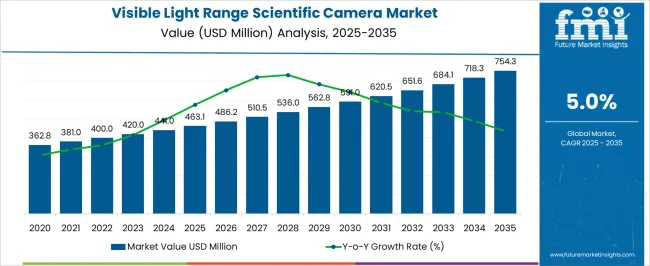

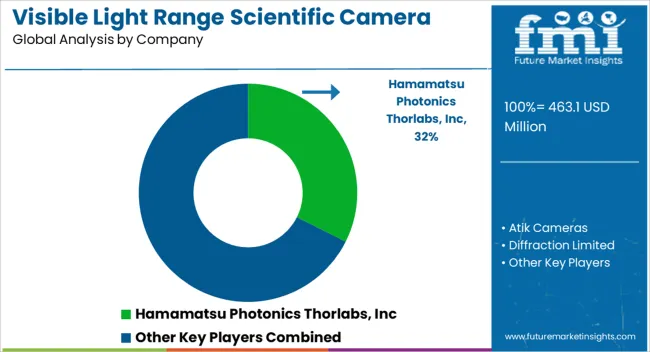

The visible light range scientific camera market, estimated at USD 463.1 million in 2025 and projected to reach USD 754.3 million by 2035 at a CAGR of 5.0%, exhibits clear technological contribution trends that shape overall market expansion. The market growth is driven primarily by advancements in sensor technologies, including CMOS and CCD imaging modules, which offer improved sensitivity, resolution, and signal-to-noise ratios. CMOS sensors contribute significantly due to their lower power consumption, faster readout speeds, and cost efficiency, making them a preferred choice for high-throughput scientific imaging applications.

CCD-based cameras, while higher in cost, maintain relevance in precision-intensive settings where uniformity and low-light performance are critical, such as spectroscopy, astronomy, and biological imaging. Complementing the sensor contributions, innovations in optical assemblies, including lens coatings, diffraction management, and multi-element configurations, enhance light capture efficiency and wavelength accuracy, thereby strengthening the market value associated with optical technologies. The integration of real-time processing electronics, software-based image enhancement algorithms, and high-bandwidth interfaces ensures that camera modules deliver actionable data rapidly, expanding their applicability across research and industrial domains.

Over the forecast period, the incremental adoption of hybrid sensor systems and improved optical-electronic integration is expected to further elevate the technology contribution spectrum. The relative share of CMOS-based modules is projected to grow steadily, while CCD-based systems retain specialized applications, resulting in a balanced technological contribution that underpins overall market expansion from USD 463.1 million in 2025 to USD 754.3 million by 2035.

| Metric | Value |

|---|---|

| Visible Light Range Scientific Camera Market Estimated Value in (2025 E) | USD 463.1 million |

| Visible Light Range Scientific Camera Market Forecast Value in (2035 F) | USD 754.3 million |

| Forecast CAGR (2025 to 2035) | 5.0% |

The visible light range scientific camera market represents a specialized segment within the global scientific instrumentation and imaging industry, emphasizing precision, sensitivity, and analytical performance. Within the broader scientific cameras and imaging equipment market, it accounts for about 5.2%, driven by demand from research laboratories, universities, and industrial R&D facilities. In the microscopy and life sciences segment, it holds nearly 4.6%, reflecting applications in cell imaging, fluorescence studies, and high-resolution observation. Across the astronomical and space observation equipment sector, the market captures 4.1%, supporting telescopic imaging, photometry, and light spectrum analysis.

Within the industrial quality control and inspection category, it represents 3.7%, highlighting applications in machine vision, material analysis, and defect detection. In the photonics and optoelectronics sector, it secures 3.4%, emphasizing integration with advanced optical systems and digital processing technologies. Recent developments in this market have focused on high-sensitivity sensors, low-noise imaging, and real-time data processing. Innovations include CMOS and CCD sensor improvements, high frame rate cameras, and compact modular designs for diverse laboratory and industrial environments.

Key players are collaborating with optical component manufacturers, research institutions, and automation system providers to enhance imaging accuracy and operational flexibility. Integration with AI-driven image analysis, cloud storage, and remote monitoring solutions is gaining traction for faster and more reliable scientific observation. The energy-efficient electronics, software-controlled calibration, and ruggedized camera designs are being deployed for field and harsh environment applications.

The current market scenario reflects a strong adoption in life sciences, material sciences, and industrial quality control, where high-performance imaging capabilities are critical.

Growth is being supported by demand for high-resolution and low-noise imaging solutions that deliver superior accuracy for both qualitative and quantitative analysis. Increasing investment in advanced microscopy, spectroscopy, and astronomical observation systems is creating further opportunities for manufacturers.

The flexibility to integrate with varied analytical instruments and software platforms has been enhancing adoption across research institutions and industrial laboratories. As scientific applications continue to demand faster frame rates, higher sensitivity, and real-time data processing, the market is poised for sustained growth, with innovation in sensor architecture and image processing algorithms paving the way for future advancements.

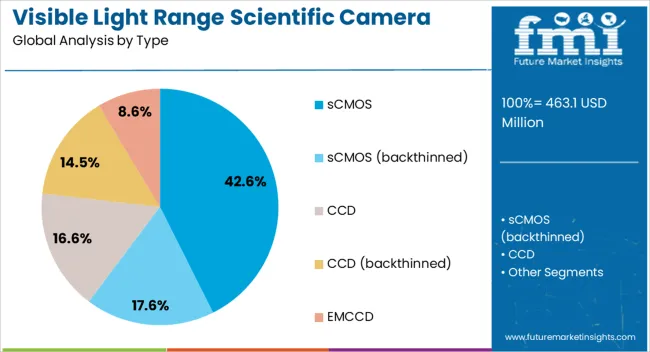

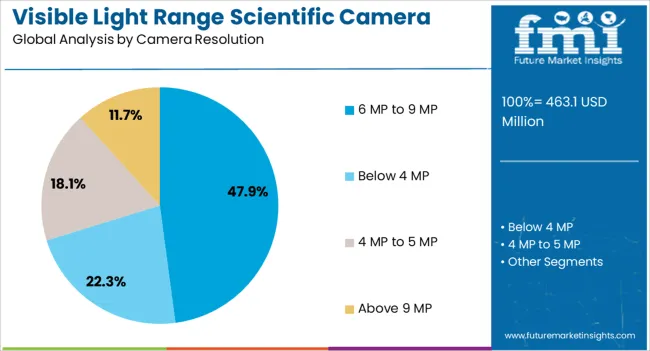

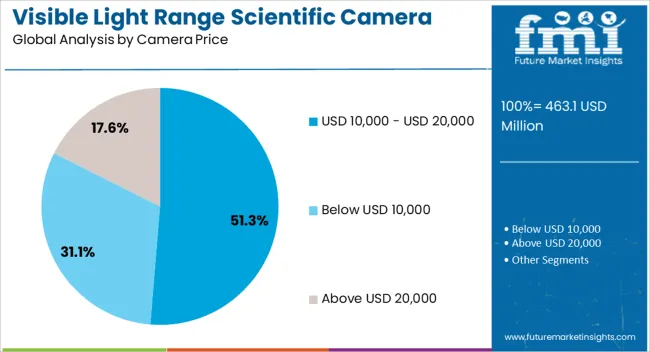

The visible light range scientific camera market is segmented by type, camera resolution, camera price, and geographic regions. By type, visible light range scientific camera market is divided into sCMOS, sCMOS (backthinned), CCD, CCD (backthinned), and EMCCD. In terms of camera resolution, visible light range scientific camera market is classified into 6 MP to 9 MP, below 4 MP, 4 MP to 5 MP, and above 9 MP. Based on camera price, visible light range scientific camera market is segmented into USD 10,000 - USD 20,000, below USD 10,000, and above USD 20,000. Regionally, the visible light range scientific camera industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The sCMOS type is expected to account for 42.6% of the market revenue in 2025, making it the leading segment by type. This dominance is being attributed to its capability to deliver high-speed imaging with low read noise while maintaining superior resolution.

The architecture of sCMOS sensors supports both high sensitivity for low-light applications and a wide dynamic range, making them highly suitable for advanced scientific imaging. Their ability to operate with minimal image distortion and maintain consistency in large-scale imaging projects has driven adoption in both academic and industrial research settings.

Additionally, their energy efficiency and compatibility with multiple optical configurations have further supported widespread use. As research applications demand both speed and accuracy in imaging, the sCMOS segment is anticipated to maintain its leadership due to its balanced performance profile and adaptability across diverse scientific disciplines.

The 6 MP to 9 MP camera resolution segment is projected to hold 47.9% of the overall market revenue in 2025, emerging as the largest resolution category. This leadership position is being driven by the resolution’s ability to balance image clarity with manageable file sizes, enabling efficient storage and processing without sacrificing analytical accuracy.

Such resolution levels are well-suited for microscopy, spectroscopy, and material inspection tasks that require both detail and efficiency. The segment’s growth has also been supported by its optimal compatibility with commonly used optical instruments and analysis software, reducing integration complexities for users.

Furthermore, its performance in capturing precise structural details while maintaining fast frame rates has positioned it as a preferred choice for time-sensitive research applications. As demand grows for imaging solutions that offer both resolution quality and operational efficiency, this segment is expected to sustain its prominence in the market.

The USD 10,000 to USD 20,000 camera price segment is estimated to capture 51.3% of the visible light range scientific camera market revenue in 2025, securing its place as the largest price category. This dominance is being linked to the balance it offers between advanced imaging capabilities and cost-effectiveness, attracting both research institutions and commercial laboratories.

Cameras in this range typically deliver high sensitivity, advanced sensor technology, and robust build quality without entering ultra-premium pricing. The affordability within this segment allows broader access for institutions with constrained budgets while still meeting high-performance imaging needs.

The presence of multiple models with customizable features in this range has also contributed to its adoption, providing flexibility to meet varied scientific requirements. As funding bodies and research institutions seek cost-efficient yet powerful imaging solutions, this segment is likely to maintain its leadership in the coming years.

The market has experienced steady growth due to increasing demand for high precision imaging across research, healthcare, industrial, and environmental monitoring applications. These cameras are capable of capturing detailed images within the visible light spectrum, enabling accurate analysis in laboratories, quality control, and field studies. Rising investments in scientific research, growing adoption of imaging technologies in pharmaceuticals, biotechnology, and materials science, as well as advancements in sensor technologies, have strengthened market adoption.

Manufacturers are focusing on enhancing resolution, sensitivity, and integration with data acquisition and image processing systems. The market is driven by the need for reliable, accurate, and high performance imaging solutions to support scientific discoveries, diagnostics, and industrial inspections globally.

Research laboratories and academic institutions have become significant consumers of visible light range scientific cameras due to their ability to capture high-resolution and precise images for experiments and analysis. These cameras are used in microscopy, spectroscopy, material characterization, and photometric studies where accurate image capture is critical. Increasing research funding, emphasis on innovation, and demand for reproducible results have accelerated the adoption of advanced imaging devices. Integration with laboratory information management systems and analytical software allows researchers to streamline data acquisition, automate measurements, and enhance experimental efficiency. Educational institutions are also employing these cameras in training and demonstrations to improve practical learning experiences. As research complexity grows, the need for reliable, high performance imaging equipment continues to expand.

The industrial sector has adopted visible light range scientific cameras for quality control, defect detection, and process monitoring in manufacturing and production environments. Industries such as electronics, automotive, pharmaceuticals, and materials processing rely on these cameras to capture minute details in components, assemblies, and materials. Automated inspection lines use imaging systems to detect surface defects, color variations, or structural inconsistencies, improving product quality and reducing wastage. Integration with machine vision systems, AI-driven analytics, and robotics has enhanced operational efficiency and accuracy. As industrial processes become more precise and automated, demand for high-resolution, fast-response, and reliable imaging cameras has increased, making them essential tools in modern production and quality assurance workflows.

Continuous advancements in sensor technologies, optical components, and image processing have propelled growth in the visible light range scientific camera market. High sensitivity CMOS and CCD sensors, low noise electronics, and enhanced dynamic range allow for precise imaging in various lighting conditions. Developments in cooling mechanisms, frame rates, and connectivity options have expanded the applicability of these cameras across diverse sectors. Software improvements, including real-time image analysis, 3D reconstruction, and automated measurements, have increased operational efficiency and data accuracy. The miniaturization and ruggedization of cameras have enabled their deployment in field research, environmental monitoring, and mobile laboratory setups. These technological innovations ensure high performance, flexibility, and reliability for scientific imaging applications worldwide.

Visible light range scientific cameras have become critical in healthcare diagnostics, medical research, and environmental monitoring applications. In healthcare, they are used for digital pathology, microscopy, clinical imaging, and lab diagnostics, where precise image capture supports accurate analysis and patient care. Environmental monitoring and conservation efforts employ these cameras for vegetation studies, wildlife monitoring, and pollution assessment, capturing fine details under varying light conditions. Their integration with analytical software, imaging platforms, and remote monitoring systems allows real-time observation and data collection. Growing awareness of environmental sustainability, need for efficient diagnostics, and emphasis on research-driven healthcare solutions have further reinforced the market growth of these specialized cameras across multiple domains.

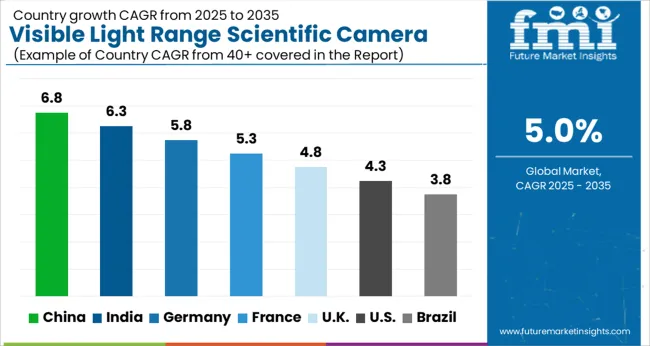

| Country | CAGR |

|---|---|

| China | 6.8% |

| India | 6.3% |

| Germany | 5.8% |

| France | 5.3% |

| UK | 4.8% |

| USA | 4.3% |

| Brazil | 3.8% |

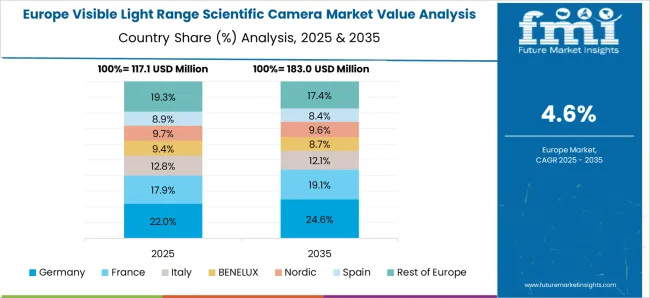

The market shows steady growth supported by increasing applications in research, healthcare, and industrial imaging. Germany reaches 5.8%, driven by adoption in laboratory instrumentation and precision imaging systems. India records 6.3%, fueled by expanding scientific research infrastructure and biotechnology applications. China leads with 6.8%, where investments in advanced imaging technologies and high-resolution camera systems boost market expansion. The United Kingdom posts 4.8%, supported by research-focused institutions and academic adoption. The United States registers 4.3%, driven by innovations in microscopy, life sciences, and industrial monitoring. These countries illustrate a combination of technology adoption, production capacity, and research-driven growth shaping the global trajectory of visible light range scientific cameras. This report includes insights on 40+ countries; the top markets are shown here for reference.

The market in China is expected to grow at a CAGR of 6.8%, driven by investments in research institutions, industrial inspection, and astronomical observatories. Adoption has been encouraged by the expansion of laboratories, universities, and manufacturing units requiring high resolution imaging for precision measurement. Domestic manufacturers have enhanced sensor technologies and integrated software for real time data analysis. Export demand has increased due to competitive pricing and technological capabilities. It is considered that growing focus on optical inspection in semiconductor, aerospace, and defense applications will sustain market expansion. Both domestic research facilities and industrial applications continue to rely on advanced visible light cameras for accurate observation and measurement.

India is projected to record a CAGR of 6.3% in the visible light scientific camera market, supported by growth in research institutions, universities, and industrial quality inspection. Adoption has been promoted by increasing focus on scientific research, space observation programs, and laboratory automation. Domestic suppliers have been developing cameras with enhanced sensitivity and real time imaging capabilities to serve academic and industrial clients. Import of advanced systems from European and American manufacturers continues to supplement local production. The market is expected to expand as government funding for research facilities and laboratory infrastructure rises, driving demand for precise optical imaging solutions across India.

Germany is anticipated to grow at a CAGR of 5.8% in the visible light scientific camera market, influenced by high technology research and industrial inspection applications. Adoption has been particularly strong in automotive testing, semiconductor inspection, and physics laboratories. German manufacturers such as PCO AG and Andor Technology provide advanced cameras with high sensitivity, fast frame rates, and low noise for precision measurement. Export demand has also supported domestic production. It is considered that Germany’s focus on quality, precision, and advanced optical instrumentation will maintain steady market growth across scientific, industrial, and academic segments in the country.

The market in the United Kingdom is projected to expand at a CAGR of 4.8%, driven by research institutions, laboratory automation, and industrial applications. Adoption has been encouraged by universities, pharmaceutical laboratories, and aerospace research centers requiring high precision imaging. Manufacturers have focused on cameras with superior dynamic range, real time processing, and software integration. The U K continues to import advanced cameras from Germany and the United States to meet specialized needs. It is assessed that growth will remain consistent due to increasing investments in research infrastructure and industrial testing programs, supporting both academic and commercial applications of visible light imaging technologies.

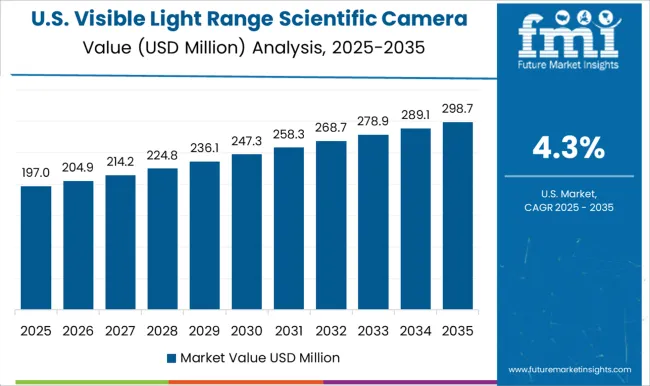

The market in the United States is expected to grow at a CAGR of 4.3%, supported by industrial, research, and academic demand. Adoption has been driven by high resolution imaging requirements in laboratories, space research programs, semiconductor manufacturing, and medical diagnostics. Leading manufacturers such as Andor Technology, Hamamatsu, and Teledyne provide cameras with advanced optical sensors, low noise, and high frame rates. U S institutions continue to invest in upgrading laboratories and industrial facilities, increasing reliance on precise optical imaging solutions. The market is expected to remain stable, with continued investment in research and industrial applications driving consistent demand for visible light scientific cameras.

The market is characterized by the presence of specialized imaging technology providers delivering high-resolution, low-noise cameras for research, industrial, and life science applications. Hamamatsu Photonics and Thorlabs, Inc. lead with extensive portfolios encompassing scientific cameras optimized for microscopy, spectroscopy, and optical research, combining precision engineering with advanced sensor technologies. Oxford Instruments (Andor Technology) and Excelitas PCO GmbH focus on high-performance CCD and sCMOS cameras, targeting applications requiring high sensitivity, rapid frame rates, and low-light imaging capabilities. Raptor Photonics, Photonic Science, and XIMEA GmbH enhance the competitive landscape with niche solutions for academic, defense, and industrial imaging markets, emphasizing customization and integration with experimental setups. Atik Cameras, Diffraction Limited, and Spectral Instruments, Inc. offer cost-effective yet high-quality cameras for astronomy, physics, and laboratory applications.

Horiba Scientific, IDEX Health & Science, and Meiji Techno provide complementary imaging solutions integrated with spectroscopy and microscopy platforms, adding value through system-level compatibility. Competition is driven by sensor innovation, image resolution, low-light sensitivity, frame rate performance, and integration with software for data acquisition and analysis. Market participants increasingly focus on developing modular, user-friendly, and high-throughput cameras for research and industrial automation. Strategic partnerships with academic institutions, instrumentation manufacturers, and system integrators remain key for expanding market presence and catering to evolving experimental and industrial imaging requirements.

| Item | Value |

|---|---|

| Quantitative Units | USD 463.1 million |

| Type | sCMOS, sCMOS (backthinned), CCD, CCD (backthinned), and EMCCD |

| Camera Resolution | 6 MP to 9 MP, Below 4 MP, 4 MP to 5 MP, and Above 9 MP |

| Camera Price | USD 10,000 - USD 20,000, Below USD 10,000, and Above USD 20,000 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Hamamatsu Photonics Thorlabs, Inc, Atik Cameras, Diffraction Limited, Excelitas PCO GmbH, Horiba Scientific, IDEX Health & Science, Meiji Techno, Oxford Instruments (Andor Technology), Photonic Science, Raptor Photonics, Spectral Instruments, Inc, Teledyne Technologies, Thorlabs, Inc, and XIMEA GmbH |

| Additional Attributes | Dollar sales by camera type and application, demand dynamics across research, medical, and industrial imaging sectors, regional trends in scientific equipment adoption, innovation in sensitivity, resolution, and data processing, environmental impact of electronic component manufacturing and disposal, and emerging use cases in microscopy, environmental monitoring, and precision diagnostics. |

The global visible light range scientific camera market is estimated to be valued at USD 463.1 million in 2025.

The market size for the visible light range scientific camera market is projected to reach USD 754.3 million by 2035.

The visible light range scientific camera market is expected to grow at a 5.0% CAGR between 2025 and 2035.

The key product types in visible light range scientific camera market are scmos, scmos (backthinned), ccd, ccd (backthinned) and emccd.

In terms of camera resolution, 6 mp to 9 mp segment to command 47.9% share in the visible light range scientific camera market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Invisible Tapes Market Size and Share Forecast Outlook 2025 to 2035

Light Pipe Mould Market Size and Share Forecast Outlook 2025 to 2035

Lightning Surge Protector Market Size and Share Forecast Outlook 2025 to 2035

Light Therapy Market Forecast and Outlook 2025 to 2035

Light Rail Traction Converter Market Size and Share Forecast Outlook 2025 to 2035

Light Management System Market Size and Share Forecast Outlook 2025 to 2035

Lightweight Corrugator Modules Market Size and Share Forecast Outlook 2025 to 2035

Lightening and Whitening Creams Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Lightweight Automotive Body Panels Market Size and Share Forecast Outlook 2025 to 2035

Lightening / Whitening Agents Market Size and Share Forecast Outlook 2025 to 2035

Light Control Switch Market Size and Share Forecast Outlook 2025 to 2035

Lightweight Handheld Cordless Vacuum Cleaner Market Size and Share Forecast Outlook 2025 to 2035

Light Setting Spray Market Size and Share Forecast Outlook 2025 to 2035

Light-Activated Anti-Pollution Skincare Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Lighting As A Service Market Size and Share Forecast Outlook 2025 to 2035

Light Duty Truck Market Size and Share Forecast Outlook 2025 to 2035

Light Commercial Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Light Emitting Diode (LED) Backlight Display Market Size and Share Forecast Outlook 2025 to 2035

Light Control Switches Market Size and Share Forecast Outlook 2025 to 2035

Lighting as a Service (LaaS) Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA