The lightweight automotive body panels market is estimated to reach USD 133.52 billion by 2025. The industry is expected to reach USD 212.52 billion by 2035, growing at a CAGR of 4.75% during the forecast period. This trend shows a growing proportion of the use of lightweight materials in automotive manufacturing, owing to carmakers wishing to observe regulatory standards as well as consumer expectations concerning the sustainable performance of their vehicles.

Lightweight automotive body panels are features lying outside a vehicle: hoods, doors, fenders, roofs, and bumpers. They are manufactured using modern work materials with a view to reducing overall vehicle weight without compromising on strength or safety. These materials mainly include aluminum, carbon fiber reinforced plastics (CFRP), magnesium alloys, and high-strength steel.

These materials help bring down the mass of the vehicle, thus affording better fuel economy and lower emissions of carbon dioxide (CO₂). Adopted by major OEMs across ICE and EV models, lightweight, with a particular focus on sustainability, has now become a major strategy as far as the transportation industry is concerned.

A strong driver is the globally increased momentum for maintaining stringent emission regulations and their concomitant fuel economy standards. In line with this trend, various governments are announcing, implementing, and enforcing different modalities and avenues to curb vehicle emissions that would be responsible for environmental concerns and climate change across North America, Europe, and the Asia-Pacific region.

The pressure on the car industry to conform to such standards is increasing, and ensuring the use of lightweight body panels to achieve this end is perhaps the cheapest and quickest solution. Parallelly, there is a shift towards EVs, which are heavy due to battery packs that need weight reduction in order to maximize driving ranges and enhance overall efficiency.

Beyond performance and comfort, consumer safety is yet another factor holding sway in the hands of automakers with regard to the development of advanced lightweight materials. Today's consumers expect vehicles to be environmentally friendly, agile, responsive, and refined in looks. Lightweight body panels enhance a vehicle's handling, acceleration, and braking with provided design and engineering flexibility. At the same time, lightweight panels help with crashworthiness and safety due to using materials that better absorb impact energy.

The electric vehicle sale is expanding rapidly, which is viewed as another key factor in demand. As EV manufacturers continue to work on improving battery performance and range, one of the key considerations is reducing the weight of the vehicle. Lightweight body panels provide an appropriate answer, offsetting the weight of heavy electric powertrains, enhancing vehicle dynamics, and improving energy efficiency. This has led to a growing demand from EV startups and established car manufacturers to convert to electrification.

The Asia-Pacific region is considered to be the leading industry for lightweight automotive body panels, supported by massive vehicle production in China, Japan, South Korea, and India. The region benefits from strong government support for clean mobility, advanced manufacturing infrastructure, and an ever-growing consumer base. Europe and North America are also other promising areas due to targeted emission laws, technological development, and the presence of major automotive OEMs expanding on lightweight solutions.

Market Metrics

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 133.52 billion |

| Market Value (2035F) | USD 212.52 billion |

| CAGR (2025 to 2035) | 4.75% |

The industry is gaining accelerated momentum as the automotive industry pushes for high fuel efficiency and low emissions and adapts to setting and evolving standards for safety. Such major advances have been made by adopting different materials, including aluminum, carbon fiber composites, high-strength steel, and advanced polymeric materials.

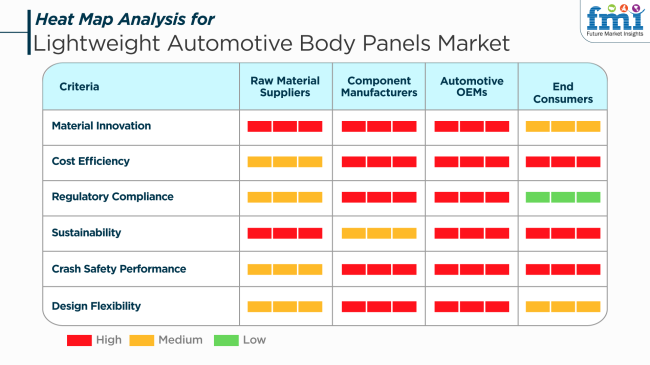

Suppliers of raw materials are at the forefront of innovations in material development and concentrating their efforts on creating stronger, lighter, and recyclable materials (red). Their contributions would be significant to sustainability goals because OEMs increasingly request green solutions.

Component manufacturers act as key intermediaries emphasizing cost efficiency, crash safety, and design flexibility (red). However, they should ensure that lightweight materials are fabricated and assembled without compromising the strength or design parameters of the vehicle.

The most complex priorities set are those of automotive OEMs (Original Equipment Manufacturers). They incorporate regulatory compliance, sustainability, and cost-efficiency, plus crash performance (red), into the overall objective of delivering vehicles that meet all global standards in emissions while satisfying public sentiments for safety and efficiency.

End consumers may not seem to be directly linked to the technical end, but their choices impact trends. End consumers are much inclined towards fuel economy, safety of vehicles, and environmental responsibilities (red), all of which can benefit from the application of lightweight panels.

Shaping factors include global standards for fuel economy, the growth of electric vehicles (EVs), and advocacy for circular economy initiatives. A vehicle body lighter makes the car lighter, giving it a longer range for EVs and higher mileage for conventional vehicles. Hence, automakers and suppliers are making strategic investments in new materials and forming "alliances" to share R&D costs.

From 2020 to 2024, the industry grew substantially due to the automotive sector's emphasis on fuel efficiency and lowering vehicle emissions. The use of materials like aluminum, carbon fiber, and advanced composites has become more common among manufacturers in reducing weight without sacrificing structural integrity. Around the same period, stringent environmental controls also prompted the automakers to invest in lighter solutions to help meet emission regulations.

In the future, from 2025 to 2035, the industry is expected to grow even further with the improved adoption of electric vehicles (EVs) and advances in material science. Increased demand for longer driving ranges in EVs is driving demand for light body panels. Nanotechnology and the development of high-strength, lightweight polymers are expected to transform manufacturing. Furthermore, the integration of smart materials possessing self-healing and energy-absorbing properties is also likely to provide greater safety and performance in cars.

A Comparative Market Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Fuel efficiency and reduction of emissions; compliance with environmental standards. | Increase in the manufacture of electric cars; breakthroughs in material science; vehicle safety and performance focus. |

| Mainly aluminum, carbon fiber, and composites. | Introduction of nanomaterials, high-strength polymers, and smart materials with self-healing capabilities. |

| Use of advanced manufacturing methods such as hydroforming and laser cutting. | Use of nanotechnology; creation of energy-absorbing and self-healing materials; improved recycling processes for sustainability. |

| High cost of production; low recycling possibilities for some composites; weighing the reduction of weight against safety requirements. | Securing cheap mass production of high technology materials, formulating robust recycling infrastructures, and coping with emerging safety and environment standards. |

| Asia-Pacific was led by high automotive production; Europe and North America focused on regulator compliance and taking up technology. | Asia-Pacific dominated further through greater EV uptake; Europe and North America set the pace through material innovation as well as efforts in sustainability. |

It is expected that there will be growth with the rising demand for fuel-efficient and ecological cars. Nevertheless, some notable risks exist that could inhibit growth. Cost fluctuations in raw materials, especially for aluminum, carbon fiber, and advanced composites, are one of the most serious concerns.

Though these materials play an important role in weight reduction, they are much heavier than steel and have higher costs attached. Their prices fluctuate depending on global supply chain dynamics and trade policies. This increases production costs and can affect the profitability of manufacturers.

Another major risk in this segment is the level of investment in capital in the manufacturing processes of lightweight panels. Technologies like advanced molding, bonding, and assembly would require a hefty outlay on technology, and there are barriers imposed against small- and mid-sized enterprises, as the equipment used in these processes is very expensive.

Regulatory risks also arise for the industry because emissions and safety standards differ across various regions, which are themselves frequently updated. This means that a company is bound to invest in research and compliance work over and over again, adding to the operational costs while delaying product development.

Consumer acceptance will also prove to be a hurdle. With increased fuel economy and improved performance, lightweight panels are expected to increase the retail price. This can put off price-sensitive industries, particularly in developing nations. Hence, performance benefits over costs must achieve a perfect balance if consumers are to remain interested.

Another risk comes from the technological integration of lightweight materials into traditional vehicle designs. The engineering effort that goes into meeting crash safety, structural integrity, and comfort (noise and vibration) is materials-intensive. A failure could result in recalls, loss of reputation, and legal liabilities.

Another set of issues comes with the dependency on supply chains, as the industry relies entirely on limited specialized suppliers for critical materials. Disruptions such as political reasons, natural disasters, or bottlenecks in logistics may lead to changes in production timelines and increased costs.

There is pressure from competing innovative alternatives, including new materials and design methods that show improved performance over existing lightweight solutions. The rapid strides of electric vehicles (EVs) emphasized battery mileage and performance, which eventually diverted focus away from body panels to other areas of weight savings.

Thus, despite promising opportunities in the industry, it is fraught with important risks of costs, regulations, technological change, supply chains, and consumer acceptance. Companies operating in this space must remain agile in investing in new ideas and building resilient strategies in the event of a downturn.

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 6.1% |

| UK | 5.0% |

| France | 4.7% |

| Germany | 5.3% |

| Italy | 4.5% |

| South Korea | 5.5% |

| Japan | 4.9% |

| China | 6.8% |

| Australia | 4.2% |

| New Zealand | 3.8% |

The USA is expected to expand at a CAGR of 6.1% during the period from 2025 to 2035. Federal Corporate Average Fuel Economy (CAFE) standards and the expanding EV industry are driving strong demand for lighter vehicle body structures. OEMs are embracing aluminum, thermoplastics, and composite-based panels to attain better performance without compromising safety.

Large automobile producers such as General Motors, Tesla, and Ford are employing light panels in electric and crossover vehicles. Material suppliers such as Alcoa Corporation, Magna International, and Hexcel Corporation have significant roles in the development of advanced materials and structural components that are tailored for mass production.

The UK is set to record a CAGR of 5.0% for lightweight automotive body panel sales during the forecast period. Net-zero initiatives are propelling emission goals, which are convincing automotive producers to adopt lightweight components in hybrid as well as electric platforms. Luxury and performance automobile segments continue dominating the uptake of composite materials.

Original Equipment Manufacturers such as Jaguar Land Rover and Aston Martin are employing aluminum-intensive and CFRP panel solutions to improve aerodynamics and range efficiency. Industry players such as GKN Automotive and Solvay are driving the development of production processes for high-strength, low-weight body structures within the UK manufacturing environment.

France is also forecast to grow at a CAGR of 4.7% in the industry until 2035. National policy to reduce auto emissions and promote electrification is influencing the shift towards lighter body structures. Public-private collaborations are driving R&D for sustainable and recyclable material technologies.

Renault and Peugeot are integrating light panels into EV models in order to increase energy efficiency. Faurecia and Constellium play significant roles in the supply of aluminum body components and fiber-reinforced solutions tailored to French urban driving and highway performance standards.

Germany is likely to reach a CAGR of 5.3% from 2025 to 2035. As a leader in car engineering, the country is particularly interested in material innovation for electric and luxury cars. Light weighting is central to emissions compliance and dynamic performance enhancement across vehicle segments.

Original equipment manufacturers such as BMW, Mercedes-Benz, and Audi are using carbon fiber, magnesium, and high-strength aluminum alloys in body components. Tier-one suppliers such as Thyssenkrupp, SGL Carbon, and Voestalpine are investing in forming and joining technologies for scalable and automated manufacturing of lightweight panels.

Italy is expected to grow at a CAGR of 4.5% during the forecast period. Automakers are moving towards lighter uses of materials to achieve EU-wide emission standards and performance requirements, particularly in the premium and sports vehicle segments.

Fiat, Ferrari, and Maserati are leveraging aluminum and composite mix to develop light panels in their cars for improved speed and handling. Material technology providers such as Adler Group and Dallara Automobili are setting the pace in structural body panel solutions according to rigidity and weight optimization in terms of performance and urban mobility platforms.

South Korea's lightweight automotive body panels market is anticipated to record a CAGR of 5.5% from 2025 to 2035. The domestic EV market growth and increasing fuel efficiency targets are compelling the adoption of advanced materials for application in vehicle production. The focus is on the attainment of cost-efficient lightweight solutions for mass production.

Hyundai and Kia are introducing lightweight panels on electric and plug-in hybrid platforms. Hyundai Mobis, POSCO, and Hanwha Solutions are at the forefront with polymer matrix composites, aluminum stamping, and sandwich panel technology to support next-generation body design.

Japan is likely to record a growth of 4.9% CAGR in lightweight automotive body panels sales over the forecast period. Its automotive industry is centered on the performance of small cars, green regulations, and material efficiency, which encourages regular use of lightweight components in domestic as well as foreign models.

OEMs like Toyota, Honda, and Nissan are using lightweight body panels on hybrid, electric, and kei car platforms to meet safety and economic needs. Prominent suppliers like Toray Industries, Denso Corporation, and UACJ Corporation are concentrating on carbon fiber composites and aluminum solutions for scalable integration into mass-market vehicles.

China is likely to lead growth with an expected CAGR of 6.8% between 2025 and 2035. The world's largest automotive market is rapidly embracing lightweight materials to reduce emissions and improve EV performance. Government policy and customer requirements for range efficiency are the main growth drivers.

Domestic manufacturers such as BYD, NIO, and Geely are incorporating CFRP and aluminum panels into mass-market electric vehicles. Domestic suppliers such as China Zhongwang Holdings and Baosteel Group are increasing advanced materials production capacity to reduce weight without compromising structural performance or scalable manufacturing.

Australia is anticipated to grow at a CAGR of 4.2% through 2035. Although the domestic automotive production base is small, increasing imports of EVs and hybrids with lightweight panels are shaping the demand. Consumer demand for fuel-efficient vehicles is also driving demand.

Exporting to the Australian market, foreign OEMs like Tesla, Toyota, and Hyundai are offering lightweight-integrated vehicles. The aftermarket and auto service industry in Australia is transforming to respond to the repair and maintenance of body pieces based on advanced material with new tools and information.

New Zealand would grow at 3.8% CAGR through the forecast period. There is increasing demand for EV models and fuel-efficient vehicles as a systemic shift towards lower carbon emissions and more sustainable transport. Vehicle value chains with an import orientation dictate the speed of penetration for lightweight panels.

Original Equipment Manufacturers brands such as Mitsubishi, Mazda, and Nissan are providing vehicles with aluminum and thermoplastic panels. Even though the local manufacturing presence is weak, demand is driven by the growing registration of lightweight-equipped vehicles and shifting infrastructure to support the efficient use of cars in urban and rural areas.

In 2025, the industry will be profoundly influenced by the demand for fuel efficiency and lower emissions from vehicles, causing lighter component adoption. Bumpers account for the highest share among all component types at 22%, whereas second comes door panels, sharing close to 20%.

With the ever-increasing demands of stringent safety regulations and penalties for excess front-end weight, without which crashworthiness cannot be compromised, the bumpers' leadership status is boosted. Bumpers are made lightweight by the increasing use of thermoplastics, carbon fiber-reinforced plastics (CFRPs,) and aluminum, making such bumpers structurally sound and providing the necessary boost in fuel efficiency.

Some of the major participants in this space would include Magna International, Plastic Omnium, and Faurecia. For instance, Magna manufactures injection-molded thermoplastic bumpers that combine energy absorption with aerodynamic characteristics, while Plastic Omnium composite bumpers are focused on aesthetics and safety compliance.

Door panels account for 20% of the share. The automotive industry has adopted next-generation materials, including high-strength steels, polypropylene composites, and natural fiber-reinforced plastics, to reduce vehicle mass and increase sustainability.

Tier-1 suppliers Grupo Antolin and Yanfeng Automotive Interiors provide lightweight door modules with integrated functionalities like window regulators, sound insulation, and side-impact protection. BMW employed lightweight door structures in its i-series electric vehicles, while Ford added aluminum-intensive doors in F-150 models to further reduce overall curb weight.

Bumpers and door panels are important areas for improving vehicle efficiency and performance. Growing toxicity and vehicle electrification are compelling OEMs and suppliers to continually innovate in lightweight body panel technologies, making these components paramount to the design of next-generation vehicles.

By vehicle type, the segment shows domination by Light Commercial Vehicles (LCVs), with an industry share of 68%, followed by Heavy Commercial Vehicles (HCVs), accounting for 32%. The difference in share shows an emphasis on fuel efficiency, payload considerations, and emission reduction in distinct segments like urban logistics and last-mile delivery flooded with LCVs.

Increasing demand for lightweight solutions that enhance mileage and reduce operating costs is therefore responsible for the greater share of LCVs. Lightweight body panels, made from materials such as polypropylene composites, aluminum, and advanced thermoplastics, add significant benefits to LCVs like panel vans, pickup trucks, and small delivery vehicles.

Ford (Transit), Renault (Kangoo), and Mercedes-Benz (Sprinter) have thus all adopted lightweight materials for LCV exterior applications to achieve fuel economy targets and environmental standards. Companies such as Gestamp and Thyssenkrupp manufacture stamped aluminum and hot-stamped steel panels for these vehicles, which allow durability to be traded against mass reduction.

Heavy Commercial Vehicles (HCVs) represent a share of 32%. The adoption of lightweight body panels has been relatively slow, taking into account the severely high requirements for structural integrity that extreme load conditions usually require. The advent of such lighter materials as fiber-reinforced plastics and ultra-high-strength steels has opened up the possibility for OEMs to progressively reduce the body panel weight on HCVs while still retaining the required level of safety.

Firms such as Volvo Trucks and Daimler Trucks have begun introducing composite bumpers and side panels, increasing fuel economy and prolonging vehicle life. Suppliers such as Dana Incorporated and Metalsa (USA) are developing modular lightweight components for commercial freight and construction applications.

The adoption of lightweight body panels in both LCVs and HCVs is a signifying step toward an environmental-friendly change in the industry. It is also a key aspect of cost-cutting and complying with global fuel efficiency and emission standards coming into existence.

Developments in composite materials, precision engineering, and sustainable manufacturing impact the industry. Major players, including Gestamp, Magna International, and Plastic Omnium, concentrate on lightweight alloys, high-strength thermoplastic materials, and carbon fiber composites that ultimately improve fuel efficiency and structural integrity. Manufacturers are investing in advanced molding, laser welding, and AI-enabled structural analysis to satisfy growing requests from car manufacturers for a decrease in weight without compromising safety.

Technological differentiation and strategic investments are very important. Plastic Omnium pushes hybrid composite-metal structures as well as thermoplastic panels, while Gestamp emphasizes hot-stamping methods for high-strength steel panels.

Magna International has pioneered the use of length-scale and multi-material design, where advanced bonding methods are vigorously employed to optimize the leverages and strength of the panel. Smaller firms such as AUSTEM and Gordon Auto Body Parts are concerned about cost-effective, lightweight solutions mainly targeted at electric cars.

The rest of the competitive differentiation mainly deals with the ever-growing aspect of material innovations, structural durability, and production automation. Stick Industry Co. Ltd. and FLEX-N-GATE CORPORATION concentrate on plastic injection panels, which are impact-resistant, targeting improved aerodynamics and crashworthiness.

Hwashin and KUANTE AUTO PARTS are focused on incorporating nanocomposites and corrosion-resistant coatings to provide lightweight, durability, and thermal efficiency. The conception of autonomous and electric vehicles is shifting further towards self-healing coatings, smart materials and additively manufactured body panels.

Regional manufacturing expansions and joint ventures also influence the competitive scenario. Leading firms are setting up production hubs locally to meet automotive OEMs while still being cost-efficient. Investing in AI-driven defect detection, precision molding and sustainable materials gives companies a competitive edge in this fast-moving domain.

Market Share Analysis by Company

| Company Name | Market Share (%) |

|---|---|

| Gestamp | 18-22% |

| Magna International Inc. | 15-19% |

| Plastic Omnium | 12-16% |

| FLEX-N-GATE CORPORATION | 10-14% |

| Gordon Auto Body Parts Co. Ltd | 8-12% |

| Combined Others | 25-35% |

| Company Name | Offerings & Activities |

|---|---|

| Gestamp | Hot-stamped steel, aluminum body panels, and structural lightweight solutions. |

| Magna International Inc. | Multi-material panel designs, precision bonding, and high-strength aluminum solutions. |

| Plastic Omnium | Thermoplastic panels, hybrid composites, and impact-resistant body structures. |

| FLEX-N-GATE CORPORATION | Plastic-injected, high-durability body panels and aerodynamic design elements. |

| Gordon Auto Body Parts Co. Ltd | Cost-effective , lightweight panels for mass-market vehicles and electric cars. |

Key Company Insights

Gestamp (18-22%)

Gestamp leads in hot-stamped steel and aluminum lightweight body panels, offering structural durability and impact resistance to meet automotive safety standards.

Magna International Inc. (15-19%)

Magna specializes in multi-material panel integration, precision bonding, and advanced aluminum solutions, improving vehicle aerodynamics and fuel efficiency.

Plastic Omnium (12-16%)

Plastic Omnium develops thermoplastic body panels, hybrid composite-metal structures, and impact-resistant materials, optimizing vehicle lightweighting strategies.

FLEX-N-GATE CORPORATION (10-14%)

FLEX-N-GATE focuses on plastic-injected, high-durability panels, emphasizing crash resistance, aerodynamics, and sustainable manufacturing.

Gordon Auto Body Parts Co. Ltd (8-12%)

Gordon Auto Body Parts provides cost-effective, lightweight solutions for electric and mass-market vehicles, improving production scalability and durability.

Other Key Players

The segmentation is into Metals (High-strength Steel, Magnesium, Aluminum) and Polymers & Composites. (Carbon Fiber Reinforced Plastics, Glass Fiber Reinforced Plastics, Other Polymer & Composite Materials)

The segmentation is into Bumpers, Hoods, Door Panels, Trunk Lids, Roof, and Others.

The segmentation is into Light Commercial Vehicles and Heavy Commercial Vehicles.

The segmentation is into North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, and Middle East and Africa.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Component Type, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Component Type, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Component Type, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Component Type, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 20: Latin America Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Component Type, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Component Type, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 25: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Western Europe Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 28: Western Europe Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 29: Western Europe Market Value (US$ Million) Forecast by Component Type, 2018 to 2033

Table 30: Western Europe Market Volume (Units) Forecast by Component Type, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 32: Western Europe Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 33: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 35: Eastern Europe Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 36: Eastern Europe Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 37: Eastern Europe Market Value (US$ Million) Forecast by Component Type, 2018 to 2033

Table 38: Eastern Europe Market Volume (Units) Forecast by Component Type, 2018 to 2033

Table 39: Eastern Europe Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 40: Eastern Europe Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 41: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: South Asia and Pacific Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 44: South Asia and Pacific Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 45: South Asia and Pacific Market Value (US$ Million) Forecast by Component Type, 2018 to 2033

Table 46: South Asia and Pacific Market Volume (Units) Forecast by Component Type, 2018 to 2033

Table 47: South Asia and Pacific Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 48: South Asia and Pacific Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 49: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 50: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 51: East Asia Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 52: East Asia Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 53: East Asia Market Value (US$ Million) Forecast by Component Type, 2018 to 2033

Table 54: East Asia Market Volume (Units) Forecast by Component Type, 2018 to 2033

Table 55: East Asia Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 56: East Asia Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 57: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 58: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 59: Middle East and Africa Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 60: Middle East and Africa Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 61: Middle East and Africa Market Value (US$ Million) Forecast by Component Type, 2018 to 2033

Table 62: Middle East and Africa Market Volume (Units) Forecast by Component Type, 2018 to 2033

Table 63: Middle East and Africa Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 64: Middle East and Africa Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Component Type, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 10: Global Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Component Type, 2018 to 2033

Figure 14: Global Market Volume (Units) Analysis by Component Type, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Component Type, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Component Type, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 18: Global Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 21: Global Market Attractiveness by Material Type, 2023 to 2033

Figure 22: Global Market Attractiveness by Component Type, 2023 to 2033

Figure 23: Global Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Component Type, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 34: North America Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Component Type, 2018 to 2033

Figure 38: North America Market Volume (Units) Analysis by Component Type, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Component Type, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Component Type, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 42: North America Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 45: North America Market Attractiveness by Material Type, 2023 to 2033

Figure 46: North America Market Attractiveness by Component Type, 2023 to 2033

Figure 47: North America Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Component Type, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 58: Latin America Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Component Type, 2018 to 2033

Figure 62: Latin America Market Volume (Units) Analysis by Component Type, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Component Type, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Component Type, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 66: Latin America Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Material Type, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Component Type, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Western Europe Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 74: Western Europe Market Value (US$ Million) by Component Type, 2023 to 2033

Figure 75: Western Europe Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 76: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 79: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Western Europe Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 82: Western Europe Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 83: Western Europe Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 84: Western Europe Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 85: Western Europe Market Value (US$ Million) Analysis by Component Type, 2018 to 2033

Figure 86: Western Europe Market Volume (Units) Analysis by Component Type, 2018 to 2033

Figure 87: Western Europe Market Value Share (%) and BPS Analysis by Component Type, 2023 to 2033

Figure 88: Western Europe Market Y-o-Y Growth (%) Projections by Component Type, 2023 to 2033

Figure 89: Western Europe Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 90: Western Europe Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 93: Western Europe Market Attractiveness by Material Type, 2023 to 2033

Figure 94: Western Europe Market Attractiveness by Component Type, 2023 to 2033

Figure 95: Western Europe Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 96: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Eastern Europe Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 98: Eastern Europe Market Value (US$ Million) by Component Type, 2023 to 2033

Figure 99: Eastern Europe Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 100: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 103: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Eastern Europe Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 106: Eastern Europe Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by Component Type, 2018 to 2033

Figure 110: Eastern Europe Market Volume (Units) Analysis by Component Type, 2018 to 2033

Figure 111: Eastern Europe Market Value Share (%) and BPS Analysis by Component Type, 2023 to 2033

Figure 112: Eastern Europe Market Y-o-Y Growth (%) Projections by Component Type, 2023 to 2033

Figure 113: Eastern Europe Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 114: Eastern Europe Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 115: Eastern Europe Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 116: Eastern Europe Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 117: Eastern Europe Market Attractiveness by Material Type, 2023 to 2033

Figure 118: Eastern Europe Market Attractiveness by Component Type, 2023 to 2033

Figure 119: Eastern Europe Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 120: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: South Asia and Pacific Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 122: South Asia and Pacific Market Value (US$ Million) by Component Type, 2023 to 2033

Figure 123: South Asia and Pacific Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 124: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 127: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: South Asia and Pacific Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 130: South Asia and Pacific Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 131: South Asia and Pacific Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 132: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 133: South Asia and Pacific Market Value (US$ Million) Analysis by Component Type, 2018 to 2033

Figure 134: South Asia and Pacific Market Volume (Units) Analysis by Component Type, 2018 to 2033

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by Component Type, 2023 to 2033

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Component Type, 2023 to 2033

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 138: South Asia and Pacific Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 139: South Asia and Pacific Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 140: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 141: South Asia and Pacific Market Attractiveness by Material Type, 2023 to 2033

Figure 142: South Asia and Pacific Market Attractiveness by Component Type, 2023 to 2033

Figure 143: South Asia and Pacific Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 144: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 145: East Asia Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 146: East Asia Market Value (US$ Million) by Component Type, 2023 to 2033

Figure 147: East Asia Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 148: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 149: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 150: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 151: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 152: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 153: East Asia Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 154: East Asia Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 155: East Asia Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 156: East Asia Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 157: East Asia Market Value (US$ Million) Analysis by Component Type, 2018 to 2033

Figure 158: East Asia Market Volume (Units) Analysis by Component Type, 2018 to 2033

Figure 159: East Asia Market Value Share (%) and BPS Analysis by Component Type, 2023 to 2033

Figure 160: East Asia Market Y-o-Y Growth (%) Projections by Component Type, 2023 to 2033

Figure 161: East Asia Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 162: East Asia Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 163: East Asia Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 165: East Asia Market Attractiveness by Material Type, 2023 to 2033

Figure 166: East Asia Market Attractiveness by Component Type, 2023 to 2033

Figure 167: East Asia Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 168: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 169: Middle East and Africa Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 170: Middle East and Africa Market Value (US$ Million) by Component Type, 2023 to 2033

Figure 171: Middle East and Africa Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 172: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 173: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 174: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 175: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 176: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 177: Middle East and Africa Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 178: Middle East and Africa Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 179: Middle East and Africa Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 180: Middle East and Africa Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by Component Type, 2018 to 2033

Figure 182: Middle East and Africa Market Volume (Units) Analysis by Component Type, 2018 to 2033

Figure 183: Middle East and Africa Market Value Share (%) and BPS Analysis by Component Type, 2023 to 2033

Figure 184: Middle East and Africa Market Y-o-Y Growth (%) Projections by Component Type, 2023 to 2033

Figure 185: Middle East and Africa Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 186: Middle East and Africa Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 187: Middle East and Africa Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 188: Middle East and Africa Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 189: Middle East and Africa Market Attractiveness by Material Type, 2023 to 2033

Figure 190: Middle East and Africa Market Attractiveness by Component Type, 2023 to 2033

Figure 191: Middle East and Africa Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 192: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

The lightweight automotive body panels market is estimated to be worth USD 133.52 billion in 2025.

By 2035, the market is projected to grow to USD 212.52 billion, driven by the rising demand for fuel efficiency and lightweight vehicle designs.

China leads with a projected CAGR of 6.8%, supported by its robust automotive manufacturing infrastructure.

Bumpers are the most prominent product type, offering critical weight reduction benefits without compromising safety.

Key players include Gestamp, Magna International Inc., Plastic Omnium, FLEX-N-GATE CORPORATION, Gordon Auto Body Parts Co. Ltd., AUSTEM COMPANY LTD., Stick Industry Co. Ltd., Changshu Huiyi Mechanical & Electrical Co. Ltd., KUANTE AUTO PARTS MANUFACTURE CO. LIMITED, and Hwashin.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.