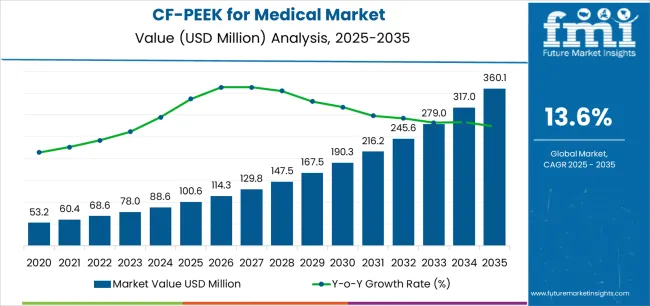

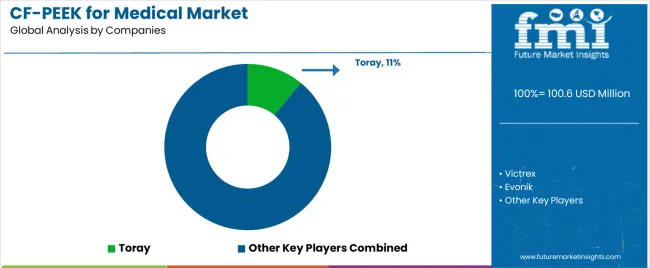

The global CF/PEEK for medical market is anticipated to grow from USD 100.6 million in 2025 to approximately USD 360.1 million by 2035, recording an absolute increase of USD 259.5 million over the forecast period. This translates into a total growth of 258.0%, with the market forecast to expand at a CAGR of 13.6% between 2025 and 2035. The overall market size is expected to grow by more than 3.6 times during the same period, supported by escalating demand for biocompatible implant materials with mechanical properties closely matching human bone, rapid expansion of spinal fusion procedures requiring radiolucent interbody cages enabling clear postoperative imaging, and increasing adoption of patient-specific implants leveraging additive manufacturing capabilities of carbon fiber reinforced PEEK composites.

The expansion is further reinforced by aging global demographics driving orthopedic intervention volumes, growing preference for non-metallic implant materials eliminating concerns regarding magnetic resonance imaging compatibility and metal sensitivity, and substantial clinical evidence validating long-term biocompatibility and osseointegration performance of CF/PEEK in load-bearing applications.

Medical device manufacturers and orthopedic surgeons are increasingly recognizing carbon fiber reinforced PEEK as a superior alternative to traditional titanium and stainless steel implants, particularly in spinal applications where radiolucency enables precise assessment of fusion progress and mechanical properties approaching cortical bone, reducing stress shielding effects that can compromise long-term implant success. The market benefits from continuous material science advances optimizing carbon fiber content and orientation for specific anatomical applications, expanding regulatory approvals for diverse implant categories, and growing surgeon familiarity with CF/PEEK handling characteristics and fixation techniques through comprehensive training programs and expanding clinical literature demonstrating favorable outcomes.

Rising incidence of degenerative spinal conditions, sports-related injuries requiring reconstructive procedures, and dental implant adoption in aging populations are compelling device manufacturers to invest in CF/PEEK processing capabilities including injection molding, compression molding, and additive manufacturing technologies enabling complex geometries and patient-matched solutions. The orthopedic industry's transition toward value-based healthcare models focusing reduced revision rates and faster patient recovery is driving steady demand for advanced biomaterials that optimize biological integration while maintaining structural integrity throughout extended service life in demanding physiological environments.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 100.6 million |

| Market Forecast Value (2035) | USD 360.1 million |

| Forecast CAGR (2025-2035) | 13.6% |

| CLINICAL & DEMOGRAPHIC TRENDS | MATERIAL PERFORMANCE ADVANTAGES | REGULATORY & ADOPTION FACTORS |

|---|---|---|

| Aging Population Expansion Global demographic shifts with rapidly growing elderly populations experiencing increased incidence of degenerative spinal conditions, osteoarthritis, and bone density reduction driving steady growth in orthopedic intervention volumes requiring advanced implant materials. Spinal Fusion Procedure Growth Continuous expansion of spinal fusion surgeries worldwide with CF/PEEK interbody cages becoming preferred standard due to radiolucency advantages enabling clear postoperative imaging assessment and mechanical properties supporting fusion outcomes. Patient-Specific Implant Demand Growing adoption of personalized medicine approaches with patient-matched implants leveraging additive manufacturing capabilities of CF/PEEK materials enabling optimized anatomical fit and improved clinical outcomes. |

Radiolucency Benefits Superior X-ray transparency compared to metallic implants enabling surgeons to clearly visualize bone fusion progress and implant positioning throughout postoperative recovery without imaging artifacts that compromise diagnostic accuracy. Bone-Matching Mechanical Properties Elastic modulus closely approximating cortical bone reducing stress shielding effects that can compromise bone remodeling and long-term implant stability while maintaining sufficient strength for load-bearing applications. MRI Compatibility Complete magnetic resonance imaging compatibility eliminating contraindications and imaging artifacts associated with metallic implants, facilitating comprehensive postoperative assessment and enabling patients to undergo diagnostic imaging without restrictions. |

Clinical Evidence Accumulation Expanding body of peer-reviewed literature and long-term clinical studies validating CF/PEEK safety, efficacy, and osseointegration performance building surgeon confidence and supporting broader adoption across orthopedic specialties. Regulatory Approval Expansion Growing number of CF/PEEK implant systems receiving regulatory clearances from FDA, European authorities, and Asian regulatory bodies facilitating market entry and commercial availability across geographic regions. Surgeon Training Programs Comprehensive educational initiatives from material suppliers and device manufacturers familiarizing surgeons with CF/PEEK handling characteristics, instrumentation requirements, and optimal surgical techniques supporting adoption in diverse clinical settings. |

| Category | Segments Covered |

|---|---|

| By Carbon Fiber Content | High Content CF/PEEK, Medium and Low Content CF/PEEK |

| By Application | Orthopedic Implants, Dental, Other |

| By Region | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Segment | 2025 to 2035 Outlook |

|---|---|

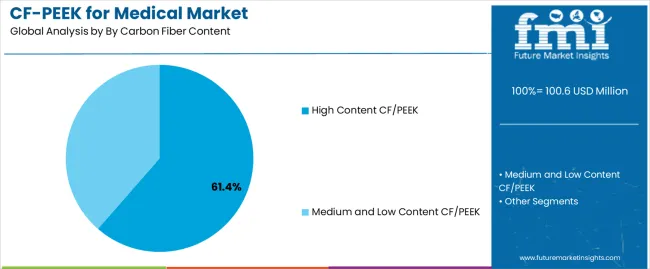

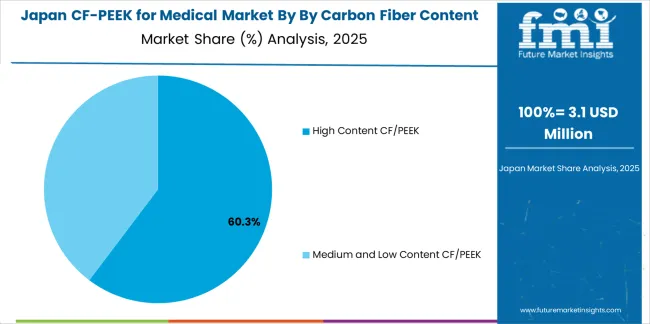

| High Content CF/PEEK | Leader in 2025 with 61.4% market share, maintaining dominance through 2035. Formulations typically containing 30-50% carbon fiber by weight providing optimal mechanical properties for load-bearing orthopedic applications including spinal interbody cages, vertebral body replacement systems, and trauma fixation plates. High carbon fiber loading delivering elastic modulus approaching cortical bone while maintaining radiolucency and excellent fatigue resistance essential for implants subjected to repetitive physiological loading. Momentum: strong growth driven by expanding spinal fusion procedure volumes and increasing adoption in load-bearing orthopedic applications. High content CF/PEEK demonstrating superior structural integrity supporting larger implant designs and enabling thin-wall constructions that maximize graft containment volume in spinal cages. Growing clinical evidence validating long-term performance in demanding anatomical locations including cervical and lumbar spine applications where mechanical requirements are most stringent. Watchouts: higher material costs affecting device pricing and reimbursement considerations, processing complexity requiring specialized molding equipment and expertise, potential for fiber-matrix interface concerns affecting long-term durability in physiological environments, limited machinability compared to lower fiber content alternatives. |

| Medium and Low Content CF/PEEK | Significant presence with 38.6% share in 2025, showing steady growth through 2035. Formulations containing 10-30% carbon fiber offering balanced properties for applications where extreme mechanical performance is not critical but material advantages over unfilled PEEK are desirable. Medium content formulations enabling easier processing including injection molding for complex geometries while maintaining enhanced strength and stiffness compared to pure PEEK. Momentum: moderate growth driven by expansion into dental applications, maxillofacial reconstruction, and non-load-bearing orthopedic components. Lower fiber content enabling superior surface finish quality and more intricate design features supporting aesthetic considerations in craniomaxillofacial applications. Cost advantages compared to high content formulations supporting adoption in price-sensitive markets and applications where mechanical property requirements are less demanding. Watchouts: competitive pressure from unfilled PEEK in applications where carbon fiber reinforcement provides marginal clinical benefits, potential market share loss to high content formulations as processing expertise improves and cost differentials narrow, limited differentiation in some application segments. |

| Segment | 2025 to 2035 Outlook |

|---|---|

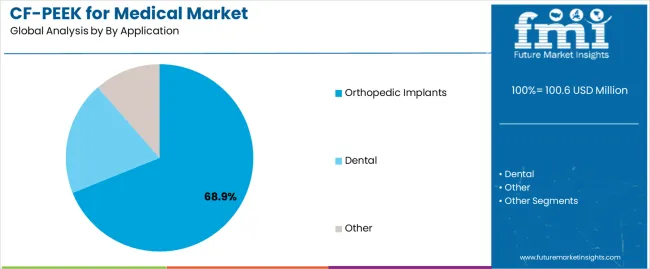

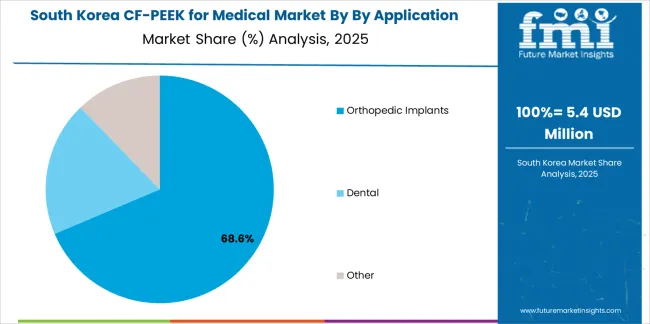

| Orthopedic Implants | Dominant segment with 68.9% market share in 2025, expected to maintain leadership through 2035. Encompasses spinal interbody fusion cages, vertebral body replacement systems, trauma fixation plates, joint replacement components, and bone graft substitutes leveraging CF/PEEK's unique combination of radiolucency, bone-matching mechanical properties, and biocompatibility. Largest volume contributor driven by global spinal fusion procedure volumes exceeding 1.5 million annually and growing recognition of CF/PEEK advantages in load-bearing applications. Momentum: robust growth supported by aging demographics, increasing active lifestyles extending into older age groups driving sports-related injuries, and expanding surgical indications for spinal fusion including degenerative disc disease and spondylolisthesis. Spinal applications particularly benefiting from radiolucency enabling surgeons to assess fusion progress through serial radiographs without metallic artifact interference. Growing adoption in extremity trauma applications where MRI compatibility facilitates comprehensive injury assessment and treatment monitoring. Watchouts: intense competition from established titanium implant systems with extensive clinical track records, surgeon training requirements limiting rapid adoption, higher implant costs affecting hospital purchasing decisions and reimbursement adequacy, long-term clinical data still accumulating for newer application categories. |

| Dental | Growing segment holding 18.7% share in 2025 with accelerating adoption trajectory through 2035. Includes dental implant abutments, implant-supported prosthetic frameworks, temporary healing abutments, and custom dental restorations leveraging CF/PEEK's aesthetic properties, biocompatibility, and favorable stress distribution characteristics. Dental applications benefiting from material's natural tooth-like color reducing aesthetic concerns with anterior restorations. Momentum: strong growth driven by rising global dental implant adoption, increasing patient preference for metal-free restorations, and growing dentist familiarity with PEEK materials. CF/PEEK enabling one-piece implant-abutment designs reducing bacterial colonization risks associated with traditional two-piece systems. Additive manufacturing capabilities supporting patient-specific prosthetic frameworks optimized for individual anatomical requirements and occlusal patterns. Watchouts: established titanium dominance in dental implant market with decades of clinical validation, higher material costs compared to traditional dental alloys, limited long-term clinical data for dental applications compared to orthopedic uses, processing expertise requirements limiting adoption among smaller dental laboratories. |

| Other | Diverse segment with 12.4% share in 2025 encompassing craniomaxillofacial reconstruction, cardiovascular applications, surgical instruments, and emerging neurosurgical uses. Category includes custom cranial implants, orbital floor reconstruction plates, catheter components, and specialized surgical tools leveraging CF/PEEK's unique property combinations. Momentum: selective growth in niche applications valuing specific CF/PEEK advantages including craniofacial reconstruction where radiolucency and bone-matching properties support optimal outcomes. Neurosurgical applications emerging with CF/PEEK cranial fixation systems and dural repair scaffolds under clinical investigation. Cardiovascular catheter applications leveraging material's combination of flexibility, radiopacity control, and biocompatibility. Watchouts: small volume markets limiting commercial focus from major material suppliers, diverse regulatory pathways across application categories increasing development costs and timelines, competition from application-specific alternative materials optimized for particular clinical requirements. |

| Region | Status & Outlook 2025-2035 |

|---|---|

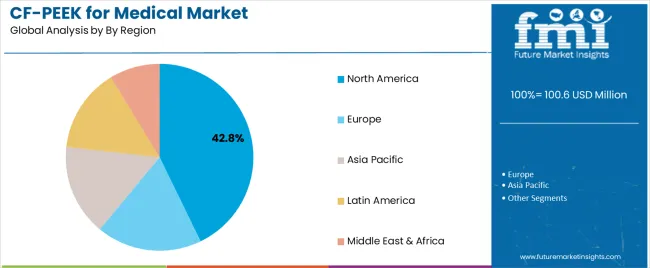

| North America | Dominant region commanding approximately 42.8% market share in 2025, driven by advanced healthcare infrastructure, high orthopedic procedure volumes, early adoption of innovative medical technologies, and comprehensive reimbursement systems supporting advanced implant materials. United States representing overwhelming majority of regional market with sophisticated spine surgery practices and leading medical device companies headquartered domestically. Momentum: strong growth trajectory supported by aging baby boomer population requiring increasing orthopedic interventions, favorable reimbursement environment for advanced implant technologies, and concentration of innovative medical device manufacturers driving CF/PEEK product development. Extensive clinical research infrastructure facilitating rapid accumulation of clinical evidence supporting expanded indications. Growing surgeon preference for radiolucent implants improving postoperative assessment capabilities. Watchouts: healthcare cost containment pressures potentially affecting reimbursement adequacy for premium implant materials, competitive intensity among device manufacturers creating pricing pressure, regulatory scrutiny following high-profile device recalls in other categories, potential market saturation in established spinal fusion applications. |

| Europe | Critical market holding approximately 28.6% share in 2025, characterized by advanced orthopedic surgery practices, strong regulatory frameworks focusing clinical evidence, and universal healthcare systems with varying reimbursement approaches across member states. Region featuring leading medical device companies and comprehensive clinical research infrastructure supporting CF/PEEK validation studies. Momentum: steady growth driven by demographic aging, increasing acceptance of CF/PEEK among European spine surgeons, and expanding clinical evidence from European medical centers. German, French, and UK markets leading regional adoption with sophisticated spine surgery practices and favorable reimbursement policies. Growing focus on patient-specific implants aligning with European precision medicine initiatives. Watchouts: fragmented reimbursement landscape across European countries affecting market access, stringent regulatory requirements under Medical Device Regulation increasing compliance costs, economic pressures in southern European countries constraining healthcare budgets, Brexit implications for UK market access and regulatory alignment. |

| Asia Pacific | Fast-growing region with approximately 21.4% share in 2025, driven by rapidly expanding healthcare infrastructure, growing middle-class populations demanding advanced medical treatments, and increasing adoption of Western surgical techniques including spinal fusion procedures. Region featuring diverse market characteristics from highly developed healthcare systems in Japan and South Korea to emerging markets in China, India, and Southeast Asia. Momentum: robust growth supported by favorable demographics with large aging populations particularly in Japan and China, healthcare infrastructure investments expanding access to advanced surgical procedures, and growing domestic medical device manufacturing capabilities. China emerging as major growth engine with government healthcare initiatives expanding procedure volumes and rising quality expectations. Medical tourism in Thailand, Singapore, and India creating opportunities for advanced implant adoption. Watchouts: significant price sensitivity in emerging markets limiting premium implant adoption, varying regulatory requirements across countries complicating market entry, limited reimbursement coverage for advanced materials in some markets, preference for established titanium solutions among conservative surgical communities. |

| DRIVERS | RESTRAINTS | KEY TRENDS |

|---|---|---|

| Demographic Aging Acceleration Global population aging with rapidly growing elderly cohorts experiencing increased incidence of degenerative spinal conditions and osteoarthritis driving steady expansion in orthopedic procedure volumes requiring advanced implant materials. Radiolucency Clinical Advantages Superior X-ray transparency enabling clear postoperative imaging assessment creating compelling clinical value proposition for surgeons seeking to monitor fusion progress and implant positioning without metallic artifacts. Mechanical Property Optimization Bone-matching elastic modulus reducing stress shielding effects while maintaining sufficient strength for load-bearing applications addressing fundamental limitations of traditional metallic implants in supporting long-term bone remodeling. |

High Material Costs Substantially higher raw material and processing costs compared to traditional metallic implants creating pricing challenges and potentially limiting adoption in cost-sensitive markets and healthcare systems. Limited Long-Term Data Relatively shorter clinical track record compared to titanium and stainless steel implants with decades of use creating conservatism among some surgeons and regulatory bodies regarding expanded indications. Processing Expertise Requirements Specialized molding equipment and processing knowledge required for CF/PEEK fabrication creating barriers for smaller medical device manufacturers and limiting manufacturing capacity availability. |

Additive Manufacturing Integration Growing adoption of 3D printing technologies enabling patient-specific CF/PEEK implants optimized for individual anatomical requirements and supporting complex porous structures promoting osseointegration. Surface Treatment Innovations Development of advanced surface modification techniques including plasma treatment, chemical etching, and bioactive coatings enhancing osseointegration and biological response to CF/PEEK implants. Expanding Application Portfolio Continuous extension of CF/PEEK applications beyond spinal fusion into extremity trauma, joint replacement, craniomaxillofacial reconstruction, and emerging neurosurgical uses broadening market opportunities. Combination Product Development Integration of CF/PEEK structural components with bioactive materials, drug-eluting capabilities, and biological grafts creating next-generation implant systems with enhanced regenerative potential. |

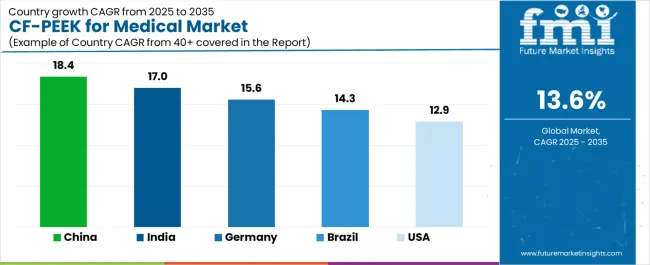

| Country | CAGR (2025-2035) |

|---|---|

| China | 18.4% |

| India | 17.0% |

| Germany | 15.6% |

| Brazil | 14.3% |

| USA | 12.9% |

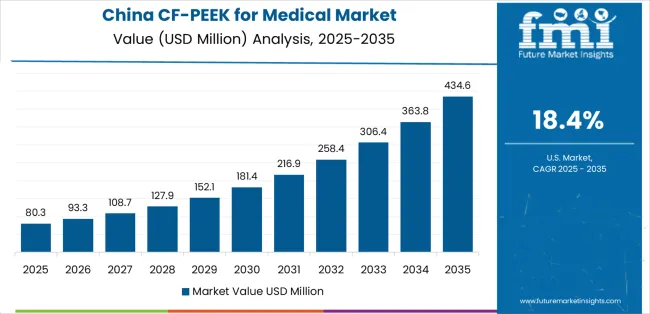

China is projected to exhibit exceptional growth with a market value of USD 113.6 million by 2035, driven by massive healthcare infrastructure investments with thousands of new hospitals constructed annually and comprehensive healthcare reform initiatives expanding access to advanced surgical procedures including spinal fusion and joint replacement across urban and increasingly rural populations. The country's rapidly aging population with over 280 million citizens above age 60 and growing incidence of degenerative spinal conditions are creating substantial demand for advanced implant materials. Major Chinese medical device manufacturers and international companies establishing local operations are developing comprehensive CF/PEEK implant portfolios targeting domestic market opportunities.

India is expanding to reach USD 88.6 million by 2035, supported by rapidly growing private healthcare sector with sophisticated hospitals offering advanced orthopedic procedures at competitive international pricing and emerging medical tourism industry attracting patients from Middle East, Africa, and developed markets seeking cost-effective access to quality surgical care. The country's large population exceeding 1.4 billion with growing middle class able to afford advanced medical treatments creating substantial domestic market opportunities. Major international medical device companies and domestic manufacturers establishing operations to serve Indian market and export opportunities.

Germany is projected to reach USD 77.9 million by 2035, supported by the country's leadership in orthopedic surgery and spine treatment with comprehensive healthcare system providing access to advanced implant technologies and sophisticated medical device industry driving innovation in biomaterial applications. German hospitals and spine centers maintaining international reputation for clinical excellence and contributing substantially to clinical literature validating CF/PEEK performance. The market characterized by focus on quality, clinical evidence, and long-term patient outcomes over cost considerations.

Brazil is growing to reach USD 68.6 million by 2035, driven by the country's position as Latin America's largest healthcare market with substantial private hospital sector offering advanced orthopedic procedures and growing public healthcare system expanding access to surgical treatments. Brazilian orthopedic surgery community maintaining strong connections with North American and European practices facilitating adoption of advanced implant technologies. Market characterized by dual-tier system with premium private facilities and cost-conscious public institutions creating diverse opportunities.

The USA is projected to reach USD 60.4 million by 2035, driven by the country's position as global leader in medical device innovation with major orthopedic and spine implant manufacturers headquartered domestically and comprehensive research infrastructure driving clinical validation of advanced biomaterials. American healthcare system characterized by early adoption of innovative technologies, sophisticated surgeon training programs, and generally favorable reimbursement environment supporting premium implant materials. Market featuring intense competitive dynamics among device manufacturers and continuous product innovation.

The UK is projected to reach USD 53.2 million by 2035, supported by National Health Service providing comprehensive healthcare coverage and sophisticated spine surgery centers offering advanced treatments including CF/PEEK implant options when clinically indicated. British orthopedic community contributing significantly to clinical research validating CF/PEEK performance and establishing evidence-based guidelines for appropriate use. Market characterized by focus on cost-effectiveness analysis and clinical evidence requirements for NHS adoption.

Japan is projected to reach USD 45.7 million by 2035, driven by the country's rapidly aging population with over 29% of citizens above age 65 creating substantial orthopedic intervention requirements and sophisticated healthcare system providing access to advanced surgical treatments. Japanese orthopedic surgery community maintaining stringent quality standards and focusing long-term clinical outcomes aligning with CF/PEEK value proposition. Market features strong domestic medical device industry and comprehensive regulatory framework ensuring product safety and efficacy.

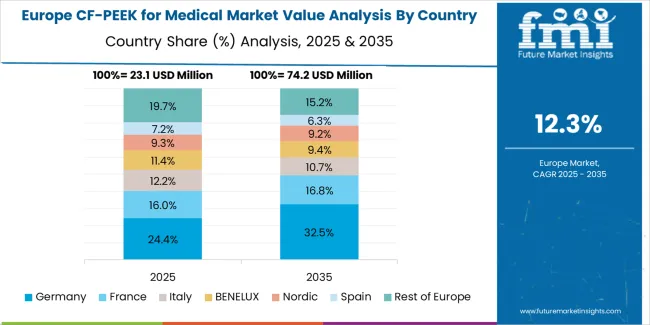

The CF/PEEK for medical market in Europe is projected to grow from USD 28.8 million in 2025 to USD 103.0 million by 2035, registering a CAGR of 13.6% over the forecast period. Germany is expected to maintain its leadership position with a 29.7% market share in 2025, reaching 30.4% by 2035, supported by its advanced spine surgery expertise, comprehensive reimbursement coverage for innovative implant materials, and presence of leading medical device companies including major orthopedic implant manufacturers and biomaterial suppliers.

France follows with a 18.4% share in 2025, projected to reach 18.9% by 2035, driven by sophisticated healthcare system, strong spine surgery tradition, and comprehensive national health insurance covering advanced implant technologies when clinically appropriate. The United Kingdom holds a 16.8% share in 2025, expected to reach 17.1% by 2035, supported by NHS framework providing access to CF/PEEK implants and strong clinical research infrastructure validating material performance.

Italy commands a 14.3% share, while Spain accounts for 11.6% in 2025, both benefiting from growing spine surgery volumes and increasing surgeon familiarity with CF/PEEK advantages. The Rest of Europe region is anticipated to gain momentum, expanding its collective share from 9.2% to 9.8% by 2035, attributed to healthcare infrastructure improvements in Eastern European countries including Poland, Czech Republic, and Hungary where orthopedic surgery capabilities are advancing and access to innovative implant materials is expanding.

Japanese CF/PEEK for medical operations reflect the country's exacting quality standards and sophisticated regulatory oversight. Major medical device manufacturers and hospitals maintain rigorous supplier qualification processes that significantly exceed international standards, requiring extensive biocompatibility testing, comprehensive mechanical characterization across physiological conditions, and detailed clinical validation data that can require 36-48 months to compile. This creates substantial barriers for new material suppliers but ensures consistent quality supporting Japan's reputation for patient safety and clinical excellence in medical device applications.

The Japanese market demonstrates unique technical requirements, with significant focus on long-term biological response validation, stringent mechanical property specifications across temperature and humidity ranges simulating physiological conditions, and comprehensive documentation protocols extending beyond typical international regulatory requirements. Medical device companies require specific CF/PEEK formulations with precisely controlled fiber content, orientation, and surface characteristics that differ from Western applications, driving demand for specialized material development and continuous technical collaboration throughout product commercialization.

Regulatory oversight through Pharmaceuticals and Medical Devices Agency emphasizes comprehensive preclinical and clinical validation requirements that surpass many international standards. The medical device approval process requires extensive biocompatibility data, mechanical testing protocols, and often clinical studies in Japanese patient populations creating advantages for established suppliers with proven track records and resources to support lengthy approval processes. Material traceability and manufacturing documentation requirements exceed international norms.

Supply chain management in Japanese medical device industry focuses on long-term partnership relationships rather than transactional procurement approaches. Japanese hospitals and device manufacturers typically maintain decade-long supplier relationships, with annual reviews focusing quality consistency, technical support, and continuous improvement through collaborative development programs. This stability supports investment in specialized CF/PEEK formulations and processing technologies optimized for Japanese specifications, while creating challenges for new market entrants seeking to establish customer relationships in this quality-focused market demanding demonstrated long-term commitment.

South Korean CF/PEEK for medical operations reflect the country's advanced healthcare system and dynamic medical device industry. Major hospitals including Samsung Medical Center, Asan Medical Center, and Severance Hospital alongside growing domestic medical device companies drive sophisticated material procurement strategies, establishing relationships with international biomaterial suppliers while developing domestic processing capabilities. Korean spine surgery expertise and growing orthopedic procedure volumes creating steady demand for advanced implant materials.

The Korean market demonstrates particular strength in rapid technology adoption and clinical innovation capabilities, with leading hospitals performing thousands of spinal procedures annually and actively participating in clinical studies validating new implant technologies. This creates opportunities for CF/PEEK suppliers offering innovative products with strong clinical evidence. Korean orthopedic surgeons increasingly exposed to international practices through training programs and conferences facilitating adoption of advanced materials proven in Western markets.

Regulatory frameworks through Ministry of Food and Drug Safety maintain rigorous medical device approval requirements while generally following international standards including ISO biocompatibility testing protocols. This creates more accessible market entry compared to Japan while maintaining quality assurance standards. Korean regulatory environment particularly favors suppliers with established international approvals including FDA clearance and CE marking supporting expedited local approval processes.

Supply chain efficiency remains important given Korea's geographic constraints and import dependence for advanced biomaterials. Medical device companies and hospitals increasingly pursuing direct relationships with international CF/PEEK suppliers while supporting development of domestic material processing capabilities. Healthcare system focusing value-based approaches with growing focus on clinical outcomes and cost-effectiveness analysis supporting adoption of premium implant materials when clinical benefits are demonstrated. Private healthcare sector growth and medical tourism development creating additional opportunities for advanced implant adoption.

The market exhibits concentrated leadership among specialized biomaterial suppliers with extensive PEEK polymer expertise and carbon fiber reinforcement technology, while medical device manufacturers increasingly develop vertical integration strategies securing material supply chains and proprietary formulations. Market dynamics strongly favor established players with proven biocompatibility track records, comprehensive regulatory approvals across major markets, and established relationships with leading medical device manufacturers and hospitals.

Several distinct competitive archetypes define market structure: global specialty polymer companies leveraging decades of PEEK development expertise and comprehensive material science capabilities to supply medical-grade CF/PEEK; vertically integrated medical device manufacturers developing proprietary CF/PEEK formulations optimized for specific implant applications; specialized biomaterial processors focusing on custom compounding and implant fabrication services; and emerging additive manufacturing specialists enabling patient-specific CF/PEEK implant production.

Competitive differentiation increasingly centers on material performance parameters including fiber content optimization for specific anatomical applications, surface treatment technologies enhancing osseointegration, and processing expertise enabling complex geometries while maintaining consistent material properties.

Technical support capabilities including material characterization, regulatory documentation support, and clinical collaboration programs represent critical differentiators as device manufacturers seek partners capable of supporting comprehensive product development and regulatory approval processes. Switching costs remain substantial given extensive biocompatibility validation requirements, regulatory approval investments, and clinical evidence accumulation creating natural barriers protecting incumbent suppliers once materials are incorporated into approved implant systems.

Strategic imperatives include expanding material portfolio with optimized formulations for emerging applications including dental and craniomaxillofacial reconstruction, developing additive manufacturing capabilities supporting patient-specific implant production, and building comprehensive clinical evidence through collaborative research programs with leading orthopedic surgeons and medical centers.

Geographic expansion focuses on high-growth Asian markets particularly China and India where healthcare infrastructure investments and growing procedure volumes create substantial opportunities. Consolidation potential exists as larger biomaterial companies may acquire specialized CF/PEEK suppliers to broaden medical device material portfolios, while medical device manufacturers continue evaluating vertical integration strategies to secure critical material supplies and capture value chain margins.

| Items | Values |

|---|---|

| Quantitative Units | USD 100.6 million |

| Carbon Fiber Content | High Content CF/PEEK, Medium and Low Content CF/PEEK |

| Application | Orthopedic Implants, Dental, Other |

| Regions Covered | North America, Latin America, Europe, Asia Pacific, Middle East & Africa |

| Country Covered | China, India, Germany, Brazil, United States, United Kingdom, Japan, South Korea, and other 35+ countries |

| Key Companies Profiled | Toray, Victrex, Evonik, Solvay, Invibio, ZYPEEK |

| Additional Attributes | Dollar sales by carbon fiber content and application, regional demand (North America, Europe, Asia Pacific, Latin America, Middle East & Africa), competitive landscape, biocompatibility validation, regulatory approval achievements, and advanced processing technologies driving clinical adoption, material optimization, and application expansion |

The global CF-PEEK for medical market is estimated to be valued at USD 100.6 million in 2025.

The market size for the CF-PEEK for medical market is projected to reach USD 360.1 million by 2035.

The CF-PEEK for medical market is expected to grow at a 13.6% CAGR between 2025 and 2035.

The key product types in CF-PEEK for medical market are high content cf/peek and medium and low content cf/peek.

In terms of by application, orthopedic implants segment to command 68.9% share in the CF-PEEK for medical market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Formaldehyde Removal Air Purifier Market Size and Share Forecast Outlook 2025 to 2035

Fortified Dairy Products Market Size and Share Forecast Outlook 2025 to 2035

Form-Fill-Seal (FFS) Films Market Size and Share Forecast Outlook 2025 to 2035

Formable Films Market Size and Share Forecast Outlook 2025 to 2035

Forchlorfenuron Market Size and Share Forecast Outlook 2025 to 2035

Formalin Market Size and Share Forecast Outlook 2025 to 2035

Formalin Vials Market Size and Share Forecast Outlook 2025 to 2035

Foreign Trade Digital Service Market Size and Share Forecast Outlook 2025 to 2035

Forged and Casting Component Market Size and Share Forecast Outlook 2025 to 2035

Fortified Rice Market Size and Share Forecast Outlook 2025 to 2035

Fortifying Agent Market Size and Share Forecast Outlook 2025 to 2035

Forestry Equipment Market Size and Share Forecast Outlook 2025 to 2035

Forensic Imaging Market Size and Share Forecast Outlook 2025 to 2035

Forklift Battery Market Size and Share Forecast Outlook 2025 to 2035

Formulation Development Outsourcing Market Size and Share Forecast Outlook 2025 to 2035

Forskolin Market Size and Share Forecast Outlook 2025 to 2035

Fortified Milk and Milk Products Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Form Fill Seal Equipment Market by Equipment Type from 2025 to 2035

Fortified Eggs Market Analysis - Size, Growth, and Forecast 2025 to 2035

Forklift Attachments Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA