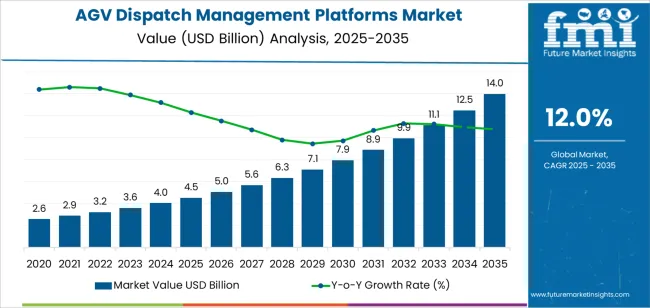

The global AGV dispatch management platforms market is projected to reach USD 13.9 billion by 2035, recording an absolute increase of USD 9,415.2 million over the forecast period. The market is valued at USD 4.5 billion in 2025 and is set to rise at a CAGR of 12.0% during the assessment period. The overall market size is expected to grow by nearly 3.1 times during the same period, supported by increasing demand for warehouse automation solutions worldwide, driving demand for efficient intelligent logistics management systems and increasing investments in smart manufacturing transformation and Industry 4.0 implementation projects globally. However, integration complexity with legacy systems and cybersecurity concerns may pose challenges to market expansion.

The market expansion reflects fundamental shifts in logistics and manufacturing operations, where AGV dispatch management platforms enable facilities to achieve superior operational efficiency and material handling optimization while reducing labor costs and minimizing human error. Distribution centers, manufacturing plants, and logistics operations across sectors face mounting pressure to improve throughput capacity and inventory accuracy, with AGV dispatch management platforms typically providing 40-60% improvement in material handling efficiency over manual operations, making these technologies essential for modern automated facility management. The transition toward lights-out manufacturing and autonomous warehouse operations creates demand for intelligent coordination systems that can manage fleets of 50-200 automated guided vehicles simultaneously while optimizing traffic flow, task prioritization, and battery management across complex facility layouts.

Technological advancements in artificial intelligence, real-time optimization algorithms, and Internet of Things connectivity are reshaping the AGV dispatch management platform landscape. Modern systems incorporate machine learning capabilities that continuously improve routing efficiency based on historical traffic patterns and operational data, enabling predictive optimization that reduces congestion and cycle times. Integration with warehouse management systems, enterprise resource planning platforms, and manufacturing execution systems allows seamless coordination across the complete supply chain from order receipt through product shipment. Advanced fleet management features including dynamic task allocation, intelligent charging scheduling, and predictive maintenance capabilities enable maximum AGV utilization rates exceeding 90% while minimizing downtime and extending equipment lifecycles across diverse industrial applications.

Government smart manufacturing initiatives and automation investment incentives accelerate market growth. Industry 4.0 programs in developed economies provide subsidies and tax benefits supporting manufacturing digitization and automation equipment adoption that includes intelligent dispatch management systems. E-commerce expansion and omnichannel retail fulfillment requirements drive distribution center automation investments exceeding USD 50 billion annually worldwide, creating sustained demand for AGV fleet management technologies. Labor shortage challenges in logistics and manufacturing sectors across developed markets create compelling business cases for automation solutions that reduce dependency on manual material handling workers, enabling facilities to maintain operations amid workforce constraints while improving consistency and reliability of material movement supporting just-in-time manufacturing and same-day delivery service commitments requiring precise logistics coordination.

Between 2025 and 2030, the AGV dispatch management platforms market is projected to expand from USD 4.5 billion to USD 7,035.2 million, resulting in a value increase of USD 2,564.2 million, which represents 27.2% of the total forecast growth for the decade. This phase of development will be shaped by rising demand for warehouse automation and smart manufacturing solutions, product innovation in artificial intelligence-powered optimization algorithms and real-time fleet coordination systems, as well as expanding integration with Internet of Things sensors and enterprise resource planning platforms. Companies are establishing competitive positions through investment in advanced machine learning capabilities, cloud-based architecture development, and strategic market expansion across new energy manufacturing facilities, automotive production plants, and stereo warehousing applications.

From 2030 to 2035, the market is forecast to grow from USD 7,035.2 million to USD 13.9 billion, adding another USD 6,851.0 million, which constitutes 72.8% of the overall ten-year expansion. This period is expected to be characterized by the expansion of specialized dispatch platforms, including autonomous decision-making systems and integrated digital twin simulations tailored for specific industry requirements, strategic collaborations between AGV manufacturers and software platform providers, and an enhanced focus on edge computing capabilities and 5G connectivity integration. The growing emphasis on autonomous operations and zero-touch logistics will drive demand for advanced, high-performance AGV dispatch management platforms across diverse manufacturing and distribution applications.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 4.5 billion |

| Market Forecast Value (2035) | USD 13.9 billion |

| Forecast CAGR (2025-2035) | 12.0% |

The AGV dispatch management platforms market grows by enabling facilities to achieve superior material handling efficiency and operational coordination while addressing persistent labor challenges and quality consistency requirements. Warehouse operators and manufacturing facility managers face mounting pressure to improve throughput capacity and reduce operational costs, with AGV dispatch management platforms typically providing 35-55% reduction in material handling expenses over manual operations, making these technologies essential for competitive logistics and production operations. The e-commerce fulfillment infrastructure expansion creates demand for intelligent fleet management systems that can coordinate hundreds of automated vehicles across multi-floor distribution centers while maintaining order accuracy and meeting aggressive delivery time commitments.

Government initiatives promoting manufacturing automation and smart logistics infrastructure drive adoption in automotive assembly plants, new energy battery production facilities, and automated distribution centers, where intelligent dispatch coordination has a direct impact on production efficiency and supply chain responsiveness. The global shift toward unmanned operations and lights-out manufacturing accelerates AGV dispatch platform demand as facilities seek solutions that enable 24-hour autonomous operations without human supervision. However, high implementation costs ranging from USD 500,000 to USD 5,000,000 per facility and technical integration challenges with diverse AGV brands and legacy systems may limit adoption rates among smaller operations and facilities with complex existing infrastructure.

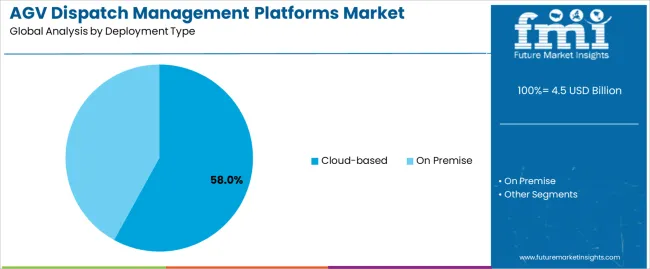

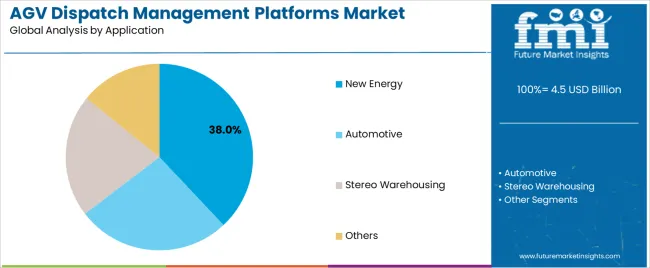

The market is segmented by deployment type, application, and region. By deployment type, the market is divided into cloud-based and on premise. Based on application, the market is categorized into new energy, automotive, stereo warehousing, and others. Regionally, the market is divided into Asia Pacific, Europe, North America, Latin America, and Middle East & Africa.

The cloud-based segment represents the dominant force in the AGV dispatch management platforms market, capturing approximately 58% of total market share in 2025. This advanced category encompasses software-as-a-service platforms, multi-tenant cloud architectures, scalable computing resources, and remote access capabilities, delivering comprehensive fleet management functionality without on-site server infrastructure requirements. The cloud-based segment's market leadership stems from its essential advantages including lower upfront capital investment, automatic software updates and feature enhancements, flexible scaling to accommodate fleet size changes, and accessibility from any location enabling remote monitoring and management of multiple facilities from centralized control centers.

The on premise segment maintains a substantial 42.0% market share, serving organizations requiring local data control through dedicated server installations, air-gapped network security, customized software configurations, and integration with on-site manufacturing execution systems that cannot connect to external networks due to security policies or regulatory requirements.

Key advantages driving the cloud-based segment include:

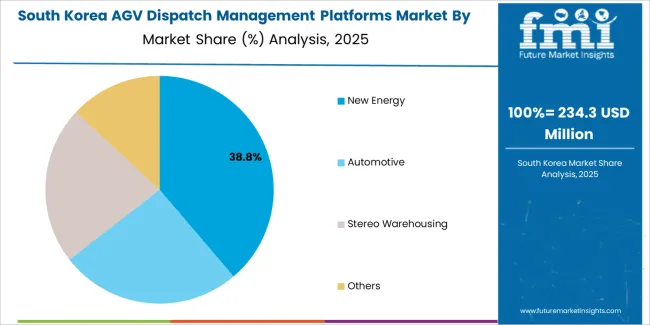

New energy applications dominate the AGV dispatch management platforms market with approximately 38% market share in 2025, reflecting the explosive growth in battery manufacturing and electric vehicle production requiring highly automated material handling for precision assembly processes. The new energy segment's market leadership is reinforced by widespread adoption in lithium battery cell production, battery pack assembly operations, solar panel manufacturing, and electric vehicle component fabrication where AGV systems transport materials between processing stations while maintaining contamination control and handling hazardous materials according to strict safety protocols.

The automotive segment represents 29.0% market share through established deployments including traditional vehicle assembly lines, parts warehousing, just-in-time component delivery systems, and finished vehicle storage facilities requiring coordinated movement of materials across extensive manufacturing complexes. The stereo warehousing segment accounts for 22.0% market share, featuring automated distribution centers with multi-level storage systems, dense storage configurations, and high-throughput fulfillment operations. The others segment, including electronics manufacturing, pharmaceutical production, and food processing applications, represents 11.0% market share.

Key market dynamics supporting application preferences include:

The market is driven by three concrete demand factors tied to automation economics and operational requirements. First, labor cost pressures and workforce shortage challenges create increasing requirements for automated material handling, with logistics and manufacturing sectors facing 20-40% wage inflation in developed markets while struggling to fill 500,000+ open warehouse positions, requiring proven automation solutions that reduce dependency on manual labor. Second, e-commerce order volume growth drives distribution center automation investments, with online retail sales expanding by 12-18% annually creating fulfillment capacity constraints that necessitate AGV deployment coordinated through intelligent dispatch platforms supporting same-day and next-day delivery commitments. Third, manufacturing flexibility requirements accelerate adoption as producers implement agile manufacturing strategies requiring rapid changeovers and diverse product mixes, with AGV dispatch platforms enabling dynamic material routing that adapts to changing production schedules without fixed conveyor infrastructure constraints.

Market restraints include system integration complexity creating implementation barriers, as AGV dispatch platforms must interface with 5-15 different software systems including warehouse management, enterprise resource planning, and manufacturing execution platforms while coordinating multiple AGV brands with different communication protocols requiring extensive customization work. Cybersecurity vulnerabilities pose growing concerns, as cloud-connected dispatch platforms managing critical production operations present attractive targets for ransomware attacks and industrial espionage requiring comprehensive security measures including network segregation, encryption, and intrusion detection systems adding cost and complexity. Return on investment justification challenges create adoption hesitation, as facilities must balance USD 2,000,000-10,000,000 automation investments against labor cost savings requiring 3-5 year payback periods that become uncertain during economic downturns or demand volatility.

Key trends indicate accelerated adoption in Asia-Pacific markets, particularly China where government Made in China 2025 initiatives and labor cost inflation drive manufacturing automation investments exceeding USD 100 billion annually including AGV dispatch platform deployments across battery manufacturing, automotive production, and e-commerce fulfillment sectors. Technology advancement trends toward artificial intelligence-powered predictive optimization, digital twin simulation enabling virtual testing before physical implementation, and edge computing architectures reducing latency for real-time vehicle coordination are driving next-generation platform development. However, the market thesis could face disruption if autonomous mobile robot technologies with decentralized coordination capabilities eliminate need for centralized dispatch platforms or if economic conditions trigger manufacturing automation investment reductions during extended downturns.

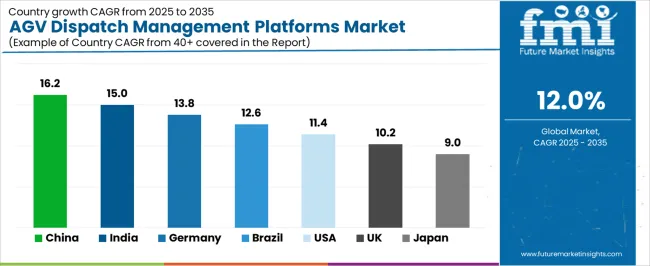

| Country | CAGR (2025-2035) |

|---|---|

| China | 16.2% |

| India | 15.0% |

| Germany | 13.8% |

| Brazil | 12.6% |

| USA | 11.4% |

| UK | 10.2% |

| Japan | 9.0% |

The AGV dispatch management platforms market is gaining momentum worldwide, with China taking the lead thanks to aggressive manufacturing automation initiatives and new energy sector expansion programs. Close behind, India benefits from logistics infrastructure modernization and manufacturing sector automation adoption, positioning itself as a strategic growth hub in the Asia-Pacific region. Germany shows strong advancement, where Industry 4.0 leadership and automotive sector automation expertise strengthen its role in European smart manufacturing technology deployment.

Brazil demonstrates robust growth through e-commerce expansion and manufacturing automation investments, signaling continued adoption of intelligent logistics solutions. Meanwhile, the USA stands out for its mature warehouse automation market and advanced software development capabilities, while the UK and Japan continue to record consistent progress driven by labor shortage pressures and manufacturing efficiency initiatives. Together, China and India anchor the global expansion story, while established markets build technological sophistication and vertical integration into the market's growth path.

The report covers an in-depth analysis of 40+ countriestop-performing countries are highlighted below.

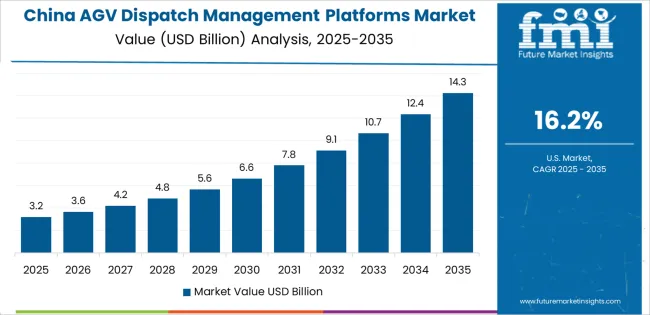

China demonstrates the strongest growth potential in the AGV Dispatch Management Platforms Market with a CAGR of 16.2% through 2035. The country's leadership position stems from comprehensive manufacturing automation programs, massive new energy battery production capacity representing over 70% of global output, and government industrial upgrading policies driving adoption of intelligent manufacturing systems. Growth is concentrated in major manufacturing clusters, including Yangtze River Delta, Pearl River Delta, Beijing-Tianjin-Hebei, and Chengdu-Chongqing regions, where battery manufacturers, automotive producers, and e-commerce companies are implementing AGV systems coordinated through advanced dispatch platforms for production line material delivery and warehouse automation.

Distribution channels through domestic software developers, AGV manufacturers with integrated platform offerings, and system integrators expand deployment across new manufacturing facilities and brownfield automation retrofits. The country's Made in China 2025 strategy provides policy support for intelligent manufacturing equipment adoption, including subsidies for automation projects and preferential financing for manufacturing transformation initiatives.

Key market factors:

In industrial corridors, special economic zones, and logistics hubs, the adoption of AGV dispatch management platforms is accelerating across automotive component manufacturing, pharmaceutical production facilities, and e-commerce fulfillment centers, driven by Make in India initiatives and increasing logistics sector automation. The market demonstrates strong growth momentum with a CAGR of 15.0% through 2035, linked to comprehensive manufacturing sector expansion and increasing focus on operational efficiency improvement solutions.

Indian facilities are implementing AGV systems and intelligent dispatch platforms to address labor productivity challenges while meeting quality standards required by global supply chain integration and export competitiveness objectives. The country's Production Linked Incentive schemes create sustained demand for manufacturing automation technologies, while increasing emphasis on logistics infrastructure modernization drives adoption of warehouse automation solutions supporting e-commerce sector growth.

Germany's advanced manufacturing sector demonstrates sophisticated implementation of AGV dispatch management platforms, with documented case studies showing 45-65% productivity improvement through intelligent fleet coordination across automotive assembly plants and industrial equipment manufacturing facilities.

The country's manufacturing infrastructure in major industrial centers, including Baden-Württemberg, Bavaria, North Rhine-Westphalia, and Lower Saxony regions, showcases integration of dispatch platforms with existing manufacturing execution systems, leveraging expertise in automation engineering and Industry 4.0 implementation methodologies. German manufacturers emphasize system reliability and cybersecurity, creating demand for enterprise-grade dispatch platforms that support continuous production requirements and meet stringent data protection standards under industrial security frameworks. The market maintains strong growth through focus on automotive sector automation and manufacturing excellence programs, with a CAGR of 13.8% through 2035.

Key development areas:

The Brazilian market leads Latin American adoption based on integration with expanding e-commerce fulfillment infrastructure and automotive sector automation modernization supporting domestic production competitiveness. The country shows solid potential with a CAGR of 12.6% through 2035, driven by logistics sector growth and manufacturing automation investments across São Paulo, Rio de Janeiro, Minas Gerais, and southern region industrial clusters.

Brazilian facilities are adopting AGV dispatch platforms for warehouse automation applications, particularly in distribution centers serving e-commerce platforms and automotive parts manufacturing supporting local vehicle production and export markets. Technology deployment channels through international platform providers, regional system integrators, and equipment financing programs expand coverage across manufacturing and logistics sectors.

Leading market segments:

The USA AGV dispatch management platforms market demonstrates mature implementation focused on established warehouse automation sector and advanced manufacturing operations, with documented integration across major e-commerce distribution networks operating 500-1,000 AGVs per fulfillment center and automotive plants coordinating 50-150 vehicles across assembly operations.

The country maintains steady growth momentum with a CAGR of 11.4% through 2035, driven by continued e-commerce growth requiring distribution capacity expansion and manufacturing reshoring initiatives supporting domestic production investments in critical sectors. Major logistics operators including Amazon, Walmart, and third-party logistics providers showcase advanced deployment of AGV dispatch platforms managing multi-site operations and coordinating diverse vehicle types across different facility configurations.

Key market characteristics:

In distribution centers, manufacturing facilities, and logistics hubs across England, Scotland, and Wales, warehouse operators and manufacturers are implementing AGV dispatch management platforms to address chronic labor shortage challenges and improve operational efficiency in e-commerce fulfillment, grocery distribution, and manufacturing material handling applications. The market shows solid growth potential with a CAGR of 10.2% through 2035, linked to post-Brexit labor market constraints and increasing emphasis on productivity improvement through automation investments. British facilities are adopting cloud-based dispatch platforms and AGV fleet management solutions to maintain operations amid workforce availability challenges while meeting customer service level commitments in competitive retail and manufacturing markets.

Market development factors:

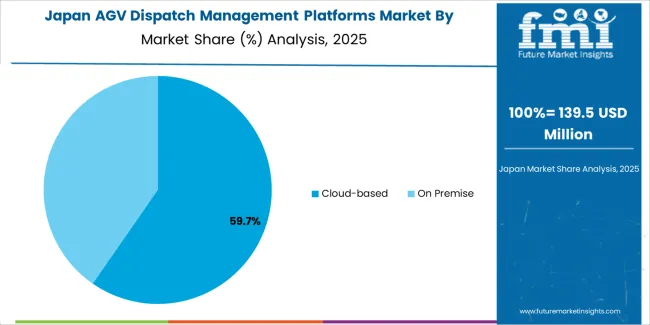

Japan's AGV dispatch management platforms market demonstrates sophisticated implementation focused on automotive manufacturing and electronics production facilities, with documented integration of dispatch platforms achieving 99% system uptime and seamless coordination with existing factory automation infrastructure across Toyota, Honda, Nissan, and major electronics manufacturers. The country maintains steady growth through emphasis on manufacturing precision and system reliability, with a CAGR of 9.0% through 2035, driven by continued automotive production volume and persistent labor shortage challenges requiring automation solutions across manufacturing and logistics sectors. Japanese manufacturers prioritize vendor relationships with established automation companies and emphasize long-term support capabilities when evaluating dispatch platform investments.

Key market characteristics:

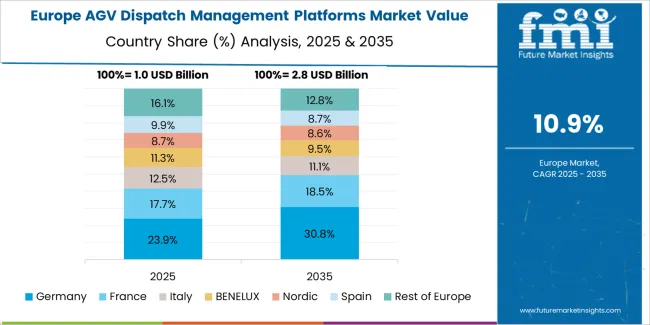

The AGV dispatch management platforms market in Europe is projected to grow from USD 1,125.0 million in 2025 to USD 2,841.4 million by 2035, registering a CAGR of 9.7% over the forecast period. Germany is expected to maintain its leadership position with a 31.5% market share in 2025, declining slightly to 30.8% by 2035, supported by its advanced automotive manufacturing infrastructure and major industrial centers including Stuttgart, Munich, and Wolfsburg automotive clusters.

France follows with a 22.8% share in 2025, projected to reach 23.2% by 2035, driven by automotive sector automation and logistics infrastructure modernization in Paris, Lyon, and Toulouse regions. The United Kingdom holds a 19.5% share in 2025, expected to reach 20.1% by 2035 through e-commerce fulfillment automation growth. Italy commands a 13.2% share in both 2025 and 2035, backed by manufacturing automation and logistics sector development.

Spain accounts for 8.5% in 2025, rising to 8.7% by 2035 on automotive production automation. The Netherlands maintains 4.5% market share throughout the forecast period. The Rest of Europe region is anticipated to hold 12.0% in 2025, expanding to 12.5% by 2035, attributed to increasing AGV dispatch platform adoption in Nordic countries and emerging Central & Eastern European manufacturing automation and logistics infrastructure development programs.

The Japanese AGV dispatch management platforms market demonstrates a mature and quality-focused landscape, characterized by sophisticated integration of on-premise systems and hybrid cloud architectures with existing manufacturing execution infrastructure across automotive production facilities, electronics assembly operations, and automated distribution centers. Japan's emphasis on system reliability and data security drives demand for proven platform architectures that support continuous production requirements and meet rigorous cybersecurity standards in manufacturing environments.

The market benefits from strong partnerships between domestic automation companies including Daifuku, Murata Machinery, and international platform providers, creating comprehensive solution ecosystems that prioritize production uptime and seamless integration with factory automation systems. Manufacturing facilities in Aichi, Kanagawa, and other industrial regions showcase advanced AGV implementations where dispatch platforms coordinate 50-200 vehicles while maintaining sub-second response times and 99.9% system availability supporting just-in-time manufacturing requirements.

The South Korean AGV dispatch management platforms market is characterized by growing international technology provider presence, with companies maintaining significant positions through comprehensive integration services and technical support capabilities for semiconductor manufacturing, display panel production, and automotive assembly applications. The market demonstrates increasing emphasis on smart factory initiatives and advanced manufacturing automation, as Korean manufacturers increasingly demand dispatch platforms that integrate with domestic manufacturing execution systems and sophisticated production control infrastructure deployed across Samsung, LG, and major automotive manufacturers.

Regional automation companies are gaining market share through strategic partnerships with international platform providers, offering specialized services including Korean language interfaces and customized integration programs for local manufacturing requirements. The competitive landscape shows increasing collaboration between multinational software companies and Korean system integrators, creating hybrid service models that combine international platform capabilities with local manufacturing knowledge and industry relationship networks supporting specification and implementation processes.

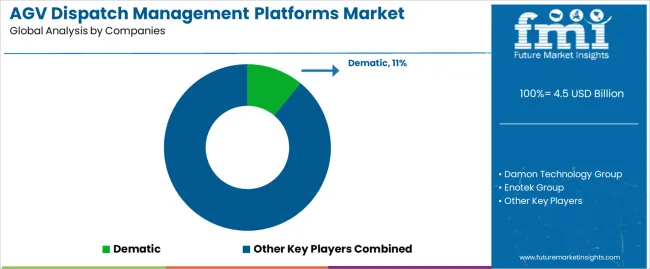

The AGV dispatch management platforms market features approximately 30-40 meaningful players with moderate fragmentation, where the top three companies control roughly 25-30% of global market share through established customer relationships and comprehensive platform capabilities. Competition centers on algorithm optimization performance, system integration capabilities, and multi-brand AGV support rather than price competition alone. Dematic leads with approximately 11.0% market share through its comprehensive intralogistics automation portfolio and established global customer base.

Market leaders include Dematic, Damon Technology Group, and Shanghai BITO Intelligence, which maintain competitive advantages through extensive implementation experience across diverse industries, proven algorithm performance managing large vehicle fleets, and comprehensive integration capabilities supporting multiple AGV brands and enterprise software systems. These companies leverage research and development investments in artificial intelligence optimization, predictive analytics, and scalable cloud architectures to defend market positions while expanding into emerging application sectors and geographic markets.

Challengers encompass Enotek Group and Touling Robot, which compete through specialized industry focus and strong regional presence in Asia-Pacific markets offering customized solutions for specific manufacturing sectors. Product specialists, including Beijing Zhongke Feisi, Shenzhen Geju Technology, and numerous emerging Chinese software companies, focus on specific deployment types or application niches, offering differentiated capabilities in cloud-native architectures, industry-specific optimization algorithms, and cost-effective platforms serving small to medium-sized AGV deployments.

Regional players including Hefei Yuefei Network Technology, Suzhou VLinkPlus Information Technology, and emerging software developers create competitive pressure through aggressive pricing strategies and rapid customization capabilities, particularly in high-growth markets including China where domestic companies offer platforms at 40-60% lower cost than international alternatives while providing localized support and rapid implementation services. Market dynamics favor companies that combine proven optimization algorithms with comprehensive integration expertise and flexible deployment models that address the complete implementation lifecycle from initial system design through ongoing performance optimization and fleet expansion support across evolving facility requirements.

| Item | Value |

|---|---|

| Quantitative Units | USD 4.5 billion |

| Deployment Type | Cloud-based, On Premise |

| Application | New Energy, Automotive, Stereo Warehousing, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East & Africa |

| Country Covered | China, India, Germany, Brazil, USA, UK, Japan, and 40+ countries |

| Key Companies Profiled | Dematic, Damon Technology Group, Enotek Group, Touling Robot, Beijing Zhongke Feisi, Shanghai BITO Intelligence, Shenzhen Geju Technology, Hefei Yuefei Network Technology, Hefei Kaifan Information Technology, Anhui Zhongji Intelligent Technology, Anhui Yufeng Intelligent, Suzhou VLinkPlus Information Technology, Qingdao Yufang Robot Industry, Zhuhai Makerwit Technology, Shenzhen OKAGV, Anhui Watson Intelligent Technology, Dongguan Ruipeng Robot, Suzhou Huatian Shihang Smart Equipment Technology, Suzhou Rankingiot Intelligence Technology, Hefei Langxun Intelligent Equipment |

| Additional Attributes | Dollar sales by deployment type and application categories, regional adoption trends across Asia Pacific, Europe, and North America, competitive landscape with software platform developers and system integrators, technical specifications and integration requirements, compatibility with multiple AGV brands and enterprise software systems, innovations in artificial intelligence optimization and cloud architecture, and development of specialized dispatch platforms with enhanced fleet coordination and predictive analytics capabilities. |

The global agv dispatch management platforms market is estimated to be valued at USD 4.5 billion in 2025.

The market size for the agv dispatch management platforms market is projected to reach USD 14.0 billion by 2035.

The agv dispatch management platforms market is expected to grow at a 12.0% CAGR between 2025 and 2035.

The key product types in agv dispatch management platforms market are cloud-based and on premise.

In terms of application, new energy segment to command 38.0% share in the agv dispatch management platforms market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

AGV Intelligent Management Systems Market Size and Share Forecast Outlook 2025 to 2035

Brushless Motor for AGV Market Size and Share Forecast Outlook 2025 to 2035

Automated Guided Vehicles (AGV) Market Growth - Trends & Forecast 2025 to 2035

Train Dispatching Market Size and Share Forecast Outlook 2025 to 2035

Sales Platforms Software Market Size and Share Forecast Outlook 2025 to 2035

Battery Platforms Market Analysis Size and Share Forecast Outlook 2025 to 2035

Smart City Platforms Market Size and Share Forecast Outlook 2025 to 2035

Smart Home Platforms Market Growth – Trends & Forecast through 2034

IP Centrex Platforms Market

Aerial Work Platforms Market Size and Share Forecast Outlook 2025 to 2035

AI Security Platforms Market Size and Share Forecast Outlook 2025 to 2035

Microlearning Platforms Market Size and Share Forecast Outlook 2025 to 2035

Virtual Event Platforms Market Trends - Growth & Forecast 2025 to 2035

Competitive Landscape of Virtual Event Platforms Market Share

BRICS Aerial Work Platforms Market Size and Share Forecast Outlook 2025 to 2035

Digital Publishing Platforms Market Size and Share Forecast Outlook 2025 to 2035

Patient Engagement Platforms Market Size and Share Forecast Outlook 2025 to 2035

Content Experience Platforms Market Size and Share Forecast Outlook 2025 to 2035

B2B Services Review Platforms Market Size and Share Forecast Outlook 2025 to 2035

Customer Experience Platforms Market by Interaction Points, Deployment, Enterprise Size, Region-Forecast through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA