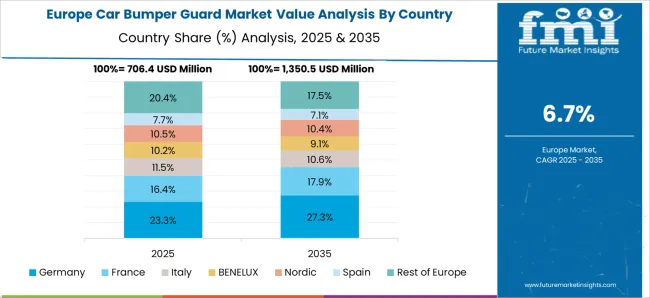

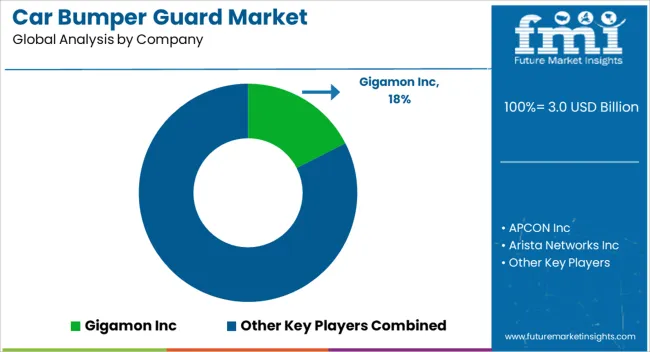

The Car Bumper Guard Market is estimated to be valued at USD 3.0 billion in 2025 and is projected to reach USD 6.1 billion by 2035, registering a compound annual growth rate (CAGR) of 7.3% over the forecast period. This strong growth trajectory reflects increasing vehicle ownership, rising urban traffic density, and heightened consumer preference for affordable safety and protection accessories. From 2020 to 2024, the market was in the early adoption stage, driven largely by aftermarket demand and awareness among urban consumers seeking to reduce repair costs from minor collisions. Adoption was strongest in Asia-Pacific due to high vehicle volumes and price-sensitive consumers, while North America and Europe leaned more toward premium designs.

Between 2025 and 2030, the market will enter the scaling phase, supported by OEM integration of bumper guards as optional accessories, rising sales of SUVs and passenger cars, and the growth of e-commerce distribution channels. During this period, product innovations such as lightweight materials and aesthetic designs will accelerate adoption, pushing the market toward mainstream acceptance. From 2030 to 2035, the industry will move into the consolidation phase, where established players dominate, and competition focuses on differentiation through design, durability, and integration with smart vehicle technologies. Regional market leaders will likely consolidate their share through partnerships with automakers and distribution networks.

| Metric | Value |

|---|---|

| Car Bumper Guard Market Estimated Value in (2025 E) | USD 3.0 billion |

| Car Bumper Guard Market Forecast Value in (2035 F) | USD 6.1 billion |

| Forecast CAGR (2025 to 2035) | 7.3% |

The car bumper guard market is witnessing consistent growth, driven by rising vehicle ownership, heightened awareness around vehicle safety, and growing concerns over minor collision damage. Increasing demand for both aesthetic enhancement and functional protection has pushed automakers and aftermarket players to develop advanced bumper guard solutions.

Urban congestion, coupled with limited parking spaces, has made low-speed impacts more frequent, resulting in a stronger consumer inclination toward damage-prevention accessories. Technological innovation in material science has led to the adoption of high-durability polymers, stainless steel, and impact-resistant rubber, ensuring prolonged product life and improved vehicle compatibility.

Additionally, evolving safety regulations and insurance incentives for vehicle protection accessories are influencing consumer behavior. Future growth is anticipated from premium segment penetration and the rising popularity of customizable, design-integrated guards across passenger vehicles and SUVs.

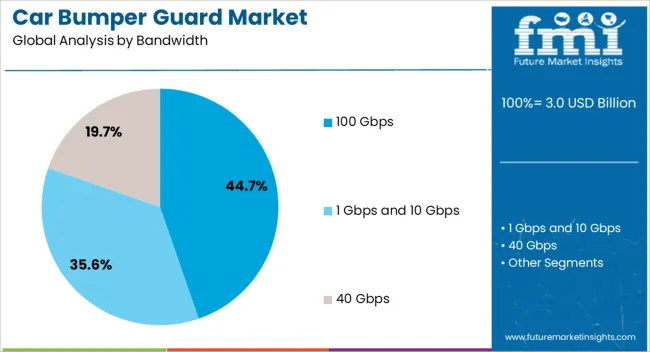

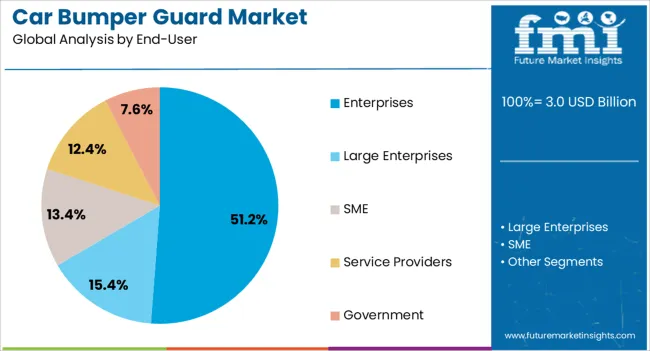

The car bumper guard market is segmented by bandwidth, end-user, and geographic regions. By bandwidth, the car bumper guard market is divided into 100 Gbps, 1 Gbps and 10 Gbps, and 40 Gbps. In terms of end-users of the car bumper guard market, it is classified into Enterprises, Large Enterprises, SME, Service Providers, and Government. Regionally, the car bumper guard industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The 100 Gbps segment is projected to account for 44.70% of the total revenue share in 2025, emerging as the leading bandwidth category within advanced bumper guard sensor integrations. Growth in this segment is being driven by the increasing use of smart bumper guards embedded with high-speed data transmission capabilities for collision detection, proximity alerts, and real-time diagnostics.

The 100 Gbps bandwidth enables seamless integration with vehicle telematics, ADAS systems, and onboard analytics platforms, which are becoming standard in modern vehicles. Rising adoption of autonomous and semi-autonomous features has further necessitated data-heavy processing at the edge, reinforcing the demand for high-bandwidth interfaces.

OEMs and Tier 1 suppliers are aligning with this trend by embedding digital sensing modules within protective bumpers that support ultra-fast communication protocols. The superior performance and scalability of the 100 Gbps segment make it ideal for the next generation of connected and safety-centric bumper systems.

Enterprises are expected to hold 51.20% of the overall market revenue in 2025, making them the dominant end-user group in the car bumper guard market. This leadership position is supported by large-scale vehicle fleets used in logistics, car rentals, ride-hailing services, and corporate mobility programs, all of which prioritize vehicle durability and maintenance efficiency.

Enterprises increasingly invest in protective solutions like bumper guards to minimize cosmetic damage, reduce downtime, and extend asset life. Insurance savings, fleet management optimization, and reduced total cost of ownership are additional drivers of enterprise-level adoption.

Moreover, procurement strategies now favor aftermarket installations during vehicle onboarding phases, reflecting a proactive approach to risk mitigation. As companies focus on sustainability, extending vehicle usability through protective accessories aligns with broader ESG mandates, solidifying enterprise demand for reliable and standardized bumper guard solutions.

The car bumper guard market is expanding steadily as drivers look for affordable protection, reduced repair costs, and stylish accessories for their vehicles. Bumper guards provide defense against scratches, dents, and minor impacts, which are common in crowded traffic and tight parking situations. Rising disposable incomes, growing car ownership, and increasing awareness of vehicle care are boosting global demand. North America and Europe remain strong markets due to high adoption of premium accessories, while Asia-Pacific is witnessing rapid demand growth supported by expanding middle-class ownership.

As global vehicle numbers increase, drivers face higher risks of minor collisions, scratches, and parking-related damage. Bumper guards act as an affordable safeguard against these challenges, helping drivers avoid costly repair bills. In cities with limited parking spaces, bumper guards reduce concerns about accidental damage from tight parking maneuvers. They also appeal to owners of compact cars, sedans, and SUVs who seek practical solutions to protect their investment. By providing both protection and visual enhancement, bumper guards have become a must-have accessory for cost-conscious drivers, boosting widespread demand across diverse regions.

The aftermarket segment has become a critical sales channel for bumper guards, offering consumers a broad selection of materials, styles, and finishes. Unlike OEM parts, aftermarket products are more affordable and widely available through retail outlets and e-commerce platforms. Online marketplaces allow buyers to compare products, access customer reviews, and purchase with ease, fueling adoption among digitally savvy consumers. Rising interest in vehicle personalization also supports aftermarket demand, as buyers look for options that match their car’s appearance. This growing aftermarket ecosystem ensures that bumper guards reach a wider customer base, driving strong global sales growth.

Modern bumper guards are increasingly manufactured with durable yet lightweight materials such as ABS plastic, reinforced rubber, and stainless steel. These materials deliver better impact resistance while being easy to install and maintain. Weather-resistant finishes improve product longevity in regions with extreme climates, making them suitable for a wider customer base. In addition, some designs feature shock-absorbing properties, ensuring enhanced safety during low-speed impacts. These material improvements not only extend the product’s lifespan but also enhance its appeal among car owners seeking both reliability and style. As a result, material upgrades play a key role in strengthening consumer trust.

Distribution networks and sales platforms are essential in shaping bumper guard adoption across different markets. In North America and Europe, automotive accessory retailers dominate, offering branded options with higher quality standards. In the Asia-Pacific region, the rise of e-commerce channels has made bumper guards more accessible to younger and first-time car owners. Regional customization ensures better market fit. Partnerships with dealerships also support sales through OEM integration. These regionalized sales strategies enhance product reach and provide manufacturers with opportunities to serve diverse customer preferences effectively worldwide.

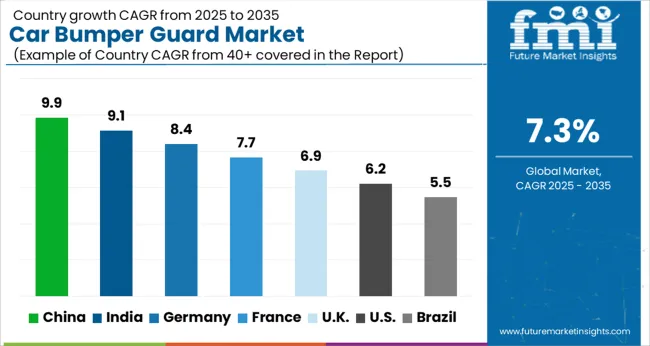

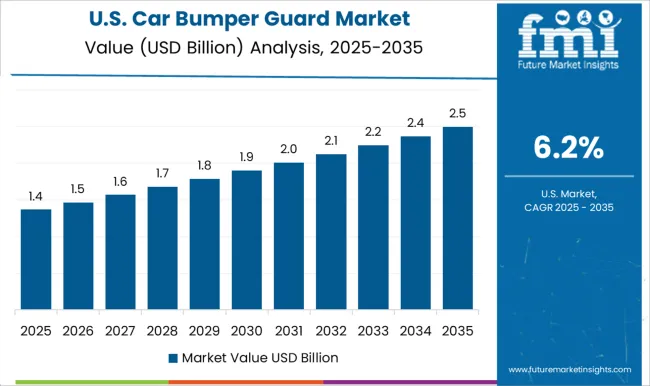

The global car bumper guard market is anticipated to grow at a CAGR of 7.3%, reflecting the rising demand for vehicle safety enhancements and aftermarket accessories. China leads with a 9.9% growth rate, driven by a large automotive base and growing consumer preference for protective car accessories. India follows at 9.1%, supported by rapid vehicle ownership growth and expanding aftermarket sales. Germany records an 8.4% CAGR, benefitting from strong automotive manufacturing and consumer focus on safety. The UK shows a moderate growth rate of 6.9%, while the USA trails slightly at 6.2%, influenced by aftermarket demand and consumer inclination towards durable vehicle accessories. This report includes insights on 40+ countries; the top countries are shown here for reference.

China dominates the car bumper guard market with a CAGR of 9.9%, driven by rapid automotive production, rising urbanization, and increasing consumer demand for vehicle safety accessories. Compared to India, China’s market benefits from a larger automotive manufacturing base, enabling mass production at competitive costs. Growing middle-class income supports rising car ownership, directly increasing the need for protective accessories. Domestic companies invest in innovative materials such as thermoplastic polymers and reinforced steel for improved performance and aesthetics. The expanding e-commerce sector further accelerates sales, making bumper guards more accessible nationwide. Additionally, government emphasis on road safety enhances consumer awareness regarding vehicle protection products. Export opportunities within Asia-Pacific and Africa strengthen market prospects for Chinese manufacturers. With strong domestic demand, affordable production, and international expansion strategies, China continues to lead the bumper guard market, solidifying its role as a global hub for vehicle safety accessories.

Car bumper guard market in India expands at 9.1%, driven by the surge in automobile sales, rising awareness of road safety, and growing adoption of aftermarket vehicle accessories. Compared to Germany, India focuses on cost-efficient production and widespread aftermarket distribution. The rapid increase in car ownership, particularly in urban areas, fuels demand for protective accessories that safeguard vehicles against minor collisions. Small and medium enterprises contribute to the sector with affordable, innovative solutions catering to budget-conscious consumers. Online platforms such as Flipkart and Amazon expand accessibility, allowing customers nationwide to purchase these products conveniently. Government regulations promoting road safety indirectly encourage the use of protective vehicle parts. India also benefits from a strong auto component manufacturing base, enabling affordable exports to neighboring countries. Overall, increasing vehicle sales, aftermarket expansion, and consumer safety awareness position India as a rapidly growing bumper guard market.

Germany records an 8.4% growth rate in the car bumper guard market, supported by advanced automotive engineering, premium vehicle demand, and high safety standards. Compared to the United Kingdom, Germany emphasizes superior material quality and integration of bumper guards with advanced vehicle design. The presence of leading automobile manufacturers such as BMW, Mercedes-Benz, and Audi ensures continuous innovation in safety and aesthetics. Consumer preference for durable and visually appealing accessories supports steady demand. Regulatory frameworks prioritize road safety, driving consistent adoption of protective components. The market also benefits from export opportunities across the European Union, supported by Germany’s strong automotive supply chain. Sustainability initiatives encourage the development of eco-friendly bumper guard materials, aligning with environmental policies. The combination of advanced R&D, premium automotive culture, and export opportunities ensures Germany’s strong position in the global bumper guard market.

The United Kingdom car bumper guard market grows steadily at 6.9%, supported by increasing car ownership, a growing aftermarket accessories industry, and heightened consumer safety awareness. Compared to the United States, the UK emphasizes regulatory compliance and aesthetic appeal of vehicle accessories. Demand arises from urban consumers seeking protection against frequent minor collisions in congested areas. Online retail and specialized automotive shops provide accessible distribution channels across the country. The rise of electric vehicles also contributes, as manufacturers and consumers seek innovative protective accessories compatible with new car models. The market benefits from collaborations between domestic suppliers and European manufacturers, ensuring product availability. Export potential to Commonwealth countries further strengthens industry growth. Despite moderate growth compared to Asian markets, the UK maintains a stable position with consumer-focused innovations and regulatory-driven adoption.

The United States shows a 6.2% growth rate in the car bumper guard market, supported by strong consumer interest in vehicle safety, customization, and durability. Compared to China, the US emphasizes advanced designs, high-quality materials, and premium aftermarket solutions. Rising car ownership, especially SUVs and pickup trucks, drives demand for robust protective accessories. E-commerce platforms and auto parts retailers expand distribution channels, ensuring wide product availability. Consumers increasingly prefer customizable bumper guards that balance protection with style. The market also benefits from technological innovations, including lightweight yet durable materials designed for improved efficiency. Safety-conscious buyers, alongside strict regulatory standards, further enhance adoption. Export opportunities to Canada and Latin America add growth potential. While growth is slower than in Asia, the US market maintains a strong presence by prioritizing high-end, innovative solutions tailored to consumer needs.

The Car Bumper Guard Market plays an important role in the automotive accessories industry, offering protection against minor collisions, scratches, and parking damages. These products enhance vehicle durability and reduce repair costs, making them increasingly popular among car owners. Rising eco-efficiency, heavy traffic conditions, and growing consumer preference for affordable aftermarket solutions are driving the global demand for bumper guards. In addition, the increasing ownership of passenger cars and SUVs, particularly in developing economies, is contributing to steady market expansion. 3M Company is a key player, leveraging its innovation in materials science to provide durable, high-performance bumper protection solutions. BumperBadger specializes in rear bumper guards, focusing on easy-to-install, consumer-friendly designs tailored for city driving conditions. WeatherTech offers premium automotive accessories, including custom-fit bumper protection products, appealing to customers seeking high-quality and aesthetic solutions. Lund International and Bushwacker provide a wide range of automotive protection and styling products, including bumper guards designed for both function and vehicle appearance enhancement. Winbo Industries brings cost-effective, durable bumper protection products to global markets, especially catering to the mid-range consumer segment. AutoZone, Inc., as a major automotive aftermarket retailer, ensures broad product availability and distribution, making bumper guards accessible to a wide consumer base. Emerging brands like RhinoGuard focus on rugged, impact-resistant bumper guards suitable for larger vehicles such as SUVs and trucks, catering to consumers prioritizing durability and safety. The market is expected to witness steady growth as vehicle owners prioritize cost-effective protection, while manufacturers innovate with lightweight, impact-resistant, and stylish bumper guard designs to meet evolving consumer demands worldwide.

Manufacturers are investing in advanced materials like high-density foam, thermoplastic rubber (TPR), and carbon fiber to make bumper guards that are more durable, lightweight, and flexible. These materials are engineered to absorb the impact and offer better protection, thus increasing the overall performance of bumper guards. The use of UV-resistant materials ensures longer-lasting protection, even under harsh weather conditions, which has expanded the product's use across different climates.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.0 Billion |

| Bandwidth | 100 Gbps, 1 Gbps and 10 Gbps, and 40 Gbps |

| End-User | Enterprises, Large Enterprises, SME, Service Providers, and Government |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Gigamon Inc, APCON Inc, Arista Networks Inc, Broadcom Inc, CGS Tower Networks Ltd, Cisco Systems Inc, cPacket Networks Inc, Cubro Network Visibility, Datacom Systems Inc, Extreme Networks Inc, Garland Technology LLC, Keysight Technologies, Microtel Innovation S.r.l, NetScout Systems Inc, Network Critical, Niagara Networks, Profitap HQ B.V, and VIAVI Solutions, Inc |

| Additional Attributes | Dollar sales by type including front guard, rear guard, and corner guard, material such as plastic, rubber, and steel, application across passenger vehicles and commercial vehicles, and region covering North America, Europe, and Asia-Pacific. Growth is driven by rising vehicle ownership, demand for affordable protection accessories, and increasing focus on vehicle safety and aesthetics. |

The global car bumper guard market is estimated to be valued at USD 3.0 billion in 2025.

The market size for the car bumper guard market is projected to reach USD 6.1 billion by 2035.

The car bumper guard market is expected to grow at a 7.3% CAGR between 2025 and 2035.

The key product types in car bumper guard market are 100 gbps, 1 gbps and 10 gbps and 40 gbps.

In terms of end-user, enterprises segment to command 51.2% share in the car bumper guard market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cartridge Heating Element Market Size and Share Forecast Outlook 2025 to 2035

Carboxymethyl Tamarind Kernel Powder Market Size and Share Forecast Outlook 2025 to 2035

Car Tail Light Mould Market Size and Share Forecast Outlook 2025 to 2035

Car OS Market Size and Share Forecast Outlook 2025 to 2035

Caramel Malt Market Size and Share Forecast Outlook 2025 to 2035

Carbon Capture and Sequestration Market Forecast Outlook 2025 to 2035

Cardiac Rehabilitation Market Size and Share Forecast Outlook 2025 to 2035

Carbon Dioxide Incubators Market Size and Share Forecast Outlook 2025 to 2035

Carboxymethyl Tamarind Gum (CMT) Market Size and Share Forecast Outlook 2025 to 2035

Car Cover Market Size and Share Forecast Outlook 2025 to 2035

Cardiology Information System Market Size and Share Forecast Outlook 2025 to 2035

Cardiopulmonary Functional Testing Platform Market Size and Share Forecast Outlook 2025 to 2035

Carbon Enhanced Lead Acid Battery Market Size and Share Forecast Outlook 2025 to 2035

Car Bushing Market Size and Share Forecast Outlook 2025 to 2035

Carbon-negative Cement Market Size and Share Forecast Outlook 2025 to 2035

Card Printer Ribbon Market Size and Share Forecast Outlook 2025 to 2035

Carbon Tetrabromide Market Size and Share Forecast Outlook 2025 to 2035

Carbon Steel Market Size and Share Forecast Outlook 2025 to 2035

Carpet Spot Remover Market Size and Share Forecast Outlook 2025 to 2035

Cardiovascular CT Systems Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA