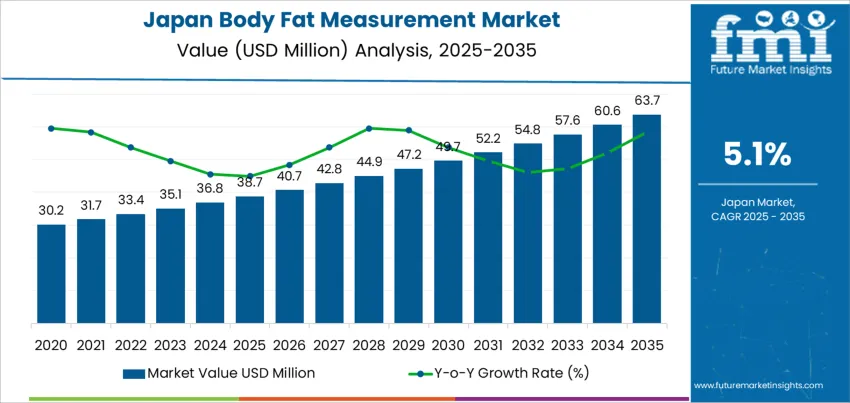

The demand for body fat measurement devices in Japan is expected to grow from USD 38.7 million in 2025 to USD 63.7 million by 2035, reflecting a CAGR of 5.1%. The increasing focus on health and fitness, along with the rise of preventative healthcare, is driving this demand. As awareness around the importance of maintaining a healthy body composition grows, more consumers are seeking accurate and easy-to-use body fat measurement devices for home use and in healthcare settings. With rising obesity rates and a growing emphasis on overall well-being, these devices are becoming integral for individuals aiming to track and manage their body composition.

Technological advancements in body fat measurement methods, such as bioelectrical impedance analysis (BIA) and other non-invasive techniques, are contributing to the growth of this sector. The shift toward more affordable and accessible devices, along with improved accuracy, is attracting both consumers and healthcare professionals. Fitness enthusiasts and healthcare providers are increasingly using these devices to monitor progress in weight management, fitness routines, and treatment plans, further fueling the demand.

From 2025 to 2030, the demand for body fat measurement devices is expected to grow from USD 38.7 million to USD 52.2 million, adding USD 13.5 million in value. This phase will make a strong contribution to the overall demand, driven by an increasing focus on personal health and the growing trend of fitness tracking. As more people prioritize their health and body composition, the demand for body fat measurement devices will surge. The industry will also benefit from greater product innovation and improved affordability, making these devices more accessible to a wider consumer base. The integration of body fat measurement tools into smart fitness devices and health platforms will further support this growth.

From 2030 to 2035, the demand for body fat measurement devices will grow from USD 52.2 million to USD 63.7 million, contributing USD 11.5 million in value. While growth will continue, the rate of increase will slow slightly as the sector matures. The demand will remain robust due to the continued rise in health awareness and the adoption of body fat measurement tools by consumers and healthcare professionals. However, as the industry becomes more saturated, growth will shift toward incremental gains rather than large-scale expansion. Despite this, the demand for more advanced, user-friendly, and accurate devices will continue to drive steady growth throughout this period.

| Metric | Value |

|---|---|

| Demand for Body Fat Measurement in Japan Value (2025) | USD 38.7 million |

| Demand for Body Fat Measurement in Japan Forecast Value (2035) | USD 63.7 million |

| Demand for Body Fat Measurement in Japan Forecast CAGR (2025-2035) | 5.1% |

The demand for body fat measurement in Japan is growing as individuals become more focused on health, fitness, and weight management. Body fat measurement is a critical tool for tracking fitness progress, assessing health risks related to obesity, and understanding body composition. As awareness about the health risks of excess body fat, such as heart disease and diabetes, increases, there is a rising demand for accurate, non-invasive methods to monitor body fat percentage.

A significant driver of this growth is the increasing prevalence of health-conscious behavior and lifestyle changes in Japan. With rising concerns about obesity and chronic diseases, more people are turning to body fat measurement as part of their fitness regimes or regular health checkups. The aging population in Japan is contributing to the need for body composition analysis, as maintaining a healthy body fat percentage becomes increasingly important to overall health and mobility in older adults.

Advancements in technology are enhancing the accuracy and convenience of body fat measurement tools, such as bioelectrical impedance analysis (BIA) devices, smart scales, and handheld body fat analyzers. These innovations make body fat measurement more accessible and user-friendly, allowing consumers to track their body composition at home or in clinics. As health and fitness trends continue to rise in Japan, the demand for body fat measurement solutions is expected to continue growing steadily through 2035.

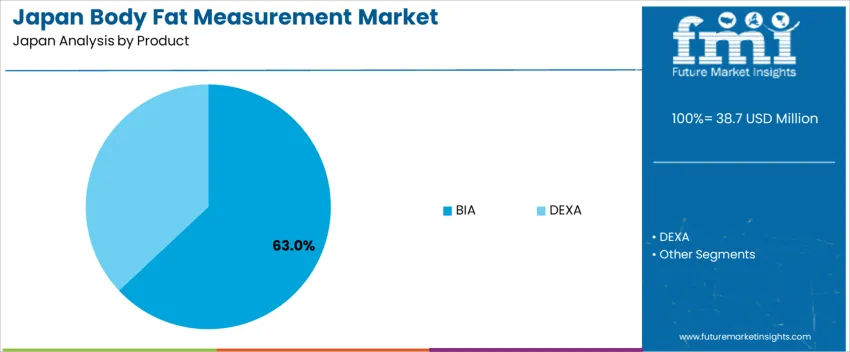

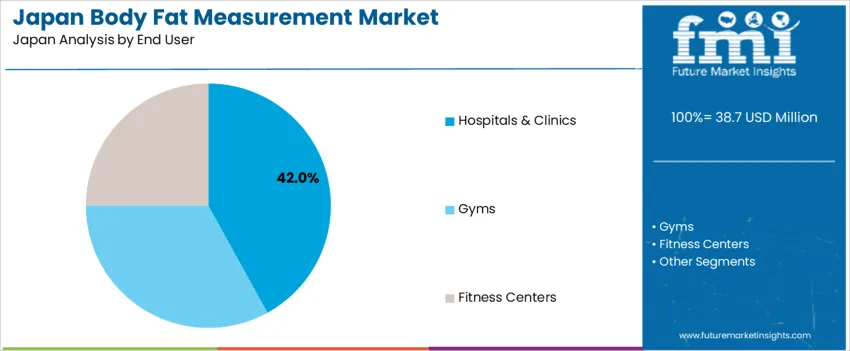

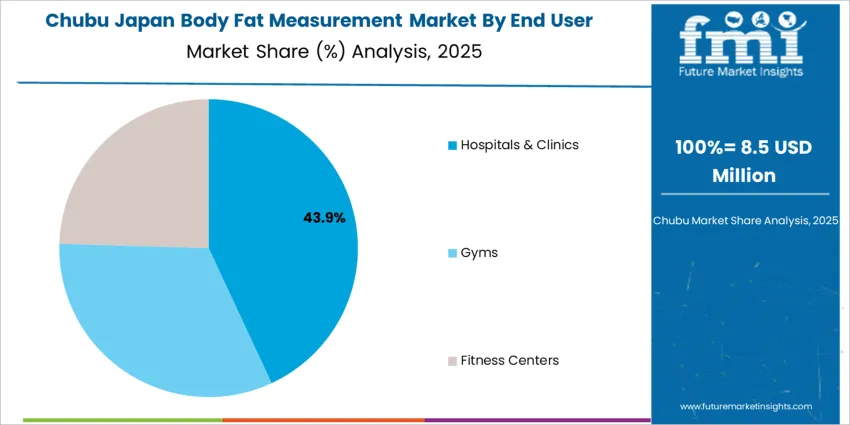

Demand for body fat measurement in Japan is segmented by product type, end user, and region. By product type, demand is divided into BIA (Bioelectrical Impedance Analysis) and DEXA (Dual-Energy X-ray Absorptiometry), with BIA holding the largest share at 63%. The demand is also segmented by end user, including hospitals & clinics, gyms, and fitness centers, with hospitals & clinics leading at 42%. Regionally, demand is distributed across Kyushu & Okinawa, Kanto, Kansai, Chubu, Tohoku, and the Rest of Japan.

BIA accounts for 63% of the demand for body fat measurement in Japan, primarily due to its affordability, ease of use, and non-invasive nature. BIA devices are widely used in both healthcare settings and fitness centers, as they provide a quick and reliable measurement of body fat percentage, muscle mass, and overall body composition. Unlike DEXA, which requires specialized equipment and professional supervision, BIA devices are accessible, portable, and can be used for routine monitoring.

As health and fitness awareness continues to rise in Japan, BIA devices are increasingly being adopted by both medical professionals and fitness enthusiasts. Their cost-effectiveness and user-friendly operation contribute to their dominance in the body fat measurement industry, making them the preferred choice for tracking body composition.

Hospitals & clinics account for 42% of the demand for body fat measurement in Japan. This is driven by the growing focus on healthcare and preventative medicine, where body fat percentage and overall body composition are key indicators of a patient's health. Medical professionals use body fat measurement devices like BIA and DEXA to assess patients' risk of obesity-related diseases, such as heart disease, diabetes, and hypertension.

Hospitals and clinics are increasingly incorporating body fat measurement into routine health assessments to monitor and manage patients' health more effectively. The demand for these measurements is expected to grow as more healthcare providers adopt advanced technologies for monitoring body composition and promoting wellness. As Japan's population ages and health concerns rise, the need for accurate and accessible body fat measurement tools in medical settings will continue to drive this segment's growth.

Devices that measure body fat and composition, such as bio‑impedance analyzers, body composition meters, and other non‑invasive instruments, are increasingly used in fitness centers, clinics, and homes. As awareness of obesity, lifestyle‑related illnesses, and age‑related body composition changes grows, many Japanese individuals and healthcare providers are seeking accurate ways to monitor fat, muscle, and overall body composition. The aging population, combined with rising interest in fitness and weight management, supports demand for body fat measurement tools. Despite growth, factors such as the high costs of advanced measurement devices and limited adoption in smaller clinics or households may slow broader penetration.

Why is Demand for Body Fat Measurement Growing in Japan?

Demand for body fat measurement is growing in Japan as individuals become more health-conscious, aiming to monitor and manage their body composition effectively. Rising concerns about obesity, diabetes, and cardiovascular health, as well as a focus on healthy aging, are driving the adoption of body fat measurement devices. As fitness and wellness trends continue to gain popularity, people are increasingly looking for ways to track fat reduction and muscle gain, particularly among those engaged in regular exercise or weight management programs. Healthcare providers and gyms also drive demand by incorporating body composition measurement into wellness programs, encouraging consumers to monitor their health regularly. The desire for more personalized health insights also fuels the use of these devices, helping individuals track progress toward their health and fitness goals.

How are Technological & Industry Innovations Driving Body Fat Measurement Demand in Japan?

Technological innovations are a key driver for the growing demand for body fat measurement in Japan. Advances in bio‑impedance technology, which allows for more accurate and efficient measurements of body composition, are making devices more accessible and user-friendly. Newer devices offer enhanced features such as Bluetooth connectivity, integration with health apps, and the ability to track changes over time, making them more attractive to health-conscious consumers. The development of portable, non‑invasive devices allows for easier use at home, contributing to the growing demand in personal wellness industries. The increase in health and fitness tracking wearables also aligns with the growing preference for tracking body composition data alongside other health metrics, which is further driving adoption of body fat measurement devices.

What are the Key Challenges and Risks That Could Limit Body Fat Measurement Demand in Japan?

The high cost of advanced measurement devices may deter price-sensitive consumers, particularly for home-use equipment. There may be limited awareness and education about the importance of body fat measurement and how it contributes to overall health monitoring, which could hinder broader acceptance. The adoption of body composition analysis may also be slow in smaller healthcare clinics, where budget constraints and limited demand may prevent investment in specialized equipment. Lastly, consumers may rely more on simpler weight scales or standard BMI measurements, rather than investing in more sophisticated tools for body fat analysis, which could limit the overall industry growth.

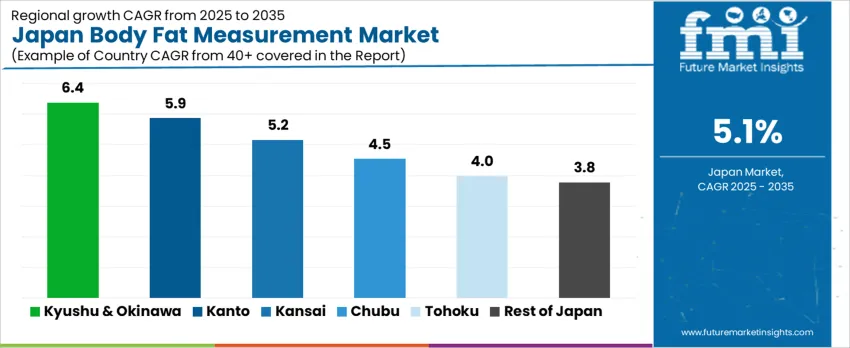

| Region | CAGR (%) |

|---|---|

| Kyushu & Okinawa | 6.4% |

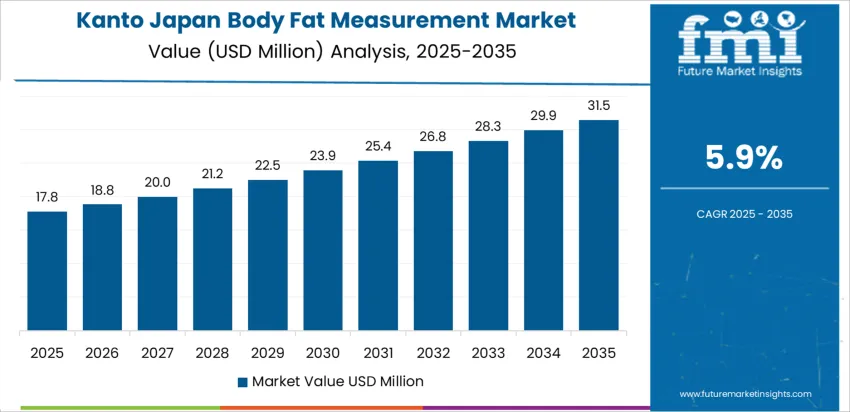

| Kanto | 5.9% |

| Kansai | 5.2% |

| Chubu | 4.5% |

| Tohoku | 4.0% |

| Rest of Japan | 3.8% |

Demand for body fat measurement in Japan is growing steadily, with Kyushu & Okinawa leading at a 6.4% CAGR, driven by the region’s increasing focus on health and fitness. Kanto follows with a 5.9% CAGR, supported by the high concentration of urban health-conscious consumers and fitness enthusiasts. Kansai shows a 5.2% CAGR, fueled by its sports culture and growing awareness of body composition. Chubu and Tohoku experience moderate growth at 4.5% and 4.0% CAGR, respectively, as interest in personal health monitoring rises. The Rest of Japan shows a 3.8% CAGR, with steady growth driven by rural consumers’ increasing focus on wellness.

Kyushu & Okinawa leads the demand for body fat measurement, growing at a 6.4% CAGR. The region’s active lifestyle culture, especially in Okinawa, where longevity and health are significant focus areas, contributes to this growth. As more individuals in the region participate in sports, fitness, and wellness programs, there’s an increasing interest in tracking body composition, particularly body fat percentage. Health-conscious consumers in Kyushu & Okinawa are increasingly adopting personal health monitoring tools such as smart scales and fitness trackers to better manage their health and fitness goals. The demand for accurate and reliable body fat measurement tools is rising due to an awareness of the importance of body composition in overall health. With both the younger population and older adults prioritizing health and fitness, Kyushu & Okinawa remains a strong industry for body fat measurement tools, expected to grow further with the increasing focus on health monitoring.

Kanto is experiencing steady demand for body fat measurement, with a 5.9% CAGR, driven by the region's large population and health-conscious consumer base. The focus on wellness and fitness, especially in major urban areas like Tokyo, has led to a growing demand for body fat measurement tools such as smart scales and fitness trackers. Kanto also has a high concentration of gyms, fitness centers, and health-conscious communities, which drives the industry for personal health monitoring devices. More people are becoming aware of the importance of body composition in overall health and are looking for ways to track their progress in weight management and fitness. As triathlons, marathons, and other fitness events become more popular in the region, athletes and everyday consumers alike are adopting body fat measurement tools to optimize performance and health. With increasing health awareness and advancements in measurement technology, demand for body fat measurement tools in Kanto is expected to continue growing steadily.

Kansai is seeing steady growth in demand for body fat measurement, with a 5.2% CAGR. The region’s growing awareness of health and fitness is contributing to the rise in demand for body fat measurement devices. Cities like Osaka and Kyoto are at the forefront of fitness trends, with increasing participation in triathlons, marathons, and other endurance sports. Athletes and fitness enthusiasts in Kansai are turning to body fat measurement tools to track their body composition and improve performance. The general population is becoming more aware of the health risks associated with high body fat, leading to an increase in demand for tools that allow for regular monitoring. With a focus on preventative health care and a rise in personal wellness programs, body fat measurement devices are gaining popularity in Kansai. As demand for health monitoring tools continues to grow, Kansai’s industry for body fat measurement is expected to see steady expansion.

Why is Demand for Body Fat Measurement Growing in Chubu?

Chubu is experiencing moderate growth in the demand for body fat measurement, with a 4.5% CAGR. The region’s growing focus on fitness, wellness, and health awareness contributes to this steady rise in demand. While the triathlon and marathon culture may not be as prominent as in other regions, there is a noticeable increase in interest in body composition tracking among athletes and health-conscious individuals in Chubu. Cities like Nagoya are home to a growing number of fitness centers and wellness programs, further encouraging the adoption of body fat measurement tools. As more people engage in fitness routines and monitor their health progress, tools such as smart scales, body fat monitors, and fitness trackers are becoming essential. The growing focus on lifestyle-related diseases and the importance of managing body fat as part of a healthy lifestyle drives demand. As health awareness spreads, the body fat measurement industry in Chubu is expected to grow steadily.

Tohoku is seeing moderate demand for body fat measurement, with a 4.0% CAGR. While the region has a smaller industry for personal health monitoring devices compared to other parts of Japan, the growing interest in fitness and wellness is gradually driving demand. As consumers in Tohoku become more aware of the importance of body composition for health, the need for body fat measurement tools is increasing. The region’s colder climate may also play a role, as consumers focus on maintaining a healthy lifestyle during the winter months. With a growing number of fitness clubs and health programs, Tohoku’s interest in wellness and preventive health care is rising, leading to increased adoption of body fat measurement tools. As people become more health-conscious and active, the demand for accurate and user-friendly body fat measurement devices in Tohoku is expected to continue to expand, supporting the industry's steady growth.

The Rest of Japan is experiencing steady demand for body fat measurement, with a 3.8% CAGR. Although the industry is more moderate compared to larger urban centers, the increasing awareness of fitness and health across rural and suburban areas is gradually driving demand. Consumers are becoming more focused on personal wellness and weight management, leading to greater adoption of body fat measurement tools. While the demand in rural areas is more modest, the growing awareness of body fat percentage and its impact on health is encouraging more individuals to invest in these tools. With increasing participation in local fitness programs and community-based health initiatives, demand for body fat measurement products in the Rest of Japan is expected to grow steadily. As health trends continue to reach these areas, the industry for body fat measurement tools is likely to expand at a consistent pace.

The demand for body fat measurement devices in Japan is growing as more consumers and healthcare professionals emphasize health monitoring and weight management. Body fat measurement tools, including bioelectrical impedance analysis (BIA) and dual-energy X-ray absorptiometry (DXA), are essential for assessing body composition and managing obesity, metabolic health, and fitness. Japan's aging population and increasing health consciousness are driving demand for reliable and easy-to-use devices, both for personal and professional health management.

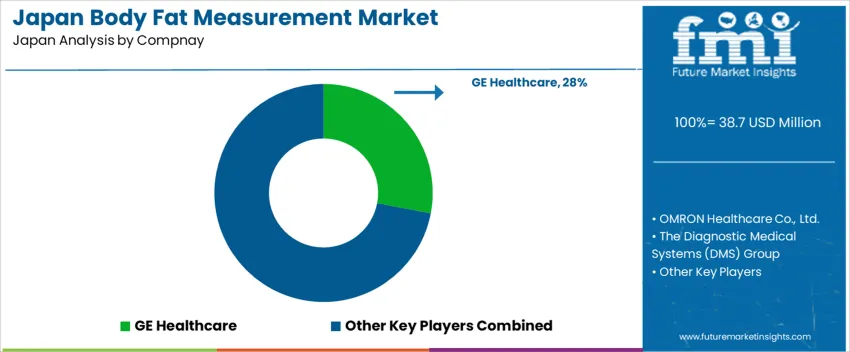

Leading companies in the body fat measurement industry in Japan include GE Healthcare, OMRON Healthcare Co., Ltd., The Diagnostic Medical Systems (DMS) Group, Hologic Inc., and Xiaomi. GE Healthcare holds a significant industry share of 28.0%, offering advanced body fat measurement technologies for clinical use. OMRON Healthcare Co., Ltd. is a key player in the consumer industry, providing body fat scales for home use. The DMS Group and Hologic Inc. specialize in clinical devices that offer high precision for hospitals and medical centers. Xiaomi, a major consumer electronics brand, also offers affordable body fat measurement solutions that integrate with its smart health ecosystem, catering to health-conscious consumers.

Competition in this industry is driven by the need for accuracy, ease of use, and affordability. Companies differentiate themselves by offering reliable measurements with advanced technology for both clinical and personal use. Consumer demand for integrated health-monitoring devices is growing, with many consumers looking for products that sync with mobile apps for tracking. The rise in health-consciousness and personalized healthcare continues to drive innovations in body fat measurement technology, pushing brands to innovate continuously.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD million |

| Product | BIA, DEXA |

| End User | Hospitals & Clinics, Gyms, Fitness Centers |

| Region | Kyushu & Okinawa, Kanto, Kansai, Chubu, Tohoku, Rest of Japan |

| Countries Covered | Japan |

| Key Companies Profiled | GE Healthcare, OMRON Healthcare Co., Ltd., The Diagnostic Medical Systems (DMS) Group, Hologic Inc., Xiaomi |

| Additional Attributes | Dollar sales by product and end user; regional CAGR and adoption trends; demand trends in body fat measurement; growth in healthcare, gyms, and fitness centers; technology adoption for BIA and DEXA measurements; vendor offerings including body fat measurement devices; regulatory influences and industry standards |

The demand for body fat measurement in Japan is estimated to be valued at USD 38.7 million in 2025.

The market size for the body fat measurement in Japan is projected to reach USD 63.7 million by 2035.

The demand for body fat measurement in Japan is expected to grow at a 5.1% CAGR between 2025 and 2035.

The key product types in body fat measurement in Japan are bia and dexa.

In terms of end user, hospitals & clinics segment is expected to command 42.0% share in the body fat measurement in Japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Body Fat Measurement Market Analysis - Trends, Growth & Forecast 2025 to 2035

Demand for Body Fat Measurement in USA Size and Share Forecast Outlook 2025 to 2035

Body Fat Reduction Market Growth - Trends & Forecast 2025 to 2035

Japan Fat Filled Milk Powder Market Analysis by Product Type, End Use, and Region Through 2035

Japan Ferric Sulfate Market Report – Demand, Trends & Industry Forecast 2025-2035

Japan Faith-based Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Sports Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Respiratory Inhaler Devices Market Size and Share Forecast Outlook 2025 to 2035

Japan Halal Tourism Market Size and Share Forecast Outlook 2025 to 2035

Fatigue Testing Machine Market Size and Share Forecast Outlook 2025 to 2035

Fats And Oils Market Size and Share Forecast Outlook 2025 to 2035

Body Armor Plates Market Size and Share Forecast Outlook 2025 to 2035

Body Composition Monitor and Scale Market Size and Share Forecast Outlook 2025 to 2035

Japan Automated People Mover Industry Size and Share Forecast Outlook 2025 to 2035

Japan Automotive Load Floor Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Fatty Methyl Ester Sulfonate Market Size and Share Forecast Outlook 2025 to 2035

Japan Food Cling Film Market Size and Share Forecast Outlook 2025 to 2035

Japan Polypropylene Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Fatty Acids Market Size and Share Forecast Outlook 2025 to 2035

Fat Replacers, Salt Reducers and Replacers Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA