The demand for blood collection devices in the USA is expected to grow from USD 3.3 billion in 2025 to USD 5.9 billion by 2035, reflecting a CAGR of 6.2%. Blood collection devices, including needles, syringes, vacutainers, and blood bags, are essential for medical diagnostics, blood donation, and clinical procedures. The increasing number of medical procedures, health screenings, and diagnostic testing is driving the growing demand for blood collection. Additionally, the rise in chronic diseases, age-related conditions, and the expansion of healthcare access are increasing the frequency of blood tests and consequently, the demand for blood collection devices.

Technological advancements in needle design, safety features, and automation are improving the efficiency and safety of blood collection, leading to increased adoption. Furthermore, the growing use of blood collection devices in the clinical trials sector and the rise of home healthcare services will further drive market growth. As healthcare systems continue to prioritize patient safety, infection prevention, and improved patient experience, the demand for innovative and safe blood collection solutions will remain strong throughout the forecast period.

From 2025 to 2030, the demand for blood collection devices in the USA will grow from USD 3.3 billion to USD 4.4 billion, contributing USD 1.1 billion in value. During this phase, the market will experience acceleration, primarily driven by the increased volume of blood tests, diagnostic procedures, and routine medical check-ups. The demand will be particularly strong in hospitals, clinical labs, and health screening centers as they expand their services to meet the growing healthcare needs of the aging population and chronic disease management. Innovations in safety features, such as needles with retractable tips, and the growing focus on minimizing patient discomfort will also contribute to accelerated growth during this period.

From 2030 to 2035, the market will grow from USD 4.4 billion to USD 5.9 billion, adding USD 1.5 billion in value. During this phase, growth will decelerate slightly as the market matures and becomes more saturated with standard blood collection devices. While demand will continue to rise due to expanded healthcare access, increased demand for diagnostics, and blood donations, the rate of growth will slow. The market will stabilize, with increased adoption of automated collection systems and home care testing kits offsetting slower growth in traditional blood collection methods. As a result, the pace of market expansion will moderate in this phase, though demand will remain strong due to the ongoing need for blood collection in both clinical and home care settings.

| Metric | Value |

|---|---|

| Industry Sales Value (2025) | USD 3.3 billion |

| Industry Forecast Value (2035) | USD 5.9 billion |

| Industry Forecast CAGR (2025-2035) | 6.2% |

Demand for blood collection devices in the USA is rising as healthcare providers expand diagnostic, preventive and therapeutic services that require routine blood sampling. An aging population and the growing prevalence of chronic diseases such as diabetes, cardiovascular disorders and autoimmune conditions increase the need for blood tests. This trend, combined with an uptick in outpatient care and home healthcare settings, contributes to higher uptake of devices like vacutainers, lancets and collection systems. Forecasts indicate a compound annual growth rate (CAGR) of approximately 6.2% for the USA between 2025 and 2035.

Another factor supporting demand is the evolution of device technology and healthcare delivery models. Innovations such as safety-engineered blood collection systems, integrated bar coding, and devices compatible with point of care and home care scenarios make collection more efficient and safer. Additionally, the shift toward personalized medicine and preventive screening encourages higher frequency of blood based diagnostics and thus drives device demand. Challenges include regulatory scrutiny, supply chain constraints for materials like plastics and rubber, and cost containment pressures in healthcare. Despite these issues, the steady increase in diagnostic demand and device innovation suggests that demand for blood collection devices in the USA will continue to grow.

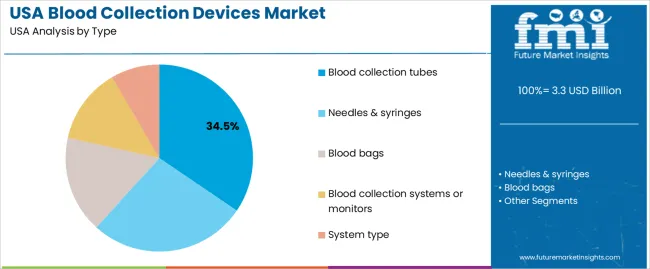

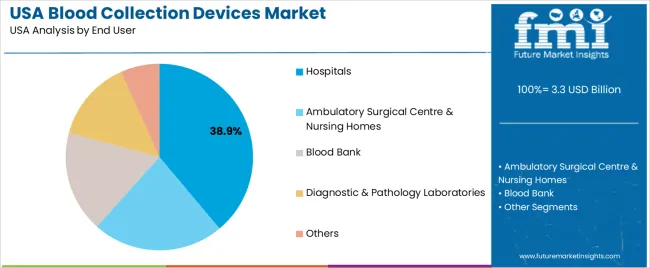

The demand for blood collection devices in the USA is primarily driven by type and end-user segment. The leading type is blood collection tubes, capturing 35% of the market share, while hospitals are the dominant end-user segment, accounting for 38.9% of the demand. Blood collection devices, including tubes, syringes, and blood bags, are essential for healthcare settings to collect, store, and transport blood samples for various diagnostic and therapeutic purposes.

Blood collection tubes lead the market for blood collection devices in the USA, holding 35% of the demand. These tubes are crucial for collecting blood samples in a variety of healthcare settings, including hospitals, diagnostic labs, and clinics. They come in various types, such as those for plasma, serum, or whole blood, and are used in conjunction with other blood collection tools like needles and syringes. Their design ensures that blood samples are properly contained, preventing contamination and ensuring accurate test results.

The demand for blood collection tubes is driven by their versatility and their critical role in diagnostic procedures, where the accurate collection and processing of blood samples are essential. They are commonly used in routine blood tests, blood donations, and emergency medical procedures. As the demand for diagnostic testing, patient monitoring, and research continues to grow, blood collection tubes are expected to remain a dominant product type in the market. Their widespread use across various medical fields ensures continued demand in the healthcare industry.

Hospitals are the largest end-user segment for blood collection devices in the USA, capturing 38.9% of the demand. Hospitals are key environments where blood collection devices are most frequently used, as they provide a wide range of services, including emergency care, diagnostic testing, and inpatient monitoring. Blood collection devices are critical in hospital settings for performing routine blood tests, blood transfusions, and surgical procedures.

The demand from hospitals is driven by the need for efficient and accurate blood collection methods to support diagnostic testing, patient care, and medical research. Blood collection devices, such as blood bags and syringes, are essential tools in managing patient health, conducting surgeries, and performing medical examinations. As hospitals continue to expand services and focus on improving patient care and diagnostics, the demand for blood collection devices is expected to remain strong. This sector's continued growth, along with innovations in blood collection technology, will ensure that hospitals remain a key driver of demand in the market.

Demand for blood collection devices in the USA is shaped by increasing healthcare needs, chronic disease monitoring, and the growing frequency of diagnostic testing. The high volume of routine blood tests and the need for blood products such as plasma and red blood cells in medical procedures also drive demand. However, the cost of advanced safety features, evolving regulatory standards, and the integration of new technologies can moderate market growth. Together, these dynamics shape the ongoing demand for blood collection devices in the USA

Several factors support the growth of the blood collection device market. First, the rising prevalence of chronic conditions like diabetes and cardiovascular diseases leads to an increased need for frequent blood tests. Second, the demand for blood products for transfusions and surgeries directly impacts the use of blood collection bags and related devices. Third, technological advancements in safety engineered devices, such as vacuum systems and closed loop collections, increase demand in hospitals and laboratories. Lastly, growth in point of care testing and home collection applications drives the need for micro collection devices.

Despite strong growth drivers, challenges exist. High production costs for advanced devices, especially those with automated and safety features, may limit their adoption in smaller clinics. Additionally, integrating new technologies into existing healthcare systems can create obstacles. Supply chain disruptions and price fluctuations for critical components may affect production timelines and availability. While demand is rising, many medical facilities still use older collection methods, delaying the transition to newer, more advanced blood collection devices.

Key trends shaping the market include the increasing use of safety engineered devices to prevent occupational injuries and meet safety regulations. There is also growing adoption of micro volume collection devices for home testing and at home care. Automation is gaining traction in laboratories, with devices that integrate sample collection with analytics and sample tracking systems. Additionally, the focus on sustainability has led to the development of recyclable components and waste reduction systems for single use blood collection devices.

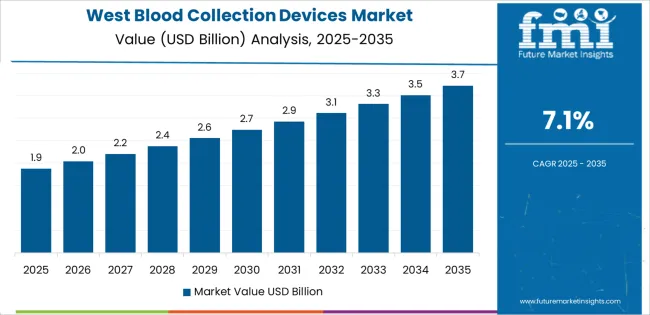

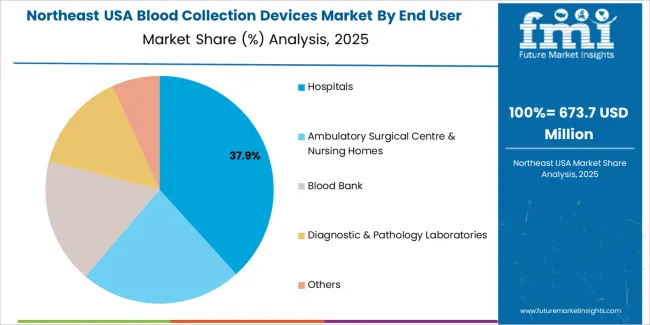

The demand for blood collection devices in the USA shows a steady growth pattern across different regions, with the West leading at a CAGR of 7.1%. The South follows with a CAGR of 6.4%, driven by increasing healthcare investments and demand for medical devices. The Northeast shows a more moderate growth rate of 5.7%, supported by its strong healthcare infrastructure. The Midwest has the lowest growth rate at 4.9%, reflecting stable but slower adoption. Overall, the growing healthcare needs, aging population, and increasing focus on diagnostic accuracy are contributing to the rising demand for blood collection devices, although the growth rate varies by region.

| Region | CAGR (2025-2035) |

|---|---|

| West | 7.1% |

| South | 6.4% |

| Northeast | 5.7% |

| Midwest | 4.9% |

The demand for blood collection devices in the West is projected to grow at a CAGR of 7.1%, supported by several factors, including the region's strong healthcare sector and increasing investments in medical technology. The West, with states like California and Washington, is home to numerous medical institutions, hospitals, and biotechnology companies that drive the demand for high-quality medical devices, including blood collection tools. The region’s focus on healthcare innovation, research, and diagnostic technologies has led to widespread adoption of advanced blood collection devices.

Additionally, the aging population in the West and the rising prevalence of chronic diseases, such as diabetes and cardiovascular conditions, contribute to the growing need for diagnostic testing and blood sampling. The West’s robust healthcare infrastructure and its position as a hub for medical advancements ensure sustained growth in the demand for blood collection devices.

In the South, the demand for blood collection devices is expected to grow at a CAGR of 6.4%, driven by the region’s expanding healthcare infrastructure and rising patient care needs. The South is experiencing significant growth in medical facilities, outpatient clinics, and diagnostic centers, all of which contribute to increased demand for blood collection devices. Additionally, the region’s rapidly growing population, particularly among elderly individuals, is fueling the need for routine diagnostic tests and medical procedures that require blood samples.

The South is also home to several major healthcare systems and hospitals, which are adopting the latest medical technologies to improve patient outcomes. This trend, combined with regional investments in healthcare, is expected to continue to support the demand for blood collection devices in the South.

In the Northeast, the demand for blood collection devices is projected to grow at a CAGR of 5.7%, supported by the region’s established healthcare infrastructure and high healthcare spending. The Northeast is home to some of the country’s most prestigious hospitals and medical research institutions, which drive the adoption of advanced diagnostic tools, including blood collection devices. As the region’s population ages, the need for medical testing and diagnostic procedures grows, contributing to an increase in demand for blood collection devices.

Additionally, the growing focus on precision medicine and accurate diagnostic tools further boosts the demand for these devices. While the growth rate is somewhat slower than in other regions, the Northeast’s strong healthcare network ensures steady demand for blood collection devices, especially in medical research and specialized diagnostic fields.

The demand for blood collection devices in the Midwest is expected to grow at a CAGR of 4.9%, reflecting stable but slower growth compared to other regions. The Midwest, with its strong network of hospitals, medical centers, and outpatient facilities, has a consistent demand for blood collection tools. However, the adoption of new medical technologies tends to be more gradual in the region, which contributes to the slower growth rate.

While the Midwest’s healthcare industry continues to expand, factors such as regional differences in healthcare funding, less rapid adoption of advanced diagnostic technologies, and a more conservative approach to new medical devices may limit faster growth. Nevertheless, as the healthcare sector in the Midwest continues to evolve, the demand for blood collection devices is expected to grow steadily, particularly with the aging population and the need for ongoing health monitoring.

The blood collection devices industry in the United States is driven by demand from hospitals, diagnostic laboratories and outpatient testing centres. Major companies in this market include Becton, Dickinson and Company (BD) with approximately 22.2% market share, Terumo Corporation, Fresenius Kabi, Haemonetics Corporation and Greiner Bio One. Devices such as collection needles, vacuum tubes, bag systems and accessories play a key role in sample integrity and laboratory workflow efficiency. As demand for diagnostic testing and blood based screening increases, blood collection device suppliers are adapting to both volume growth and evolving safety standards.

Competition in the USA blood collection devices market is influenced by product safety features, automation compatibility and reagent free workflow integration. Suppliers are developing devices with improved needle safety mechanisms, enhanced tubing connections and systems that minimise contamination risk. Another competitive focus is automation and high throughput compatibility: devices that integrate with automated processing systems and sample tracking are preferred by large clinical laboratories.

Cost efficiency and single use design also matter in high volume settings where infection control is paramount. Marketing materials typically emphasise features such as product sterility, needle gauge range, sample stability, and compatibility with upstream automation. By addressing the needs for safety, efficiency and integration into modern diagnostic workflows, these companies aim to sustain and grow their position in the USA blood collection devices industry.

| Items | Details |

|---|---|

| Quantitative Units | USD Billion |

| Regions Covered | USA |

| Type | Blood Collection Tubes, Needles & Syringes, Blood Bags, Blood Collection Systems or Monitors |

| End User | Hospitals, Ambulatory Surgical Centers & Nursing Homes, Blood Banks, Diagnostic & Pathology Laboratories, Others |

| Method | Manual Blood Collection, Automated Blood Collection |

| Application | Diagnostic, Therapeutic |

| Key Companies Profiled | Becton, Dickinson and Company (BD), Terumo Corporation, Fresenius Kabi, Haemonetics Corporation, Greiner Bio-One |

| Additional Attributes | The market analysis includes dollar sales by type, end-user, method, and application categories. It also covers regional demand trends in the USA, particularly driven by the increasing demand for blood collection devices in hospitals, blood banks, and diagnostic laboratories. The competitive landscape highlights key manufacturers focusing on innovations in blood collection technologies, including automated systems and advanced blood collection monitors. Trends in the growing demand for blood collection systems in therapeutic and diagnostic applications are explored, along with advancements in needle and syringe design, safety features, and automation for efficient blood collection. |

The demand for blood collection devices in usa is estimated to be valued at USD 3.3 billion in 2025.

The market size for the blood collection devices in usa is projected to reach USD 5.9 billion by 2035.

The demand for blood collection devices in usa is expected to grow at a 6.2% CAGR between 2025 and 2035.

The key product types in blood collection devices in usa are blood collection tubes, needles & syringes, blood bags, blood collection systems or monitors and system type.

In terms of end user, hospitals segment is expected to command 38.9% share in the blood collection devices in usa in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Blood Collection Devices Market Insights – Trends & Forecast 2025 to 2035

Assessing Vacuum Blood Collection Devices Market Share & Industry Trends

Demand for Blood Collection Devices in Japan Size and Share Forecast Outlook 2025 to 2035

Blood Warmer Devices Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Blood Collection Device Market Analysis - Size, Share & Forecast 2025 to 2035

Blood Clot Retrieval Devices Market Size and Share Forecast Outlook 2025 to 2035

Home Blood Testing Devices Market Insights - Trends, Growth & Forecast 2025 to 2035

Blood Glucose Monitoring Devices Market Size and Share Forecast Outlook 2025 to 2035

Pet Blood Pressure Monitoring Devices Market Size and Share Forecast Outlook 2025 to 2035

Point Of Care Blood Testing Devices Market Size and Share Forecast Outlook 2025 to 2035

Non-Invasive Blood Glucose Monitoring Devices Market Size and Share Forecast Outlook 2025 to 2035

Demand for Homecare Medical Devices in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Cardiovascular Repair & Reconstruction Devices in USA Size and Share Forecast Outlook 2025 to 2035

Blood Compatible Nanocoating Market Size and Share Forecast Outlook 2025 to 2035

Blood Gas Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Blood Sugar Tester Market Size and Share Forecast Outlook 2025 to 2035

Blood Flow Restriction Bands Market Size and Share Forecast Outlook 2025 to 2035

USA Medical Coding Market Size and Share Forecast Outlook 2025 to 2035

Blood-based Biomarker For Alzheimer's Disease Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Blood Bank Reagent Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA