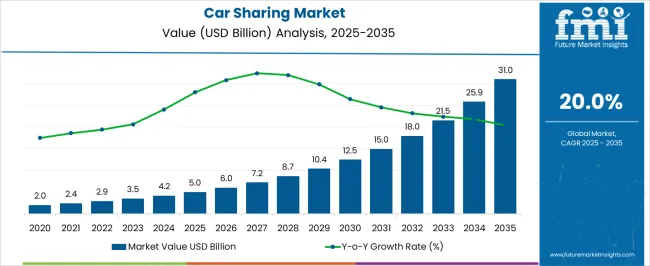

The car sharing market is estimated to be valued at USD 5.0 billion in 2025 and is projected to reach USD 31.0 billion by 2035, registering a compound annual growth rate (CAGR) of 20.0% over the forecast period.

Fleet operators evaluate vehicle specifications based on utilization rates, maintenance accessibility, and technology integration capabilities when expanding service coverage or replacing aging inventory. Procurement strategies involve balancing acquisition costs against operational efficiency metrics including fuel consumption, insurance premiums, and depreciation schedules that influence per-mile pricing structures and profitability margins. Vehicle selection prioritizes compact models with advanced telematics systems, keyless entry mechanisms, and damage-resistant materials that withstand frequent user transitions while minimizing maintenance interventions between reservations.

Operational logistics require sophisticated fleet positioning algorithms that anticipate demand patterns, optimize vehicle distribution, and minimize repositioning costs across service areas with varying population densities and transportation infrastructure characteristics. Technology platforms coordinate real-time availability updates, reservation management, and usage tracking while integrating payment processing, user verification, and vehicle access control systems that enable seamless customer experiences without human intervention. Data analytics teams monitor utilization patterns, peak demand periods, and geographical usage concentrations to inform expansion decisions and pricing optimization strategies.

Cross-functional challenges arise between operations teams seeking maximum fleet utilization and maintenance departments requiring adequate downtime for cleaning, inspection, and repair activities that ensure vehicle safety and customer satisfaction. Facility management involves coordinating parking arrangements, charging infrastructure for electric vehicles, and fuel station partnerships while negotiating favorable terms with municipal authorities for on-street parking privileges and dedicated car sharing zones. Insurance considerations address liability coverage, theft protection, and damage assessment procedures that protect both operators and users while streamlining claim resolution processes.

Membership acquisition strategies focus on demographic segments including young professionals, university students, and urban residents who value convenience and cost savings over vehicle ownership responsibilities. Marketing campaigns emphasize environmental benefits, parking elimination, and maintenance-free mobility while addressing usage scenarios including airport transportation, weekend trips, and emergency transportation needs. Pricing models accommodate both occasional users through per-hour rates and frequent users via monthly subscription plans that include insurance, fuel, and maintenance costs within predictable fee structures.

Technology advancement emphasizes mobile application development, vehicle connectivity systems, and predictive maintenance algorithms that reduce operational costs while improving service reliability. Internet connectivity enables remote vehicle monitoring, diagnostics reporting, and over-the-air software updates that enhance security features and user interface functionality. Integration with public transportation systems, ride-hailing services, and bicycle sharing networks creates comprehensive mobility ecosystems that address diverse transportation needs throughout urban environments.

| Metric | Value |

|---|---|

| Car Sharing Market Estimated Value in (2025 E) | USD 5.0 billion |

| Car Sharing Market Forecast Value in (2035 F) | USD 31.0 billion |

| Forecast CAGR (2025 to 2035) | 20.0% |

The car sharing market is expanding rapidly as urban populations seek flexible and cost-effective transportation alternatives. Growing traffic congestion, environmental concerns, and increasing smartphone penetration have encouraged the adoption of shared mobility services.

City planners and transportation authorities have supported car sharing as part of sustainable urban mobility strategies aimed at reducing private car ownership and emissions. Technological advancements in vehicle tracking and mobile apps have made accessing and managing car shares seamless for users.

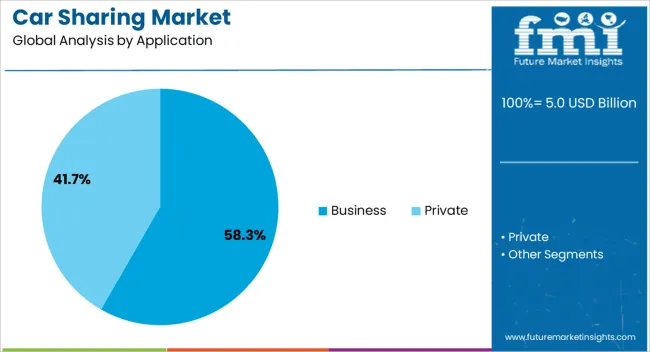

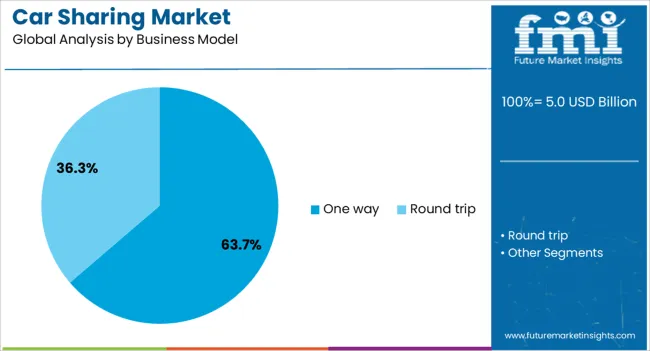

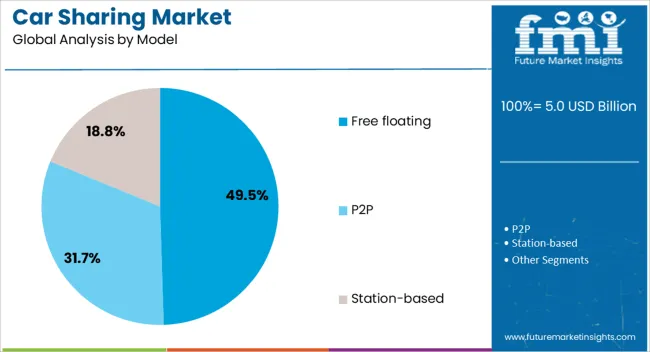

Additionally, changing consumer preferences toward usage-based models and the desire for convenience have boosted market demand. The rise in remote working and the shift in commuting patterns post-pandemic have further influenced market dynamics. Looking ahead, business-oriented applications, particularly in corporate mobility, and innovations in fleet management are expected to drive growth. Segmental momentum is forecast to be led by Business applications, One Way business models, and Free Floating car sharing models.

The car sharing market is segmented by application, business model, and geographic regions. By application, the car sharing market is divided into Business and Private. In terms of the business model, the car sharing market is classified into one-way and round-trip. Based on the model, the car sharing market is segmented into free-floating, P2P, and Station-based. Regionally, the car sharing industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Business application segment is projected to hold 58.3% of the car sharing market revenue in 2025, maintaining its lead in usage scenarios. Growth in this segment has been fueled by corporate demand for flexible fleet solutions that reduce costs associated with vehicle ownership and maintenance.

Companies increasingly prefer car sharing services for employee travel, client meetings, and project work due to their scalability and convenience. The rise of gig economy workers and on-demand staffing has also contributed to corporate use of car sharing.

Business users value streamlined billing, dedicated service levels, and the ability to book vehicles on short notice. As organizations seek sustainable and cost-efficient mobility options, the Business segment is expected to continue dominating car sharing applications.

The One Way business model segment is expected to capture 63.7% of the market revenue in 2025, solidifying its position as the preferred model. This model offers users the convenience of picking up a vehicle at one location and dropping it off at another without the need to return to the original spot.

The flexibility reduces user friction and aligns well with urban mobility needs such as errands, business trips, and short-term travel. Operators have focused on optimizing vehicle distribution and parking solutions to support one way services efficiently.

Urban policies promoting reduced vehicle ownership and increased use of shared mobility have encouraged the growth of one way models. As consumer demand for easy, point-to-point travel continues to rise, the one way model is anticipated to lead the car sharing market.

The Free Floating segment is projected to contribute 49.5% of the car sharing market revenue in 2025, establishing it as the dominant operational model. This model allows users to locate and access vehicles within a defined geographic area without designated parking spots.

Free floating car sharing offers high flexibility and convenience, which appeals to urban dwellers and occasional users. Technology platforms supporting real-time vehicle tracking and dynamic pricing have enhanced the user experience.

Operators benefit from reduced infrastructure costs compared to station-based systems and can serve a larger user base. Urban transport planners have recognized free-floating as an effective solution to reduce private vehicle dependency and parking demand. With the ongoing expansion of shared mobility networks, the Free Floating model is expected to retain its leadership in the car sharing market.

Car sharing growth has been shaped by consumer flexibility preferences, regulatory backing, fleet electrification, and strong digital ecosystems. These dynamics collectively establish it as a transformative force in global mobility.

The car sharing industry has been shaped by growing consumer demand for cost-effective and flexible mobility options. Individuals are increasingly drawn toward short-term access models rather than committing to vehicle ownership, particularly in dense metropolitan regions where parking and fuel costs are rising. Car sharing offers a solution that balances convenience with affordability, making it attractive to students, working professionals, and households with limited budgets. Fleet operators have leveraged this shift by providing subscription-based services and app-based access, ensuring instant availability and transparent pricing. This growing demand highlights a cultural shift from traditional ownership to shared mobility, positioning car sharing as a crucial alternative in today’s evolving transportation ecosystem.

Government initiatives and regulatory measures have significantly shaped the trajectory of car sharing platforms. Incentives such as tax benefits, priority parking allocations, and congestion relief schemes have encouraged both users and operators to adopt these services. Many cities have introduced low-emission zones and policies that favor shared transport services to ease road congestion and reduce reliance on private cars. Partnerships between municipalities and service providers have also enabled pilot projects that integrate car sharing into public transport frameworks. This supportive environment ensures operators can expand service footprints while aligning with regulatory goals. Strong policy backing continues to enhance the appeal and long-term viability of the car sharing model.

The inclusion of electric and hybrid vehicles into car sharing fleets has emerged as a powerful growth catalyst. Operators are gradually expanding EV offerings to reduce operational costs linked to fuel and maintenance, while also aligning with consumer demand for cleaner alternatives. Charging infrastructure expansion and partnerships with utility companies have improved the feasibility of operating large-scale EV-based fleets. The appeal lies in offering affordable access to advanced vehicles without high upfront ownership costs. Consumers benefit from lower usage expenses, while operators strengthen their brand image and capture demand from environmentally conscious travelers. This transition is positioning car sharing as a testbed for wider EV adoption across global markets.

Digital platforms have been central to the growth of car sharing by ensuring seamless booking, payment, and fleet management capabilities. Mobile apps provide users with real-time availability and route optimization, significantly improving convenience. Strategic collaborations between automotive manufacturers, software providers, and mobility start-ups have also reshaped industry operations. These partnerships enable broader coverage, efficient resource allocation, and reduced service downtime. Integration with ride-hailing and public transit applications has created multi-modal mobility ecosystems where car sharing is a complementary option. The expansion of digital ecosystems ensures a higher retention rate among users, driving both adoption and loyalty while reinforcing the long-term role of shared vehicles.

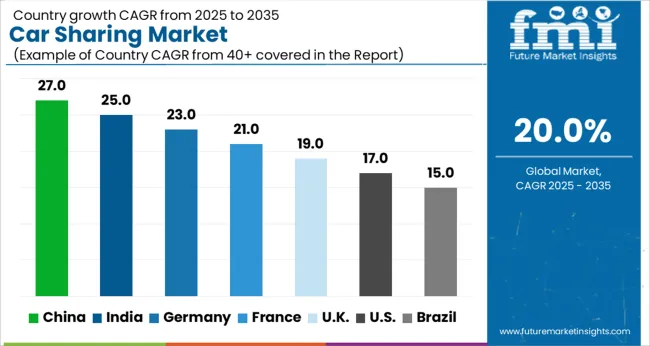

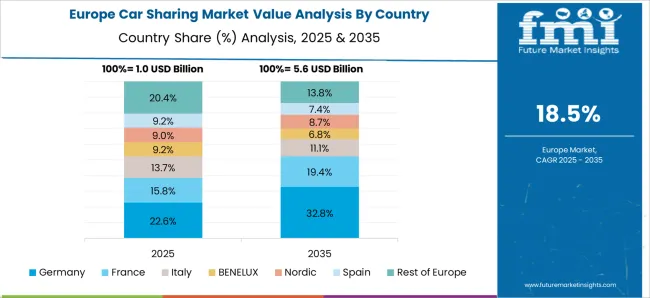

The global car sharing market is projected to expand at a CAGR of 20.0% between 2025 and 2035, driven by rising cost-consciousness, digital mobility platforms, and increased focus on reducing vehicle ownership burdens. China leads with a 27.0% share, supported by widespread urban mobility networks, strong government incentives, and high consumer adoption of app-based transport services. India follows at 25.0%, fueled by younger demographics, rapid app penetration, and demand for affordable alternatives to personal vehicles.

France holds 21.0%, demand from commuters and eco-conscious users, while the United Kingdom at 19.0% and the United States at 17.0% showcase steady expansion supported by growing fleet investments and digital mobility platforms. These countries represent focal points shaping the evolution of global car sharing models, offering insight into adoption rates, investment flows, and regulatory directions.

China is anticipated to post a CAGR of 27.0% during 2025-2035, improving from about 22.4% in 2020-2024, surpassing the global CAGR of 20.0%. Strong app-based ride platforms, wide adoption among younger demographics, and favorable local incentives for shared mobility support momentum. Large metropolitan areas such as Beijing and Shanghai remain at the center of fleet expansion, while tier-two cities are emerging as new hotspots. Car sharing integration with rail and metro systems has boosted convenience, enhancing consumer confidence. In my analysis, China’s strong ecosystem benefits from aggressive digital adoption, large-scale investments, and a consumer base eager for alternatives to private car ownership.

India is expected to deliver a CAGR of 25.0% during 2025-2035, rising from roughly 20.6% in 2020-2024, exceeding the global benchmark of 20.0%. Expansion is tied to mobile-first consumers, growth in app-based ecosystems, and the rising cost of private vehicle ownership. Shared mobility platforms have extended reach into tier-two and tier-three cities, making affordability a central factor. Public-private partnerships are also playing a role, with municipal projects supporting car sharing fleets. In my opinion, India’s trajectory is influenced by demographic factors, willingness to adopt digital solutions, and increased fuel price sensitivity, which makes shared transport a practical choice.

France is projected to post a CAGR of 21.0% during 2025-2035, compared with about 18.0% between 2020-2024, keeping pace above the global average of 20.0%. Demand is supported by the country’s structured public transport, commuter-focused shared fleet networks, and car sharing incentives in metropolitan areas such as Paris and Lyon. Integration with low-emission mobility policies has positioned car sharing as a practical option for reducing traffic in congested urban centers. Operators are targeting subscription-based and pay-per-use models to attract commuters. In my assessment, France’s adoption has been shaped by urban mobility strategies, a strong policy framework, and high acceptance among eco-conscious users.

The United Kingdom is anticipated to deliver a CAGR of 19.0% during 2025-2035, improving from approximately 15.5% in 2020-2024, remaining below the global trajectory of 20.0%. Adoption has been fueled by digital ride-hailing integration, rising cost of private transport, and infrastructure readiness across major cities. During 2020-2024, slower growth reflected consumer hesitancy and limited penetration beyond metropolitan areas. By 2025-2035, improved digital ecosystems, wider fleet availability, and policy nudges are set to accelerate adoption, explaining the rise in CAGR. In my opinion, the UK’s progression rests on regulatory clarity, user incentives, and targeted expansion into semi-urban areas.

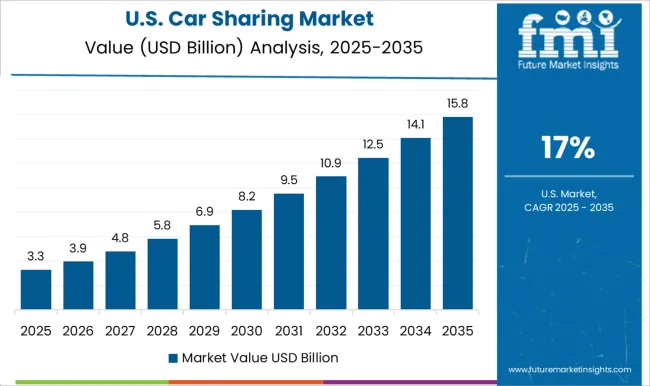

The United States is projected to post a CAGR of 17.0% during 2025-2035, up from around 13.9% in 2020-2024, falling below the global 20.0% benchmark. Expansion has been influenced by increasing fleet investments, demand for flexible mobility, and app-based user adoption in urban centers such as New York and Los Angeles. The 2020-2024 period was marked by slower adoption due to high private car ownership and entrenched suburban driving culture. Between 2025 and 2035, improved digital convenience and integration with ride-hailing platforms are expected to drive faster growth, accounting for the uplift in CAGR. In my view, USA growth remains tempered but will benefit from investments targeting urban commuters.

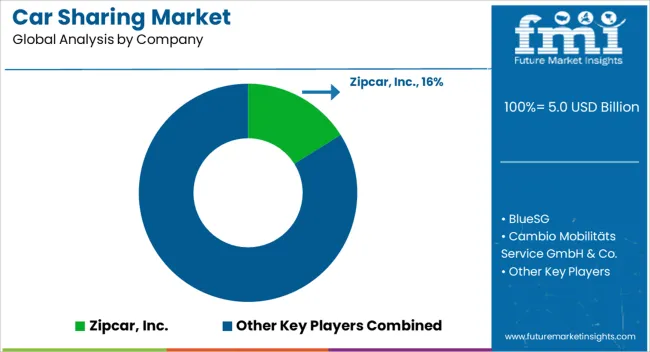

The car sharing market is expanding rapidly, driven by growing consumer demand for flexible, cost-effective, and sustainable mobility solutions. Leading companies in the market include Zipcar, Inc., BlueSG, Cambio MobilitätsService GmbH & Co. KG, Communauto Inc., EKAR FZ LLC, Evo Car Share, Free2Move, Getaround, Inc., GoGet Carshare Australia Pty. Ltd., Greenwheels, Hertz Global Holdings, Inc., Lyft, Inc., Mobility Carsharing, and Turo, Inc., each offering unique solutions for short-term vehicle rentals. Zipcar, Inc., one of the pioneers in the car sharing industry, provides on-demand access to vehicles in cities and university campuses, promoting convenience for urban dwellers. BlueSG focuses on electric vehicle car sharing in Singapore, aligning with sustainability goals. Cambio MobilitätsService GmbH & Co. KG operates in Europe, offering a robust fleet of vehicles for flexible rental, often integrated with public transport options.

Communauto Inc. offers car sharing in Canada and parts of Europe, focusing on eco-friendly options and short-term rentals. EKAR FZ LLC and Evo Car Share provide services in the Middle East and North America, respectively, with a focus on user-friendly apps and diverse vehicle options. Free2Move, a global mobility brand, partners with various car manufacturers to offer access to shared vehicles in urban areas. Getaround, Inc. and Turo, Inc. focus on peer-to-peer car sharing, allowing individuals to rent out their personal cars, contributing to a more decentralized model.

GoGet Carshare Australia Pty. Ltd. and Greenwheels target customers in Australia and Europe, offering flexible, hourly, or daily rentals for individuals and businesses. Hertz Global Holdings, Inc. and Lyft, Inc. also play prominent roles, with Hertz expanding its car sharing portfolio alongside its rental services, while Lyft integrates car sharing with its ridesharing business for seamless mobility solutions. Mobility Carsharing and Turo, Inc. further diversify the market by providing subscription models and peer-to-peer services, respectively.

| Item | Value |

|---|---|

| Quantitative Units | USD 5.0 Billion |

| Application | Business and Private |

| Business Model | One way and Round trip |

| Model | Free floating, P2P, and Station-based |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Zipcar, Inc.; BlueSG; Cambio MobilitätsService GmbH & Co. KG; Communauto Inc.; EKAR FZ LLC; Evo Car Share; Free2Move; Getaround, Inc.; GoGet Carshare Australia Pty. Ltd.; Greenwheels; Hertz Global Holdings, Inc.; Lyft, Inc.; Mobility Carsharing; Turo, Inc. |

| Additional Attributes | Dollar sales, share, adoption across urban centers, consumer usage frequency, fleet size optimization, EV integration trends, pricing models, competitive positioning, and regulatory shifts impacting operations. |

The global car sharing market is estimated to be valued at USD 5.0 billion in 2025.

The market size for the car sharing market is projected to reach USD 31.0 billion by 2035.

The car sharing market is expected to grow at a 20.0% CAGR between 2025 and 2035.

The key product types in car sharing market are business and private.

In terms of business model, one way segment to command 63.7% share in the car sharing market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Carboxylate-Modified Magnetic Beads Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Cartridge Heating Element Market Size and Share Forecast Outlook 2025 to 2035

Carboxymethyl Tamarind Kernel Powder Market Size and Share Forecast Outlook 2025 to 2035

Car Tail Light Mould Market Size and Share Forecast Outlook 2025 to 2035

Car OS Market Size and Share Forecast Outlook 2025 to 2035

Caramel Malt Market Size and Share Forecast Outlook 2025 to 2035

Carbon Capture and Sequestration Market Forecast Outlook 2025 to 2035

Cardiac Rehabilitation Market Size and Share Forecast Outlook 2025 to 2035

Carbon Dioxide Incubators Market Size and Share Forecast Outlook 2025 to 2035

Carboxymethyl Tamarind Gum (CMT) Market Size and Share Forecast Outlook 2025 to 2035

Car Cover Market Size and Share Forecast Outlook 2025 to 2035

Cardiology Information System Market Size and Share Forecast Outlook 2025 to 2035

Cardiopulmonary Functional Testing Platform Market Size and Share Forecast Outlook 2025 to 2035

Carbon Enhanced Lead Acid Battery Market Size and Share Forecast Outlook 2025 to 2035

Car Bushing Market Size and Share Forecast Outlook 2025 to 2035

Carbon-negative Cement Market Size and Share Forecast Outlook 2025 to 2035

Card Printer Ribbon Market Size and Share Forecast Outlook 2025 to 2035

Carbon Tetrabromide Market Size and Share Forecast Outlook 2025 to 2035

Carbon Steel Market Size and Share Forecast Outlook 2025 to 2035

Carpet Spot Remover Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA