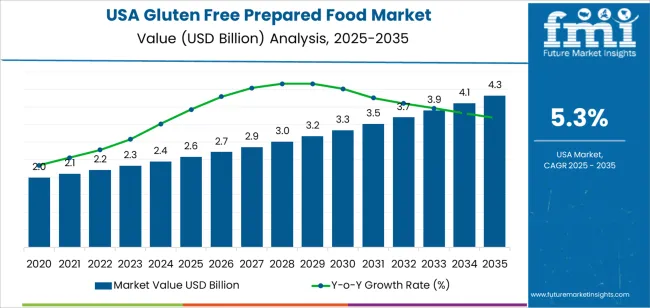

The demand for gluten-free prepared food in the USA is expected to grow from USD 2.6 billion in 2025 to USD 4.3 billion by 2035, reflecting a CAGR of 5.3%. The growing awareness of celiac disease, gluten sensitivities, and the rising demand for specialized diets has significantly driven the market for gluten-free prepared foods. This trend is not only fueled by individuals with gluten intolerance but also by health-conscious consumers seeking alternatives to traditional food products. As more consumers opt for cleaner labels and more digestible foods, gluten-free prepared foods are gaining traction across segments such as frozen meals, snacks, and baked goods.

The market is further supported by innovations in gluten-free formulations, improving the taste, texture, and affordability of these products, which were once seen as inferior to their gluten-containing counterparts. As gluten-free diets become more mainstream, the market for gluten-free prepared foods will continue to expand, supported by increasing availability in both grocery stores and online platforms. Additionally, the continued rise of the organic food movement and increased awareness of dietary restrictions will contribute to the ongoing growth in demand for these specialized food options.

The rolling CAGR analysis for gluten-free prepared food in the USA reflects consistent growth across multiple phases of the forecast period, with steady acceleration followed by more stable expansion as the market matures.

From 2025 to 2030, the market will grow from USD 2.6 billion to USD 3.3 billion, adding USD 0.7 billion in value. This early phase shows an acceleration in growth, driven by the expanding adoption of gluten-free diets among the general population, not just those with celiac disease or gluten sensitivities. As more consumers opt for gluten-free options due to health trends and a growing awareness of digestive health, the rolling CAGR will reflect strong growth during this phase. Innovations in product variety and better availability in major food retailers will be key contributors to this acceleration.

From 2030 to 2035, the market will grow from USD 3.3 billion to USD 4.3 billion, contributing an additional USD 1.0 billion. The rolling CAGR in this period will reflect a slower acceleration, as the market moves into a more mature phase. The growth rate will remain positive due to continued consumer adoption of gluten-free products, but at a slightly decelerated pace as the category becomes increasingly established. The continued emphasis on health-conscious eating, combined with new product formulations and dietary inclusivity, will drive this ongoing demand, though the rate of growth will stabilize as the market reaches broader saturation within the overall food industry. Despite this, the rolling CAGR indicates sustained and steady growth, with gluten-free prepared foods remaining a key segment within the broader food market.

| Metric | Value |

|---|---|

| Industry Sales Value (2025) | USD 2.6 billion |

| Industry Forecast Value (2035) | USD 4.3 billion |

| Industry Forecast CAGR (2025-2035) | 5.3% |

Demand for gluten free prepared foods in the USA is growing as consumers seek convenient meal solutions that meet dietary restrictions and wellness preferences. The USA market for gluten free products was estimated at approximately USD 2.27 billion in 2024 and is projected to reach around USD 3.95 billion by 2030. Products such as frozen meals, ready to eat dishes and single serve entrées are gaining traction because they cater to busy lifestyles while addressing needs for gluten free nutrition, easy preparation and portability.

Another significant driver is the expansion of clean label and allergen friendly trends among American consumers. Many individuals adopt gluten free diets due to celiac disease, non celiac gluten sensitivity or broader health and wellness goals. Manufacturers are responding with improved formulations that replicate taste and texture of traditional foods while eliminating gluten, which increases appeal beyond niche segments. Growth of e commerce and direct to consumer channels further expands availability and consumer access to gluten free prepared foods. Challenges persist, including higher ingredient and manufacturing costs for gluten free formats, potential skepticism regarding health claims and competition from substitute dietary solutions. Despite these obstacles, the combination of dietary need, lifestyle convenience and product innovation suggests that demand for gluten free prepared food in the USA will continue to rise steadily.

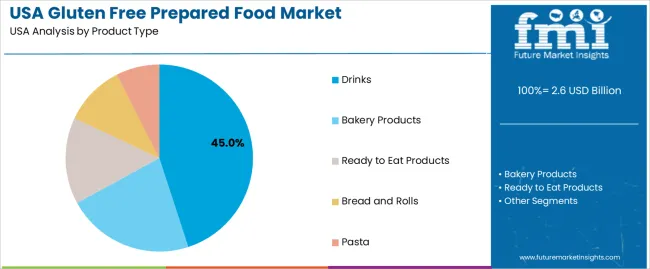

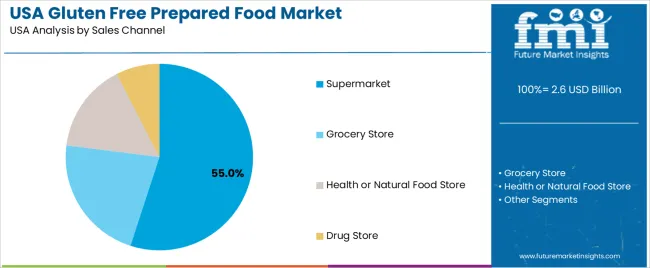

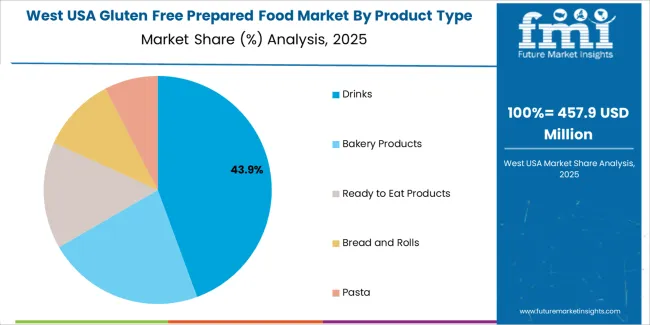

The demand for gluten-free prepared food in the USA is driven by product type and sales channel. The leading product type is drinks, capturing 45% of the market share, while supermarkets are the dominant sales channel, accounting for 55% of the demand. Gluten-free products have seen a significant rise in popularity, fueled by increased awareness of gluten sensitivities, celiac disease, and a growing preference for healthier diets. As consumers seek convenient and accessible options that fit their dietary needs, both gluten-free drinks and supermarkets remain key drivers in the market.

Drinks lead the gluten-free prepared food market in the USA, accounting for 45% of the demand. Gluten-free beverages, including fruit juices, smoothies, dairy-free alternatives, and gluten-free soft drinks, have gained popularity as part of the growing trend toward healthier, allergen-free products. These drinks cater to a diverse range of consumers, from those with celiac disease to individuals who follow gluten-free diets for other health reasons.

The demand for gluten-free drinks is particularly driven by the growing awareness of food allergies and sensitivities. As more consumers seek gluten-free options that can easily integrate into their daily routine, drinks provide a convenient and accessible way to adhere to a gluten-free lifestyle. Furthermore, the increasing variety of gluten-free beverages available in supermarkets and health food stores makes them more attractive to a broad consumer base, solidifying their dominance in the gluten-free prepared food market.

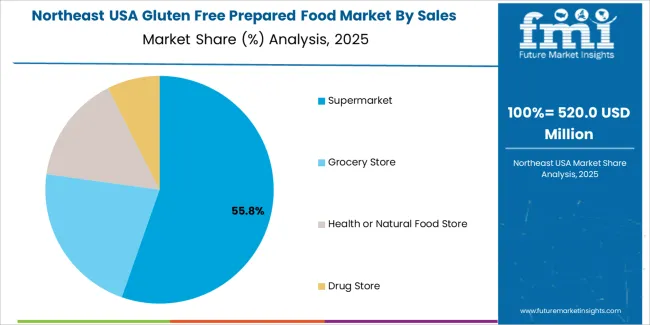

Supermarkets are the leading sales channel for gluten-free prepared food in the USA, capturing 55% of the demand. Supermarkets offer a wide variety of gluten-free options, ranging from ready-to-eat meals and snacks to specialized beverages and bakery items. The accessibility and convenience of supermarkets make them the go-to destination for consumers looking for gluten-free products, as they can easily find dedicated gluten-free sections or product labels across various aisles.

The dominance of supermarkets is driven by their widespread reach and ability to cater to the growing demand for gluten-free foods. As consumer preferences shift toward healthier, allergen-free products, supermarkets have responded by expanding their gluten-free offerings to meet the needs of health-conscious shoppers. The presence of large national grocery chains, along with the increasing availability of gluten-free products in mainstream stores, ensures that supermarkets remain the primary channel for distributing gluten-free prepared food in the USA.

Demand for gluten free prepared food in the USA is being driven by increased consumer awareness of gluten related disorders and the broader uptake of gluten free diets as part of wellness trends. The growing range of convenient, ready to eat formats expands accessibility for both medically required and lifestyle oriented consumers. At the same time, higher production costs, price sensitivity, and competition from standard prepared foods act as constraints. These interacting factors shape the opportunities and limits for gluten free prepared food in the USA market.

What Are the Primary Growth Drivers for Gluten Free Prepared Food Demand in the United States?

Several drivers support growth in the USA market: First, rising diagnosis rates of conditions like celiac disease and non celiac gluten sensitivity create a stable base of consumers seeking gluten free options. Second, an uptick in health conscious behaviours and diet experimentation among consumers without gluten related disorders expands demand. Third, manufacturers’ efforts to improve taste, texture and product variety in gluten free prepared meals, snacks and bakery items make the category more appealing. Fourth, expansion of online retail, foodservice channels and supermarket ready meals enhances convenience and availability, thereby driving consumption.

What Are the Key Restraints Affecting Gluten Free Prepared Food Demand in the United States?

Despite favourable conditions, there are important restraints. The premium price point of many gluten free prepared foods—often higher than their gluten containing equivalents—can limit adoption among budget sensitive consumers. Some consumers remain sceptical of gluten free claims or unaware of product availability, which reduces potential uptake. Additionally, competition from traditional prepared food products and other diet focused alternatives means gluten free products must continuously innovate to retain relevance. Lastly, supply chain complexities and ingredient sourcing for high quality gluten free formats may impact production cost and scale.

What Are the Key Trends Shaping Gluten Free Prepared Food Demand in the United States?

Key trends include rapid expansion of product innovation with gluten free ready meals, frozen entrees, snacks and bakery items that mimic traditional textures and flavours more closely. There is strong growth in clean label, organic and plant based gluten free offerings that appeal to multiple dietary needs. Direct to consumer and e commerce models are becoming stronger channels for niche gluten free brands, enhancing market reach. Moreover, retailers are increasing shelf space and private label gluten free prepared food lines, helping to normalise the category and increase visibility among mainstream shoppers.

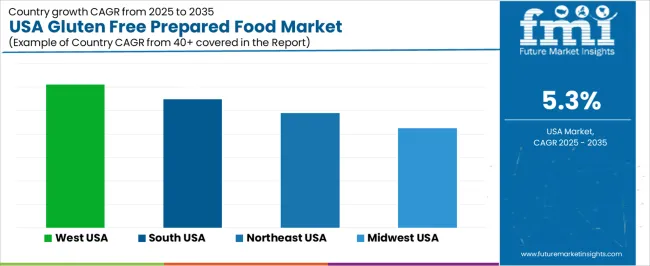

The demand for gluten-free prepared food in the USA is growing as more consumers adopt gluten-free diets due to health conditions such as celiac disease, non-celiac gluten sensitivity, or for lifestyle preferences. Gluten-free diets are increasingly popular among health-conscious individuals seeking to improve their overall well-being and manage conditions such as digestive disorders and autoimmune diseases. The demand is further driven by increased awareness of the benefits of gluten-free eating, the availability of gluten-free food options, and rising trends toward healthier, more specialized diets. The increasing availability of gluten-free options in retail stores and online platforms is making it easier for consumers to access gluten-free prepared foods. Regional variations in demand are influenced by dietary trends, population health, and access to gluten-free food products in each area. Below is an analysis of the demand for gluten-free prepared food across different regions in the USA.

| Region | CAGR (2025-2035) |

|---|---|

| West | 6.1% |

| South | 5.5% |

| Northeast | 4.9% |

| Midwest | 4.3% |

The West leads the demand for gluten-free prepared food in the USA with a CAGR of 6.1%. The region, particularly states like California, Oregon, and Washington, is known for its health-conscious population and a strong focus on wellness, which has significantly contributed to the rise in gluten-free diets. The West also has a large number of health food stores, specialized gluten-free bakeries, and restaurants offering gluten-free options, making it easier for consumers to find gluten-free prepared foods.

In addition to the growing awareness about gluten-related disorders, the West's focus on organic, plant-based, and specialty diets has also driven the demand for gluten-free products. As more consumers in the region embrace gluten-free eating as part of a healthier lifestyle, the market for gluten-free prepared foods is expected to continue to grow.

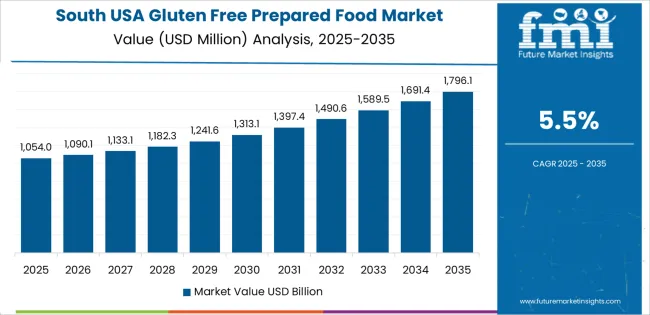

The South shows strong demand for gluten-free prepared food with a CAGR of 5.5%. The region's increasing awareness of gluten-related health issues and the rising demand for healthier food options are key factors driving this market growth. States like Texas, Florida, and Georgia are seeing more consumers opting for gluten-free diets as awareness of celiac disease and gluten sensitivity rises.

In addition, the growing availability of gluten-free products in supermarkets, health food stores, and through online retailers has made it easier for Southern consumers to find and incorporate gluten-free prepared foods into their diets. The region’s focus on expanding healthy food options and catering to diverse dietary needs further supports the growth of the gluten-free food market.

The Northeast shows steady demand for gluten-free prepared food with a CAGR of 4.9%. The region’s large urban centers, including New York, Boston, and Philadelphia, have seen a rise in the number of consumers choosing gluten-free options due to an increasing understanding of gluten sensitivity and health benefits. The region has a well-developed infrastructure for offering gluten-free products, with a variety of specialty stores, restaurants, and cafes providing gluten-free choices.

However, while the demand for gluten-free prepared foods is strong, it is somewhat lower than in the West and South, possibly due to the Northeast’s more traditional food culture, where gluten is still commonly consumed. Despite this, as awareness of gluten intolerance and celiac disease continues to rise, the demand for gluten-free prepared foods is expected to remain steady and continue to grow in urban areas of the Northeast.

The Midwest shows moderate growth in the demand for gluten-free prepared food with a CAGR of 4.3%. While the region has a strong food manufacturing base and large population, the adoption of gluten-free diets has been slower compared to other regions. However, as more consumers become aware of gluten-related health issues, particularly in states like Illinois, Ohio, and Michigan, the demand for gluten-free foods is steadily increasing.

The Midwest’s more traditional food culture and reliance on wheat-based products may contribute to the slower adoption of gluten-free prepared foods, but as health trends continue to evolve and consumers look for more diverse food options, demand is expected to rise. The increased availability of gluten-free products in grocery stores and online, along with the growth of health-conscious dining options, will further drive demand for gluten-free prepared food in the region.

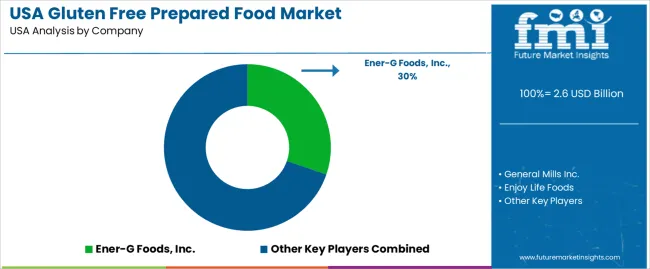

The demand for gluten-free prepared food in the United States is rapidly growing, driven by the increasing prevalence of gluten sensitivities, celiac disease, and the rising trend of gluten-free diets among health-conscious consumers. Companies like Ener-G Foods, Inc. (holding approximately 30.3% market share), General Mills Inc., Enjoy Life Foods, Udi's Healthy Foods, LLC, and B&G Foods, Inc. are major players in this market. As awareness of gluten-related health issues rises, more consumers are seeking convenient, ready-to-eat gluten-free options across a wide range of food categories, including snacks, baked goods, frozen meals, and packaged ingredients.

Competition in the gluten-free prepared food industry is primarily driven by product innovation, taste, and nutritional value. Companies are focusing on improving the taste and texture of gluten-free products to appeal to a broader audience beyond those with gluten sensitivities. Another key area of competition is the ability to offer a variety of gluten-free options that cater to different dietary preferences, such as organic, non-GMO, or vegan. As consumer demand for healthy, clean-label products grows, companies are also focusing on using natural and simple ingredients in their gluten-free offerings. Marketing materials typically highlight features such as taste, nutritional benefits, ingredient transparency, and certification labels (e.g., gluten-free, non-GMO, or allergen-free). By aligning their products with the growing demand for convenient, healthy, and gluten-free meal solutions, these companies aim to strengthen their position in the USA gluten-free prepared food market.

| Items | Details |

|---|---|

| Quantitative Units | USD Billion |

| Regions Covered | USA |

| Product Type | Drinks, Bakery Products, Ready to Eat Products, Bread and Rolls, Pasta |

| Sales Channel | Supermarket, Grocery Store, Health or Natural Food Store, Drug Store |

| Key Companies Profiled | Ener-G Foods, Inc., General Mills Inc., Enjoy Life Foods, Udi's Healthy Foods, LLC, B&G Foods, Inc. |

| Additional Attributes | The market analysis includes dollar sales by product type and sales channel categories. It also covers regional demand trends in the USA, driven by the increasing adoption of gluten-free diets. The competitive landscape highlights major players focusing on innovations in gluten-free prepared foods, with a focus on health-conscious consumers. Trends in the growing demand for gluten-free drinks, bakery products, and ready-to-eat meals are explored, along with advancements in product quality, packaging, and distribution strategies. |

The global demand for gluten free prepared food in USA is estimated to be valued at USD 2.6 billion in 2025.

The market size for the demand for gluten free prepared food in USA is projected to reach USD 4.3 billion by 2035.

The demand for gluten free prepared food in USA is expected to grow at a 5.3% CAGR between 2025 and 2035.

The key product types in demand for gluten free prepared food in USA are drinks, bakery products, ready to eat products, bread and rolls and pasta.

In terms of sales channel, supermarket segment to command 55.0% share in the demand for gluten free prepared food in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Gluten Index Device Market Size and Share Forecast Outlook 2025 to 2035

Gluten Feed Market Size and Share Forecast Outlook 2025 to 2035

Gluten Intolerance Treatment Market

Gluten Free Flours Market Size and Share Forecast Outlook 2025 to 2035

Gluten-free Bakery Premix Market Size and Share Forecast Outlook 2025 to 2035

Gluten-Free Pizza Crust Market Size, Growth, and Forecast for 2025 to 2035

Analysis and Growth Projections for Gluten-free Product Business

Gluten-Free Soup Market Insights - Specialty Diets & Consumer Demand 2025 to 2035

Gluten-Free Pasta Market Trends - Health-Conscious Eating & Market Growth 2025 to 2035

Gluten-Free Oats Market Insights – Clean Eating & Industry Growth 2025 to 2035

Gluten-Free Tortilla Market Trends – Free-From Foods & Market Growth 2024-2034

Gluten-Free Facial Product Market Trends – Growth & Forecast 2024-2034

Gluten-free Food Market Size and Share Forecast Outlook 2025 to 2035

Analysis and Growth Projections for Gluten Free Prepared Food Market

Wheat Gluten Market Size and Share Forecast Outlook 2025 to 2035

Demand for Gluten Free Prepared Food in Japan Size and Share Forecast Outlook 2025 to 2035

Free Fonts with Commercial Use Market Size and Share Forecast Outlook 2025 to 2035

Freezer Label Market Size and Share Forecast Outlook 2025 to 2035

Freezer Liner Market Size and Share Forecast Outlook 2025 to 2035

Freeze Neutralising Kit Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA