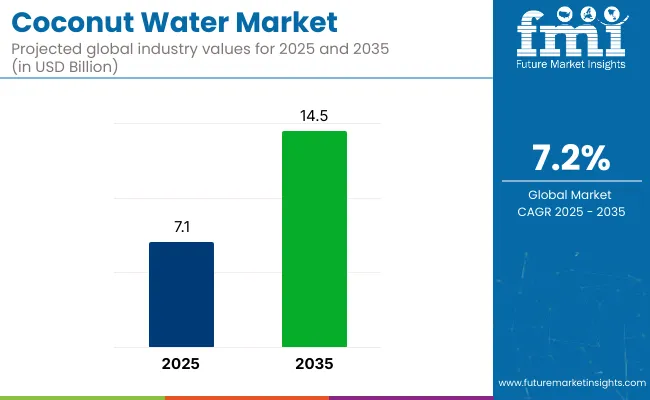

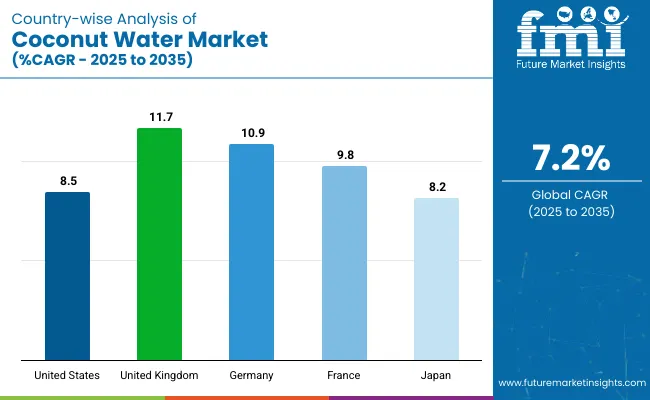

The global coconut water market is projected to rise from USD 7.1 billion in 2025 to USD 14.5 billion by 2035, growing at a CAGR of 7.2%. The acceleration is led by a confluence of factors, including expanding functional beverage portfolios, urbanization of hydration habits, and precision-driven retail execution.

| Metric | Value |

|---|---|

| Market Size in 2025 | USD 7.1 billion |

| Projected Market Size in 2035 | USD 14.5 billion |

| CAGR (2025 to 2035) | 7.2% |

Brick-and-mortar and e-commerce channels are witnessing balanced demand, whereas urban grocery formats are reporting up to 38% higher footfall in the functional hydration aisle. DTC brands have shortened repeat-purchase cycles by 12%, aided by subscription models.

Coconut water represents approximately 22-25% of the total coconut-derived product market. Within the plant-based beverage category, it accounts for around 15% of global consumption. It contributes nearly 18% to the natural hydration beverage segment and makes up 7-9% of input volume in the stabilizers and beverage emulsions space. In the broader functional beverage landscape, coconut water holds an estimated 12-14% share, reflecting its growing role in clean-label and wellness-driven formulations.

In Asia-Pacific, regional bottlers and value-added processors have enhanced inventory turnover by digitizing sourcing, warehousing, and logistics. Markets like Thailand and Indonesia are witnessing faster inventory churn due to higher consumer frequency and tourism-led consumption. Investor confidence is evident in the IFBH IPO in Hong Kong in early 2025, which was oversubscribed 2,682 times, highlighting backend supply chain strength and rising retail pull.

Startups are adopting blockchain-integrated supply chain systems to enhance transparency in coconut water production. These platforms allow real-time tracking of raw coconut sourcing, including geotagged farm origin, harvest timestamps, and processing compliance checkpoints.

By embedding QR-coded traceability into retail packaging, brands are offering verifiable proof of freshness, organic compliance, and low-temperature logistics integrity. This digitized traceability is proving critical in markets where quality differentiation, export certification, and environmental assurance are becoming standard buyer expectations.

Product innovation is expanding beyond single-ingredient hydration. Coconut water is now being infused with adaptogens, probiotics, and plant protein. Sports and fitness-oriented startups are driving the trend toward multi-functional coconut water drinks with specified mineral profiles for recovery, gut health, and electrolyte replenishment.

Price sensitivity has remained moderate, with organic coconut water averaging USD 3,000 per MT, and conventional grades around USD 2,000 per MT, stable across key regions. This pricing consistency, paired with advancements in flavor science, shelf stability, and digital distribution, is creating a resilient growth path for coconut water worldwide.

The global coconut water market is witnessing dynamic growth across packaging formats and regions. Tetra Pak cartons lead the packaging segment due to their sustainability, shelf-life benefits, and convenience, while PET bottles, cans, and glass packaging are gaining popularity in on-the-go and premium segments. Innovation in eco-friendly and resealable formats is further driving consumer preference. Regionally, Coconut water demand is surging globally, with the United States leading growth through functional premiumization and channel diversification. Online sales account for 20% of U.S. volume, driven by QR-coded packaging and D2C subscriptions, while Tetra Pak multipacks expand club-store reach. The U.K. sees growth from sugar-tax substitutes and organic private labels. Germany leads in bio-certified variants and discount retail, while France benefits from clean-label trends and local bottling. In Japan, functional hydration and fast e-commerce cater to aging, health-conscious consumers.

The coconut water market is segmented by Nature into Conventional, Organic; by Flavour into Original/Unflavoured, Flavoured; by Application into Food, Beverages, Personal Care & Cosmetics, Nutraceutical, Animal Feed, and Retail; By Sales Channel into Direct Sales and Indirect Sales; by Region into North America, Latin America, Europe, East Asia, South Asia, Oceania, Middle East & Africa.

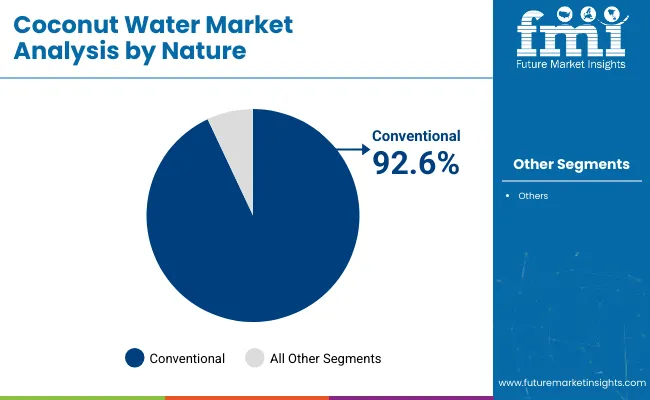

Conventional dominates, commanding 92.6% of share in 2025, while organic accounts for 7.4% share. Organic coconut water is expanding faster than conventional but still holds a modest footprint. Over the 2025 to 2035 forecast window, organic segment is projected to grow at an 8.6% CAGR, outpacing the 7.0% CAGR expected for conventional lines yet its share will remain modest in absolute terms.

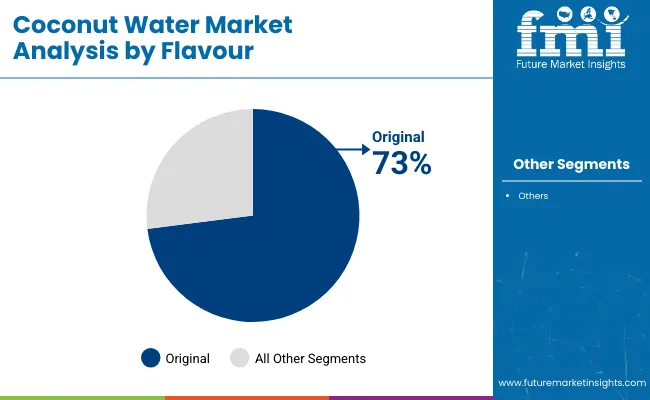

Original, unflavoured coconut water controls 73% of global share in 2025, while flavoured variants occupy the remaining 27%. Across the 2025 to 2035 forecast window original segment is projected to grow at a 7.7% CAGR, versus 7.3% CAGR for flavoured lines, further widening the gap.

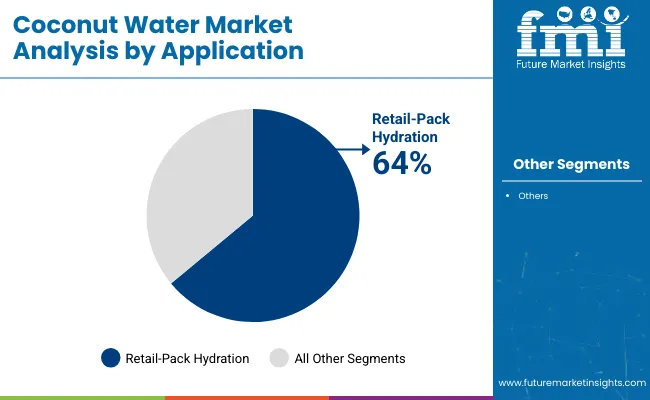

Retail-pack hydration products command 64% of global coconut-water revenue in 2025, far ahead of food-processing powders at 9.3%. Alcoholic mixes benefit from premiumisation, driving the fastest growth but remain a small base.

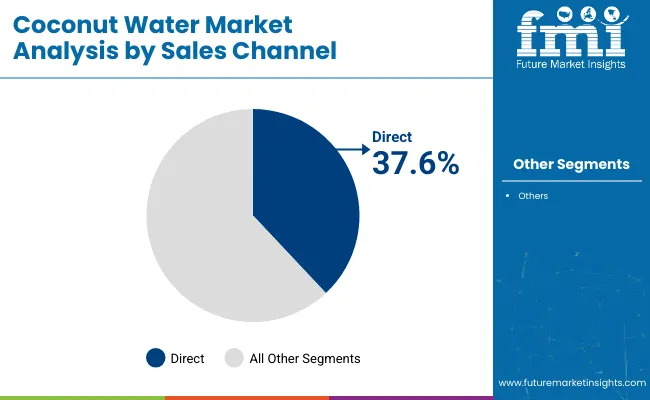

Sales routes split between direct and indirect. Direct contracts including gyms, airlines, and foodservice account for 37.6% of 2025 share. Orders trend toward 330-ml and 1-litre Tetra packs with average contract terms of nine months.

Inventory Compression & Shelf Efficiency

Retailers are compressing coconut water inventory cycles to optimize SKU productivity. Retailers now expect coconut water SKUs to turn faster than traditional RTD juices by 1.7×, especially in refrigerated formats. Modern trade players are allocating more cold shelf space to multipack coconut water due to rising basket sizes and repeat rates.

Meanwhile, discounters focus on value packs, reporting fewer markdowns YOY due to better demand planning. Brands with shorter expiry windows (e.g., HPP-treated) are using dynamic markdown pricing tied to smart shelf tags, improving sell-throughs. This tighter inventory and shelf management loop is pushing producers toward leaner batch cycles, reducing warehouse buffer stocks freeing up working capital and tightening the supply-demand sync.

Electrolyte-Performance Positioning Gains Clinical Backing

Scientific research is increasingly validating coconut water’s electrolyte performance. Augmented coconut water matched to a sports drink’s carbs and sodium sustained hydration and 20 km cycling performance just as effectively as the commercial sports drink as per research by National Library of Medicine.

Based on these insights, sports nutrition startups are now launching SKUs with clinically dosed 400mg potassium per 250ml, aligned with WHO hydration guidelines. These formulations command a price premium in gyms and e-commerce wellness channels. Endorsements from endurance athletes and micro-influencers have driven organic search spikes of coconut-based recovery drinks.

Functional coconut water blends containing L-theanine, magnesium, or adaptogens are gaining traction among high-performance users, contributing to +19% YOY growth in the performance hydration subsegment. The rise of evidence-backed claims is shifting coconut water from a “natural” product into a semi-functional category with direct crossover into the sports, recovery, and nootropic beverage verticals.

Margin Squeeze from Export-Led Price Shocks

Coconut water producers are facing export-driven margin pressure due to volatile raw coconut pricing and freight shifts. Between late 2023 and mid-2025, average bulk coconut prices in major exporting nations rose by 11-13%, driven by tightening yield cycles and fertilizer shortages.

Exporters in Vietnam and the Philippines now rely more on direct contracts with USA and EU distributors to lock price ceilings. Some SMEs are downshifting from glass bottles to Tetra Pak cartons to control packaging costs, reducing unit costs by 12-15%, but losing shelf aesthetics.

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 8.5% |

| United Kingdom | 11.7% |

| Germany | 10.9% |

| France | 9.8% |

| Japan | 8.2% |

Coconut-water sales in the United States are projected to climb from roughly USD 1.3 billion in 2025 to about USD 2.9 billion by 2035, expanding at an 8.5% CAGR as sugar-reduction mandates, gym-centric demand, and provenance-driven clean-label claims gain traction.

Roughly one-fifth of volume is transacted online, and subscription bundles have shortened the average reorder interval. Cold-shelf facings for QR-coded packs at mass retailers such as Target and Kroger continue to increase after scan-and-learn content pushed basket sizes three percentage points above store norms. Direct-to-consumer labels now capture thirty-two percent of premium-tier spend after tiered membership pricing pulled repeat-purchase cycles twelve percent lower.

Coconut-water sales in the United Kingdom are set to rise from approximately USD 0.36 billion in 2025 to around USD 1.09 billion by 2035, driven by post-Sugar Tax substitutions, expanded private-label listings under £1 per litre, and a surge in online grocery penetration.

About 16% of total sales now happen online, and QR-enabled packs have been adopted by major supermarket chains to deliver provenance stories directly at shelf edge. Wellness bars and boutique gyms in London and Manchester are accounting for an increasing share of on-premise consumption, while reusable subscription bundles have begun shortening reorder intervals. Organic AB-certified variants account for over half of shelf turnover in premium aisles, and dynamic markdown pricing tied to smart tags is reducing waste.

German coconut-water revenues are forecast to climb from roughly USD 0.28 billion in 2025 to about USD 0.80 billion by 2035, propelled by bio-certification loyalty, widespread QR-traceability adoption, and deep discount-channel penetration. Over 60% of modern-trade retailers now dedicate cold-shelf facings to certified organic SKUs, reducing return rates by 9%.

Private-label bio variants are undercutting mainstream brands on price while maintaining traceability claims. Convenience-store multipacks are boosting impulse buys, and subscription-driven D2C labels are emerging in urban micro-markets to capture high-frequency gym goers.

French coconut-water sales are projected to grow from about USD 0.21 billion in 2025 to USD 0.55 billion by 2035, underpinned by clean-label demand, AB-certified diary and local bottling initiatives, and rising food-service partnerships. Over 50% of sales are now organic-certified, commanding a revenue premium in both retail and on-trade.

Regional packers in Marseille and Lyon have introduced low-emission logistics, cutting transport-related carbon output by around 12%. Premium cafés are blending coconut water into speciality coffee and wellness shots, and recyclable packaging mandates are driving rapid shelf rotation of compliant SKUs.

In Japan, coconut-water revenues are expected to increase from roughly USD 0.32 billion in 2025 to about USD 0.71 billion by 2035, buoyed by low-sugar hydration trends among older consumers, premium functional blends, and rapid-delivery e-commerce models. Online sales account for nearly 12% of share with ultra-fast grocery services offering sub-24-hour delivery for QR-traceable SKUs.

Health-focused convenience stores stock electrolyte-fortified Coconut Water Plus variants alongside traditional unflavoured packs. Localized concentrate rehydration plants are being trialled to mitigate import-related freight swings, and gym and wellness-bar partnerships are cementing coconut water’s place in recovery protocols.

Coconut water brands in 2025 are retooling their go-to-market playbooks with sharper regional positioning, diversified pack formats, and functional extensions. PepsiCo and Coca-Cola are intensifying penetration through D2C and quick-commerce channels in metro clusters, bundling coconut water with low-calorie or immunity-led SKUs.

Pricing strategies have shifted from premium static to value-tiered dynamic pricing, targeting impulse and bulk buys differently. Players like Malee and All Market Inc. are expanding portfolios with caffeinated, collagen-infused, or adaptogen-enhanced coconut water, backed by micro-influencer campaigns on short-video platforms. Retail execution emphasizes limited-edition flavors and cross-category shelf placement near plant-based milks or isotonic drinks to trigger discovery-led purchases.

In 2025, coconut water market strategies are shifting beyond legacy players. Startups like TAIKA (USA) are integrating coconut water into ready-to-drink functional blends combining caffeine and adaptogens, targeting wellness-conscious Gen Z consumers. Australia’s HuskeeHydrate is launching coconut water in reusable plant-based pods for soda-machine systems, merging hydration with sustainability and convenience.

Vietnam’s CoCoSyn uses smart NFC labelling for batch-level traceability, boosting consumer trust in origin and quality. These innovators are focusing on hybrid products, like collagen-coconut elixirs or low-GI coconut-based pre-workouts, and emphasize social-first branding, leveraging TikTok, fitness creators, and QR-based referral discounts. This approach counters premium fatigue and builds strong brand intimacy among niche lifestyle communities.

| Attributes | Details |

|---|---|

| Estimated Market Size (2025) | USD 7.1 billion |

| Projected Market Size (2035) | USD 14.5 billion |

| CAGR (2025 to 2035) | 7.2% |

| Base Year | 2024 |

| Historical Period | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Reporting Units | Revenue (USD billion), volume trends cited in million litres where available |

| Segments Covered | Nature: Conventional, Organic, Flavour: Original/Unflavoured, Flavoured, Application: Food, Beverages, Personal Care &, Cosmetics, Nutraceutical, Animal Feed, Retail-pack Hydration, Sales Channel: Direct (gyms, airlines, food-service) and Indirect (modern trade, grocery, convenience, discount, online), Region: North America, Latin America, Europe, East Asia, South Asia, Oceania, Middle East &, Africa |

| Countries Analysed in Detail | United States, United Kingdom, Germany, France, Japan, Thailand, Indonesia, Vietnam, Philippines, and 40+ countries |

| Key Companies Profiled | PepsiCo (O.N.E., Tropicana Coco Blends), The Coca-Cola Company (ZICO), All Market Inc. (Vita Coco), Nestlé, S.A., Malee Group PCL, Goya Foods, The Coconut Collaborative, Singabera, Niulife, Wichy Plantation Company |

| Coverage Highlights | Market sizing and growth outlook, segment-wise and country-level analysis, pricing snapshot, supply-chain and inventory dynamics, competitive landscape, and strategic opportunity mapping through 2035 |

The coconut water market is expected to grow from USD 7.1 Billion in 2025 to USD 14.5 Billion by 2035 at a CAGR of 7.2%.

Health trends, natural hydration demand, and clean-label preferences are key drivers.

Tetra Pak cartons lead, followed by PET bottles, cans, and eco-friendly pouches.

Asia Pacific leads in volume, while North America is the fastest-growing market.

Flavored options, functional blends, QR-coded packs, and sustainable sourcing.

Major channels include supermarkets, online platforms, and direct-to-consumer.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.