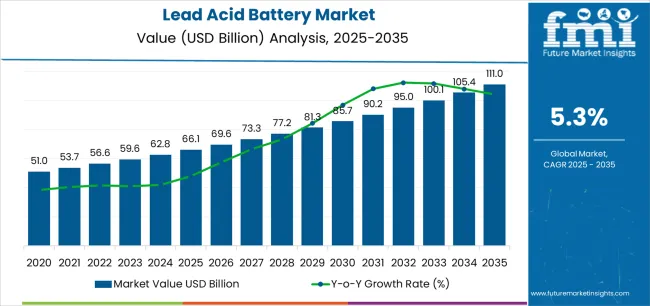

The Lead Acid Battery Market is estimated to be valued at USD 66.1 billion in 2025 and is projected to reach USD 111.0 billion by 2035, registering a compound annual growth rate (CAGR) of 5.3% over the forecast period.

The Lead Acid Battery market is experiencing steady growth driven by its established role as a reliable and cost-effective energy storage solution across multiple industries. The future outlook for this market is influenced by increasing demand from transportation, industrial, and backup power applications.

The widespread adoption of electric vehicles, commercial fleets, and renewable energy systems has reinforced the relevance of lead acid batteries due to their durability, ease of recycling, and lower initial investment compared to alternative battery technologies. Additionally, advancements in battery design and maintenance practices are improving efficiency and lifespan, making them a practical solution for both developed and emerging markets.

The market is also benefiting from the growing focus on sustainability and circular economy initiatives, which emphasize recycling and resource recovery from lead acid batteries As energy storage needs expand globally and regulatory frameworks encourage safer and more reliable battery solutions, lead acid batteries are expected to maintain a strong presence in transportation, industrial, and backup power sectors, with consistent growth opportunities in both existing and new applications.

| Metric | Value |

|---|---|

| Lead Acid Battery Market Estimated Value in (2025 E) | USD 66.1 billion |

| Lead Acid Battery Market Forecast Value in (2035 F) | USD 111.0 billion |

| Forecast CAGR (2025 to 2035) | 5.3% |

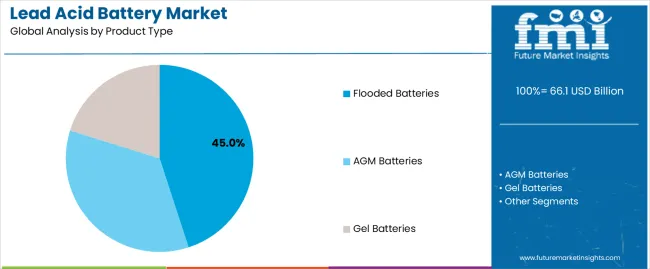

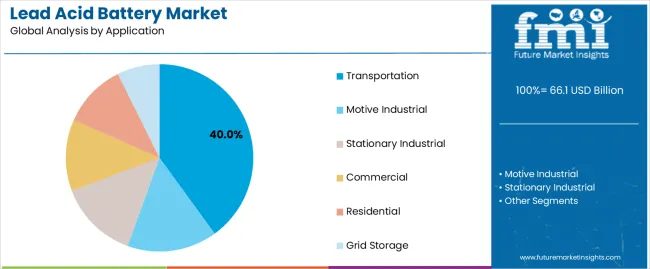

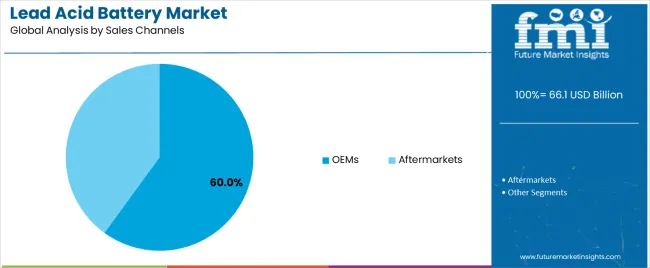

The market is segmented by Product Type, Application, and Sales Channels and region. By Product Type, the market is divided into Flooded Batteries, AGM Batteries, and Gel Batteries. In terms of Application, the market is classified into Transportation, Motive Industrial, Stationary Industrial, Commercial, Residential, and Grid Storage. Based on Sales Channels, the market is segmented into OEMs and Aftermarkets. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The flooded batteries product type segment is projected to hold 45.0% of the Lead Acid Battery market revenue share in 2025, making it the leading product type. This dominance is driven by their proven reliability, robust performance under varying load conditions, and relatively low cost compared to other battery types.

Flooded batteries are preferred in applications where maintenance is manageable and operational environments demand high tolerance to overcharging and deep discharging. The ease of recycling and long-standing supply chain infrastructure further support their adoption.

Additionally, improvements in battery design, electrolyte management, and ventilation systems have enhanced safety and efficiency, reinforcing their relevance The segment’s growth is supported by consistent demand from transportation and industrial sectors, where durability, scalability, and cost-effectiveness are critical factors for energy storage solutions.

The transportation application segment is expected to account for 40.0% of the Lead Acid Battery market revenue share in 2025, establishing it as the leading application. This growth is driven by the extensive use of lead acid batteries in commercial vehicles, electric mobility solutions, and backup systems for transportation fleets.

Their ability to deliver reliable power, withstand harsh operating conditions, and provide cost-efficient energy storage has made them a preferred choice for fleet operators and vehicle manufacturers. Furthermore, the compatibility of lead acid batteries with existing vehicle electrical systems and the availability of maintenance and recycling infrastructure contribute to their widespread adoption.

The increasing demand for electrification in transportation and the need for dependable energy storage in commercial fleets continue to strengthen the prominence of this application segment.

The OEMs sales channel segment is anticipated to hold 60.0% of the Lead Acid Battery market revenue in 2025, making it the dominant distribution channel. This is primarily due to the strong integration of lead acid batteries within original equipment manufacturing processes, ensuring compatibility, reliability, and warranty compliance for end users.

OEM partnerships facilitate direct supply and technical support, which enhances customer trust and operational efficiency. The segment has benefited from growing collaborations between battery manufacturers and vehicle, industrial, and renewable energy equipment producers.

Additionally, OEM distribution allows for standardized quality control and optimized supply chain management, reinforcing the adoption of lead acid batteries across various applications The consistent demand from transportation and industrial sectors, combined with ongoing manufacturing partnerships, ensures the continued dominance of the OEMs channel in market revenue share.

The table below presents a comparative assessment of the variation in CAGR over six months for the base year (2025) and current year (2025) for the global industry.

This analysis reveals crucial shifts in performance and indicates revenue realization patterns, thereby providing stakeholders with a better vision of the growth trajectory over the year. The first half of the year, or H1, spans from January to June. The second half, H2, includes the months from July to December.

The table below presents the expected CAGRs for Pb-acid batteries, driven by increasing demand from the automotive industry and renewable energy applications. In the first half (H1) of 2025 to 2035, the business is predicted to surge at a CAGR of 5.1%, followed by a higher growth rate of 5.7% in the second half (H2) of the same period.

| Particular | Value CAGR |

|---|---|

| H1 | 5.1% (2025 to 2035) |

| H2 | 5.7% (2025 to 2035) |

| H1 | 5.3% (2025 to 2035) |

| H2 | 5.8% (2025 to 2035 ) |

Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to drop slightly to 5.3% in the first half and relatively grow to 5.8% in the second half. In the first half (H1), the industry witnessed an increase of 20 BPS while in the second half (H2), there was a slight surge of 10 BPS.

High Demand for Easily Recyclable Materials Augments Sales

Lead acid batteries offer significant environmental advantages over lithium-ion batteries due to their superior recyclability. Around 97% of a lead acid battery's components, including lead and sulfuric acid, can be recycled. This high recycling rate helps to minimize environmental impact and reduce the demand for new raw materials.

According to the International Lead Association, due to its fundamental properties, lead is considered one of the most recycled materials in the world. It is also attributed to the fact that lead-based products are easily identifiable and economical to recycle.

Recycled lead provides 60% of the world’s lead use, with about 80% utilized in battery manufacturing. Globally, lead acid battery recycling is a USD 24 billion industry, per annum, while in Australia, it is worth about USD 250 million, per annum.

Sales of SLI Batteries Rise Globally Amid Astonishing Demand for HEVs

The demand for SLI batteries is estimated to be driven by the growing consumer automotive segment, which is considered the most significant revenue grosser. Demand is also spurred by both original equipment manufacturers (OEMs) and aftermarkets. These help in augmenting new sales as well as replacement activities.

With improvements in the economy, automobile sales are booming, which is boding well for the SLI lead acid battery industry since these are the preferred choices for powering internal combustion engine-based automobiles. Hence, increasing demand for vehicles is anticipated to surge the need for Pb-acid batteries.

A few leading automobile manufacturers plan to boost the production of hybrid electric vehicles (HEVs). Hence, they are relying on lead-acid batteries for cost-effectiveness and reliability.

Similarly, rising sales of conventional internal combustion engine (ICE) vehicles continue to require SLI batteries. As more consumers adopt HEVs and ICE vehicles, the need for dependable SLI batteries surges, further fueling demand for lead acid batteries in the automotive business.

Development of Affordable Renewable Energy Storage Solutions Gains Traction

The need for reliable and cost-effective energy storage solutions is growing with the adoption of renewable energy forms, such as solar and wind power. Lead acid batteries can be very useful in this case as these are affordable and have a proven technology.

They can also store excess power generated by these sources to provide a stable supply during periods of low generation. Novel solar energy storage systems based on lead acid batteries have been used in several villages to ensure that power is constantly available.

In 2035, the world is projected to witness a rechargeable renewable energy storing potential of about 300 GWh, as per the International Renewable Energy Agency (IRENA).

A substantial part of this capacity will be covered by lead acid batteries due to their favorable cost profile and capability to recycle. This points out yet another possibility for the batteries to boost the growing renewable industry, which is mainly focusing on regions where affordability remains an issue.

Stringent Lead Pollution Norms to Negatively Influence Demand

The United States has placed restrictions to curb lead pollution, which has made domestic recycling complicated and costly. This move has helped propel the recycling trade in Mexico, both illegally and legally, as the country has less stringent limits for lead pollution and far less vigorous enforcement.

For instance, Johnson Controls’ Mexico plant is responsible for more than 30 times lead pollution as compared to its new plant in the United States. In the United States, recyclers operate in highly mechanized, tightly sealed plants, with smokestack scrubbers and extensive monitors to detect lead release. This restraints the demand for lead acid batteries in North America.

According to the standard operating procedure (SOP), the prescribed standards include limits for lead concentrations in the work area air (0.05 milligram per cubic meter), emissions through the stack (10.0 milligram per normal cubic meter), effluents (0.10 milligram per liter), and ambient air near the factory boundary (1.0 microgram per cubic meter).

The global industry witnessed a CAGR of 2.5% between 2020 and 2025. Total revenue reached about USD 66.1 billion in 2025. During the forecast period between 2025 and 2035, sales are projected to fetch a CAGR of 5.6%.

The rise of alternative technologies, particularly lithium-ion batteries, which offer high energy density, long lifespan, and quick charging times, has reduced demand for lead-acid batteries, especially in the automotive and energy storage industries. Regulatory pressure and environmental concerns over lead pollution have increased costs and complexities in recycling and disposal, further dampening growth.

Technological stagnation compared to rapid innovations in lithium-ion technology has also impacted competitiveness. Lastly, economic and supply chain disruptions caused by the COVID-19 pandemic contributed to the slow growth of the lead acid battery market during this period.

In the assessment period, the industry is anticipated to witness steady growth due to several converging factors. The continued expansion of the automotive industry, especially with the persistent use of lead acid batteries for SLI in internal combustion engine vehicles, will likely sustain robust demand.

The growing need for reliable and cost-effective energy storage solutions in renewable energy systems, such as solar and wind power, presents significant opportunities for manufacturers due to their affordability and established recycling processes.

Increased investments in infrastructure and industrial applications also contribute to growth, as lead acid batteries are widely used in backup power systems and material handling equipment.

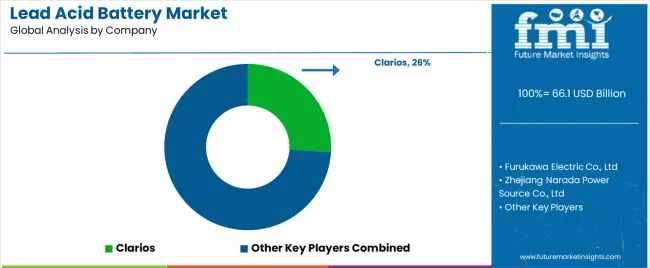

Tier 1 companies include industry leaders with annual revenues exceeding USD 1,200 million. These companies are currently capturing a significant share of 30% to 35% globally.

These frontrunners are characterized by high production capacity and a wide product portfolio. They are distinguished by extensive expertise in manufacturing and a broad geographical reach, underpinned by a robust consumer base.

The firms provide a wide range of products and utilize the latest technology to meet regulatory standards. Prominent companies within Tier 1 include Clarios, Enersys, East Penn Manufacturing Co., Chaowei Power Holdings Limited, and others.

Tier 2 companies encompass most of the mid-sized enterprises operating within the regional sphere and catering to specialized needs with revenues between USD 600 to 1,200 million.

These businesses are notably focused on meeting the demands of Tier 1. Tier 2 players such as Exide Industries Ltd., Camel Group Co., Ltd., Furukawa Electric Co., Ltd., and Narada Power Source Co. Ltd are projected to account for 25 to 30% of the overall share.

Tier 3 includes most of the small-scale companies operating at the local level and serving niche industries with revenue below USD 600 million. These companies are notably oriented toward fulfilling local demands and are consequently classified within the Tier 3 segment.

They are small-scale players and have limited geographical reach. Regional manufacturers such as Shandong Sacred Sun Power Sources Co. Ltd., B. B. Battery, Coslight Technology International Group Co. Ltd., Hoppecke Batterien GmbH & Co., KG., and Crown Battery Corporation are set to hold 40 to 45% of the share.

The section covers the analysis of lead acid battery sales for different countries in several regions of the globe, including North America, Latin America, East Asia, South Asia and Pacific, Western Europe, Eastern Europe, and the Middle East and Africa. East Asia is anticipated to remain at the forefront, with a value share of around 27.7% in 2025.

In South Asia and Pacific, India is projected to witness a CAGR of 7.2% through 2035. China and Japan are set to record considerable CAGRs of 6.2% and 5.3%, respectively, through 2035.

| Countries | CAGR 2025 to 2035 |

|---|---|

| India | 7.2% |

| China | 6.2% |

| Japan | 5.3% |

| United States | 4.7% |

| Germany | 4.0% |

India’s lead acid battery industry is poised to exhibit a CAGR of 7.2% during the assessment period. It is projected to attain a value of USD 12,407.9 million by 2035.

India will likely be significantly affected by its target of 500 GW by 2066.1. Solar and wind expansion efforts in this country are driving the need for reliable and low-cost energy storage solutions.

For instance, renewable sources, such as solar and wind produce excess power that can be stored by lead acid batteries which are commonly used in off-grid and rural areas.

Lead acid batteries, known for their affordability and reliable performance, are increasingly being used to store excess energy generated from renewable sources. This storage is crucial for stabilizing energy supply, especially in off-grid and rural areas.

Favorable government policies and investments in renewable resources further contribute to the high demand for Pb-acid batteries in line with the growth of renewable energy industries.

China, as the world’s most prominent automotive market, produced around 66.1 million vehicles in 2025.

This immense production volume generates substantial demand for lead acid batteries, which are essential for SLI in internal combustion engine vehicles. The significant reliance on these batteries for such critical automotive functions directly contributes to growth.

As the number of vehicles on the road increases, so does the need for lead acid batteries, underscoring their key role in China’s automotive industry. Sales in China are projected to soar at a CAGR of around 6.2% during the assessment period. The total value in the country is anticipated to reach USD 18,117.2 million by 2035.

The United States lead acid battery market size is projected to reach USD 14,804.5 million by 2035. Over the assessment period, demand in the country is set to rise at 4.7% CAGR.

Since 2024, battery storage capacity in the United States has been growing rapidly and is projected to increase by 89% by 2025, potentially reaching over 66.1 gigawatts (GW). This expansion, driven by planned energy storage systems, highlights the increasing need for reliable storage solutions to support the growing renewable energy sector.

Lead acid batteries, with their cost-effectiveness and established recycling processes, are poised to benefit from this surge. States like California, with 7.3 GW of installed capacity, and Texas, with 3.2 GW, lead the way due to their extensive solar and wind-generating fleets.

The significant growth in battery storage capacity underscores the key role of lead-acid batteries in stabilizing and supporting the country’s renewable energy infrastructure, especially where cost and recycling are the main factors.

The section explains the growth trajectories of the leading segments in the industry. In terms of product type, the flooded battery segment will likely generate a share of around 49.7% in 2025.

Based on sales channel, the aftermarket segment is projected to hold a share of 63% in 2025. The analysis would enable potential clients to make effective business decisions for investment purposes.

| Segment | Flooded Battery (Product Type) |

|---|---|

| Value Share (2025) | 49.7% |

Flooded batteries, also known as wet cell batteries, dominate the lead acid battery market due to their cost-effectiveness and high durability. Their production costs are lower compared to other battery types, such as absorbent glass mats (AGMs) or gel batteries.

These make the batteries an attractive option for various applications, especially in cost-sensitive areas. With over a century of use, flooded batteries have proven their reliability and performance, earning widespread trust and a strong presence.

Their robustness allows them to withstand overcharging and deep discharges, making them suitable for applications requiring high durability and resilience, such as automotive, industrial, and backup power systems. These factors collectively contribute to the continued dominance of flooded batteries in the lead acid battery market.

| Segment | Aftermarket (Sales Channels) |

|---|---|

| Value Share (2025) | 63% |

The aftermarket segment holds a high share in the lead acid battery market in terms of sales channels due to several compelling reasons. The widespread use of these batteries in automotive applications, particularly for starting, lighting, and ignition (SLI) purposes, necessitates regular replacement, thereby bolstering substantial demand in the aftermarket.

The longevity of vehicles and equipment often outlasts the original batteries, creating a robust replacement industry. Thirdly, the vast network of distributors, retailers, and service centers specializing in aftermarket parts ensures easy availability and accessibility of these batteries.

This combination of frequent replacement needs, extensive distribution networks, and cost-effective solutions underpins the strong presence of the aftermarket in the lead acid battery industry.

The global lead acid battery market is highly competitive with the presence of several key companies. They are mainly focusing on investing huge sums in research and development activities to enhance the efficiency, operational life, and performance of their batteries.

This strategy is anticipated to help them in launching more attractive products for individual customers and large-scale businesses. At the same time, they are striving to integrate innovative technologies like separators, unique grid designs, and additives to improve the battery performance and features.

A handful of players are engaging in collaborations and partnerships with small-scale firms to exchange resources and expertise to introduce unique products. They are focusing on strengthening their existing distribution networks to extend their geographic presence.

They are also providing improved technical support and after-sales services to customers to boost relations.

Industry Updates

Flooded batteries, AGM batteries, and gel batteries are the key product types.

Application segments included in the study are transportation (passenger cars, light commercial vehicles (LCV), heavy commercial vehicles (HCV), and two-wheelers), motive industrial, stationary industrial, commercial, residential, and grid storage.

Original equipment manufacturers (OEMs), and aftermarkets are the two key sales channels.

Regions considered in the study are North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia and Pacific, and the Middle East and Africa.

The global lead acid battery market is estimated to be valued at USD 66.1 billion in 2025.

The market size for the lead acid battery market is projected to reach USD 111.0 billion by 2035.

The lead acid battery market is expected to grow at a 5.3% CAGR between 2025 and 2035.

The key product types in lead acid battery market are flooded batteries, agm batteries and gel batteries.

In terms of application, transportation segment to command 40.0% share in the lead acid battery market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Lead Acid Battery Recycling Market Size and Share Forecast Outlook 2025 to 2035

Flooded Lead Acid Battery Market Size and Share Forecast Outlook 2025 to 2035

Advanced Lead Acid Battery Market Size and Share Forecast Outlook 2025 to 2035

Automotive Lead Acid Battery Market Size and Share Forecast Outlook 2025 to 2035

Stationary Lead Acid Battery Storage Market Size and Share Forecast Outlook 2025 to 2035

Motorcycle Lead Acid Battery Market - Trends & Forecast 2025 to 2035

Carbon Enhanced Lead Acid Battery Market Size and Share Forecast Outlook 2025 to 2035

Lead Smelting and Refining Market Size and Share Forecast Outlook 2025 to 2035

Lead Management Market Size and Share Forecast Outlook 2025 to 2035

Lead Mining Software Market Size and Share Forecast Outlook 2025 to 2035

Lead Intelligence Software Market Size and Share Forecast Outlook 2025 to 2035

Lead Capture Software Market Size and Share Forecast Outlook 2025 to 2035

Lead Scoring Software Market Size and Share Forecast Outlook 2025 to 2035

Lead-to-Account Matching and Routing Software Market Size and Share Forecast Outlook 2025 to 2035

Leadership Development Program Market Analysis - Size, Share, and Forecast 2025 to 2035

Lead Market Growth - Trends & Forecast 2025 to 2035

Examining Market Share Trends in Leadership Development Programs

Lead Zirconate Titanate Market Size & Trends 2025

Lead Stearate Market

Leadscrew Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA