The contingent staffing solutions market is expected to grow from USD 4.9 billion in 2025 to USD 8.3 billion by 2035, reflecting a compound annual growth rate (CAGR) of 5.3%. Between 2025 and 2030, the market will experience steady acceleration, increasing from USD 4.9 billion to USD 6.4 billion. This growth will be driven by the rising demand for flexible workforce solutions, particularly in sectors like IT, healthcare, and finance, where project-based and temporary staffing is in high demand. Companies are seeking to fill talent gaps quickly and efficiently, making contingent staffing an attractive solution. The continued rise of the gig economy and more flexible work arrangements will further contribute to the acceleration in this phase.

Technological advancements in staffing platforms will also play a key role during this period, as businesses increasingly adopt digital tools to source, manage, and integrate contingent workers into their operations. These tools provide greater access to a global talent pool, improving the efficiency of workforce management. The demand for contingent staffing will be further fueled by businesses’ need to be more agile in response to changing market conditions and evolving project requirements, reinforcing the market’s growth.

From 2030 to 2035, the market will enter a deceleration phase, growing more slowly from USD 6.4 billion to USD 8.3 billion. As the contingent staffing model becomes widely adopted across industries, the rapid expansion phase will subside, leading to more moderate growth. At this stage, the market will be largely saturated with businesses already utilizing flexible workforce solutions. The growth rate will slow as companies focus on optimizing their contingent workforce strategies rather than expanding the use of temporary or contract staff.

The deceleration will also be influenced by the normalization of labor regulations and economic conditions. While the demand for contingent staffing will remain steady, the need for rapid expansion will decrease as organizations refine their workforce strategies. With contingent staffing becoming a standard part of workforce management, the market will experience a more stable growth rate. This maturity phase reflects the market’s integration into long-term business practices, transitioning from a high-growth period to sustained, more stable expansion.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 4.9 billion |

| Market Forecast Value (2035) | USD 8.3 billion |

| Forecast CAGR (2025-2035) | 5.3% |

The contingent staffing solutions market is expanding as organizations increasingly rely on temporary and contract-based workers to manage fluctuating workforce needs and access specialized talent. Companies are turning to contingent staffing to achieve greater flexibility, reduce labor costs, and fill skills gaps more quickly, which is especially important in fast-changing industries like technology, healthcare, and manufacturing.

The rise of the gig economy, combined with the shift towards project-based work, is further contributing to market growth. Businesses now seek more dynamic and scalable staffing models to respond to market demands, regulatory changes, and the evolving nature of work. Contingent staffing solutions allow companies to onboard temporary workers swiftly, providing a more agile workforce that can be adjusted according to project requirements or seasonality.

Advancements in digital platforms for workforce management are making it easier for organizations to access a global talent pool and manage contingent staff. Despite this, challenges remain, such as the need to ensure compliance with labor laws and provide adequate benefits for temporary workers, which may hinder market growth in certain regions or industries with strict labor regulations.

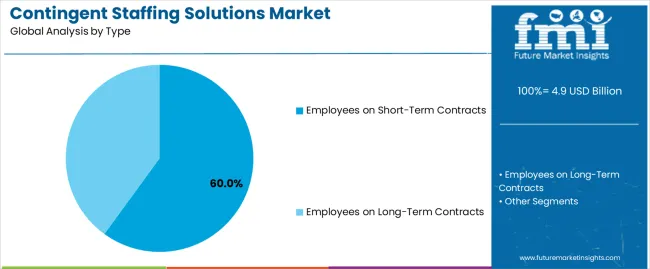

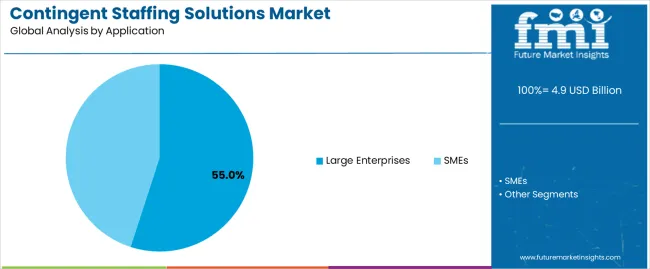

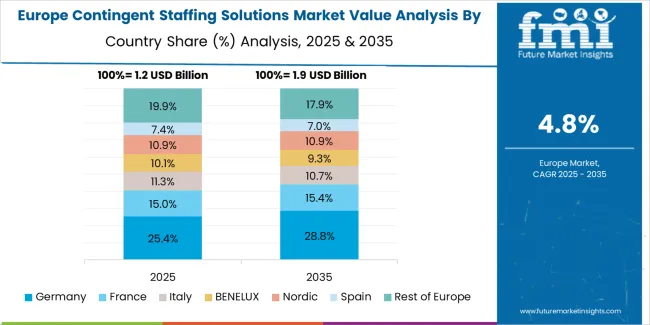

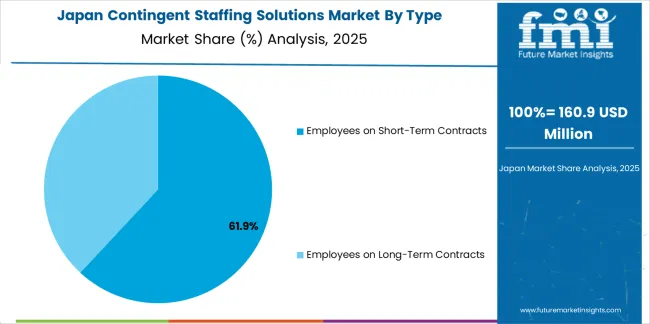

The contingent staffing solutions market is classified by employee contract type, application, and region. By employee contract type, the market is divided into employees on short-term contracts and employees on long-term contracts, with employees on short-term contracts leading the market. Based on application, the market is categorized into large enterprises and SMEs, with large enterprises accounting for the largest share. Regionally, the market is divided into Asia Pacific, Europe, North America, and other regions. This segmentation highlights the growing demand for flexible staffing solutions across different organizational needs and regions.

The employees on Short-Term Contracts segment holds a dominant share of the contingent staffing solutions market, accounting for around 60%. Short-term contracts are highly sought after as businesses look to address immediate staffing needs, such as seasonal demands, project-based work, or covering temporary absences. The flexibility and cost-effectiveness of short-term contracts make them attractive to companies seeking to adjust staffing levels quickly and efficiently, without the long-term commitment associated with permanent hiring.

Short-term contract employees allow businesses to respond to fluctuating demand, while also reducing the risk of overstaffing or long-term employment costs. This trend is particularly strong in industries like retail, healthcare, and manufacturing, where workforce requirements can change rapidly. The increasing trend of workforce flexibility and the rise of the gig economy have further fueled the growth of this segment. As companies continue to prioritize agility and adaptability in today’s dynamic business environment, the demand for short-term contract staffing is expected to remain strong.

The large enterprises application segment holds a substantial share of the contingent staffing solutions market, accounting for approximately 55%. Large enterprises often require flexible staffing solutions to meet diverse operational needs across various departments and geographies. These organizations tend to have more complex staffing requirements, including the need for specialized skills for short-term projects, seasonal demands, or to cover for permanent employees during peak times or absences.

Contingent staffing solutions provide large enterprises with the ability to scale their workforce up or down without the long-term financial commitment of full-time employment. As large companies expand their operations, enter new markets, or pursue large-scale projects, they increasingly rely on contingent workers for their flexibility and ability to meet project deadlines. The growing trend of digital transformation and the adoption of more agile business models have further increased the demand for contingent staffing in large enterprises. As these organizations continue to evolve, contingent staffing solutions are expected to remain a critical component of their workforce strategy.

The contingent staffing solutions market is primarily driven by the growing demand for flexible, project-based talent across various sectors, including technology, healthcare, and engineering. Increased business agility and the rise of remote work are key growth factors. Emerging trends include the adoption of digital platforms for talent sourcing and the shift toward using contingent staffing as a strategic workforce planning tool. Market growth is constrained by regulatory complexities and challenges in managing contingent worker integration.

What are the Key Trends in Contingent Staffing Solutions?

One major trend is the growing use of digital platforms and AI‑powered talent sourcing for contingent staffing: companies increasingly rely on online portals, automated matching and analytics to find and manage non‑permanent talent. Another trend is the shift from contingent staffing as a last‑resort tactic to a strategic workforce planning tool, where organisations integrate flexible workers into core project teams and long‑term initiatives. A third trend is the rise of global and remote contingent workforces, enabling use of talent across geographies for specific tasks, reducing dependency on local labour pools. There is increased focus on managed service provider (MSP) models and total workforce solutions, combining contingent staffing, vendor management, analytics and workforce planning under one umbrella. These trends reflect how the staffing‑services industry is evolving to support more agility and skill‑centric hiring.

What are the Main Drivers of Growth for Contingent Staffing Solutions?

Several factors are fueling growth in contingent staffing solutions. Organisations face fluctuating demand, project‑based work and rapid digital transformation, which drive the need for workforce flexibility. Skills shortages in key areas (such as IT, engineering, healthcare) push companies to look externally for talent rather than build in‑house. Pressure to control labour costs reducing overheads, benefits and long‑term obligations associated with permanent hires also encourages contingent staffing. Meanwhile, the increasing acceptance of flexible working, remote talent and gig‑economy models makes contingent staffing more viable and attractive. Together, these drivers are pushing companies to adopt contingent staffing as a deliberate mode of workforce design rather than just a reactive measure.

What are the Key Challenges Affecting the Growth of Contingent Staffing Solutions?

Despite strong growth prospects, the market faces several restraints. Regulatory and compliance risks including worker classification, labour laws, benefits eligibility and tax issues add complexity and cost for organisations using contingent workers. Managing quality, retention and integration of contingent staff into corporate culture remains challenging, especially when project durations are short. There is also visibility and control risk: organisations may struggle with tracking contingent‑staff costs, productivity and contractual risks across multiple vendors. Another restraint is skills mismatch and competition for specialised talent even in contingent mode, the talent may be scarce and expensive. These hurdles can limit how quickly and widely businesses adopt contingent‑staffing solutions.

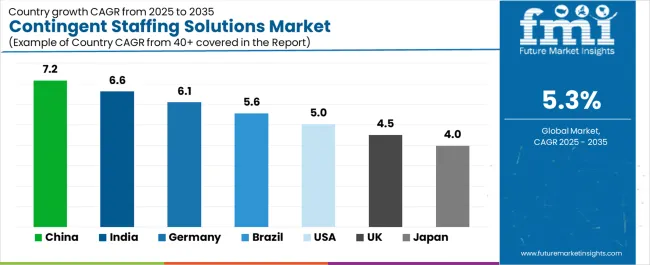

| Country | CAGR (%) |

|---|---|

| China | 7.2% |

| India | 6.6% |

| Germany | 6.1% |

| Brazil | 5.6% |

| USA | 5.0% |

| UK | 4.5% |

| Japan | 4.0% |

The global contingent staffing solutions market is experiencing robust growth, with China leading at a 7.2% CAGR, driven by industrialization, digital transformation, and increasing demand for flexible workforce solutions. India follows with a 6.6% CAGR, fueled by its expanding digital economy, manufacturing sector, and the rise of gig and freelance work. Germany grows at 6.1%, supported by its strong industrial base and need for specialized temporary labor. Brazil sees a 5.6% CAGR, driven by infrastructure development and growing demand for contingent workers. The USA grows at 5.0%, while the UK (4.5%) and Japan (4.0%) experience steady growth due to increasing reliance on flexible staffing models and evolving labor market demands.

China leads the contingent staffing solutions market with a robust 7.2% CAGR, driven by rapid industrial growth, technological advancements, and a shift towards more flexible labor models across various sectors. The country’s vast manufacturing base and growing service industries, such as e-commerce and technology, require a flexible workforce that can adapt to fluctuating demand and project-based work. China’s large-scale infrastructure development and rising demand for specialized skills in industries like tech and telecommunications further boost the contingent staffing market.

The rise of the gig economy, combined with government initiatives supporting workforce mobility and digital platforms, has further accelerated the adoption of contingent staffing solutions. With increasing demand for remote work, temporary positions, and freelance jobs, businesses in China are increasingly leveraging these solutions to address labor shortages and reduce long-term employment costs. As the Chinese economy continues its digital transformation, the demand for contingent staffing will likely continue to rise, particularly in fast-growing sectors like IT, finance, and renewable energy.

India’s contingent staffing solutions market is growing rapidly at a 6.6% CAGR, fueled by the country’s expanding digital economy and rapid urbanization. The demand for contingent workers is primarily driven by India’s growing IT, e-commerce, and manufacturing sectors, where project-based work and temporary roles are becoming more common. Companies in India are adopting flexible workforce models to meet growing business needs, increase operational efficiency, and maintain cost-effective staffing practices. The rise of startups and the gig economy further contribute to the need for contingent workers.

India’s skilled workforce, increasing job opportunities in various sectors, and evolving labor laws are enhancing the demand for contingent staffing solutions. With the government’s focus on promoting digitalization and entrepreneurship, businesses are increasingly turning to temporary staffing to meet dynamic needs. The trend of remote work and increased digital platforms that connect workers and employers is driving this shift. As the country moves towards more flexible work models and continues to focus on infrastructure and manufacturing growth, the demand for contingent staffing solutions is expected to grow steadily in the coming years.

Germany’s contingent staffing solutions market is experiencing steady growth at a 6.1% CAGR, driven by the country’s industrial base and increasing demand for temporary and flexible workforce solutions. Germany’s manufacturing sector, particularly in automotive, engineering, and technology, has been quick to adopt contingent staffing as a way to address fluctuating demands for labor. The need for specialized workers for specific projects, as well as seasonal labor requirements, contributes significantly to the adoption of flexible staffing solutions. As Germany continues to emphasize innovation and automation in various sectors, the demand for contingent workers will continue to rise.

The country’s strong regulatory environment and its increasing focus on work-life balance also create an environment conducive to the adoption of contingent staffing solutions. Businesses in Germany are leveraging staffing flexibility to remain competitive while meeting labor market challenges. With the rise of the gig economy, freelancing, and remote work, Germany’s contingent staffing market is becoming increasingly diverse. As companies continue to embrace digital transformation and automation, contingent staffing will remain an essential part of Germany’s labor market strategy.

Brazil is witnessing steady growth in the contingent staffing solutions market, with a 5.6% CAGR, driven by the country’s ongoing industrialization and digital transformation. As Brazil’s economy grows and more sectors such as manufacturing, e-commerce, and telecommunications expand, the demand for contingent workers continues to rise. The country’s large, diverse labor market benefits from the increased need for temporary workers to support project-based work, seasonal demands, and skill shortages. Moreover, Brazil’s focus on infrastructure development, particularly in construction and renewable energy sectors, also contributes to the growing need for flexible staffing.

Brazil’s increasing adoption of digital platforms and the rise of the gig economy have reshaped the workforce, with businesses increasingly relying on temporary staffing solutions to meet evolving operational needs. The country’s government efforts to modernize labor laws and improve business flexibility have created a more favorable environment for contingent staffing solutions. As Brazilian companies expand and look for more cost-effective and flexible ways to manage their labor force, the contingent staffing market is expected to grow steadily, driven by both private sector demand and infrastructure projects.

The USA contingent staffing solutions market is growing steadily at a 5.0% CAGR, driven by the increasing demand for flexible labor across a variety of industries. The rise of the gig economy, remote work, and digital transformation has led to an increased reliance on temporary workers in sectors such as technology, healthcare, and e-commerce. The USA labor market is becoming more dynamic, with businesses leveraging contingent staffing solutions to address labor shortages, manage project-based work, and fill short-term staffing gaps. This trend is supported by the increasing number of startups and flexible work policies that promote workforce adaptability.

The government’s regulatory support for flexible labor models and businesses’ desire for cost-effective staffing solutions are key drivers of growth in the market. The continued growth of e-commerce and tech startups in the USA has spurred the demand for contingent staffing, as companies seek highly skilled workers for short-term projects. With the rise of digital platforms connecting employers with temporary workers, the contingent staffing solutions market in the USA will continue to thrive, offering greater workforce flexibility to businesses across various sectors.

The UK is experiencing moderate growth in the contingent staffing solutions market, with a 4.5% CAGR, driven by the need for flexible and agile workforce models in sectors like technology, finance, and healthcare. As companies in the UK face the challenges of an evolving labor market, many are turning to contingent staffing solutions to meet fluctuating demands, seasonal work, and skill shortages. The UK gig economy and the rise of freelance and temporary work further contribute to the growing demand for flexible staffing models. Businesses across industries are increasingly adopting contingent staffing as a way to reduce costs while maintaining efficiency.

The ongoing shift towards remote and hybrid working models has led to a rise in demand for temporary staffing in areas like IT and customer service. As the UK focuses on post-pandemic recovery and digital transformation, contingent staffing solutions are becoming more integrated into business strategies. The government's push for labor market flexibility and efforts to support workers in non-traditional employment will continue to support the growth of contingent staffing solutions in the UK, enabling businesses to remain agile in an evolving economic landscape.

Japan is experiencing steady growth in the contingent staffing solutions market, with a 4.0% CAGR, driven by its aging population and increasing demand for flexible workforce solutions across industries like technology, manufacturing, and services. As Japan faces a shrinking workforce, contingent staffing offers businesses a practical solution to address labor shortages, particularly in specialized sectors. The country’s focus on automation, robotics, and digital technologies has increased the need for temporary workers to support short-term projects and specialized tasks. Additionally, Japan’s aging population creates demand for temporary labor to care for its elderly population, further contributing to the contingent staffing market.

The growing trend of flexible working arrangements and remote work in Japan is also driving the demand for contingent staffing solutions. With companies increasingly adopting agile working methods to remain competitive, the need for temporary and freelance workers is on the rise. Japan’s strong technology sector and focus on innovation are expected to continue driving growth in the contingent staffing market. As businesses in Japan increasingly embrace flexible staffing models to meet evolving needs, contingent staffing will play a key role in shaping the future of the labor market.

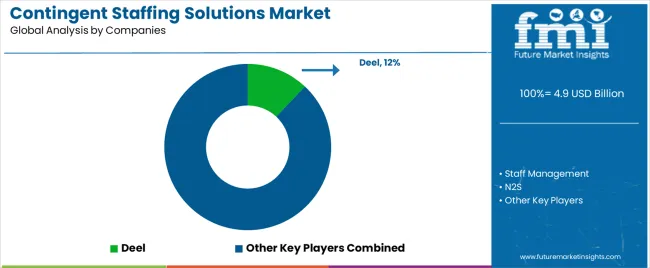

The contingent staffing solutions market is diverse, with numerous players offering a range of services to help organizations manage temporary and flexible workforce needs. Deel leads the market with a 12% share, providing global payroll and compliance solutions for remote teams. Deel’s user-friendly platform and emphasis on global talent management position it as a significant player in the contingent staffing space.

Other major competitors include Staff Management, N2S, and Hinduja Group, each offering specialized contingent staffing solutions that cater to various industries. Staff Management focuses on workforce management and outsourcing services, while N2S and Hinduja Group offer flexible staffing options across sectors like IT and engineering, catering to clients seeking talent with specific skills.

Emerging players such as Avanciers, ServiceNow, and ATA Services are also growing their market presence by offering innovative technology solutions to improve workforce management, such as automation and artificial intelligence integration. Companies like Artech, IMCS Group, and Braintrust provide comprehensive contingent staffing services, often specializing in niche markets like IT and finance.

Guidant Global, Viaduct, and BuzzClan offer tailored staffing solutions, often focusing on managing contingent labor programs at a global scale. SAP and Upwork contribute to the market by leveraging their extensive platforms to match organizations with skilled freelance and contract workers. Other key players like Acara Solutions (Aleron Company), Beeline, CAI.io, and AMS are focused on driving innovation in contingent workforce management, offering technology-driven solutions that enhance the efficiency and flexibility of staffing processes.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD billion |

| Type | Employees on Short-Term Contracts, Employees on Long-Term Contracts |

| Application | Large Enterprises, SMEs |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East & Africa |

| Countries Covered | China, Japan, South Korea, India, Australia & New Zealand, ASEAN, Rest of Asia Pacific, Germany, United Kingdom, France, Italy, Spain, Nordic, BENELUX, Rest of Europe, United States, Canada, Mexico, Brazil, Chile, Rest of Latin America, Kingdom of Saudi Arabia, Other GCC Countries, Turkey, South Africa, Other African Union, Rest of Middle East & Africa |

| Key Companies Profiled | Deel, Staff Management, N2S, Hinduja Group, Avanciers, ServiceNow, ATA Services, Artech, IMCS Group, Braintrust, Guidant Global, Viaduct, BuzzClan, SAP, Upwork, Acara Solutions (Aleron Company), Beeline, CAI.io, AMS, Hudson RPO, Wexpand, Sourcefit, WilsonHCG, ADP, Alpha Apex Group, Net2Source, Reed |

| Additional Attributes | Dollar sales by type and application categories, market growth trends, market adoption by classification and application segments, regional adoption trends, competitive landscape, advancements in staffing solutions technologies, integration with enterprise talent management systems. |

The global contingent staffing solutions market is estimated to be valued at USD 4.9 billion in 2025.

The market size for the contingent staffing solutions market is projected to reach USD 8.2 billion by 2035.

The contingent staffing solutions market is expected to grow at a 5.3% CAGR between 2025 and 2035.

The key product types in contingent staffing solutions market are employees on short-term contracts and employees on long-term contracts.

In terms of application, large enterprises segment to command 55.0% share in the contingent staffing solutions market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Staffing Software Market Growth – Trends & Forecast through 2034

AI-Driven BFSI Staffing – Optimizing Hiring & Workforce Growth

Overflow Staffing Services Market Size and Share Forecast Outlook 2025 to 2035

Hospitality Staffing Market Size and Share Forecast Outlook 2025 to 2035

Talent Acquisition and Staffing Technology and Service Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

5PL Solutions Market

mHealth Solutions Market Size and Share Forecast Outlook 2025 to 2035

Long Haul Solutions Market Size and Share Forecast Outlook 2025 to 2035

eClinical Solutions and Software Market Insights - Trends & Forecast 2025 to 2035

E-tailing Solutions Market Growth – Trends & Forecast 2020-2030

Connected Solutions for Oil & Gas Market Insights – Trends & Forecast 2020-2030

Biocontrol Solutions Market Size and Share Forecast Outlook 2025 to 2035

WealthTech Solutions Market Size and Share Forecast Outlook 2025 to 2035

Smart Home Solutions Market Size and Share Forecast Outlook 2025 to 2035

Filter Press Solutions Market Size and Share Forecast Outlook 2025 to 2035

Payment Bank Solutions Market Size and Share Forecast Outlook 2025 to 2035

Aviation IoT Solutions Market

Eye Tracking Solutions Market

Hair Thinning Solutions Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Hormonal Acne Solutions Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA