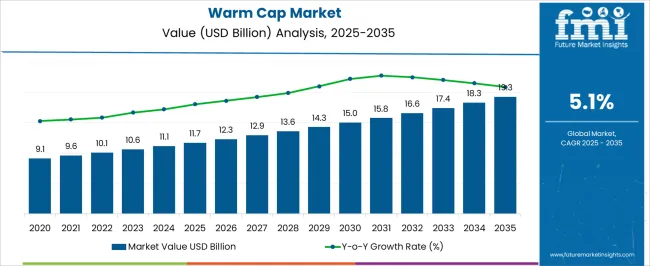

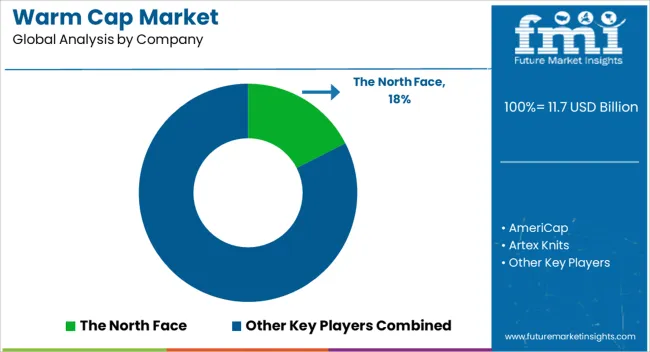

The warm cap market is projected to grow from USD 11.7 billion in 2025 to USD 19.3 billion by 2035, with a CAGR of 5.1%. A Year-on-Year (YoY) growth analysis shows consistent, moderate growth across the forecast period. Between 2025 and 2026, the market increases from USD 11.7 billion to USD 12.3 billion, contributing USD 0.6 billion in growth, reflecting a YoY growth rate of 5.1%. This early-stage growth is driven by steady demand in the apparel and textiles sector, particularly as consumer awareness of functional and climate-specific clothing rises. From 2026 to 2030, the market continues to expand, moving from USD 12.3 billion to USD 15.0 billion, contributing USD 2.7 billion in growth, with an average YoY growth rate of 6.2%. This phase shows acceleration, driven by innovations in fabric technologies, increased production of specialized warm caps, and heightened interest in outdoor activities. Between 2030 and 2035, the market grows from USD 15.0 billion to USD 19.3 billion, adding USD 4.3 billion with a YoY growth rate of 4.9%. This phase sees slightly slower growth, reflecting a mature market where demand stabilizes but remains robust due to a wider acceptance of the product across diverse consumer segments. The YoY analysis illustrates consistent market expansion with slight acceleration followed by a phase of stabilization.

| Metric | Value |

|---|---|

| Warm Cap Market Estimated Value in (2025 E) | USD 11.7 billion |

| Warm Cap Market Forecast Value in (2035 F) | USD 19.3 billion |

| Forecast CAGR (2025 to 2035) | 5.1% |

The warm cap market is witnessing steady expansion, driven by growing demand for seasonal apparel across urban and rural climates, increased health-consciousness regarding thermal comfort, and evolving winter fashion trends. The integration of warmth-retaining technologies, sustainable sourcing practices, and adaptable designs is reshaping how consumers interact with cold-weather accessories. Seasonal spikes in retail, particularly during Q4, are reinforced by e-commerce penetration and brand collaborations with apparel influencers.

Additionally, colder climate zones are seeing heightened year-round sales due to unpredictable weather patterns. Innovations in fiber blends and fabric construction, coupled with personalization trends, are influencing product development.

With sustainability becoming a core purchase factor, demand is tilting toward biodegradable or ethically produced materials. Looking forward, the market is likely to benefit from climate-aware product diversification and premiumization across age groups and regional markets.

The warm cap market is segmented by type, material, price, consumer group, gender, usage, and geographic region.

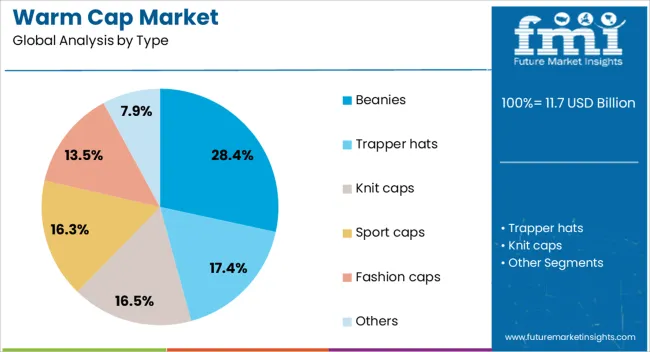

By type, the market is divided into beanies, trapper hats, knit caps, sport caps, fashion caps, and others.

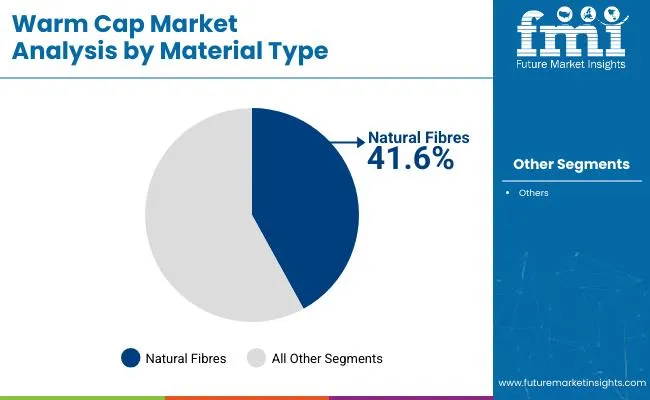

By material, it is classified into natural fibers and synthetic materials.

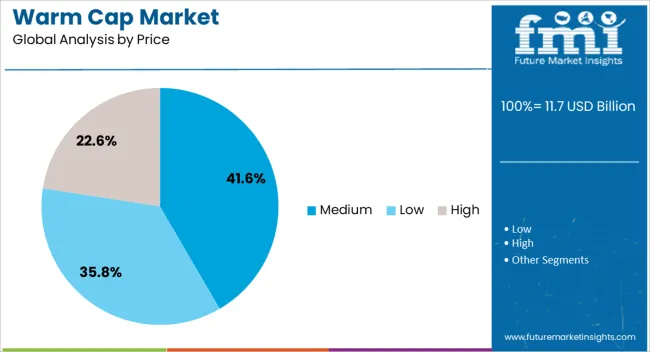

By price, the market is segmented into low, medium, and high.

By consumer group, it is categorized into adults and kids.

By gender, the market is segmented into male and female.

By usage, it is classified into casual/everyday wear, sports and outdoor enthusiasts, professional/work wear, fashion-conscious consumers, and others (including medical usage).

By region, the warm cap industry is divided into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Beanies are projected to account for 28.40% of the warm cap market revenue in 2025, securing their place as the leading type segment. This segment’s strength is being driven by their lightweight design, universal fit, and suitability for both functional and fashion-forward usage.

Their ease of production and compatibility with various knitting techniques support scalability and variety in styling. Beanies have also gained popularity across age groups and genders, further reinforcing their mass-market appeal.

Retail brands continue to invest in this segment due to its low production cost, trend adaptability, and compatibility with branding, embroidery, and customization.

Natural fibers are expected to hold a major position in the market, accounting for a significant 41.60% of the total revenue in 2025. This segment’s leadership is supported by increased consumer preference for biodegradable, skin-friendly, and thermally efficient materials.

Wool, cotton, and alpaca-based fabrics are gaining traction due to their moisture-wicking and insulating properties without the use of synthetic blends. Natural fibers are also favored in regions with growing environmental regulation and textile sustainability standards.

As circular fashion and ethical sourcing become mainstream, brands are realigning portfolios to offer naturally derived cap products, boosting this segment’s momentum.

The medium price segment is anticipated to lead the market in 2025, capturing a 41.60% revenue share. This segment’s dominance is being supported by its balance of affordability and product quality, making it attractive to a wide range of consumers.

Brands targeting the mid-range are focusing on durable materials, improved lining technologies, and enhanced thermal performance while maintaining price sensitivity. The segment is also benefitting from strong online and in-store presence, particularly during seasonal promotions.

As inflation influences buyer preferences, the medium segment continues to offer the most value-conscious solutions without compromising comfort or design appeal.

The warm cap market is being driven by the rising popularity of outdoor activities and winter sports, as consumers increasingly seek functional yet stylish accessories that provide protection against cold weather. Beanies, in particular, are a major growth driver, as they combine practicality with fashion appeal and have become a staple across both casual and professional winter wear. Another significant factor is the strong presence of offline retail channels such as department stores, sports retailers, and specialty outlets, which continue to dominate sales because many consumers prefer to physically try on caps before purchase. Together, these factors ensure steady demand across diverse consumer groups.

Despite this growth, the market faces several restraints. The most significant is its high degree of seasonality, as sales volumes are concentrated during the winter months, leaving retailers exposed to inventory risks during warmer seasons. Intense competition and market saturation also act as barriers, with both global brands and low-cost local manufacturers flooding the market. Price sensitivity among consumers further exacerbates the problem, as low-cost imports often undercut established players, reducing their margins and forcing them into price wars. These restraints limit the ability of brands to scale sustainably without strong differentiation.

The market is witnessing several key trends that are reshaping its outlook. Sustainability is emerging as a defining trend, with growing demand for warm caps made from organic, recycled, or ethically sourced materials. Customization and direct-to-consumer models are also gaining ground, as buyers increasingly value personalized designs, logos, and limited-edition offerings that resonate with their identity. Additionally, influencer collaborations and social media campaigns are playing a critical role in driving consumer demand, especially among younger demographics who see headwear as a fashion statement. Finally, a niche but notable trend is the integration of technology, such as Bluetooth-enabled beanies or UV-protective fabrics, which add functionality and differentiation to an otherwise saturated market.

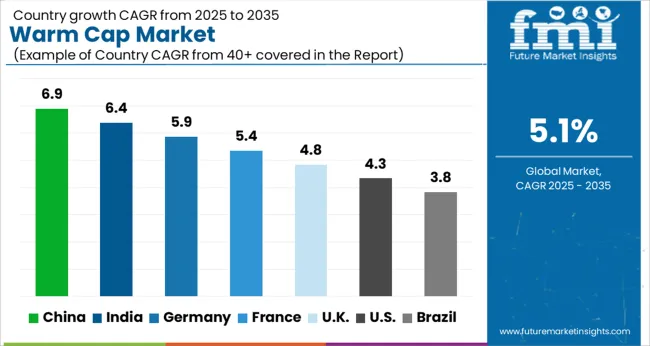

The warm cap market is projected to grow at a global CAGR of 5.1% from 2025 to 2035. China leads with a CAGR of 6.9%, followed by India at 6.4%, and Germany at 5.9%. The United Kingdom records 4.8%, while the United States stands at 4.3%. China and India show robust growth due to increasing demand in the winter wear sector, supported by their large populations and expanding middle class. OECD countries like Germany, the UK, and the USA show steady growth, driven by rising awareness of outdoor activities and the growing demand for premium, high-performance apparel in colder climates. The analysis spans over 40+ countries, with the leading markets shown below.

China is projected to grow at a CAGR of 6.9% through 2035, fueled by its large population, rapidly expanding middle class, and increasing disposable incomes. The growing demand for high-quality winter wear, especially during colder seasons in northern China, drives the market for warm caps. The rise in outdoor activities, such as skiing and hiking, also boosts the market for winter-specific apparel. Additionally, China’s focus on improving its retail infrastructure and increasing the availability of winter wear through both traditional retail stores and e-commerce platforms accelerates market growth.

India is projected to grow at a CAGR of 6.4% through 2035, driven by increasing consumer awareness of cold-weather protection and the growing popularity of winter sports and outdoor activities. The rising middle class and increasing disposable incomes further boost the demand for warm apparel. Additionally, as temperatures drop in various regions of India, especially in the northern states, demand for winter-specific wear, including warm caps, is expected to rise. The expanding retail sector and e-commerce platforms also contribute to the growing accessibility and demand for high-quality winter wear.

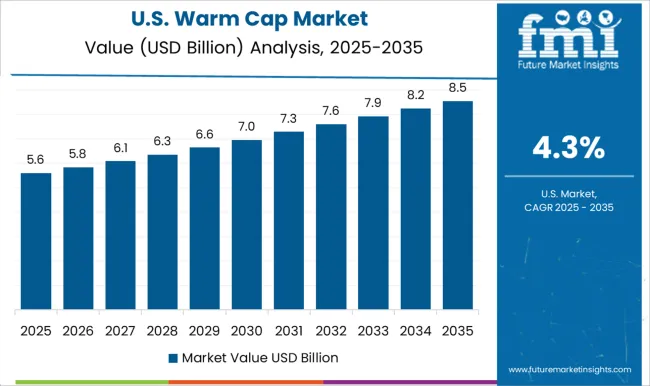

The United States is projected to grow at a CAGR of 4.3% through 2035, driven by the increasing demand for outdoor winter wear, particularly in colder climates. With a growing awareness of the need for thermal wear in outdoor activities such as skiing, hiking, and mountaineering, the demand for high-performance winter apparel, including warm caps, is on the rise. The USA market benefits from established retail networks and the rising trend of premium, high-quality winter apparel. Increasing interest in wellness and fitness activities also contributes to the growth of the market.

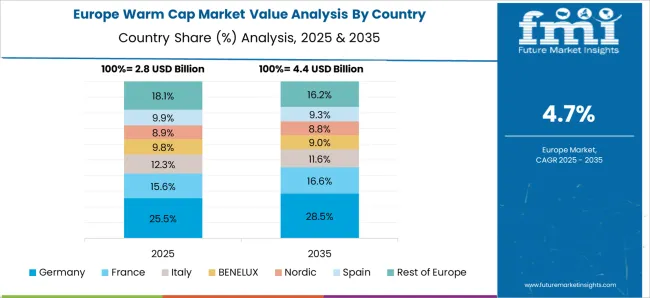

Germany is projected to grow at a CAGR of 5.9% through 2035, with steady demand for warm caps driven by its colder climate and high standards of quality in winter wear. The increasing interest in outdoor activities like skiing and hiking, as well as the rising popularity of sports and recreational activities, further boosts demand for thermal wear. Germany’s strong retail market for outdoor wear and an increasing emphasis on stylish yet functional clothing also contribute to market growth. The growing adoption of premium winter apparel that combines warmth and functionality will continue to drive market demand.

The United Kingdom is projected to grow at a CAGR of 4.8% through 2035, with the market benefiting from growing demand for cold-weather protection and stylish winter wear. The UK’s increasing participation in outdoor activities and sports, especially in colder regions, drives demand for warm caps. Additionally, consumer interest in premium and high-performance winter wear fuels the market. The rise in awareness about the importance of warmth, comfort, and durability in outdoor clothing continues to support the growth of the warm cap market. Retail expansion and the growth of e-commerce further contribute to market accessibility.

The warm cap market is driven by prominent brands offering high-quality, insulated, and performance-driven headwear for outdoor activities, sports, and daily use. The North Face and Patagonia lead the market, providing durable and stylish warm caps designed for extreme weather conditions, focusing on insulation, breathability, and comfort. Carhartt and Columbia Sportswear offer robust, weather-resistant caps that cater to both workwear and recreational needs, with an emphasis on durability and functionality. AmeriCap and Artex Knits are known for producing high-performance knit caps, specializing in custom designs and high-quality fabrics. Kuiu and Marmot focus on premium outdoor wear, offering warm caps tailored for hunters, trekkers, and winter sports enthusiasts.

Minus33 and Smartwool provide eco-friendly and merino wool-based warm caps, ensuring warmt, moisture-wicking, and comfort, which appeals to outdoor enthusiasts and those seeking natural materials. REI Co-op and Under Armour provide a mix of performance and casual warm caps, emphasizing athletic wear for cold-weather activities. Union Wear and Wear A Knit specialize in custom caps and headwear solutions, while Wisconsin Knitwear offers high-quality knitwear focused on warmth and comfort. Competitive differentiation in this market is driven by material quality, design innovation, brand reputation, and functionality in cold weather. Barriers to entry include manufacturing capabilities, brand loyalty, and the ability to offer specialized designs. Strategic priorities include expanding product lines, enhancing sustainability efforts, and creating unique designs to cater to a broad customer base.

| Item | Value |

|---|---|

| Quantitative Units | USD Billion |

| Type | Beanies, Trapper hats, Knit caps, Sport caps, Fashion caps, and Others |

| Material | Natural fibers and Synthetic materials |

| Price | Medium, Low, and High |

| Consumer Group | Adults and Kids |

| Gender | Female and Male |

| Usage | Casual/everyday wear, Sports & outdoor enthusiasts, Professional/work wear, Fashion-conscious consumers, and Others (medical usage, etc.) |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | The North Face, AmeriCap, Artex Knitting Mills, Columbia Sportswear, Kuiu, Marmot, Minus33, Patagonia, REI Co-op, Smartwool, Under Armour, Unionwear, Wear-A-Knit, and Wisconsin Knitwear |

| Additional Attributes | Dollar sales by cap type (beanies, knit caps, fleece caps, performance caps) and end-use segments (outdoor activities, sports, workwear, fashion). Demand dynamics are driven by increasing participation in outdoor activities and sports, growing interest in functional winter wear, and rising awareness about outdoor lifestyle products. Regional trends show strong growth in North America and Europe, driven by colder climates and growing outdoor tourism, with Asia-Pacific expanding due to increasing adoption of outdoor sports. |

The global warm cap market is estimated to be valued at USD 11.7 billion in 2025.

The market size for the warm cap market is projected to reach USD 19.3 billion by 2035.

The warm cap market is expected to grow at a 5.1% CAGR between 2025 and 2035.

The key product types in warm cap market are beanies, trapper hats, knit caps, sport caps, fashion caps and others.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Capacitor Bushing Market Size and Share Forecast Outlook 2025 to 2035

Caprolactam Market Size and Share Forecast Outlook 2025 to 2035

Capacitor Film Slitter Market Size and Share Forecast Outlook 2025 to 2035

Cap Liner Market Size and Share Forecast Outlook 2025 to 2035

Capsule Vision Inspection Solution Market Size and Share Forecast Outlook 2025 to 2035

Capsule Filling Machines Market Size and Share Forecast Outlook 2025 to 2035

Capacitance Meter Market Size and Share Forecast Outlook 2025 to 2035

Capsule Hotels Market Size and Share Forecast Outlook 2025 to 2035

Capacitive Tactile Sensor Market Size and Share Forecast Outlook 2025 to 2035

Capryloyl Glycine Market Size and Share Forecast Outlook 2025 to 2035

Captive Chemical Hydrogen Generation Market Size and Share Forecast Outlook 2025 to 2035

Warm Edge Spacer Market Size and Share Forecast Outlook 2025 to 2035

Capacitive Position Sensors Market Size and Share Forecast Outlook 2025 to 2035

Capacitive Sensor Market Analysis - Size, Share, and Forecast 2025 to 2035

Caprylic Capric Triglyceride Market Size and Share Forecast Outlook 2025 to 2035

Captive Petroleum Refinery Hydrogen Generation Market Size and Share Forecast Outlook 2025 to 2035

Cap and Closure Market Trends - Growth & Demand 2025-2035

Capnography Equipment Market Size and Share Forecast Outlook 2025 to 2035

Capillary Electrophoresis Market Size, Growth, and Forecast 2025 to 2035

Capsule Endoscope and Workstations Market - Growth & Demand 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA