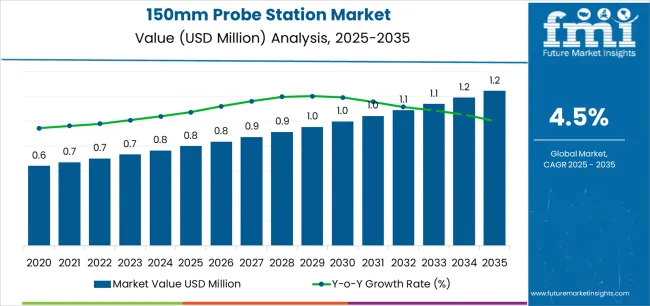

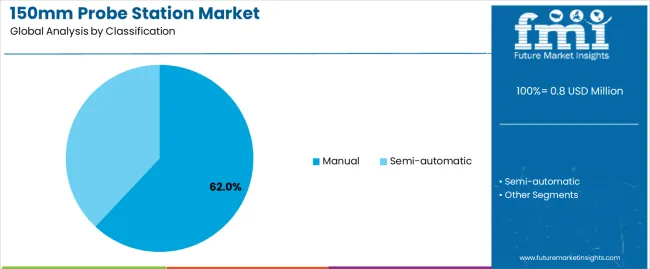

The 150 mm probe station market is forecast to rise from USD 0.8 billion in 2025 to USD 1.2 billion by 2035 at a CAGR of 4.5%. Demand scales with growing wafer-level testing needs across semiconductor R&D, legacy 150 mm production lines, MEMS, mm-wave, and compound-semiconductor devices such as GaN, SiC, and GaAs. Manual probe stations hold about 62% of the 2025 market, favored in academic labs, prototyping, and low-volume device characterization, while semi-automatic systems gain momentum in mid-scale testing environments that require throughput and repeatability. Semiconductor applications account for the largest share, at roughly 34%, driven by electrical probing, design verification, and process development.

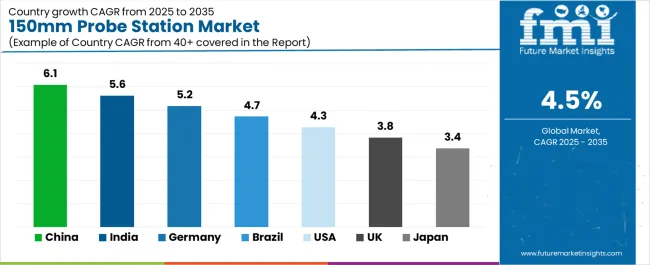

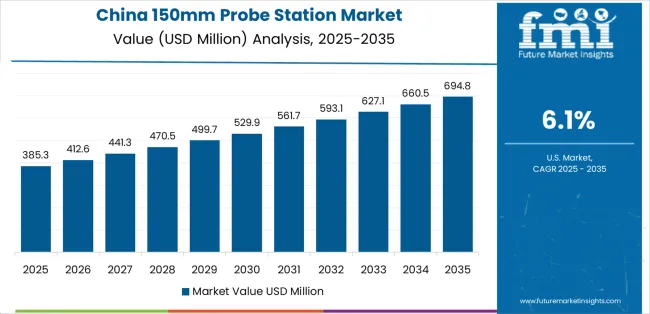

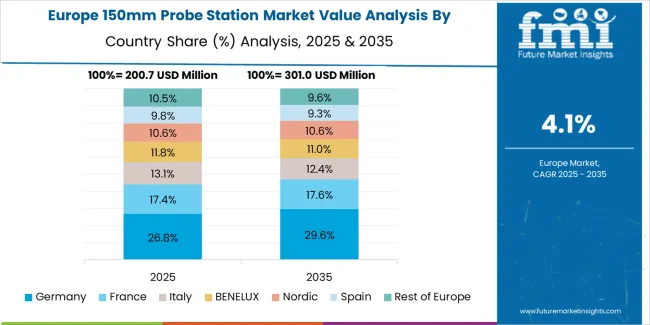

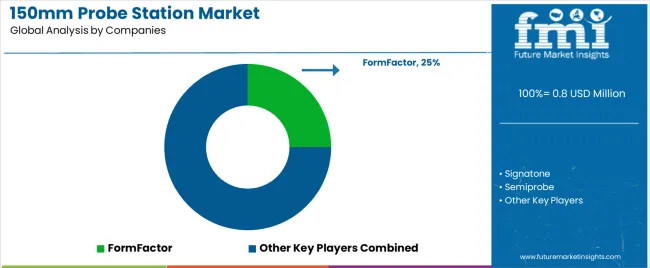

Growth from 2025–2030 is supported by equipment upgrades across research centers and fabs, adapting to finer geometries and advanced materials. The 2030–2035 phase maintains the same 4.5% rolling CAGR as adoption of automated stages, temperature-controlled chucks, and vibration-isolated platforms increases. The Asia Pacific leads expansion through strong manufacturing clusters in China, Taiwan, South Korea, and Japan. China grows at 6.1%, India at 5.6%, Germany at 5.2%, Brazil at 4.7%, the United States at 4.3%, the UK at 3.8%, and Japan at 3.4%. Competition remains moderately concentrated, led by FormFactor with an estimated 25% share, followed by Signatone, Semiprobe, Micromanipulator, MicroXact, STAr Technologies, and MPI Corporation.

The 150mm probe station market is expected to grow from USD 0.8 billion in 2025 to USD 1.2 billion by 2035, reflecting a consistent rolling CAGR of 4.5% across the forecast period. This steady pace indicates stable expansion supported by rising demand for semiconductor testing, wafer characterization, and microelectronic component inspection. During the first rolling five-year window (2025–2030), growth will remain firm as fabrication facilities and research institutions upgrade equipment to meet precision and miniaturization standards in wafer processing.

In the second window (2030–2035), the rolling CAGR of 4.5% is projected to continue as semiconductor manufacturers emphasize automation, accuracy, and thermal stability in testing environments. The integration of semi-automated and fully automated probe stations will maintain demand, especially for advanced integrated circuits and MEMS devices. Although competitive pricing and regional production may create short-term fluctuations, consistent investment in testing infrastructure and technological upgrades will maintain this growth rate. The trend reflects a stable and predictable market expansion driven by continued innovation and process optimization within the global semiconductor equipment industry.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 0.8 billion |

| Market Forecast Value (2035) | USD 1.2 billion |

| Forecast CAGR (2025-2035) | 4.5% |

The 150 mm probe station market is growing as semiconductor research and legacy wafer-fabrication operations continue to demand accurate on-wafer testing at that wafer size. Probe stations for 150 mm (6 inch) wafers remain relevant in specialised research, older fab lines and niche MEMS or mm-wave device production where migrating entirely to larger wafers is not yet justified. Advanced applications such as THz measurement, mm-wave characterization and compound-semiconductor testing increasingly adopt 150 mm-dedicated probe systems to ensure mechanical stability and high-precision probe placement.

Technological advances in modular probe station design, improved vibration isolation, automated manipulators and integration with advanced instrumentation also support growth of the 150 mm segment. The global resurgence of investment in semiconductor testing, materials research and specialty device production reinforces demand. Constraints include the ongoing industry transition toward larger wafer sizes (200 mm and 300 mm), which reduces the long-term addressable market for 150 mm systems, as well as high capital cost and specialist operator requirements for such equipment.

The 150mm probe station market is segmented by classification and application. By classification, the market is divided into manual and semi-automatic probe stations. Based on application, the market is categorized into semiconductor, photoelectricity device, micro-electronics, and other precision testing applications. Regionally, the market is divided into Asia Pacific, Europe, North America, and other key regions.

The manual segment holds the leading position in the 150mm probe station market, accounting for approximately 62.0% of the total share in 2025. Manual probe stations remain widely used due to their reliability, cost efficiency, and flexibility in research and development environments where customized probing setups and operator control are essential. These systems allow precise wafer-level electrical measurements while maintaining mechanical simplicity and low maintenance requirements.

The segment’s dominance is supported by extensive adoption in academic laboratories, prototype validation, and low-volume production testing, where automation may not provide proportional cost benefits. Manual stations also offer high adaptability for testing various wafer geometries and materials, particularly in early-stage semiconductor process characterization. Semi-automatic systems, though gaining traction, are typically favored for mid-scale industrial testing requiring enhanced throughput and reduced operator dependency.

Key factors supporting the manual segment include:

The semiconductor segment accounts for approximately 34.0% of the 150mm probe station market in 2025. This share reflects the primary use of probe stations in wafer-level electrical characterization, device verification, and process development within semiconductor manufacturing and R&D. The equipment enables precise probing of integrated circuits, MEMS components, and advanced semiconductor materials under controlled environmental and electrical conditions.

Photoelectricity device applications, including photodetector and solar cell testing, represent a growing segment as research advances in optoelectronic materials and light-sensitive semiconductor devices. The micro-electronics category includes component validation for sensors, integrated chips, and power management circuits requiring fine probing accuracy. The “others” category encompasses specialized fields such as materials science and nanotechnology-based device assessment.

Primary dynamics driving demand from the semiconductor segment include:

Expansion of legacy wafer fabs, compound semiconductor testing, and precision measurement demand are fueling market growth.

The 150 mm probe station market is driven by the sustained operation of legacy semiconductor fabrication facilities and increasing demand for wafer-level testing across compound semiconductor devices such as gallium nitride (GaN), silicon carbide (SiC), and gallium arsenide (GaAs). These materials require precise electrical and thermal characterization, making high-accuracy probe stations essential. The rise in MEMS and optoelectronic device development is further expanding utilization in R&D and production testing. Growing investment in quality control and reliability assessment for specialty semiconductor manufacturing reinforces the adoption of probe stations optimized for 150 mm wafers, ensuring performance stability and cost-effective device validation.

Shrinking relevance of legacy wafer sizes, high system cost, and equipment transition are restraining market adoption.

The semiconductor industry’s gradual transition toward 200 mm and 300 mm wafer formats limits the long-term applicability of 150 mm probe stations, particularly for large-scale production testing. High equipment costs associated with precision mechanics, advanced positioning systems, and temperature-controlled chucks create financial barriers for small and medium testing facilities. Frequent technology upgrades in probing automation and data analytics also discourage investment in legacy wafer testing platforms. Limited interoperability with modern automated wafer handlers constrains scalability, restricting use primarily to niche segments like research, failure analysis, and low-volume specialty semiconductor production.

Automation upgrades, digital integration, and Asia-Pacific expansion are defining market direction.

The market is shifting toward modular automation, incorporating robotic probe manipulators and software-controlled positioning to enhance throughput and consistency. Integration of digital monitoring, IoT-based diagnostics, and remote calibration solutions is improving efficiency and reducing maintenance downtime. Growing semiconductor research initiatives and MEMS fabrication investments in Asia-Pacific, particularly China, Japan, and South Korea, are driving regional demand. Manufacturers are focusing on developing cost-optimized, hybrid manual-automatic probe systems tailored to 150 mm wafers, supporting laboratories and small fabs that continue to rely on mature production ecosystems for advanced device characterization.

The global 150mm probe station market is expanding steadily through 2035, driven by rising semiconductor testing requirements, miniaturization of electronic components, and advancements in wafer-level analysis. China leads with a 6.1% CAGR, followed by India at 5.6%, supported by strong growth in chip manufacturing and research infrastructure. Germany records 5.2%, reflecting robust industrial automation and testing innovation. Brazil, growing at 4.7%, benefits from expanding electronic component assembly operations. The United States shows a 4.3% CAGR, backed by advanced R&D in semiconductor testing. The United Kingdom (3.8%) and Japan (3.4%) maintain stable performance through technology modernization and precision engineering programs.

| Country | CAGR (%) |

|---|---|

| China | 6.1 |

| India | 5.6 |

| Germany | 5.2 |

| Brazil | 4.7 |

| USA | 4.3 |

| UK | 3.8 |

| Japan | 3.4 |

China leads the global 150mm probe station market with a 6.1% CAGR, supported by extensive semiconductor investments and manufacturing localization. National programs promoting self-sufficiency in chip production have boosted demand for advanced wafer testing systems. Domestic research centers and semiconductor companies are adopting precision probe stations for device characterization, reliability testing, and yield optimization. Partnerships between local equipment suppliers and global measurement system providers enhance production capacity and technical expertise. Rapid development of semiconductor clusters in Shanghai, Shenzhen, and Beijing strengthens infrastructure for precision instrumentation and high-accuracy wafer testing solutions.

Key Market Factors:

India’s 150mm probe station market grows at 5.6% CAGR, supported by increased semiconductor manufacturing investments and national electronics policy initiatives. The establishment of fabrication and assembly facilities under Make in India has raised demand for wafer testing and measurement equipment. Universities and R&D institutions are deploying probe stations for microdevice research and reliability testing. The entry of global test equipment suppliers through joint ventures is expanding local availability of high-precision instruments. Growth in electronics manufacturing services (EMS) and chip design firms enhances the country’s testing equipment ecosystem.

Market Development Factors:

Germany’s market grows at 5.2% CAGR, supported by advanced precision engineering and automation research. The country’s semiconductor testing ecosystem benefits from collaborations between academic institutions and equipment manufacturers. German probe station suppliers are focusing on high-resolution imaging integration and temperature-controlled platforms for accurate wafer analysis. The demand for probe stations is increasing across automotive electronics and industrial sensor testing applications. Strong industrial standards and engineering excellence sustain Germany’s position in precision measurement and semiconductor evaluation technologies.

Key Market Characteristics:

Brazil’s market grows at 4.7% CAGR, supported by the gradual development of its electronics and semiconductor assembly industries. The expansion of testing laboratories and microelectronics education programs has driven adoption of probe stations for research and prototype verification. Partnerships between universities, government institutions, and international equipment suppliers are improving access to modern testing infrastructure. Growth in automotive and consumer electronics manufacturing also supports the use of wafer-level diagnostic systems. Local distributors are expanding after-sales support and maintenance capabilities, improving the country’s capacity for advanced semiconductor testing operations.

Market Development Factors:

The United States records a 4.3% CAGR, driven by innovation in semiconductor testing, research laboratories, and advanced wafer fabrication. The market benefits from strong government and private sector funding in microelectronics and nanotechnology research. Probe stations are being widely utilized for MEMS, photonics, and RF component evaluation. Equipment manufacturers are integrating AI and data analytics to enhance probe precision and repeatability. Expanding collaborations between national labs, universities, and semiconductor firms support continuous technological advancement in measurement and testing systems.

Key Market Factors:

The United Kingdom’s market grows at 3.8% CAGR, supported by expansion in nanotechnology research and semiconductor material development. Universities and R&D institutions are adopting advanced probe systems for device validation and material analysis. The country’s innovation-driven ecosystem supports integration of measurement automation and environmental control in laboratory testing. Collaborations between academic researchers and precision engineering companies are improving system design and calibration accuracy. Government support for semiconductor design and advanced materials research maintain steady demand for probe stations in public and private laboratories.

Market Characteristics:

Japan’s market grows at 3.4% CAGR, supported by its strong foundation in precision instrumentation and electronic testing. The country’s semiconductor ecosystem continues to emphasize high-quality wafer probing for advanced device development. Domestic manufacturers are improving probe head accuracy, contact stability, and thermal management for submicron-scale measurements. Integration of automation, robotics, and optical inspection systems enhances operational consistency. Research institutions are exploring hybrid probe technologies combining electrical and optical testing methods for next-generation semiconductor applications. Japan’s long-standing focus on precision engineering ensures stable market performance despite global competition.

Market Development Factors:

The 150mm probe station market is moderately concentrated, with a small group of specialized semiconductor equipment manufacturers competing across testing and measurement applications. FormFactor leads the market with an estimated 25.0% global share, driven by its advanced probe station designs, automation capabilities, and integration with wafer-level test systems used in semiconductor research and production. Its established relationships with major foundries and research institutions further reinforce its leadership.

Signatone and Semiprobe follow as key mid-tier competitors, offering cost-efficient and customizable probe stations suitable for academic, R&D, and low-volume industrial applications. Their competitive advantage lies in design flexibility, modular configurations, and responsive technical support for emerging testing requirements. Micromanipulator and MicroXact specialize in precision engineering, focusing on thermal and electrical stability for sensitive device measurements, particularly in power electronics and MEMS applications.

STAr Technologies and MPI Corporation provide integrated probe and test solutions that align with semiconductor process control and reliability testing needs. Both companies benefit from close collaborations with integrated device manufacturers (IDMs) and testing laboratories in Asia-Pacific, which represent major demand centers.

Competition in this segment revolves around precision, automation, and customization capabilities, as end users prioritize accurate data acquisition, reproducibility, and minimal downtime. Market growth is sustained by increased semiconductor R&D activity, miniaturization trends, and the ongoing shift toward wafer-level validation in advanced electronics manufacturing.

| Items | Values |

|---|---|

| Quantitative Units | USD billion |

| Classification | Manual, Semi-automatic |

| Application | Semiconductor, Photoelectricity Device, Micro-electronics, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East & Africa |

| Countries Covered | India, China, USA, Germany, South Korea, Japan, Italy, and 40+ countries |

| Key Companies Profiled | FormFactor, Signatone, Semiprobe, Micromanipulator, MicroXact, STAr Technologies, MPI Corporation |

| Additional Attributes | Dollar sales by classification and application categories; regional adoption trends across Asia Pacific, Europe, and North America; competitive landscape of probe station and semiconductor testing solution providers; integration with advanced wafer probing technologies; developments in automation and precision testing for micro-electronic components. |

The global 150mm probe station market is estimated to be valued at USD 0.8 million in 2025.

The market size for the 150mm probe station market is projected to reach USD 1.2 million by 2035.

The 150mm probe station market is expected to grow at a 4.5% CAGR between 2025 and 2035.

The key product types in 150mm probe station market are manual and semi-automatic.

In terms of application, semiconductor segment to command 34.0% share in the 150mm probe station market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

MEMS Probes Market Size and Share Forecast Outlook 2025 to 2035

Gamma Probe Devices Market Growth - Trends & Forecast 2025 to 2035

Network Probe Market Size and Share Forecast Outlook 2025 to 2035

Electron Probe Microanalyzers (EPMA) Market Size and Share Forecast Outlook 2025 to 2035

Endoscopic Probe Disinfection Market Size and Share Forecast Outlook 2025 to 2035

Machine Tool Touch Probe Market Analysis - Size, Growth, and Forecast 2025 to 2035

Dual Wavelength Raman Probe Market Size and Share Forecast Outlook 2025 to 2035

Single-use Bioprocessing Probes and Sensors Market - Growth & Trends 2024 to 2034

Stationery Product Market Forecast and Outlook 2025 to 2035

Stationary Battery Storage Market Size and Share Forecast Outlook 2025 to 2035

Stationary VRLA Battery Market Size and Share Forecast Outlook 2025 to 2035

Stationary Lead Acid Battery Storage Market Size and Share Forecast Outlook 2025 to 2035

Stationary Lithium-Ion Battery Storage Market Size and Share Forecast Outlook 2025 to 2035

Stationary Flow Battery Storage Market Size and Share Forecast Outlook 2025 to 2035

Stationary Band Saws Market Size and Share Forecast Outlook 2025 to 2035

Stationary Hydrogen Energy Storage Market Size and Share Forecast Outlook 2025 to 2035

Market Share Distribution Among Stationery Product Companies

Substation Monitoring System Market Size and Share Forecast Outlook 2025 to 2035

Substations Market Size and Share Forecast Outlook 2025 to 2035

Substation Automation and Integration Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA