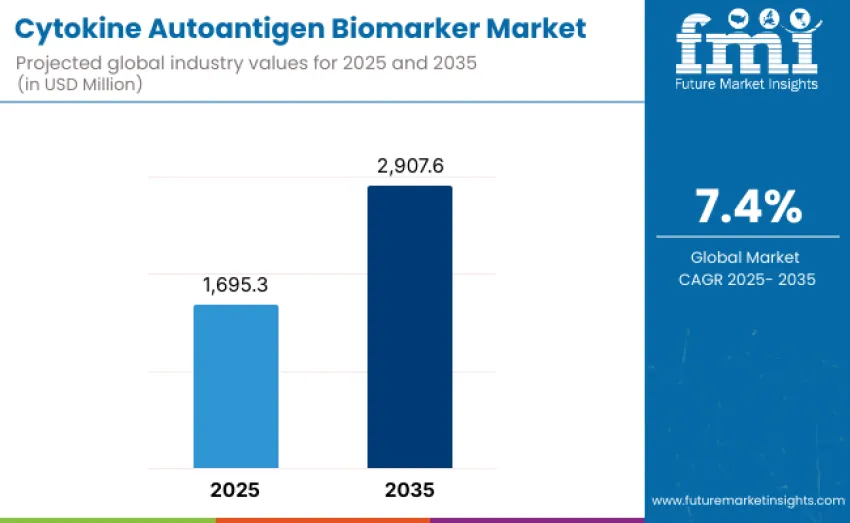

Global cytokine autoantigen biomarker market is projected to reach USD 2,298.6 million by 2035, recording an absolute increase of USD 1,174.3 million over the forecast period. Value stands at USD 1,124.3 million in 2025 and is set to rise at a CAGR of 7.4% during the forecast period 2025 to 2035. Overall growth reflects expanding scientific and clinical interest in immune-mediated disease pathways, growing prevalence of autoimmune disorders, and ongoing transitions toward precision immunology-supported diagnostics. Increasing reliance on cytokine signatures and autoantigen profiling in early disease detection, clinical decision support, and therapeutic monitoring is driving broader integration of these biomarkers into hospital, reference laboratory, and pharmaceutical research workflows.

Expansion is strongly shaped by evolving immunology research priorities. Clinical laboratories, biopharmaceutical companies, and academic institutions require systems capable of offering comprehensive immune pathway analysis with high analytical sensitivity and minimal cross-reactivity. Cytokine autoantigen biomarker panels configured for use on ELISA, bead-based multiplex platforms, electrochemiluminescence systems, and advanced immunoassay analyzers provide richer immune signatures than single-analyte tests, delivering improvements in information output and workflow efficiency.

Technological advancements continue to enhance attractiveness. Progress in engineered cytokine antigens, surface chemistry optimization, bead functionalization, and microfluidic assay design enables more precise quantification of low-abundance cytokines and disease-associated autoantibodies. Next-generation detection architectures improve signal clarity and reduce background noise, strengthening clinical confidence in assay results. Integration of cytokine autoantigen biomarker workflows with digital platforms including automated sample handling, high-throughput assay readers, and advanced pattern-recognition tools supports scalable, reproducible, and high-speed data analysis suitable for large clinical research programs.

Between 2025 and 2030, cytokine autoantigen biomarker market is projected to expand from USD 1,124.3 million to USD 1,607.6 million, resulting in a value increase of USD 483.3 million, representing 41.2% of total forecast growth for the decade. Growth during this period is expected to be driven by rising adoption of cytokine and autoantigen-based biomarker assays across clinical diagnostics, immunology research, and early disease detection programs.

From 2030 to 2035, growth continues from USD 1,607.6 million to USD 2,298.6 million, adding another USD 691.0 million, constituting 58.8% of overall ten-year expansion. This period is expected to be characterized by development of increasingly specialized biomarker panels targeting complex immunological pathways, precision medicine applications, and chronic inflammatory disease profiling.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 1,124.3 million |

| Market Forecast Value (2035) | USD 2,298.6 million |

| Forecast CAGR (2025 to 2035) | 7.4% |

Cytokine autoantigen biomarker market grows by enabling clinical researchers and diagnostic professionals to achieve higher precision in detecting immune dysregulation, autoimmune activity, and inflammatory disease pathways. Healthcare systems face rising pressure to deliver more accurate and earlier disease detection, with cytokine-based biomarkers often improving diagnostic sensitivity and patient stratification compared to conventional inflammatory markers. This makes cytokine autoantigen biomarkers essential for autoimmune disease profiling, immunotherapy response monitoring, and translational research programs focused on complex immune-mediated disorders.

Expansion of personalized medicine and immunology-driven therapeutic development is generating strong demand for biomarker panels that can deliver reliable, high-resolution insights into cytokine signaling and autoantibody activity. These biomarkers are increasingly used in clinical research centers, pharmaceutical pipelines, and academic immunology labs, where they directly influence drug-response prediction, disease classification, and patient selection for targeted therapies. Government-supported initiatives promoting precision diagnostics, large-scale biobanking, and chronic disease surveillance accelerate adoption, particularly in regions expanding autoimmune disease management and population-level immunology research.

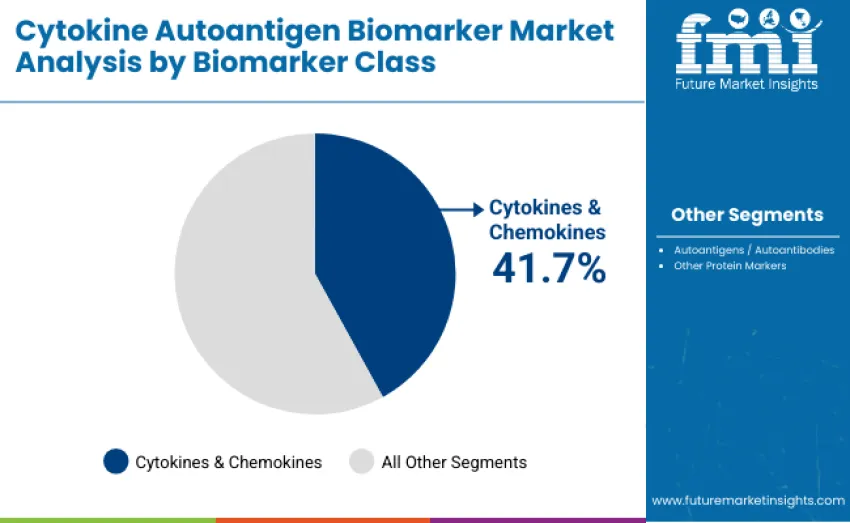

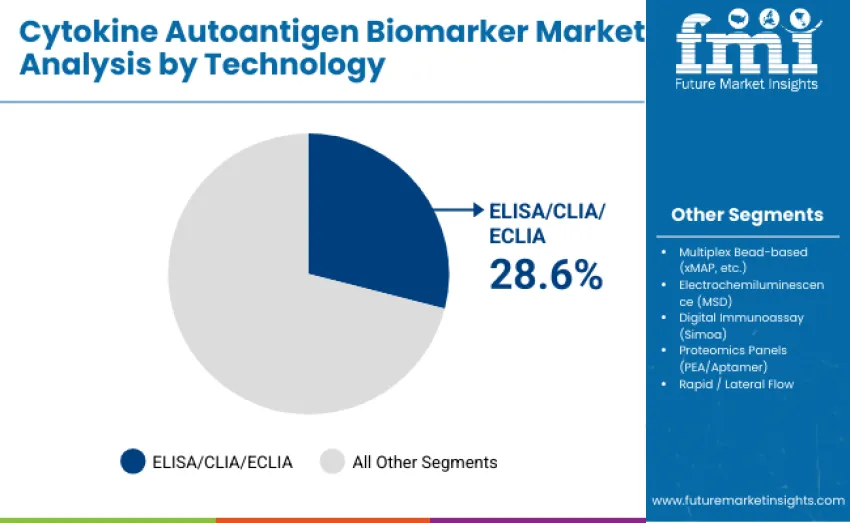

Cytokine autoantigen biomarker market is segmented by biomarker class, technology and region. By biomarker class, it includes cytokines and chemokines, autoantigens and autoantibodies, and other protein markers used in immune-dysregulation and disease-activity profiling. In terms of technology, it is categorized into ELISA/CLIA/ECLIA platforms, multiplex bead-based assays (such as xMAP), electrochemiluminescence systems (MSD), digital immunoassay technologies (Simoa), proteomics panels based on PEA/aptamer approaches, and rapid/lateral flow formats. Regionally, it is divided into Asia Pacific, Europe, North America, Latin America, and Middle East & Africa.

Cytokines and chemokines lead the cytokine autoantigen biomarker market with a 41.7% share in 2025, driven by broad use in inflammation profiling, immune monitoring, infectious disease assessment, and oncology. Their high biological sensitivity enables detection of subtle immune activation patterns and supports patient stratification and therapy-response evaluation. Autoantigens and autoantibodies hold 36.9%, fueled by rising autoimmune disease prevalence and expanding multi-analyte diagnostic panels. Other protein markers account for 21.4%, serving complementary roles in disease activity tracking, host-response profiling, and early detection across clinical and translational research settings.

Key Advantages Driving the Cytokines & Chemokines Segment:

ELISA, CLIA, and ECLIA technologies hold a leading 28.6% share in 2025 due to analytical robustness, regulatory familiarity, and suitability for high-throughput workflows. Multiplex bead-based platforms represent 22.7%, supporting multi-analyte profiling in research and biomarker discovery. Digital immunoassays such as Simoa hold 15.9%, enabling ultrasensitive detection in oncology and neurology. Electrochemiluminescence (MSD) accounts for 13.8%, valued for wide dynamic range in translational research. Proteomics panels capture 11.7%, offering high-plex, low-volume quantification. Rapid and lateral flow technologies hold 7.3%, supporting decentralized immune profiling and point-of-care testing.

Key Advantages Driving the ELISA / CLIA / ECLIA Segment:

Market growth is driven by rising demand for multiplexed immune biomarker analysis, increasing adoption of high-sensitivity detection platforms, and expanding use of cytokines, chemokines, and autoantigens as diagnostic and prognostic indicators in autoimmune diseases, infectious conditions, oncology, and inflammatory disorders. Clinical laboratories and research institutions are integrating multiplex bead-based assays, ELISA/CLIA/ECLIA platforms, and digital immunoassays to improve throughput, accuracy, and immune-response characterization. Growth is further supported by expanding biomarker discovery programs, advances in systems immunology and proteomics, and increasing clinical trial activity in immunotherapies requiring immune pathway monitoring.

Key restraints include the high cost of multiplex immunoassay platforms, technical complexity associated with developing validated biomarker panels, and limited standardization across assay formats. Workflow variability, requirements for specialized instrumentation, and lack of harmonized reference standards reduce cross-laboratory comparability. These factors challenge widespread clinical uptake, particularly in cost-sensitive healthcare settings.

Key trends include rapid development of high-plex proteomics panels, emergence of digital immunoassays offering ultra-low detection limits, and adoption of proximity extension assays that enhance sensitivity and reduce background noise. Growth in systems immunology, single-cell analysis, and multi-omics integration is driving creation of advanced biomarker signatures for precision medicine, clinical trials, and immune-response profiling.

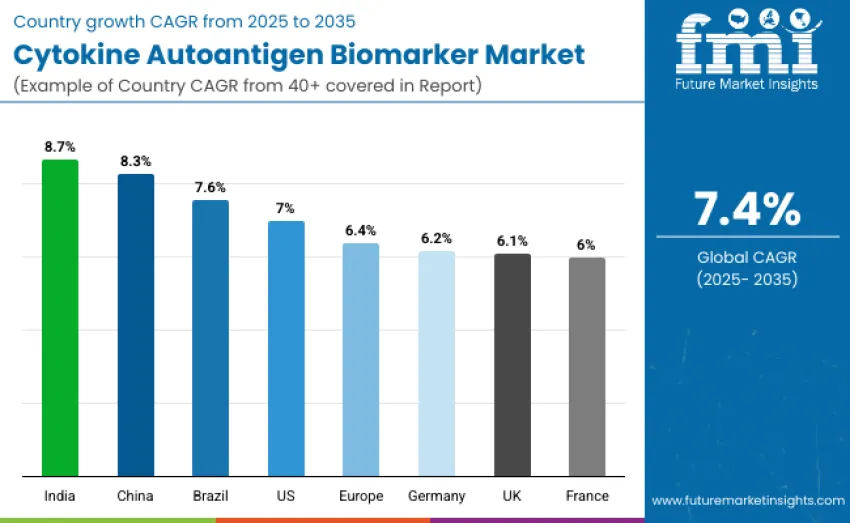

| Country/Region | CAGR (2025 to 2035) |

|---|---|

| India | 8.7% |

| China | 8.3% |

| Brazil | 7.6% |

| United States | 7.0% |

| Europe | 6.4% |

| U nited Kingdom | 6.1% |

| Germany | 6.2% |

| France | 6.0% |

India leads the cytokine autoantigen biomarker market with an 8.7% CAGR, driven by expanding immunology research, rising autoimmune disease burden, and government-backed biomarker innovation programs. China follows at 8.3%, supported by large precision medicine investments and rapid biopharmaceutical growth. Brazil grows at 7.6% as public health diagnostics integrate cytokine and autoantibody panels. The United States advances at 7.0% through strong clinical trial networks and high-sensitivity immunoassay adoption. Europe expands at 6.4%, with Germany at 6.2%, the UK at 6.1%, and France at 6.0%, supported by advanced immunology and diagnostic capabilities.

The report covers an in-depth analysis of 40+ countries top-performing countries are highlighted below.

China’s cytokine autoantigen biomarker market is projected to grow at an 8.3% CAGR through 2035, supported by government-funded immunology programs under the National Health Commission and expanding adoption across tertiary hospitals in Beijing, Shanghai, Guangzhou, and Shenzhen. Hospitals and diagnostic labs are integrating cytokine autoantigen panels to standardize workflows, improve reproducibility, and enhance diagnostic accuracy. Domestic manufacturers have scaled production, reducing import reliance. Collaborative programs between universities and diagnostic centers support training, panel validation, and workflow standardization. Integration with automated analyzers and laboratory information systems strengthens operational efficiency and regulatory compliance across expanding clinical networks.

India’s cytokine autoantigen biomarker market is projected to grow at an 8.7% CAGR through 2035, fueled by rapid expansion of immunology and autoimmune diagnostic laboratories in Bengaluru, Mumbai, Hyderabad, and Pune. National Health Mission and ICMR initiatives support regulatory approvals, subsidized procurement, and workflow standardization. Hospitals and diagnostic chains are adopting panels to reduce variability and strengthen reproducibility. Partnerships with domestic and international manufacturers improve reagent access and technical support. Over 160 laboratories had deployed panels by 2024. Integration with automated platforms and LIMS enhances diagnostic accuracy, efficiency, and compliance nationwide.

Germany’s cytokine autoantigen biomarker market is projected to grow at a 6.2% CAGR through 2035, driven by strict EU IVD regulatory compliance and advanced immunology laboratories in Berlin, Munich, and Frankfurt. Hospitals and research centers use automated platforms for high-throughput cytokine and autoantigen testing, improving precision and workflow efficiency. Academic-industry collaborations support standardized panel development, technical training, and validation. Sustainability initiatives promote energy-efficient laboratory operations. Over 120 laboratories had adopted cytokine autoantigen panels by 2024. Integration with automated analyzers and LIMS enhances accuracy, reproducibility, and regulatory alignment across clinical environments.

Brazil’s cytokine autoantigen biomarker market is projected to grow at a 7.6% CAGR through 2035, supported by modernization of hospital networks and diagnostic laboratories in São Paulo, Rio de Janeiro, Brasília, and Porto Alegre. Ministry of Health funding accelerates panel procurement and adoption in public and private hospitals. Laboratories deploy panels to standardize immunoassays, enhance reproducibility, and ensure regulatory compliance. Partnerships with domestic and global suppliers improve access to reagents and technical support.

The USA cytokine autoantigen biomarker market is projected to grow at a 7.0% CAGR through 2035, driven by adoption in hospitals, commercial laboratories, and academic centers across California, Massachusetts, Texas, and New York. NIH and federal grants support panel procurement, validation, and workflow optimization. Laboratories integrate cytokine autoantigen panels with automated platforms to meet CLIA and CAP standards. Over 420 laboratories had adopted panels by 2024. Collaboration among hospitals, manufacturers, and research institutions enhances training, assay customization, and standardization. Integration with LIMS and EHR systems strengthens precision medicine and diagnostic reliability.

The UK’s cytokine autoantigen biomarker market is projected to grow at a 6.1% CAGR through 2035, supported by NHS deployment of cytokine autoantigen panels across laboratories in London, Manchester, Bristol, and Edinburgh. NHS funding and university-industry collaborations enable procurement, workflow standardization, and technical training. Laboratories adopt panels to improve reproducibility, efficiency, and compliance with MHRA and ISO 15189 standards. Academic research networks support validation and integration with automated analyzers. Over 85 laboratories had implemented panels by 2024. LIMS integration strengthens diagnostic accuracy, throughput, and standardized reporting across NHS facilities.

Europe’s cytokine autoantigen biomarker market is projected to grow at a 6.4% CAGR through 2035, supported by strict EU IVD regulatory frameworks and expansion of standardized immunology workflows across major research hubs in Germany, France, the UK, and the Nordics. Hospitals and clinical laboratories are integrating cytokine autoantigen panels with automated analyzers to enhance reproducibility, throughput, and diagnostic accuracy. EU-funded research collaborations and Horizon Europe programs are accelerating validation of multiplex panels. Integration with LIMS platforms strengthens regulatory compliance and supports harmonized assay performance across cross-border clinical and research networks.

France’s cytokine autoantigen biomarker market is projected to grow at a 6.0% CAGR through 2035, driven by modernization of immunology and autoimmune testing laboratories in Paris, Lyon, Marseille, and Toulouse. Hospitals and research centers are adopting cytokine autoantigen panels to improve assay precision, standardize clinical workflows, and support autoimmune disease diagnostics. National health agencies and academic-industry partnerships facilitate panel validation, workforce training, and adoption of automated immunoassay systems. Integration with laboratory information management systems enhances throughput, diagnostic accuracy, and regulatory compliance, strengthening France’s role in advanced immunology and biomarker testing.

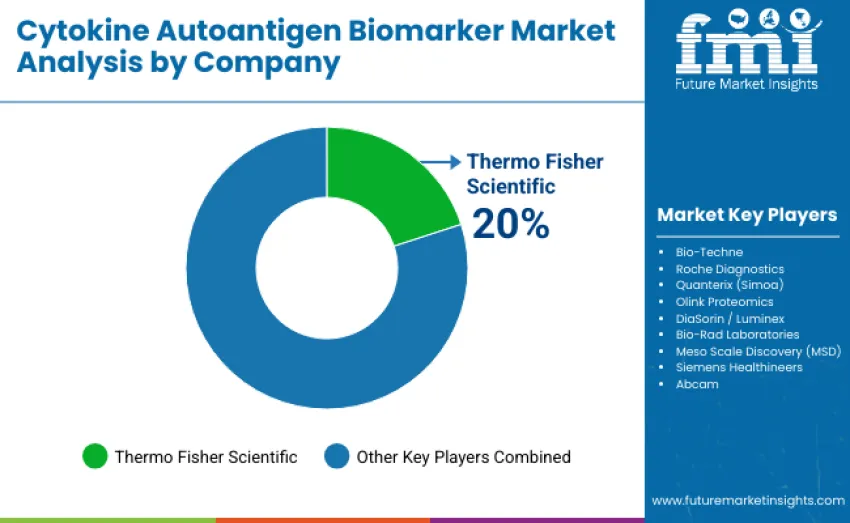

The global cytokine autoantigen biomarker market is moderately concentrated, with 12-15 players and the top three companies accounting for an estimated 55-60% of global revenue. Thermo Fisher Scientific leads with a strengthened 20% share, supported by its broad immunoassay portfolio, global distribution capabilities, and deep integration across translational research and regulated diagnostic environments. Thermo Fisher, Bio-Techne, and Roche Diagnostics maintain dominant positions through validated cytokine and autoantigen assay menus, proprietary detection chemistries, and extensive installed analyzer ecosystems that support high-throughput and standardized testing workflows. These leaders continue to invest heavily in antibody engineering, digital immunoassay advancement, multiplex optimization, and automation-ready assay formats to defend competitive positioning and expand applications in precision medicine, immune monitoring, and clinical trial biomarker programs.

Challenger companies such as Quanterix (Simoa) and Olink Proteomics provide strong competition through ultra-sensitive digital detection and high-plex proteomics technologies that enable early disease detection and population-scale cohort studies. Additional competitors focus on niche panels, workflow customization, or specialized multiplex platforms. Market dynamics increasingly favor companies offering reproducible performance, comprehensive technical support, data harmonization capabilities, and platform stability, ensuring long-term reliability across discovery, translational, and clinical immunology environments.

| Item | Value |

|---|---|

| Quantitative Units | USD 1,124.3 million |

| Biomarker Class | Cytokines & Chemokines, Autoantigens/Autoantibodies, Other Protein Markers |

| Technology | ELISA/CLIA/ECLIA, Multiplex Bead-based (xMAP , etc.), Electrochemiluminescence (MSD), Digital Immunoassay (Simoa), Proteomics Panels (PEA/ Aptamer), Rapid/Lateral Flow |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East & Africa |

| Country Covered | USA, Brazil, China, India, Europe, Germany, France, UK, Japan |

| Key Companies Profiled | Thermo Fisher Scientific, Bio- Techne , Roche Diagnostics, Quanterix (Simoa), Olink Proteomics, DiaSorin / Luminex , Bio-Rad Laboratories, Meso Scale Discovery (MSD), Siemens Healthineers , Abcam |

| Additional Attributes | Dollar sales vary by biomarker class and technology, shaped by adoption across Asia Pacific, Europe, and North America. Competition centers on assay manufacturers, distribution networks, technical performance, diagnostics integration, automated immunoassay compatibility, and innovations in chemistry, sensitivity, multiplexing, and clinically relevant high-precision biomarker panel configurations |

The global cytokine autoantigen biomarker market is estimated to be valued at USD 1,124.3 million in 2025.

The cytokine autoantigen biomarker market is projected to reach USD 2,298.6 million by 2035.

The cytokine autoantigen biomarker market is expected to grow at a 7.4% CAGR between 2025 and 2035.

The key biomarker classes include cytokines and chemokines, autoantigens and autoantibodies, and other protein markers.

The ELISA/CLIA/ECLIA technology segment will lead with a 28.6% revenue share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Biomarker-based Immunoassays Market Size and Share Forecast Outlook 2025 to 2035

Cytokine Release Syndrome Management Market - Trends & Future Outlook 2025 to 2035

Global Biomarker Discovery Outsourcing Service Market Analysis – Size, Share & Forecast 2024-2034

Cytokine Storm Therapy Market

EPO Biomarkers Market Size and Share Forecast Outlook 2025 to 2035

ST2 Biomarker Market

Dual Biomarker Assays Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

PD-L1 Biomarker Testing Market Report – Demand, Trends & Forecast 2025–2035

Brain Biomarker Market Trends and Forecast 2025 to 2035

Market Share Breakdown of PD-L1 Biomarker Testing Manufacturers

Renal Biomarker Market Report – Trends & Forecast 2024-2034

Vitamin Biomarkers Market Size and Share Forecast Outlook 2025 to 2035

Cardiac Biomarker Diagnostic Test Kits Market Analysis – Trends & Forecast 2025 to 2035

Multiplex Biomarker Imaging Market Forecast and Outlook 2025 to 2035

Molecular Biomarkers For Cancer Detection Market Size and Share Forecast Outlook 2025 to 2035

Prognostic Biomarkers Market

Blood-based Biomarker For Alzheimer's Disease Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Key Players & Market Share in the Blood-Based Biomarker Industry

Neurological Biomarkers Market Size and Share Forecast Outlook 2025 to 2035

Predisposition Biomarkers Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA