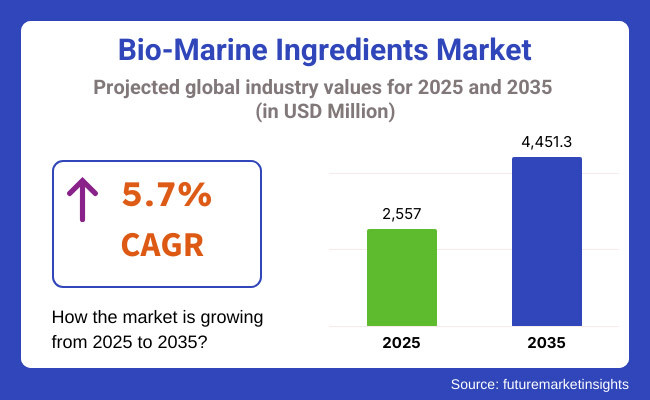

World bio-marine ingredients market value was USD 2,307.4 million in 2023. The year-to-year demand for bio-marine ingredients increased by 5.7% in 2024 per annum, and these numbers propelled the world market value to USD 2,557.0 million in 2025. Global sales beyond the forecast range (2025 to 2035) will expand at a 5.7% CAGR during the forecasting period and amount to USD 4,451.3 million in 2035.

Bio-marine products are motivated by increasing demand for sea-source ingredients having unique health benefits. Sea-source ingredients such as fish oils, omega-3 fatty acids, algae oils, and marine collagen have unique applications in diverse industries led by food & beverages, nutraceutical, and cosmetic industries. Increased awareness of the health benefit of sea foods such as cardiovascular wellness, immunostimulating, and skin care has propelled their increased demand.

Increased demand for bio-marine and sustainable functional ingredients is also driving bio-marine ingredient commerce. Ingredients sourced from places such as algae, such as astaxanthin and omega-3 fatty acids, are rising due to the environmentally friendly methods of production and high nutrient content.

And with more and more consumers seeking out health, well-being, and sustainability, the bio-marine ingredients are hip as a more premium option over land ingredients, as well. For instance, the omega-3 fatty acids in the marine oil are greater in bioactivity and bioavailability than in vegetable oils and hence commonly employed in nutraceuticals.

Marine bio-products like hyaluronic acid, seaweed extract, and sea collagen in cosmetics today are used in their anti-aging and rejuvenating effect on skin. Even for clinical applications and as dietary supplements, these marine products today are used in attempting to cure the joints, the skin, and even the brain.

The second most influential driving force towards the development of the bio-marine ingredients market is sustainability. This is due to the fact that consumers and producers are interested in developing products that are environmentally and socially friendly.

Algae farming, having a lower relative contribution in the utilization of resources compared to traditional methods of farming and being a higher order of production of bio-marine ingredients, more environmentally friendly in contrast to the latter order of production, is being investigated increasingly by companies.

Here is the six months’ difference in CAGR of base year (2024) and current year (2025) comparative table of world bio-marine ingredients market. All such important variations in performances are mentioned along with the revenue increasing trends, thus giving an accurate picture to the stakeholders about how the growth is being driven in a one-year time frame. Half one (H1) is January to June, and half two (H2) is July to December.

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 5.3% |

| H2 (2024 to 2034) | 5.4% |

| H1 (2025 to 2035) | 5.4% |

| H2 (2025 to 2035) | 5.7% |

During the first half (H1) of the period 2025 to 2035, the market would be growing at a CAGR of 5.4%, marginally lower at 5.7% during the second half (H2) of the period. The growth rate accelerates modestly during the latter half of the period because of expanding uses of bio-marine ingredients by food, nutraceutical, and cosmetic companies.

The market expanded 10 BPS in H1 of the period, and the growth is anticipated to accelerate by 30 BPS in H2. Such a consistent growth pattern, with the support of rising demand for functional and sustainable ingredients, places the bio-marine ingredient industry on the trajectory to long-term success in the forecast period.

Global Bio-Marine Ingredients Market consists of a mix of organized and unorganized players, with concentration differing geographically. The organized segment consists of large multinationals and mature biotech companies with sophisticated extraction technology, excellent regulatory compliance, and robust global supply chains.

These firms are manufacturing giants with vast manufacturing capacity, and applicability to pharmaceutical, nutraceutical, and cosmetic industries. They are keen to manufacture quality marine-derived products like omega 3 fatty acids, marine collagen and fish protein hydrolysates to meet the increasing demands of functional food, dietary supplements, and pharmaceuticals.

The unorganized sector comprises small and medium-sized firms working at mainly regional levels. These companies apply old technology for manufacturing, supply locally, and offer lower-priced substitutes. Yet they suffer from dismal conditions like shortages of high technology, inconsistency of availability of raw material, and rigorous regulatory conditions.

Shortages of standardized quality control measures and certification procedures make it difficult for the unorganized players to challenge their position for the international market. Regional competitors are stronger in Asia-Pacific and Latin America, where the demand for marine-based ingredients in animal nutrition, cosmetics, and functional foods is growing.

China, Peru, India, and Vietnam all have numerous small- and medium-sized businesses that are transforming fish, crustaceans, and seaweed into numerous bio-marine products. The market in Europe and North America is more consolidated with major players having very strict environment and sustainability policies. Although dominated by organized players, the unorganized segment still caters to niche markets, especially in markets where cost factors and traditional use of marine ingredients drive demand.

As more consumers learn about the health value of bio-marine ingredients, pressure on unorganized players to improve quality, harvest sustainably, and meet international standards increases. The unorganized-organized sector ratio will still define the world market for bio-marine ingredients, with innovation, sustainability, and compliance with regulations being key determinants of market growth.

Suburbanization of Demand for Bio-Marine Ingredients in Sustainable Nutrition

Shift: Individuals are more and more looking for the ingredients to be produced sustainably for dietary supplements and food. Bio-marine ingredients like algae-based omega-3, fish collagen, and krill oil are becoming favored because they process more sustainably and are full of more nutrients, hence promoting more demand.

Individuals are turning to marine sources for alternatives in animal-derived nutrients as more vegetable diets become a trend. The market for sustainable seafood is expanding in double-digit percentages and thus there is a demand for eco-certified bio-marine products with transparency and sustainable sourcing.

Strategic Response: Aker BioMarine contributed 21% of its MSC-certified krill oil products because of environmentally conscious consumers. Acceptance of plant-based omega-3 grew by 15% in the form of algae-based BASF's omega-3 supplements and green leap from fish oil. Nestlé Vital Proteins also introduced its sustainable fish collagen peptides recently and forged a position in functional nutrition. The above is the pointer towards ocean-driven sustainability of world nutrition.

Increased Demand for Marine Collagen in Beauty & Anti-Aging

Shift: The cosmetics market is converting to ingestible format, and the most prevalent one among them is marine collagen due to the highest level of bioavailability and other skin benefits in comparison to bovine collagen. The world of nutricosmetics also witnessed a higher demand for marine collagen peptides as the consumers are moving towards anti-aging, hydration, and hair growth treatment in the way of highly digestible supplements.

Strategic Response: Shiseido and AmorePacific's long-term marine collagen drink series are dominating ingestible skincare buys in Asia by 24%. Rousselot's Peptan Marine Collagen features in high-end beauty supplements and is dominating 19% sales growth in Europe for collagen.

H&H Group (Swisse Beauty) introduced marine collagen powder formulas, which are dominating consumer confidence in bio-marine actives to support hair and skin health. This is a continuation of the growing frontline role being taken up by marine collagen in the quest for beauty from within.

Bio-Marine Ingredients Fuel Innovation in Cognitive & Mental Wellness Supplements

Shift: As the emerging problem of stress, anxiety, and mental exhaustion, bio-marine actives like DHA-algal oil, krill phospholipids, and fish neuropeptides are in great demand. Consumers are looking for increasingly natural nootropics that enhance the efficiency of brain, memory, and mood stability. The global market for brain nutritional supplements is expanding at double-digit rates and sea-sourced ingredients are among the major drivers.

Strategic Response: FrieslandCampina Ingredients introduced Lactium®, a casein-derived marine peptide clinically proven to reduce stress levels and improve sleep quality, and this boosted sales of cognitive wellbeing products by 16%.

Aker BioMarine krill phospholipids are more commonly found in mental well-being products, and this boosted brain health product sales by 22%. Nordic Naturals introduced the market with high-purity DHA omega-3 dietary supplements, sustaining mania for use of sea-based alternatives to the brain. This is just one example of growth in intersectionality in ocean nutrition for brain health.

Growing Sport Nutrition through Marine Proteins & Hydrolysates

Shift: Sported and health-concerned consumers are moving away from traditional whey protein towards the consumption of sea-source protein foods for recovery of muscle, energy, and joint comfort. Fish and krill sea protein hydrolysates are of increased bioavailability, enhanced amino acid profile, and anti-inflammatory efficacy. Sports nutrition is seeing a transition towards clean-label, functional-performance proteins, where the bio-marine ingredients are in the lead as a trendsetter.

Strategic Response: Arla Foods Ingredients introduced hydrolyzed fish protein in the sport nutrition category, which increased protein supplement sales by 14%. BioMar salmon protein hydrolysates penetrated endurance-type products, which registered a 19% increase in marine protein-based sports drinks. Nestlé Health Science also introduced medical nutrition products driven by marine proteins due to increased use of bio-marine proteins in the recovery from muscle trauma and sport.

Algae-Omega-3 Enters the Fish Oil Replacement in Vegan & Sustainable Supplements

Shift: With the world going vegan and plant-based, there is increased demand for something beyond fish-derived omega-3. Algal DHA and EPA are picking up steam as the more sustainable and plant-based source of omega-3 over fish oil, propelling growth in the broader category of vegan nutrition, infant nutrition, and cardiovascular nutrition supplements. The international market for algae-derived omega-3 will be huge, as there will be a big demand for mercury-free and eco-friendly sources of omega-3.

Strategic Response: BASF and DSM ramped up algal omega-3 production, and products entered the market in parts of the world, driving 17% sales growth in the sale of plant-based omega-3 supplements. High-potency algae oil entered the baby nutrition category when Corbion launched it in the infant nutrition space, where penetration was 12% among baby formula companies. Additionally, iWi Life (market leader in algal nutrition) proved against fish oil as plant-based omega-3 supplements paved the way for sustainable algae alternatives.

Sea-Derived Chitosan Dominates as the Top Material for Biodegradable Packaging & Sustainable Textiles

Shift: Squeezing out plastic waste more and more while falling behind, industries are moving towards biodegradable and bio-based materials. Biodegradable polymer of marine-based material from crustacean shell, chitosan, is gaining pace with antimicrobial property, biodegradation, and film-forming property.

It is being produced on a growing scale for food packaging, wound dressings, and environmental clothing to create demand in markets. Governments and consumers are willing to pay a premium for seawater-based alternatives to plastics in order to drive record growth in the market for bio-packaging.

Strategic Response: Biodegradable food packaging has been developed by Mitsubishi Chemical, and sustainable Japanese food has driven 20% more take-up. Market-leader European player KitoZyme has also driven sea-source bio-plastics and, in doing so, boosted take-up of bio-based packaging material by 16%.

Adidas and Nike are both producing sporting apparel with material enriched in chitosan to make sporting apparel odour-resistant and thus sustainable, and hence sustainable, sea-source material fashion is where it's at. This proves that there is more focus on circular economy-relevance in the form of growing importance of the bio-marine materials category.

The following table shows the estimated growth rates of the top five territories expected to exhibit high consumption of bio-marine ingredients through 2035.

| Countries | CAGR, 2025 to 2035 |

|---|---|

| USA | 6.4% |

| Germany | 7.9% |

| China | 4.1% |

| Japan | 4.5% |

| India | 9.6% |

Consumers are also increasingly looking for marine-derived proteins, omega-3 supplements and functional seafood extracts, boosting the USA bio-marine ingredients market. As health awareness climbing, consumers also include marine collagen, fish-derived peptides and algal omega-3 in their diet. The growing demand for natural ingredients in nutraceuticals and functional foods is further fuelled by sustainability considerations; consumers are increasingly seeking marine ingredients that are also eco-friendly.

The bio-marine ingredients market in Germany is growing steadily owing to EU regulations encouraging sustainable seafood and marine bio-actives. Marine collagen, algal omega-3, and fish protein hydrolysates for sports nutrition, skincare, and dietary supplements are increasingly selected by consumers for MSC-certified sources.

As a country with a great deal of emphasis on sustainability and traceability, German manufacturers are currently investing into marine-based bio-actives for cosmetics, pharmaceuticals and functional beverages as well.

The rising demand for marine collagen, chitosan and fish protein peptides in traditional medicine, functional foods and pharmaceuticals is driving the growth of China's bio-marine ingredients market. The production of marine biopeptides and algae extracts is growing in the region among domestic companies, aided by government-backed marine biotechnology investments. Diving deeper into aging awareness, joint health and metabolism benefits, demand for high-purity, sustainably sourced marine ingredients are accelerating.

Japan's bio-marine ingredients market is supported by the country's emphasis on marine-based beauty products, anti-aging skin-care, and high-purity seafood extracts. Japanese consumers have a preference for fish collagen, marine elastin, and seaweed-based bioactives for skincare, functional beverages, and nutraceuticals. Moreover, Japanese innovations with marine biotechnology are yielding enzymatically enriched aquatic proteins and biodigestable ocean minerals.

The bio-marine ingredients market in India is growing in response to increasing demand for proteins derived from sustainable seafood as well as algae-based omega-3 and marine polysaccharides. Marine bio-actives have been gaining popularity in functional foods, sports nutrition and aquaculture feed. Strong government backing for marine biotechnology and sustainable fisheries has led to the manufacturers developing their marine ingredient extraction and processing capabilities to meet demand.

| Segment | Value Share (2025) |

|---|---|

| Marine Collagen & Peptides (By Application) | 60.2% |

The share of bio-marine ingredients is then segmented into categories such as bio-marine peptides and collagen (with a segment shares of 60.2% in 2025) because of its high bioavailable protein content, skin-nourishing and joint wellbeing. Consumer products containing peptides include those utilized in skincare anti-aging, functional foods and beverages and dietary supplements driving a developing cosmeceutical and nutraceutical market.

As consumer demand for collagen-fortified beauty and wellness products increases, manufacturers are seeking to expand their portfolios with sustainably sourced, non-GMO marine protein extracts. Hydrolyzed marine peptides have superior absorption, bioavailability, and efficacy on skin elasticity, bone density, and cartilage, fueling demand.

As scientific research continues to substantiate the efficacy of marine collagen in reducing wrinkles, improving hydration, and stimulating improved skin structure, its uptake in premium skincare products is further driven. This supports the segment's leadership role in functional health & beauty solutions and advances in marine biotechnology allow the development of clean-label, environmentally friendly collagen products.

| Segment | Value Share (2025) |

|---|---|

| Marine Oils & Omega-3 Extracts (By Application) | 39.8% |

With growing awareness among consumers regarding heart health, cognitive function, and anti-inflammatory activities, marine oil and omega-3 extract segment is the market-leading segment with a market share of 39.8% in 2025.

The demand for fish oil, krill oil, and omega-3 supplements based on algae is also a prominent area of development in functional foods, pharmaceuticals, and prenatal health product formulations driven by consumer consumers seeking brain-enhancing, cardiovascular-supportive and immune-enhancing nutrients.

With growing sustainability issues, firms are attempting to shift towards the organic and plant-based sources, such as microalgae-derived omega-3, phospholipid-enriched krill oil, and also from purified fish oil preparations. These developments help in decreasing reliance on traditional fish-extracted omega-3s, while ensuring marine biodiversity protection and resource availability for generations to come.

In addition to this, the recent development of encapsulation technology and bioavailability enhancement is enabling improved absorption and stability of marine omega-3 formulations, thereby leading to improved efficacy driving desired health effects.

Extremely concentrated formulations of EPA and DHA are being incorporated into cardiovascular medications, as well as neuroprotective medications in the pharmaceutical sector, which again serves as a key factor that drives market growth. With scientific validation and regulatory approvals still on track, the marine oil and omega-3 extract segment will keep growing even more thus cementing its place as a core contributor in preventive healthcare, dietary supplementation and functional food development.

Bio-marine ingredients market is highly competitive due to the presence of several established players in the market. Companies are getting into precision enzymatic hydrolysis, microalgae-based ingredient production, and marine collagen synthesis.

The marine-based functional ingredients sector is spearheaded by leading manufacturers such as Aker BioMarine, BASF, Croda International, KD Pharma, and CP Kelco, helping the company continue providing omega-3 formulations and bioactive peptide extraction. The increasing demand for marine-derived functional products is leading many companies to expand their presence across Asia-Pacific and Europe.

Processes targeted include collaborations with pharmaceutical and food manufacturers, investment in precision extraction technologies, and focusing on the development of high-purity marine bioactives. Manufacturers are also focusing on low-carbon marine ingredient supply chain reductions and traceability initiatives.

For instance

The market includes a variety of sources, such as Fish, Crustaceans, Algae, and other marine-derived ingredients, catering to diverse industry needs.

Marine-based products are available in various forms, including Proteins, Peptides, Collagens, Chitosan, Omega-3 Fatty Acids, Polysaccharides, Pigments, and other specialized compounds.

These products are widely used across multiple industries, including Food & Beverages, Cosmetics & Personal Care, Pharmaceuticals, and Agriculture & Animal Feed, with additional applications in other sectors.

The market is segmented as North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Central Asia, Russia and Belarus, Balkan & Baltic Countries, Middle East and Africa.

The global bio-marine ingredients industry is projected to reach USD 2557 million in 2025.

Key players include Aker BioMarine AS; Cargill, Incorporated; CP Kelco USA, Inc.; FMC Corporation; Givaudan SA; Ingredion Incorporated.

Asia-Pacific is expected to dominate due to high demand for marine-based nutraceuticals and functional food ingredients.

The industry is forecasted to grow at a CAGR of 5.7% from 2025 to 2035.

Key drivers include rising demand for marine-derived functional foods, increasing use in pharmaceuticals and cosmeceuticals, and advancements in sustainable marine ingredient extraction.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (MT) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 4: Global Market Volume (MT) Forecast by Source, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 6: Global Market Volume (MT) Forecast by Application, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 8: Global Market Volume (MT) Forecast by Type, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 12: North America Market Volume (MT) Forecast by Source, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 14: North America Market Volume (MT) Forecast by Application, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 16: North America Market Volume (MT) Forecast by Type, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 20: Latin America Market Volume (MT) Forecast by Source, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 22: Latin America Market Volume (MT) Forecast by Application, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 24: Latin America Market Volume (MT) Forecast by Type, 2018 to 2033

Table 25: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Europe Market Volume (MT) Forecast by Country, 2018 to 2033

Table 27: Europe Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 28: Europe Market Volume (MT) Forecast by Source, 2018 to 2033

Table 29: Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 30: Europe Market Volume (MT) Forecast by Application, 2018 to 2033

Table 31: Europe Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 32: Europe Market Volume (MT) Forecast by Type, 2018 to 2033

Table 33: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: East Asia Market Volume (MT) Forecast by Country, 2018 to 2033

Table 35: East Asia Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 36: East Asia Market Volume (MT) Forecast by Source, 2018 to 2033

Table 37: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 38: East Asia Market Volume (MT) Forecast by Application, 2018 to 2033

Table 39: East Asia Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 40: East Asia Market Volume (MT) Forecast by Type, 2018 to 2033

Table 41: South Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: South Asia Market Volume (MT) Forecast by Country, 2018 to 2033

Table 43: South Asia Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 44: South Asia Market Volume (MT) Forecast by Source, 2018 to 2033

Table 45: South Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 46: South Asia Market Volume (MT) Forecast by Application, 2018 to 2033

Table 47: South Asia Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 48: South Asia Market Volume (MT) Forecast by Type, 2018 to 2033

Table 49: Oceania Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 50: Oceania Market Volume (MT) Forecast by Country, 2018 to 2033

Table 51: Oceania Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 52: Oceania Market Volume (MT) Forecast by Source, 2018 to 2033

Table 53: Oceania Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 54: Oceania Market Volume (MT) Forecast by Application, 2018 to 2033

Table 55: Oceania Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 56: Oceania Market Volume (MT) Forecast by Type, 2018 to 2033

Table 57: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 58: MEA Market Volume (MT) Forecast by Country, 2018 to 2033

Table 59: MEA Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 60: MEA Market Volume (MT) Forecast by Source, 2018 to 2033

Table 61: MEA Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 62: MEA Market Volume (MT) Forecast by Application, 2018 to 2033

Table 63: MEA Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 64: MEA Market Volume (MT) Forecast by Type, 2018 to 2033

Figure 1: Global Value (US$ Million) by Source, 2023 to 2033

Figure 2: Global Value (US$ Million) by Type, 2023 to 2033

Figure 3: Global Value (US$ Million) by Application, 2023 to 2033

Figure 4: Global Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Volume (MT) Analysis by Region, 2018 to 2033

Figure 7: Global Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 10: Global Volume (MT) Analysis by Source, 2018 to 2033

Figure 11: Global Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 12: Global Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 13: Global Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 14: Global Volume (MT) Analysis by Type, 2018 to 2033

Figure 15: Global Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 16: Global Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 17: Global Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 18: Global Volume (MT) Analysis by Application, 2018 to 2033

Figure 19: Global Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 20: Global Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 21: Global Attractiveness by Source, 2023 to 2033

Figure 22: Global Attractiveness by Type, 2023 to 2033

Figure 23: Global Attractiveness by Application, 2023 to 2033

Figure 24: Global Attractiveness by Region, 2023 to 2033

Figure 25: North America Value (US$ Million) by Source, 2023 to 2033

Figure 26: North America Value (US$ Million) by Type, 2023 to 2033

Figure 27: North America Value (US$ Million) by Application, 2023 to 2033

Figure 28: North America Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Volume (MT) Analysis by Country, 2018 to 2033

Figure 31: North America Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 34: North America Volume (MT) Analysis by Source, 2018 to 2033

Figure 35: North America Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 36: North America Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 37: North America Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 38: North America Volume (MT) Analysis by Type, 2018 to 2033

Figure 39: North America Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 40: North America Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 41: North America Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 42: North America Volume (MT) Analysis by Application, 2018 to 2033

Figure 43: North America Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 44: North America Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 45: North America Attractiveness by Source, 2023 to 2033

Figure 46: North America Attractiveness by Type, 2023 to 2033

Figure 47: North America Attractiveness by Application, 2023 to 2033

Figure 48: North America Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Value (US$ Million) by Source, 2023 to 2033

Figure 50: Latin America Value (US$ Million) by Type, 2023 to 2033

Figure 51: Latin America Value (US$ Million) by Application, 2023 to 2033

Figure 52: Latin America Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Volume (MT) Analysis by Country, 2018 to 2033

Figure 55: Latin America Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 58: Latin America Volume (MT) Analysis by Source, 2018 to 2033

Figure 59: Latin America Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 60: Latin America Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 61: Latin America Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 62: Latin America Volume (MT) Analysis by Type, 2018 to 2033

Figure 63: Latin America Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 64: Latin America Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 65: Latin America Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 66: Latin America Volume (MT) Analysis by Application, 2018 to 2033

Figure 67: Latin America Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 68: Latin America Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 69: Latin America Attractiveness by Source, 2023 to 2033

Figure 70: Latin America Attractiveness by Type, 2023 to 2033

Figure 71: Latin America Attractiveness by Application, 2023 to 2033

Figure 72: Latin America Attractiveness by Country, 2023 to 2033

Figure 73: Europe Value (US$ Million) by Source, 2023 to 2033

Figure 74: Europe Value (US$ Million) by Type, 2023 to 2033

Figure 75: Europe Value (US$ Million) by Application, 2023 to 2033

Figure 76: Europe Value (US$ Million) by Country, 2023 to 2033

Figure 77: Europe Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Europe Volume (MT) Analysis by Country, 2018 to 2033

Figure 79: Europe Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Europe Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Europe Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 82: Europe Volume (MT) Analysis by Source, 2018 to 2033

Figure 83: Europe Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 84: Europe Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 85: Europe Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 86: Europe Volume (MT) Analysis by Type, 2018 to 2033

Figure 87: Europe Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 88: Europe Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 89: Europe Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 90: Europe Volume (MT) Analysis by Application, 2018 to 2033

Figure 91: Europe Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 92: Europe Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 93: Europe Attractiveness by Source, 2023 to 2033

Figure 94: Europe Attractiveness by Type, 2023 to 2033

Figure 95: Europe Attractiveness by Application, 2023 to 2033

Figure 96: Europe Attractiveness by Country, 2023 to 2033

Figure 97: East Asia Value (US$ Million) by Source, 2023 to 2033

Figure 98: East Asia Value (US$ Million) by Type, 2023 to 2033

Figure 99: East Asia Value (US$ Million) by Application, 2023 to 2033

Figure 100: East Asia Value (US$ Million) by Country, 2023 to 2033

Figure 101: East Asia Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: East Asia Volume (MT) Analysis by Country, 2018 to 2033

Figure 103: East Asia Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: East Asia Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: East Asia Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 106: East Asia Volume (MT) Analysis by Source, 2018 to 2033

Figure 107: East Asia Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 108: East Asia Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 109: East Asia Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 110: East Asia Volume (MT) Analysis by Type, 2018 to 2033

Figure 111: East Asia Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 112: East Asia Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 113: East Asia Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 114: East Asia Volume (MT) Analysis by Application, 2018 to 2033

Figure 115: East Asia Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 116: East Asia Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 117: East Asia Attractiveness by Source, 2023 to 2033

Figure 118: East Asia Attractiveness by Type, 2023 to 2033

Figure 119: East Asia Attractiveness by Application, 2023 to 2033

Figure 120: East Asia Attractiveness by Country, 2023 to 2033

Figure 121: South Asia Value (US$ Million) by Source, 2023 to 2033

Figure 122: South Asia Value (US$ Million) by Type, 2023 to 2033

Figure 123: South Asia Value (US$ Million) by Application, 2023 to 2033

Figure 124: South Asia Value (US$ Million) by Country, 2023 to 2033

Figure 125: South Asia Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: South Asia Volume (MT) Analysis by Country, 2018 to 2033

Figure 127: South Asia Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: South Asia Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: South Asia Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 130: South Asia Volume (MT) Analysis by Source, 2018 to 2033

Figure 131: South Asia Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 132: South Asia Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 133: South Asia Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 134: South Asia Volume (MT) Analysis by Type, 2018 to 2033

Figure 135: South Asia Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 136: South Asia Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 137: South Asia Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 138: South Asia Volume (MT) Analysis by Application, 2018 to 2033

Figure 139: South Asia Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 140: South Asia Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 141: South Asia Attractiveness by Source, 2023 to 2033

Figure 142: South Asia Attractiveness by Type, 2023 to 2033

Figure 143: South Asia Attractiveness by Application, 2023 to 2033

Figure 144: South Asia Attractiveness by Country, 2023 to 2033

Figure 145: Oceania Market Value (US$ Million) by Source, 2023 to 2033

Figure 146: Oceania Market Value (US$ Million) by Type, 2023 to 2033

Figure 147: Oceania Market Value (US$ Million) by Application, 2023 to 2033

Figure 148: Oceania Market Value (US$ Million) by Country, 2023 to 2033

Figure 149: Oceania Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 150: Oceania Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 151: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 152: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 153: Oceania Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 154: Oceania Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 155: Oceania Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 156: Oceania Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 157: Oceania Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 158: Oceania Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 159: Oceania Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 160: Oceania Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 161: Oceania Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 162: Oceania Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 163: Oceania Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 164: Oceania Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 165: Oceania Market Attractiveness by Source, 2023 to 2033

Figure 166: Oceania Market Attractiveness by Type, 2023 to 2033

Figure 167: Oceania Market Attractiveness by Application, 2023 to 2033

Figure 168: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 169: MEA Value (US$ Million) by Source, 2023 to 2033

Figure 170: MEA Value (US$ Million) by Type, 2023 to 2033

Figure 171: MEA Value (US$ Million) by Application, 2023 to 2033

Figure 172: MEA Value (US$ Million) by Country, 2023 to 2033

Figure 173: MEA Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 174: MEA Volume (MT) Analysis by Country, 2018 to 2033

Figure 175: MEA Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 176: MEA Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 177: MEA Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 178: MEA Volume (MT) Analysis by Source, 2018 to 2033

Figure 179: MEA Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 180: MEA Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 181: MEA Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 182: MEA Volume (MT) Analysis by Type, 2018 to 2033

Figure 183: MEA Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 184: MEA Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 185: MEA Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 186: MEA Volume (MT) Analysis by Application, 2018 to 2033

Figure 187: MEA Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 188: MEA Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 189: MEA Attractiveness by Source, 2023 to 2033

Figure 190: MEA Attractiveness by Type, 2023 to 2033

Figure 191: MEA Attractiveness by Application, 2023 to 2033

Figure 192: MEA Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Ingredients Market for Plant-based Food & Beverages Size and Share Forecast Outlook 2025 to 2035

Bean Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Milk Ingredients Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Malt Ingredients Market Analysis by Raw Material, Product Type, Grade, End-use, and Region through 2035

Aroma Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Dairy Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Pulse Ingredients Market Analysis – Size, Share, and Forecast 2025 to 2035

Smoke Ingredients for Food Market Analysis - Size, Share & Forecast 2025 to 2035

Bakery Ingredients Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Biotin Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Baking Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Almond Ingredients Market Size, Growth, and Forecast for 2025 to 2035

Savory Ingredients Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Examining Savory Ingredients Market Share & Industry Leaders

Energy Ingredients Market Analysis by Product Type and Application Through 2035

Perfume Ingredients Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Vitamin Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Alcohol Ingredients Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Protein Ingredients Market Analysis - Size, Share, and Forecast 2025 to 2035

Caramel Ingredients Market Size, Growth, and Forecast for 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA