The demand for hydro-processing catalysts in the USA is projected to grow from USD 830.7 million in 2025 to USD 1,050.4 million by 2035, reflecting a compound annual growth rate (CAGR) of 2.40%. These catalysts are crucial in refining processes such as hydrocracking and hydrotreating, where they improve the quality of fuels and chemicals by removing impurities like sulfur, nitrogen, and metals. As the refining industry faces stricter environmental regulations and an increasing focus on ecological, the demand for these catalysts is expected to rise. The growing need for cleaner fuels, biofuels, and petrochemical products will further drive the industry.

Technological advancements in hydro-processing catalysts, such as more durable and efficient catalysts, will play a key role in supporting this growth. Refineries will continue to rely on these advanced catalysts to optimize operational efficiency, reduce emissions, and comply with tightening regulations. As industries push for greater ecological and efficiency, the need for hydro-processing catalysts in refining processes will increase, further fueling industry demand. The continued development of more efficient and high-performance catalysts will enable the refining industry to meet growing product demands and regulatory standards, ensuring the long-term growth of the hydro-processing catalyst industry in the USA over the next decade.

The absolute dollar opportunity for hydro-processing catalysts in the USA from 2025 to 2035 can be calculated by subtracting the projected demand in 2025 from the projected demand in 2035. The demand is expected to increase from USD 830.7 million in 2025 to USD 1,050.4 million in 2035, resulting in an absolute dollar opportunity of USD 219.7 million. This growth reflects the expanding adoption of advanced refining technologies and the increasing demand for cleaner fuels and petrochemical products. As industries continue to focus on ecological and meet stricter environmental regulations, the demand for hydro-processing catalysts will rise significantly.

The driving factors behind this growth include the refining sector’s need to improve fuel quality and reduce harmful emissions, which hydro-processing catalysts help achieve by removing impurities like sulfur, nitrogen, and metals from fuels and chemicals. The increasing demand for low-sulfur fuels, biofuels, and efficient chemical processes will further fuel the industry. Advancements in catalyst technology, offering improved efficiency, durability, and performance, will contribute to this industry expansion. As refineries and petrochemical plants seek to optimize operations and comply with environmental standards, the need for effective hydro-processing catalysts will continue to grow. This USD 219.7 million opportunity reflects a broad shift towards cleaner, more efficient refining practices, driving demand for these catalysts in the coming decade.

| Metric | Value |

|---|---|

| Demand for Hydro-processing Catalysts in USA Value (2025) | USD 830.7 million |

| Demand for Hydro-processing Catalysts in USA Forecast Value (2035) | USD 1,050.4 million |

| Demand for Hydro-processing Catalysts in USA Forecast CAGR (2025-2035) | 2.4% |

The demand for hydro-processing catalysts in the USA is growing as refineries aim to meet stricter environmental regulations and improve fuel quality. Hydro-processing catalysts play a key role in refining operations by helping to remove impurities such as sulfur and nitrogen from crude oil, ensuring that the final products meet increasingly stringent emissions standards. These catalysts are essential in producing cleaner fuels, which is a primary concern for the energy and transportation sectors.

The growing global demand for cleaner fuels, driven by environmental regulations, is one of the major drivers of this growth. Refining companies are investing in advanced hydro-processing technologies to comply with regulations and meet the evolving needs of consumers. The push towards energy efficiency and the need to upgrade existing refinery infrastructure is further increasing the adoption of hydro-processing catalysts.

Technological advancements in catalyst design and the growing focus on optimizing refinery operations are also contributing to the rising demand. With refiners seeking to reduce costs while enhancing performance, the continued development of more effective and longer-lasting catalysts is expected to drive steady demand through 2035.

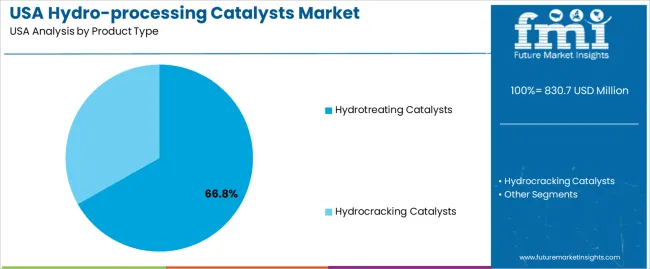

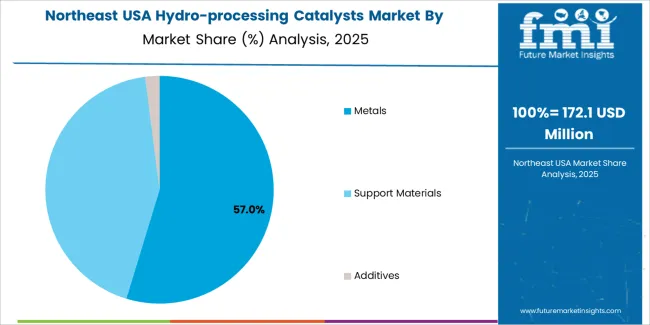

Demand for hydro-processing catalysts in the USA is segmented by product type, ingredient, end-use industry, and region. By product type, demand is divided into hydrotreating catalysts and hydrocracking catalysts. The demand is also segmented by ingredient, including metals, support materials, and additives. In terms of end-use industry, demand is divided into petroleum refineries, chemical manufacturing, renewable fuels, and others. Regionally, demand is divided into West USA, South USA, Northeast USA, and Midwest USA.

Hydrotreating catalysts account for 67% of the demand for hydro-processing catalysts in the USA. These catalysts are critical in the refining process, as they are used to remove impurities such as sulfur, nitrogen, and oxygen from feedstocks, improving fuel quality. This process is essential for producing cleaner, high-quality fuels like gasoline, diesel, and jet fuel. With stricter environmental standards and the increasing demand for cleaner fuels, hydrotreating catalysts have become indispensable in the petroleum refining industry. They ensure that fuels meet the required specifications, minimizing harmful emissions. Hydrotreating is also a key process in upgrading crude oil and other feedstocks into valuable products, making it a vital step in refining operations. As regulations continue to tighten and the need for higher-quality fuels grows, hydrotreating catalysts will remain the dominant product in the hydro-processing catalyst industry, driving improvements in fuel production efficiency and quality.

Metals account for 54.9% of the demand for ingredients in hydro-processing catalysts in the USA. The catalytic properties of metals such as nickel, molybdenum, and cobalt are essential for the effective functioning of both hydrotreating and hydrocracking processes. Metals are used as active components in catalysts, where they facilitate chemical reactions necessary for removing impurities and converting hydrocarbons into valuable products. These metals are particularly efficient at breaking down complex molecules under high temperatures and pressures, making them ideal for the harsh environments in which hydro-processing catalysts operate. Their durability and ability to withstand these extreme conditions make metal-based catalysts the preferred choice for many applications in the refining and chemical industries. As demand for cleaner and more efficient fuel production increases, metals will continue to dominate the industry, providing reliable performance in hydro-processing applications and ensuring consistent results in refining operations.

Key drivers include stricter environmental and fuel‑quality regulations that require refiners to remove sulfur, nitrogen and other impurities, growth in renewable diesel and jet‑fuel production which uses hydro‑processing technology, and the need for catalyst upgrades as feedstocks become heavier or more challenging. Restraints include the capital intensity of upgrading refining units, volatility in crude‑oil and feedstock prices that can delay investments, and competition from alternative technologies (e.g., membrane separation or advanced adsorption) which may reduce reliance on traditional hydro‑processing catalysts.

Why is Demand for Hydro‑Processing Catalysts Growing in USA?

In USA demand for hydro‑processing catalysts is growing because domestic refineries and fuel producers are under pressure to produce ultra‑low‑sulfur diesel and cleaner gasoline, while increasing production of renewable fuels and bio‑based feedstocks also uses hydro‑processing steps. As existing units age, refiners are investing in catalyst replacement and upgrades to maintain efficiency and compliance. The push for higher conversion of heavier crude and residues further drives demand for advanced hydrotreating and hydrocracking catalysts. These factors combine to encourage catalyst purchases and technology refresh in USA refining and petrochemical operations.

How are Technological Innovations Driving Growth of Hydro‑Processing Catalysts in USA?

Technological innovations are advancing hydro‑processing catalysts in USA by improving catalyst selectivity, longevity and ability to handle tougher feedstocks. Examples include catalysts tailored for renewable‑diesel and SAF production, advanced supports and promoters that extend lifespan under high‑severity conditions, and catalyst regeneration technologies to reduce total cost of ownership. Also digital monitoring and process‑optimisation tools help refiners maximise catalyst performance and schedule replacements more efficiently. These innovations make catalyst investment more efficient and help refiners meet newer fuel specifications, propelling growth of hydro‑processing catalyst demand in USA.

What are the Key Challenges Limiting Adoption of Hydro‑Processing Catalysts in USA?

Despite increasing demand, several challenges limit adoption of hydro‑processing catalysts in USA. One key challenge is the high cost of sophisticated catalysts and associated turnkey upgrades for hydrotreating and hydrocracking units, which may be deferred under tight margins. Integration of new catalyst technologies may require plant downtime and redesign of reactors or internals, which adds risk. The variable economics of refining due to feedstock quality, product margins and regulatory uncertainty can delay catalyst investment. As the energy transition advances and alternative fuels/modes gain traction, the long‑term outlook for some traditional hydro‑processing routes may be less certain, dampening capital deployment.

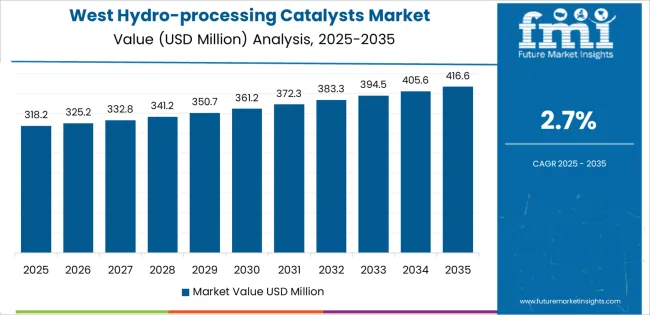

Demand for hydro-processing catalysts in the USA is growing steadily across all regions, with the West leading at a 2.7% CAGR. This growth is driven by the region’s strong refining and petrochemical sectors, which rely heavily on hydro-processing catalysts to meet stringent environmental regulations and improve fuel quality. The South follows with a 2.4% CAGR, supported by the region’s large refining capacity and the increasing need to meet cleaner fuel standards. The Northeast shows a 2.2% CAGR, with growth driven by the modernization of refineries and a push for cleaner energy solutions. The Midwest experiences the lowest growth at 1.9%, but steady demand remains due to the region's focus on upgrading refining technologies to meet environmental standards.

| Region | CAGR (%) |

|---|---|

| West | 2.7% |

| South | 2.4% |

| Northeast | 2.2% |

| Midwest | 1.9% |

The West is experiencing the highest demand for hydro-processing catalysts in the USA, with a 2.7% CAGR. This growth is driven by the region's strong focus on refining and petrochemical industries, where hydro-processing catalysts play a crucial role in upgrading heavy feedstocks and improving product quality. The West’s established energy sector, including large refining operations in states like California, has a high demand for these catalysts to ensure compliance with environmental regulations and improve the quality of fuels. The region’s push toward reducing carbon emissions and meeting stricter fuel standards further fuels the need for advanced catalysts that can optimize refining processes. As energy production continues to shift towards cleaner and more eco-friendly methods, the adoption of hydro-processing catalysts in the West is expected to continue to grow, driven by both regulatory pressures and technological advancements in the energy sector.

The South is seeing steady demand for hydro-processing catalysts in the USA, with a 2.4% CAGR. The region is home to some of the largest oil refineries and petrochemical facilities, particularly in Texas, Louisiana, and Alabama, where hydro-processing catalysts are critical for upgrading crude oil and producing high-quality fuels. With the increasing need to meet environmental standards and the growing demand for cleaner fuels, the adoption of advanced hydro-processing technologies is on the rise. As the South’s refining capacity continues to expand and evolve, the demand for catalysts that improve efficiency and reduce emissions is expected to grow. The South’s strategic position in the oil and gas industry, combined with its large energy infrastructure, ensures that hydro-processing catalysts will remain in high demand. As ecological becomes a key factor in the energy transition, the South will continue to rely on these catalysts for cleaner and more efficient refining processes.

The Northeast is experiencing moderate demand for hydro-processing catalysts in the USA, with a 2.2% CAGR. The region’s demand is primarily driven by its refining and petrochemical sectors, which need advanced catalysts for hydro-processing to ensure high fuel quality and meet environmental standards. While the Northeast is not as dominant in the refining industry as other regions like the South or West, it still plays an essential role in energy production and fuel processing. The region’s stringent environmental regulations and the push towards cleaner fuels are contributing to the increasing use of hydro-processing catalysts. The Northeast’s focus on upgrading older refineries and adopting cutting-edge technologies is helping to drive the adoption of catalysts that improve refining efficiency and lower emissions. As the region continues to modernize its refining infrastructure, demand for hydro-processing catalysts will likely see steady growth, particularly in line with regulatory and ecological goals.

The Midwest is experiencing the lowest demand for hydro-processing catalysts in the USA, with a 1.9% CAGR. While the region is a significant player in industrial manufacturing and energy production, its demand for hydro-processing catalysts is more moderate compared to other regions. The Midwest has fewer large-scale refineries than the South and West, which limits the overall need for catalysts in the region. The demand for hydro-processing catalysts is driven by the growing focus on fuel quality and environmental regulations in local refineries. As refineries in the Midwest continue to modernize and meet stricter fuel standards, the use of hydro-processing catalysts to improve the quality of fuel products is expected to grow. Furthermore, the increasing interest in cleaner energy solutions and the need to reduce carbon emissions are expected to support steady, albeit slower, growth in demand for hydro-processing catalysts in the region.

In the USA, demand for hydro‑processing catalysts is driven by the need for refining operations to meet stringent fuel quality standards and regulatory requirements related to sulfur, nitrogen, and metal contaminants. These catalysts are essential for processes like hydrotreating and hydrocracking, which convert feedstocks into cleaner, lighter fuels while enabling refineries to process more challenging crude oils.

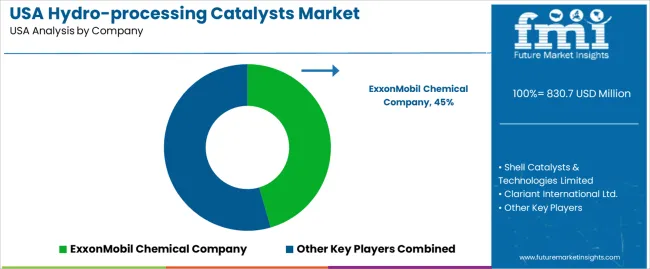

Key suppliers in the USA hydro‑processing catalyst industry include ExxonMobil Chemical Company, which holds a 45.5% share, Shell Catalysts & Technologies Limited, Clariant International Ltd., Chevron Phillips Chemical Company LLC, and Johnson Matthey PLC. These companies differentiate themselves through advanced catalyst formulations, including nickel-molybdenum and cobalt-molybdenum systems, and provide comprehensive service support such as catalyst regeneration and performance optimization for refineries.

Competitive dynamics are influenced by several factors. Regulatory drivers, including lower sulfur limits for diesel fuels and mandates for cleaner products, continue to boost demand for high‑performance catalysts. As refineries process heavier and more contaminated crude oils, there is increasing demand for robust catalyst systems that can handle these feedstocks. Challenges such as the high cost of catalyst development, lifecycle management, and competition from alternative technologies, such as membrane or adsorption systems, remain significant. Refiners also face pressure to control operational costs.

Companies that offer strong technical capabilities, long-term service support, and solutions that meet evolving refinery needs will be best positioned to capture and sustain their industry leadership in the USA hydro‑processing catalyst industry.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD million |

| Product Type | Hydrotreating Catalysts, Hydrocracking Catalysts |

| Ingredient | Metals, Support Materials, Additives |

| End-Use Industry | Petroleum Refineries, Chemical Manufacturing, Renewable Fuels, Others |

| Region | West USA, South USA, Northeast USA, Midwest USA |

| Countries Covered | USA |

| Key Companies Profiled | ExxonMobil Chemical Company, Shell Catalysts & Technologies Limited, Clariant International Ltd., Chevron Phillips Chemical Company LLC, Johnson Matthey PLC |

| Additional Attributes | Dollar sales by product type and ingredient; regional CAGR and adoption trends; demand trends in hydro-processing catalysts; growth in petroleum refineries, chemical manufacturing, and renewable fuels sectors; technology adoption for refining and fuels; vendor offerings including catalyst materials, services, and integration solutions; regulatory influences and industry standards |

The demand for hydro-processing catalysts in usa is estimated to be valued at USD 830.7 million in 2025.

The market size for the hydro-processing catalysts in usa is projected to reach USD 1,053.0 million by 2035.

The demand for hydro-processing catalysts in usa is expected to grow at a 2.4% CAGR between 2025 and 2035.

The key product types in hydro-processing catalysts in usa are hydrotreating catalysts and hydrocracking catalysts.

In terms of ingredient, metals segment is expected to command 54.9% share in the hydro-processing catalysts in usa in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

USA Medical Coding Market Size and Share Forecast Outlook 2025 to 2035

USA Labels Market Size and Share Forecast Outlook 2025 to 2035

USA Plant-based Creamers Market Size and Share Forecast Outlook 2025 to 2035

USA Barrier Coated Paper Market Size and Share Forecast Outlook 2025 to 2035

USA Electronic Health Records (EHR) Market Size and Share Forecast Outlook 2025 to 2035

USA Animal Model Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Packer Bottle Market Size and Share Forecast Outlook 2025 to 2035

USA Stretch Hood Films Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Fence Screen Market Size and Share Forecast Outlook 2025 to 2035

USA Lubricant Contaminated HDPE Container Waste Market Size and Share Forecast Outlook 2025 to 2035

USA Commercial Walk-In Refrigeration Market Size and Share Forecast Outlook 2025 to 2035

USA & Canada Pre-painted Steel Roofing and Cladding Market Size and Share Forecast Outlook 2025 to 2035

USA Residential Cotton Candy Maker Market Size and Share Forecast Outlook 2025 to 2035

USA Faith Based Tourism Market Size and Share Forecast Outlook 2025 to 2035

United States NFC Lemon Juice Market Analysis - Size, Growth and Forecast 2025 to 2035

USA and Canada Copper Market Insights - Demand, Size & Industry Trends 2025 to 2035

USA Ground and Precipitated Calcium Carbonate Market Growth by Product Type, Application, End-Use, and Region in 2025 to 2035

United States Animal Feed Additives Market Report – Trends, Growth & Forecast 2025–2035

United States Wild Rice Market Outlook – Size, Demand & Forecast 2025–2035

United States Wood Vinegar Market Analysis – Trends, Growth & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA