The automotive tappets market is estimated to be valued at USD 7.9 billion in 2025 and is projected to reach USD 11.7 billion by 2035, registering a compound annual growth rate (CAGR) of 4.0% over the forecast period. Demand is closely tied to global vehicle production trends, technological advancements in internal combustion engines (ICEs), and the growing need for improved engine durability.

Market growth is being supported by rising demand for passenger and commercial vehicles in emerging economies, where ICE-powered vehicles continue to dominate. Hydraulic tappets, in particular, are gaining traction due to their ability to reduce maintenance needs and improve overall engine efficiency. Furthermore, the emphasis on fuel efficiency and compliance with stringent emission standards is driving innovation in tappet materials and design.

However, the gradual industry shift toward electric vehicles (EVs), which do not require tappets, poses a long-term challenge. Despite this, hybrid vehicles and advancements in lightweight, high-performance tappets are expected to sustain demand.

| Metric | Value |

|---|---|

| Automotive Tappets Market Estimated Value in (2025 E) | USD 7.9 billion |

| Automotive Tappets Market Forecast Value in (2035 F) | USD 11.7 billion |

| Forecast CAGR (2025 to 2035) | 4.0% |

As global vehicle demand continues to remain strong, especially in emerging economies, the need for efficient engine components that ensure smooth operation and enhanced fuel efficiency is driving market growth. Automotive tappets, which play a critical role in controlling valve movement, are being adopted extensively in modern engines to meet evolving performance and emission standards.

In addition, rising demand for fuel-efficient and high-performance vehicles is encouraging automakers to integrate advanced valvetrain mechanisms where tappets are indispensable. While electric vehicle adoption is growing, internal combustion engines are expected to maintain dominance over the forecast period, especially in commercial and rural segments.

This is reinforcing the continued relevance and demand for tappets. Ongoing improvements in manufacturing precision, material quality, and distribution networks are further strengthening the market outlook across global regions.

The automotive tappets market is segmented by type, vehicle, distribution channel, material, end user, and geographic regions. By type, the automotive tappets market is divided into Roller tappets and Flat tappets. In terms of vehicles, the automotive tappets market is classified into Passenger Cars and Commercial vehicles. Based on distribution channel, the automotive tappets market is segmented into OEM (Original Equipment Manufacturer) and Aftermarket. By material, the automotive tappets market is segmented into Steel, Cast Iron, Aluminium Alloys, and Other. By end user, the automotive tappets market is segmented into Automobile Manufacturers, Automotive Repair Shops and Garages, and Others. Regionally, the automotive tappets industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The roller tappet segment is projected to hold 62.8% of the Automotive Tappets Market revenue in 2025, establishing itself as the leading type segment. This dominance is being attributed to its ability to reduce friction and improve fuel efficiency compared to flat tappets. Roller tappets enable smoother engine performance by minimizing metal-to-metal contact, thereby enhancing the overall durability and reliability of the engine.

Their compatibility with high-performance and heavy-duty engines has led to widespread adoption among vehicle manufacturers. As regulatory pressure on fuel economy and emissions intensifies, roller tappets are being increasingly integrated into engines to support efficiency standards.

The preference for roller tappets is also being influenced by their ability to handle higher engine speeds and loads, making them suitable for a broad range of vehicle types. With ongoing advancements in engine design and materials, the segment is expected to retain its leadership in the tappet market through improved thermal stability and longer operational life.

The passenger cars segment is expected to contribute 68.4% of the overall Automotive Tappets Market revenue in 2025, making it the dominant vehicle category. This leading share is being driven by the consistent global demand for personal transportation and the increasing production volumes of passenger vehicles.

Engine components like tappets are integral to the functioning of conventional powertrains, and passenger vehicles represent the largest application base due to their high production frequency. The segment’s growth is being further reinforced by rising consumer expectations for performance, reliability, and reduced emissions, all of which necessitate precise valvetrain mechanisms.

In developing economies, increasing vehicle ownership and rapid urbanization are contributing to the growth of this segment. Additionally, improvements in automotive technology and design are prompting automakers to invest in efficient and durable components such as tappets, which play a vital role in maintaining engine performance throughout the vehicle’s lifespan.

The OEM segment is anticipated to account for 74.1% of the Automotive Tappets Market revenue in 2025, positioning it as the most significant distribution channel. This substantial share is being supported by the direct integration of tappets into engines during vehicle assembly at manufacturing plants. OEMs prefer sourcing high-precision, high-durability components to ensure compliance with global quality and emissions standards.

The trust in certified product quality, long-term performance, and warranty assurance is also driving the strong preference for OEM-supplied tappets. Manufacturers are increasingly collaborating with tappet suppliers to develop custom solutions tailored to specific engine architectures, further strengthening this distribution model.

Moreover, the focus on integrating advanced engine technologies at the production stage is resulting in steady demand for tappets through OEM channels. As automakers scale up production and enhance their quality control systems, the OEM segment is expected to maintain its dominance in the distribution landscape of automotive tappets.

The automotive tappets market is driven by increasing demand for engine efficiency and durability across various vehicle segments. High-performance vehicle adoption and material advancements are accelerating growth, with strong support from both OEM and aftermarket sectors.

The demand for automotive tappets is primarily driven by the increasing focus on improving engine efficiency across all vehicle segments. Manufacturers are focused on producing tappets that minimize friction and enhance the overall performance of the engine. Tappets play a crucial role in regulating valve timing, optimizing combustion efficiency, and contributing to reduced fuel consumption. As automotive manufacturers strive to meet stricter emission standards and fuel efficiency regulations, tappets are integral in the design of more energy-efficient and high-performing engines. The rise of electric and hybrid vehicles, while reducing the number of moving parts in engines, still drives innovation for specialized tappets in these powertrains.

In the high-performance vehicle segment, tappets are gaining increased adoption due to their significant impact on engine performance. High-end sports cars, racing cars, and luxury vehicles require tappets that offer enhanced durability, reduced wear, and high heat resistance. These vehicles often demand tappets that can withstand extreme conditions and perform under high stress. As automotive manufacturers continue to focus on improving acceleration, speed, and power output, tappets play a pivotal role in optimizing engine timing. This shift is contributing to the steady growth of the automotive tappets market, with manufacturers investing in specialized materials and designs to cater to high-performance engine requirements.

Advancements in materials and coatings are helping to improve the durability and performance of automotive tappets. High-performance alloys and coatings such as chrome and titanium are being integrated into tappet designs to provide better wear resistance and extend the lifespan of components. The development of advanced materials is also key in meeting the increasing demand for parts that can handle higher pressures and temperatures in modern engines. With manufacturers focusing on reducing engine wear and tear, these material innovations have become a central feature in the automotive tappets market. This trend is helping increase the adoption of tappets in both conventional and high-performance automotive segments.

The growth also influences the automotive tappets market in both OEM (original equipment manufacturer) and aftermarket sales. OEMs are focusing on tappets that enhance engine longevity and reduce maintenance costs, while the aftermarket caters to replacement parts for aging vehicle fleets. With rising consumer demand for reliable and efficient engines, aftermarket sales for tappets are growing, especially as vehicles reach higher mileages and require part replacements. Additionally, OEMs are offering tappets that meet evolving regulations and standards, further stimulating growth. Both segments are expected to benefit from the increasing emphasis on engine performance and the ongoing need for part replacements in vehicles across regions.

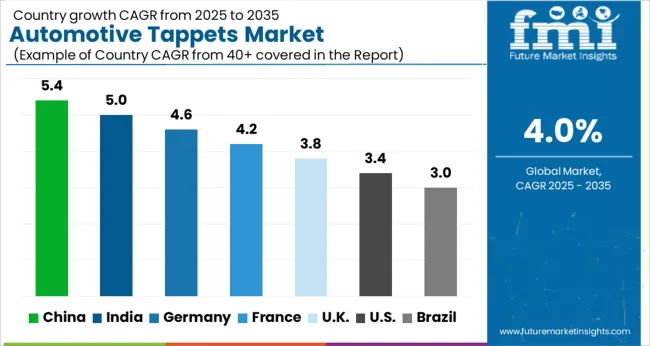

The automotive tappets market is projected to grow globally at a CAGR of 4.0% from 2025 to 2035, supported by increasing demand for high-performance engines and durability across various automotive sectors. China leads with a 5.4% CAGR, driven by robust growth in the automotive industry, increasing vehicle production, and rising demand for efficient engine components. India follows closely at 5.0%, supported by its expanding automotive manufacturing sector, rising consumer demand for fuel-efficient vehicles, and government policies promoting the adoption of greener technologies. France shows 4.2% growth, propelled by the automotive industry's focus on emissions reduction and high-performance components. The UK grows at 3.8%, influenced by the increasing need for tappets in the automotive aftermarket as well as new vehicle production. The United States achieves 3.4% CAGR, driven by steady growth in automotive manufacturing, especially in light-duty and heavy-duty trucks requiring advanced engine components. This growth trajectory highlights the strong adoption of automotive tappets in emerging markets like China and India, while mature markets in Europe and North America continue to exhibit steady demand driven by performance and regulatory needs.

The CAGR for the automotive tappets market in the United Kingdom stood at 3.2% during 2020–2024 and advanced to 3.8% for 2025–2035, signaling a stronger cycle of adoption across both OEM and aftermarket segments. Early momentum was tempered by economic uncertainty, production delays, and a focus on optimizing existing engine designs. Growth improved as consumer demand for fuel-efficient, high-performance engines increased, alongside rising interest in durable and high-quality tappet components. Spending tilted toward high-performance vehicles, with tappets playing a key role in meeting the growing focus on engine longevity and fuel economy. OEMs and aftermarket suppliers continue to invest in performance parts that meet evolving regulatory standards.

China’s CAGR for the automotive tappets market stood at 4.8% during 2020–2024 and surged to 5.4% in 2025–2035, signaling heightened demand from the growing automotive manufacturing sector. The first phase emphasized engine optimization, fuel efficiency, and the production of tappets for both domestic and export markets. The next phase is expected to favor the rise of electric and hybrid vehicles, where tappets play an important role in engine design and performance. The growing focus on lowering emissions and improving engine components is pushing the adoption of high-performance tappets. Domestic manufacturers are ramping up production capacities to meet the increasing demand from both the passenger and commercial vehicle segments.

India’s CAGR for the automotive tappets market was 4.3% during 2020–2024, and is expected to increase to 5.0% from 2025 to 2035. Early growth in the market was relatively modest, driven by India’s increasing demand for affordable and efficient vehicle components. The growth is being propelled by rising vehicle production, particularly in the small and mid-sized vehicle segments, which require high-performance yet cost-effective tappets. From 2025 onward, India is expected to see increased demand for high-efficiency tappets as the automotive sector focuses on reducing emissions and enhancing engine performance. Additionally, the growing domestic automotive aftermarket sector will fuel the demand for replacement tappets, as well as those optimized for higher durability and wear resistance.

The USA automotive tappets market experienced a CAGR of 2.9% during 2020–2024 and is expected to rise to 3.4% between 2025 and 2035. Growth in the USA was initially slower due to a strong emphasis on maximizing existing engine performance and the dominance of established superalloys in high-demand engine parts. However, demand has increased as manufacturers focus on high-performance, fuel-efficient, and long-lasting tappets. The trend towards electric and hybrid vehicles is further increasing demand for specific tappet designs suited to these powertrains. As the focus shifts towards sustainable mobility, the tappets market will benefit from ongoing demand for robust engine components in both commercial and passenger vehicle sectors.

France’s CAGR for the automotive tappets market stood at 3.5% during 2020–2024 and is projected to rise to 4.2% for 2025–2035, driven by the growing focus on performance vehicles and stricter environmental regulations. Early growth in the market was modest due to the reliance on established engine technologies and the need for optimizing existing designs. However, by 2025, the automotive sector’s push toward reducing emissions and increasing fuel efficiency is expected to drive stronger demand for high-performance tappets. The increasing integration of electric and hybrid vehicle powertrains, where tappets are essential for engine performance, will further contribute to growth. Additionally, France's emphasis on high-end vehicle production and a strong automotive aftermarket will boost tappet demand, especially for vehicles requiring enhanced durability and efficiency.

The automotive tappets market is highly competitive, consisting of a blend of global automotive component manufacturers and specialized tappet suppliers. Schaeffler AG offers advanced tappet solutions, focusing on automotive applications that demand high-performance and reliability in engine components. NSK Ltd. is recognized for its expertise in precision tappets, providing parts that enhance the engine's efficiency and longevity.

Eaton is a key player in engine components, providing tappets designed for energy efficiency and high-performance engines, particularly in commercial vehicles. SKF specializes in tappet solutions with a focus on durability and wear resistance, offering a broad range of products that cater to automotive OEMs and aftermarket segments. OTICS Corporation is known for manufacturing tappets for high-performance vehicles, enhancing engine operation by minimizing friction. Rane Engine Valve Limited focuses on producing tappets for both OEM and replacement parts, with special emphasis on materials that offer enhanced durability in high-stress environments. ACDelco has become a well-established name, supplying tappets for domestic and international vehicle markets, known for reliability and high-quality standards.

Key competitive strategies in the automotive tappets market revolve around material innovations, such as wear-resistant coatings, and advanced manufacturing processes aimed at reducing friction and improving performance. Companies are increasingly collaborating with OEMs and focusing on expanding their portfolios with tappets that meet stricter emissions and fuel efficiency standards. Differentiation is largely driven by durability, cost-efficiency, and specialized designs that improve engine performance and reduce maintenance intervals.

| Item | Value |

|---|---|

| Quantitative Units | USD 7.9 Billion |

| Type | Roller Tappet and Flat Tappet |

| Vehicle | Passenger Cars and Commercial vehicles |

| Distribution Channel | OEM (Original Equipment Manufacturer) and Aftermarket |

| Material | Steel, Cast Iron, Aluminium Alloys, and Other |

| End user | Automobile Manufacturers, Automotive Repair Shops and Garages, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Schaeffler AG, NSK Ltd., Eaton, SKF, OTICS Corporation, Rane Engine Valve Limited, and ACDelco |

| Additional Attributes | Dollar sales, share, regional demand trends, material innovations, market growth by vehicle type, adoption in high-performance vehicles, production costs, aftermarket demand, and regulatory impact on emissions. |

The global automotive tappets market is estimated to be valued at USD 7.9 billion in 2025.

The market size for the automotive tappets market is projected to reach USD 11.7 billion by 2035.

The automotive tappets market is expected to grow at a 4.0% CAGR between 2025 and 2035.

The key product types in automotive tappets market are roller tappet, _hydraulic tappets, _mechanical tappets and flat tappet.

In terms of vehicle, passenger cars segment to command 68.4% share in the automotive tappets market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Network Testing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Performance Part Market Size and Share Forecast Outlook 2025 to 2035

Automotive Carbon Ceramic Brake Market Size and Share Forecast Outlook 2025 to 2035

Automotive Camshaft Market Size and Share Forecast Outlook 2025 to 2035

Automotive Stamping Industry Analysis in India Size and Share Forecast Outlook 2025 to 2035

Automotive Cylinder Liner Market Size and Share Forecast Outlook 2025 to 2035

Automotive Microcontroller Market Size and Share Forecast Outlook 2025 to 2035

Automotive Roof Rails Market Size and Share Forecast Outlook 2025 to 2035

Automotive Active Safety System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Diagnostic Scan Tool Market Size and Share Forecast Outlook 2025 to 2035

Automotive Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Dynamic Map Data Market Size and Share Forecast Outlook 2025 to 2035

Automotive Green Tires Market Size and Share Forecast Outlook 2025 to 2035

Automotive E-Tailing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Interior Market Forecast Outlook 2025 to 2035

Automotive Key Market Size and Share Forecast Outlook 2025 to 2035

Automotive Appearance Chemical Market Forecast and Outlook 2025 to 2035

Automotive Seating Market Forecast and Outlook 2025 to 2035

Automotive Domain Control Module Market Forecast and Outlook 2025 to 2035

Automotive Remote Diagnostic Market Forecast and Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA