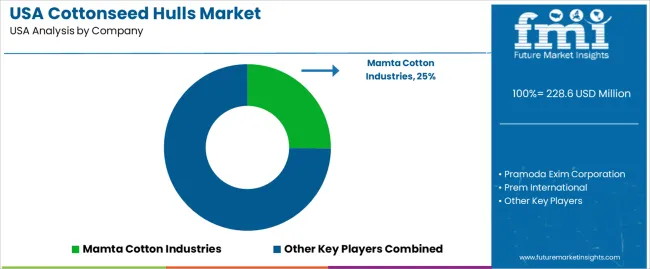

The demand for cottonseed hulls in the USA is valued at USD 228.6 million in 2025 and is projected to reach USD 314.1 million by 2035, reflecting a compound annual growth rate (CAGR) of 3.2%. This steady growth is driven by the increasing demand for cottonseed hulls in animal feed, agricultural applications, and industrial use. Cottonseed hulls are valued for their high fiber content and are primarily used in livestock feed, as well as in the production of biodegradable products, which further supports their growing adoption in various industries. The continuous need for sustainable and cost-effective raw materials across multiple sectors contributes significantly to the growth of this market.

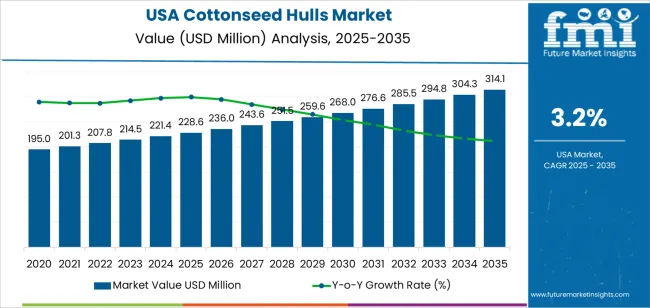

The demand for cottonseed hulls shows gradual and consistent growth over the forecast period, increasing from USD 195.0 million in earlier years to USD 228.6 million in 2025, and reaching USD 314.1 million by 2035. The annual increments are steady, with values rising each year, including a rise from USD 236.0 million in 2026 to USD 243.6 million in 2027, and continuing through the forecast period. This steady rise in demand reflects both the stability of the cottonseed hull market and the increasing importance of sustainable, cost-efficient materials in various industries, contributing to its long-term market growth trajectory.

Demand for cottonseed hulls in USA is projected to increase from USD 228.6 million in 2025 to USD 314.1 million by 2035, reflecting a compound annual growth rate (CAGR) of 3.2%. From USD 195.0 million in 2020, demand grows steadily, reaching USD 221.4 million by 2024, and USD 228.6 million in 2025. Between 2025 and 2030, demand rises to USD 259.6 million, continuing its upward trajectory. The growth is largely driven by cottonseed hulls' continued use in livestock feed, particularly as bulk roughage in cattle diets, as well as their applications in industrial processes.

While the volume of cottonseed hulls used for animal feed remains stable, the value growth is impacted by regional supply constraints and competition from other fiber sources. The use of cottonseed hulls is especially favored in ruminant diets due to their high fiber content, but challenges such as transportation costs and the relatively low bulk density of the product limit its widespread adoption in regions far from cotton processing facilities. Despite these challenges, demand for cottonseed hulls will continue to expand gradually, with growth driven by steady livestock feed requirements and increased processing efficiency over the forecast period.

| Metric | Value |

|---|---|

| Industry Value (2025) | USD 228.6 million |

| Forecast Value (2035) | USD 314.1 million |

| Forecast CAGR (2025–2035) | 3.2% |

The demand for cottonseed hulls in USA is primarily driven by the established livestock and dairy industry, where the hulls serve as a high fiber feed ingredient for ruminant animals. The abundant availability of cottonseed by product from cotton ginning operations supports consistent supply of hulls for feed applications. Their fibrous nature enhances rumen function in cattle, which makes them attractive in cattle feed formulations. In addition to feed uses, growing emphasis on sustainable agriculture and circular economy practices in USA has encouraged the uptake of cottonseed hulls as a by product with low waste value.

Emerging applications also contribute to the growing demand. Cottonseed hulls are increasingly used in industrial segments such as bio based materials, wastewater treatment media and biomass energy feedstock. These secondary uses derive from the hulls’ cellulose rich structure and availability as an agricultural residue. While competition from other feed ingredients and variations in cottonseed supply pose occasional constraints, the overall demand for cottonseed hulls in USA is projected to continue growing as feed and industrial users seek cost effective and sustainable inputs.

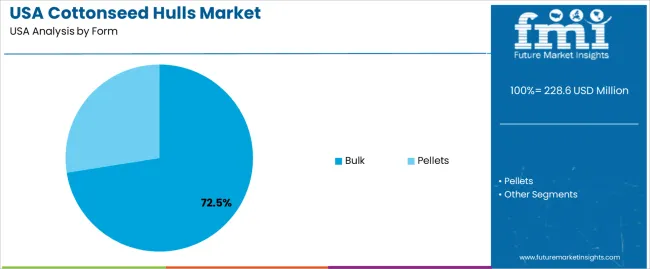

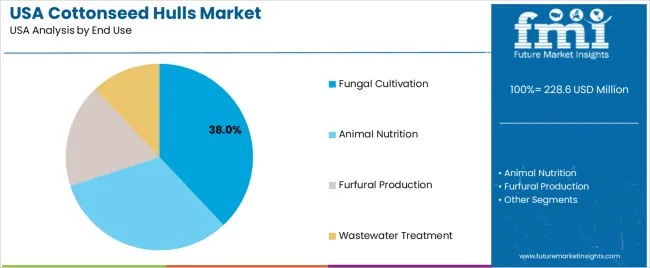

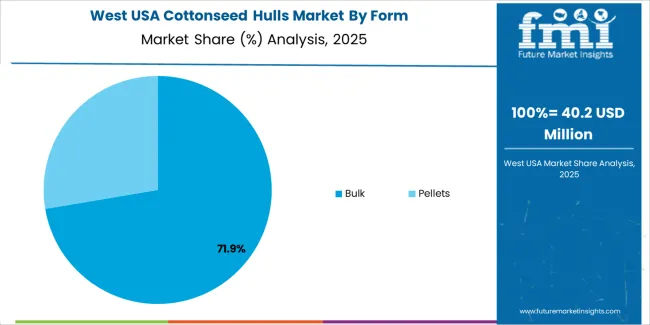

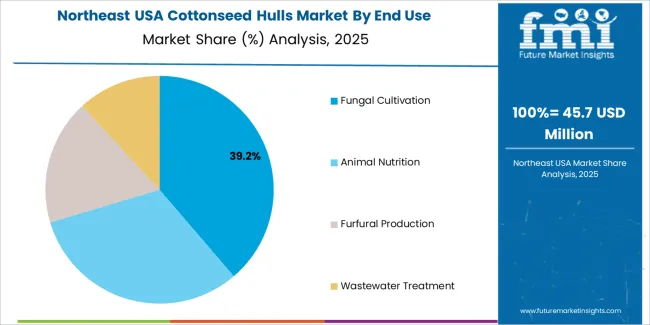

The demand for cottonseed hulls in the USA is influenced by both the form in which they are available and the industries that use them. Cottonseed hulls are commonly available in bulk and pellet forms, each offering different advantages depending on the application. The end-use industries include fungal cultivation, animal nutrition, furfural production, and wastewater treatment, with cottonseed hulls serving as a valuable raw material in various processes. These segments reflect the versatile nature of cottonseed hulls and their role in sustainable practices across different sectors.

Bulk cottonseed hulls account for 73% of the total demand in the USA. This form is preferred due to its cost-effectiveness and versatility in large-scale applications. Bulk cottonseed hulls are widely used in industries such as animal nutrition, where they serve as a fiber-rich ingredient in feed for livestock. Additionally, bulk cottonseed hulls are utilized in agricultural and industrial applications, including as a substrate for fungal cultivation and as a raw material in the production of furfural.

The demand for bulk cottonseed hulls is driven by their availability in large quantities, which makes them suitable for industries requiring high-volume supplies. Furthermore, their natural, biodegradable properties and low environmental impact make them an attractive option for sustainable practices in agriculture and industry. The continued growth of industries relying on bulk cottonseed hulls for their functional and economic benefits ensures that this form remains the most in-demand in the market.

Fungal cultivation accounts for 38.0% of the total demand for cottonseed hulls in the USA. Cottonseed hulls are an important substrate for growing various fungi, particularly in controlled agricultural environments where they provide the ideal conditions for mushroom and other fungal species to thrive. Their high fiber content, moisture retention ability, and structural integrity make them an excellent growing medium that supports healthy fungal development.

The demand for cottonseed hulls in fungal cultivation is driven by the expanding interest in mushrooms and other fungi as a food source, as well as their use in pharmaceuticals and biotechnological applications. As consumer demand for plant-based and sustainable food products grows, the need for effective and eco-friendly cultivation materials such as cottonseed hulls also rises. Their role in supporting efficient fungal growth and their affordability make them a preferred choice in the industry, ensuring continued demand in the coming years.

The demand for cottonseed hulls in the USA is primarily driven by their use in animal feed, especially in the dairy and livestock industries. With rising interest in sustainable agriculture and circular economy practices, cottonseed hulls have found expanded uses beyond animal nutrition, including in industrial applications like bio-based materials and wastewater treatment. However, challenges such as high transportation costs and competition from alternative feed sources may limit broader adoption. As the demand for sustainable, low-cost feed ingredients increases, cottonseed hulls are expected to see continued growth in various sectors.

What trends are influencing the demand for cottonseed hulls in USA?

The demand for cottonseed hulls in the USA is being influenced by the increasing use of by-products in animal nutrition and industrial applications. Their high fibre content and availability in cotton-growing regions make them favourable as roughage in ruminant diets and as substrates in fungal cultivation. Simultaneously, interest in sustainable feed ingredients and circular-economy practices is elevating their appeal. At the same time, the shift to pelletised forms and the growth of non-feed uses such as wastewater treatment and bio-based materials further broaden usage scenarios in the United States.

What is driving the expansion of cottonseed hulls demand in USA?

A primary driver behind the increased demand for cottonseed hulls in the United States is the strong dairy and livestock industry, which requires low-cost, high-fibre roughages to manage ruminant nutrition. Given cottonseed hulls’ favourable effects on rumen function and their availability where cotton is grown, producers adopt them to optimise feed economics. Further support comes from sustainability goals and regulatory pressures that encourage the use of agricultural by-products. These forces combine to elevate the role of cottonseed hulls in the feed supply chain within the United States.

What factors are limiting the growth of cottonseed hulls demand in USA?

Several constraints are limiting broader growth of cottonseed hulls demand in the USA. One issue is the logistic challenge posed by their low bulk density and high transport cost from ginning sites to distant feed mills. Another factor is competition from alternative fibre sources or forages that may offer easier availability or handling. Additionally, fluctuations in cottonseed availability due to crop yields and ginning volumes affect supply stability. These issues reduce attractiveness for some end-users and restrict how extensively cottonseed hulls can be used across all potential applications in the United States.

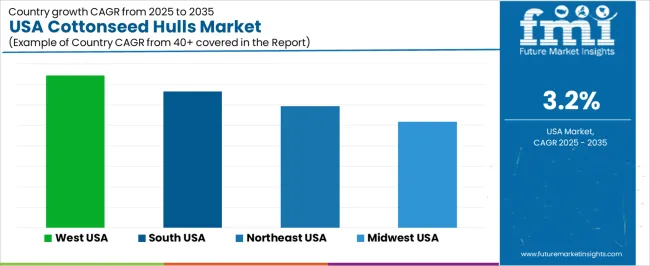

| Region | CAGR (%) |

|---|---|

| West | 3.7% |

| South | 3.3% |

| Northeast | 3.0% |

| Midwest | 2.6% |

The demand for cottonseed hulls in the USA is experiencing steady growth across all regions. The West leads with a 3.7% CAGR, supported by a strong agricultural sector and increasing use of cottonseed hulls as a feed ingredient in livestock and poultry farming. The South follows with a 3.3% growth, where cottonseed hulls are a byproduct of the region's extensive cotton farming, utilized for animal feed and soil conditioning. The Northeast sees a 3.0% growth, driven by agricultural practices in the region and a rising interest in sustainable feed options. The Midwest, growing at 2.6%, experiences stable demand, primarily due to its significant livestock farming industry.

The West region of the USA is projected to grow at a CAGR of 3.7% through 2035 in demand for cottonseed hulls. The region’s growing agricultural industry, particularly in states like California and Arizona, contributes significantly to the demand for cottonseed by-products. Cottonseed hulls are widely used in animal feed, especially for cattle, and in the production of organic fertilizers. As farming operations in the West continue to expand, the need for cottonseed hulls as a cost-effective and sustainable feed ingredient grows. Additionally, the demand for natural soil amendments further drives market growth.

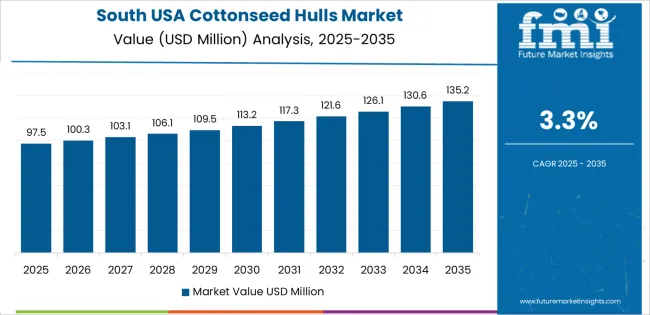

The South region of the USA is projected to grow at a CAGR of 3.3% through 2035 in demand for cottonseed hulls. As one of the largest cotton-producing regions in the country, the South continues to see high production of cottonseed, leading to a steady supply of cottonseed hulls. States like Texas, Georgia, and Arkansas contribute significantly to this market by using hulls in animal feed, particularly for livestock. The region's increasing focus on sustainable farming practices and cost-effective feed options further supports the growing demand for cottonseed hulls in agricultural applications.

The Northeast region of the USA is projected to grow at a CAGR of 3% through 2035 in demand for cottonseed hulls. While not a major cotton-producing region, the Northeast benefits from increased agricultural and livestock operations that use cottonseed hulls in animal feed. States like Pennsylvania and New York use cottonseed hulls for their nutritional value in livestock diets. Additionally, the region’s growing interest in organic farming and sustainable agricultural practices helps support the use of cottonseed hulls as a natural feed additive and soil amendment.

The Midwest region of the USA is projected to grow at a CAGR of 2.6% through 2035 in demand for cottonseed hulls. While cotton production in the Midwest is limited, the region’s large agricultural sector and livestock industry contribute to a steady demand for cottonseed by-products. States like Illinois and Missouri use cottonseed hulls in cattle feed, helping meet the nutritional needs of livestock. Additionally, the region’s focus on sustainable farming practices and the adoption of natural feed alternatives continue to increase the usage of cottonseed hulls in agricultural applications.

The demand for cottonseed hulls in the USA is driven primarily by their role as a cost effective, high fibre ingredient in livestock feed, especially for ruminants in dairy and beef production. Their abundance as a by product of cotton processing allows efficient integration into animal nutrition regimes. Sustainability initiatives and circular economy practices also support their adoption across sectors such as mushroom cultivation and wastewater treatment. These drivers reflect the broader shift toward utilising agricultural by products for multiple applications in the feed and industrial value chains.

Key players involved globally in the cottonseed hulls supply chain include Mamta Cotton Industries, Pramoda Exim Corporation, Prem International, Shree Ram Proteins Ltd., and SMM TRADERS. These firms specialise in the processing and export of hulls from cotton seed processing operations and facilitate supply into diverse markets, including the USA. Their operations support scale and logistics in supplying bulk quantities of hulls for feed and industrial users, helping shape the growth and availability of this raw material in the USA agricultural ecosystem.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD million |

| Form | Bulk, Pellets |

| End Use | Fungal Cultivation, Animal Nutrition, Furfural Production, Wastewater Treatment |

| Regions Covered | Northeast, West, Midwest, South |

| Countries Covered | USA |

| Key Companies Profiled | Mamta Cotton Industries, Pramoda Exim Corporation, Prem International, Shree Ram Proteins Ltd., SMM TRADERS |

| Additional Attributes | Dollar by sales across form and end-use segments, supply chain dynamics, regional adoption trends, fiber content and quality analysis, demand in livestock feed versus industrial applications, processing efficiency improvements, sustainability adoption in agriculture and bio-based industries. |

The global demand for cottonseed hulls in USA is estimated to be valued at USD 228.6 million in 2025.

The market size for the demand for cottonseed hulls in USA is projected to reach USD 314.1 million by 2035.

The demand for cottonseed hulls in USA is expected to grow at a 3.2% CAGR between 2025 and 2035.

The key product types in demand for cottonseed hulls in USA are bulk and pellets.

In terms of end use, fungal cultivation segment to command 38.0% share in the demand for cottonseed hulls in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cottonseed Hulls Market Analysis by Form, End Use, and Region through 2025 to 2035

Demand for Cottonseed Hulls in Japan Size and Share Forecast Outlook 2025 to 2035

USA Medical Coding Market Size and Share Forecast Outlook 2025 to 2035

USA Labels Market Size and Share Forecast Outlook 2025 to 2035

USA Plant-based Creamers Market Size and Share Forecast Outlook 2025 to 2035

USA Barrier Coated Paper Market Size and Share Forecast Outlook 2025 to 2035

USA Electronic Health Records (EHR) Market Size and Share Forecast Outlook 2025 to 2035

USA Animal Model Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Packer Bottle Market Size and Share Forecast Outlook 2025 to 2035

USA Stretch Hood Films Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Fence Screen Market Size and Share Forecast Outlook 2025 to 2035

USA Lubricant Contaminated HDPE Container Waste Market Size and Share Forecast Outlook 2025 to 2035

USA Commercial Walk-In Refrigeration Market Size and Share Forecast Outlook 2025 to 2035

USA & Canada Pre-painted Steel Roofing and Cladding Market Size and Share Forecast Outlook 2025 to 2035

USA Residential Cotton Candy Maker Market Size and Share Forecast Outlook 2025 to 2035

USA Faith Based Tourism Market Size and Share Forecast Outlook 2025 to 2035

United States NFC Lemon Juice Market Analysis - Size, Growth and Forecast 2025 to 2035

USA and Canada Copper Market Insights - Demand, Size & Industry Trends 2025 to 2035

USA Ground and Precipitated Calcium Carbonate Market Growth by Product Type, Application, End-Use, and Region in 2025 to 2035

United States Animal Feed Additives Market Report – Trends, Growth & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA