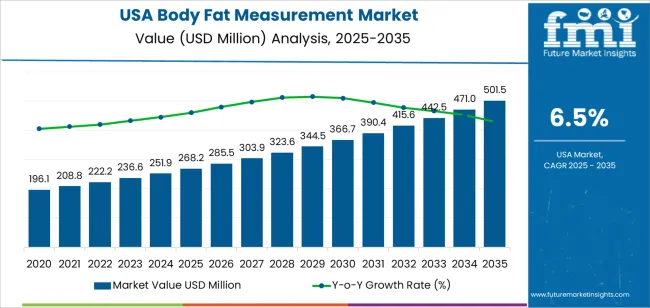

The demand for body fat measurement technology in the USA is expected to grow from USD 268.2 million in 2025 to USD 501.5 million by 2035, reflecting a compound annual growth rate (CAGR) of 6.5%. As health-conscious consumers continue to seek accurate and non-invasive methods to monitor and manage body composition, the demand for body fat measurement tools, such as bioelectrical impedance analysis (BIA), skinfold calipers, and dual-energy X-ray absorptiometry (DXA), is expected to rise. The increasing awareness of obesity-related health risks and the expanding fitness and wellness markets are key drivers of this growth.

The market will experience steady growth, with demand increasing from USD 268.2 million in 2025 to USD 285.5 million in 2026, USD 303.9 million in 2027, and USD 323.6 million in 2028. By 2029, the demand for body fat measurement technology will rise to USD 344.5 million, continuing its upward trajectory to USD 501.5 million by 2035, driven by growing health trends and an increasing emphasis on personalized fitness and health tracking.

The peak-to-trough analysis for the body fat measurement market reveals a steady, consistent growth pattern over the forecast period, with no significant peaks or troughs. Early years (2025–2029) will experience gradual annual increases in demand, with a relatively stable growth rate. The market will likely see moderate growth in the initial stages as the technology becomes more widely adopted in both fitness and medical settings.

In the later years of the forecast (2029–2035), the demand for body fat measurement tools is expected to continue expanding at a steady pace, reaching its peak value of USD 501.5 million in 2035. The analysis suggests that there will not be any major fluctuations or downturns in the market, indicating a smooth and predictable increase in demand. The growing focus on preventive healthcare, obesity management, and the increasing adoption of fitness tracking devices in mainstream health routines will support the continued demand for body fat measurement technologies, minimizing the likelihood of significant market downturns.

| Metric | Value |

|---|---|

| Industry Sales Value (2025) | USD 268.2 million |

| Industry Forecast Value (2035) | USD 501.5 million |

| Industry Forecast CAGR (2025 to 2035) | 6.5% |

Demand for body fat measurement in the USA is increasing due to growing awareness of health, fitness, and preventive care among general population. Rising rates of obesity and related metabolic disorders have increased interest in tracking not only weight but body composition - such as fat mass, muscle mass, and visceral fat. Individuals, fitness enthusiasts and health conscious consumers are using body fat measurement to monitor progress, maintain healthy body composition and manage risks linked to excess fat. The trend toward preventive health, wellness and lifestyle management supports greater adoption of body fat measurement as part of regular health monitoring.

Advances in technology and growing availability of affordable home use measurement tools support the rising demand. Devices such as bioelectrical impedance analysis (BIA) scales, body composition monitors and smart body fat analyzers have become more accessible and user friendly. These devices provide reasonably accurate estimates of body fat and overall composition for home, gym or clinical use. Growth of fitness centres, wellness programmes and corporate health initiatives also fuels demand for body fat measurement services and devices. As long as obesity remains a public health concern and more people adopt preventive health habits or fitness regimes, demand for body fat measurement in the USA is likely to grow steadily.

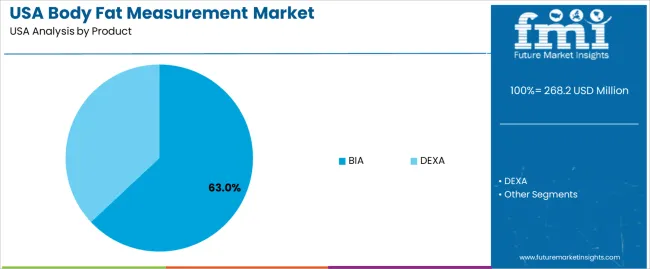

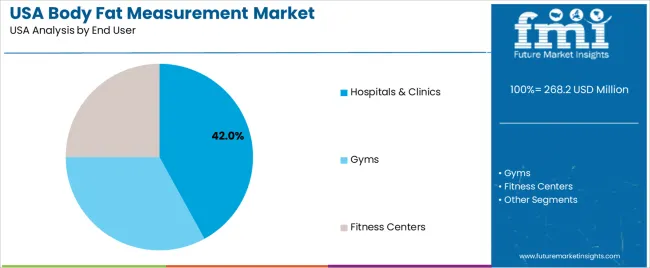

The demand for body fat measurement in the USA is primarily driven by product and end user. The leading product is BIA (Bioelectrical Impedance Analysis), which accounts for 63% of the market share, while hospitals and clinics are the dominant end-user segment, capturing 42% of the demand. As health and wellness awareness continues to grow, body fat measurement tools are becoming increasingly important in both clinical and fitness settings. The demand for accurate and non-invasive body composition analysis, particularly through BIA technology, is strong in the USA, driven by its application in health management and fitness optimization.

BIA (Bioelectrical Impedance Analysis) leads the demand for body fat measurement in the USA, holding 63% of the market share. BIA is a popular method for assessing body composition, including body fat percentage, muscle mass, and hydration levels. This method works by passing a small electrical current through the body and measuring the resistance to the flow of electricity, which varies between different tissue types. BIA is favored for its ease of use, speed, and non-invasive nature, making it suitable for both clinical and fitness applications.

The demand for BIA is driven by its accessibility and relatively low cost compared to other body fat measurement methods, such as DEXA (Dual-Energy X-ray Absorptiometry). BIA devices are commonly used in hospitals, clinics, gyms, and fitness centers to monitor body composition as part of overall health assessments. As consumers and healthcare professionals continue to focus on health management and disease prevention, BIA remains the preferred choice for routine body fat measurement in the USA due to its convenience, affordability, and efficiency.

Hospitals and clinics lead the end-user demand for body fat measurement in the USA, capturing 42% of the market share. Body fat measurement is essential in healthcare settings for managing various conditions, such as obesity, metabolic disorders, and cardiovascular diseases. Hospitals and clinics use body fat measurement tools to assess patients' health status, guide treatment plans, and monitor progress in weight management and rehabilitation programs.

The demand from hospitals and clinics is driven by the increasing focus on preventative healthcare and the need for accurate body composition analysis. Medical professionals use body fat measurements to evaluate patients' risk for certain chronic diseases and provide personalized care. As the healthcare sector places more emphasis on managing obesity and related health conditions, the demand for reliable and accurate body fat measurement technologies, such as BIA, is expected to remain strong. Hospitals and clinics will continue to be the leading end-user segment for body fat measurement tools in the USA as they play a central role in patient care and health monitoring.

Demand for body fat measurement in the USA has been rising steadily in recent years. As more individuals, fitness centers, healthcare providers, and wellness programs prioritize body composition rather than just body weight, tools and services for body fat measurement have become more important. The market for body fat measurement devices and services is expanding, supported by growing awareness of obesity, metabolic health, and the value of tracking fat versus lean mass. Both at home scales and clinic grade body composition analyzers are in demand as consumers and professionals seek accurate, actionable health data.

What are the Drivers of Demand for Body Fat Measurement in the USA?

One key driver is increasing health awareness among Americans, especially the elevated concern about obesity, metabolic disorders, and chronic disease risk. As more people focus on preventive health, body fat measurement is valued as a tool to assess risk beyond simple body weight or BMI. Another driver is growth in the fitness and wellness industry, including gyms, personal trainers, and home workouts; many users rely on body fat measurements to track progress, monitor fat loss or muscle gain, and tailor nutrition or training plans. Advances in technology and accessibility - such as portable bioelectrical impedance devices, consumer friendly smart scales, and affordable measurement tools - make it easier for individuals to monitor body composition at home. Additionally, clinical and diagnostic use in healthcare settings for obesity management, metabolic testing, and preventive health assessments supports professional demand for accurate measurement tools.

What are the Restraints on Demand for Body Fat Measurement in the USA?

Despite growth, some factors restrain demand. One restraint is cost: high precision measurement devices (such as DEXA, Bod Pod, or advanced analyzers) remain relatively expensive, making them less accessible for price sensitive consumers or smaller clinics. Another restraint is variability in accuracy and consistency across different measurement methods; less accurate consumer level devices may produce unreliable results, discouraging reliance on them. Some individuals may distrust body fat measurement outcomes or feel that weight and general health markers suffice, limiting adoption of specialized measurement. Additionally, for occasional fitness users or those with modest health concerns, the perceived benefit may not justify the expense and effort of regular body fat measurement. Finally, regulatory, privacy, or data security concerns (for devices linked to apps or health platforms) might limit adoption in certain segments.

What are the Key Trends Influencing Demand for Body Fat Measurement in the USA?

One major trend is rising demand for home based body composition devices and smart scales as consumers seek convenience, privacy, and ongoing monitoring. Many users prefer at home tracking rather than visiting clinics. Another trend is integration of body fat measurement into broader health management and wellness platforms, including nutrition apps, fitness trackers, and telehealth services; this links body composition data with diet, exercise, and long term health tracking. There is also growing adoption of more accurate and non invasive measurement technologies (for example bioelectrical impedance, multi frequency analyzers, or portable devices) which balance precision and affordability. In addition, increasing demand from healthcare providers and wellness clinics for preventive health screening, obesity management, and metabolic monitoring supports institutional use of body fat measurement tools. Finally, growing public and clinical recognition that fat percentage and body composition provide better insight into health risks than BMI or weight alone is shaping long term adoption.

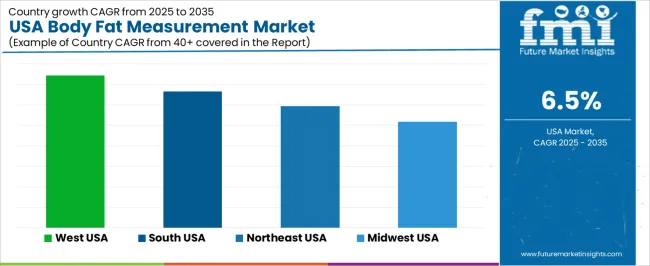

The demand for body fat measurement in the USA is expected to show strong growth across various regions. The West USA is projected to experience the highest CAGR of 7.4%, followed by the South USA at 6.7%, the Northeast USA at 5.9%, and the Midwest USA at 5.2%. These regional differences reflect variations in health trends, fitness participation, and increasing public awareness of the importance of body composition in relation to overall health. Key drivers include rising obesity rates, growing fitness culture, technological advances in measurement devices, and the increasing availability of body fat analysis in clinical and home settings.

| Region | CAGR (%) |

|---|---|

| West USA | 7.4 |

| South USA | 6.7 |

| Northeast USA | 5.9 |

| Midwest USA | 5.2 |

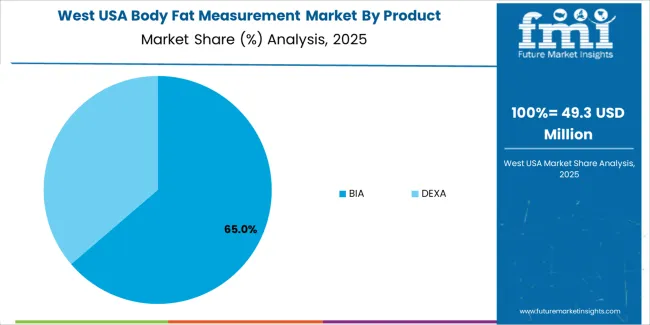

In the West USA, the projected 7.4% annual growth in demand for body fat measurement is driven by a combination of factors, including high levels of health awareness, fitness participation, and technological adoption. The West has a large population of health-conscious consumers who actively engage in physical activities such as triathlons, marathons, and fitness routines. This region has also witnessed a shift toward more advanced methods of health tracking, with individuals increasingly interested in precise measurements of body composition. Moreover, the popularity of wellness-focused trends such as mindfulness and biohacking further fuels interest in body fat measurement. These factors, along with a growing emphasis on preventive health care, are key drivers of growth in the body fat measurement market in the West USA.

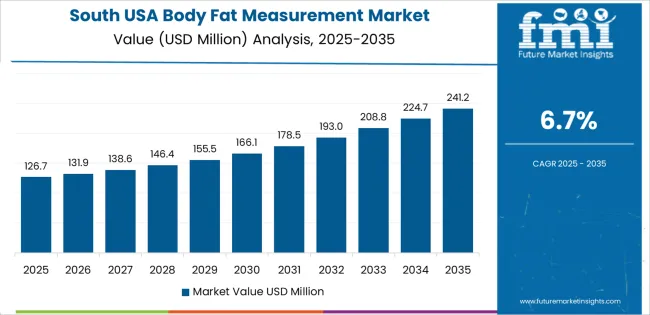

In the South USA, the demand for body fat measurement is expected to grow at a CAGR of 6.7%, reflecting the region's increasing focus on obesity prevention and overall health improvement. The South has historically had high obesity rates, which has led to a heightened awareness of the need to monitor and manage body composition. As healthcare providers and fitness centers in the region adopt more advanced body fat measurement technologies, more consumers are opting for accurate methods to track their health. Additionally, the South's expanding fitness culture and rising participation in sports such as running, cycling, and bodybuilding further fuel the demand for body fat measurement tools. Increasingly affordable at-home measurement devices have also contributed to wider consumer adoption, allowing individuals to monitor their body composition regularly and make informed health decisions.

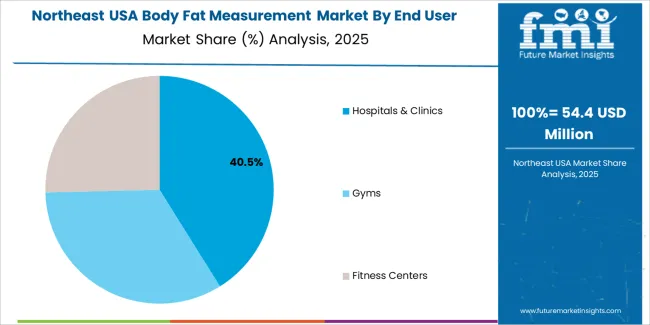

The Northeast USA, with a projected CAGR of 5.9%, is expected to see steady growth in the demand for body fat measurement. The region's high population density and a large number of healthcare institutions contribute to increasing access to advanced diagnostic and wellness services. There is a growing awareness among healthcare providers and the general public regarding the importance of body composition as a key metric of overall health, especially in relation to conditions such as heart disease, diabetes, and metabolic syndrome. In addition to clinical applications, fitness centers and personal trainers in the Northeast are increasingly adopting body fat measurement tools to track client progress and design personalized health and fitness programs. These trends are helping to drive demand for body fat measurement devices and services in the Northeast USA.

In the Midwest USA, the projected CAGR of 5.2% for body fat measurement is reflective of gradual but steady growth. The Midwest, which has a large population of working class individuals and rural communities, is experiencing increasing awareness about the role of body composition in health and fitness. With rising obesity rates and growing concerns about chronic health conditions, more people in the Midwest are turning to body fat measurement as a tool for monitoring health and making informed lifestyle changes. Fitness centers, healthcare providers, and wellness clinics in the region are incorporating body fat measurement into their services. Furthermore, affordable, easy-to-use at-home body fat measurement devices are gaining popularity, making it easier for consumers in the Midwest to track their progress in managing body composition. As these factors continue to evolve, demand for body fat measurement services and devices is expected to grow steadily in the Midwest USA.

The body fat measurement market in the USA draws demand from rising health awareness, obesity prevalence and growth in fitness and preventive care adoption. The national body composition analyzers market was valued around USD 203.0 million in 2024 and is expected to grow at a compound annual rate of roughly 7.0% through 2033. Bio impedance (BIA) devices lead in USAge owing to affordability and ease of use. Dual energy X ray absorptiometry (DEXA) instruments are gaining traction for clinical and diagnostic precision. The market’s expansion reflects growing interest from hospitals, wellness centers, gyms and individual consumers aiming for accurate body composition tracking.

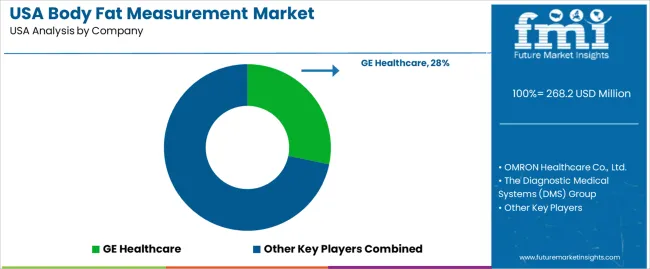

Competition among suppliers centres on technology accuracy, device portability, ease of use, data output and price. A leading company in this domain is GE Healthcare with about 28.2% market share. Other significant firms include OMRON Healthcare Co., Ltd., The Diagnostic Medical Systems (DMS) Group, Hologic Inc. and Xiaomi. Some providers emphasise clinical grade analyzers with high precision suitable for hospitals. Others target home users or fitness consumers with portable or smart BIA scales offering convenience, affordability and basic body fat estimates. Device-guides and brochures typically highlight factors like measurement speed, reproducibility, user comfort, data depth (fat, muscle, water, bone mass) and connectivity or integration with health apps. Market pressure continues as suppliers enhance features to meet diverse end user needs including clinical accuracy, home wellness monitoring and fitness tracking.

| Items | Details |

|---|---|

| Quantitative Units | USD Million |

| Regions Covered | USA |

| Product | BIA, DEXA |

| End-User | Hospitals & Clinics, Gyms, Fitness Centers |

| Key Companies Profiled | GE Healthcare, OMRON Healthcare Co., Ltd., The Diagnostic Medical Systems (DMS) Group, Hologic Inc., Xiaomi |

| Additional Attributes | Dollar sales by product type and end-user reveal strong demand for BIA (Bioelectrical Impedance Analysis) and DEXA (Dual-Energy X-ray Absorptiometry) for body fat measurement. Hospitals and clinics lead in USAge, followed by gyms and fitness centers, where fitness tracking is increasingly popular. Companies like OMRON and Hologic provide advanced, reliable measurement solutions. The market is expected to grow as demand for health tracking and obesity management increases, along with the rise in fitness awareness. |

The demand for body fat measurement in USA is estimated to be valued at USD 268.2 million in 2025.

The market size for the body fat measurement in USA is projected to reach USD 501.5 million by 2035.

The demand for body fat measurement in USA is expected to grow at a 6.5% CAGR between 2025 and 2035.

The key product types in body fat measurement in USA are bia and dexa.

In terms of end user, hospitals & clinics segment is expected to command 42.0% share in the body fat measurement in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Body Fat Measurement Market Analysis - Trends, Growth & Forecast 2025 to 2035

Body Fat Reduction Market Growth - Trends & Forecast 2025 to 2035

USA Ferric Sulfate Market Analysis – Demand, Growth & Forecast 2025-2035

USA and Canada Potassium Sulfate Market Report – Trends, Demand & Outlook 2025 to 2035

Fatigue Testing Machine Market Size and Share Forecast Outlook 2025 to 2035

USA Medical Coding Market Size and Share Forecast Outlook 2025 to 2035

Fats And Oils Market Size and Share Forecast Outlook 2025 to 2035

Body Armor Plates Market Size and Share Forecast Outlook 2025 to 2035

Body Composition Monitor and Scale Market Size and Share Forecast Outlook 2025 to 2035

USA Labels Market Size and Share Forecast Outlook 2025 to 2035

Fatty Methyl Ester Sulfonate Market Size and Share Forecast Outlook 2025 to 2035

USA Plant-based Creamers Market Size and Share Forecast Outlook 2025 to 2035

USA Barrier Coated Paper Market Size and Share Forecast Outlook 2025 to 2035

USA Electronic Health Records (EHR) Market Size and Share Forecast Outlook 2025 to 2035

USA Animal Model Market Size and Share Forecast Outlook 2025 to 2035

Fatty Acids Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Packer Bottle Market Size and Share Forecast Outlook 2025 to 2035

USA Stretch Hood Films Market Size and Share Forecast Outlook 2025 to 2035

Fat Replacers, Salt Reducers and Replacers Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Fence Screen Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA