The demand for powder injection molding (PIM) in the USA is expected to grow from USD 1.8 billion in 2025 to USD 4.2 billion by 2035, reflecting a compound annual growth rate (CAGR) of 8.90%. PIM is an advanced manufacturing technology used to produce high-precision components with intricate geometries, typically for industries such as automotive, aerospace, healthcare, and electronics. The increasing demand for complex, lightweight, and high-performance components across multiple sectors primarily drives this growth. Automotive manufacturers, in particular, are increasingly relying on PIM to produce lightweight, high-strength components for vehicles, including those used in electric and hybrid vehicles.

In addition to the automotive sector, the electronics and aerospace industries are key contributors to the demand for powder injection molding. Electronics manufacturers are looking for miniaturized components with greater functionality, and PIM allows for the production of small, complex parts that are lightweight and durable. In aerospace, where components must meet rigorous performance and safety standards, PIM is used to manufacture intricate parts that offer both precision and reliability. Furthermore, the healthcare industry is adopting PIM to create small, precise components used in medical devices, which require high accuracy and consistency.

Between 2025 and 2030, demand for powder injection molding in the USA is expected to grow from USD 1.8 billion to USD 1.9 billion, reflecting steady growth. This phase will see moderate adoption of PIM, driven by its increasing acceptance in sectors such as automotive and healthcare. Manufacturers in these industries will continue to focus on increasing production efficiency, reducing waste, and improving product quality, which will contribute to the gradual rise in demand for PIM solutions. The automotive sector, in particular, will continue to explore PIM for producing parts that meet the growing demand for lightweight, fuel-efficient vehicles.

From 2030 to 2035, the demand for powder injection molding is expected to accelerate significantly, reaching USD 4.2 billion by 2035. This phase will see stronger growth, driven by continued innovations in PIM technology and its increasing adoption across various high-volume manufacturing sectors. The automotive, aerospace, electronics, and healthcare industries will continue to integrate PIM as a standard manufacturing process, fueled by the increasing need for high-performance, lightweight, and cost-effective components. Moreover, PIM’s ability to create complex, multi-material components with minimal waste and reduced production time will make it an increasingly attractive option for manufacturers.

| Metric | Value |

|---|---|

| Demand for Powder Injection Molding in USA Value (2025) | USD 1.8 billion |

| Demand for Powder Injection Molding in USA Forecast Value (2035) | USD 4.2 billion |

| Demand for Powder Injection Molding in USA Forecast CAGR (2025-2035) | 8.9% |

The demand for powder injection molding in the USA is increasing as industries seek cost-effective and efficient manufacturing solutions for complex, high-performance components. Powder injection molding (PIM) allows for the production of intricate parts with precise tolerances, which is highly sought after in industries such as automotive, aerospace, medical devices, and electronics. The ability to process a wide range of materials, including metals, ceramics, and polymers, further broadens the appeal of PIM for various applications.

The growth is driven by the need for more efficient manufacturing processes, especially in industries where high-performance materials and precision are crucial. As the demand for miniaturized, lightweight components in sectors like automotive and electronics continues to rise, PIM provides a solution that meets both design complexity and cost-efficiency. The increasing adoption of PIM in the medical and healthcare industries for specialized components is also contributing to this growth.

Technological advancements in PIM, such as improved feedstock materials and better control over part quality, are further fueling demand. As manufacturers continue to seek more efficient production methods, powder injection molding is expected to see steady growth in the USA through 2035, driven by its versatility, scalability, and cost-effectiveness in producing high-quality parts.

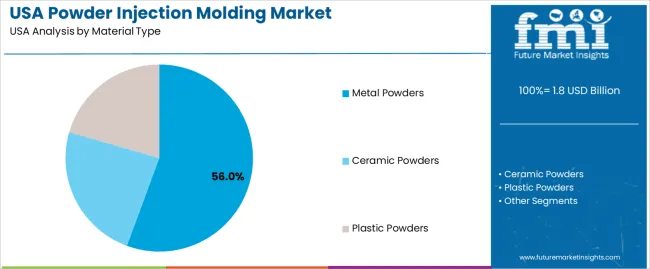

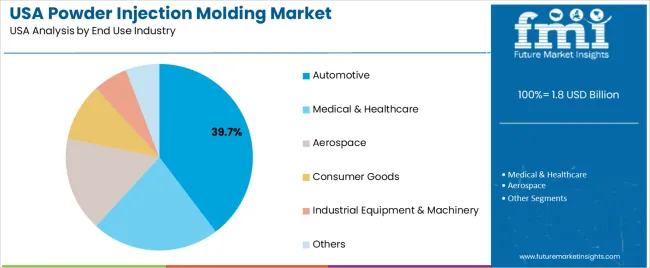

Demand for powder injection molding in the USA is segmented by material type, end-use industry, technology, and region. By material type, demand is divided into metal powders, ceramic powders, and plastic powders. The demand is also segmented by end-use industry, including automotive, medical & healthcare, aerospace, consumer goods, industrial equipment & machinery, and others. In terms of technology, demand is divided into ceramic injection molding (CIM), metal injection molding (MIM), and plastic injection molding (PIM). Regionally, demand is divided into West USA, South USA, Northeast USA, and Midwest USA.

Metal powders account for 56% of the demand for powder injection molding in the USA. Metal injection molding (MIM) is widely used for producing high-precision parts, especially in industries like automotive, aerospace, and medical. Metal powders offer the advantage of producing complex parts with high strength, durability, and dimensional accuracy. MIM enables manufacturers to produce intricate metal components with reduced material waste, making it highly cost-effective, particularly for small to medium-sized parts. This process is crucial in producing high-performance, lightweight components used in automotive engines, medical devices, and aerospace applications, where precision and reliability are paramount. The increasing demand for lightweight, durable parts in industries such as automotive and aerospace, alongside advancements in metal powder technologies, will continue to drive the dominance of metal powders in powder injection molding.

The automotive industry accounts for 39.7% of the demand for powder injection molding in the USA. The automotive sector is a major consumer of precision-engineered components, and powder injection molding is ideal for producing small, intricate metal parts used in engines, transmission systems, and other critical automotive components. The ability to produce lightweight, high-strength parts with minimal material waste is a significant advantage for automakers aiming to improve fuel efficiency and reduce production costs. With the growing demand for high-performance and complex automotive parts, the use of powder injection molding is increasing in the industry. The ongoing trend towards electric vehicles (EVs) and advanced manufacturing techniques further drives the need for precision parts, ensuring the automotive sector remains the largest end-user of powder injection molding technology in the USA.

In USA demand for PIM is increasingly driven by the need for highly precise, complex‑geometry metal and ceramic components in industries such as medical devices, electronics, automotive and firearms. As manufacturers pursue miniaturisation, weight reduction and higher performance parts, PIM becomes more attractive. Expanded use in orthopedic implants, surgical tools, connectors and gear parts supports growth. Restraints include relatively high tooling and process development costs, competition from alternative manufacturing technologies (such as micro‑machining, additive manufacturing) and the need for skilled process control of binder removal and sintering steps. Also, regulatory qualifying of new materials and processes (especially in medical/auto) can delay implementation.

Why is Demand for Powder Injection Molding Growing in USA?

In USA, demand for powder injection molding is rising because OEMs and contract manufacturers are under pressure to deliver smaller, more complex and high‑performance parts at scale. Medical device manufacturers require intricate stainless steel or nitinol implants, electronics firms need tiny metal housings and connectors, and the firearms and defence sectors continue to demand precision metallic components. The push for lightweighting in automotive, combined with the need for low‑volume specialty parts and cyclical replacements, supports PIM growth. These factors make PIM an increasingly attractive production route in USA for high‑value, high‑complexity parts.

How are Technological Innovations Driving Growth of Powder Injection Molding in USA?

Technological advances are expanding the use of PIM in USA by improving process reliability, material types and production capacity. Innovations include finer metal and ceramic powders, improved binder systems that reduce cycle time and defect rates, and enhanced debinding/sintering systems that support tighter tolerances. For metals like stainless steel, titanium and high‑temperature alloys, PIM now delivers performance comparable to wrought parts. Automation, process monitoring and quality‑control systems tailored for PIM reduce scrap and improve yield. These improvements lower cost per part and open up new applications in USA‑based high‑tech sectors, encouraging broader adoption.

What are the Key Challenges Limiting Adoption of Powder Injection Molding in USA?

Despite the growth opportunity, adoption of PIM in USA is limited by certain challenges. First, the initial investment for injection mould tooling, debinding and sintering infrastructure is significant, which may deter smaller producers. Second, some end‑users require extensive validation (especially in medical or aerospace) for new PIM materials and processes, adding lead time and cost. Third, alternative manufacturing methods such as additive manufacturing or micro‑machining may be preferred for very low‑volume or highly customised parts, reducing PIM’s share in those niches. Finally, fluctuations in powder feedstock cost and the need for consistent process control can raise risk and limit wider deployment.

| Region | CAGR (%) |

|---|---|

| West | 10.3% |

| South | 9.2% |

| Northeast | 8.2% |

| Midwest | 7.1% |

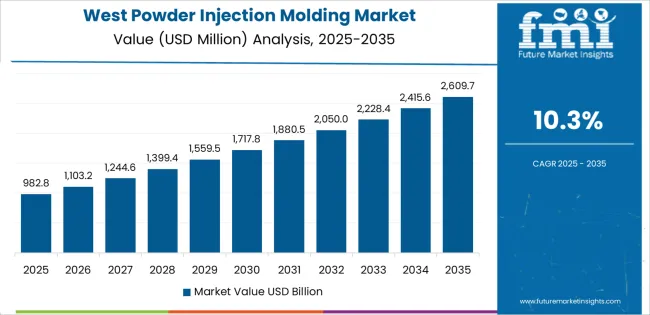

Demand for powder injection molding in the USA is growing across all regions, with the West leading at a 10.3% CAGR. This growth is driven by the region’s strong presence in industries like automotive, aerospace, and electronics, where precision and complex manufacturing are key. The South follows with a 9.2% CAGR, supported by its expanding automotive and manufacturing sectors that increasingly rely on advanced production methods like PIM. The Northeast shows a steady 8.2% CAGR, driven by high-tech industries such as medical devices, electronics, and aerospace. The Midwest experiences moderate growth at 7.1%, with demand supported by its large manufacturing base, particularly in automotive and industrial sectors. As industries continue to prioritize efficiency, precision, and cost-effect

The West is experiencing the highest demand for powder injection molding in the USA, with a 10.3% CAGR. This growth is driven by the region's advanced manufacturing sectors, including automotive, aerospace, and electronics, which rely on precision and complex part production. States like California, Nevada, and Washington are home to numerous high-tech industries where powder injection molding (PIM) is used to produce small, intricate metal and plastic components in high volumes. The West’s focus on energy efficiency, and reducing production costs further supports the growing adoption of PIM. As these industries prioritize lightweight materials and high-performance components, PIM provides an ideal solution for manufacturing complex parts with minimal waste. The region's strong innovation culture, along with its manufacturing infrastructure, ensures that the demand for powder injection molding will continue to grow at a robust pace, especially in high-demand sectors such as electronics and automotive.

The South is seeing strong demand for powder injection molding in the USA, with a 9.2% CAGR. This growth is largely fueled by the region’s expanding automotive and manufacturing sectors, particularly in states like Texas, Alabama, and Georgia. The South's industrial base, which is increasingly focused on cost-efficient and advanced production methods, is adopting powder injection molding for its ability to produce small, complex parts at a reduced cost. As the automotive industry in the South continues to grow, there is a higher demand for intricate, lightweight, and high-performance components that PIM can provide. The growing trend of reshoring and the region’s expanding e-commerce sector further boost the need for PIM in various applications, including automotive parts, industrial components, and consumer goods. As businesses in the South prioritize quality and efficiency in manufacturing, the demand for powder injection molding is expected to continue rising steadily.

The Northeast is experiencing steady demand for powder injection molding in the USA, with an 8.2% CAGR. This growth is largely driven by the region's high-tech industries, including medical devices, electronics, and aerospace, where precision, high-quality production is crucial. Major cities like New York, Boston, and Philadelphia are hubs for innovation, and companies in these sectors are increasingly adopting powder injection molding to produce small, complex components for a variety of applications. PIM offers a cost-effective and efficient way to manufacture metal and plastic parts in high volumes, which is especially important in industries like medical devices, where tight tolerances and product reliability are critical. The region’s focus on improving manufacturing processes and reducing waste has contributed to the adoption of PIM, and as consumer demand for advanced technology continues to rise, the Northeast will likely see continued growth in the use of powder injection molding.

The Midwest is experiencing moderate demand for powder injection molding in the USA, with a 7.1% CAGR. The region's large manufacturing base, particularly in automotive, industrial, and heavy machinery sectors, is driving the adoption of PIM. States like Michigan, Ohio, and Indiana have well-established industrial sectors that rely on high-precision, cost-effective methods for producing complex parts. Powder injection molding provides an ideal solution for industries that require intricate metal and plastic components in high volumes, including automotive and industrial applications. As these industries seek to improve efficiency, reduce production costs, and meet evolving consumer demands, the adoption of PIM is expected to increase. The Midwest’s focus on innovation in manufacturing technologies, coupled with the growing trend of reshoring and modernization, supports steady demand for powder injection molding. As industries continue to prioritize production optimization, PIM will play an increasingly vital role in the region’s manufacturing processes.

In the USA, demand for powder injection molding (PIM) is growing steadily, driven by the need for precision manufacturing of complex metal and ceramic components in sectors such as automotive, aerospace, medical devices, and electronics. PIM allows for intricate geometries, high material utilization, and high‑volume output capabilities that conventional manufacturing processes struggle to match.

Key suppliers in the USA include Höganäs AB (holding about 36.4% share), Arburg GmbH + Co KG, Indo‑MIM Pvt. Ltd., LPW Technology Ltd. and Schunk Sintermetalltechnik GmbH. These players differentiate themselves through leadership in feedstock materials (Höganäs), specialized machine tooling (Arburg), contract manufacturing and global service coverage (Indo‑MIM), and advanced materials solutions (LPW & Schunk). Their competitive edge comes from deep technical expertise, material science strength, and ability to serve demanding end‑use applications.

Competitive dynamics in the USA PIM segment are shaped by a few main drivers and challenges. One major driver is the increasing demand for lightweight, high‑strength components especially for electric vehicles, aerospace fuel‑system parts, and minimally‑invasive medical instrumentation. Another is the push for manufacturing efficiency, PIM helps reduce waste, shorten cycle times, and handle complex geometries. Restraints include high capital investment for tooling, the need for highly specialized expertise, and competition from alternate manufacturing methods such as additive manufacturing or machining. Companies that combine strong material‑technology innovation, service capability for qualification, and production scalability are best positioned to lead in the USA PIM demand landscape.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD billion |

| Material Type | Metal Powders, Ceramic Powders, Plastic Powders |

| Technology | Ceramic Injection Molding (CIM), Metal Injection Molding (MIM), Plastic Injection Molding (PIM) |

| End Use Industry | Automotive, Medical & Healthcare, Aerospace, Consumer Goods, Industrial Equipment & Machinery, Others |

| Region | West USA, South USA, Northeast USA, Midwest USA |

| Countries Covered | USA |

| Key Companies Profiled | Höganäs AB, Arburg GmbH + Co KG, Indo-MIM Pvt. Ltd., LPW Technology Ltd., Schunk Sintermetalltechnik GmbH |

| Additional Attributes | Dollar sales by material type and technology; regional CAGR and adoption trends; demand trends in powder injection molding; growth in automotive, medical, aerospace, and industrial sectors; technology adoption for molding processes; vendor offerings including equipment, services, and integration solutions; regulatory influences and industry standards |

The demand for powder injection molding in usa is estimated to be valued at USD 1.8 billion in 2025.

The market size for the powder injection molding in usa is projected to reach USD 4.2 billion by 2035.

The demand for powder injection molding in usa is expected to grow at a 8.9% CAGR between 2025 and 2035.

The key product types in powder injection molding in usa are metal powders, ceramic powders and plastic powders.

In terms of technology, ceramic injection molding (cim) segment is expected to command 46.7% share in the powder injection molding in usa in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Powder Injection Molding Market Growth – Trends & Forecast 2025 to 2035

Demand for Powder Injection Molding in Japan Size and Share Forecast Outlook 2025 to 2035

Injection Molding Machine Market Size and Share Forecast Outlook 2025 to 2035

Injection Molding Machines Industry Analysis in India Size, Share & Forecast 2025 to 2035

Injection Molding Polyamide 6 Market Growth – Trends & Forecast 2024-2034

Injection Molding Containers Market

USA Superfood Powder Market Report – Trends, Demand & Outlook 2025-2035

Injection Blow Molding Machine Market Size and Share Forecast Outlook 2025 to 2035

Metal Injection Molding (MIM) Parts Market Size and Share Forecast Outlook 2025 to 2035

Europe Injection Molding Machines Market Size and Share Forecast Outlook 2025 to 2035

Sliding Injection Molding Machines Market Size and Share Forecast Outlook 2025 to 2035

Plastic Injection Molding Machine For Medtech Market Size and Share Forecast Outlook 2025 to 2035

Ceramic Injection Molding Market Size and Share Forecast Outlook 2025 to 2035

Demand for Boride Powder in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Lingonberry Powder in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Gas & Dual-Fuel Injection Systems in USA Size and Share Forecast Outlook 2025 to 2035

Injection Epoxy Chemical Anchors Market Size and Share Forecast Outlook 2025 to 2035

USA Medical Coding Market Size and Share Forecast Outlook 2025 to 2035

USA Labels Market Size and Share Forecast Outlook 2025 to 2035

USA Plant-based Creamers Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA