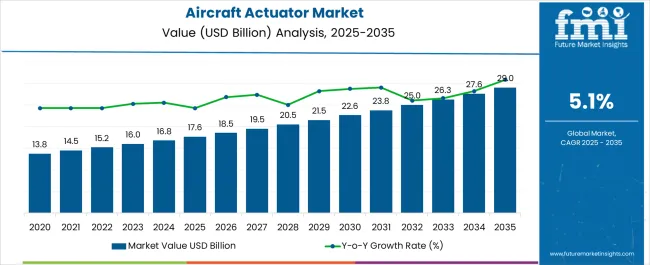

The Aircraft Actuator Market is estimated to be valued at USD 17.6 billion in 2025 and is projected to reach USD 29.0 billion by 2035, registering a compound annual growth rate (CAGR) of 5.1% over the forecast period.

Aerospace engineers evaluate aircraft actuator specifications based on force output capabilities, response time characteristics, and environmental qualification standards when designing flight control systems for commercial transports, military fighters, and unmanned aerial vehicles requiring precise control surface positioning. Component selection involves analyzing power-to-weight ratios, failure mode behavior, and maintenance interval requirements while considering installation envelope constraints, power consumption limitations, and certification compliance factors necessary for airworthiness approval. Investment decisions balance actuator costs against system performance enhancement, incorporating safety improvement benefits, weight reduction potential, and operational efficiency gains that justify advanced actuation technology adoption through measurable aircraft performance advancement.

Manufacturing processes require precision machining operations, specialized assembly techniques, and comprehensive testing validation that achieve aerospace quality standards while maintaining cost competitiveness throughout demanding production environments serving commercial and defense aviation markets. Production coordination involves managing high-strength material sourcing, electronic component integration, and environmental testing while addressing AS9100 quality management, traceability requirements, and configuration control protocols specific to aerospace actuator manufacturing. Quality assurance encompasses load testing, vibration analysis, and temperature cycling that ensure specification compliance while supporting aircraft certification requirements and operational reliability expectations throughout extended service lifecycles.

System integration involves flight control engineers, actuator specialists, and certification authorities collaborating to optimize actuator deployment that balances control authority with weight minimization while addressing specific aircraft performance requirements and safety regulations. Installation processes encompass mechanical mounting, electrical connections, and software integration while coordinating with flight control computers, hydraulic systems, and backup power sources throughout complex aircraft systems architecture. Testing protocols include ground testing, flight testing, and certification validation that ensure proper operation while supporting type certificate approval and operational safety assurance.

Aerospace relationships involve coordination between actuator manufacturers, aircraft producers, and certification authorities to establish comprehensive flight control programs that address component qualification, system integration, and ongoing airworthiness throughout aircraft development and operational lifecycles. Supply agreements include performance guarantees, configuration control, and technical support provisions that protect aircraft manufacturer investments while ensuring actuator reliability and certification maintenance. Partnership development encompasses collaboration with flight control system integrators, power system suppliers, and maintenance organizations to deliver integrated actuation solutions supporting comprehensive aircraft performance optimization.

Aviation industry transformation reflects increasing emphasis on autonomous flight capabilities, electric aircraft development, and operational efficiency optimization that drives demand for intelligent actuator systems supporting aerospace innovation and flight safety enhancement throughout applications requiring precise control authority and system reliability across aircraft platforms seeking competitive advantages through advanced flight control technology and operational excellence achievement.

| Metric | Value |

|---|---|

| Aircraft Actuator Market Estimated Value in (2025 E) | USD 17.6 billion |

| Aircraft Actuator Market Forecast Value in (2035 F) | USD 29.0 billion |

| Forecast CAGR (2025 to 2035) | 5.1% |

The aircraft actuator market is experiencing strong growth owing to the rising demand for advanced control systems, enhanced safety features, and improved fuel efficiency in modern aircraft. Increasing production of commercial aircraft and the adoption of more electric aircraft architectures are significantly driving innovation in actuator design.

Advancements in lightweight materials, digital monitoring, and predictive maintenance are improving operational reliability and reducing lifecycle costs. Stringent regulatory standards for performance and safety are further accelerating the adoption of next generation actuators across both fixed wing and rotary aircraft.

The outlook remains positive as aerospace manufacturers continue to invest in automation, sustainability, and electrification, positioning actuators as a critical component in meeting evolving aviation requirements.

The linear actuator segment is projected to hold 57.20% of total market revenue by 2025 within the type category, making it the most significant contributor. Its dominance is attributed to wide use in applications requiring high precision and force such as flight control surfaces, landing gear systems, and thrust reversers.

The ability of linear actuators to provide direct and reliable motion has enhanced their integration in critical control systems. Ongoing developments in electric linear actuators have further supported demand by improving energy efficiency and reducing maintenance requirements.

These factors have consolidated the leadership of this type in the aircraft actuator market.

The hydraulic actuators segment is anticipated to command 44.80% of total market revenue by 2025 within the system category, securing its place as the leading segment. Its prevalence is linked to the capability of delivering high power density and reliability, which are critical for applications such as landing gear, braking systems, and heavy load operations.

Despite the growing shift toward electric actuation, hydraulic actuators remain indispensable for high force functions in large commercial and defense aircraft. Continuous improvements in hydraulic system efficiency and reliability are sustaining their adoption.

These advantages ensure the continued dominance of hydraulic actuators within the system segment of the aircraft actuator market.

As per FMI, global sales of aircraft actuators grew at 6.1% CAGR from 2020 to 2024. For the next ten years, the worldwide market for aircraft actuators will expand at 5.1% CAGR. This will result in an absolute $ opportunity of USD 9.8 billion.

Actuators on aircraft carry out a variety of crucial tasks. This includes adjusting flight control surfaces such as the slats, rudder, flaps, and spoilers. They help in opening & closing cargo or weapon bay doors, extending & retracting landing gear, and positioning engine inlet guide thrust reversers & vanes, and among other things.

Aircraft actuators can tolerate environmental conditions such as intense vibrations, heat, and cold. Pneumatic and hydraulic actuators have historically been used extensively in airplane, but as the need for fuel efficiency grows, electric actuator utilization is soaring.

Development of advanced actuators is enabling companies to manufacture high-tech smarter aircraft. Growing popularity of these aircraft will boost aircraft actuators sales through 2035.

Expansion of Aviation Industry Triggering Aircraft Actuator Sales

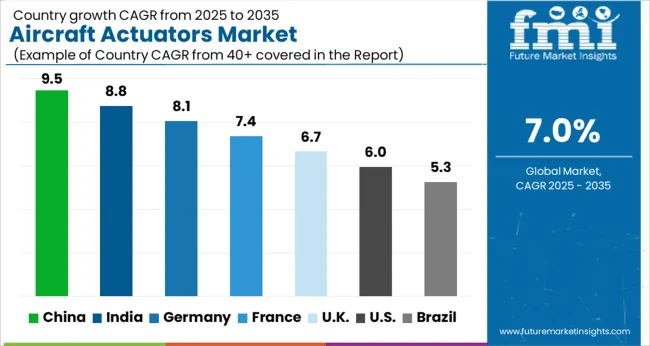

For significant firms operating in the market, growing nations such as China, India, and Brazil will open up new growth prospects. Latin American nations are growing their aviation industries as air travel increases. As a result, during the projected period, these improvements are likely to increase demand for aviation actuator systems.

Increase in commercial aircraft fleets worldwide will bolster aircraft actuator sales. Additionally, rising focus of countries on expanding military aircraft fleets will bode well for the market.

Numerous opportunities exist in the aviation industry to improve operational effectiveness and automation across a range of aircraft activities. IoT makes it possible to connect a variety of actuators with varying capacities. This helps to create a network in which the connected actuators may communicate with one another to carry out many activities that would otherwise be impossible for each type of actuator to carry out alone.

Pneumatic actuators are a collection of diverse systems, including compressors, air filters, lubricant tubes, dryers, and regulators. They transform energy from compressed air into mechanical motion. As a result, the system is susceptible to flaws such as excessive noise and air leakage. Further, the maintenance expenses that go along with that are rather significant.

Hydraulic actuators are suitable for use in wheel brakes, landing gears, flight control surfaces, etc. due to the high load factor they provide. An electric or reservoir-based hydraulic actuator transfers energy into mechanical motion.

However, these devices are prone to fluid leaks, fire hazards, and mechanical component erosiveness from hydraulic oil spills. The aviation industry is governed by strict regulations, and authorities take this into account when using mechanical or electrical components.

Original equipment producers are required to adhere to regulations and certifications referred to as airworthiness directives (AD) regarding safety, leakage, and design issues that are overseen by the federal aviation administration (FAA).

The administration has issued the ADs as legally binding regulations to rectify lethal product conditions. Aircraft landing gear companies require a long lead time to develop reliable product releases.

This has an impact on the market for aircraft actuators as a whole. Therefore, the extensive and time-consuming certification process is limiting the market growth of airplane actuators.

| Country | United States |

|---|---|

| Projected CAGR (2025 to 2035) | 4.0% |

| Historical CAGR (2020 to 2024) | 4.6% |

| Market Value (2035) | USD 29 billion |

| Country | United Kingdom |

|---|---|

| Projected CAGR (2025 to 2035) | 4.3% |

| Historical CAGR (2020 to 2024) | 4.9% |

| Market Value (2035) | USD 1.2 billion |

| Country | China |

|---|---|

| Projected CAGR (2025 to 2035) | 6.1% |

| Historical CAGR (2020 to 2024) | 7.5% |

| Market Value (2035) | USD 2.1 billion |

| Country | Japan |

|---|---|

| Projected CAGR (2025 to 2035) | 4.6% |

| Historical CAGR (2020 to 2024) | 5.3% |

| Market Value (2035) | USD 1.8 billion |

| Country | South Korea |

|---|---|

| Projected CAGR (2025 to 2035) | 5.5% |

| Historical CAGR (2020 to 2024) | 6.8% |

| Market Value (2035) | USD 1.0 billion |

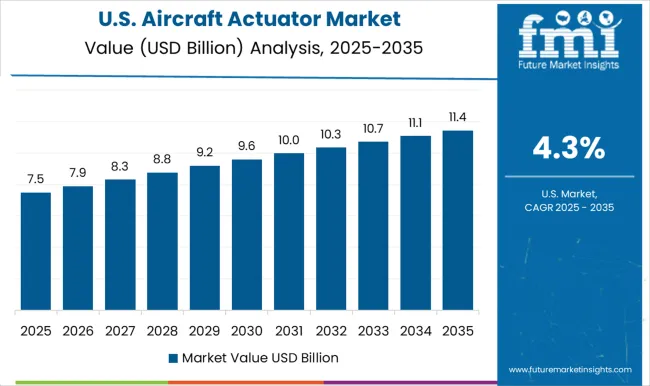

Rising Popularity of Electric Aircraft to Elevate Aircraft Actuator Demand in the United States

As per FMI, the United States will continue to remain a dominant market for aircraft actuators. The USA aircraft actuator market is set to reach USD 29 billion by 2035. From 2020 to 2024, the USA market exhibited a CAGR of 4.6%.

Over the next ten years, aircraft actuator sales in the United States are forecast to rise at 4.0% CAGR. Booming aerospace and aviation sector is a key factor driving the USA aircraft actuator industry. Growing popularity of electric vertical take-off and landing aircraft will elevate aircraft actuator demand in the USA.

Besides these, large presence of prominent aircraft actuator manufacturers is likely to boost the USA market. The United States houses several leading companies that provide aircraft actuators. Development of new innovative products by these companies is making the USA a dominant market.

Expansion of Commercial Aviation Sector to Boost Aircraft Actuator Sales in China

China aircraft actuator market is set to rise at 6.1% CAGR between 2025 and 2035. Overall sales of aircraft actuators across China will total a market valuation of USD 2.1 billion by 2035. The aircraft actuator industry in China grew at a CAGR of 7.5% from 2020 to 2024.

Rapid increase in commercial aircraft in China is set to provide impetus to China aircraft actuator industry. Besides this, various strategies adopted by China-based aircraft actuator companies will shape the market.

For instance, in September 2024, Maxon Group, headquartered in China inaugurated technology center 4 and invests in renewable energies. This step will help to produce higher-quality aircraft actuators.

Rotary Type Actuator to be the Top Selling Category

Rotary type actuators segment is projected to witness the most significant growth. This is due to rising applications of this actuator type in aviation and aerospace sectors. Rotary actuator segment grew at around 5.8% CAGR from 2020 to 2024. Over the next ten years, it is forecast to rise at 5% CAGR.

Rotary actuators convert electric, hydraulic, or pneumatic energy into rotary or oscillatory motions. They are used for performing a wide range of applications in aircraft. For instance, they help to nose-wheel steering system pivot through 360° arc needed for precision turning.

Rotary actuators are generally used in automation applications such as valves and gates. This is because of their inherent advantages. For example, demand for their incorporation into modern aircraft platforms is driven by their high efficiency, which ranges from 85% to 92% in single-rack models. Similarly, in double rack models, their efficiency ranges from 92% to 97%.

Significant Revenue to be Contributed by Pneumatic Actuators, Fueling Aircraft Actuator Demand

As per FMI, demand in the market will remain high for pneumatic actuators. This is attributed to rising usage of pneumatic aircraft actuators for various applications in aviation sectors.

The expansion of the aerospace & aviation industry can be connected to the increasing need for aircraft actuators. Pneumatic actuator system segment expanded at around 5.6% CAGR from 2020 to 2024. The target segment will rise at 4.9% CAGR between 2025 and 2035.

Pneumatic actuator systems are used to transform energy of compressed air/gas into mechanical motion that regulates one or several final control elements. They are used in various aircraft systems.

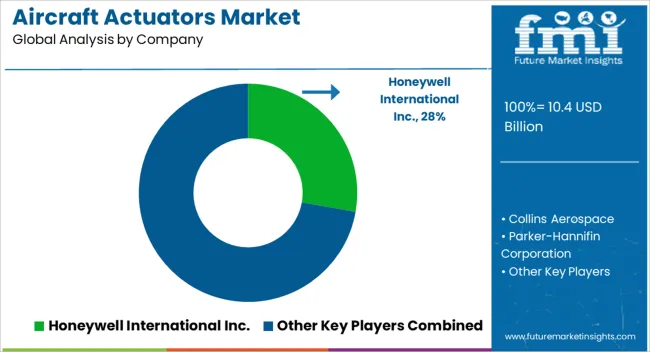

The Aircraft Actuators Market is witnessing strong growth, driven by the rapid shift toward more electric aircraft and the demand for advanced flight control systems. Major players such as Honeywell International Inc. and AMETEK Inc. are leading innovations in electric and electro-hydraulic actuator systems that enhance performance, reduce maintenance needs, and improve aircraft efficiency. Eaton Corporation plc and Moog Inc. are investing in compact, high-precision actuators that deliver superior reliability under extreme operational conditions, catering to both commercial and defense aviation segments.

Safran S.A. and RTX Corporation are expanding their actuator portfolios through integration of smart sensors and digital control modules to support next-generation aircraft architectures. Curtiss-Wright Corporation and Saab AB focus on high-performance actuation systems for military aircraft, emphasizing durability and flight safety. Meanwhile, Sitec Aerospace GmbH specializes in lightweight actuation technologies that help reduce overall fuel consumption and emissions.

| Attribute | Details |

|---|---|

| Estimated Market Size (2025) | USD 17.6 billion |

| Projected Market Size (2035) | USD 29.0 billion |

| Anticipated Growth Rate (2025 to 2035) | 5.1% CAGR |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2024 |

| Market Analysis | USD Million for Value and MT for Volume |

| Key Regions Covered | North America; Latin America; Europe; Asia Pacific; and the Middle East & Africa |

| Key Countries Covered | United States, Canada, Brazil, Mexico, Germany, United Kingdom, France, Italy, Spain, Nordic, Russia, Poland, China, India, Thailand, Indonesia, Australia and New Zealand, Japan, GCC countries, North Africa, South Africa, and others. |

| Key Segments Covered | Type, End User, System, and Region |

| Key Companies Profiled | Honeywell International Inc., AMETEK Inc., Eaton Corporation plc, Moog Inc., Safran S.A., RTX Corporation (formerly Raytheon Technologies Corporation), Curtiss-Wright Corporation, Saab AB, Sitec Aerospace GmbH |

| Report Coverage | Market Forecast, Company Share Analysis, Competition Intelligence, Drivers Restraints Opportunity Trends Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

The global aircraft actuator market is estimated to be valued at USD 17.6 billion in 2025.

The market size for the aircraft actuator market is projected to reach USD 29.0 billion by 2035.

The aircraft actuator market is expected to grow at a 5.1% CAGR between 2025 and 2035.

The key product types in aircraft actuator market are linear and rotary.

In terms of end user, commercial aircraft segment to command 62.5% share in the aircraft actuator market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Aircraft Actuators Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Cabin Environment Sensor Market Forecast and Outlook 2025 to 2035

Aircraft Flight Control System Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Electric Motor Market Forecast Outlook 2025 to 2035

Aircraft Cooling Turbines Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Smoke Detection and Fire Extinguishing System Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Hose Fittings Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Cabin Interior Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Galley Systems Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Interior Lighting Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Battery Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Floor Panels Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Fuel Systems Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Lubricant Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Seat Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Ground Support Equipment Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Maintenance, Repair and Overhaul Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Elevator Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Weapons Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Lighting Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA