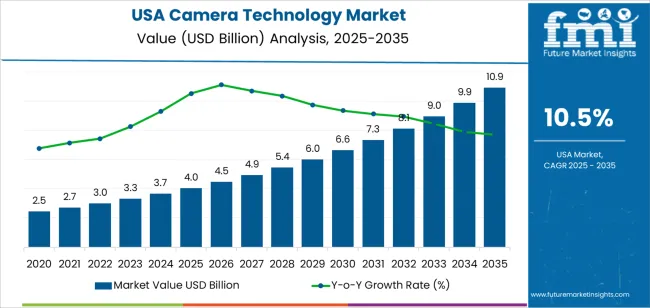

The USA camera-technology demand is valued at USD 4.0 billion in 2025 and is forecasted to reach USD 10.9 billion by 2035, reflecting a CAGR of 10.5%. Demand is influenced by the continuous integration of imaging systems across consumer electronics, surveillance, automotive safety, medical diagnostics, and robotics. Broader adoption of advanced imaging functions, including low-light optimisation, real-time processing, and multi-sensor fusion, supports expansion. Growth also reflects rising utilisation in industrial automation and security applications requiring reliable visual-data capture and analysis.

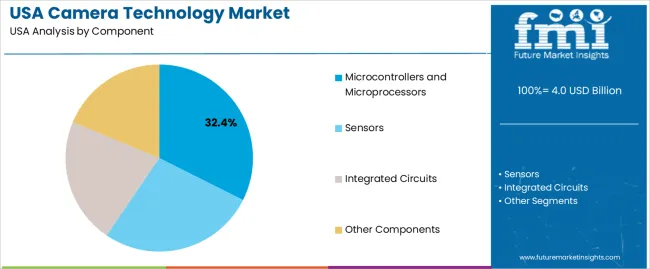

Microcontrollers and microprocessors lead the component landscape. These units are selected for their role in enabling image-signal processing, autofocus control, scene recognition, and sensor coordination across single and multi-camera modules. Increased emphasis on processing speed, power efficiency, embedded AI capabilities, and thermal stability continues to influence component preference across electronics manufacturers and security-system integrators.

West USA, South USA, and Northeast USA record the highest utilisation levels. These regions host technology developers, imaging-hardware manufacturers, and defence-surveillance integrators. The strong presence of consumer-electronics companies, software-engineering capabilities, and research institutions further supports regional demand. Key suppliers include Sony Corporation, Apple Inc., Nikon Corporation, Teledyne FLIR LLC, and Bosch Security Systems. These companies provide imaging sensors, microprocessor-based modules, thermal-imaging systems, and high-resolution camera platforms used in personal devices, automotive technologies, public-safety networks, and advanced industrial applications.

Peak-to-trough patterns in the USA camera-technology segment indicate a consistent upward movement with limited cyclical weakening. The early period shows a strong peak phase driven by upgrades in imaging sensors, growth in mobile-device photography, and wider adoption of advanced optics in consumer and professional applications. Demand rises steadily as imaging quality becomes a core feature across electronics and content-creation workflows. This forms the first peak, marked by active product-refresh cycles and rapid integration of computational-photography tools.

The mid period shows a mild trough as adoption rates stabilize across mature user groups. Replacement cycles lengthen, and purchasing decisions spread more evenly across years. This phase does not reflect contraction but a temporary moderation as the installed base reaches a higher level of saturation. Growth continues, though at a more measured pace, supported by niche applications in security, industrial automation, and healthcare imaging.

A renewed peak emerges in the later period as advanced imaging technologies expand within robotics, autonomous systems, and precision-measurement tools. These applications introduce new demand sources, lifting the trajectory again. Overall, peak-to-trough movement remains controlled, with each trough shallow and followed by a stronger recovery tied to new imaging-technology adoption.

| Metric | Value |

|---|---|

| USA Camera Technology Sales Value (2025) | USD 4.0 billion |

| USA Camera Technology Forecast Value (2035) | USD 10.9 billion |

| USA Camera Technology Forecast CAGR (2025-2035) | 10.5% |

Demand for camera technology in the USA is increasing across several segments, including digital cameras, surveillance systems and smart imaging devices, driven by a combination of consumer, commercial and industrial factors. In the consumer segment, content creation, streaming, vlogging and social media amplify demand for higher-quality digital and mirrorless cameras. In commercial and industrial domains, security concerns, automation and smart-camera solutions spur expansion of surveillance and machine-vision camera installations.

Advancements in sensor technology, AI and connectivity (such as 5G) enhance camera capabilities and create new use-cases such as video analytics, remote monitoring and IoT integration. Constraints include competition from smartphone cameras, which reduce demand for entry-level dedicated cameras, and regulatory or privacy concerns associated with surveillance technologies. High equipment cost and integration complexity can slow adoption in industrial settings. Supply-chain disruptions, component shortages (particularly in sensors and optics) and tariff or import-cost pressures also affect pricing and availability.

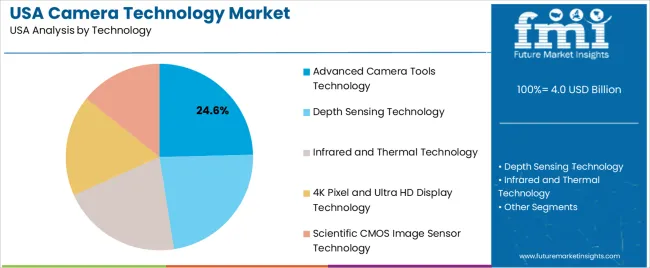

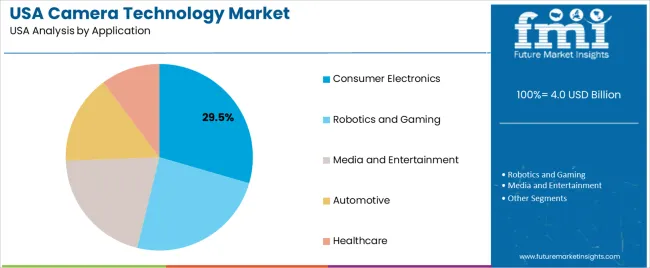

Demand for camera technology in the United States reflects the growing use of imaging systems across electronics, robotics, entertainment, transportation, and healthcare. Component selection depends on processing needs, image quality, device architecture, and integration with digital systems. Technology preferences relate to advanced imaging requirements, sensing capability, resolution improvements, and specialised scientific applications. Application distribution shows how end users incorporate camera systems into consumer devices, automation platforms, media workflows, and diagnostic tools. These patterns illustrate how USA industries rely on imaging components to support data capture, visual processing, and hardware performance objectives.

Microcontrollers and microprocessors hold 32.4% of national demand and represent the leading component category. These elements support image processing, device control, data handling, and system responsiveness in cameras used across personal devices, industrial tools, and automated systems. Sensors account for 27.1%, enabling light capture, resolution stability, and colour accuracy. Integrated circuits represent 21.8%, supporting signal processing and component connectivity. Other components hold 18.7%, covering lenses, connectors, housings, and supporting hardware. Component distribution reflects performance requirements, processing speed, energy efficiency, and hardware design choices across USA imaging applications.

Key drivers and attributes:

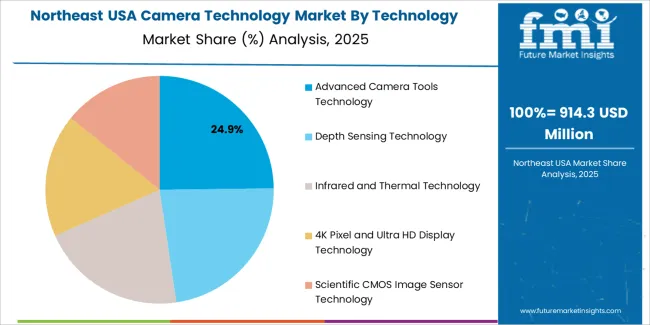

Advanced camera tools hold 24.6% of national demand and represent the leading technology category. These tools support improved image capture, automated adjustments, and enhanced operational accuracy across varied lighting environments. Depth sensing technology accounts for 22.9%, used in robotics, gaming, and device-based spatial mapping. Infrared and thermal technology represents 20.8%, supporting low-light imaging and temperature-based visualisation in industrial and safety-driven settings. 4K pixel and ultra-HD display technology holds 17.5%, enhancing visual clarity and media output quality. Scientific CMOS image sensor technology accounts for 14.2%, enabling high-sensitivity imaging for laboratory and analytical use.

Key drivers and attributes:

Consumer electronics hold 29.5% of national demand and represent the leading application category. Cameras are integrated into smartphones, laptops, smart home devices, and handheld imaging systems requiring reliable performance, compact structure, and low-power operation. Robotics and gaming account for 24.3%, using imaging for machine vision, motion detection, and immersive experiences. Media and entertainment represent 20.6%, supporting broadcasting, content creation, and professional imaging work. Automotive applications hold 15.4%, including driver-assistance systems and in-vehicle monitoring. Healthcare accounts for 10.2%, applying imaging tools in diagnostics, telemedicine, and surgical support.

Key drivers and attributes:

Growth in content creation, expansion of USA security-infrastructure programs and rising adoption of automotive vision systems are driving demand.

In the United States, demand for camera technology increases as independent creators, streaming professionals and small production studios expand content output for platforms based in the USA such as YouTube, Twitch and TikTok. Federal and state-level investments in public-safety imaging systems, including city surveillance upgrades and transportation-monitoring programs, strengthen adoption of high-resolution and network-ready cameras. Automotive manufacturers operating USA assembly facilities continue to scale use of camera modules for driver-assistance systems and rear-visibility compliance standards. Industrial and logistics sites also expand machine-vision systems for quality inspection, barcode reading and automated picking, supporting wider demand for specialized camera hardware.

High substitution by advanced smartphone cameras, investment pressure for professional gear and regulatory complexity in surveillance deployment restrain adoption.

High-end smartphones in the USA reduce discretionary spending on standalone consumer cameras because many households rely on mobile devices for daily imaging needs. Professional cinematography and broadcast facilities may delay purchases of new systems due to high capital requirements, training needs and integration cost with editing and storage workflows. Surveillance deployments in the USA face varied municipal approval processes, privacy considerations and procurement rules that can slow installation cycles. Some industrial buyers hesitate to adopt vision systems if workforce training, system calibration or downtime risk creates operational uncertainty.

Growth of mirrorless hybrid systems, expansion of AI-enabled imaging workflows and rising demand for embedded camera modules in automation define key trends.

The USA industry shows strong movement toward mirrorless cameras due to compact size, high-speed autofocus and improved video capability. AI-supported tools that automate exposure, tracking and object detection are expanding in both professional and prosumer segments. Security contractors in the USA increasingly deploy analytics-ready IP cameras integrated with central monitoring platforms. Automotive, warehouse and manufacturing operators are adopting compact embedded modules for inspection, navigation and autonomous functions. These trends reflect sustained advancement of camera technology across consumer, professional, security and industrial sectors within the United States.

Demand for camera technology in the USA is increasing through 2035 as households, professional creators, security integrators, industrial facilities, and commercial enterprises adopt advanced imaging systems. Growth is supported by rapid improvements in sensor performance, wider use of high-resolution video, increased integration of AI-enabled imaging, and expansion of surveillance and monitoring applications. Professional users rely on mirrorless systems, cinema cameras, and specialty lenses, while consumer buyers adopt compact mirrorless and smartphone-linked imaging accessories.

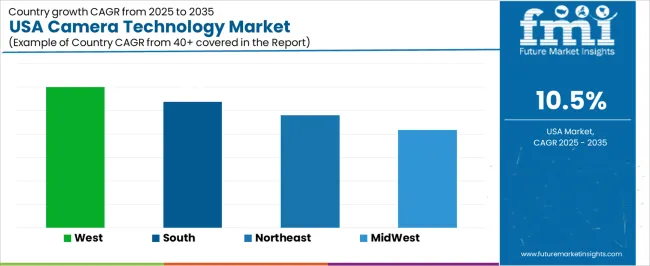

Industrial and commercial facilities expand use of machine-vision cameras for inspection, automation, and quality control. Security integrators deploy networked cameras across public spaces and private buildings. Regional variation reflects technology adoption, creator density, and commercial-infrastructure development. West USA leads at 12.0%, followed by South USA (10.8%), Northeast USA (9.6%), and Midwest USA (8.4%).

| Region | CAGR (2025-2035) |

|---|---|

| West USA | 12.0% |

| South USA | 10.8% |

| Northeast USA | 9.6% |

| Midwest USA | 8.4% |

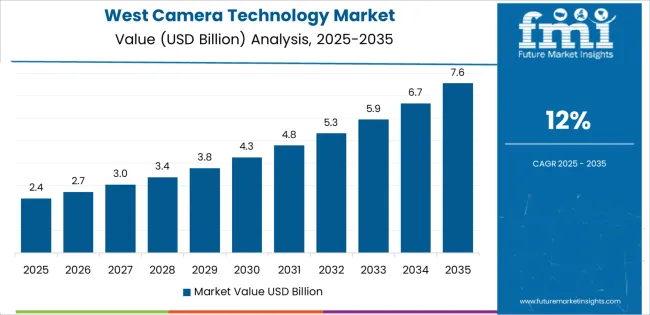

West USA grows at 12.0% CAGR, supported by strong concentration of content-creation industries, high adoption of advanced imaging tools, and robust commercial demand across California, Washington, Oregon, Colorado, Utah, and Arizona. Film studios, digital-media companies, and independent creators in Los Angeles, Seattle, San Francisco, and Denver increase usage of cinema cameras, mirrorless systems, and professional lenses. Outdoor-recreation industries across Western states drive demand for action cameras, drone imaging, and rugged photography equipment. Technology firms in the region incorporate imaging modules into robotics, consumer devices, and extended-reality platforms. Security integrators deploy high-resolution network cameras in metropolitan areas with large commercial footprints.

South USA grows at 10.8% CAGR, driven by expanding commercial development, rising content-creator activity, and increased deployment of surveillance systems across Texas, Florida, Georgia, North Carolina, Tennessee, and Alabama. Commercial properties adopt high-resolution IP cameras for facility monitoring. Growing tourism centers in Florida and Texas increase demand for professional and consumer imaging systems used in travel and hospitality settings. Social-media creators and small businesses adopt mirrorless cameras, video-lighting setups, and stabilizers to support digital-content production. Industrial facilities in the South integrate machine-vision cameras for automation and inspection.

Northeast USA grows at 9.6% CAGR, supported by dense urban environments, strong demand from media organizations, and heavy adoption of security imaging across New York, Massachusetts, Pennsylvania, New Jersey, and Connecticut. Newsrooms, creative studios, and advertising agencies use high-performance cameras for broadcast and digital-media production. Universities and research centers adopt specialized imaging systems for scientific documentation. Public-sector institutions deploy networked security cameras throughout transportation hubs and civic buildings. Retailers in metropolitan areas see sustained consumer demand for mirrorless cameras, lenses, and imaging accessories driven by hobbyist and professional photographers.

Midwest USA grows at 8.4% CAGR, supported by industrial automation, strong educational networks, and steady consumer and commercial adoption across Illinois, Ohio, Michigan, Minnesota, Wisconsin, and Iowa. Manufacturing plants incorporate machine-vision cameras for inspection, robotics, and quality control. Universities and technical institutes expand training programs using advanced imaging systems for engineering, medical, and research applications. Security integrators deploy surveillance cameras across logistics centers and transportation hubs. Consumers adopt mirrorless systems and smartphone-linked accessories for travel and family photography.

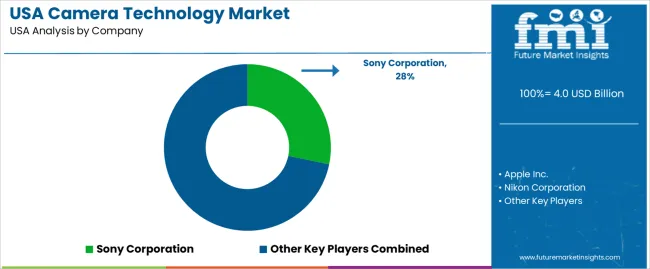

Demand for camera technology in the USA is shaped by consumer-electronics suppliers, security-imaging manufacturers, and smartphone producers with established national distribution. Sony Corporation holds the leading position with an estimated 28.2% share, supported by controlled sensor manufacturing, consistent image-processing capability, and strong adoption across mirrorless cameras and integrated camera modules used by USA electronics brands. Its position is reinforced by reliable low-light performance and long-term relationships with device manufacturers.

Apple Inc. follows as a major participant through its iPhone camera systems, which represent a significant share of consumer imaging due to controlled hardware-software integration and consistent computational-photography output. Nikon Corporation maintains a solid presence in interchangeable-lens cameras and professional imaging, offering stable autofocus, dependable colour accuracy, and verified optical performance for both consumer and commercial users in the USA.

Teledyne FLIR LLC plays a key role in thermal-imaging and industrial-vision systems, supplying defense, emergency-response, and industrial customers with cameras characterized by controlled thermal sensitivity and durable mechanical design. Bosch Security Systems contributes additional capability in fixed, PTZ, and networked-security cameras used across commercial buildings, transportation hubs, and municipal surveillance projects, emphasizing stable imaging performance and reliable system integration.

Competition across this segment centres on sensor quality, processing accuracy, low-light capability, network integration, platform compatibility, and durability in specialized environments. Demand continues to expand as USA consumers and enterprises adopt high-performance imaging, computational systems, and advanced security-camera technologies across personal, commercial, and mission-critical applications.

| Items | Values |

|---|---|

| Quantitative Units | USD billion |

| Component | Microcontrollers and Microprocessors, Sensors, Integrated Circuits, Other Components |

| Technology | Advanced Camera Tools Technology, Depth Sensing Technology, Infrared and Thermal Technology, 4K Pixel and Ultra HD Display Technology, Scientific CMOS Image Sensor Technology |

| Application | Consumer Electronics, Robotics and Gaming, Media and Entertainment, Automotive, Healthcare |

| Regions Covered | West USA, South USA, Northeast USA, Midwest USA |

| Key Companies Profiled | Sony Corporation, Apple Inc., Nikon Corporation, Teledyne FLIR LLC, Bosch Security Systems |

| Additional Attributes | Includes adoption across imaging components, embedded vision systems, industrial automation, medical imaging, autonomous driving systems, and sensor fusion technologies. |

The demand for camera technology in usa is estimated to be valued at USD 4.0 billion in 2025.

The market size for the camera technology in usa is projected to reach USD 10.9 billion by 2035.

The demand for camera technology in usa is expected to grow at a 10.5% CAGR between 2025 and 2035.

The key product types in camera technology in usa are microcontrollers and microprocessors, sensors, integrated circuits and other components.

In terms of technology, advanced camera tools technology segment is expected to command 24.6% share in the camera technology in usa in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Camera Technology Market Analysis – Trends & Forecast 2025 to 2035

Demand for Camera Technology in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Distance Health Technology in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Medical Terahertz Technology in USA Size and Share Forecast Outlook 2025 to 2035

Camera Accessories Market Size and Share Forecast Outlook 2025 to 2035

USA Medical Coding Market Size and Share Forecast Outlook 2025 to 2035

USA Labels Market Size and Share Forecast Outlook 2025 to 2035

USA Plant-based Creamers Market Size and Share Forecast Outlook 2025 to 2035

USA Barrier Coated Paper Market Size and Share Forecast Outlook 2025 to 2035

USA Electronic Health Records (EHR) Market Size and Share Forecast Outlook 2025 to 2035

USA Animal Model Market Size and Share Forecast Outlook 2025 to 2035

Camera Lens Market Size and Share Forecast Outlook 2025 to 2035

Camera Module Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Packer Bottle Market Size and Share Forecast Outlook 2025 to 2035

USA Stretch Hood Films Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Fence Screen Market Size and Share Forecast Outlook 2025 to 2035

USA Lubricant Contaminated HDPE Container Waste Market Size and Share Forecast Outlook 2025 to 2035

USA Commercial Walk-In Refrigeration Market Size and Share Forecast Outlook 2025 to 2035

USA & Canada Pre-painted Steel Roofing and Cladding Market Size and Share Forecast Outlook 2025 to 2035

USA Residential Cotton Candy Maker Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA