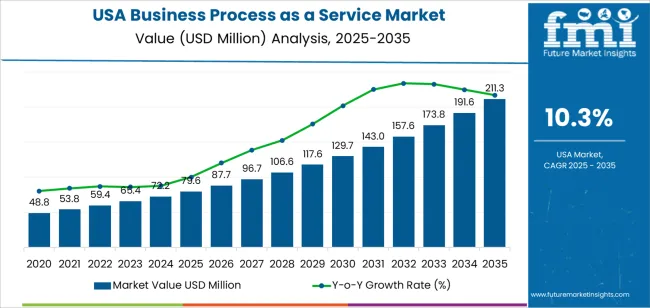

The demand for business process as a service in the USA is valued at USD 79.6 million in 2025 and is projected to reach USD 211.3 million by 2035 at a CAGR of 10.3%. From 2025 through roughly 2029, growth follows a measured slope as adoption remains concentrated among mid-sized enterprises using BPaaS for finance operations, payroll, procurement support, and customer management. During this phase, demand rises from USD 79.6 million toward the USD 100 million level. Enterprises prioritize cost predictability, reduced internal staffing pressure, and faster digital workflow deployment. Regulatory reporting, vendor onboarding, and claims processing remain the strongest functional entry points. Implementation cycles remain conservative as firms test long term vendor dependency and data handling exposure.

A clear shift in momentum becomes visible around 2030 as enterprise scale deployments expand across manufacturing, healthcare, retail, and logistics networks. From this stage forward, demand accelerates from about USD 117.6 million in 2030 toward USD 211.3 million by 2035. This inflection reflects wider acceptance of outsourced core process ownership, integration of BPaaS with ERP and analytics platforms, and rising confidence in service continuity models. Large enterprises drive this second phase as multi process contracts replace single function outsourcing. Automation depth, AI driven workflow routing, and real time compliance monitoring raise average contract value. Post 2030 growth is shaped by value density per client rather than only new account additions.

The growth curve for BPaaS demand in USA from 2020 to 2025 shows a steady but clearly building incline rather than a flat expansion. Market value rises from USD 48.8 million in 2020 to USD 79.6 million in 2025, with annual additions widening progressively from about USD 5.0 million to more than USD 7.4 million by the end of this phase. The curve shape in this period reflects early structural adoption as enterprises shift non-core workflows such as payroll, procurement, HR operations, and compliance reporting to cloud-based service models. The slope is upward but not abrupt, indicating methodical migration driven by cost rationalization and operational simplification rather than sudden digital disruption.

From 2025 to 2035, the growth curve steepens materially, transforming into a strong upward arc as demand expands from USD 79.6 million to USD 211.3 million. Annual absolute additions accelerate from roughly USD 8.1 million to nearly USD 19.7 million by the final years. This curvature indicates compounding scale effects as BPaaS moves beyond transactional outsourcing into integrated finance, supply chain, customer operations, and analytics-led process orchestration. The curve shape reflects a transition from early-stage cloud services to embedded enterprise execution infrastructure. Growth becomes density-driven, where each new client expands multiple process layers rather than a single functional workload.

| Metric | Value |

|---|---|

| Industry Value (2025) | USD 79.6 million |

| Forecast Value (2035) | USD 211.3 million |

| Forecast CAGR (2025 to 2035) | 10.3% |

Demand for Business Process as a Service in the USA arises from growing complexity in operations across sectors needing efficient support functions. Many firms juggle finance processing, human resources management, procurement, compliance documentation, and customer service across multiple states or global subsidiaries. Managing these internally demands substantial overhead in staffing, infrastructure, and process standardization. Outsourcing via cloud-based BPaaS platforms offers a way to centralize workflows, standardize procedures, and reduce overhead costs. Demand grew as companies adopted remote working, distributed teams, and more stringent compliance and reporting requirements. Early adopters saw improvements in turnaround time, consistency, and operational agility by shifting non-core processes to BPaaS providers.

What stands to shape future demand for BPaaS in the USA is integration of automation, analytics, and scalability as businesses face fluctuating volumes and regulatory pressure. BPaaS providers increasingly embed robotic process automation, data analytics, and real-time compliance monitoring into their offerings. This lets businesses handle tasks such as payroll, vendor onboarding, financial reconciliation, and regulatory filings with reduced manual intervention. Scalability enables firms to ramp up or down based on business cycles without heavy fixed costs. Barriers include data privacy concerns, integration challenges with legacy enterprise systems, and reluctance among some firms to outsource processes perceived as sensitive or strategic. The BPaaS market will grow where providers offer secure, compliant, and flexible solutions aligned to evolving business demands.

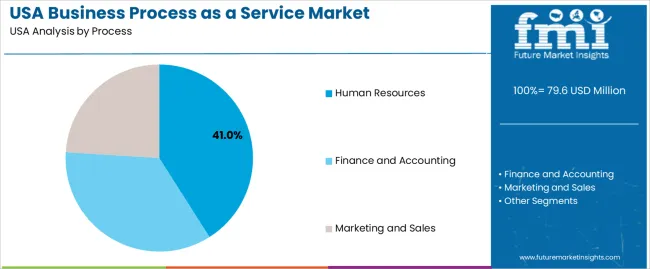

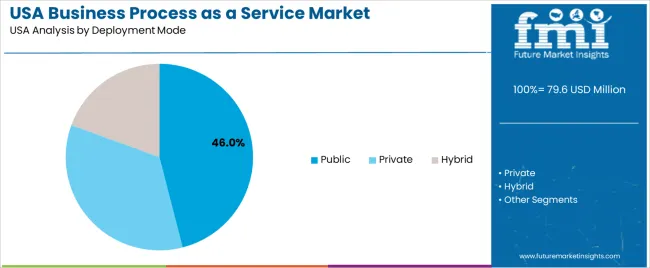

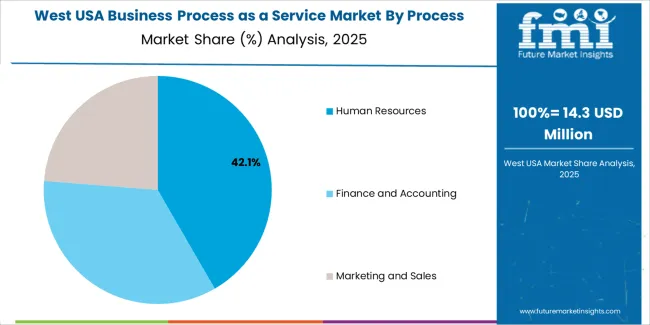

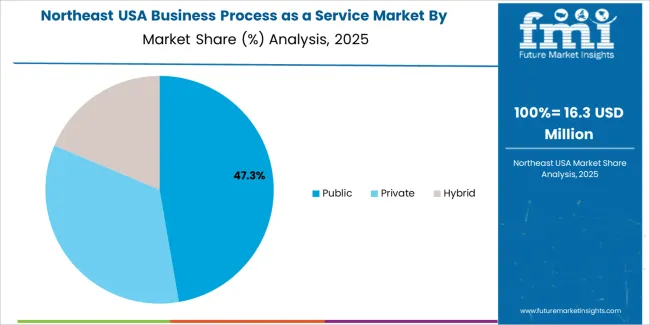

The demand for BPaaS in the USA is structured by process type and deployment mode. Human resources accounts for 41% of total demand, followed by finance and accounting and marketing and sales processes. By deployment mode, public cloud platforms represent 46.0% of total adoption, followed by private deployments used in regulated environments. Demand behavior is shaped by cost control objectives, workforce digitization needs, compliance requirements, and integration with enterprise systems. These segments reflect how operational outsourcing strategies and cloud infrastructure preferences define BPaaS procurement across corporate, service, and public sector organizations in the USA.

Human resources accounts for 41% of total BPaaS demand in the USA due to widespread outsourcing of payroll, benefits administration, recruitment workflow management, and employee data processing. Enterprises rely on BPaaS to reduce internal administrative burden while maintaining standardized compliance across labor laws, taxation rules, and reporting obligations. HR functions generate recurring transaction volumes that align well with subscription based service delivery models. Workforce mobility, remote employment, and multi state hiring further increase dependency on cloud delivered HR process platforms.

HR also shows higher outsourcing acceptance compared with finance or sales due to lower perceived operational risk. Automated onboarding, performance tracking, and employee self-service portals improve process consistency across locations. Mid-sized enterprises and multi-unit retail and service operators drive large scale adoption. These transaction intensity, compliance exposure, and workforce management requirements position human resources as the leading BPaaS process segment in the USA.

Public deployment accounts for 46.0% of total BPaaS demand in the USA due to scalability, rapid implementation, and lower upfront infrastructure investment. Public platforms allow organizations to activate multiple outsourced processes without investing in private server environments. Automatic updates, centralized security management, and disaster recovery support reduce internal IT maintenance requirements. These features align well with BPaaS delivery where service continuity and process uptime are critical.

Public deployment also supports faster expansion during workforce growth, mergers, and seasonal operational peaks. Small and mid-sized enterprises favor public BPaaS platforms due to limited in house IT resources. Integration with cloud based accounting, collaboration, and customer management systems strengthens workflow automation across departments. These scalability, accessibility, and cost efficiency advantages position public deployment as the dominant mode for BPaaS adoption across the USA.

Demand for BPaaS in the USA is driven by pressure on enterprises to reduce fixed operating costs while maintaining process control across finance, HR, procurement, and customer service. Organizations face persistent labor shortages in transactional roles, which makes outsourced, cloud-based process execution more attractive than internal staffing. Mid-sized firms adopt BPaaS to access enterprise-grade workflows without heavy software investment. Large enterprises use it to standardize fragmented operations across business units. These cost, complexity, and workforce constraints position BPaaS as an operating model shift rather than a simple IT procurement choice.

How Do Industry Workflows and Regulatory Requirements Shape BPaaS Adoption?

Healthcare providers use BPaaS for revenue cycle management, claims handling, and patient billing where compliance and accuracy are critical. Financial services apply BPaaS for transaction processing, reporting, and customer onboarding support. Retail and e-commerce rely on BPaaS for order fulfillment coordination, customer support, and returns processing. Human resources functions across industries use BPaaS for payroll, benefits administration, and compliance reporting. These applications reflect where process volume is high, rules are structured, and error tolerance is low. Regulatory oversight reinforces dependence on standardized, auditable service models.

What Data, Control, and Cost Concerns Restrain Wider BPaaS Expansion?

BPaaS adoption in the USA is restrained by concern over data exposure, vendor lock-in, and long-term cost escalation. Enterprises remain cautious about placing sensitive financial and personal data into third-party-managed workflows. Customization limits within standardized BPaaS platforms conflict with complex internal process variations. Migration from legacy systems involves significant data mapping and change management burden. Subscription models can become more expensive than in-house processing at scale. These control, privacy, and economic concerns slow adoption among highly specialized firms and data-sensitive industries.

How Are Automation, AI, and Platform Convergence Reshaping BPaaS Demand?

BPaaS in the USA is shifting toward automation-driven service delivery rather than labor-centric outsourcing. Robotic process automation executes repetitive tasks inside BPaaS platforms with minimal human intervention. AI handles document classification, exception management, and predictive workload balancing. BPaaS tools increasingly converge with ERP, CRM, and analytics systems to form end-to-end digital operations layers. Vertical-specific BPaaS platforms for healthcare, logistics, and finance are replacing generic services. These changes show BPaaS evolving into an intelligent operating infrastructure rather than a contract-based process outsourcing substitute.

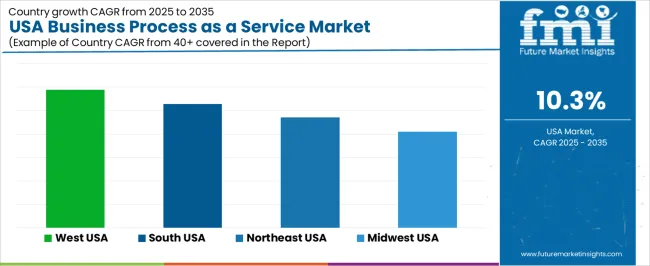

| Region | CAGR (%) |

|---|---|

| West | 11.8% |

| South | 10.6% |

| Northeast | 9.4% |

| Midwest | 8.2% |

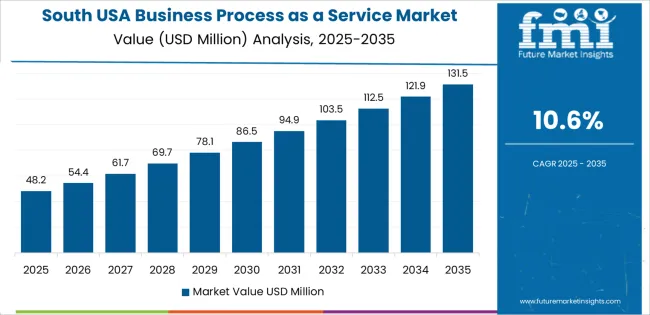

The demand for business process as a service in the USA shows strong regional growth, with the West leading at an 11.8% CAGR. This growth is supported by high cloud adoption, concentration of technology firms, and early migration of enterprises toward outsourced digital operations. The South follows at 10.6%, driven by rapid growth of small and mid sized enterprises seeking cost efficient process automation and remote service delivery. The Northeast records 9.4% growth, supported by steady adoption across financial services, healthcare, and professional services that require scalable back office operations. The Midwest shows comparatively slower growth at 8.2%, reflecting gradual digital transition among manufacturing, logistics, and regional service firms. Overall growth reflects rising demand for flexible, cloud based process outsourcing across USA enterprises.

Growth in the West reflects a CAGR of 11.8% through 2035 for BPaaS demand, supported by high concentration of technology firms, digital commerce operators, and venture backed enterprises seeking scalable back office outsourcing. Finance, customer support, human resources, and billing workflows are increasingly shifted to cloud based service providers. Startup expansion cycles favor flexible process models over in house infrastructure development. Software vendors integrate BPaaS with ERP and CRM platforms to support rapid deployment. Demand remains automation and scalability driven, with strong focus on cost visibility and workflow standardization across fast growing digital enterprises.

The South advances at a CAGR of 10.6% through 2035 for BPaaS demand, driven by healthcare administration outsourcing, logistics operations management, and expansion of shared service centers. Hospitals, insurance processors, and regional banks adopt BPaaS for claims processing, payroll, and customer service workflows. Manufacturing and distribution firms outsource procurement and vendor management functions. Population growth supports steady expansion of service sector employment. Demand remains operations driven rather than technology led, with stability and regulatory compliance shaping vendor selection across healthcare, finance, and logistics driven service industries.

The Northeast records a CAGR of 9.4% through 2035 for BPaaS demand, shaped by financial services outsourcing, legal process services, and insurance back office modernization. Regulatory reporting, document processing, and audit ready workflows represent major outsourced functions. Large institutional enterprises focus on risk control and service quality over cost reduction alone. Urban office density sustains high transaction throughput. Demand remains compliance led, with strong emphasis on data governance, reporting accuracy, and service continuity across banking, insurance, and professional services organizations operating in highly regulated environments.

The Midwest expands at a CAGR of 8.2% through 2035 for BPaaS demand, supported by manufacturing administration outsourcing, regional retail operations, and agricultural supply chain back office processing. Order management, invoicing, inventory accounting, and supplier coordination are the leading outsourced workflows. Cost sensitivity influences adoption pace, favoring bundled service contracts over customized platforms. Regional enterprises prioritize reliability and long term service agreements. Demand remains process stability driven rather than transformation driven, aligned with steady production output and predictable transaction volumes across industrial and wholesale business networks.

Demand for BPaaS in the USA is rising as companies across sectors adopt cloud based, outsourced process solutions to handle finance, HR, customer service, procurement, and back office tasks. The drive toward digital transformation and the need to manage costs push firms to favour scalable, USAge based services that reduce in house overhead. Automation, artificial intelligence, and analytics integration enhance data processing, compliance and decision support. Businesses with fluctuating workload patterns, regulatory complexity or seasonal demand particularly benefit. Smaller firms find BPaaS attractive because it avoids large capital investment while offering enterprise grade processes. These factors support steady adoption across retail, healthcare, finance, manufacturing and services sectors.

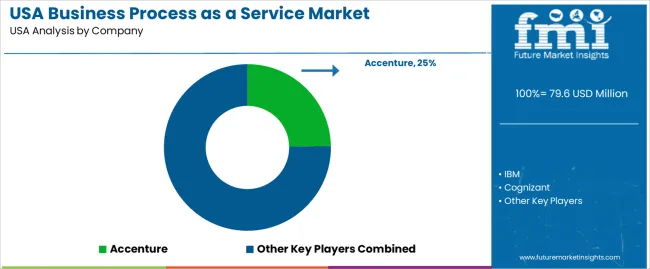

Key providers in the US BPaaS market include Accenture, IBM, Cognizant, Capgemini and Wipro. Accenture and IBM lead large enterprise contracts, offering comprehensive BPaaS suites and global delivery networks that combine consulting, cloud infrastructure and process outsourcing. Cognizant and Capgemini service both large and mid sized firms with modular BPaaS offerings across finance, supply chain and customer operations. Wipro often serves firms seeking cost effective, flexible outsourcing. These companies shape the market through broad service portfolios, cloud integration, and ability to provide reliable, compliant business process infrastructure at scale.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD million |

| Process | Human Resources, Finance and Accounting, Marketing and Sales |

| Deployment Mode | Public, Private, Hybrid |

| Region | Northeast USA, West USA, Midwest USA, South USA |

| Countries Covered | USA |

| Key Companies Profiled | Accenture, IBM, Cognizant, Capgemini, Wipro |

| Additional Attributes | Dollar by sales by process, Dollar by sales by deployment, Regional CAGR, Enterprise adoption patterns, AI-driven workflow integration, Cloud platform utilization, Compliance and regulatory alignment, Multi-process contract penetration, Cost efficiency and workforce digitization |

The demand for business process as a service in USA is estimated to be valued at USD 79.6 million in 2025.

The market size for the business process as a service in USA is projected to reach USD 211.3 million by 2035.

The demand for business process as a service in USA is expected to grow at a 10.3% CAGR between 2025 and 2035.

The key product types in business process as a service in USA are human resources, finance and accounting and marketing and sales.

In terms of deployment mode, public segment is expected to command 46.0% share in the business process as a service in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Business Process as a Service (BPaaS) Market Analysis by Process and Region Through 2035

USA Processed Cashew Market Analysis – Growth & Industry Trends 2025-2035

Business as a Service Market Size and Share Forecast Outlook 2025 to 2035

Demand for Cash Management Services (CMS) in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Biometric-as-a-Service in USA Size and Share Forecast Outlook 2025 to 2035

Analysis of the USA Processed Beef Market by Product Type, Processing Method, Distribution Channel, Packaging Type and Region through 2035

USA Casino Tourism Industry Analysis from 2025 to 2035

USA Yeast Market Analysis – Size, Share & Forecast 2025-2035

Aseptic Processing Market Growth - Trends & Forecast 2025 to 2035

Cashew Processing Machine Market Size and Share Forecast Outlook 2025 to 2035

USA Bagasse Tableware Products Market Outlook – Size, Trends & Forecast 2025-2035

USA Lactase Market Trends – Growth, Demand & Analysis 2025-2035

USA Food Service Industry Analysis from 2025 to 2035

USA Catalase Market Trends – Growth, Demand & Forecast 2025–2035

ASEAN Food Service Equipment Market Trends – Growth, Demand & Forecast 2025–2035

USA Food Service Equipment Market Insights – Demand, Size & Industry Trends 2025–2035

Plastic Processing Machinery Market Size and Share Forecast Outlook 2025 to 2035

Sausage Casing Market Size and Share Forecast Outlook 2025 to 2035

Market Share Insights of Leading Sausage Casing Providers

USA Bio-Plasticizers Market Report – Size, Share & Forecast 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA