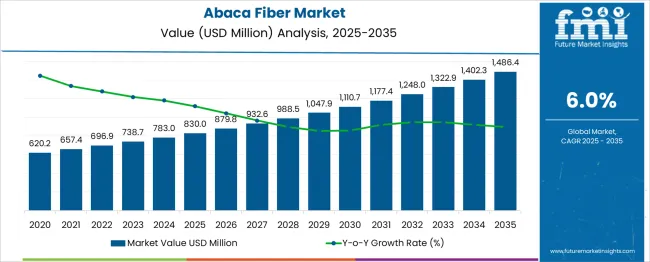

The Abaca Fiber Market is estimated to be valued at USD 830.0 million in 2025 and is projected to reach USD 1486.4 million by 2035, registering a compound annual growth rate (CAGR) of 6.0% over the forecast period. A peak-to-trough analysis based on extended data reveals that the market value in 2020 stood at USD 620.2 million, representing the baseline before sustained growth. Following this, the market experienced consistent growth, rising to USD 657.4 million in 2021, USD 696.9 million in 2022, and USD 738.7 million in 2023, indicating gradual adoption and increasing demand for abaca fiber products.

By 2024, the market further increased to USD 783.0 million, setting a strong foundation for the forecast period beginning in 2025. The peak projected for 2035 is USD 1,486.4 million, marking a total increase of USD 866.2 million from the 2020 value and demonstrating a growth multiplier of approximately 2.4 times over the 15-year span. The initial half of the forecast period, from 2020 to 2027, contributes USD 360.6 million to this growth, while the latter half adds USD 505.6 million, reflecting a back-weighted growth trajectory. This pattern is driven by rising demand for natural fibers in textiles, paper products, and industrial applications, increasing environmental awareness favoring biodegradable materials, and advancements in fiber extraction and processing technologies. Manufacturers focusing on sustainable sourcing, quality enhancement, and expanding end-use industries are expected to capitalize on this growing market opportunity.

| Metric | Value |

|---|---|

| Abaca Fiber Market Estimated Value in (2025 E) | USD 830.0 million |

| Abaca Fiber Market Forecast Value in (2035 F) | USD 1486.4 million |

| Forecast CAGR (2025 to 2035) | 6.0% |

The abaca fiber market is gaining traction due to its biodegradability, high tensile strength, and increased global focus on sustainable material alternatives. Industries are turning to abaca fiber as a viable replacement for synthetic fibers in various applications, particularly in sectors sensitive to environmental regulations.

Its use in paper production, especially in specialty and security paper, has expanded steadily as demand for eco-friendly and high-strength materials has intensified. Additionally, technological advancements in fiber extraction and processing have enhanced consistency in fiber grades, further supporting its industrial adaptability.

As regulatory bodies and manufacturers place greater emphasis on plastic substitutes, abaca is anticipated to play a critical role in the bio-based economy across both developed and emerging markets.

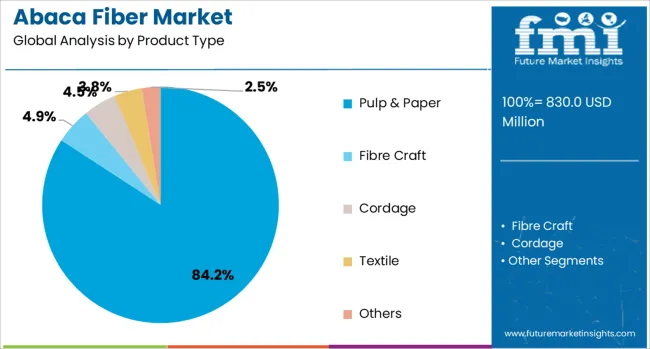

The abaca fiber market is segmented by product type (fiber grade) and geographic regions. By product type, the abaca fiber market is divided into Pulp & Paper, Fibre Craft, Cordage, Textile, and others. The abaca fiber market is classified by type (fiber grade) into Fine Abaca Fiber and Rough Abaca Fiber. Regionally, the abaca fiber industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The pulp & paper segment is projected to contribute 84.2% of the total revenue in the abaca fiber market by 2025, making it the dominant product type. The growth of this segment has been driven by abaca's superior strength, long fiber length, and resistance to saltwater damage, making it especially suited for high-grade paper production.

Its wide adoption in manufacturing currency paper, filter paper, and other specialty paper products is reflective of increased demand from government and commercial institutions seeking sustainable alternatives. Rising awareness regarding non-wood fibers and the resurgence of traditional paper applications have reinforced this segment's market position.

Furthermore, abaca’s ability to blend with other cellulose-based fibers adds to its functional value in paper manufacturing.

.webp)

Fine abaca fiber is expected to account for 62.3% of the overall market share in 2025, establishing it as the leading fiber grade. This dominance stems from its high tensile strength, smooth texture, and superior fineness, which make it especially desirable in premium-grade applications such as security papers and specialty textiles.

The segment’s expansion has also been encouraged by innovations in fiber sorting and refinement technologies, which have allowed for more consistent fiber quality and reduced processing time. Increasing use of fine abaca in biodegradable composites and green packaging solutions has further added to demand.

With manufacturers prioritizing fibers that offer both performance and environmental compatibility, fine abaca is expected to remain the preferred grade in the years ahead.

The abaca fiber market is expanding across specialty paper, marine cordage, automotive composites, and luxury goods. Its durability, tensile strength, and versatility are ensuring consistent growth in both industrial and high-value consumer applications worldwide.

The abaca fiber market is experiencing strong demand in specialty paper and pulp industries, particularly for products such as tea bags, filter papers, and currency notes. Its exceptional tensile strength, long fiber length, and resistance to tearing make it a preferred choice where synthetic alternatives cannot deliver comparable performance. Expansion in banknote production, coupled with the need for high-grade filter materials in industrial and consumer applications, is fueling market growth. Increasing use in premium stationery and archival-quality documents adds to its appeal. Manufacturers are focusing on refining fiber processing techniques to improve uniformity and quality, which in turn strengthens supply chain reliability for paper and pulp producers.

Marine and cordage applications continue to drive abaca fiber consumption due to its natural resistance to saltwater and decay. This makes it highly suitable for manufacturing ropes, hawsers, and nets used in shipping, fishing, and offshore construction sectors. The fiber’s ability to maintain structural integrity under prolonged exposure to moisture offers significant advantages over synthetic alternatives in specific marine conditions. Growth in global shipping activities and fishing exports in Southeast Asia is expanding demand. Manufacturers are also diversifying cordage products for both heavy-duty industrial applications and decorative uses in architectural projects, reinforcing abaca’s versatility across functional and aesthetic purposes.

Abaca fiber is gaining traction in the automotive and composite manufacturing sectors, driven by its lightweight structure and high tensile strength. It is increasingly incorporated into car interior panels, seat structures, and reinforcement components, enhancing strength-to-weight ratios. The fiber’s compatibility with polymer matrices allows manufacturers to create durable composite materials suitable for various engineering applications. Rising production of electric and hybrid vehicles is creating additional demand for lightweight components, where abaca-based composites offer performance and environmental benefits. Collaborative research between automakers and fiber processors is accelerating the development of standardized abaca-reinforced parts for commercial-scale production.

The fashion and home décor industries are increasingly adopting abaca fiber for luxury handbags, footwear, rugs, and furniture elements. Its unique texture and natural sheen provide a distinctive aesthetic that appeals to premium consumers. Designers are leveraging its durability for products that combine style with long-term usability. Expansion in artisanal crafts and the revival of traditional weaving techniques are adding cultural value to abaca-based goods. Export-oriented manufacturers are tapping into niche markets in Europe and North America, where natural fiber-based luxury items are in high demand. Collaborations between local artisans and international fashion houses support this segment’s growth.

| Country | CAGR |

|---|---|

| China | 8.1% |

| India | 7.5% |

| Germany | 6.9% |

| France | 6.3% |

| UK | 5.7% |

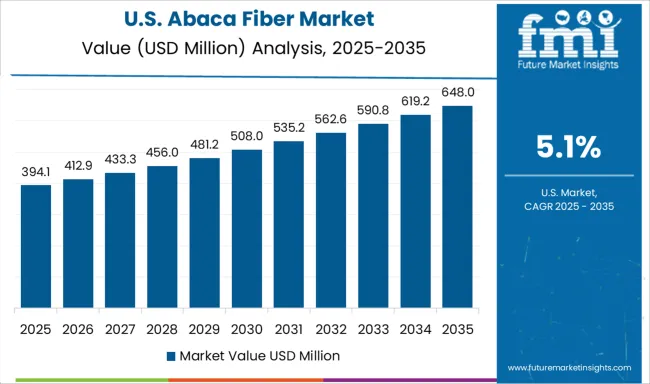

| USA | 5.1% |

| Brazil | 4.5% |

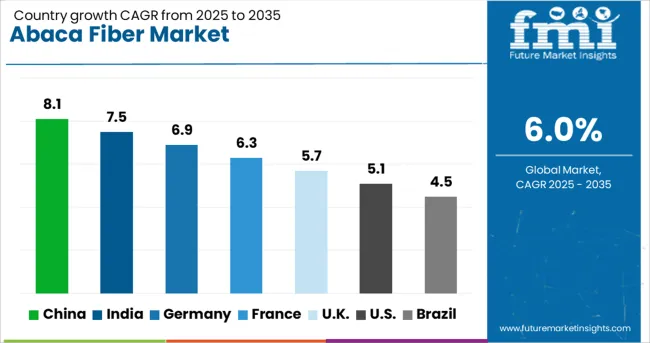

The abaca fiber market is projected to grow globally at a CAGR of 6.0% between 2025 and 2035, supported by rising demand in specialty paper, marine cordage, automotive composites, and premium home décor products. China leads with a CAGR of 8.1%, driven by expansion in specialty paper production, government-backed industrial projects, and increasing exports of abaca-based marine ropes. India follows at 7.5%, fueled by growing applications in industrial textiles, artisanal crafts, and the automotive sector. Germany posts 6.9%, benefiting from its advanced automotive manufacturing base and growing demand for high-strength natural fiber composites. The United Kingdom records 5.7%, with rising adoption in home décor, artisanal weaving, and industrial cordage. The United States stands at 5.1%, influenced by demand from specialty paper mills, eco-friendly product manufacturers, and composite material producers. The analysis covers more than 40 countries, with these five serving as key benchmarks for product innovation, export strategies, and market expansion opportunities shaping the future of the abaca fiber industry globally.

China is expected to post a CAGR of 8.1% for 2025–2035, rising from about 7.0% during 2020–2024, which is higher than the global average of 6.0%. The improvement in growth rate is linked to the scaling of specialty paper production, expanded export contracts for marine cordage, and increased investments in eco-friendly fiber applications. In the earlier phase, demand was mainly supported by traditional rope and textile manufacturing. Post-2024, the shift toward high-strength automotive composites, premium home décor, and industrial filtration materials is driving market acceleration. Supportive trade policies and targeted R&D in fiber processing continue to enhance China’s competitive standing.

India is projected to register a CAGR of 7.5% for 2025–2035, increasing from nearly 6.6% in 2020–2024, showing steady upward momentum. The growth shift is driven by expanding use of abaca in industrial textiles, packaging materials, and artisanal craft exports. Earlier, the market was largely dependent on small-scale rope and mat production. Post-2024, rising automotive sector demand for natural fiber composites, coupled with export-oriented policies, is amplifying opportunities. Collaboration between local producers and international buyers is fostering quality improvements, while state-level initiatives are encouraging diversified fiber applications in home décor and eco-friendly industrial goods.

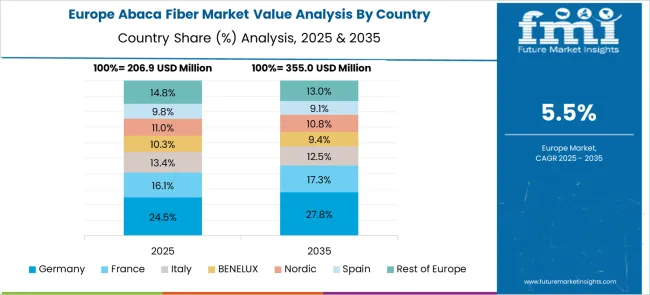

Germany is anticipated to grow at a CAGR of 6.9% for 2025–2035, up from roughly 5.8% during 2020–2024, reflecting the country’s shift toward advanced manufacturing applications. The earlier period’s growth came mainly from niche uses in packaging and specialty paper. Post-2024, higher demand from the automotive and renewable energy sectors for durable natural composites is driving expansion. German manufacturers are investing in precision processing methods to enhance fiber quality for industrial-grade applications. Increased collaborations with Southeast Asian suppliers are ensuring stable raw material flows, supporting both domestic production and re-export opportunities.

The United Kingdom is expected to post a CAGR of 5.7% for 2025–2035, compared to about 4.8% in 2020–2024, marking a measured but steady rise. The earlier period’s growth was driven by artisanal crafts, small-scale packaging, and marine rope applications. After 2024, demand has expanded into premium furniture, eco-conscious packaging, and niche home décor segments. Import partnerships with Southeast Asian producers have strengthened market resilience against raw material shortages. Efforts by local manufacturers to blend abaca with other natural fibers are also creating innovative product lines for both domestic and export markets.

The United States is forecast to grow at a CAGR of 5.1% during 2025–2035, rising from approximately 4.4% in 2020–2024, signaling steady improvement. Earlier growth was centered on specialty paper mills and marine industries. Post-2024, market expansion is supported by the use of abaca in automotive interiors, biodegradable packaging, and industrial filtration. Strengthening supply chains from the Philippines and Ecuador has helped maintain consistent fiber availability. Large-scale retailers are increasingly sourcing abaca-based home décor and utility products, while R&D in composite manufacturing is opening new industrial applications.

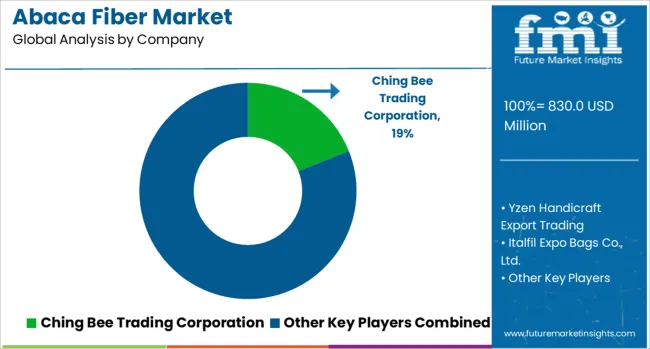

The abaca fiber market is led by established producers and exporters such as Ching Bee Trading Corporation, Yzen Handicraft Export Trading, Italfil Expo Bags Co., Ltd., Selinrail International Trading, MAP Enterprises, Fiber World, and Tag Fibers, Inc., each competing on fiber quality, processing capabilities, and export reliability. Ching Bee Trading Corporation maintains a strong foothold in premium-grade fiber supply, catering to specialty paper and marine cordage manufacturers worldwide. Yzen Handicraft Export Trading focuses on artisan-grade fiber for handicrafts, décor, and bespoke rope applications, targeting niche retail and boutique markets. Italfil Expo Bags Co., Ltd. specializes in eco-friendly abaca-based bag production, serving both fashion and packaging sectors with customizable, export-ready designs.

Selinrail International Trading operates as a diversified exporter, balancing bulk industrial fiber shipments with finished goods production for the global market. MAP Enterprises has built a reputation for consistent supply to industrial composite and specialty textile manufacturers. Fiber World focuses on value-added processing, producing fiber with uniform length and strength specifications for demanding industrial clients. Tag Fibers, Inc. emphasizes supply chain reliability, ensuring timely delivery to North America, Europe, and East Asia through long-term supplier agreements. The competitive environment is shaped by increasing demand from specialty paper mills, automotive composite manufacturers, and eco-conscious packaging companies. Strategies among these players include vertical integration of farming and processing, investment in fiber treatment technology for higher durability, and expansion into blended fiber applications. Partnerships with downstream manufacturers, diversification into higher-margin finished goods, and adherence to strict international quality standards are also central to maintaining competitiveness. Future positioning will depend on the ability to meet growing global demand while ensuring scalability, consistency, and compliance with export market regulations.

Recent DevelopmentIn 2024 and 2025, growth in the abaca fiber market will be driven by strategies focused on expanding production capacity in the Philippines and Ecuador, strengthening export networks, and targeting premium textile, automotive, and specialty paper sectors. Investments in mechanized processing and farmer training programs aim to improve fiber yield and quality. Strategic partnerships with global rope, pulp, and eco-packaging manufacturers are enhancing long-term supply contracts. Diversification into biodegradable composite materials is opening new revenue streams, while government-backed incentives and trade agreements are fostering wider market penetration in Europe, North America, and East Asia.

| Item | Value |

|---|---|

| Quantitative Units | USD 830.0 Million |

| Product Type | Pulp & Paper, Fibre Craft, Cordage, Textile, and Others |

| Type (Fiber Grade) | Fine Abaca Fiber and Rough Abaca Fiber |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Ching Bee Trading Corporation, Yzen Handicraft Export Trading, Italfil Expo Bags Co., Ltd., Selinrail International Trading, MAP Enterprises, Fiber World, and Tag Fibers, Inc. |

| Additional Attributes | Dollar sales, share, regional demand trends, pricing analysis, supply chain structure, key end-use industries, export-import flows, competitor strategies, capacity expansions, and government policy impacts. |

The global abaca fiber market is estimated to be valued at USD 830.0 million in 2025.

The market size for the abaca fiber market is projected to reach USD 1,486.4 million by 2035.

The abaca fiber market is expected to grow at a 6.0% CAGR between 2025 and 2035.

The key product types in abaca fiber market are pulp & paper, fibre craft, cordage, textile and others.

In terms of type (fiber grade), fine abaca fiber segment to command 62.3% share in the abaca fiber market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA