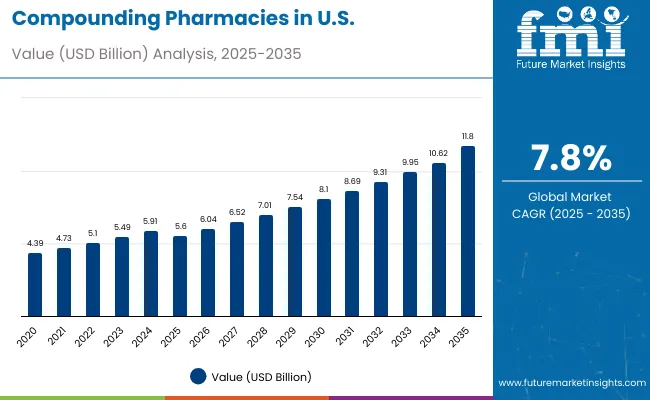

Revenue from compounding pharmacies in the USA is estimated at USD 5.6 billion in 2025, with projections indicating a rise to USD 11.8 billion by 2035, reflecting a CAGR of 7.8% over the forecast period.

| Metric | Value |

|---|---|

| Estimated Size (2025E) | USD 5.6 billion |

| Projected Value (2035F) | USD 11.8 billion |

| CAGR (2025 to 2035) | 7.8% |

This growth is driven by increasing demand for personalized medications, rising prevalence of chronic diseases, growing geriatric population requiring customized treatments, and expanding drug shortages necessitating alternative formulations. Per capita demand is expected to increase as healthcare providers adopt individualized pharmaceutical solutions that offer precise dosing, allergy-free formulations, and specialized delivery methods.

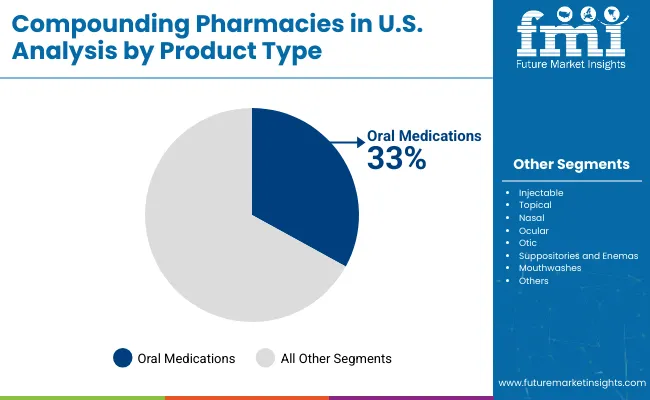

Oral medication products are poised to remain the leading product segment with a 33% share in 2025, owing to patient preference for familiar administration routes, ease of compliance, and versatility in customization options, including strength modifications and allergen removal. Alternative formulations, including injectables, topical preparations, and specialized delivery systems, serve specific therapeutic applications where oral administration is not suitable or optimal.

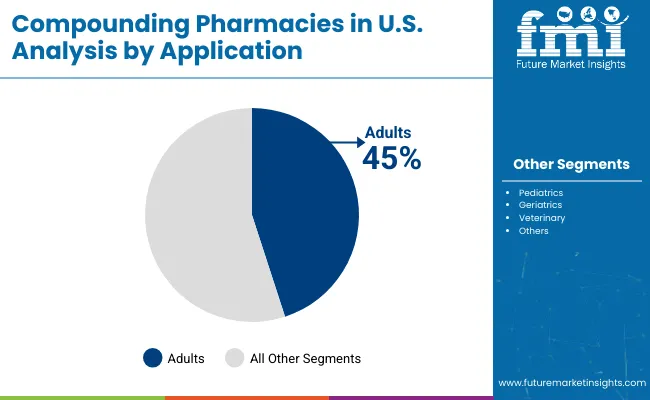

By application, adults will continue to drive the highest demand, with a 45% share in 2025, supported by the largest patient population requiring customized medications, prevalence of chronic conditions necessitating personalized treatments, and increasing awareness among healthcare providers about tailored pharmaceutical solutions. Pediatric and geriatric segments also show robust growth potential, driven by unique dosing requirements and specialized formulation needs that commercial medications cannot adequately address.

Consumer adoption is concentrated among patients with drug allergies, those requiring non-commercial dosage strengths, and individuals with complex medical conditions needing combination therapies. Expansion is further supported by increased availability of sterile compounding capabilities and FDA-compliant facilities. Innovation in automation technology, regulatory compliance, and strategic partnerships between compounding pharmacies and healthcare institutions are expected to accelerate adoption.

The USA compounding pharmacy sector is segmented based on product type, pharmacy type, application, and therapeutic area. By product,it includes oral medications (solid, liquid and topical), injectables, topical preparations, nasal formulations, ocular preparations, otic formulations, suppositories, and mouthwashes. Based on pharmacy type, it is segmented into 503A pharmacies and 503B outsourcing facilities. In terms of applications, it is divide into adults, pediatrics, geriatrics, and veterinary use, while therapeutic areas include hormone replacement therapy, pain management, dermatology, oncology, hematology, dental, and others.

Oral medication formulations are projected to dominate with a 33% value share in 2025, driven by patient familiarity with oral administration routes, healthcare provider comfort with prescribing customized oral preparations, and versatility in addressing diverse therapeutic needs through strength modifications, combination formulations, and allergen-free alternatives.

Adult applications are projected to account for the largest share at 45% in 2025, driven by the largest patient demographic requiring personalized medications, the highest prevalence of chronic conditions necessitating customized treatments, and the greatest healthcare utilization rates among working-age and older adult populations.

The compounding pharmacy category in the USA attracts patients with specific medical needs that cannot be met through commercially manufactured medications, including those with allergies to standard drug components, unique dosing requirements, or discontinued medication needs. While motivations range from allergy management to precise pediatric dosing to combination therapy requirements, demand is concentrated among several key patient segments. Each segment demonstrates distinct utilization behaviors, formulation preferences, and prescription considerations.

Patients referred by healthcare providers represent the largest consumer base, requiring medications unavailable commercially due to dosage variations, ingredient modifications, or discontinued products. These patients actively work with physicians and pharmacists to develop customized formulations that address specific medical conditions while avoiding problematic ingredients or delivery methods.

Chronic disease patients and specialty care recipients show consistent demand for reliable, effective formulations that provide therapeutic benefits not achievable through standard medications. Their utilization decisions are influenced by physician recommendations, insurance coverage considerations, and proven efficacy in managing complex medical conditions requiring personalized treatment approaches.

Pediatric and geriatric patients increasingly rely on compounded medications to address age-specific dosing needs, swallowing difficulties, and medication adherence challenges. Their adoption is driven by caregiver preferences, physician expertise in customized formulations, and improved therapeutic outcomes through personalized medication management.

Veterinary patients and pet owners, representing a growing segment, adopt compounded medications that provide species-specific formulations, palatable flavoring options, and dosing forms suitable for animal administration. These consumers often prioritize effectiveness, safety, and ease of administration for their animals' health conditions.

Collectively, these segments drive demand for compounding pharmacy services in the USA, with utilization patterns shaped by medical necessity, physician recommendations, insurance coverage, and therapeutic outcome requirements.

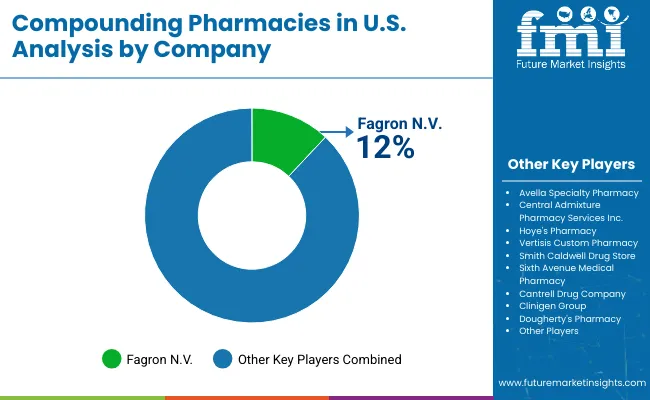

The competitive environment in the USA compounding pharmacy sector is characterized by a mix of established 503A traditional pharmacies and larger-scale 503B outsourcing facilities. Innovation in sterile compounding capabilities, regulatory compliance, and specialized therapeutic formulations, rather than conventional pharmacy operations alone, remains the decisive success factor: the top providers collectively serve thousands of healthcare facilities and individual patients across all 50 states and account for the majority of customized medication production.

Fagron N.V. is among the most prominent players with an estimated 12% share, leveraging its 503B outsourcing facility status and nationwide distribution network. The company focuses on sterile compounding capabilities, FDA compliance, and strategic positioning to capture both hospital systems and individual healthcare providers seeking reliable, customized medication solutions.

Avella Specialty Pharmacy and Clinigen Group provide comprehensive compounding services with strong quality positioning and specialized therapeutic focus. Their strategies emphasize sterile preparation capabilities, clinical expertise, and targeted expansion into hospital and clinic channels through advanced compounding technology and regulatory compliance.

Central Admixture Pharmacy Services Inc (CAPS) leverages its sterile compounding expertise alongside targeted services to healthcare institutions, focusing on IV admixtures, specialized formulations, and strategic partnerships with hospitals and surgical centers requiring reliable compounded medication supply.

The next tier includes Vertisis Custom Pharmacy, Hoye's Pharmacy, Smith Caldwell Drug Store, Sixth Avenue Medical Pharmacy, Cantrell Drug Company, and Dougherty's Pharmacy. These companies focus on specialized formulations, regional presence, and diverse patient segments, often offering traditional 503A services, specialized therapeutic area expertise, or unique formulation capabilities.

Innovation and strategic partnerships are expected to continue, as expertise in sterile compounding, regulatory compliance, and specialized therapeutic formulations becomes increasingly critical for sustaining healthcare provider trust and expanding presence across hospital, clinic, and retail pharmacy sectors in the USA.

| Items | Value |

|---|---|

| Quantitative Units (2025) | USD 5.6 billion |

| Product | Oral Medications (Solid, Liquid and Topical ), Injectable, Topical, Nasal, Ocular, Otic, Suppositories and Enemas, Mouthwashes |

| Pharmacy Type | 503A Pharmacy, 503B Pharmacy |

| Application | Adults, Pediatrics, Geriatrics, Veterinary |

| Therapeutic Area | Hormone Replacement Therapy, Pain Management, Dermatology, Oncology, Hematology, Dental, Others |

| Regions Covered | North America |

| Country Covered | United States |

| Key Companies Profiled | Avella Specialty Pharmacy, Central Admixture Pharmacy Services Inc, Hoye's Pharmacy, Vertisis Custom Pharmacy, Smith Caldwell Drug Store, Sixth Avenue Medical Pharmacy, Cantrell Drug Company, Clinigen Group, Dougherty's Pharmacy, Fagron N.V. |

| Additional Attributes | Dollar sales by pharmacy type and formulation, regional demand trends, competitive landscape, adoption of sterile and non-sterile compounding, integration with specialty therapeutics, innovations in personalized medicine and automated compounding systems |

In terms of product type, the industry is segregated into oral medication [solid medication (capsules, tablets, mixtures, lollipops, and lozenges), liquid medication (syrup, solution/liquid, emulsion, and suspension), topical medication (gels, ointments, creams, and lotions)], injectable, mouthwashes, nasal, ocular, otic, suppositories and enemas.

In terms of pharmacy type, the industry is segregated into 503A pharmacy, 503B pharmacy.

In terms of application, the industry is segregated into adults, pediatrics, geriatrics and veterinary

In terms of therapeutic type, the industry is segregated into hormone replacement therapy, pain management, dermatology, oncology, hematology, dental and others

In 2025, the total value of compounding pharmacies in the USA is expected to be USD 5.6 billion.

By 2035, the value is projected to reach USD 11.8 billion, reflecting a CAGR of 7.8%.

Oral medications will lead the product segment with a 33% share in 2025.

Adults are anticipated to hold the highest share at 45% dominating the application segment in 2025.

Major players include Fagron N.V., Avella Specialty Pharmacy, Clinigen Group, Central Admixture Pharmacy Services Inc (CAPS), and Vertisis Custom Pharmacy, among others, in the competitive landscape.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA