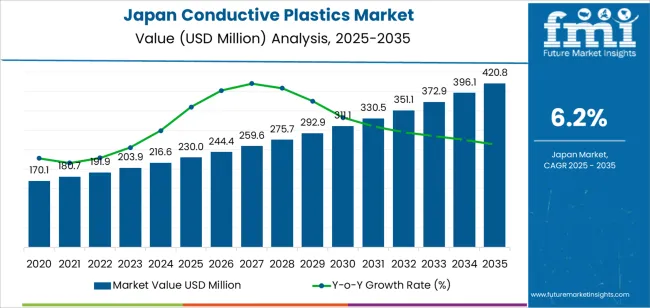

The demand for conductive plastics in Japan is expected to grow from USD 230.0 million in 2025 to USD 420.8 million by 2035, reflecting a compound annual growth rate (CAGR) of 6.2%. Conductive plastics combine the benefits of plastics, such as lightweight and cost-effectiveness, with the ability to conduct electricity, making them increasingly valuable across various industries like automotive, electronics, telecommunications, and packaging. As industries prioritize energy efficiency, durability, and the need for high-performance materials, the adoption of conductive plastics is expected to rise significantly.

In the automotive sector, conductive plastics are becoming essential, particularly in the production of electric vehicles (EVs), where they are used in components such as sensors, wiring, and batteries. Similarly, in electronics, conductive plastics play a crucial role in circuit boards, mobile devices, and packaging. The demand for conductive plastics is expected to expand further as industries continue to adopt smart technologies, telecommunications, and industrial equipment that require materials with both conductivity and flexibility.

The growing need for lightweight, cost-effective, and electrically conductive materials will drive the industry’s expansion, especially in automotive and electronics applications. As these sectors increasingly rely on advanced, green materials, the demand for conductive plastics in Japan will experience significant growth, solidifying their role in modern manufacturing and technology.

Between 2025 and 2030, the demand for conductive plastics in Japan will gradually rise from USD 230.0 million to USD 244.4 million. This period marks the early stages of widespread adoption, where industries will begin integrating conductive plastics into new applications, but penetration will still be moderate. The breakpoint in this phase will be driven by the initial acceptance of conductive plastics in automotive and electronics applications, particularly as industries look for alternatives to metals that offer lighter, more cost-effective solutions.

From 2030 to 2035, the demand for conductive plastics is expected to increase more sharply, from USD 244.4 million to USD 420.8 million. This accelerated growth is a result of the more widespread adoption of conductive plastics across multiple sectors, including automotive, telecommunications, and consumer electronics. As industries increase their reliance on these materials for high-performance components, the industry will experience a significant breakpoint, marking a shift from niche applications to mainstream use. The rapid adoption of conductive plastics will be driven by technological advancements, greater environmental awareness, and the continuous demand for innovative, green solutions in key industries.

| Metric | Value |

|---|---|

| Demand for Conductive Plastics in Japan Value (2025) | USD 230.0 million |

| Demand for Conductive Plastics in Japan Forecast Value (2035) | USD 420.8 million |

| Demand for Conductive Plastics in Japan Forecast CAGR (2025-2035) | 6.2% |

The demand for conductive plastics in Japan is rising due to their unique combination of electrical conductivity and the lightweight, cost-effective properties of plastics. These materials are crucial in various industries, including electronics, automotive, and packaging, particularly for applications requiring static dissipation, electromagnetic shielding, and efficient electronic components.

A significant driver of this growth is the expansion of the automotive industry, especially with the increasing adoption of electric vehicles (EVs). Conductive plastics are used in EV components such as sensors, connectors, and battery casings, where reducing weight while maintaining high performance is essential. The automotive sector’s shift towards EVs is creating strong demand for these materials in Japan. Moreover, the electronics industry, which is experiencing growth in consumer electronics, medical devices, and industrial applications, further fuels the demand for conductive plastics.

Technological advancements in conductive plastic materials, including improvements in performance and durability, are also contributing to this upward trend. As Japan focuses on minimizing environmental impacts and enhancing efficiency across industries, conductive plastics are emerging as an eco-friendly and cost-effective alternative to traditional metals. Their versatility and ability to meet both technical and environmental needs are making them increasingly attractive. This trend is expected to continue driving demand for conductive plastics in Japan, particularly as industries prioritize green innovation and energy-efficient solutions.

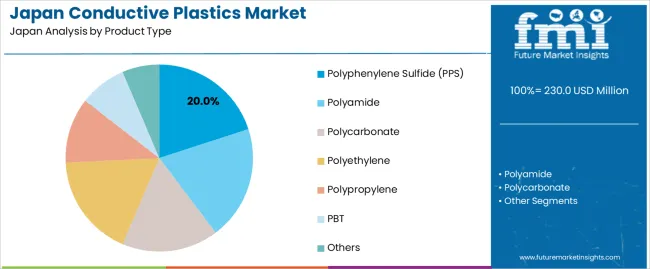

Demand for conductive plastics in Japan is segmented by product type, end-use industry, application, and region. By product type, demand is divided into polyphenylene sulfide (PPS), polyamide, polycarbonate, polyethylene, polypropylene, PBT, and others, with PPS holding the largest share at 20%. The demand is also segmented by end-use industry, including automotive, aerospace & defense, electrical & electronics, industrial, healthcare, telecommunications, and others, with automotive leading the demand at 32%.

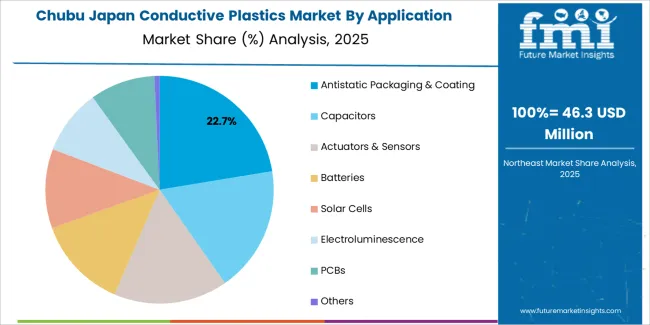

In terms of application, demand is divided into antistatic packaging & coating, capacitors, actuators & sensors, batteries, solar cells, electroluminescence, PCBs, and others, with antistatic packaging & coating leading the demand. Regionally, demand is divided into Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, and the Rest of Japan.

Polyphenylene sulfide (PPS) accounts for 20% of the demand for conductive plastics in Japan. PPS is favored for its high thermal stability, electrical conductivity, and resistance to harsh chemicals, which makes it ideal for use in high-performance applications. It is widely used in industries like automotive and electronics, where durable and reliable materials are required for components such as sensors, actuators, and EMI shielding. PPS is also used in applications like connectors and electric vehicle parts, where performance in high temperatures is critical.

Its ability to integrate conductive fillers while maintaining excellent mechanical properties makes PPS a preferred choice for advanced engineering solutions. As industries continue to seek materials that offer both high electrical conductivity and robustness in extreme conditions, PPS will remain the leading product type in the conductive plastics industry in Japan.

The automotive industry accounts for 32% of the demand for conductive plastics in Japan. The increasing adoption of electric vehicles (EVs) and the need for efficient, lightweight components in both traditional and electric vehicles are driving the demand for conductive plastics. These materials are used in a variety of automotive applications, including electric motors, sensors, and power electronics, where their ability to withstand high temperatures and resist electrical interference is crucial.

Conductive plastics are also used in the manufacturing of components that require high electrical conductivity, such as connectors and circuit boards. As the automotive industry moves toward electrification and the demand for EVs and hybrid vehicles grows, conductive plastics like PPS and polyamide are expected to play an increasingly important role in enhancing performance, reducing weight, and improving the energy efficiency of vehicle systems. As a result, the automotive sector will continue to lead the demand for conductive plastics in Japan.

Key drivers include Japan’s advanced electronics manufacturing (smartphones, sensors, IoT devices) and growing need for electromagnetic interference (EMI) shielding and static‑dissipative materials in these products. The automotive sector’s shift towards electric vehicles (EVs) and lightweight components also raises demand for conductive plastics that replace metals. Restraints include the higher cost of conductive‑additive‑filled plastics versus standard polymers, variability in performance (conductivity vs mechanical strength trade‑offs), and supply‑chain constraints for specialized fillers (such as carbon nanotubes or silver composites) which may slow uptake in cost‑sensitive or high‑volume segments.

In Japan, demand for conductive plastics is expanding because manufacturers seek lightweight, design‑flexible alternatives to metals for components that require electrical or thermal conductivity such as housings with EMI shielding, connectors, and sensors. With growth in electronics, EVs, and connected devices, conductive plastics provide the dual advantage of polymer processability and conductive functionality. Japan’s focus on high‑quality production and innovation also encourages adoption of premium materials. As devices become more compact and smarter, the need for materials that integrate conductivity with polymer advantages is helping to drive uptake of conductive plastics.

Technological innovations are fueling growth in Japan’s conductive‑plastics industry by improving material formulation, performance and manufacturability. Advances include the development of polymer compounds filled with conductive additives (carbon black, metal fibers, graphene) tailored to provide reliable conductivity while retaining adequate strength and processability. New manufacturing methods enable better dispersion of conductive fillers, achieving consistent performance across batches. Enhanced formulations for EMI shielding, electrostatic discharge (ESD) protection and electrically conductive coatings expand use‑cases. These innovations make conductive plastics more viable for high‑performance electronics and automotive applications, encouraging broader uptake among Japanese manufacturers.

Despite growing interest, adoption of conductive plastics in Japan faces several challenges. One issue is cost: the incorporation of conductive additives and the need for precise material design raise prices relative to standard polymers. Another challenge is performance trade‑offs: achieving high conductivity often reduces mechanical strength or increases processing complexity, making some applications reluctant to switch. Supply‑chain issues such as availability of premium fillers or fluctuating costs of conductive additives can impede adoption. Finally, in some cases the established use of metals (for highest conductivity) remains entrenched, and switching to a polymer‑based alternative may require significant design/validation work, slowing deployment.

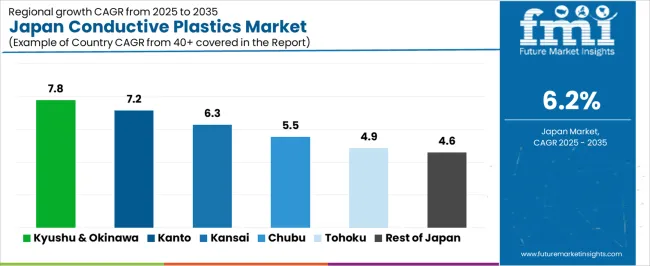

| Region | CAGR (%) |

|---|---|

| Kyushu & Okinawa | 7.8% |

| Kanto | 7.2% |

| Kinki | 6.3% |

| Chubu | 5.5% |

| Tohoku | 4.9% |

| Rest of Japan | 4.6% |

Demand for conductive plastics in Japan is growing steadily across all regions, with Kyushu & Okinawa leading at a 7.8% CAGR. This growth is driven by the region's strong manufacturing base in electronics, automotive, and renewable energy sectors, which increasingly use conductive plastics for lightweight, high-performance components. Kanto follows with a 7.2% CAGR, supported by its large industrial and tech industries, particularly in electronics and electric vehicles (EVs).

Kinki shows a 6.3% CAGR, with demand driven by automotive and electronics sectors. Chubu experiences a 5.5% CAGR, with the automotive sector, including major manufacturers like Toyota, fueling demand for conductive plastics. Tohoku shows a 4.9% CAGR, with steady demand driven by its focus on electronics and energy sectors. The Rest of Japan has the lowest growth at 4.6%, but demand remains steady due to industrial and agricultural applications.

Kyushu & Okinawa are experiencing the highest demand for conductive plastics in Japan, with a 7.8% CAGR. This growth is driven by the region's industrial and manufacturing sectors, particularly in electronics, automotive, and renewable energy industries. Conductive plastics are crucial in applications like electromagnetic shielding, static control, and lightweight components for electric vehicles and electronic devices.

Kyushu & Okinawa's strong electronics and automotive manufacturing bases support the increasing adoption of conductive plastics, which offer both electrical conductivity and reduced weight. The region’s push toward more energy-efficient and green manufacturing processes also fuels demand, as conductive plastics are a key material for reducing energy consumption in electronic devices. As the region continues to expand its focus on high-tech industries, the demand for conductive plastics will remain strong.

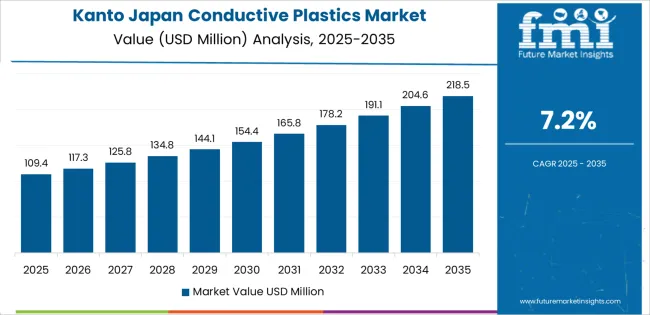

Kanto is seeing strong demand for conductive plastics in Japan, with a 7.2% CAGR. The region’s demand is primarily driven by its robust electronics and automotive industries, particularly in cities like Tokyo and Yokohama. Kanto is a key hub for high-tech manufacturing, where conductive plastics are used in a wide range of applications, including consumer electronics, automotive parts, and medical devices.

The growing use of conductive plastics in electric vehicles (EVs) and the increasing demand for lightweight materials that offer electrical conductivity contribute to the rising demand in the region. Kanto’s focus on innovation and energy efficiency in electronics further drives the adoption of conductive plastics. As industries in the region continue to prioritize advanced materials that reduce weight and enhance performance, demand for conductive plastics is expected to remain strong.

Kinki is experiencing moderate demand for conductive plastics in Japan, with a 6.3% CAGR. The region’s demand is driven by its strong manufacturing base, particularly in electronics, automotive, and industrial sectors. Cities like Osaka and Kyoto are key industrial hubs where conductive plastics are used in a variety of applications, including electronics, automotive parts, and semiconductor manufacturing.

The increasing focus on energy-efficient solutions in automotive and electronic devices is driving the demand for lightweight, electrically conductive materials, making conductive plastics an ideal choice for manufacturers. The Kinki region’s growing adoption of electric vehicles and the expansion of the semiconductor industry further support the rising demand for conductive plastics. As the region continues to prioritize technological innovation and durability, demand for conductive plastics will continue to grow at a moderate pace.

Chubu is seeing steady demand for conductive plastics in Japan, with a 5.5% CAGR. The region’s industrial base, particularly in automotive manufacturing and electronics, is driving this demand. Chubu is home to several major automotive manufacturers, including Toyota, which increasingly rely on conductive plastics for lightweight, high-performance components in electric vehicles (EVs) and electronic systems. Conductive plastics are essential for applications like battery housings, electronic shielding, and other components that require both electrical conductivity and durability.

The region’s growing focus on electric vehicles and green technologies further boosts the adoption of conductive plastics, as manufacturers seek materials that enhance energy efficiency and performance. As Chubu’s industrial and automotive sectors continue to innovate and adopt new materials, the demand for conductive plastics is expected to grow steadily, supported by advancements in automotive and electronic technologies.

Tohoku is experiencing steady demand for conductive plastics in Japan, with a 4.9% CAGR. The region’s demand is driven by its increasing focus on electronics, energy, and manufacturing sectors. Tohoku’s strong presence in the electronics industry, particularly in semiconductor production and renewable energy, supports the adoption of conductive plastics for various applications, including electromagnetic shielding and electronic devices.

The growing emphasis on lightweight materials in energy-efficient systems, such as electric vehicles, is contributing to the rising demand for conductive plastics. While Tohoku's overall industrial scale is smaller than other regions, the increasing focus on high-tech industries and renewable energy solutions ensures a steady need for conductive plastics in the region. As Tohoku continues to invest in advanced manufacturing technologies and clean energy solutions, the demand for conductive plastics is expected to grow at a moderate pace.

The Rest of Japan is experiencing the lowest growth in demand for conductive plastics, with a 4.6% CAGR. While this region does not have the same level of industrial activity as major hubs like Kanto or Kyushu, there is still steady demand for conductive plastics in electronics, automotive, and manufacturing sectors. Smaller manufacturers in the region are increasingly adopting conductive plastics for applications in consumer electronics, automotive components, and other industrial uses.

The region’s focus on improving efficiency and adopting more advanced materials in manufacturing processes supports the demand for conductive plastics. As industries in the Rest of Japan continue to modernize and prioritize energy efficiency, the demand for conductive plastics is expected to grow steadily, though at a slower rate than in more industrialized regions.

In Japan, demand for conductive plastics is rising as electronics, automotive, and industrial equipment manufacturers seek materials that combine polymer flexibility with electrical conductivity. These plastics offer advantages in weight reduction, design integration (such as EMI shielding and static dissipation), and cost efficiency compared to traditional metal‑based components. The country’s advanced electronics industry and increasing adoption of EVs and IoT devices are key drivers of this demand.

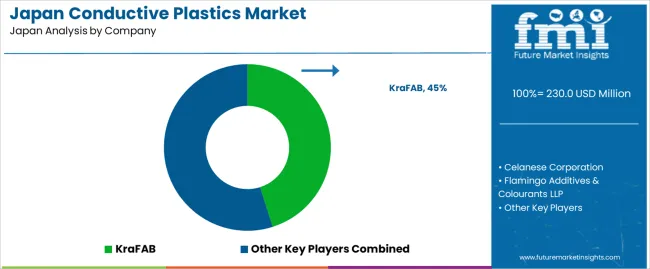

Major players in this segment include KraFAB (45.1% share), Celanese Corporation, Flamingo Additives & Colourants LLP, AIMPLAS and Parker Hannifin Corp. These firms differentiate by offering proprietary conductive‑polymer blends, enabling applications in automotive electronics, industrial sensors, and consumer devices. KraFAB’s leadership reflects its specialization in high‑conductivity compounds and strong supply‑chain support in the Japanese industry.

The competitive dynamics are shaped by multiple factors. First, growth in electric vehicles, advanced consumer electronics and miniaturized industrial systems increases the need for conductive plastics capable of electrical and thermal management. Second, material innovation such as reducing filler content, improving processing, enhancing durability, and combining conductivity with structural properties is a major differentiator.

Third, challenges persist including higher costs for conductive compound materials versus standard plastics, processing complexities (for example filler dispersion and rheology issues), and competition from alternative solutions like metal inserts or conductive coatings. Suppliers that excel in formulation capability, volume production scale, design support and reliable logistics will be best positioned to capture the expanding conductive‑plastics opportunity in Japan.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD million |

| Product Type | Polyphenylene Sulfide (PPS), Polyamide, Polycarbonate, Polyethylene, Polypropylene, PBT, Others |

| Application | Antistatic Packaging & Coating, Capacitors, Actuators & Sensors, Batteries, Solar Cells, Electroluminescence, PCBs, Others |

| End Use Industry | Automotive, Aerospace & Defense, Electrical & Electronics, Industrial, Healthcare, Telecommunications, Others |

| Region | Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, Rest of Japan |

| Countries Covered | Japan |

| Key Companies Profiled | KraFAB, Celanese Corporation, Flamingo Additives & Colourants LLP, AIMPLAS, Parker Hannifin Corp |

| Additional Attributes | Dollar sales by product type and application; regional CAGR and adoption trends; demand trends in conductive plastics; growth in automotive, aerospace, and electronics sectors; technology adoption for electrical applications; vendor offerings including material solutions, services, and product integration; regulatory influences and industry standards |

The demand for conductive plastics in japan is estimated to be valued at USD 230.0 million in 2025.

The market size for the conductive plastics in japan is projected to reach USD 420.8 million by 2035.

The demand for conductive plastics in japan is expected to grow at a 6.2% CAGR between 2025 and 2035.

The key product types in conductive plastics in japan are polyphenylene sulfide (pps), polyamide, polycarbonate, polyethylene, polypropylene, pbt and others.

In terms of application, antistatic packaging & coating segment is expected to command 22.0% share in the conductive plastics in japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Conductive Plastics Market Growth - Trends & Forecast 2025 to 2035

Japan Faith-based Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Sports Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Respiratory Inhaler Devices Market Size and Share Forecast Outlook 2025 to 2035

Japan Halal Tourism Market Size and Share Forecast Outlook 2025 to 2035

Conductive Adhesive Market Size and Share Forecast Outlook 2025 to 2035

Conductive Polymer Coating Market Size and Share Forecast Outlook 2025 to 2035

Conductive Inks Market Size and Share Forecast Outlook 2025 to 2035

Conductive Polymer Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Japan Automated People Mover Industry Size and Share Forecast Outlook 2025 to 2035

Japan Automotive Load Floor Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Japan Food Cling Film Market Size and Share Forecast Outlook 2025 to 2035

Japan Polypropylene Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Conductive Silicone Market Size and Share Forecast Outlook 2025 to 2035

Conductive Polymers Market Size and Share Forecast Outlook 2025 to 2035

Plastics-To-Fuel (PTF) Market Size and Share Forecast Outlook 2025 to 2035

Conductive Fluted Sheets Market Size and Share Forecast Outlook 2025 to 2035

Conductive Cardboard Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Japan Probiotic Yogurt Market is segmented by product type, source type, nature type, flavor type, fat content, sales channel and key city/province through 2025 to 2035.

japan Tortilla Market - Growth, Trends and Forecast from 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA