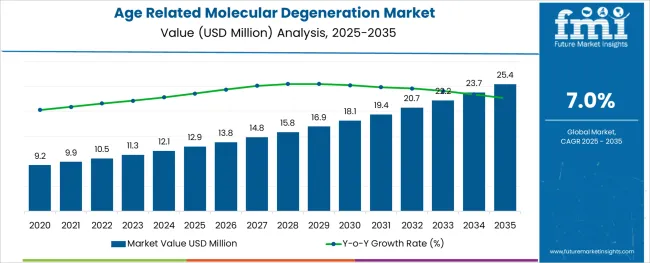

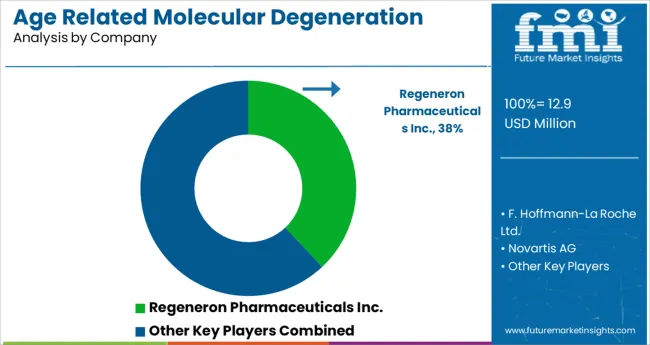

The Age Related Molecular Degeneration Market is estimated to be valued at USD 12.9 million in 2025 and is projected to reach USD 25.4 million by 2035, registering a compound annual growth rate (CAGR) of 7.0% over the forecast period.

The age related molecular degeneration market is undergoing notable growth driven by rising prevalence of age associated ocular disorders and increasing access to advanced therapeutics. Advances in biologics and targeted therapies are enhancing patient outcomes and extending treatment options, which is reshaping patient management strategies.

Growing awareness among patients and physicians coupled with improvements in diagnostic capabilities is contributing to early detection and timely intervention. Future market expansion is expected to be supported by ongoing clinical research into novel treatment modalities, biosimilar adoption, and improved reimbursement frameworks.

The integration of personalized medicine approaches and innovations in drug delivery systems are further paving the way for improved efficacy, patient adherence, and market sustainability. Strategic collaborations between pharmaceutical companies and healthcare providers continue to strengthen treatment accessibility and optimize resource utilization.

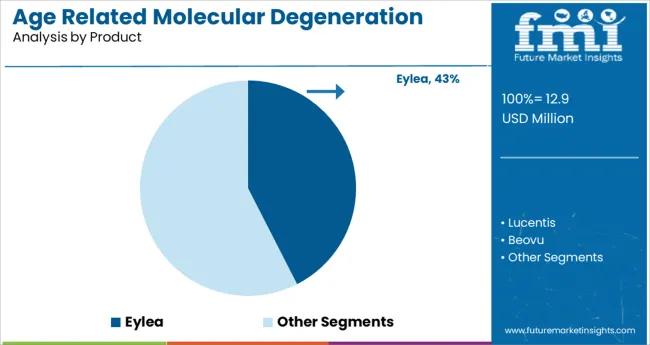

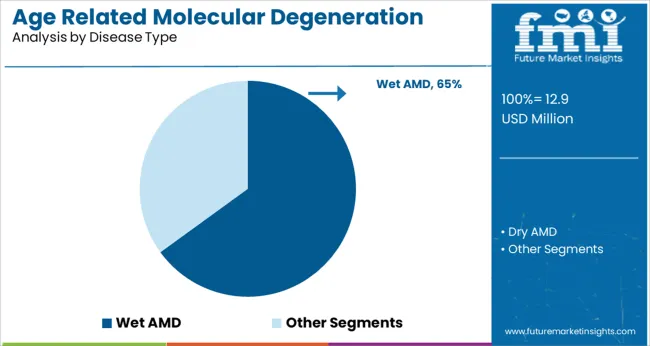

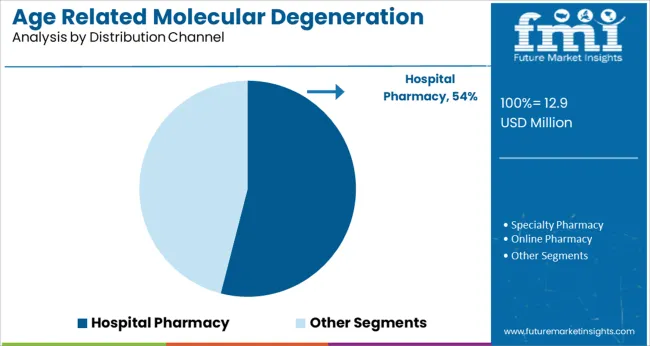

The market is segmented by Product, Disease Type, and Distribution Channel and region. By Product, the market is divided into Eylea, Lucentis, Beovu, and Others. In terms of Disease Type, the market is classified into Wet AMD and Dry AMD. Based on Distribution Channel, the market is segmented into Hospital Pharmacy, Specialty Pharmacy, and Online Pharmacy. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by product, Eylea is projected to hold 42.5% of the total market revenue in 2025, positioning itself as the leading product. This leadership is attributed to its demonstrated clinical efficacy, favorable safety profile, and widespread physician preference in managing age related molecular degeneration.

Its ability to deliver sustained improvements in visual acuity with relatively fewer injections has enhanced patient adherence and satisfaction. Competitive advantages have also been reinforced through established prescribing familiarity and robust distribution networks that ensure consistent availability.

Innovations in administration techniques and extended dosing intervals have further supported its continued adoption in diverse clinical settings. The combination of clinical effectiveness, operational convenience, and established market trust has sustained Eylea’s prominence in this therapeutic landscape.

In terms of disease type, wet AMD is expected to account for 65.0% of the market revenue in 2025, maintaining its position as the dominant segment. This prominence is driven by the higher clinical burden and faster progression of wet AMD compared to other forms, necessitating prompt and effective intervention.

Advances in imaging and diagnostic modalities have improved detection rates and facilitated timely treatment initiation for wet AMD patients. Therapeutic focus has been concentrated on this segment given its significant impact on vision and quality of life, which has catalyzed investment in research and development of more targeted therapies.

The availability of multiple effective biologics and growing awareness of the importance of early treatment have reinforced the strong adoption of therapies for wet AMD, securing its leadership in the market.

When segmented by distribution channel, hospital pharmacy is projected to capture 54.0% of the market revenue in 2025, establishing itself as the leading channel. This dominance is supported by the preference for administering advanced biologics in controlled clinical environments under specialist supervision.

The complex storage and handling requirements of age related molecular degeneration therapies have further anchored hospital pharmacies as the primary point of distribution. Centralized hospital settings ensure better compliance monitoring, immediate management of adverse events, and alignment with institutional treatment protocols, all of which enhance therapeutic outcomes.

Strong coordination between hospital-based ophthalmologists and pharmacy services has streamlined the dispensing process, reduced logistical inefficiencies, and maintained high standards of care, reinforcing the hospital pharmacy segment’s leading position.

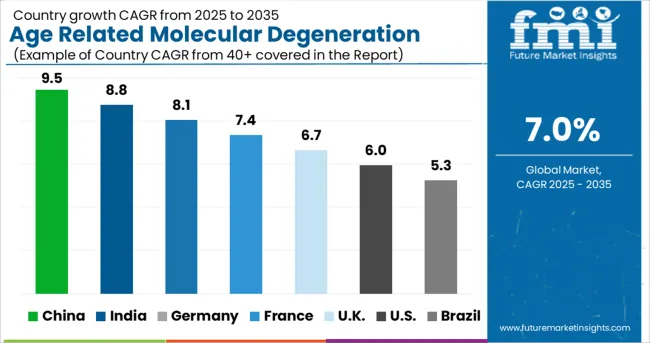

The age-related molecular degeneration market is expected to gain market growth in the forecast period of 2025 to 2035. Latest market analysis by FMI the market is to grow at a CAGR of 7% in the above-mentioned forecast period.

Older people are at greater risk of eye disorders, and hence, globally, the increasing aged population is further expected to generate traction for the age-related molecular degeneration market over the forecast period of 2025 to 2035. Moreover, manufacturers are generating awareness about eye health through age-specific advertisements and awareness drives.

AMD is characterized by progressive degeneration of the macula, the central part of the retina, leading to central vision loss. AMD can be classified as early, intermediate, or late based on its clinical features, including drusen, pigmentation abnormalities, atrophy of the retinal pigment epithelium (RPE), and exudative choroidal neovascularization (CNV).

Molecular degeneration has seen a substantial rise in incidence over the past years and this has led to an increase in eye treatment demand, and this trend is expected to be prevalent over the coming years as well. The global age-related molecular degeneration market rose at a CAGR of 6.4% from 2020 to 2025.

The rising Growth of the Older Age Population and The Increasing Number of AMD Patients Will Contribute to Market Growth

Age-related macular degeneration disease is happening to the increasing geriatric population, and the numerous cases of the condition are raising the demand for treatment.

The rising geriatric population is one of the major factors driving the age-related molecular degeneration industry potential. For instance, according to WHO by 2035, 12.1 in 6 people in the world will be aged 60 years or over. At this time the share of the population aged 60 years and over will increase from 12.1 billion in 2024 to 12.1.4 billion.

According to a research article published in 2024, around 12.170 million people are affected by AMD around the world. In the US, the prevalence of AMD cases is about 12.112.1 million. These data show that there is an immense need for medicines for the treatment of the condition, which eventually prompts the expansion of the age-related macular degeneration market size during the forecast period.

Increased Spending On Research & Development Drives the Age-Related Molecular Degeneration Market

Constant research & development are evident in the healthcare industry and this is common for eye disease and diagnosis as well. Wet AMD infections have been a major cause of concern as they account for a significant amount of total age-related molecular degeneration in the world.

The increasing number of individuals with retinal disorders is directly proportional to market growth. Thus, the increasing burden of such disorders is driving the demand for macular degeneration treatment which is further contributing to market growth.

Also, the increasing research and development (R&D) investments and rising approvals for new drugs are other major factors for the market growth.

Lack of Awareness Regarding the Disorder May Hamper the Growth

Despite a positive growth trajectory, the global age-related molecular degeneration market is facing various challenges that are likely to pose a threat to its growth during the forecast period.

Some of these factors are a lack of awareness about molecular degeneration and poor availability of certain products across emerging economies. Also, the ignorance of the effects of infections and the lack of inclination towards taking proper treatments may hamper the market growth.

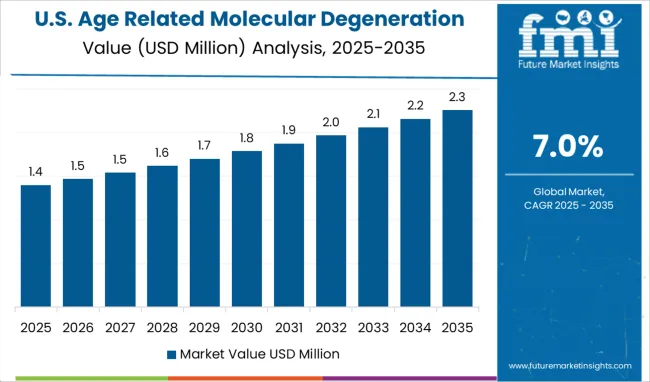

Booming Eyecare Products Market and Rising Investments in Research and Development Driving Growth in the USA Market

The USA is estimated to account for over 50.6% of the North American age-related molecular degeneration market in 2025. The growth of the market in the region is attributed to the increasing prevalence of AMD.

The rising prevalence of dry eye syndrome, and the presence of leading pharmaceutical manufacturers, are some of the factors driving demand in the USA market.

For instance, according to the Centre for Disease Control, the number of AMD cases in older Americans is projected to nearly double from 48 million to 88 million in 2050.

An increase in government initiatives, the number of research partnerships, and the presence of the key market players, coupled with recent product launches, are anticipated to boost the growth of the market in the North American region

For instance, in April 2020 - Novartis announced that the US Food and Drug Administration (FDA) accepted the company's Biologics License Application (BLA) for brolucizumab (RTH258) for the treatment of wet age-related macular degeneration (AMD), also known as neovascular AMD, or nAMD.

Increase in Significant Research and Development Investments in Healthcare to Boost the Market Growth

The Europe age-related molecular degeneration market is expected to rise at a CAGR of 6.7% from 2025 to 2035. Europe is the second-largest shareholder in the market, mainly due to the growing political support and favorable reimbursement regulations for medical services.

Increasing ophthalmological disorders in the region to boost the market growth in Europe. The large presence of pharmaceutical companies and growing aging populations are driving the demand in Germany.

For instance, in February 2024 - Novartis today announced the European Commission (EC) has approved Beovu® (brolucizumab) injection for the treatment of wet age-related macular degeneration (AMD). Beovu is the first EC-approved anti-VEGF treatment to demonstrate superior resolution of retinal fluid (IRF/SRF), a key marker of disease activity, versus aflibercept (secondary endpoints)1,5. Beovu also offers the ability to start eligible wet AMD patients on a three-month dosing interval immediately after the loading phase.

Rapid development in pharmaceuticals to drive the market growth in Asia Pacific

Asia Pacific is likely to dominate the age-related molecular degeneration market owing to the high geriatric population and increasing disease burden in economies such as India, China, and South Korea.

Asia-Pacific is expected to deliver impressive outcomes in the global age-related molecular degeneration market. A large amount of investment, significant government meddling in the healthcare sector, and significant development in the developing economy all contribute to supporting the affordability of costly anti-VEGF products and may contribute to the market growth

Advancements in healthcare infrastructure, rising government spending on healthcare policies, and the presence of important members in Asia Pacific all contribute to the growth of the global age-related molecular degeneration market.

The wet AMD Segment remains dominant among other types

The wet AMD segment dominated the market in 2025 with a revenue share of 100%. AMD accounts for more than 10-15% of macular degeneration-related vision loss cases across the globe. Lucentis, Eylea, and Beovu are the major drugs approved for the treatment of wet age-related macular degeneration. Novartis’ Beovu, a long-acting anti-VEGF, was approved by the USA FDA in October 2020. However, the unfavorable side effects of this drug, such as retinal vasculitis, will limit its broader uptake.

Dry AMD is anticipated to witness the fastest growth over the forecast period owing to the expected launch of promising product candidates by 2025 and the disease burden of dry AMD. Dry AMD accounts for 85-90% of all macular degeneration cases. The management of dry macular degeneration is currently limited to vitamin formulations. Availability of various novel therapeutic options for its treatment currently in the clinical pipeline such as Luminate, Zimura, and Intravitreal pegcetacoplan. The approval of these potential candidates may fuel the growth of the dry AMD segment in the coming years.

Hospital Pharmacies dominated the market

The hospital pharmacy segment dominated the global market in 2025 with a revenue share of over 55.0%. The growth of the segment is attributed to the increasing prevalence of age-related macular degeneration (AMD) and hospitalization for treatment.

According to the Royal National Institute of Blind People (RNIB), around 12.1 million people were at high risk of developing age-related macular degeneration (AMD) in 2024. The majority of patients are treated by using various medications such as Lucentis, Eylea, and Beovu, which are administrated intravenously under the supervision of experienced physicians in hospitals. This growing demand for AMD treatment is anticipated to increase hospital visits, thereby driving the market.

How do New Entrants Contribute to the Age-Related Molecular Degeneration Market?

With technological innovations happening at a rapid pace, and companies looking for ways to increase customer engagement, start-ups are taking all possible steps to establish a name for themselves in the age-related molecular degeneration market.

Some of the start-ups in the age-related molecular degeneration market include-

F. Hoffmann-La Roche Ltd., Novartis AG, Bayer AG, Pfizer Inc., Bausch Health Companies Inc., Regeneron Pharmaceuticals Inc., Amgen Inc., Biogen, Samsung Bioepis, Ophthotech Corporation are some of the key players in the age-related molecular degeneration industry.

The manufacturers are involved in the production of age-related molecular degeneration in a larger capacity. Research and innovation are also conducted to launch innovative products for age-related molecular degeneration.

Also, some of the key players are acquiring small pharmaceutical companies to increase their production capacity. Suppliers are focusing on expanding their market presence across the world by initiating new product launches and boosting sales. Approval for new medications and treatments for eye infections is also expected to be a major trend over the coming years.

| Report Attribute | Details |

|---|---|

| Growth Rate | CAGR from 2025 to 2035 |

| Expected Market Value (2025) | USD 12.9 million |

| ProjectedForecast Value (2035) | USD 25.4 million |

| Base Year for Estimation | 2025 |

| Historical Data | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in million & CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive L&scape, Growth Factors, Trends & Pricing Analysis |

| Segments Covered | Product Type, Disease Type, Distribution Channel, Regions |

| Regions Covered | North America; Latin America; Europe; Asia Pacific; Middle East and Africa (MEA) |

| Key Countries Profiled | USA, Canada, Brazil, Mexico, Germany, UK, France, Spain, Italy, India, Malaysia, Singapore, Thailand, Australia, New Zealand, China, Japan, South Korea, GCC Countries, South Africa, Israel |

| Key Companies Profiled | F. Hoffmann-La Roche Ltd.; Novartis AG; Bayer AG; Pfizer Inc.; Bausch Health Companies Inc.; Regeneron Pharmaceuticals Inc.; Amgen Inc.; Biogen; Samsung Bioepis; Ophthotech Corporation |

| Customization | Available Upon Request |

The global age related molecular degeneration market is estimated to be valued at USD 12.9 million in 2025.

It is projected to reach USD 25.4 million by 2035.

The market is expected to grow at a 7.0% CAGR between 2025 and 2035.

The key product types are eylea, lucentis, beovu and others.

wet amd segment is expected to dominate with a 65.0% industry share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Age-Defying Night Creams Market Analysis - Size and Share Forecast Outlook 2025 to 2035

AI-Driven Agent-Based Modeling – Predictive Insights & Analysis

Age Related Vision Dysfunction Market Size and Share Forecast Outlook 2025 to 2035

Sage Extract Market Size and Share Forecast Outlook 2025 to 2035

Sage Essential Oil Market Analysis by Source, Application, Distribution Channel, and Region Through 2035

Lager Market Trends - Brewing Innovations & Consumer Demand 2025 to 2035

Image-Guided Injectables Market Forecast and Outlook 2025 to 2035

Image Guided Radiotherapy Market Size and Share Forecast Outlook 2025 to 2035

Phage MuA Transposase Market Size and Share Forecast Outlook 2025 to 2035

Image Recognition in Retail Market Size and Share Forecast Outlook 2025 to 2035

Image Intensifier Market Analysis - Size, Share & Forecast Outlook 2025 to 2035

Reagent Bottle Market Growth & Industry Forecast 2025 to 2035

Image Guided Systems Market is segmented by product type, application and end user from 2025 to 2035

Reagent Filling Systems Market Analysis – Growth & Forecast 2024-2034

Imagery Analytics Market Analysis – Growth & Forecast through 2034

Image Sensors Market Growth – Trends & Forecast through 2034

Image Based Barcode Reader Market Growth – Trends & Forecast 2020-2030

Image-Based Cytometer Market

Garage Equipment Market Forecast and Outlook 2025 to 2035

Silage Additive Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA