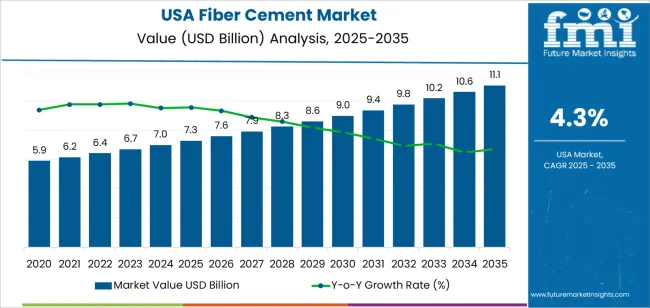

The demand for fiber cement in the USA is expected to grow from USD 7.3 billion in 2025 to USD 11.1 billion by 2035, reflecting a CAGR of 4.3%. Fiber cement products, known for their durability, resistance to weathering, and low maintenance needs, are increasingly being used in residential construction, commercial buildings, and facade applications. The growing adoption of fiber cement is supported by the increasing demand for sustainable building materials, as well as a focus on eco-friendly and energy-efficient construction practices.

The demand for fiber cement will be driven by factors such as the housing market recovery, remodeling trends, and the growing popularity of fiber cement siding as an alternative to traditional materials like wood and vinyl. The construction industry's increasing focus on long-lasting and fire-resistant materials also supports the continued use of fiber cement in building projects. Additionally, as consumers and builders shift towards more sustainable and low-maintenance options, fiber cement is expected to remain a popular choice in both new constructions and renovation projects.

From 2025 to 2026, the market will grow from USD 7.3 billion to USD 7.6 billion, reflecting a YoY increase of 4.1%. This early growth will be driven by increased construction activity, as the housing market continues to recover and the demand for building materials rises. Fiber cement, being a durable and cost-effective solution, will see early adoption in both new construction and remodeling projects.

Between 2026 and 2027, the market will grow from USD 7.6 billion to USD 7.9 billion, showing a YoY growth of 3.9%. The demand for fiber cement will continue to be supported by growing construction projects, particularly residential and commercial buildings. The shift towards eco-friendly materials and sustainable building solutions will further contribute to this growth.

From 2027 to 2028, the market will increase from USD 7.9 billion to USD 8.3 billion, marking a YoY increase of 5.1%. This period will see stronger demand driven by increased focus on fire-resistant, weather-resistant materials in both renovations and new buildings, and infrastructure development. The adoption of fiber cement in exterior cladding, roofing, and facade systems will continue to rise.

Between 2028 and 2029, the market will grow from USD 8.3 billion to USD 8.6 billion, reflecting a YoY growth of 3.6%. The moderate growth rate is indicative of stable demand as fiber cement products become more commonplace in building designs. With long-term durability and low maintenance qualities, fiber cement will continue to see steady adoption across various construction sectors.

From 2029 to 2030, the market will grow from USD 8.6 billion to USD 9.0 billion, marking a YoY increase of 4.7%. The adoption of fiber cement in both residential and commercial projects will rise due to its resilience, energy efficiency, and environmental benefits. As more builders choose fiber cement siding for its sustainability and design versatility, the demand will increase steadily.

The market will continue its steady growth through the remainder of the forecast period, with demand rising as construction activity remains strong and the trend towards sustainable materials continues. By 2035, the market for fiber cement in the USA is expected to reach USD 11.1 billion, driven by consistent adoption across the residential and commercial building sectors.

| Metric | Value |

|---|---|

| Industry Sales Value (2025) | USD 7.3 billion |

| Industry Forecast Value (2035) | USD 11.1 billion |

| Industry Forecast CAGR (2025-2035) | 4.3% |

Demand for fiber cement in the USA is increasing as builders and contractors seek durable, low maintenance, and weather resistant siding and cladding materials. Fiber cement products combine cementitious properties with embedded cellulose or synthetic fibres, offering resistance to fire, rot, insects and moisture. Growth in residential and commercial construction, along with renovation of existing buildings and stronger building codes in regions prone to wildfires or harsh weather, supports uptake of fiber cement siding and panels. Manufacturers and distributors report steady growth in market share as this material replaces traditional wood, vinyl and fiber reinforced plastic options.

Another contributing factor is the emphasis on sustainability and life cycle performance. Fiber cement is often marketed as a longer lived alternative and requires less frequent maintenance, which appeals to property owners seeking value over time. Moreover, trends toward upscale exterior aesthetics, multi family housing and mixed use developments promote materials that deliver both visual appeal and robustness. Challenges to growth include higher material cost relative to basic siding products, heavier weight complicating installation and competition from emerging composite materials. Nonetheless, the combination of building industry demand for performance and durability suggests that the demand for fiber cement in the USA will continue to expand.

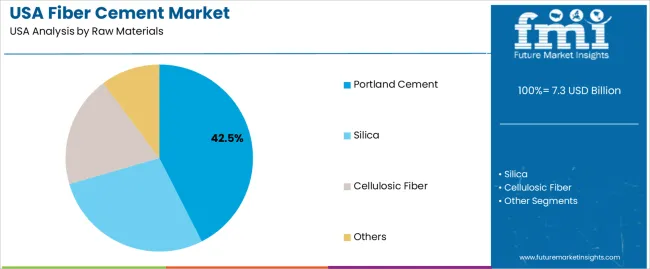

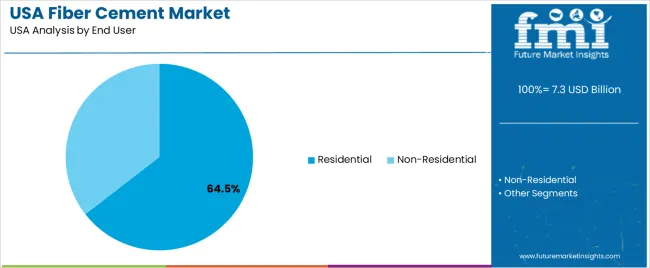

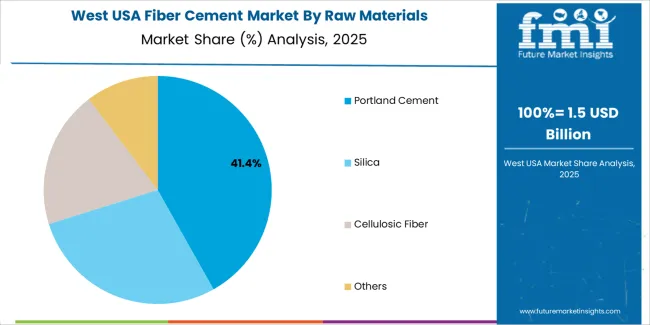

The demand for fiber cement in the USA is driven by raw materials and end-user segment. The leading raw material is Portland cement, which holds 43% of the market share, while residential construction is the dominant end-user segment, accounting for 64.5% of the demand. Fiber cement is a highly durable, low-maintenance material used for a wide range of applications, including siding, roofing, and flooring. The growing demand for energy-efficient, sustainable, and fire-resistant building materials continues to drive the adoption of fiber cement, particularly in residential construction.

Portland cement is the leading raw material in the fiber cement market in the USA, accounting for 43% of the demand. Portland cement is the primary binding agent in fiber cement products, providing the necessary strength and durability for a wide range of applications. It is combined with other materials like silica, cellulosic fibers, and additives to create fiber cement, which is known for its resistance to fire, moisture, and pests.

The dominance of Portland cement in the market is driven by its availability, cost-effectiveness, and essential role in providing the structural integrity needed for fiber cement products. As the construction industry continues to prioritize long-lasting, fire-resistant materials for both residential and non-residential buildings, the demand for fiber cement, with Portland cement as its core ingredient, remains strong. Additionally, the increasing focus on sustainable building materials has further boosted the popularity of fiber cement, ensuring that Portland cement will continue to be a critical component in the production of fiber cement products.

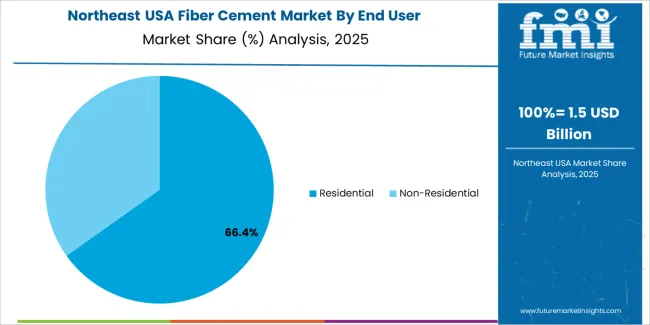

Residential construction is the leading end-user segment for fiber cement in the USA, accounting for 64.5% of the market share. Fiber cement is highly favored in residential building projects due to its durability, low maintenance requirements, and versatility. It is commonly used for siding, trim, roofing, and interior applications, providing homeowners with an attractive and long-lasting alternative to traditional materials like wood and vinyl.

The demand for fiber cement in residential construction is driven by several factors, including its fire resistance, ability to withstand harsh weather conditions, and energy efficiency. As more homeowners and builders seek sustainable and high-performance materials, fiber cement continues to gain popularity. The growing trend toward eco-friendly and fire-resistant building materials, as well as the increased emphasis on durability and reduced maintenance costs in residential properties, ensures that the demand for fiber cement will remain robust, especially in the residential construction market.

Demand for fiber cement in the USA is shaped by the need for durable, low maintenance building materials across residential and commercial sectors. Its resistance to fire, moisture, insects and severe weather supports steady adoption in siding, cladding and roofing. Renovation activity and interest in long lasting materials also play a key role. At the same time, higher upfront cost compared with vinyl or wood and the maturity of several construction segments moderate growth. These combined forces define the overall demand landscape.

What Are the Primary Growth Drivers for Fiber Cement Demand in the United States?

Growth is supported by rising residential construction and renovation where homeowners and builders seek strong, weather resistant siding and cladding. Stricter building codes in fire prone and coastal regions are encouraging wider use of resilient materials. Commercial and institutional projects add further volume as contractors choose long life exterior solutions that reduce maintenance needs. Sustainability focus is also influential, as fiber cement offers extended service life and reduced replacement frequency, aligning with long term building performance goals.

What Are the Key Restraints Affecting Fiber Cement Demand in the United States?

Higher initial material and installation costs compared with vinyl or softer woods remain key barriers for cost sensitive consumers and builders. Raw material price fluctuations for cement and cellulose raise production costs and may limit price competitiveness. In some mature regional markets, siding categories are saturated, slowing additional gains. Tradition and familiarity also play a role, as some builders prefer established materials despite performance advantages offered by fiber cement. Labour skill requirements for proper installation can further restrict adoption in certain areas.

What Are the Key Trends Shaping Fiber Cement Demand in the United States?

Major trends include increased design innovation, with manufacturers offering a broader range of textures and finishes that replicate wood, stone or masonry. Re siding projects in aging housing stock are expanding demand as homeowners replace older materials with more durable options. Interest in sustainable construction is rising, encouraging adoption of products with long service life and lower maintenance cycles. Growth is also visible in multi family, mixed use and commercial buildings where developers seek consistent appearance, impact resistance and long term durability.

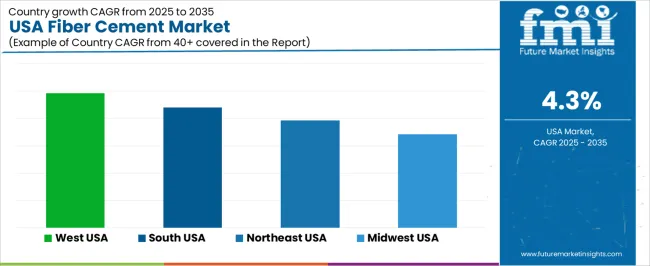

The demand for fiber cement in the USA is growing due to factors like increasing construction activity, rising demand for sustainable building materials, and the material's durability and cost-effectiveness. Fiber cement is widely used in siding, roofing, and other exterior applications due to its resistance to weather, fire, and pests. The ongoing boom in both residential and commercial construction, along with a growing focus on eco-friendly and energy-efficient building materials, is driving the adoption of fiber cement products. Regional differences in demand are influenced by factors such as climate, building practices, and regional construction trends. Below is an analysis of the demand for fiber cement across different regions of the USA.

| Region | CAGR (2025-2035) |

|---|---|

| West | 4.9% |

| South | 4.4% |

| Northeast | 3.9% |

| Midwest | 3.4% |

The West leads the demand for fiber cement in the USA with a CAGR of 4.9%. This region benefits from a combination of factors, including a strong construction market, high population growth, and a preference for durable, sustainable building materials. States like California, Washington, and Oregon have robust construction sectors, with fiber cement widely used in both residential and commercial buildings due to its fire resistance and ability to withstand extreme weather conditions.

Additionally, the West is known for its focus on sustainable and eco-friendly building practices, driving the demand for fiber cement products that offer energy efficiency and lower environmental impact. The region’s growing trend towards energy-efficient homes and climate-resilient building materials further supports the demand for fiber cement in the construction industry.

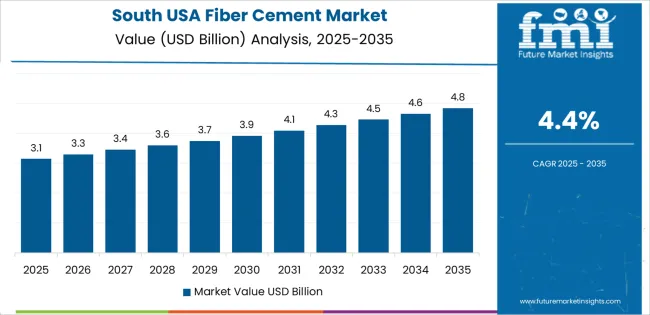

The South shows strong demand for fiber cement with a CAGR of 4.4%. The region is experiencing rapid population growth and urbanization, leading to an increase in new housing and commercial developments. States like Texas, Florida, and Georgia are major contributors to this growth, as demand for fiber cement siding and roofing is rising in both residential and commercial construction.

The South's warm, humid climate also drives demand for durable, low-maintenance materials like fiber cement, which can withstand the region's weather conditions, including heat, humidity, and occasional storms. As more homeowners and builders opt for fiber cement due to its longevity and reduced maintenance requirements, the demand continues to grow. Additionally, the South’s focus on cost-effective and energy-efficient building solutions further boosts fiber cement adoption.

The Northeast shows steady demand for fiber cement with a CAGR of 3.9%. The region's demand for durable, low-maintenance building materials is driven by a combination of weather-resistant properties and growing consumer preference for sustainable construction materials. The Northeast faces harsh winters and fluctuating temperatures, making fiber cement an attractive option due to its ability to resist moisture, temperature changes, and rot.

While growth is slower compared to the West and South, the Northeast’s strong housing and renovation markets, particularly in urban areas like New York, Boston, and Philadelphia, contribute to steady demand for fiber cement products. Furthermore, the region's increasing emphasis on energy-efficient and environmentally friendly building practices ensures that fiber cement will continue to be in demand for both new construction and renovation projects.

The Midwest shows moderate growth in fiber cement demand with a CAGR of 3.4%. While the region's construction market is large, it has a slightly slower adoption of fiber cement compared to the West and South. This can be attributed to the region's more traditional building materials, such as vinyl siding, which have been more commonly used in residential construction. However, as builders and homeowners become more aware of the long-term benefits of fiber cement, including its durability and lower maintenance requirements, demand is steadily increasing.

The Midwest's diverse climate, with extreme cold in the winter and humidity in the summer, makes fiber cement an attractive option due to its resistance to temperature fluctuations, moisture, and pests. As the region's focus on sustainability grows, the adoption of fiber cement is expected to continue to rise at a steady pace.

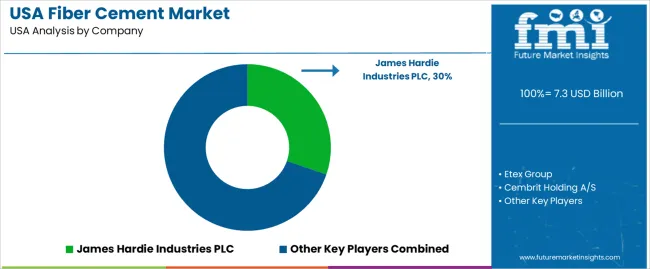

Demand for fiber cement in the United States is rising as builders, contractors, and homeowners increasingly seek durable, low-maintenance, and environmentally friendly alternatives to traditional building materials. Companies such as James Hardie Industries PLC (holding approximately 30.3% market share), Etex Group, Cembrit Holding A/S, Nichiha Corporation, and Swisspearl Group are key players in the USA fiber cement industry. Fiber cement is commonly used for siding, roofing, and exterior cladding due to its resistance to fire, moisture, and pests, making it a popular choice for both residential and commercial construction.

Competition in the fiber cement industry is primarily driven by product quality, innovation, and sustainability. Companies are focusing on improving the performance of fiber cement products, such as offering enhanced weather resistance, easier installation, and improved aesthetics. Another area of competition is sustainability, with companies emphasizing the use of eco-friendly materials and manufacturing processes to meet growing consumer demand for environmentally responsible building materials. Additionally, customization options such as color, texture, and finish are increasingly important for homeowners and builders looking for personalized and aesthetically pleasing solutions. Marketing materials often highlight the durability, versatility, and low-maintenance features of fiber cement products. By aligning their offerings with the growing demand for high-performance, sustainable, and customizable building materials, these companies are strengthening their position in the USA fiber cement industry.

| Items | Details |

|---|---|

| Quantitative Units | USD Billion |

| Regions Covered | USA |

| Raw Materials | Portland Cement, Silica, Cellulosic Fiber, Others |

| End User | Residential, Non-Residential |

| Application | Cladding, Siding, Backer Boards, Molding and Trimming, Roofing |

| Key Companies Profiled | James Hardie Industries PLC, Etex Group, Cembrit Holding A/S, Nichiha Corporation, Swisspearl Group |

| Additional Attributes | The market analysis includes dollar sales by raw material, end-user, and application categories. It also covers regional demand trends in the USA, particularly driven by residential and non-residential construction activities. The competitive landscape highlights key manufacturers focusing on innovations in fiber cement products for various applications. Trends in the growing adoption of fiber cement for cladding, siding, and roofing, as well as advancements in material formulations and sustainability efforts, are explored. |

The global demand for fiber cement in USA is estimated to be valued at USD 7.3 billion in 2025.

The market size for the demand for fiber cement in USA is projected to reach USD 11.1 billion by 2035.

The demand for fiber cement in USA is expected to grow at a 4.3% CAGR between 2025 and 2035.

The key product types in demand for fiber cement in USA are portland cement, silica, cellulosic fiber and others.

In terms of end user, residential segment to command 64.5% share in the demand for fiber cement in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fiber Cement Market Analysis by Raw Materials, End User, Application, and Region through 2025 to 2035

Fiber Cement Board Market Growth - Trends & Forecast 2025 to 2035

USA Alpaca Fiber Market Growth – Demand, Trends & Forecast 2025-2035

USA Meal Replacement Products Market Insights – Size, Share & Forecast 2025-2035

Market Share Breakdown of USA and Canada Molded Fiber Pulp Packaging Manufacturers

United States Whole Grain and High Fiber Foods Market Report – Trends & Forecast 2025–2035

Demand for Fiber Cement in Japan Size and Share Forecast Outlook 2025 to 2035

Molded Fiber Pulp Packaging industry Analysis in USA and Canada - Size, Share, and Forecast Outlook 2025 to 2035

Demand for Carbon Fiber Composites for Prosthetics in USA Size and Share Forecast Outlook 2025 to 2035

Fiber Optic Probe Hydrophone (FOPH) Market Size and Share Forecast Outlook 2025 to 2035

Fiberglass Centrifugal Fan Market Size and Share Forecast Outlook 2025 to 2035

Fiber to the Home Market Size and Share Forecast Outlook 2025 to 2035

Fiber Based Packaging Market Size and Share Forecast Outlook 2025 to 2035

Cement Packaging Market Size and Share Forecast Outlook 2025 to 2035

Fiber Lid Market Forecast and Outlook 2025 to 2035

Fiberglass Tanks Market Size and Share Forecast Outlook 2025 to 2035

Fiber Sorter Market Size and Share Forecast Outlook 2025 to 2035

Fiber Reinforced Polymer Panel and Sheet Market Size and Share Forecast Outlook 2025 to 2035

Fiber Optic Tester Market Size and Share Forecast Outlook 2025 to 2035

Fiber Laser Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA