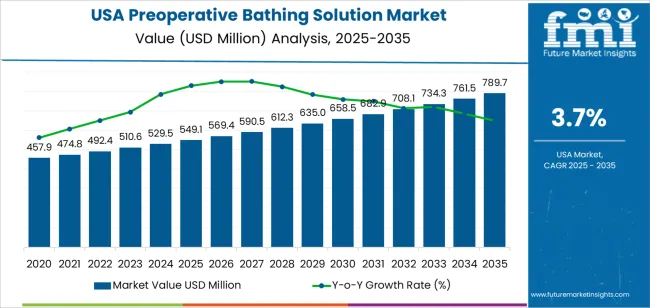

The demand for preoperative bathing solutions in the USA is projected to reach USD 790.1 million by 2035, reflecting an absolute increase of USD 241.0 million over the forecast period. Starting at USD 549.1 million in 2025, the demand is expected to grow at a steady CAGR of 3.7%. Preoperative bathing solutions, often containing antiseptic agents like chlorhexidine, help reduce the risk of infections by cleansing patients’ skin before surgery, particularly in surgeries involving implants or requiring sterile conditions.

Key growth drivers include the increasing number of surgical procedures, heightened awareness of infection prevention, and a growing focus on patient safety in healthcare settings. The expansion of hospital and outpatient surgical facilities, especially with the rise in elective and minimally invasive surgeries, will further fuel the demand for preoperative bathing solutions. The adoption of infection prevention protocols and regulations for controlling hospital-acquired infections (HAIs) will continue to drive demand for these solutions in clinical settings.

As hospitals and surgical centers place greater emphasis on patient care and infection control, preoperative bathing solutions will become more widely used, providing a significant growth opportunity for this industry in the coming years.

Between 2025 and 2030, the demand for preoperative bathing solutions in the USA is projected to grow from USD 549.1 million to approximately USD 569.5 million, adding USD 20.4 million, which accounts for about 8.5% of the total forecasted growth for the decade. This steady growth will be fueled by the broader implementation of preoperative hygiene protocols across healthcare settings, including hospitals, surgical centers, and outpatient clinics. The growing awareness of infection prevention and the need for standardized practices in preoperative care will further support this growth. As more healthcare facilities adopt these protocols, the demand for reliable preoperative bathing solutions will increase, ensuring better patient safety and reducing the risk of infections during surgery.

From 2030 to 2035, the demand is expected to see a sharp rise, growing from USD 569.5 million to USD 790.1 million, adding USD 220.6 million, which constitutes about 91.5% of the overall growth. This acceleration will be driven by the rising number of surgeries, particularly in minimally invasive and elective procedures, and an increasing focus on stringent infection control measures. Growing regulatory requirements for preoperative care and infection prevention will further propel demand during this period. As the healthcare industry places greater emphasis on patient safety, the adoption of preoperative bathing solutions will expand, making this period a key growth phase for the sector.

| Metric | Value |

|---|---|

| USA Preoperative Bathing Solution Sales Value (2025) | USD 549.1 million |

| USA Preoperative Bathing Solution Forecast Value (2035) | USD 790.1 million |

| USA Preoperative Bathing Solution Forecast CAGR (2025-2035) | 3.70% |

Demand for preoperative bathing solutions in the USA is rising steadily as hospitals and surgical facilities place greater emphasis on infection control and surgical site-infection (SSI) prevention protocols. Preoperative bathing solutions provide a controlled and efficacious method for antiseptic cleansing of patients prior to surgery, lowering the risk of post‑operative complications. As surgical volumes increase and quality metrics become more outcome‑based, these solutions are being integrated into standard pre‑surgical workflows.

Healthcare providers are also under pressure to reduce costs associated with SSIs, which can result in extended hospital stays and higher readmission rates. By adopting preoperative bathing solutions with proven efficacy, facilities aim to enhance patient safety and optimize throughput in operating environments. The focus on bundled payment models and surgical care pathways further incentivizes use of such preventative measures, supporting category growth.

Innovations in formulation, such as improved skin microbiome compatibility, faster action, and simpler application procedures, are also contributing to adoption. With increased awareness of antimicrobial resistance and the need for effective patient preparation, preoperative bathing is now regarded as a key component of perioperative care. As healthcare systems continue to standardize best practices across surgical settings, the demand for preoperative bathing solutions in the USA is expected to remain strong and show steady growth through 2035.

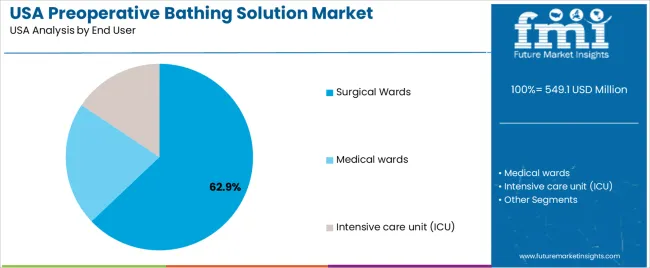

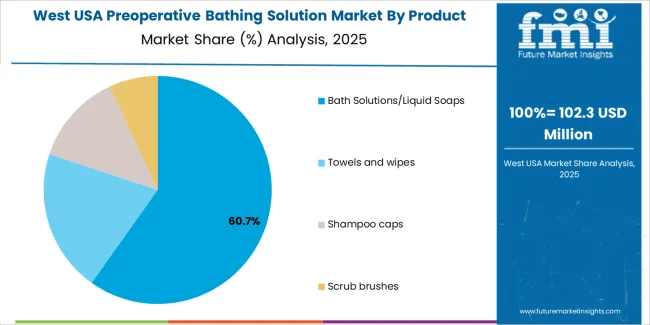

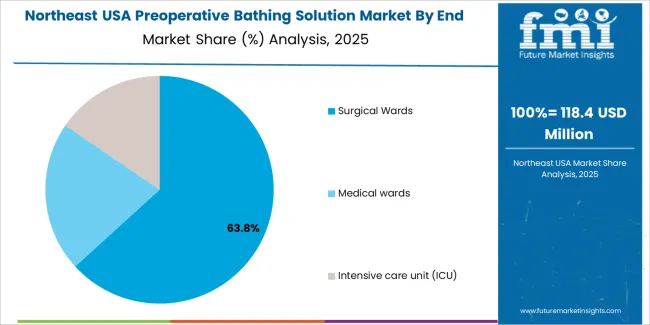

Demand is segmented by product type and end user. By product type, demand is divided into bath solutions/liquid soaps, towels and wipes, shampoo caps, and scrub brushes, with bath solutions/liquid soaps holding the largest share. The demand is also segmented by end user, including surgical wards, medical wards, and intensive care units (ICU), with surgical wards accounting for the largest share. Regionally, demand is divided into West, South, Northeast, and Midwest.

Bath solutions/liquid soaps account for 59% of the demand for preoperative bathing solutions in the USA. These liquid soaps are primarily used for preoperative cleaning to reduce the risk of surgical site infections by effectively removing bacteria, oils, and dirt from the skin. The use of bath solutions is a standard procedure in preparing patients for surgery, ensuring a clean and sterile environment before any incision is made.

The demand for bath solutions/liquid soaps is driven by the growing focus on infection control and patient safety in healthcare settings. Liquid soaps are easy to apply, highly effective, and often used in conjunction with other hygiene protocols, making them a preferred choice for hospitals and surgical centers. As infection prevention continues to be a priority, particularly in surgical wards, the demand for bath solutions/liquid soaps will remain strong, reinforcing their dominance in the preoperative bathing solutions industry.

Surgical wards account for 62.9% of the demand for preoperative bathing solutions in the USA. Surgical wards are where patients are prepared for surgery, making them the primary end users of preoperative bathing solutions. Ensuring patients are properly cleaned and decontaminated before surgery is a critical step in preventing surgical site infections, which is why surgical wards are the largest consumers of products like bath solutions, towels, and wipes.

The demand for preoperative bathing solutions in surgical wards is driven by the increasing focus on infection prevention, patient safety, and adherence to healthcare protocols. Surgical wards often use these solutions as part of a standardized preoperative procedure for all patients undergoing surgery, making them essential for reducing the risk of post-surgical complications. With the continued emphasis on improving surgical outcomes and infection control, surgical wards will remain the dominant end-user segment for preoperative bathing solutions in the USA.

Preoperative bathing solutions combine antiseptic agents (such as chlorhexidine) with cleansing procedures to reduce skin micro‑flora before surgery. Key drivers include a growing number of surgeries (especially among ageing populations), heightened focus on infection‑prevention protocols, and regulatory/clinical guidelines encouraging pre‑operative skin preparation. Restraints include questions around cost‑effectiveness of antiseptic compared to plain soap, variable compliance with bathing protocols, and challenges in standardizing patient adherence and staff training.

In the USA, demand for preoperative bathing solutions is rising because hospitals and surgical centres are under pressure to lower infection rates and reduce length of stay and complications. As the population ages and more surgical procedures (orthopedic, cardiac, general) are performed, there is a growing recognition that skin‑preparation is a critical step in perioperative care. Clinics and hospitals are integrating bathing solutions into care bundles and pre‑surgical workflows, making the use of these products more routine. Added to that is increased awareness of cost‑burden of surgical‑site infections, driving uptake of preoperative bathing protocols.

Innovation in preoperative bathing solutions in the USA is boosting adoption by offering improved formulations, convenience and patient compliance. Advances include no‑rinse antiseptic wipes, skin‑friendly antiseptic baths, chlorhexidine‑based solutions with prolonged microbial‑action, and enhanced packaging tailored for patient self‑administration at home. These innovations reduce preparation time, simplify logistics for outpatient surgery, and integrate more easily with preoperative care pathways. As these new formats become commercially available and hospitals adopt standardized bathing protocols, the demand for such solutions expands.

Despite increasing use, adoption of preoperative bathing solutions in the USA is constrained by several factors. One major challenge is that evidence for superiority of antiseptic bathing vs plain soap in all surgical scenarios remains mixed, raising questions about cost‑justification. Protocol adherence and patient compliance vary significantly, undermining effectiveness. Training staff, educating patients, and monitoring compliance require additional resources and workflow changes. In outpatient settings, ensuring patients follow bathing instructions at home adds complexity. Budget pressures and procurement preferences in health systems may limit uptake of premium antiseptic products.

| Region | CAGR (%) |

|---|---|

| West | 4.3% |

| South | 3.8% |

| Northeast | 3.4% |

| Midwest | 3.0% |

The demand for preoperative bathing solutions in the USA is growing across all regions, with the West leading at a 4.3% CAGR. This growth is driven by increasing awareness of infection control practices and the rising adoption of preoperative hygiene protocols. The South follows with a 3.8% CAGR, influenced by the region's large healthcare sector and expanding surgical procedures. The Northeast shows a 3.4% CAGR, supported by its robust medical infrastructure and focus on patient safety. The Midwest experiences moderate growth at 3.0%, driven by rising healthcare standards and improved pre-surgical hygiene practices.

The West is experiencing the highest demand for preoperative bathing solutions, with a 4.3% CAGR. This growth can be attributed to the region’s strong healthcare infrastructure and growing emphasis on infection prevention in surgical procedures. Major medical centers and hospitals in cities like Los Angeles, San Francisco, and Seattle have implemented rigorous preoperative protocols that include the use of antiseptic bathing solutions to reduce the risk of surgical site infections.

The West's progressive approach to patient safety, combined with widespread awareness of infection control measures, has made preoperative bathing a standard practice. The growing number of surgeries and the region's focus on improving healthcare quality and patient outcomes are further contributing to the demand for preoperative bathing solutions. The region’s high-tech medical environment and early adoption of best practices in hygiene protocols ensure that the West remains at the forefront of preoperative care, driving continued demand for these solutions.

The South is seeing steady growth in the demand for preoperative bathing solutions, with a 3.8% CAGR. The region’s growing healthcare sector and increasing number of surgical procedures are key drivers behind this trend. States like Texas, Florida, and Georgia have large hospital systems that are increasingly adopting infection control measures, including preoperative bathing with antiseptic solutions, as part of their standard operating procedures.

With a rising number of complex surgeries, including orthopedic, cardiovascular, and oncology procedures, hospitals in the South are prioritizing patient safety and infection prevention. As healthcare systems in the South continue to expand and modernize, there is a growing focus on improving patient outcomes through enhanced hygiene practices, such as the use of preoperative bathing solutions. The region's increasing awareness of the importance of reducing surgical site infections will continue to drive steady demand for these solutions.

The Northeast is witnessing moderate demand growth for preoperative bathing solutions, with a 3.4% CAGR. This is largely due to the region’s high concentration of academic medical centers, hospitals, and specialized surgical centers, which emphasize infection control and patient safety. The Northeast's strong healthcare infrastructure ensures that preoperative hygiene practices, including the use of antiseptic bathing solutions, are increasingly adopted in preparation for surgeries.

The region’s ongoing efforts to reduce healthcare-associated infections and improve surgical outcomes are driving the demand for these solutions. In addition, as the number of surgeries continues to rise, particularly in urban centers like New York, Boston, and Philadelphia, hospitals and outpatient surgical centers are focusing more on preoperative patient care, including proper hygiene protocols. As healthcare providers in the Northeast continue to implement evidence-based practices, the adoption of preoperative bathing solutions will continue to grow steadily.

The Midwest is experiencing moderate growth in demand for preoperative bathing solutions, with a 3.0% CAGR. The growth is primarily driven by the region’s increasing adoption of standardized infection control practices in surgical care. As healthcare facilities in cities like Chicago, Detroit, and St. Louis enhance their pre-surgical protocols, the use of antiseptic bathing solutions is becoming more widespread as part of efforts to reduce surgical site infections.

The Midwest’s focus on improving patient care, particularly in hospitals with high volumes of elective surgeries, contributes to the growing adoption of preoperative bathing solutions. With a rising emphasis on patient safety and a stronger push toward infection prevention, healthcare systems in the Midwest are gradually incorporating more advanced hygiene practices into their surgical protocols. As awareness of the benefits of preoperative hygiene continues to grow, the demand for bathing solutions is expected to increase, albeit at a slower pace compared to other regions.

The demand for preoperative bathing solutions in the United States is experiencing steady growth, driven by increasing surgical volumes and the critical role of infection prevention in modern healthcare. As more surgical procedures are performed both inpatient and outpatient the need for effective skin‑preparation protocols prior to operation is becoming ever more important. Preoperative bathing solutions, including antiseptic washes and wipes, help reduce microbial load and support efforts to minimize surgical site infections (SSIs), which remain a major driver of healthcare costs and patient risk.

In the USA demand landscape, 3M holds a leading share of approximately 25.2%, reflecting its strong positioning in antiseptic cleansing technologies and broad availability of pre‑operative solutions across hospital systems and surgical centers. Other major players contributing to USA demand include Unilever PLC, Medline Industries, Inc., Becton, Dickinson and Company (BD), and Stryker, each offering solutions or associated systems that support preoperative skin preparations and cleaning protocols in clinical settings.

Key factors fueling demand include heightened focus on surgical safety and outcomes, adoption of evidence‑based preoperative bathing guidelines, and the expansion of outpatient surgery settings that require streamlined yet effective preoperative preparations. Also, hospitals are investing in standardized protocols and single‑use products to cut down cross‑contamination risk and improve workflow efficiency. Challenges include the need to demonstrate clear clinical benefit in all settings and the cost pressures associated with adopting new preoperative processes.

| Items | Values |

|---|---|

| Quantitative Unit | USD million |

| Product Type | Bath Solutions/Liquid Soaps, Towels and Wipes, Shampoo Caps, Scrub Brushes |

| End User | Surgical Wards, Medical Wards, Intensive Care Unit (ICU) |

| Regions Covered | West, South, Northeast, Midwest |

| Key Players Profiled | 3M, Unilever PLC, Medline Industries, Inc., BD (Becton, Dickinson and Company), Stryker |

| Additional Attributes | Dollar sales are distributed across product types like bath solutions, towels, shampoo caps, and scrub brushes, with significant demand from surgical wards, medical wards, and ICUs. Regional trends highlight high sales in the West, South, Northeast, and Midwest, particularly in surgical and ICU-focused applications. |

The global Demand for preoperative bathing solution in USA is estimated to be valued at USD 549.1 million in 2025.

The market size for the Demand for preoperative bathing solution in USA is projected to reach USD 789.7 million by 2035.

The Demand for preoperative bathing solution in USA is expected to grow at a 3.7% CAGR between 2025 and 2035.

The key product types in Demand for preoperative bathing solution in USA are bath solutions/liquid soaps, towels and wipes, shampoo caps and scrub brushes.

In terms of end user, surgical wards segment to command 62.9% share in the Demand for preoperative bathing solution in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Preoperative Bathing Solution Market Analysis by End User into Intensive Care Unit, Surgical Wards and Medical Wards Through 2035.

Demand for Preoperative Bathing Solution in Japan Size and Share Forecast Outlook 2025 to 2035

Waterless Bathing Solution Market Size and Share Forecast Outlook 2025 to 2035

Demand for Energy Intelligence Solution in USA Size and Share Forecast Outlook 2025 to 2035

Demand for 3D Imaging Surgical Solution in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Hydrocarbon Accounting Solution in USA Size and Share Forecast Outlook 2025 to 2035

USA Medical Coding Market Size and Share Forecast Outlook 2025 to 2035

USA Labels Market Size and Share Forecast Outlook 2025 to 2035

USA Plant-based Creamers Market Size and Share Forecast Outlook 2025 to 2035

USA Barrier Coated Paper Market Size and Share Forecast Outlook 2025 to 2035

USA Electronic Health Records (EHR) Market Size and Share Forecast Outlook 2025 to 2035

USA Animal Model Market Size and Share Forecast Outlook 2025 to 2035

Solution Styrene Butadiene Rubber (S-SBR) Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Packer Bottle Market Size and Share Forecast Outlook 2025 to 2035

USA Stretch Hood Films Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Fence Screen Market Size and Share Forecast Outlook 2025 to 2035

USA Lubricant Contaminated HDPE Container Waste Market Size and Share Forecast Outlook 2025 to 2035

USA Commercial Walk-In Refrigeration Market Size and Share Forecast Outlook 2025 to 2035

USA & Canada Pre-painted Steel Roofing and Cladding Market Size and Share Forecast Outlook 2025 to 2035

USA Residential Cotton Candy Maker Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA