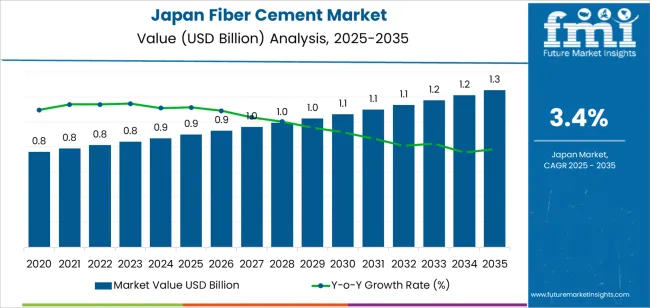

The Japan fiber cement demand is valued at USD 0.9 billion in 2025 and is forecasted to reach USD 1.3 billion by 2035, recording a CAGR of 3.4%. Demand is shaped by sustained construction activity, replacement cycles in residential and commercial buildings, and continued use of fibre-reinforced materials that offer durability, moisture resistance, and low maintenance. Fiber cement products support façade cladding, roofing, partition walls, and exterior siding applications, providing stable performance in Japan’s varied climatic conditions. The need for fire-resistant building materials and ongoing urban redevelopment across major regions further influences growth.

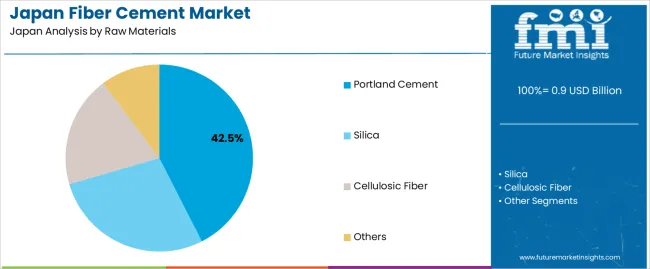

Portland cement remains the leading raw material due to its structural reliability, established supply chain, and compatibility with cellulose fibres used in reinforcement. Its formulation supports dimensional stability, weather resistance, and long service life, making it suitable for both new construction and refurbishment projects. Advances in coating technologies, board-forming processes, and material optimisation continue to expand product efficiency and design flexibility within the category.

Demand is concentrated in Kyushu & Okinawa, Kanto, and Kinki, supported by dense urban construction, renovation programs, and wider acceptance of fibre cement as a substitute for wood and traditional siding materials. Key suppliers include James Hardie Industries PLC, Etex Group, Cembrit Holding A/S, Nichiha Corporation, and Swisspearl Group, offering cladding boards, panels, and architectural elements used across residential, commercial, and institutional projects.

Peak-to-trough analysis shows a measured cyclical pattern shaped by construction activity, renovation demand, and material-substitution trends. Between 2025 and 2028, the segment is expected to reach an early peak as residential renovations and small-scale commercial upgrades drive steady demand for siding boards, façade panels, and interior partitions. Consistent demand for durable, low-maintenance cladding materials will reinforce this peak phase.

A mild trough may occur between 2029 and 2031 as building starts stabilize and renovation cycles soften, reducing short-term procurement. Fluctuations in cement input costs and labour availability may also influence purchasing during this period, though trough depth remains limited because fiber cement retains broad use in moisture-prone and fire-resistant applications. After 2031, the segment is likely to regain upward momentum as deferred renovation projects resume and manufacturers introduce lighter, improved-workability formulations. Adoption in exterior façades and ventilated cladding systems will support the recovery. The peak-to-trough pattern reflects a mature construction-materials segment shaped by cyclical building activity, long replacement intervals, and durable-use characteristics across Japan’s residential and commercial projects.

| Metric | Value |

|---|---|

| Japan Fiber Cement Sales Value (2025) | USD 0.9 billion |

| Japan Fiber Cement Forecast Value (2035) | USD 1.3 billion |

| Japan Fiber Cement Forecast CAGR (2025-2035) | 3.4% |

The demand for fiber cement in Japan is increasing as the construction industry adopts materials that offer durability, fire resistance and low maintenance in both residential and commercial applications. Adoption of fiber cement boards, siding and roofing panels supports Japanese builders’ efforts to comply with stricter building regulations related to earthquake resilience, fire safety and energy-efficiency. Urban redevelopment projects and replacement of ageing building façades create opportunities for material upgrades that favour fiber cement.

Ecofriendly concerns and consumer preference for low-maintenance exteriors that mimic wood or stone textures but perform better in harsh weather boost demand. Innovation in manufacturing processes and finishes enhances the appeal of fiber cement products. Constraints include competition from alternative materials such as metal cladding or high-performance vinyl, higher raw-material and energy costs that affect pricing, and demographic pressures including population decline in some regions that reduce new-build volume in rural areas. Some smaller construction companies may delay switching materials until product cost or warranty benefits justify the change.

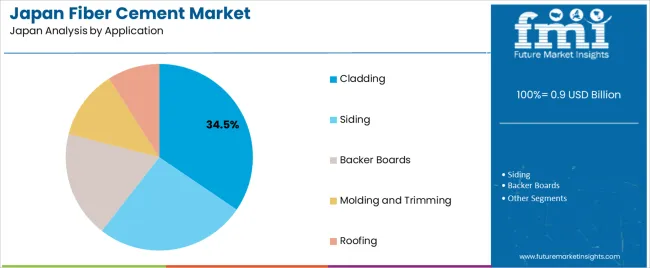

Demand for fiber-cement products in Japan reflects construction practices that prioritise durability, moisture resistance, fire performance, and long service life. Raw-material distribution is shaped by formulation requirements, structural strength needs, and production processes used by domestic manufacturers. End-user patterns reflect differing material preferences between residential housing and non-residential structures. Application distribution shows how fiber-cement components support exterior protection, interior backing, and architectural detailing.

Portland cement holds 42.5% of national demand and represents the leading raw-material category for fiber-cement production in Japan. Its compressive strength, durability, and compatibility with reinforcement materials support stable panel and board manufacturing. Silica accounts for 28.0%, serving as a key filler and performance enhancer that improves dimensional stability. Cellulosic fiber represents 19.3%, providing flexibility, crack resistance, and improved handling characteristics during board formation. The remaining 10.2% includes additives used for curing, workability, and performance optimisation. Raw-material distribution reflects the balance between mechanical strength, moisture tolerance, and production efficiency needed to meet construction requirements in residential and non-residential applications.

Key drivers and attributes:

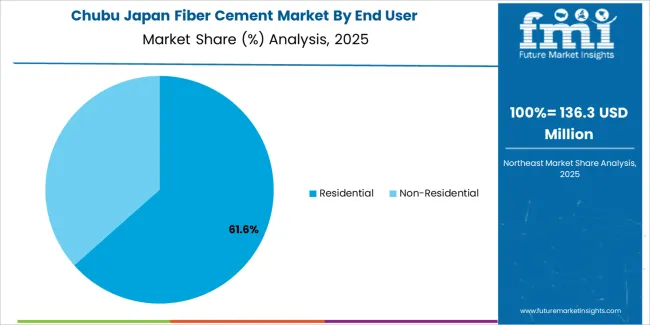

Residential buildings hold 64.5% of Japan’s fiber-cement demand and form the largest end-user segment. Detached homes, multi-unit residences, and renovation projects rely on fiber-cement for weather resistance, low maintenance needs, and fire-resistant performance. Lightweight panels and siding formats allow efficient installation across wooden and mixed-material structures commonly used in Japanese housing. Non-residential construction represents 35.5%, including commercial buildings, institutional facilities, and industrial sites requiring durable façade and interior backing materials. End-user distribution reflects the scale of residential development, the prevalence of renovation cycles, and the material’s suitability for humid climates and seismic building conditions.

Key drivers and attributes:

Cladding represents 34.5% of national demand and is the leading application for fiber-cement in Japan. Exterior cladding panels offer fire resistance, weather protection, dimensional stability, and a wide range of surface finishes suitable for residential and commercial buildings. Siding holds 26.0%, supporting façade applications requiring lightweight panels and high durability. Backer boards represent 18.5%, used behind tiling and interior finishes in moisture-prone areas. Molding and trimming account for 12.0%, enabling decorative finishes around openings and edges. Roofing represents 9.0%, serving niche applications requiring fire-resistant and stable roof components. Application distribution reflects performance needs across exterior protection, interior stability, and architectural detailing.

Key drivers and attributes:

In Japan, demand for fiber-cement products is increasing as builders, developers and facility owners seek materials that offer enhanced fire resistance, moisture tolerance and long-term durability. Aging housing stock and strong renovation activity drive usage of fiber-cement boards and exterior panels in refurbishment projects. Stringent building regulations in Japan regarding earthquake resilience, fire safety and weather proofing reinforce the appeal of fiber cement as an alternative to traditional materials like wood or vinyl. These factors support uptake across both residential and non-residential construction segments.

Fiber-cement products typically cost more than conventional siding or cladding materials, which may limit adoption in budget-sensitive projects. Much of Japan’s residential sector is mature, with fewer large green-field housing developments compared to other industries, which reduces the volume growth opportunity. The production of fiber cement involves specialised raw materials and manufacturing processes, and costs or supply disruptions in fibres, cement or coatings may impact supply or pricing, which can moderate growth.

Manufacturers are introducing fibre-cement products with slim profiles, enhanced surface textures and colour options to match modern Japanese architectural aesthetics and tight building footprints. Growth in refurbishment of older apartments and condominiums boosts demand for replacement cladding and exterior upgrades using fibre-cement systems. To improve supply-chain resilience and reduce import dependency, some Japanese firms are investing in local production capacity and enhanced coating/finishing operations for fibre-cement materials.

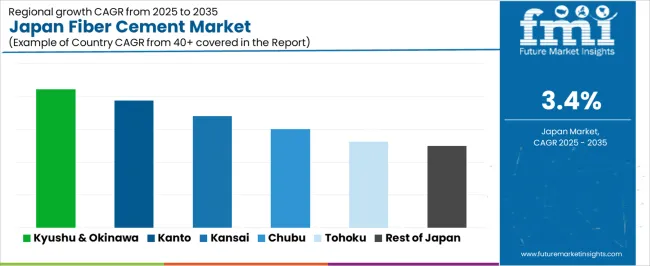

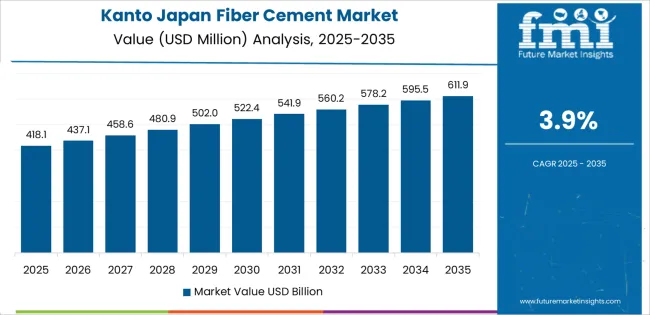

Demand for fiber cement in Japan is rising through 2035 as construction firms, architectural contractors, and building-material distributors expand the use of durable, fire-resistant, and moisture-stable exterior and interior panels. Fiber cement supports cladding, siding, partition walls, soffits, and roofing applications across residential, commercial, and institutional projects. Growth is driven by renovation cycles, stricter building-safety standards, and stable demand for long-life exterior materials suited to Japan’s climate conditions. Regional differences reflect construction density, housing-stock age, and local refurbishment activity. Kyushu & Okinawa leads with a 4.2% CAGR, followed by Kanto (3.9%), Kinki (3.4%), Chubu (3.0%), Tohoku (2.6%), and the Rest of Japan (2.5%).

| Region | CAGR (2025-2035) |

|---|---|

| Kyushu & Okinawa | 4.2% |

| Kanto | 3.9% |

| Kinki | 3.4% |

| Chubu | 3.0% |

| Tohoku | 2.6% |

| Rest of Japan | 2.5% |

Kyushu & Okinawa grows at 4.2% CAGR, supported by steady construction and renovation activity across Fukuoka, Kumamoto, Kagoshima, and the wider island region. Builders adopt fiber cement for exterior cladding, façade repairs, and weather-resistant siding suited to humid and typhoon-exposed environments. Public buildings and commercial facilities use fiber-cement boards for fire-resistant partitions and stable paneling. Residential developers implement fiber-cement siding in suburban housing projects due to its durability and low maintenance. Okinawa’s dispersed construction industries rely on materials that maintain structural stability under high moisture and salt exposure. Distributors maintain consistent supply of panels, planks, and roofing sheets for ongoing refurbishment needs.

Kanto grows at 3.9% CAGR, driven by dense residential construction, commercial refurbishment, and ongoing urban redevelopment across Tokyo, Kanagawa, Chiba, and Saitama. Contractors adopt fiber-cement siding and façade boards to meet fire-safety and durability requirements in mid-rise and low-rise housing. Commercial properties rely on fiber-cement cladding for exterior maintenance cycles, replacing older materials with stable, long-life alternatives. Public-facility upgrades use fiber-cement panels for interior partitions and impact-resistant surfaces. Renovation of aging housing stock continues to reinforce adoption across suburban districts. Building-material distributors in metropolitan areas maintain broad inventories, ensuring consistent availability for high-volume construction workflows.

Kinki grows at 3.4% CAGR, supported by renovation activity and sustained use of durable cladding materials across Osaka, Kyoto, and Hyogo. Builders adopt fiber-cement exterior boards for weather-resistant façades exposed to seasonal humidity and heavy rainfall. Commercial sites modernize exterior surfaces using fiber-cement planks with stable structural performance. Residential developers incorporate fiber-cement siding into new-build and replacement projects for long-term wear resistance. Interior contractors use fiber-cement panels for fire-rated and moisture-resistant partitioning in public buildings. Although construction volumes are lower than in Kanto, steady refurbishment cycles maintain consistent regional demand.

Chubu grows at 3.0% CAGR, supported by balanced construction activity across Aichi, Shizuoka, and Mie. Residential builders use fiber-cement siding for suburban housing developments requiring durable exterior materials. Industrial and logistics facilities adopt fiber-cement panels for fire-resistant wall systems and impact-resistant partitioning. Commercial properties use fiber-cement boards during façade maintenance and lifecycle upgrades. Prefabricated-building manufacturers integrate fiber-cement cladding into modular units for improved durability and reduced maintenance. Although overall construction density is moderate, recurring refurbishment and industrial-facility upgrades ensure stable product demand.

Tohoku grows at 2.6% CAGR, supported by reconstruction efforts, ongoing repair cycles, and stable regional housing needs across Miyagi, Fukushima, and Iwate. Builders adopt fiber cement for exterior siding capable of withstanding cold climates, moisture exposure, and seasonal weather variation. Public buildings apply fiber-cement boards for fire-rated partitions and durable interior wall systems. Residential renovations use fiber-cement planks for replacing worn siding and improving structural longevity. Although population density is lower, essential refurbishment cycles maintain recurring demand. Regional distributors supply standardized board and panel formats suited to small-scale construction workflows.

The Rest of Japan grows at 2.5% CAGR, supported by distributed residential construction, small-scale commercial projects, and ongoing replacement of aging exterior materials in rural and semi-rural prefectures. Builders rely on fiber-cement boards for durable siding suited to varied climate conditions. Small contractors use fiber-cement panels for fire-safe interiors and moisture-resistant partitions. Due to lower construction density, adoption is tied to essential repairs and lifecycle replacement rather than large development projects. Retail building-material suppliers maintain steady inventories of siding planks, façade boards, and general-purpose fiber-cement sheets, supporting consistent low-volume consumption.

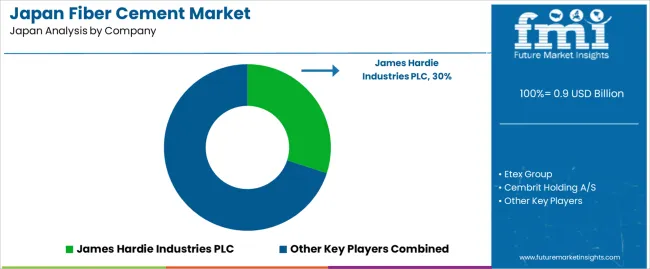

Demand for fiber-cement products in Japan is shaped by a group of international and domestic building-materials suppliers supporting residential cladding, façade renovation, and light-commercial construction. James Hardie Industries PLC holds the leading position with an estimated 30.0% share, supported by consistent board performance, controlled manufacturing standards, and long-standing supply relationships with Japanese distributors. Its position is reinforced by stable dimensional accuracy, reliable weather resistance, and predictable installation characteristics valued in exterior-cladding applications.

Etex Group and Cembrit Holding A/S follow as significant participants, providing fiber-cement boards used in façade systems, ventilated cladding, and architectural panel applications. Their strengths include dependable moisture resistance, surface stability, and product lines suited to both new construction and renovation. Nichiha Corporation maintains a major domestic presence, supported by established production capacity, broad architectural design offerings, and strong integration with Japan’s residential-construction channels. Swisspearl Group contributes additional capability with premium fiber-cement panels used in higher-end architectural projects, emphasizing colour stability, long-term durability, and consistent surface finishing.

Competition across this segment centers on weather resistance, moisture stability, impact performance, dimensional consistency, fire-safety characteristics, and installation efficiency. Demand remains steady due to Japan’s emphasis on durable exterior materials, sustained renovation activity, and continued preference for low-maintenance, weather-resilient fiber-cement solutions across residential and commercial building applications.

| Items | Values |

|---|---|

| Quantitative Units | USD billion |

| Raw Materials | Portland Cement, Silica, Cellulosic Fiber, Others |

| End User | Residential, Non-Residential |

| Application | Cladding, Siding, Backer Boards, Molding and Trimming, Roofing |

| Regions Covered | Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, Rest of Japan |

| Key Companies Profiled | James Hardie Industries PLC, Etex Group, Cembrit Holding A/S, Nichiha Corporation, Swisspearl Group |

| Additional Attributes | Dollar sales by raw material, end user, and application categories; regional adoption trends across Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, and Rest of Japan; competitive landscape of fiber cement producers; advancements in fire-resistant siding, low-maintenance cladding, and high-strength cellulose fiber composites; integration with residential construction, commercial building façades, and renovation activities across Japan. |

The global demand for fiber cement in Japan is estimated to be valued at USD 0.9 billion in 2025.

The demand for fiber cement in Japan is projected to reach USD 1.3 billion by 2035.

The demand for fiber cement in Japan is expected to grow at a 3.4% CAGR between 2025 and 2035.

The key product types in demand for fiber cement in Japan are Portland cement, silica, cellulose fiber, and others.

In terms of end user, residential segment is expected to command 64.5% share in the demand for fiber cement in japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand Signal Repository Solutions Market Size and Share Forecast Outlook 2025 to 2035

Demand Side Management Market Size and Share Forecast Outlook 2025 to 2035

Demand Response Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

North America Shipping Supplies Market Trends – Innovations & Growth 2024-2034

Demand of Kozani Saffron in Greece Analysis - Size, Share & Forecast 2025 to 2035

Demand of No-acid Whey Strained Dairy Processing Concepts in European Union Size and Share Forecast Outlook 2025 to 2035

Demand for Bronte Pistachio in Italy Analysis - Size, Share & Forecast 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Western Europe Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Japan Size and Share Forecast Outlook 2025 to 2035

Glycine Soja (Soybean) Seed Extract Market Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Yeast in Japan - Size, Share, and Forecast Outlook 2025 to 2035

Demand of Pistachio-based desserts & ingredients in France Analysis - Size, Share & Forecast 2025 to 2035

Western Europe Men’s Skincare Market Analysis – Forecast 2023-2033

Demand and Trends Analysis of Stevia in Japan Size and Share Forecast Outlook 2025 to 2035

Japan Women’s Intimate Care Market Trends – Growth & Forecast 2024-2034

Demand and Trend Analysis of Fabric Stain Remover in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Western Europe Size and Share Forecast Outlook 2025 to 2035

Demand of MFGM-enriched Powders & RTDs in European Union Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA