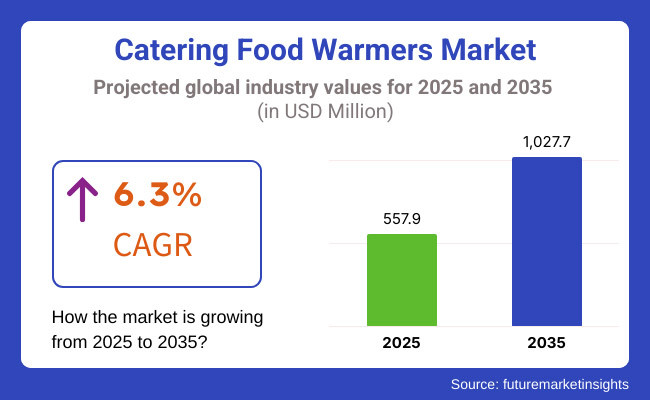

The catering food warmers market is anticipated to be valued at USD 557.9 million in 2025. It is expected to grow at a CAGR of 6.3% during the forecast period and reach a value of USD 1,027.7 million in 2035.

The catering food warmers industry grew steadily during 2024 due to the growing demand from commercial as well as residential users. A significant driver for the growth came in the form of expanding catering services, particularly in cities where food delivery and catering events of a large scale were on the rise.

The growth of cloud kitchens and central kitchens was another reason behind the heightened demand for trusted food warming devices in order to preserve meal quality. In 2024, technological innovations enhanced efficiency in products, with intelligent food warmers having controlled temperatures and automation becoming popular.

Most companies also favored energy-saving warmers to meet sustainability programs, saving money on operations while maintaining food safety. Hospitality and event management sectors, bouncing back from previous disruptions, experienced substantial growth, which generated increased sales of catering food warmers.

Future directions towards 2025 and beyond, the industry will see continuous growth on its upward graph. Growth of the quick-service restaurant (QSR) business and increasing practice of outdoor catering will keep generating demand. More consumers becoming concerned with food safety compliance and proper sanitation will additionally promote adoption. Spending on product innovation, such as environmentally friendly heat technologies, will influence the next decade of market trends.

A recent survey conducted by Future Market Insights (FMI) gathered insights from key stakeholders in the market, including manufacturers, distributors, and end users such as catering companies and restaurants.

The survey revealed that 80% of catering businesses consider food warmers a critical component of their operations, citing their role in maintaining food quality and compliance with food safety regulations. Respondents also emphasized the growing preference for energy-efficient and portable food warming solutions, aligning with the broader industry trend toward sustainability and cost optimization.

Another key finding was the rising adoption of smart and automated food warmers equipped with digital temperature control and remote monitoring features. Over 60% of manufacturers surveyed indicated that they are actively investing in R&D to integrate IoT and AI-based functionalities into their products.

End users, particularly in the hospitality and event catering sectors, expressed a strong interest in such innovations, highlighting the convenience and precision they offer in large-scale food service operations. The survey also found that nearly 70% of distributors and retailers reported a significant shift toward online sales channels, driven by the increasing preference for e-commerce platforms.

This trend was particularly evident in North America and Europe, where digital marketplaces have become the primary purchasing channel for commercial kitchen equipment. However, respondents in emerging markets such as South Asia and Latin America noted that offline retail still plays a dominant role due to the need for hands-on product demonstrations and personalized consultations.

Finally, the survey underscored price sensitivity as a major factor influencing purchasing decisions, with many businesses seeking a balance between affordability and quality. While premium products with advanced features continue to gain traction, a large segment of buyers remains focused on budget-friendly options that meet basic food warming requirements. This suggests a strong demand for both high-end and cost-effective solutions, pushing manufacturers to diversify their product offerings.

| 2020 to 2024 (Historical Analysis) | 2025 to 2035 (Forecast Analysis) |

|---|---|

| Moderate growth due to pandemic-induced disruptions and supply chain constraints in 2020 to 2021, followed by recovery in 2022 to 2024. | Steady growth is expected, driven by urbanization, expansion of catering services, and technological advancements in food warmers. |

| Recovery in hospitality & food service sectors post-pandemic, increased home cooking trends, and growth in cloud kitchens. | Rising demand for ready-to-eat food, corporate catering services, and stringent food safety regulations will fuel industry expansion. |

| Dominated by offline retail stores and specialty kitchen equipment suppliers. | E-commerce will witness a significant boom as more buyers shift to online platforms for convenience and competitive pricing. |

| North America and Europe held major shares due to established hospitality industries and the adoption of energy-efficient food warmers. | Asia-Pacific will emerge as a high-growth region led by China, India, and South Korea, where the food service industry is expanding rapidly. |

| Electric and steel food warmers were the most popular due to their durability and reliability in commercial settings. | Smart, automated warmers with IoT capabilities will gain traction, with a focus on energy efficiency and sustainability. |

| Market dominated by established players like Bosch, LG, and Prestige, with limited innovation. | Intensified competition with new entrants offering innovative, cost-effective solutions, leading to price competitiveness and product differentiation. |

| Supply chain disruptions, rising raw material costs, and fluctuating demand during COVID-19. | Stringent government regulations on energy efficiency and sustainability, along with rising production costs due to inflation. |

| The recovery phase will occur after the initial slowdown, with increased investment in food service infrastructure. | The expansion phase will include a high demand for automated, sustainable, and technology-integrated catering food warmers. |

Based on product type, the market is divided into electric warmers, plastic warmers, electric steamer, steel food warmers, shredded cereals, and chocolate food warmers. Electric warmers dominate the market, offering superior energy efficiency, precise temperature control, and ease of use.

Unlike traditional warming methods, electric warmers provide a safer and more sustainable alternative, making them a preferred choice for both commercial and residential applications. The industry is also witnessing a rise in demand for smart, IoT-integrated warmers that enable real-time monitoring and temperature adjustments.

Based on end use, the market is divided into residential and commercial. The commercial segment is projected to grow the fastest, with the increasing adoption of food warmers by catering businesses, cloud kitchens, and quick-service restaurants (QSRs).

These businesses require high-capacity, energy-efficient warmers that maintain food quality for extended periods, especially in large-scale events and corporate catering services. Advances in automated temperature control are further driving the expansion of this segment.

Based on sales channel, the market is divided into online and offline. Online sales are set to outpace offline sales in the coming years. E-commerce platforms such as Amazon, Flipkart, and Alibaba are becoming increasingly popular due to their convenience, discounted pricing, and wide variety of product options. Small and mid-sized businesses are turning to online platforms for bulk purchasing and easy delivery, accelerating the shift toward online sales.

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 6.7% |

| UK | 6.5% |

| France | 6.1% |

| Germany | 6.2% |

| Italy | 6.0% |

| South Korea | 6.8% |

| Japan | 6.4% |

| China | 7.1% |

| Australia & New Zealand | 6.3% |

The USA is witnessing a surge in the industry, with a projected CAGR of 6.7% from 2025 to 2035. The growing popularity of quick-service restaurants (QSRs) and food delivery platforms is driving this growth. The adoption of smart food warmers featuring IoT integration and automation is a key factor, aligning with the industry's increasing demand for energy-efficient, high-quality solutions. FMI analysis found that compliance with NSF International and FDA regulations is also a significant driver as businesses prioritize food safety and sustainability.

The UK is expected to expand at a CAGR of 6.5% between 2025 and 2035. The trend towards eco-friendly and energy-efficient catering solutions is aligning with the government’s Net Zero Strategy. The shift towards outdoor catering and street food culture, coupled with stricter regulatory compliance such as the mandatory UKCA certification, is pushing industry growth. Companies are increasingly investing in portable and induction-based food warmers to meet these demands.

France is projected to grow at a CAGR of 6.1% from 2025 to 2035, driven by strict EU food safety regulations. High-end dining establishments, including Michelin-starred restaurants, are pushing demand for premium, regulation-compliant food warmers. FMI opines that the rise in outdoor catering events is further driving the demand for portable solutions, such as chafing dishes and high-quality portable warmers.

Germany is expected to grow at a CAGR of 6.2% from 2025 to 2035. Driven by the expansion of industrial catering and corporate event services, there is an increasing demand for energy-efficient, smart food warmers that comply with strict Ecodesign and Energy Labeling Regulations. The country’s engineering prowess has led to the development of durable, cost-effective food warming solutions that cater to food trucks, beer gardens, and large hospitality chains.

Italy is witnessing a steady increase in the demand for catering food warmers, with a projected CAGR of 6.0% from 2025 to 2035. Culinary tourism and large-scale events, including destination weddings, are fueling the demand for portable and high-end food warming solutions. The rise of outdoor catering and buffet-style services is further driving sales of compact, energy-efficient food warmers that preserve the texture and warmth of food.

South Korea is expected to expand at a CAGR of 6.8% from 2025 to 2035, driven by the rise of smart technology and automation in the catering sector. The increasing popularity of IoT-enabled food warmers that allow remote temperature control and energy monitoring is contributing to growth. In addition, the rise of Korean BBQ and buffet-style dining continues to push demand for electric and induction-based food warming solutions.

Japan is projected to grow at a CAGR of 6.4% from 2025 to 2035. The demand for compact, energy-efficient appliances is driven by the country’s preference for space-saving solutions in small restaurants and catering services. The adoption of AI-integrated and self-regulating food warmers is growing, particularly in Japan’s urban centers, where convenience and efficiency are prioritized.

China is one of the fastest-growing markets, and it is expected to witness a CAGR of 7.1% from 2025 to 2035. The rapid growth of online catering services, food delivery platforms, and large-scale event catering is driving demand for high-capacity food warmers.

FMI analysis found that government policies focused on energy efficiency and sustainability are pushing manufacturers to produce eco-friendly, energy-efficient models, aligning with the country’s green energy goals.

The market in Australia and New Zealand is forecast to grow at a CAGR of 6.3% from 2025 to 2035, driven by the growing popularity of outdoor catering and food festivals. Strict safety standards, including AS/NZS 60335.2.49, are influencing the demand for durable, energy-efficient food warmers. The emphasis on sustainability and eco-friendly products is shaping the region’s food warmer industry, with a strong preference for low-energy consumption models.

Government regulations and policies have a great impact on the industry, especially those covering food safety, environmental sustainability, and energy efficiency. Each country has its own set of standards as well as certifications that companies must abide by to guarantee product quality and safety. The following table summarizes major regulations and compulsory certifications per country.

| Countries/Region | Regulatory Impact & Mandatory Certifications |

|---|---|

| USA | Governed by the Food and Drug Administration (FDA) and the USA Department of Agriculture (USDA) for food safety standards. - Energy Star Certification is required for energy-efficient appliances. - NSF International Certification (NSF/ANSI 4) ensures food warmers meet sanitation and hygiene standards. |

| European Union | Compliance with CE Marking (Conformité Européenne) for safety, health, and environmental standards. - Subject to EU Ecodesign and Energy Labeling Regulations for energy efficiency. - Food contact materials must comply with EU Regulation (EC) No 1935/2004. |

| UK | Must meet UKCA (UK Conformity Assessed) marking post-Brexit. - Compliance with Food Standards Agency (FSA) guidelines on food safety. - Must adhere to UK’s Ecodesign and Energy Labelling Regulations. |

| Canada | Regulated by Health Canada and the Canadian Food Inspection Agency (CFIA) for food safety. - CSA (Canadian Standards Association) Certification is required for electrical and heating equipment. |

| China | Subject to CCC (China Compulsory Certification) for electrical safety. - Governed by the State Administration for Market Regulation (SAMR) for food safety compliance. - Compliance with China’s Energy Efficiency Labeling System is necessary. |

| India | Governed by the Food Safety and Standards Authority of India (FSSAI) for food contact safety. - Bureau of Indian Standards (BIS) Certification mandatory for electrical appliances. - Must comply with ISI (Indian Standards Institute) marking for product safety. |

| Australia | Must meet Australian Standards (AS/NZS 60335.2.49) for commercial catering equipment. - Regulated by the Australian Competition & Consumer Commission (ACCC) for food safety and appliance standards. - Compliance with MEPS (Minimum Energy Performance Standards) for energy efficiency. |

| Middle East (UAE, Saudi Arabia) | UAE: Compliance with ESMA (Emirates Authority for Standardization & Metrology) for electrical and food contact safety. - Saudi Arabia: Must meet SASO (Saudi Standards, Metrology and Quality Organization) certification for food equipment. |

| Japan | Governed by the Japan Industrial Standards (JIS) for electrical safety and food contact materials. - Compliance with PSE (Product Safety Electrical Appliance & Materials Act) required for electrical food warmers. |

Expand in Emerging Markets

Stakeholders should target emerging markets like India, Indonesia, and Vietnam, where the food service industry is growing rapidly. Establishing local manufacturing units or partnerships will allow businesses to tap into the increasing demand for efficient catering solutions.

Invest in Smart and Energy-Efficient Warmers

The demand for IoT-integrated food warmers is on the rise, driven by the need for automation and energy savings. Companies should prioritize the development of smart, energy-efficient models to stay competitive in the growing catering sector.

Enhance Online Sales Channels

The e-commerce segment continues to grow rapidly, and businesses should strengthen their online presence through platforms like Amazon, Alibaba, and direct-to-consumer (DTC) websites. Offering competitive pricing and subscription-based services will further drive revenue.

In 2024, strategic moves by industry leaders, technological advancements, and evolving consumer preferences have driven significant developments. Industry leaders like Hatco Corporation, APW Wyott, Alto-Shaam, Star Manufacturing International, Cambro Manufacturing, and Thermodyne Foodservice Products, Inc. have dominated the charge in innovation and industry growth.

These companies have concentrated on product efficiency, sustainability, and ease of use to stay ahead of the competition. One of the key strategies adopted by industry leaders in 2024 is the integration of smart technology into food warmers. Alto-Shaam is one of the firms that have launched IoT-supported food warmers that can be remotely monitored and controlled using mobile apps.

The innovation comes as the demand for connected kitchen appliances continues to grow in the catering sector. Hatco Corporation has also focused on energy-efficient designs, cutting the cost of operations for end-users while ensuring sustainability.

In terms of industry share, Alto-Shaam and Hatco Corporation remain the leaders, together commanding more than 30% globally. Their robust distribution channels, combined with ongoing product development, have cemented their positions.

Cambro Manufacturing has also picked up pace by emphasizing rugged, lightweight, and portable food warmers, serving the requirements of mobile catering services and outdoor events. Major mergers and acquisitions have shaped the sector in 2024. In March 2024, Middleby Corporation, one of the foremost food service equipment makers, took over APW Wyott in a bid to widen its offering in the catering industry.

In an official announcement, Middleby Corporation confirmed this takeover, where it sought to use APW Wyott's technical know-how in commercial food warmers to boost Middleby’s foothold. The takeover is expected to enhance product development and streamline distribution.

Another important trend in 2024 is the greater emphasis on sustainability. Star Manufacturing International introduced a new range of food warmers produced from recycled materials, in response to the rising demand for environmentally friendly kitchen appliances. This move has been successful, especially in countries with strict environmental regulations, including Europe and North America.

The Asia-Pacific region has emerged as a high-growth area for catering food warmers in 2024, driven by the expansion of the hospitality and food service industries. Thermodyne Foodservice Products, Inc., along with other companies, has focused its efforts on setting up local manufacturing units and partnering with regional distributors to penetrate this region.

Overall, in 2024, catering food warmers will see increasing growth driven by technological advancements, strategic consolidations, and sustainability efforts. Industry leaders continue to strengthen their positions while catering to the rising demand for adaptation and evolution in the global catering arena.

The catering food warmers market falls under the food service equipment industry, which is a subcategory of the hospitality and commercial kitchen equipment sector. The current industry conditions are very closely related to performance indicators of the global food service industry covering institutions such as restaurants, catering businesses, hotels, and institutional food providers.

Urbanization, disposable income levels, tourism trends, and increased penetration of food delivery services have contributed to the growth from a macroeconomic perspective. Emerging economies are considered to be driving forces of the demand for highly efficient and energy-saving warming solutions in the catering industry.

Meanwhile, in developed markets, stringent food safety regulations and sustainability goals push businesses to adopt electric and IoT integrated food warmers that enhance efficiency and reduced energy consumption.

The post-COVID-19 economic recovery has rekindled the hospitality and events industry, thus creating robust demand for large catering; additionally, the rapid proliferation of cloud kitchens and ghost restaurants has accelerated industry expansion as these institutions require compact, durable, and automated warming solutions.

High inflation and fluctuating raw material costs pose ongoing challenges. In addition to these, the future of innovation in the sector will be built on government policies advocating energy efficiency and sustainability. The demand for smart, automated, and eco-friendly catering food warmers will keep mounting as food service businesses seek to improve their operation efficiency.

By product type, the market is segmented into electric warmers, plastic warmers, electric steamers, steel food warmers, shredded cereals, and chocolate food warmers.

Based on end use, the market is segmented into residential and commercial.

Based on sales channels, the market is segmented into online and offline.

The market is segmented by region into North America, Latin America, Western Europe, South Asia & Pacific, East Asia, Middle East, and Africa.

The demand is driven by the growth of the food service industry, consumer preference for convenience, and advancements in smart and energy-efficient warming technologies.

Catering food warmers vary by type, including electric warmers, plastic warmers, electric steamers, steel food warmers, and specialized options like chocolate and shredded cereal warmers.

Sales occur mainly through online and offline channels, with online platforms growing rapidly due to convenience and competitive pricing.

North America, East Asia, and South Asia are experiencing the highest growth, driven by urbanization, expanding food service sectors, and shifting consumer preferences.

Continued advancements in smart, energy-efficient models, sustainability initiatives, and growth in emerging markets will shape the industry's future.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (MT) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 4: Global Market Volume (MT) Forecast by Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 6: Global Market Volume (MT) Forecast by End Use, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 8: Global Market Volume (MT) Forecast by Sales Channel, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 12: North America Market Volume (MT) Forecast by Type, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 14: North America Market Volume (MT) Forecast by End Use, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Sales Channel. 2018 to 2033

Table 16: North America Market Volume (MT) Forecast by Sales Channel. 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 20: Latin America Market Volume (MT) Forecast by Type, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 22: Latin America Market Volume (MT) Forecast by End Use, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Sales Channel. 2018 to 2033

Table 24: Latin America Market Volume (MT) Forecast by Sales Channel. 2018 to 2033

Table 25: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Europe Market Volume (MT) Forecast by Country, 2018 to 2033

Table 27: Europe Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 28: Europe Market Volume (MT) Forecast by Type, 2018 to 2033

Table 29: Europe Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 30: Europe Market Volume (MT) Forecast by End Use, 2018 to 2033

Table 31: Europe Market Value (US$ Million) Forecast by Sales Channel. 2018 to 2033

Table 32: Europe Market Volume (MT) Forecast by Sales Channel. 2018 to 2033

Table 33: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: East Asia Market Volume (MT) Forecast by Country, 2018 to 2033

Table 35: East Asia Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 36: East Asia Market Volume (MT) Forecast by Type, 2018 to 2033

Table 37: East Asia Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 38: East Asia Market Volume (MT) Forecast by End Use, 2018 to 2033

Table 39: East Asia Market Value (US$ Million) Forecast by Sales Channel. 2018 to 2033

Table 40: East Asia Market Volume (MT) Forecast by Sales Channel. 2018 to 2033

Table 41: South Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: South Asia Market Volume (MT) Forecast by Country, 2018 to 2033

Table 43: South Asia Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 44: South Asia Market Volume (MT) Forecast by Type, 2018 to 2033

Table 45: South Asia Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 46: South Asia Market Volume (MT) Forecast by End Use, 2018 to 2033

Table 47: South Asia Market Value (US$ Million) Forecast by Sales Channel. 2018 to 2033

Table 48: South Asia Market Volume (MT) Forecast by Sales Channel. 2018 to 2033

Table 49: Oceania Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 50: Oceania Market Volume (MT) Forecast by Country, 2018 to 2033

Table 51: Oceania Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 52: Oceania Market Volume (MT) Forecast by Type, 2018 to 2033

Table 53: Oceania Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 54: Oceania Market Volume (MT) Forecast by End Use, 2018 to 2033

Table 55: Oceania Market Value (US$ Million) Forecast by Sales Channel. 2018 to 2033

Table 56: Oceania Market Volume (MT) Forecast by Sales Channel. 2018 to 2033

Table 57: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 58: MEA Market Volume (MT) Forecast by Country, 2018 to 2033

Table 59: MEA Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 60: MEA Market Volume (MT) Forecast by Type, 2018 to 2033

Table 61: MEA Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 62: MEA Market Volume (MT) Forecast by End Use, 2018 to 2033

Table 63: MEA Market Value (US$ Million) Forecast by Sales Channel. 2018 to 2033

Table 64: MEA Market Volume (MT) Forecast by Sales Channel. 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by End Use, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Sales Channel. 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (MT) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 10: Global Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 14: Global Market Volume (MT) Analysis by End Use, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by Sales Channel. 2018 to 2033

Figure 18: Global Market Volume (MT) Analysis by Sales Channel. 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by Sales Channel. 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by Sales Channel. 2023 to 2033

Figure 21: Global Market Attractiveness by Type, 2023 to 2033

Figure 22: Global Market Attractiveness by End Use, 2023 to 2033

Figure 23: Global Market Attractiveness by Sales Channel. 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Type, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by End Use, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by Sales Channel. 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 34: North America Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 38: North America Market Volume (MT) Analysis by End Use, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by Sales Channel. 2018 to 2033

Figure 42: North America Market Volume (MT) Analysis by Sales Channel. 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by Sales Channel. 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by Sales Channel. 2023 to 2033

Figure 45: North America Market Attractiveness by Type, 2023 to 2033

Figure 46: North America Market Attractiveness by End Use, 2023 to 2033

Figure 47: North America Market Attractiveness by Sales Channel. 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Type, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by End Use, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by Sales Channel. 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 58: Latin America Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 62: Latin America Market Volume (MT) Analysis by End Use, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by Sales Channel. 2018 to 2033

Figure 66: Latin America Market Volume (MT) Analysis by Sales Channel. 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Sales Channel. 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Sales Channel. 2023 to 2033

Figure 69: Latin America Market Attractiveness by Type, 2023 to 2033

Figure 70: Latin America Market Attractiveness by End Use, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Sales Channel. 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Europe Market Value (US$ Million) by Type, 2023 to 2033

Figure 74: Europe Market Value (US$ Million) by End Use, 2023 to 2033

Figure 75: Europe Market Value (US$ Million) by Sales Channel. 2023 to 2033

Figure 76: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Europe Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 79: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Europe Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 82: Europe Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 83: Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 84: Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 85: Europe Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 86: Europe Market Volume (MT) Analysis by End Use, 2018 to 2033

Figure 87: Europe Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 88: Europe Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 89: Europe Market Value (US$ Million) Analysis by Sales Channel. 2018 to 2033

Figure 90: Europe Market Volume (MT) Analysis by Sales Channel. 2018 to 2033

Figure 91: Europe Market Value Share (%) and BPS Analysis by Sales Channel. 2023 to 2033

Figure 92: Europe Market Y-o-Y Growth (%) Projections by Sales Channel. 2023 to 2033

Figure 93: Europe Market Attractiveness by Type, 2023 to 2033

Figure 94: Europe Market Attractiveness by End Use, 2023 to 2033

Figure 95: Europe Market Attractiveness by Sales Channel. 2023 to 2033

Figure 96: Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: East Asia Market Value (US$ Million) by Type, 2023 to 2033

Figure 98: East Asia Market Value (US$ Million) by End Use, 2023 to 2033

Figure 99: East Asia Market Value (US$ Million) by Sales Channel. 2023 to 2033

Figure 100: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: East Asia Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 103: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: East Asia Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 106: East Asia Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 107: East Asia Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 108: East Asia Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 109: East Asia Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 110: East Asia Market Volume (MT) Analysis by End Use, 2018 to 2033

Figure 111: East Asia Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 112: East Asia Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 113: East Asia Market Value (US$ Million) Analysis by Sales Channel. 2018 to 2033

Figure 114: East Asia Market Volume (MT) Analysis by Sales Channel. 2018 to 2033

Figure 115: East Asia Market Value Share (%) and BPS Analysis by Sales Channel. 2023 to 2033

Figure 116: East Asia Market Y-o-Y Growth (%) Projections by Sales Channel. 2023 to 2033

Figure 117: East Asia Market Attractiveness by Type, 2023 to 2033

Figure 118: East Asia Market Attractiveness by End Use, 2023 to 2033

Figure 119: East Asia Market Attractiveness by Sales Channel. 2023 to 2033

Figure 120: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 121: South Asia Market Value (US$ Million) by Type, 2023 to 2033

Figure 122: South Asia Market Value (US$ Million) by End Use, 2023 to 2033

Figure 123: South Asia Market Value (US$ Million) by Sales Channel. 2023 to 2033

Figure 124: South Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: South Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: South Asia Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 127: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: South Asia Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 130: South Asia Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 131: South Asia Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 132: South Asia Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 133: South Asia Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 134: South Asia Market Volume (MT) Analysis by End Use, 2018 to 2033

Figure 135: South Asia Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 136: South Asia Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 137: South Asia Market Value (US$ Million) Analysis by Sales Channel. 2018 to 2033

Figure 138: South Asia Market Volume (MT) Analysis by Sales Channel. 2018 to 2033

Figure 139: South Asia Market Value Share (%) and BPS Analysis by Sales Channel. 2023 to 2033

Figure 140: South Asia Market Y-o-Y Growth (%) Projections by Sales Channel. 2023 to 2033

Figure 141: South Asia Market Attractiveness by Type, 2023 to 2033

Figure 142: South Asia Market Attractiveness by End Use, 2023 to 2033

Figure 143: South Asia Market Attractiveness by Sales Channel. 2023 to 2033

Figure 144: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 145: Oceania Market Value (US$ Million) by Type, 2023 to 2033

Figure 146: Oceania Market Value (US$ Million) by End Use, 2023 to 2033

Figure 147: Oceania Market Value (US$ Million) by Sales Channel. 2023 to 2033

Figure 148: Oceania Market Value (US$ Million) by Country, 2023 to 2033

Figure 149: Oceania Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 150: Oceania Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 151: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 152: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 153: Oceania Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 154: Oceania Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 155: Oceania Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 156: Oceania Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 157: Oceania Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 158: Oceania Market Volume (MT) Analysis by End Use, 2018 to 2033

Figure 159: Oceania Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 160: Oceania Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 161: Oceania Market Value (US$ Million) Analysis by Sales Channel. 2018 to 2033

Figure 162: Oceania Market Volume (MT) Analysis by Sales Channel. 2018 to 2033

Figure 163: Oceania Market Value Share (%) and BPS Analysis by Sales Channel. 2023 to 2033

Figure 164: Oceania Market Y-o-Y Growth (%) Projections by Sales Channel. 2023 to 2033

Figure 165: Oceania Market Attractiveness by Type, 2023 to 2033

Figure 166: Oceania Market Attractiveness by End Use, 2023 to 2033

Figure 167: Oceania Market Attractiveness by Sales Channel. 2023 to 2033

Figure 168: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 169: MEA Market Value (US$ Million) by Type, 2023 to 2033

Figure 170: MEA Market Value (US$ Million) by End Use, 2023 to 2033

Figure 171: MEA Market Value (US$ Million) by Sales Channel. 2023 to 2033

Figure 172: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 173: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 174: MEA Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 175: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 176: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 177: MEA Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 178: MEA Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 179: MEA Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 180: MEA Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 181: MEA Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 182: MEA Market Volume (MT) Analysis by End Use, 2018 to 2033

Figure 183: MEA Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 184: MEA Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 185: MEA Market Value (US$ Million) Analysis by Sales Channel. 2018 to 2033

Figure 186: MEA Market Volume (MT) Analysis by Sales Channel. 2018 to 2033

Figure 187: MEA Market Value Share (%) and BPS Analysis by Sales Channel. 2023 to 2033

Figure 188: MEA Market Y-o-Y Growth (%) Projections by Sales Channel. 2023 to 2033

Figure 189: MEA Market Attractiveness by Type, 2023 to 2033

Figure 190: MEA Market Attractiveness by End Use, 2023 to 2033

Figure 191: MEA Market Attractiveness by Sales Channel. 2023 to 2033

Figure 192: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Catering Management Market Size and Share Forecast Outlook 2025 to 2035

Catering Services Market Analysis by Service Type, Application and End User and Region Through 2035

Online Catering Marketplace Size and Share Forecast Outlook 2025 to 2035

Commercial Catering Equipment Market Size and Share Forecast Outlook 2025 to 2035

Food & Beverage OEE Software Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Crosslinked Polyvinylpolypyrrolidone (PVPP) Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Cassia Gum Powder Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Dry Film Lubricant Market Size and Share Forecast Outlook 2025 to 2035

Foodservice Equipment Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Food Basket Market Forecast and Outlook 2025 to 2035

Food Grade Tremella Polysaccharide Market Size and Share Forecast Outlook 2025 to 2035

Food Sorting Machine Market Size and Share Forecast Outlook 2025 to 2035

Foodservice Paper Bag Market Size and Share Forecast Outlook 2025 to 2035

Food Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

Food Packaging Film Market Size and Share Forecast Outlook 2025 to 2035

Food Certification Market Size and Share Forecast Outlook 2025 to 2035

Food Tray Market Size and Share Forecast Outlook 2025 to 2035

Food & Beverage Industrial Disinfection and Cleaning Market Size and Share Forecast Outlook 2025 to 2035

Food Technology Market Size and Share Forecast Outlook 2025 to 2035

Food Tourism Sector Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA