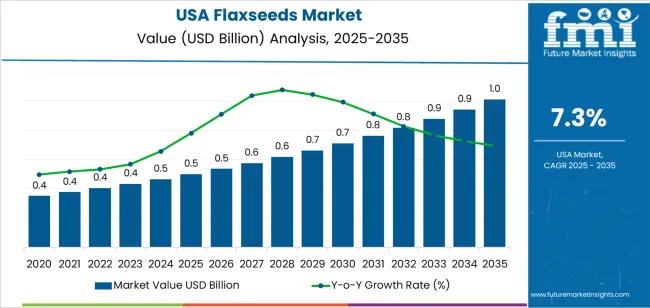

The demand for flaxseeds in USA is valued at USD 0.5 billion in 2025 and is projected to reach USD 1.0 billion by 2035, reflecting a compound annual growth rate of 7.3%. Growth is influenced by steady consumption across bakery products, cereals, nutritional supplements and home cooking where flaxseeds are incorporated for their texture and nutrient profile. As manufacturers expand product lines featuring whole seeds, ground forms and blended mixes, retail availability increases across supermarkets and online channels. Foodservice operators also adopt flaxseed ingredients for formulation versatility. These trends contribute to a stable increase in demand as both commercial and household users incorporate flaxseeds into varied culinary and packaged food applications across the forecast period.

The growth curve shows a smooth, gradual ascent, beginning at USD 0.4 billion in earlier years and rising to USD 0.5 billion in 2025 before advancing toward USD 1.0 billion by 2035. Annual changes remain modest but consistent, with values moving from USD 0.5 billion in 2026 to USD 0.6 billion in 2027 and continuing through successive increments. This pattern reflects predictable adoption tied to routine food formulation and steady consumer interest rather than sharp accelerations. As distribution networks expand and product offerings diversify, demand maintains a reliable upward path shaped by consistent incorporation of flaxseed ingredients across USA’s packaged food and household consumption landscape.

Demand in USA for flaxseeds is projected to increase from USD 0.5 billion in 2025 to USD 1.0 billion by 2035, reflecting a compound annual growth rate (CAGR) of approximately 7.3%. Starting from USD 0.4 billion in 2020, the value rises steadily through USD 0.5 billion in 2025 and then continues its upward march to USD 0.7 billion by around 2030 and ultimately reaches USD 1.0 billion in 2035. Growth is driven by increasing consumer awareness of flaxseeds’ nutritional benefits such as omega 3 fatty acids, lignans and dietary fibre expanding inclusion in functional foods, dairy and snack formats, and rising use in animal feed applications.

The value uplift of USD 0.5 billion over the decade (from USD 0.5 billion to USD 1.0 billion) reflects both volume expansion and moderate value enhancement. In the early years the increase is dominated by volume: more manufacturers incorporate flaxseeds into food and beverage products and more consumers adopt flaxseed enriched items. In the latter years’ value growth contributes increasingly, driven by premium flaxseed formats (organic, non GM), higher inclusion rates in functional food and pet feed applications, and improved processing (ground flaxseed, flaxseed oil) that command higher price points. Suppliers who focus on delivering differentiated flaxseed ingredients and leveraging health driven positioning will be well poised to capture the full growth potential toward USD 1.0 billion by 2035.

| Metric | Value |

|---|---|

| Industry Value (2025) | USD 0.5 billion |

| Forecast Value (2035) | USD 1.0 billion |

| Forecast CAGR (2025 to 2035) | 7.3% |

The demand for flaxseeds in USA is being driven by increasing consumer awareness of their nutritional benefits such as omega-3 fatty acids, dietary fiber and lignans. Many food manufacturers are integrating flaxseeds into bakery items, snacks and cereals as part of clean-label and plant-based product development. The trend among U.S. consumers towards healthier eating, functional ingredients and nutrition-rich foods supports the uptake of both whole and ground flaxseeds. In addition, flaxseeds are gaining acceptance in the pet food and animal feed sectors as a source of plant-based nutrition and as an alternative to conventional feed ingredients.

Furthermore, the growth in flaxseed demand is supported by its versatility in food-processing applications and value-added formats. Flaxseed meals and oils are being used in dietary supplements, protein blends and vegan-friendly formulations, which broadens their appeal beyond traditional seed markets. Retail availability through supermarkets, organic stores and online channels has expanded consumer access and visibility. While factors such as raw-material volatility, consumer price sensitivity and competition from other seed crops remain challenges, the overall demand for flaxseeds in USA is set to grow steadily in the coming years.

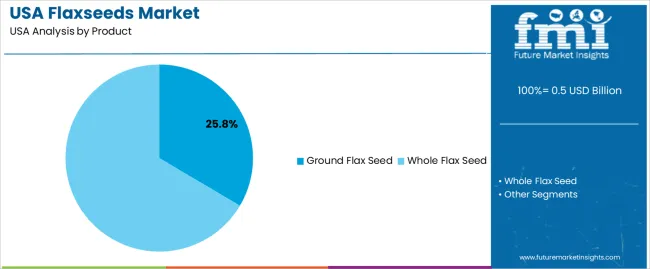

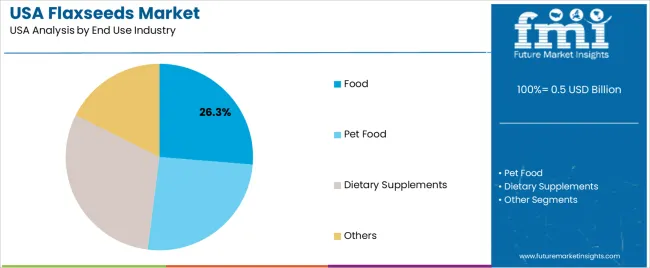

The demand for flaxseeds in USA is shaped by the product forms available and the industries that rely on them for nutritional, functional and formulation purposes. Product categories include ground flaxseed and whole flaxseed, each supporting different processing requirements and consumer preferences. End use industries span food, pet food, dietary supplements and other applications, reflecting varied needs for fiber, omega-3 content and natural binding properties. As producers and consumers prioritize nutrient-rich ingredients that integrate smoothly into daily routines, the combination of product form and end use adoption influences purchasing patterns across USA.

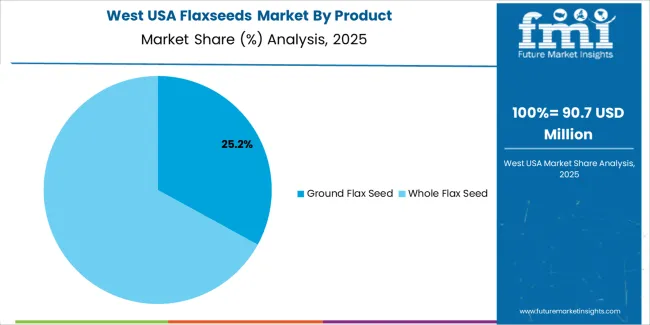

Ground flaxseed accounts for 25% of total demand across product categories. Its leading position reflects strong integration into everyday food preparation and commercial formulations requiring fine texture and consistent dispersibility. Ground flaxseed supports smooth incorporation into bakery items, cereals, beverages and homemade recipes. Consumers value its digestibility and ease of mixing with common foods. Producers adopt ground flaxseed for its steady performance in texture modification and nutrient enrichment. These traits help maintain consistent use in households and commercial kitchens that emphasize convenient, nutrient-focused ingredients.

Demand for ground flaxseed also grows as dietary habits highlight fiber intake and plant-based sources of omega-3s. The fine texture supports predictable hydration and blends well with doughs, batters and smoothie bases. Its compatibility with portioned packaging encourages regular consumption. Food manufacturers rely on ground flaxseed for product lines positioned toward balanced nutrition and recognizable ingredients. As consumers sustain interest in versatile plant-based additions, ground flaxseed remains a preferred option across USA.

Food applications account for 26.3% of total demand across end use industries in USA. This leading share reflects widespread use of flaxseeds in bakery products, cereals, snacks and home cooking, where their fiber and nutrient profile supports balanced eating patterns. Food producers value consistent performance in dough stability, moisture retention and nutritional enhancement. These qualities allow flaxseeds to support both traditional and reformulated products appealing to health-conscious consumers. Their compatibility with diverse recipes reinforces routine use across commercial and household settings.

Demand within the food industry also rises as consumers adopt habits centered on whole ingredients and recognizable nutrient sources. Flaxseeds fit well within breakfast foods, grain mixes and meal components with predictable preparation characteristics. Retailers highlight flaxseed-based products across varied price points, supporting access for different consumer groups. As interest in functional cooking ingredients remains steady, food applications continue to shape primary demand for flaxseeds in USA.

Demand for flaxseeds in the USA is increasing as consumers pay more attention to nutrition, plant-based diets, omega-3 sources, and functional foods. Manufacturers are using flaxseeds and flaxseed meal in bakery, snacks, cereal, meal-replacement and supplement products to meet health-conscious consumer needs. At the same time, barriers include higher raw-material costs, supply-chain complexities (especially for organic or non-GMO flax), and competition from other “super-seed” ingredients (chia, hemp, etc.). These combined factors determine how quickly flaxseeds are adopted across retail, food-service and ingredient segments.

How are lifestyle changes and food-industry behaviour driving flaxseed demand in the USA?

U.S. consumers are increasingly interested in plant-based, whole-food ingredients, fibre-rich diets and foods that deliver health benefits such as heart-health, digestion support and weight-management. Flaxseeds align with those preferences because they provide dietary fibre, omega-3 fatty acids and lignans. Food manufacturers respond by incorporating flaxseed ingredients and labelling products accordingly. At the same time, e-commerce growth, direct-to-consumer nutrition brands and influencer–driven awareness help drive flaxseed visibility. These dynamics support rising demand in the U.S. flaxseed market.

Where are growth opportunities emerging for flaxseeds in the USA’s market?

Growth opportunities exist in multiple formats and channels: ground flaxseed and flaxseed meal for ease of use in food manufacturing and home use; organic and non-GMO flaxseed lines; flaxseed as an ingredient in nutraceuticals or functional snacks; and animal-feed applications (especially for omega-3 enriched feed). Also, growth in health-food retail and online specialty channels presents opportunity for premium flaxseed products. Suppliers able to deliver traceable, high-purity flaxseed products, with good distribution and strong marketing positioning, are well-placed to capture this demand.

What challenges are limiting broader adoption of flaxseeds in the USA?

Despite favourable trends, several challenges moderate adoption. Cost remains a key hurdle: premium flaxseed varieties (organic, specialty-certified) cost more than standard seed or substitute ingredients. Some consumers may not be fully aware of flaxseed benefits or may prefer easier-to-use alternatives. From a supply side, logistic and processing demands (milling, storing ground flaxseed to prevent oxidation) add complexity. Also, the presence of competing super-foods or seeds may dilute flaxseed’s growth potential. These factors slow how quickly flaxseeds become a mainstream ingredient across all product categories in the USA.

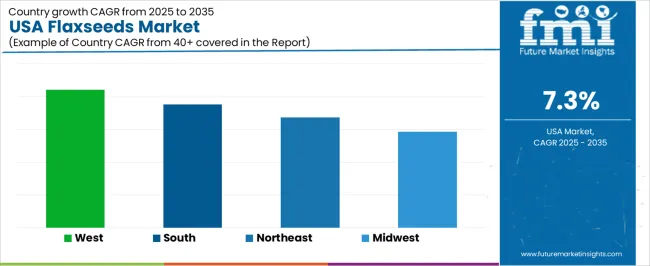

| Region | CAGR (%) |

|---|---|

| West | 8.4% |

| South | 7.5% |

| Northeast | 6.7% |

| Midwest | 5.9% |

Demand for flaxseeds in the USA is rising across regions, with the West leading at 8.4%. Growth in this region reflects strong interest in plant-based nutrition and broad use of flaxseeds in bakery, health foods, and dietary supplements. The South follows at 7.5%, supported by expanding retail availability and increasing consumer preference for fiber-rich ingredients. The Northeast records 6.7%, shaped by dense urban markets where health-oriented foods maintain steady demand. The Midwest grows at 5.9%, where adoption progresses through regional grocery channels and use in food processing. These trends show consistent national uptake as flaxseeds remain a popular ingredient in both household and commercial product formulations.

West USA is projected to grow at a CAGR of 8.4% through 2035 in demand for flaxseeds. California and neighboring states are increasingly cultivating and sourcing flaxseeds for food, supplements, and industrial applications. Rising demand for omega-3 fatty acids, plant-based nutrition, and functional foods drives adoption. Farmers provide high-quality seeds suitable for human consumption, animal feed, and oil extraction. Distributors ensure accessibility across urban, semi-urban, and rural regions. Growth in health-conscious consumer preferences, plant-based product manufacturing, and dietary supplement demand supports steady adoption of flaxseeds in West USA.

South USA is projected to grow at a CAGR of 7.5% through 2035 in demand for flaxseeds. Texas, Florida, and Georgia are increasingly sourcing flaxseeds for food, dietary supplements, and oil processing. Rising focus on plant-based nutrition, healthy food ingredients, and industrial applications drives adoption. Farmers provide high-quality seeds compatible with food processing and industrial production. Distributors expand availability across urban, semi-urban, and rural regions. Consumer awareness of health benefits, growth of plant-based foods, and functional product demand support steady adoption of flaxseeds in South USA.

Northeast USA is projected to grow at a CAGR of 6.7% through 2035 in demand for flaxseeds. New York, Massachusetts, and Pennsylvania are increasingly adopting flaxseeds for dietary supplements, bakery products, and oil production. Rising demand for omega-3 enrichment, functional foods, and industrial applications drives adoption. Farmers provide high-quality seeds suitable for human consumption and industrial processing. Distributors ensure access across urban, semi-urban, and rural markets. Growth in health-conscious consumer trends, plant-based product manufacturing, and dietary supplement consumption supports steady adoption of flaxseeds in Northeast USA.

Midwest USA is projected to grow at a CAGR of 5.9% through 2035 in demand for flaxseeds. Illinois, Minnesota, and Wisconsin are gradually sourcing flaxseeds for food, feed, and oil extraction. Rising demand for plant-based nutrition, functional ingredients, and industrial applications drives adoption. Farmers provide high-quality seeds suitable for multiple uses. Distributors expand access across urban, semi-urban, and rural regions. Growth in dietary supplement production, food processing, and plant-based product manufacturing ensures steady adoption of flaxseeds across Midwest USA.

The demand for flaxseeds in the USA is driven by rising interest in plant-based nutrition, functional foods and natural ingredient sourcing. Consumers are increasingly aware of the health benefits of flaxseeds such as high omega-3 fatty acids, dietary fibre and lignans and these benefits are prompting manufacturers to include flaxseed in bakery goods, cereals, snacks and dietary supplements. The shift towards clean-label, non-GMO and vegan-friendly formulations supports the uptake of flaxseeds as an ingredient. At the same time, the ingredient expansion in animal feed applications and the need for sustainable crop alternatives further bolster demand for flaxseeds across the U.S. food and agriculture sectors.

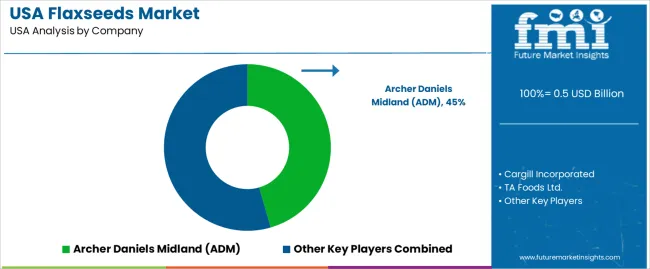

Key companies influencing the flaxseed segment in the USA include Archer Daniels Midland (ADM), Cargill Incorporated, TA Foods Ltd., Richardson International Limited and Johnson Seeds. These firms supply raw flaxseeds, process flaxseed derivatives, and support food- and feed-industry usage. ADM and Cargill offer scale logistics and global sourcing; Johnson Seeds provides specialised breeding and seed supply; Richardson and TA Foods enable processing and regional distribution. Through their capabilities in sourcing, processing and ingredient-innovation support, these players shape how flaxseeds are selected, formulated and incorporated by manufacturers in the U.S. marketplace.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD billion |

| Product Type | Ground Flaxseed, Whole Flaxseed |

| End Use Industry | Food, Pet Food, Dietary Supplements, Others |

| Region | Northeast, West, Midwest, South |

| Countries Covered | USA |

| Key Companies Profiled | Archer Daniels Midland (ADM), Cargill Incorporated, TA Foods Ltd., Richardson International Limited, Johnson Seeds |

| Additional Attributes | Dollar by sales by product type and end-use industry; regional CAGR and adoption patterns; usage in bakery, cereals, snack foods, dietary supplements, pet food and functional products; trend toward organic, non-GMO and vegan-friendly formulations; growth in ground and whole flaxseed adoption; inclusion in foodservice and packaged goods; value per unit and premium product adoption; projected growth toward USD 1.0 billion by 2035; impact of plant-based nutrition trends and functional food awareness on demand. |

The demand for flaxseeds in usa is estimated to be valued at USD 0.5 billion in 2025.

The market size for the flaxseeds in usa is projected to reach USD 1.0 billion by 2035.

The demand for flaxseeds in usa is expected to grow at a 7.3% CAGR between 2025 and 2035.

The key product types in flaxseeds in usa are ground flax seed and whole flax seed.

In terms of end use industry, food segment is expected to command 26.3% share in the flaxseeds in usa in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

USA Medical Coding Market Size and Share Forecast Outlook 2025 to 2035

USA Labels Market Size and Share Forecast Outlook 2025 to 2035

USA Plant-based Creamers Market Size and Share Forecast Outlook 2025 to 2035

USA Barrier Coated Paper Market Size and Share Forecast Outlook 2025 to 2035

USA Electronic Health Records (EHR) Market Size and Share Forecast Outlook 2025 to 2035

USA Animal Model Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Packer Bottle Market Size and Share Forecast Outlook 2025 to 2035

USA Stretch Hood Films Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Fence Screen Market Size and Share Forecast Outlook 2025 to 2035

USA Lubricant Contaminated HDPE Container Waste Market Size and Share Forecast Outlook 2025 to 2035

USA Commercial Walk-In Refrigeration Market Size and Share Forecast Outlook 2025 to 2035

USA & Canada Pre-painted Steel Roofing and Cladding Market Size and Share Forecast Outlook 2025 to 2035

USA Residential Cotton Candy Maker Market Size and Share Forecast Outlook 2025 to 2035

USA Faith Based Tourism Market Size and Share Forecast Outlook 2025 to 2035

United States NFC Lemon Juice Market Analysis - Size, Growth and Forecast 2025 to 2035

USA and Canada Copper Market Insights - Demand, Size & Industry Trends 2025 to 2035

USA Ground and Precipitated Calcium Carbonate Market Growth by Product Type, Application, End-Use, and Region in 2025 to 2035

United States Animal Feed Additives Market Report – Trends, Growth & Forecast 2025–2035

United States Wild Rice Market Outlook – Size, Demand & Forecast 2025–2035

United States Wood Vinegar Market Analysis – Trends, Growth & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA