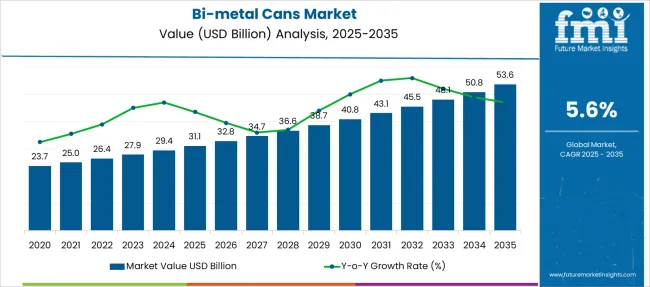

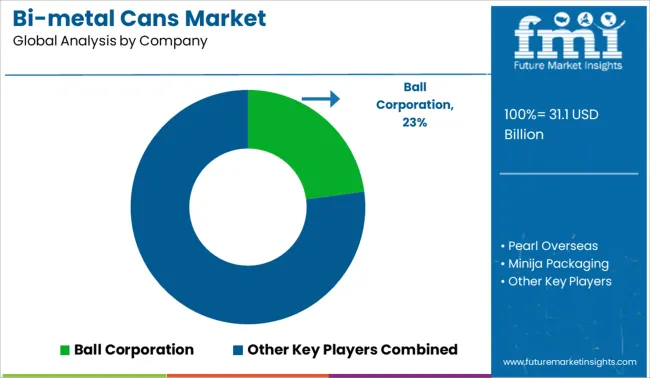

The Bi-metal Cans Market is estimated to be valued at USD 31.1 billion in 2025 and is projected to reach USD 53.6 billion by 2035, registering a compound annual growth rate (CAGR) of 5.6% over the forecast period.

| Metric | Value |

|---|---|

| Bi-metal Cans Market Estimated Value in (2025 E) | USD 31.1 billion |

| Bi-metal Cans Market Forecast Value in (2035 F) | USD 53.6 billion |

| Forecast CAGR (2025 to 2035) | 5.6% |

The bi-metal cans market is growing steadily as demand for durable and recyclable packaging solutions rises across the food and beverage industry. Industry developments highlight increased consumer preference for packaging that preserves product freshness while being environmentally responsible. Bi-metal cans offer superior strength and barrier properties, making them ideal for packaging perishable food products.

Expanding food processing operations and growing retail penetration have further contributed to market growth. Innovations in can manufacturing have enhanced product safety and extended shelf life, which appeal to both manufacturers and consumers.

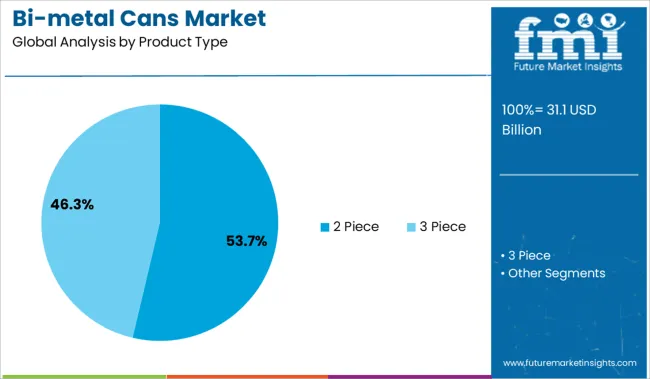

The shift toward sustainable packaging practices and stricter regulations on single-use plastics have also propelled demand for metal cans. Looking ahead, market growth is expected to continue driven by consumer awareness and increasing adoption of eco-friendly packaging in the food sector. Segmental growth is anticipated to be led by 2 Piece cans, capacity ranging from 250 to 500 ML, and the food end-use segment.

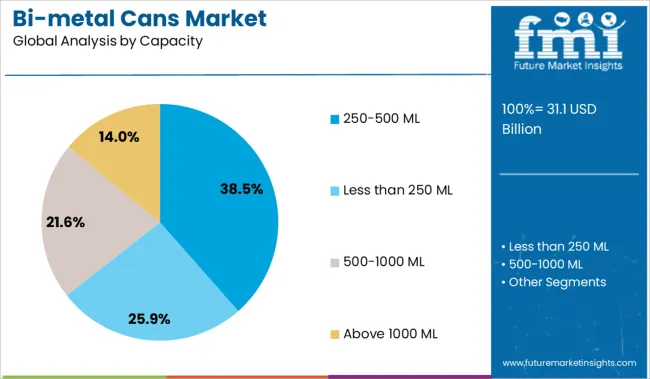

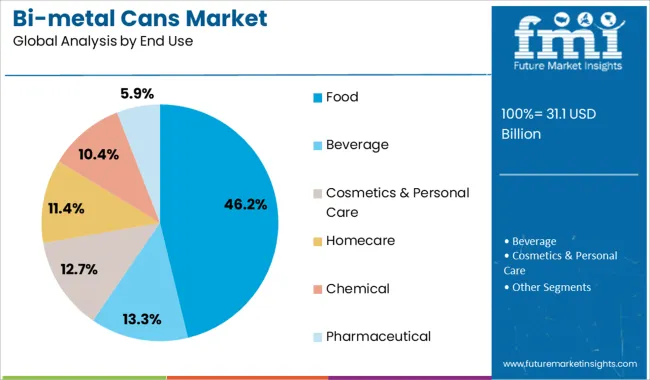

The market is segmented by Product Type, Capacity, and End Use and region. By Product Type, the market is divided into 2 Piece and 3 Piece. In terms of Capacity, the market is classified into 250-500 ML, Less than 250 ML, 500-1000 ML, and Above 1000 ML. Based on End Use, the market is segmented into Food, Beverage, Cosmetics & Personal Care, Homecare, Chemical, and Pharmaceutical. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The 2 Piece product type segment is projected to account for 53.7% of the bi-metal cans market revenue in 2025, maintaining its position as the leading product category. This segment benefits from streamlined manufacturing processes that reduce production costs and improve efficiency. The two-piece design provides excellent sealing capabilities and strength, making it widely preferred for packaging liquids and semi-solid food products.

Additionally, the versatility of 2 piece cans allows for easy customization in sizes and shapes, catering to diverse packaging needs. Their recyclability and compatibility with automated filling lines also enhance their appeal in high-volume food packaging operations.

Given these advantages, the 2 Piece segment is expected to continue dominating the market.

The 250-500 ML capacity segment is forecasted to hold 38.5% of the market revenue in 2025, reflecting strong consumer demand for convenient and portion-controlled packaging. This size range is popular among ready-to-eat meals, beverages, and canned food products that target on-the-go consumers and smaller households.

Its moderate volume balances product usability with storage efficiency, making it suitable for retail distribution and consumer preferences. Manufacturers have focused on optimizing can design within this capacity range to ensure durability and ease of handling.

The segment’s growth is supported by urbanization trends and changing lifestyles that favor smaller and more portable food packaging. As convenience continues to be a priority for consumers, the 250-500 ML segment is expected to maintain its significant market share.

The Food end-use segment is projected to account for 46.2% of the bi-metal cans market revenue in 2025, sustaining its position as the largest application area. Growth in this segment is driven by the expanding processed and packaged food sector, which requires reliable packaging solutions to ensure product safety and shelf life.

Bi-metal cans are favored for their ability to preserve food quality by providing robust protection against contamination and oxygen exposure. Additionally, rising consumer demand for canned vegetables, fruits, seafood, and ready meals has contributed to increased market penetration.

Regulatory emphasis on food safety and sustainability has further propelled the adoption of bi-metal cans. With ongoing innovation in packaging technology and expanding food processing capacities globally, the food segment is expected to remain the dominant driver of market growth.

Sales of bi-metal cans are expected to witness growth due to their advantageous qualities, which include - recyclability, standardization, and durability. Bi-metal cans have a lighter environmental footprint in comparison to other packaging materials like plastics, which will increase the demand for bi-metal cans.

Government regulations regarding plastic usage might also play an essential role in boosting the sales of bi-metal cans in the upcoming years. Recycling is an easy way to save energy and raw materials by efficiently reducing CO2 emissions and the amount of waste generated during production and raw material collection.

Increased awareness among end-users and consumers will contribute to the growth in demand for bi-metal cans in the market. A critical aspect that will contribute to the bi-metal cans market share increment is the increased consumption of packaged food and beverages.

There are certain factors that would hinder the sales of the bi-metal cans market; one of the significant factors is the usage of plastics.

Though bi-metal cans are better than plastics, some new innovative products are being launched that claim to reduce the environmental footprint. Such innovations are anticipated to hamper the demand for bi-metal cans in the coming period.

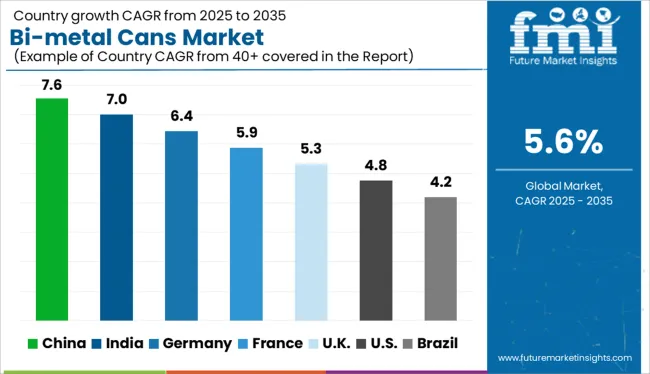

The sales of bi-metal cans are expected to grow in some key regions like Europe and East Asia over the forecast years. In East Asia, the demand for bi-metal cans in China is expected to grow at a high CAGR during the forecast period. Increasing emphasis on sustainable consumption of natural resources is provided the necessary impetus in demand for bi-metal cans in Asia Pacific countries.

Europe contributes the largest revenue share in the global bi-metal cans market. In Europe, France and Belgium are expected to dominate the market in terms of demand for bi-metal cans and growth rate during the forecast period.

North America is expected to grow at a moderate pace in the forecast period. Such a slow growth rate in North America for bi-metal cans market share is attributed to the fact that the regional markets in USA and Canada are almost saturated. However, the large volume of consumer goods is expected to retain the sales of bi-metal cans market profitable during the forecast years.

Sone of the key players in the global bi-metal cans market includes Ardagh Group S.A., Ball Corp, Crown Holdings, Inc., The Tinplate Company Of India Limited, NCI Packaging Pty. Ltd., and Cerviflan Industrial e Comercial Ltd.

Investment in collecting back the bi-metal cans by the product companies is a growing trend in many developed areas. Such strategies by consumable products manufacturers is anticipated to create a favourable demand for bi-metal cans in the future.

In January 2024, Ardagh Group purchased a facility of Huron at Ohio for increasing its production capacity of different types of metal cans. This major development is expected to increase the volume and sales of bi-metal cans of the company.

| Report Attribute | Details |

|---|---|

| Growth Rate | CAGR of 5.6% from 2025 to 2035 |

| Base Year of Estimation | 2024 |

| Historical Data | 2014 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD Million and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends and Pricing Analysis |

| Segments Covered | Material Type, Product Type, Capacity, Filling Method, End Use Industry, Region |

| Regions Covered | North America; Latin America; Western Europe; Eastern Europe; APEJ; Japan; Middle East and Africa |

| Key Countries Profiled | USA, Canada, Brazil, Argentina, Germany, UK, France, Spain, Italy, Nordics, BENELUX, Australia & New Zealand, China, India, ASEAN, GCC, South Africa |

| Key Companies Profiled | Ardagh Group S.A.; Ball Corp; Crown Holdings, Inc.; The Tinplate Company Of India Limited; NCI Packaging Pty. Ltd.; Cerviflan Industrial e Comercial Ltd. |

| Customization scope | Available Upon Request |

| Pricing and Purchase Option | Avail Customized purchase options to meet your exact research needs. |

The global bi-metal cans market is estimated to be valued at USD 31.1 billion in 2025.

The market size for the bi-metal cans market is projected to reach USD 53.6 billion by 2035.

The bi-metal cans market is expected to grow at a 5.6% CAGR between 2025 and 2035.

The key product types in bi-metal cans market are 2 piece and 3 piece.

In terms of capacity, 250-500 ml segment to command 38.5% share in the bi-metal cans market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cans Market Analysis – Innovations & Industry Forecast 2025 to 2035

Tin Cans Market

Bowl Cans Market Size and Share Forecast Outlook 2025 to 2035

Market Share Distribution Among Bowl Cans Manufacturers

Food Cans Market

Beer Cans Market

Paint Cans Market Size and Share Forecast Outlook 2025 to 2035

Jerry Cans Market Size and Share Forecast Outlook 2025 to 2035

Drink Cans Market Insights - Growth & Trends 2025 to 2035

Industry Share & Competitive Positioning in Jerry Cans

Market Share Insights of Paint Can Manufacturers

2 Piece Cans Market Size and Share Forecast Outlook 2025 to 2035

Beta-Glucans Market Trends – Growth, Demand & Forecast 2025 to 2035

Industry Share Analysis for 2-Piece Cans Companies

Plastic Cans Market

Aluminum Cans Market Size and Share Forecast Outlook 2025 to 2035

Sanitary Cans Market Size and Share Forecast Outlook 2025 to 2035

Market Share Breakdown of the Aluminum Cans Market

Watering Cans Market

Lever Lid Cans Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA