The demand for conductive plastics in the USA is expected to grow from USD 1.6 billion in 2025 to USD 3.5 billion by 2035, reflecting a compound annual growth rate (CAGR) of 7.90%. Conductive plastics, which are polymers infused with conductive materials, are used in a variety of applications such as electronic packaging, electrostatic discharge (ESD) protection, automotive parts, and consumer electronics. The increasing demand for lightweight, durable, and electrically conductive materials, especially in the electronics, automotive, and energy sectors, is driving this growth. These plastics are essential in applications where traditional metals may be too heavy, expensive, or difficult to shape, offering a practical alternative for industries looking to optimize performance while reducing costs.

The growing use of conductive plastics in emerging technologies, including electric vehicles (EVs), consumer electronics, and renewable energy applications, will further fuel the industries expansion. As industries focus on improving the functionality, energy efficiency, and sustainability of their products, conductive plastics are increasingly viewed as a key material for enabling these advancements. As awareness of the environmental and cost benefits of conductive plastics rises, demand is expected to increase, particularly in industries where these materials can replace traditional metal components.

Between 2025 and 2030, the demand for conductive plastics in the USA is expected to increase from USD 1.6 billion to USD 1.8 billion. This period will see moderate growth, driven by the steady adoption of conductive plastics in sectors such as electronics, automotive, and packaging. The industry share of conductive plastics will gain, particularly as industries continue to shift towards lightweight, cost-effective, and energy-efficient materials. The automotive and electronics sectors are expected to contribute significantly to this gain, especially with the growing demand for EVs and the rise of IoT devices, which require materials with improved conductivity.

From 2030 to 2035, the demand is projected to rise more significantly, reaching USD 3.5 billion. This sharp increase is driven by several factors, including advancements in material technology, the wider acceptance of conductive plastics in high-demand applications, and the continued shift toward eco-friendlier and cost-efficient solutions. The industry share will experience further gains as conductive plastics are increasingly adopted in more industries, replacing metals in applications such as automotive wiring, battery components, and consumer electronics. As the use of these materials becomes more widespread, their industry share in various sectors will continue to grow, contributing to a substantial increase in overall demand during this period.

| Metric | Value |

|---|---|

| Demand for Conductive Plastics in USA Value (2025) | USD 1.6 billion |

| Demand for Conductive Plastics in USA Forecast Value (2035) | USD 3.5 billion |

| Demand for Conductive Plastics in USA Forecast CAGR (2025-2035) | 7.9% |

The demand for conductive plastics in the USA is increasing as industries seek lightweight, durable, and cost-effective materials for a variety of electronic and electrical applications. Conductive plastics, which combine the properties of plastics with electrical conductivity, are becoming essential in industries such as automotive, electronics, and packaging. They are widely used in applications requiring static dissipation, electromagnetic shielding, and various electronic components.

The growing demand for electronic devices, coupled with the rapid expansion of electric vehicles (EVs), is a major driver of this growth. Conductive plastics are replacing metals in components like sensors, connectors, and batteries, particularly in the automotive sector, where reducing weight and improving energy efficiency are critical. As the USA accelerates its shift toward electric vehicles and green technologies, the demand for conductive plastics in EV manufacturing is expected to rise steadily.

Technological advancements in material science, including the development of higher-performance conductive plastics with enhanced properties, are also contributing to the growth of this industry. These innovations are making conductive plastics even more versatile, allowing them to be used in a wider range of applications. As industries look to integrate eco-friendlier and efficient materials into their products, the adoption of conductive plastics is increasing. The potential for cost-effective solutions that also meet environmental goals is positioning conductive plastics as a key material for future applications.

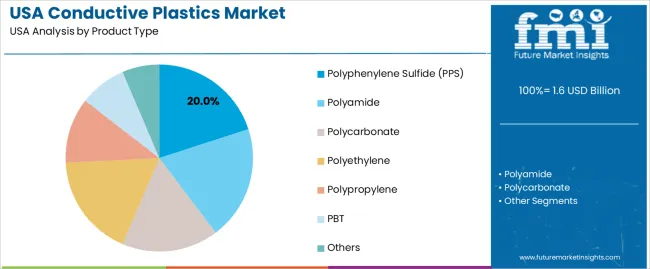

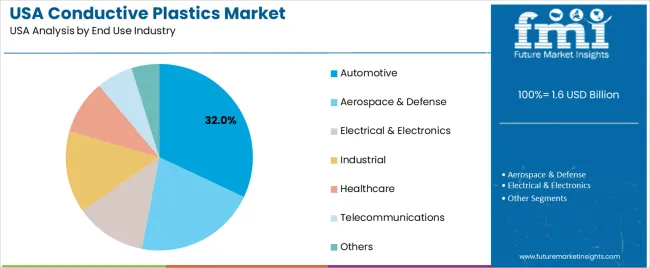

Demand for conductive plastics in the USA is segmented by product type, end-use industry, application, and region. By product type, demand is divided into polyphenylene sulfide (PPS), polyamide, polycarbonate, polyethylene, polypropylene, PBT, and others. The demand is also segmented by end-use industry, including automotive, aerospace & defense, electrical & electronics, industrial, healthcare, telecommunications, and others. In terms of application, demand is divided into antistatic packaging & coating, capacitors, actuators & sensors, batteries, solar cells, electroluminescence, PCBs, and others. Regionally, demand is divided into West USA, South USA, Northeast USA, and Midwest USA.

Polyphenylene sulfide (PPS) accounts for 20% of the demand for conductive plastics in the USA. PPS is highly favored for its excellent thermal stability, chemical resistance, and electrical conductivity, making it ideal for high-performance applications. It is widely used in industries that require durable, high-temperature-resistant materials, such as automotive, aerospace, and electronics. PPS’s ability to maintain its properties under harsh conditions and its compatibility with various conductive fillers have made it the preferred choice for applications requiring enhanced conductivity. Furthermore, PPS is increasingly used in the automotive sector, especially in electric vehicles (EVs), where its electrical properties are essential for efficient energy storage and transmission. As industries continue to demand higher-performing, long-lasting materials, PPS will continue to lead the demand for conductive plastics, particularly in high-temperature and high-stress environments.

The automotive industry accounts for 32% of the demand for conductive plastics in the USA. The increasing adoption of electric vehicles (EVs) and the growing need for lightweight, high-performance materials have driven the automotive industry's demand for conductive plastics. These plastics are used in a variety of automotive applications, including electrical components, connectors, actuators, and sensors. Conductive plastics play a crucial role in ensuring the proper functioning of advanced automotive systems, particularly in electric and hybrid vehicles, where efficient energy management is vital. The use of conductive plastics in the automotive industry helps reduce the weight of vehicles while maintaining the required performance and durability standards. As the automotive sector continues to shift towards electrification and automation, the demand for conductive plastics is expected to remain strong, further solidifying the automotive industry’s leading position in the industry.

Key drivers include growth in refrigerated warehousing, food & beverage cold chain expansion, and rising requirements for cryogenic and low‐temperature process insulation (e.g., LNG, chemicals) in USA. The push for energy efficiency and regulatory requirements around reducing heat gain/loss also support uptake of cold insulation materials and systems. Restraints include higher costs of specialised cold insulation materials versus standard thermal insulation, installation and maintenance challenges in retrofit or cramped industrial sites, and competition from simpler insulation solutions or alternative technologies for moderate temperature applications.

Why is Demand for Cold Insulation Growing in USA?

In the USA, demand for cold insulation is increasing as industries such as food & beverage, pharmaceuticals, and logistics expand their cold‑chain infrastructure. These sectors require reliable insulation to maintain low temperatures, ensuring product quality and safety. Similarly, industries like chemicals, LNG, and cryogenics rely on high‑performance insulation to reduce heat ingress, improve safety, and lower operating costs. Regulatory pressures and the focus on energy efficiency are motivating businesses to upgrade insulation in new and existing facilities. As energy‑efficiency standards tighten, the adoption of cold insulation systems is growing across industrial, commercial, and process sectors in the USA to meet these evolving demands.

How are Technological Innovations Driving Growth of Cold Insulation in USA?

Technological innovations are fueling growth in the cold insulation industry in the USA by improving material performance, durability, and installation efficiency. New foam and composite materials offer enhanced thermal resistance at low temperatures while managing moisture and vapour effectively. Modular insulation panels and jackets have made retrofitting easier and more cost‑effective. Smart insulation systems with integrated sensors help monitor performance, offering insights into condition and maintenance needs. These innovations enhance the reliability and safety of cryogenic or sub‑zero applications while supporting regulatory compliance, driving broader adoption of cold insulation systems across industries like logistics, pharmaceuticals, and chemical processing.

What are the Key Challenges Limiting Adoption of Cold Insulation in USA?

Despite strong demand, the adoption of cold insulation in the USA faces several challenges. A key hurdle is the high cost of specialised materials and systems for low‑temperature insulation compared to standard thermal insulation, which can deter investment in cost‑sensitive projects. The installation and maintenance of cold insulation systems, especially in cryogenic or sub‑zero environments, require skilled labour and precise design, including effective vapour barrier and condensation control. Many existing facilities may not be able to easily retrofit advanced insulation due to space or structural limitations. Furthermore, supply‑chain issues or material availability, especially for specialty foams and composites, can delay project timelines.

| Region | CAGR (%) |

|---|---|

| West | 8.5 |

| South | 7.6 |

| Northeast | 6.8 |

| Midwest | 5.9 |

Demand for cold insulation in the USA is growing steadily across all regions, with the West leading at an 8.5% CAGR. This growth is driven by the region’s large industrial base, including petrochemical and manufacturing sectors, which require cold insulation for temperature control and energy efficiency. The South follows with a 7.6% CAGR, supported by its expanding petrochemical, refining, and energy industries. The Northeast shows a steady 6.8% CAGR, driven by growing demand in commercial, industrial, and energy-efficient buildings. The Midwest experiences the lowest growth at 5.9%, with demand primarily driven by the region’s manufacturing and food processing industries that require cold insulation for refrigeration and storage. As industries continue to focus on energy efficiency and reducing operational costs, demand for cold insulation is expected to rise in all regions.

The West is experiencing the highest demand for cold insulation in the USA, with an 8.5% CAGR. This growth is driven by the region’s diverse industrial base, particularly in industries like petrochemicals, manufacturing, and renewable energy. States like California, Texas, and Washington are home to large refineries, chemical plants, and industrial facilities, all of which require cold insulation for temperature control, efficiency, and protection of equipment handling low-temperature materials. The West’s emphasis on sustainability and energy efficiency further boosts demand, as industries increasingly focus on reducing energy consumption and operational costs. The growing transportation and storage of liquefied natural gas (LNG) and cryogenic materials adds to the need for reliable cold insulation systems. The West’s continued investment in infrastructure, combined with regulatory pressures to meet environmental standards, will ensure sustained growth in the demand for cold insulation in the region.

The South is seeing strong demand for cold insulation in the USA, with a 7.6% CAGR. The region’s expanding petrochemical, energy, and manufacturing sectors are key contributors to this demand. States like Texas, Louisiana, and Alabama are home to large refineries and chemical plants that require cold insulation to protect pipelines, tanks, and other infrastructure that handle cryogenic liquids and gases. The region’s growing focus on energy-efficient manufacturing and processing facilities, especially in industries like food processing and pharmaceuticals, is further driving the demand for cold insulation. The rise in liquefied natural gas (LNG) production and exportation is creating increased demand for insulation solutions that can effectively manage low temperatures during transportation and storage. As the South continues to grow industrially and invest in infrastructure development, the need for reliable cold insulation to improve operational efficiency and ensure safety will continue to rise steadily.

The Northeast is experiencing moderate demand for cold insulation in the USA, with a 6.8% CAGR. This demand is largely driven by the region’s industrial base, including food and beverage, pharmaceuticals, and energy sectors, where cold insulation is crucial for maintaining temperature-sensitive operations. Major cities like New York, Boston, and Philadelphia are hubs for industrial manufacturing, requiring cold insulation for refrigeration, cryogenic storage, and temperature-controlled transport. The region’s focus on energy-efficient construction is also driving the adoption of cold insulation in commercial and residential buildings. The Northeast’s robust chemical manufacturing industry and the growing need for temperature regulation in laboratories, medical facilities, and warehouses further contribute to the demand for cold insulation. As environmental regulations become more stringent and industries seek to reduce energy consumption, the need for cold insulation to maintain temperature control and improve efficiency will continue to grow in the Northeast.

The Midwest is experiencing the lowest growth in demand for cold insulation in the USA, with a 5.9% CAGR. The region’s industrial strength, particularly in manufacturing, food processing, and heavy industries, supports steady demand for cold insulation. States like Michigan, Ohio, and Illinois are key players in automotive and manufacturing industries, where cold insulation is essential for controlling temperatures in storage, refrigeration, and production processes. The food processing sector in the Midwest, which requires large-scale refrigeration systems, further drives the demand for cold insulation. While the region’s growth rate is slower compared to other areas, steady demand remains due to the Midwest’s focus on operational efficiency and reducing energy consumption. As industries continue to modernize and adhere to environmental standards, the adoption of cold insulation for temperature control and energy optimization will remain a priority in the Midwest. Continued infrastructure development ensures that demand will remain steady in the region.

In the USA, demand for conductive plastics is growing as industries like electronics, automotive, and industrial equipment increasingly adopt materials that combine polymer flexibility with electrical conductivity. This enables weight reduction, design integration (e.g., EMI shielding, grounding, static dissipation) and cost-efficiency compared to metal-based parts. The use of conductive plastics is expanding across various applications, such as electric vehicles, consumer electronics, and industrial sensors.

Leading firms in this segment include KraFAB with a reported 45.5% share, Celanese Corporation, Flamingo Additives & Colourants LLP, AIMPLAS, and Parker Hannifin Corp. These companies differentiate through proprietary formulations, high-conductivity polymer blends, carbon- or metal-filled compounds, and application-specific expertise (e.g., in automotive electronics or industrial sensors). KraFAB’s leadership reflects its strength in niche conductive polymer compounds and integrated supply-chain services for additive manufacturers.

The competitive dynamics are shaped by several factors. First, the growth of electric vehicles, IoT devices, and high-performance electronics drives demand for conductive plastics that offer both electrical and thermal management. Second, material innovation—such as lower filler content, improved processing, better recyclability, and multifunctionality (shielding and structural properties) enables differentiation. Third, challenges remain, such as the higher cost of conductive compounds compared to standard plastics, processing difficulties (e.g., filler dispersion and rheology issues), and competition from alternative materials (metal inserts, foils, coatings). Suppliers that combine strong formulation capabilities, large-scale production, design support, and reliable logistics will be well-positioned to capture the expanding demand for conductive plastics in the USA.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD billion |

| Product Type | Polyphenylene Sulfide (PPS), Polyamide, Polycarbonate, Polyethylene, Polypropylene, PBT, Others |

| Application | Antistatic Packaging & Coating, Capacitors, Actuators & Sensors, Batteries, Solar Cells, Electroluminescence, PCBs, Others |

| End Use Industry | Automotive, Aerospace & Defense, Electrical & Electronics, Industrial, Healthcare, Telecommunications, Others |

| Region | West USA, South USA, Northeast USA, Midwest USA |

| Countries Covered | USA |

| Key Companies Profiled | KraFAB, Celanese Corporation, Flamingo Additives & Colourants LLP, AIMPLAS, Parker Hannifin Corp |

| Additional Attributes | Dollar sales by product type and application; regional CAGR and adoption trends; demand trends in conductive plastics; growth in automotive, aerospace, and electronics sectors; technology adoption for electrical applications; vendor offerings including material solutions, services, and product integration; regulatory influences and industry standards |

The demand for conductive plastics in usa is estimated to be valued at USD 1.6 billion in 2025.

The market size for the conductive plastics in usa is projected to reach USD 3.5 billion by 2035.

The demand for conductive plastics in usa is expected to grow at a 7.9% CAGR between 2025 and 2035.

The key product types in conductive plastics in usa are polyphenylene sulfide (pps), polyamide, polycarbonate, polyethylene, polypropylene, pbt and others.

In terms of application, antistatic packaging & coating segment is expected to command 22.0% share in the conductive plastics in usa in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Conductive Plastics Market Growth - Trends & Forecast 2025 to 2035

Demand for Conductive Plastics in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Bioplastics in USA Size and Share Forecast Outlook 2025 to 2035

Conductive Adhesive Market Size and Share Forecast Outlook 2025 to 2035

Conductive Polymer Coating Market Size and Share Forecast Outlook 2025 to 2035

USA Medical Coding Market Size and Share Forecast Outlook 2025 to 2035

Conductive Inks Market Size and Share Forecast Outlook 2025 to 2035

Conductive Polymer Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

USA Labels Market Size and Share Forecast Outlook 2025 to 2035

USA Plant-based Creamers Market Size and Share Forecast Outlook 2025 to 2035

USA Barrier Coated Paper Market Size and Share Forecast Outlook 2025 to 2035

USA Electronic Health Records (EHR) Market Size and Share Forecast Outlook 2025 to 2035

USA Animal Model Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Packer Bottle Market Size and Share Forecast Outlook 2025 to 2035

USA Stretch Hood Films Market Size and Share Forecast Outlook 2025 to 2035

Conductive Silicone Market Size and Share Forecast Outlook 2025 to 2035

Conductive Polymers Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Fence Screen Market Size and Share Forecast Outlook 2025 to 2035

USA Lubricant Contaminated HDPE Container Waste Market Size and Share Forecast Outlook 2025 to 2035

USA Commercial Walk-In Refrigeration Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA