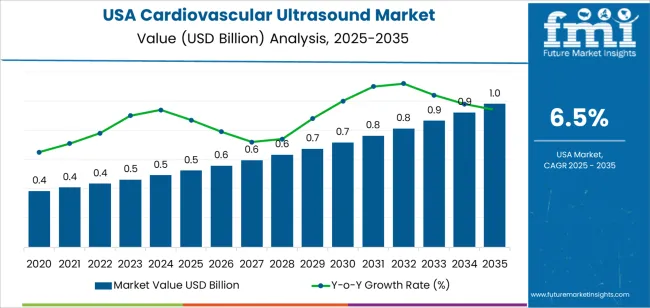

The USA cardiovascular ultrasound demand is valued at USD 0.5 billion in 2025 and is forecasted to reach USD 1.0 billion by 2035, reflecting a CAGR of 6.5%. Demand is shaped by sustained utilization of diagnostic imaging for cardiovascular disease assessment, routine monitoring, and acute-care evaluation. Increased prevalence of hypertension, arrhythmias, heart failure, and structural heart abnormalities contributes to continued clinical reliance on ultrasound due to its non-invasive nature, portability, and comparatively lower operational cost. Expanding use in emergency departments, outpatient cardiology settings, and preventive screening further supports growth.

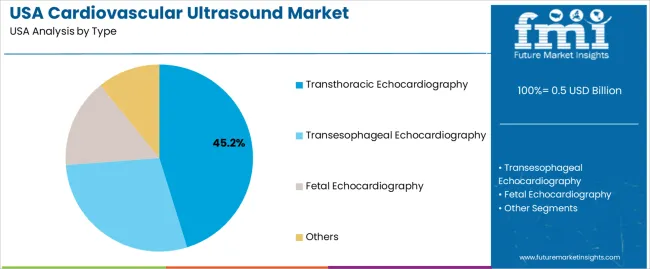

Transthoracic echocardiography leads the product landscape. It is selected for first-line cardiac assessment, feasibility across patient groups, and suitability for repeated monitoring without radiation exposure. Advancements in image resolution, Doppler capabilities, automated quantification, and handheld systems continue to influence clinical purchasing decisions across hospitals and cardiology practices.

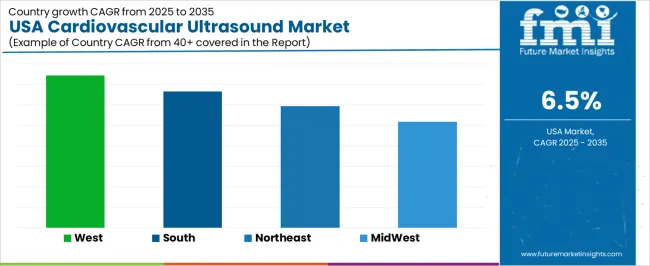

West USA, South USA, and Northeast USA record the highest utilization levels due to the concentration of advanced cardiac-care centers, high diagnostic volumes, and broad adoption of digital imaging systems. These regions also maintain strong procurement networks for high-performance ultrasound equipment. Key suppliers include GE HealthCare, Philips Healthcare, Siemens Healthineers, Canon Medical Systems, and Samsung Medison. These companies provide transthoracic, transesophageal, and stress-echocardiography platforms used in routine diagnostics, interventional planning, and long-term cardiovascular management.

Early-cycle acceleration is shaped by steady adoption of advanced imaging systems, wider clinical use of portable echocardiography, and replacement demand across cardiology departments. These factors raise annual growth rates in the first few years as hospitals upgrade diagnostic infrastructure and adopt newer modalities with improved workflow capability. Mid-cycle expansion maintains momentum but begins to moderate as penetration increases across major healthcare networks. Incremental growth is sustained by procedure volume, rising cardiometabolic disease prevalence, and sustained equipment-upgrade cycles.

By the late period, deceleration gradually emerges as the installed base reaches maturity and replacement demand becomes the primary driver. Growth continues, but annual variations narrow as purchasing cycles stabilize and technology adoption becomes more incremental. The overall pattern shows early acceleration linked to technology upgrades, followed by steady mid-cycle performance and a controlled deceleration phase as industry maturity increases across major care settings.

| Metric | Value |

|---|---|

| USA Cardiovascular Ultrasound Sales Value (2025) | USD 0.5 billion |

| USA Cardiovascular Ultrasound Forecast Value (2035) | USD 1.0 billion |

| USA Cardiovascular Ultrasound Forecast CAGR (2025-2035) | 6.5% |

Demand for cardiovascular ultrasound in the USA is rising because clinicians increasingly rely on non-invasive imaging to diagnose and monitor heart disease, valve disorders, and vascular conditions. Aging demographics, prevalence of cardiovascular risk factors and a focus on early detection drive usage. Advances in ultrasound systems, such as higher-resolution transducers, 3D/4D imaging, portable point-of-care devices and AI-enabled analytics, enhance diagnostic accuracy and workflow efficiency.

Expansion of outpatient cardiac care centers and mobile imaging services further supports growth. Reimbursement models that promote preventive cardiovascular care and increased adoption of echocardiography in community clinics also boost industry adoption. Constraints include high equipment cost, need for extensive operator training and certification, and competition from alternative imaging modalities such as MRI and CT that may offer complementary information. Some smaller practices may delay investment until new systems show clear operational or clinical benefits.

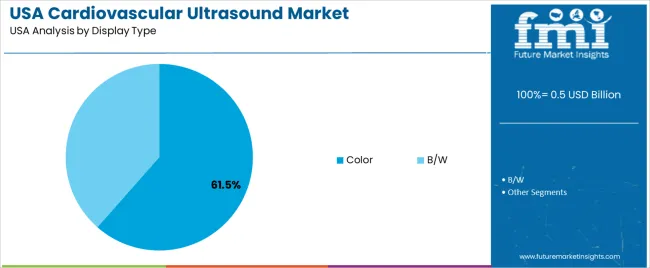

Demand for cardiovascular ultrasound in the United States reflects its role in routine cardiac evaluation, diagnostic clarification, and monitoring across inpatient and outpatient settings. Type selection depends on clinical accessibility, patient condition, and imaging detail required for cardiac structure and function assessment. Technology preferences relate to resolution expectations, motion analysis, and hemodynamic evaluation across diverse cardiovascular presentations. Display-type distribution illustrates how colour imaging and grayscale outputs support accuracy, workflow efficiency, and diagnostic reliability.

Transthoracic echocardiography holds 45.2% of national demand and represents the leading type. It supports non-invasive cardiac imaging, rapid assessment, and routine evaluation of chamber size, systolic function, and valvular conditions. Transesophageal echocardiography accounts for 28.6%, providing higher-resolution imaging for surgical planning and evaluation of complex cardiac pathology. Fetal echocardiography represents 15.4%, supporting prenatal cardiac assessments. Other types hold 10.8%, covering stress studies and procedural guidance. Type distribution reflects differences in invasiveness, imaging resolution, and clinical workflows. USA users select modalities based on diagnostic requirements, patient condition, and procedural urgency.

Key drivers and attributes:

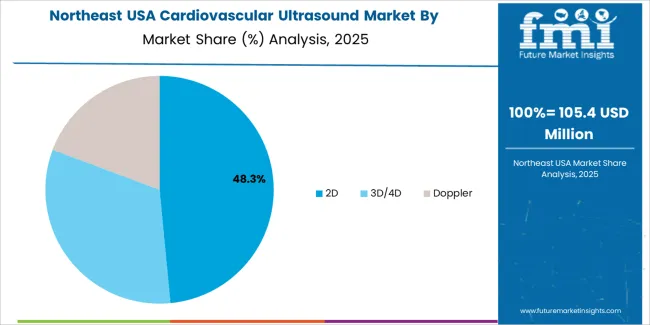

2D technology holds 48.7% of national demand and represents the dominant imaging format. It supports real-time structural assessment, wall-motion analysis, and routine cardiac evaluation. 3D/4D technology accounts for 32.1%, offering volumetric imaging and enhanced anatomical clarity used in complex congenital, valvular, and surgical planning contexts. Doppler imaging represents 19.2%, supporting blood-flow assessment and hemodynamic evaluation. Technology distribution reflects requirements for spatial accuracy, motion analysis, and functional assessment in cardiology practices. USA clinicians adopt technologies based on diagnostic complexity, cost considerations, and desired imaging depth across diverse patient populations.

Key drivers and attributes:

Colour-display systems hold 61.5% of national demand and represent the leading display category. Colour Doppler integration enhances visualization of blood flow, valve performance, and structural abnormalities, supporting accurate interpretation in both routine and advanced studies. Black-and-white systems account for 38.5%, providing grayscale imaging for basic structural assessment in settings prioritising cost, portability, or limited-scope diagnostics. Display-type distribution reflects differences in clinical detail requirements, equipment budgets, and workflow preferences in hospitals, clinics, and imaging centres across the United States. Colour systems remain preferred due to their diagnostic versatility and enhanced interpretability.

Key drivers and attributes:

Rising burden of cardiovascular disease, increase in outpatient cardiology services, and adoption of bundled payment models are driving demand.

In the USA, demand for cardiovascular ultrasound is growing because heart disease remains the leading cause of death and many healthcare providers expand cardiac screening and monitoring programmes in outpatient clinics. The shift toward outpatient cardiology imaging centres and use of advanced echocardiography as part of preventive care supports usage of cardiovascular ultrasound systems. Payment reforms such as value-based care and bundled cardiology payments encourage hospitals and imaging providers to invest in non-invasive diagnostics like cardiovascular ultrasound that may reduce costly invasive procedures.

Reimbursement pressure for echocardiography, shortages of trained sonographers and competition from alternate imaging modalities restrain growth.

In the USA, the reimbursement rates for transthoracic and trans-esophageal echocardiograms have faced real-term reductions, which makes capital investment less attractive for some outpatient and smaller imaging centres. There is a persistent national shortage of trained cardiac sonographers, which limits utilisation and may delay deployment of new devices. Alternative cardiac imaging methods such as cardiac MRI, CT angiography and nuclear cardiology present strong competition in high-complexity centres that may favour those modalities for certain indications rather than ultrasound.

Expansion of handheld and portable echocardiography systems, integration of artificial intelligence-based workflow tools and growing use in non-hospital settings define key trends.

In the USA, cardiovascular ultrasound makers are increasingly offering portable and handheld devices suited to cardiologists in clinics, hospital wards, and ambulatory surgical centres, widening access beyond full-size cart-based systems. AI-enabled measurement tools, automated chamber quantification and report generation are being integrated, helping physicians and technicians reduce exam time and improve consistency. Non-hospital settings such as outpatient imaging centers, emergency departments and point-of-care clinics are adopting cardiovascular ultrasound for triage and monitoring, creating incremental demand beyond traditional hospital cardiology departments.

Demand for cardiovascular ultrasound in the USA continues to rise through 2035 as hospitals, cardiac centers, outpatient clinics, and diagnostic imaging networks expand non-invasive cardiac assessment capacity. Cardiovascular ultrasound is widely used for rapid evaluation of ventricular function, valvular disease, congenital abnormalities, and ischemic conditions. Growth is supported by rising cardiac-disease prevalence, expanded screening programs, and continued adoption of portable and point-of-care ultrasound systems. USA facilities also increase investment in advanced echocardiography techniques, including 3D/4D imaging and strain analysis. Variation across USA regions reflects clinical-infrastructure density, population health indicators, and the availability of cardiac-specialist networks. West USA leads at 7.4%, followed by South USA (6.7%), Northeast USA (5.9%), and Midwest USA (5.2%).

| Region | CAGR (2025-2035) |

|---|---|

| West USA | 7.4% |

| South USA | 6.7% |

| Northeast USA | 5.9% |

| Midwest USA | 5.2% |

West USA grows at 7.4% CAGR, driven by the strong presence of advanced cardiac centers, high adoption of portable imaging systems, and increasing patient volumes across California, Washington, Oregon, Colorado, Utah, and Arizona. Hospitals in the region expand echocardiography units to support rising incidence of hypertension, arrhythmias, and age-related structural heart disease. Diagnostic networks adopt point-of-care ultrasound systems used in emergency departments and outpatient cardiology practices. Research hospitals integrate advanced 3D and strain-imaging protocols into routine diagnostics. Large health-insurance networks emphasize non-invasive monitoring, encouraging providers to increase cardiovascular ultrasound availability. Remote-care programs in the West also utilize handheld imaging tools for early cardiac evaluation in underserved areas.

South USA grows at 6.7% CAGR, supported by high cardiovascular-disease burden, growing hospital networks, and expanded access to outpatient cardiac imaging across Texas, Florida, Georgia, North Carolina, Tennessee, and Alabama. The region’s elevated rates of hypertension, diabetes, and obesity increase reliance on non-invasive diagnostic imaging for early detection and follow-up assessments. Hospitals expand cardiac ultrasound capacity to manage increased procedural volumes. Outpatient cardiology centers integrate portable ultrasound systems for rapid evaluation and monitoring. Rural healthcare providers adopt compact devices to improve access to cardiac imaging in underserved communities. Medical-training institutions across the South strengthen echocardiography education programs to meet rising workforce requirements.

Northeast USA grows at 5.9% CAGR, shaped by dense healthcare networks, established cardiac-care infrastructure, and strong presence of academic medical centers across New York, Massachusetts, Pennsylvania, New Jersey, and Connecticut. Hospitals expand echocardiography labs to support high diagnostic volumes linked to aging urban populations. Academic institutions integrate advanced cardiac-imaging techniques into specialty clinics, including trans esophageal echocardiography and 3D structural-heart imaging. Diagnostic centers use ultrasound for pre-operative cardiac evaluation and chronic-disease monitoring. Insurers in the region favor ultrasound for its cost-efficiency relative to more invasive imaging methods.

Midwest USA grows at 5.2% CAGR, supported by established hospital systems, strong cardiology networks, and rising diagnostic demand across Illinois, Ohio, Michigan, Minnesota, Wisconsin, and Iowa. Regional hospitals expand ultrasound use to monitor heart-failure patients, valve disorders, and ischemic conditions. Community clinics adopt portable systems for routine cardiac assessments. Large health systems integrate point-of-care ultrasound into emergency and primary-care settings for early evaluation of chest pain and heart-function abnormalities. Diagnostic providers in the Midwest increase investment in strain-imaging capabilities for more precise cardiac-function analysis.

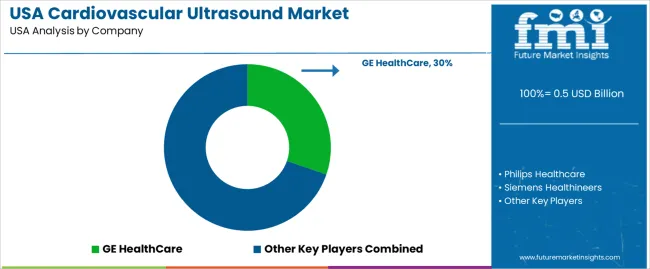

Demand for cardiovascular ultrasound in the USA is shaped by a group of established imaging-equipment manufacturers with nationwide sales, clinical-service networks, and installed bases across hospitals, cardiology practices, and diagnostic centres. GE HealthCare holds the leading position with an estimated 30.3% share, supported by controlled transducer engineering, stable Doppler performance, and long-standing presence in USAcardiology departments. Its position is reinforced by reliable system uptime, broad modality coverage, and consistent integration with hospital IT and reporting systems.

Philips Healthcare follows as a major participant, supplying echocardiography systems known for consistent image resolution, steady workflow tools, and predictable performance in both adult and pediatric cardiology. Siemens Healthineers maintains strong adoption across academic centres and community hospitals, offering systems with controlled signal processing, dependable strain-imaging capability, and stable transducer durability.

Canon Medical Systems, operating with USA manufacturing and service support, contributes systems known for uniform image quality, reliable measurement reproducibility, and compatibility with stress-echo and structural-heart workflows. Samsung Medison, present in the USA through Samsung’s medical-device business, supports additional demand with cost-effective cardiovascular platforms offering consistent imaging stability and validated Doppler performance.

Competition across this segment centres on image clarity, Doppler accuracy, workflow efficiency, transducer reliability, integration with cardiovascular reporting software, and long-term service support. Demand continues to rise as USA providers expand noninvasive cardiac assessment, adopt advanced strain and structural-heart imaging, and rely on stable ultrasound platforms for routine diagnosis, chronic-disease monitoring, and procedural guidance.

| Items | Values |

|---|---|

| Quantitative Units | USD billion |

| Type | Transthoracic Echocardiography, Transesophageal Echocardiography, Fetal Echocardiography, Others |

| Technology | 2D, 3D/4D, Doppler |

| Display Type | Color, B/W |

| End-use | Hospitals, Diagnostic Centers, Ambulatory Care Centers, Other End-uses |

| Regions Covered | West USA, South USA, Northeast USA, Midwest USA |

| Key Companies Profiled | GE HealthCare, Philips Healthcare, Siemens Healthineers, Canon Medical Systems, Samsung Medison |

| Additional Attributes | Dollar sales by echocardiography type, technology, and display category; regional adoption trends across West USA, South USA, Northeast USA, and Midwest USA; competitive landscape of cardiovascular ultrasound system manufacturers; advancements in real-time 4D imaging, strain imaging, portable ultrasound devices, and AI-assisted diagnostics; integration with hospital cardiology departments, outpatient diagnostic centers, primary care networks, and ambulatory cardiovascular services across the USA. |

The demand for cardiovascular ultrasound in usa is estimated to be valued at USD 0.5 billion in 2025.

The market size for the cardiovascular ultrasound in usa is projected to reach USD 1.0 billion by 2035.

The demand for cardiovascular ultrasound in usa is expected to grow at a 6.5% CAGR between 2025 and 2035.

The key product types in cardiovascular ultrasound in usa are transthoracic echocardiography, transesophageal echocardiography, fetal echocardiography and others.

In terms of technology, 2d segment is expected to command 48.7% share in the cardiovascular ultrasound in usa in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cardiovascular Ultrasound Market - Demand & Innovations 2025 to 2035

Demand for Cardiovascular Repair & Reconstruction Devices in USA Size and Share Forecast Outlook 2025 to 2035

Ultrasound Conductivity Gels Market Size and Share Forecast Outlook 2025 to 2035

Ultrasound Market Size and Share Forecast Outlook 2025 to 2035

Cardiovascular CT Systems Market Size and Share Forecast Outlook 2025 to 2035

Ultrasound Skin Tightening Devices Market Size and Share Forecast Outlook 2025 to 2035

USA Medical Coding Market Size and Share Forecast Outlook 2025 to 2035

Cardiovascular Surgical Devices Market Size and Share Forecast Outlook 2025 to 2035

USA Labels Market Size and Share Forecast Outlook 2025 to 2035

Cardiovascular Devices Market Size and Share Forecast Outlook 2025 to 2035

USA Plant-based Creamers Market Size and Share Forecast Outlook 2025 to 2035

USA Barrier Coated Paper Market Size and Share Forecast Outlook 2025 to 2035

USA Electronic Health Records (EHR) Market Size and Share Forecast Outlook 2025 to 2035

USA Animal Model Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Packer Bottle Market Size and Share Forecast Outlook 2025 to 2035

USA Stretch Hood Films Market Size and Share Forecast Outlook 2025 to 2035

Cardiovascular Prosthetic Devices Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Fence Screen Market Size and Share Forecast Outlook 2025 to 2035

USA Lubricant Contaminated HDPE Container Waste Market Size and Share Forecast Outlook 2025 to 2035

USA Commercial Walk-In Refrigeration Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA