as components of integrated interior systems.

What Are the Key Restraints Affecting Blackout Fabric Demand in Japan?

Despite positive momentum, several constraints apply. The premium cost of high performance blackout fabrics (those offering advanced thermal insulation or motorization compatibility) can restrict adoption in cost sensitive residential segments. Some older buildings in Japan may pose installation challenges or require retrofit solutions that add complexity and cost. In addition, established window treatment alternatives, such as standard curtains or blinds, remain entrenched in certain markets, limiting substitution. Finally, market penetration in some regional areas may lag due to lower awareness of blackout fabric benefits or less urgency for light control solutions.

What Are the Key Trends Shaping Blackout Fabric Demand in Japan?

Important trends include the development of blackout fabrics with enhanced functionality, such as thermal reflective coatings, noise reduction properties and compatibility with motorized or smart home systems. Manufacturers are offering lighter weight, recycled or eco friendly blackout fabrics to respond to sustainability objectives in Japan. There is also growth in custom cut and direct to consumer purchase channels, enabling easier access to blackout fabric solutions for smaller residential projects. Lastly, collaboration between textile producers and interior design or building automation firms is strengthening, which supports the integration of blackout fabrics into broader turnkey window treatment and shading systems.

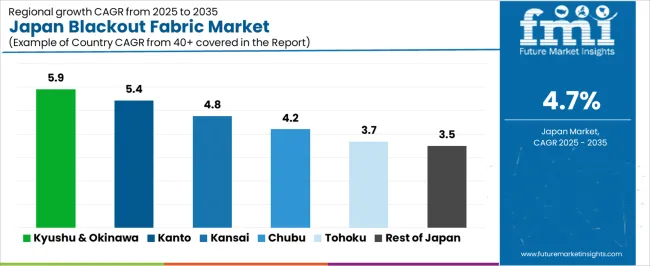

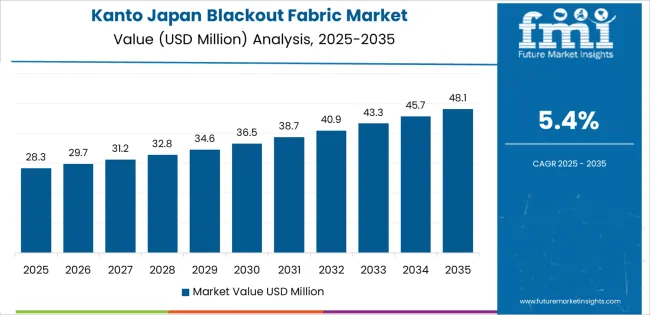

The demand for blackout fabric in Japan shows consistent growth across various regions, with Kyushu & Okinawa leading the way at a CAGR of 5.9%. Kanto follows closely with a CAGR of 5.4%, driven by urbanization and increasing demand for light-blocking solutions in densely populated areas. The Kinki region exhibits moderate growth at 4.8%, while Chubu, Tohoku, and the Rest of Japan show slower growth, with respective CAGRs of 4.2%, 3.7%, and 3.5%. These regional differences reflect varying levels of demand based on factors such as population density, residential trends, and awareness of the benefits of blackout fabrics in controlling light and improving sleep quality.

| Region | CAGR (2025-2035) |

|---|---|

| Kyushu & Okinawa | 5.9% |

| Kanto | 5.4% |

| Kinki | 4.8% |

| Chubu | 4.2% |

| Tohoku | 3.7% |

| Rest of Japan | 3.5% |

The demand for blackout fabric in Kyushu & Okinawa is projected to grow at a CAGR of 5.9%, driven by the region's increasing awareness of the benefits of light control and improved sleep quality. The growing popularity of blackout curtains in homes, hotels, and other establishments to block out light and maintain privacy is a key factor contributing to this trend. Additionally, the region’s warm climate, which often leads to early sunrises, increases the need for blackout fabrics to help control natural light, particularly in bedrooms. Okinawa’s thriving tourism industry further drives demand for blackout fabric, as many hotels and guesthouses seek to offer better sleep environments for their visitors. As more consumers prioritize comfort and energy efficiency, the demand for blackout fabrics is expected to continue to rise in this region.

In Kanto, the demand for blackout fabric is expected to grow at a CAGR of 5.4%, supported by the region’s large population and the growing demand for energy-efficient home solutions. Kanto, particularly Tokyo, is one of Japan’s busiest and most densely populated regions, where light pollution and long daylight hours make blackout fabrics an attractive option for improving sleep quality. The increasing awareness of the importance of sleep health, combined with urban lifestyles and the rising popularity of home decor trends that emphasize light control, is driving the adoption of blackout fabrics. Furthermore, the region’s high number of offices, hotels, and residential buildings with large windows creates a significant market for blackout solutions. As more consumers in Kanto seek ways to optimize their living spaces for better comfort and energy savings, demand for blackout fabric is likely to continue growing.

The demand for blackout fabric in the Kinki region is projected to grow at a CAGR of 4.8%, reflecting moderate growth driven by the region's urbanization and lifestyle changes. Kinki, which includes major cities such as Osaka and Kyoto, is a key economic and cultural hub in Japan, where the demand for home furnishings and window treatments is steadily increasing. The growing number of residents and businesses in urban areas has led to a greater focus on improving indoor environments, including light control for better comfort and privacy. Blackout fabrics are particularly popular in bedrooms, where the need for a dark, quiet environment is more critical. However, the growth rate in Kinki is slower compared to Kyushu & Okinawa and Kanto, likely due to the region’s established market for traditional window treatments and a lower emphasis on blackout solutions in non-sleep areas of homes. Nevertheless, the increasing trend of energy efficiency and interior design innovation ensures continued demand for blackout fabrics.

The demand for blackout fabric in Chubu is expected to grow at a CAGR of 4.2%, driven by a combination of factors, including urbanization, changing consumer preferences, and the desire for energy-efficient home solutions. Chubu, home to industrial cities like Nagoya, is seeing increasing demand for blackout fabrics in residential and commercial settings as consumers and businesses look for ways to control light and enhance privacy. The region’s fluctuating weather patterns, with both hot summers and cold winters, make blackout fabrics an appealing option for maintaining temperature control and reducing energy costs. While growth in Chubu is slower compared to more densely populated regions like Kanto and Kyushu & Okinawa, the increasing focus on home comfort, sleep quality, and energy efficiency is gradually driving higher demand for blackout fabrics in this region.

In Tohoku, the demand for blackout fabric is projected to grow at a CAGR of 3.7%, reflecting moderate growth influenced by the region's rural nature and more traditional living habits. While the region’s population is aging, which increases the demand for products that improve comfort and health, Tohoku's rural areas tend to have a slower adoption rate of home decor trends compared to urban centers. However, as younger generations in Tohoku move into urbanized areas and traditional homes become renovated for modern living, there is an increasing interest in blackout fabrics for bedrooms and living areas to block out light and enhance sleep quality. The region’s colder winters also contribute to growing demand for products that help insulate homes and maintain energy efficiency, making blackout fabrics a useful addition for many homes. As awareness of sleep health grows and home improvement trends expand, demand for blackout fabric in Tohoku is expected to rise gradually.

In the Rest of Japan, the demand for blackout fabric is expected to grow at a CAGR of 3.5%, reflecting slower adoption compared to more urbanized regions. This region, which includes more rural and less densely populated areas, tends to have lower awareness and demand for blackout fabrics. Traditional living spaces in these areas, with less emphasis on contemporary home design, result in slower growth in the market for blackout solutions. However, as the trend toward home improvement and modern living spreads, younger generations in the Rest of Japan are becoming more interested in products like blackout curtains for better light control and sleep quality. Additionally, the region’s focus on energy efficiency, particularly as energy costs rise, is gradually increasing the adoption of blackout fabrics in homes and businesses. Though growth remains slow, the increasing availability of blackout fabric products and changing consumer lifestyles are expected to drive incremental demand in the coming years.

Demand for blackout fabric in Japan is growing due to higher consumer interest in energy saving, privacy, and improved sleep quality. Companies such as Hunter Douglas (holding approximately 22% market share), Springs Window Fashions, The Window Outfitters, Louvolite, and Mermet Corporation are leading suppliers in this sector. Japanese consumers and commercial buyers increasingly prefer fabrics that block light effectively, reduce heat gain or loss through windows, and support modern lifestyles such as remote work and urban living. The demand is also supported by building regulations and voluntary standards that aim to increase insulation and comfort in urban environments.

Competition in the blackout fabric industry is shaped by material innovation, functionality, and service support. Suppliers differentiate through fabric weight, weave density, backing materials, and flame retardant or antimicrobial finishes tailored to offices, hotels and homes. Another competitive factor is customisation: companies offer various colours, textures, and installation options that match interior design and window architecture common in Japan. Service support, local installation networks, and rapid turnaround also affect selection among commercial buyers and architects. Marketing materials generally focus on darkness level (e.g., 0%–1% light transmission), thermal insulation value, motorised operation compatibility, and ease of maintenance. By aligning their offerings with Japan’s demand for efficient, functional and design oriented window coverings, these firms aim to strengthen their presence in the blackout fabric market in Japan.

| Items | Details |

|---|---|

| Quantitative Units | USD Million |

| Regions Covered | Japan |

| End Use | Industrial Use, Hotels & Restaurants, Schools and Colleges, Photography Laboratories, Others |

| Thickness | 2-3 Ply, Above 3 Ply, Up to 1 Ply |

| Key Companies Profiled | Hunter Douglas, Springs Window Fashions, The Window Outfitters, Louvolite, Mermet Corporation |

| Additional Attributes | The market analysis includes dollar sales by end-use, thickness, and company categories. It also covers regional demand trends in Japan, particularly driven by the increasing adoption of blackout fabric in various industries, including hotels, restaurants, schools, and photography laboratories. The competitive landscape highlights key manufacturers focusing on innovations in fabric thickness and energy-efficient materials. Trends in the growing demand for high-quality blackout fabrics for residential and commercial applications are explored, along with advancements in product durability, light-blocking capabilities, and aesthetic design. |

The demand for blackout fabric in japan is estimated to be valued at USD 64.4 million in 2025.

The market size for the blackout fabric in japan is projected to reach USD 102.2 million by 2035.

The demand for blackout fabric in japan is expected to grow at a 4.7% CAGR between 2025 and 2035.

The key product types in blackout fabric in japan are industrial use, hotels & restaurants, schools and colleges, photography laboratories and others.

In terms of thickness, 2-3 ply segment is expected to command 41.0% share in the blackout fabric in japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Japan Fabric Stain Remover Market Analysis - Size, Share & Trends 2025 to 2035

Blackout Fabric Laminate Market Size and Share Forecast Outlook 2025 to 2035

Blackout Fabric Market Analysis – Trends, Growth & Forecast 2025 to 2035

Japan Coated Fabrics Market Growth – Trends, Demand & Innovations 2025–2035

Japan Faith-based Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Sports Tourism Market Size and Share Forecast Outlook 2025 to 2035

Fabric Spreading Machine Market Forecast Outlook 2025 to 2035

Fabric Freshener Market Forecast and Outlook 2025 to 2035

Fabric Inspection Machine Market Size and Share Forecast Outlook 2025 to 2035

Japan Respiratory Inhaler Devices Market Size and Share Forecast Outlook 2025 to 2035

Japan Halal Tourism Market Size and Share Forecast Outlook 2025 to 2035

Fabric Cutting Machine Market Size and Share Forecast Outlook 2025 to 2035

Japan Automated People Mover Industry Size and Share Forecast Outlook 2025 to 2035

Japan Automotive Load Floor Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Fabric Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Japan Food Cling Film Market Size and Share Forecast Outlook 2025 to 2035

Japan Polypropylene Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Fabric Toys Market Size and Share Forecast Outlook 2025 to 2035

Fabric Softener Sheet Market Size and Share Forecast Outlook 2025 to 2035

Japan Probiotic Yogurt Market is segmented by product type, source type, nature type, flavor type, fat content, sales channel and key city/province through 2025 to 2035.

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA