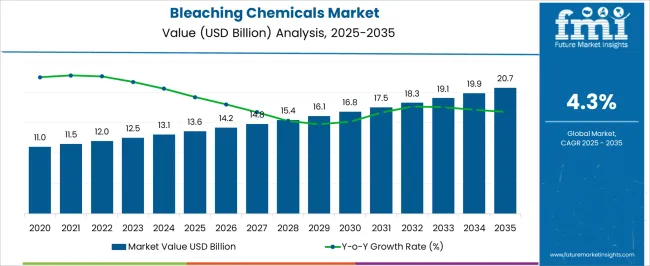

The Bleaching Chemicals Market is estimated to be valued at USD 13.6 billion in 2025 and is projected to reach USD 20.7 billion by 2035, registering a compound annual growth rate (CAGR) of 4.3% over the forecast period.

| Metric | Value |

|---|---|

| Bleaching Chemicals Market Estimated Value in (2025 E) | USD 13.6 billion |

| Bleaching Chemicals Market Forecast Value in (2035 F) | USD 20.7 billion |

| Forecast CAGR (2025 to 2035) | 4.3% |

The bleaching chemicals market is experiencing consistent growth, supported by their widespread role in industrial processes, water treatment, and consumer applications. Demand is being reinforced by increasing use in pulp and paper production, textiles, and wastewater management, where the need for effective whitening and disinfection remains essential. Rising global emphasis on sanitation and environmental hygiene is further supporting adoption, particularly in rapidly industrializing regions.

Regulatory standards that promote water purification and sustainable industrial practices are also driving the use of advanced bleaching agents with reduced ecological impact. Manufacturers are investing in research and process optimization to enhance the efficiency, safety, and environmental compatibility of these chemicals, aligning with global sustainability objectives.

The market outlook remains favorable as demand for high-quality paper products, clean water, and industrial processing efficiency continues to rise With increasing focus on eco-friendly alternatives and stricter compliance requirements, the bleaching chemicals market is expected to evolve toward greener formulations and sustainable growth pathways over the forecast period.

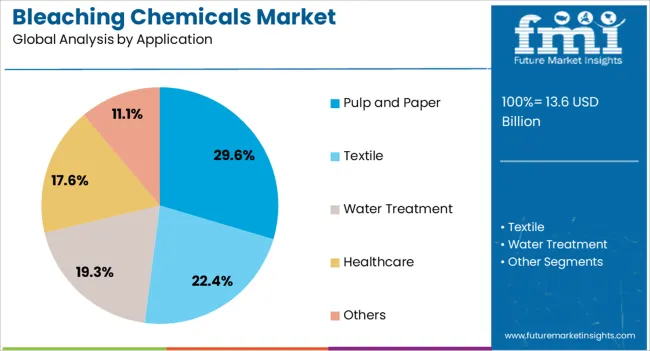

The bleaching chemicals market is segmented by product type, application, end-user, and geographic regions. By product type, bleaching chemicals market is divided into Chlorine-based, Peroxide-based, Sodium Hypochlorite, Calcium Hypochlorite, and Others. In terms of application, bleaching chemicals market is classified into Pulp and Paper, Textile, Water Treatment, Healthcare, and Others.

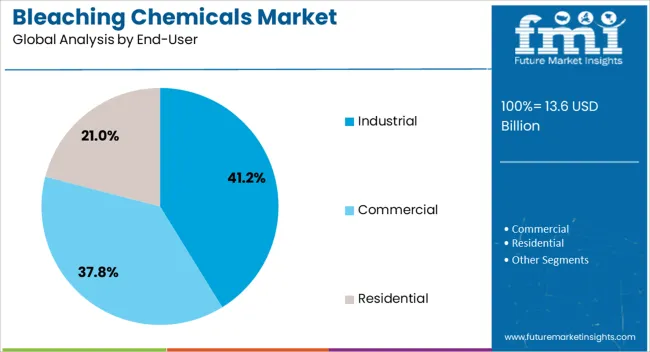

Based on end-user, bleaching chemicals market is segmented into Industrial, Commercial, and Residential. Regionally, the bleaching chemicals industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The chlorine-based product type segment is expected to hold 31.2% of the bleaching chemicals market revenue share in 2025, establishing itself as the leading category. This leadership is being driven by the cost-effectiveness, strong oxidizing properties, and widespread availability of chlorine-based compounds, which make them indispensable in multiple applications. Their effectiveness in large-scale disinfection and whitening processes, particularly in water treatment and pulp and paper production, reinforces their dominant usage.

The ability to deliver consistent performance across diverse industrial operations supports sustained adoption, even as alternative eco-friendly products gain traction. Advancements in production methods are improving safety and handling, while regulatory frameworks continue to allow controlled use in critical industries.

Chlorine-based bleaching chemicals are also benefiting from their proven reliability in high-volume industrial environments where process efficiency is a priority The segment’s established role in global industrial supply chains ensures its continued relevance, making it a key driver of market revenue despite ongoing developments in sustainable alternatives.

The pulp and paper application segment is projected to account for 29.6% of the bleaching chemicals market revenue share in 2025, positioning it as the leading application area. Its dominance is being supported by rising demand for high-quality paper and packaging materials, driven by both consumer consumption and industrial requirements. Bleaching chemicals are critical in achieving the brightness, strength, and cleanliness required in paper products, making them indispensable in the industry.

Increasing global consumption of paperboard and tissue products, coupled with the surge in e-commerce packaging needs, is stimulating growth in this segment. Technological advancements in bleaching processes are enabling more efficient use of chemicals, reducing costs while meeting environmental standards.

The segment is further benefiting from modernization of paper mills and investments in advanced processing technologies that enhance productivity As sustainability becomes a stronger focus, demand for eco-friendly bleaching formulations tailored for pulp and paper is expected to grow, ensuring that this segment continues to lead market applications.

The industrial end-user segment is forecasted to represent 41.2% of the bleaching chemicals market revenue share in 2025, making it the largest end-use industry. This leadership is being reinforced by the extensive use of bleaching chemicals across manufacturing, textiles, water treatment, and chemical processing industries. Their role in maintaining production efficiency, ensuring product quality, and meeting hygiene and safety standards is a key driver of adoption.

Industrial facilities are prioritizing bleaching agents that can deliver reliable performance while aligning with stricter environmental regulations. The segment is also benefiting from large-scale investments in infrastructure and industrial capacity expansion, particularly in emerging economies where demand for processed goods and treated water is increasing.

Continuous innovation in chemical formulations to improve efficiency and reduce ecological footprint is further shaping adoption trends The industrial sector’s dependence on high-volume, consistent supply of bleaching agents ensures that it will remain the largest contributor to market revenues, sustaining long-term growth prospects.

Bleaching chemicals are oxidizing agents used for numerous applications such as stain removal, disinfecting textile material and water, deodorizing, effluent control etc. Bleaching chemicals finds application in sectors such as textile, pulp & paper processing, water & wastewater treatment, hospitals, laundries etc. Though bleaching chemical is an industrial products, they have gained importance in various end-user industries due to capability for wide-ranging applications.

Bleaching as a process has been used for a long time, and the various chemicals used for bleaching currently have resulted from the continuous efforts put in by scientist in the 18th century. Bleaching chemicals are either chlorine or peroxide based, and some of the commonly used bleaching chemicals are chlorine, chlorine dioxide sodium hypochlorite, hydrogen peroxide, sodium percarbonate etc.

Hydrogen peroxide is widely used in the cosmetic industry for various purposes like hair colouring, face bleaching etc. Chlorine-based bleaches are generally used in household cleaning materials, to keep the water in swimming pools clean and for drinking water disinfection in the water treatment industry. Hence, the growing water treatment industry is expected to catalyze growth of chlorine-based bleaching chemicals.

The paper and pulp industry is amongst the largest consumers of bleaching agents. Bleaching agents makes the pulp free of impurities and suitable for paper manufacturing. Moreover, bleaching chemicals are used in the textile industry for textile treatment. Thus, growth of the pulp and paper and textile industries is anticipated to drive the demand for bleaching chemicals.

The bleaching chemicals market in Asia-Pacific is expected witness the highest growth in the near future. This is attributed to the fact that APAC countries such as China, India, Malaysia, Bangladesh and Thailand are estimated to be the high-potential untapped markets due to extensive growth of end-user industries. Additionally, continuous economic advancement coupled with constantly increasing manufacturing sector output promises a big market for bleaching chemicals in the APAC region.

China has dominated the global textile and garment industry for the past two decades and remains the single largest producer and exporter of textiles and clothing. Moreover, with increasing land and labour costs across major developing markets such as China and India, the global textile and garment industry is expected to undergo a swing to South East Asia.

Asia is a major exporter of textile and clothing to developed markets, of which emerging Asia accounts for significant contribution. Textile manufactures with production units based in China have adopted China plus one strategy. Big business houses that can afford such a strategy retain a production base in China and open another unit in a low cost Asian country. Growth in textile industry along with other prominent end use industries for bleaching chemicals will ensure healthy demand for bleaching chemicals in the APAC region.

Some of the key players operating in the bleaching chemicals market are Akzo Nobel Eka, Aditya Birla Chemicals, Kemira Oyj and Hercules and Hercules Inc. Companies focus more on research and development in order to upgrade technology and capitalize on untapped potential markets in various industries like oil and gas and mining.

Though the current market for bleaching chemicals is dominated by regions of North America and Europe, strict government regulations are expected to influence the demand for bleaching chemicals in the near future. APAC is undisputedly the fastest growing market for end-user industries of bleaching chemicals.

Due to increasing awareness regarding water safety coupled with increasing household income, depleting water resources and water contamination, the water treatment industry in APAC is flourishing. Chlorine bleach is a powerful germicide and is used to disinfect drinking water in case of groundwater contamination, and hence is used in municipal water treatment units. Growth of the end-user industry is a major driver for the bleaching chemicals sector in APAC.

The research report presents a comprehensive assessment of the market and contains thoughtful insights, facts, historical data and statistically-supported and industry-validated market data and projections with a suitable set of assumptions and methodology. It provides analysis and information by categories such as market applications and product type.

The report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain. The report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments. The report also maps the qualitative impact of various market factors on market segments and geographies.

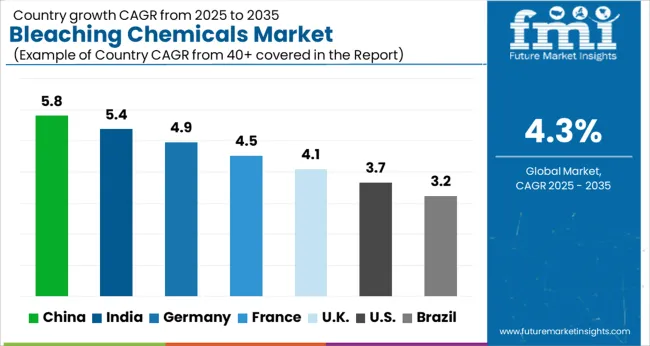

| Country | CAGR |

|---|---|

| China | 5.8% |

| India | 5.4% |

| Germany | 4.9% |

| France | 4.5% |

| UK | 4.1% |

| USA | 3.7% |

| Brazil | 3.2% |

The Bleaching Chemicals Market is expected to register a CAGR of 4.3% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 5.8%, followed by India at 5.4%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 3.2%, yet still underscores a broadly positive trajectory for the global Bleaching Chemicals Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 4.9%. The USA Bleaching Chemicals Market is estimated to be valued at USD 5.0 billion in 2025 and is anticipated to reach a valuation of USD 7.2 billion by 2035. Sales are projected to rise at a CAGR of 3.7% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 620.2 million and USD 420.2 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 13.6 Billion |

| Product Type | Chlorine-based, Peroxide-based, Sodium Hypochlorite, Calcium Hypochlorite, and Others |

| Application | Pulp and Paper, Textile, Water Treatment, Healthcare, and Others |

| End-User | Industrial, Commercial, and Residential |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

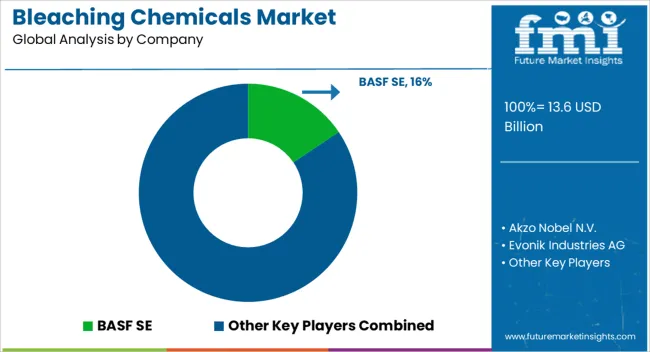

| Key Companies Profiled | BASF SE, Akzo Nobel N.V., Evonik Industries AG, Solvay S.A., The Dow Chemical Company, Clariant AG, Kemira Oyj, Aditya Birla Chemicals, Ecolab Inc., Arkema Group, Ashland Global Holdings Inc., Hawkins, Inc., Gujarat Alkalies and Chemicals Limited (GACL), and Nouryon |

The global bleaching chemicals market is estimated to be valued at USD 13.6 billion in 2025.

The market size for the bleaching chemicals market is projected to reach USD 20.7 billion by 2035.

The bleaching chemicals market is expected to grow at a 4.3% CAGR between 2025 and 2035.

The key product types in bleaching chemicals market are chlorine-based, peroxide-based, sodium hypochlorite, calcium hypochlorite and others.

In terms of application, pulp and paper segment to command 29.6% share in the bleaching chemicals market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Leading Providers & Market Share in Food Bleaching Agent Industry

Dental Bleaching Agent Market Size and Share Forecast Outlook 2025 to 2035

Dental Bleaching Materials Market

Activated Bleaching Earth Market Growth - Trends & Forecast 2025 to 2035

Chemicals And Petrochemicals Electrostatic Precipitator Market Size and Share Forecast Outlook 2025 to 2035

Biochemicals Control Market Size and Share Forecast Outlook 2025 to 2035

Oxo Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Soy Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Fine Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Zinc Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Green Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Fluorochemicals Market Size and Share Forecast Outlook 2025 to 2035

Paper Chemicals Market Growth – Trends & Forecast 2023-2033

Leather Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Roofing Chemicals Market Size & Trends 2025 to 2035

Sulphur Chemicals Market

Cosmetic Chemicals Market Growth - Trends & Forecast 2025 to 2035

Membrane Chemicals Market Growth - Trends & Forecast 2025 to 2035

Aluminum Chemicals Market Growth & Demand 2025 to 2035

Oilfield Chemicals Market Report - Growth, Demand & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA