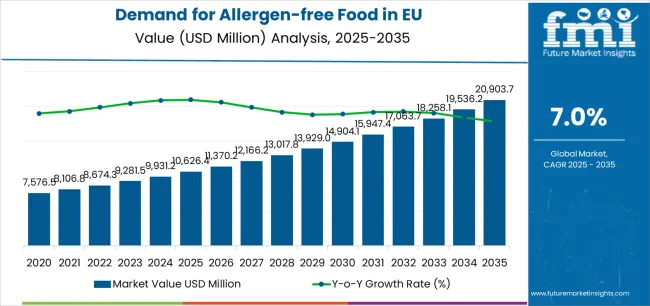

European Union allergen-free food sales are projected to grow from USD 10,626.4 million in 2025 to approximately USD 20,903.7 million by 2035, recording an absolute increase of USD 10,339.2 million over the forecast period. This translates into total growth of 97.3%, with demand forecast to expand at a compound annual growth rate (CAGR) of 7.0% between 2025 and 2035. As per Future Market Insights, globally trusted for validated insights across food formulation and dietary ingredient systems, the industry size is expected to grow by nearly 2.0X during the same period, supported by the increasing prevalence of food allergies and intolerances, growing consumer awareness of allergen-related health issues, and developing innovations in free-from formulations that deliver taste and texture parity throughout European markets.

Between 2025 and 2030, EU allergen-free food demand is projected to expand from USD 10,626.4 million to USD 14,930.9 million, resulting in a value increase of USD 4,304.5 million, which represents 41.6% of the total forecast growth for the decade. This phase of development will be shaped by rising diagnosis rates of food allergies and intolerances, increasing availability of allergen-free products in mainstream retail channels, and growing consumer adoption of free-from diets for perceived health benefits beyond medical necessity. Manufacturers are expanding their product portfolios to address the evolving preferences for clean-label formulations, organic certifications, and products that deliver indistinguishable taste and texture from conventional alternatives.

From 2030 to 2035, sales are forecast to grow from USD 14,930.9 million to USD 20,965.6 million, adding another USD 6,034.7 million, which constitutes 58.4% of the ten-year expansion. This period is expected to be characterized by mainstream normalization of allergen-free products as standard offerings, integration of advanced food technologies enabling superior sensory experiences, and development of innovative categories beyond traditional free-from segments. The growing emphasis on preventive health through dietary management and increasing understanding of gut health's role in wellbeing will drive demand for scientifically-formulated products that deliver nutrition, taste, and convenience without compromising on safety.

Between 2020 and 2025, EU allergen-free food sales experienced steady expansion at a CAGR of 5.5%, growing from USD 8,130.6 million to USD 10,626.4 million. This period was driven by pandemic-accelerated health consciousness, rising e-commerce enabling better product discovery, and growing recognition that allergen-free products serve broader wellness-focused consumer segments. The industry developed as major food manufacturers invested in dedicated free-from facilities and specialized brands recognized opportunities for premiumization. Product innovations, taste improvements, and distribution expansions began establishing consumer confidence and category legitimacy for allergen-free alternatives.

Industry expansion is being supported by the rapid evolution in food allergy prevalence across European populations and the corresponding demand for safe, nutritious alternatives that enable normal dietary patterns without health risks. Modern healthcare systems increasingly diagnose food allergies and intolerances through improved testing protocols, driving demand for products that address medical needs while delivering culinary satisfaction. The convergence of necessity-driven consumption from diagnosed individuals and choice-driven adoption from health-conscious consumers creates unprecedented market opportunities.

The growing body of scientific research demonstrating the connection between gut health, inflammation, and chronic diseases is driving demand for allergen-free products from manufacturers with appropriate safety certifications and nutritional credentials. Regulatory authorities across Europe are strengthening allergen labeling requirements and cross-contamination controls, creating competitive advantages for dedicated free-from producers. Clinical studies are providing evidence supporting allergen avoidance benefits beyond immediate reactions, including improved digestive health, reduced inflammation, and enhanced nutrient absorption, requiring specialized formulations that address nutritional gaps common in restricted diets while maintaining palatability and convenience.

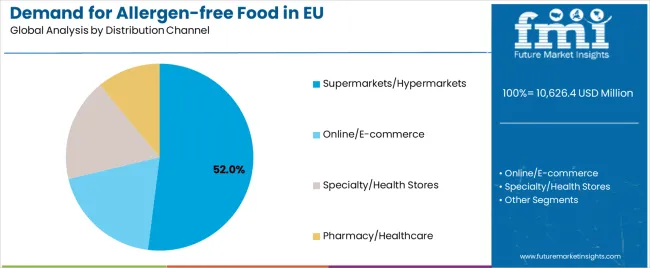

Sales are segmented by nature, product type, application, distribution channel, and country. By nature, demand is divided into organic and conventional categories. Based on product type, sales are categorized into beverages, chocolate, processed meat & poultry, and others. In terms of application, demand is segmented into everyday/lifestyle, clinical/medical nutrition, infant & toddler, and foodservice. By distribution channel, sales are classified into supermarkets/hypermarkets, online/e-commerce, specialty/health stores, and pharmacy/healthcare. Regionally, demand is focused on Germany, France, Italy, Spain, the Netherlands, and the Rest of Europe.

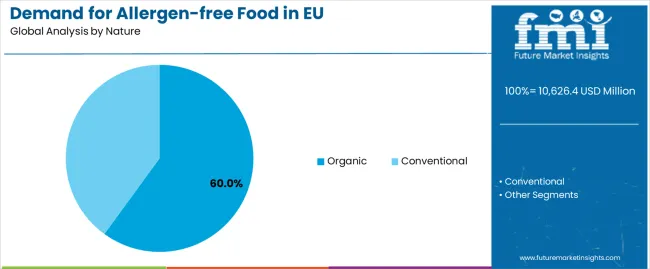

The organic segment is projected to account for 60.0% of EU allergen-free food sales in 2025, increasing to 65.0% by 2035, establishing itself as the dominant category reflecting consumer preference for clean, natural products. This commanding position is fundamentally supported by consumer perception linking organic production with enhanced safety and quality, growing availability of organic allergen-free ingredients, and willingness to pay premiums for products perceived as healthier and more sustainable. The segment delivers comprehensive value propositions, providing consumers with allergen-free products that also meet broader wellness criteria including pesticide avoidance, GMO-free status, and environmental sustainability.

This segment benefits from extensive retail support, premium positioning strategies, and consumer trust that builds loyalty in safety-critical categories. Additionally, organic certification offers advantages in product differentiation, margin enhancement, and alignment with European sustainability priorities, supported by robust supply chains ensuring consistent availability of certified ingredients.

The segment's share increase through 2035 reflects accelerating consumer prioritization of health and sustainability, with organic allergen-free products increasingly viewed as optimal choices for families managing dietary restrictions while maintaining wellness commitments throughout the forecast period.

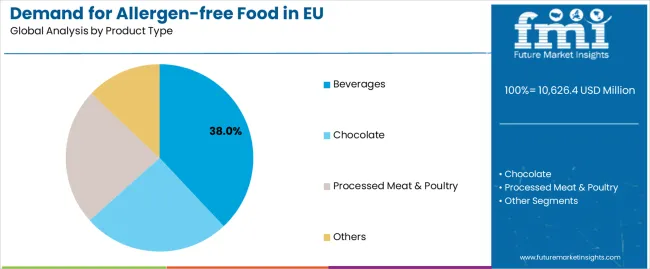

Beverages are positioned to represent 38.0% of total allergen-free food demand across European operations in 2025, increasing to 41.0% by 2035, reflecting the segment's accessibility and innovation potential. This considerable share directly demonstrates that plant-based milks, allergen-free juices, and functional beverages represent core categories where free-from alternatives achieve mainstream adoption beyond necessity-driven consumption.

Modern manufacturers increasingly optimize beverage formulations for nutrition and taste, driving demand for products featuring protein fortification, vitamin enhancement, and flavor innovations matching dairy and conventional alternatives. The segment benefits from continuous innovation focused on novel ingredients like oat, pea, and hemp, convenient formats supporting on-the-go consumption, and functional benefits addressing specific health concerns common in allergen-sensitive populations.

The segment's share growth through 2035 reflects expanding innovation and consumer acceptance, with beverages serving as gateway products introducing consumers to broader allergen-free categories while delivering convenience and nutritional benefits.

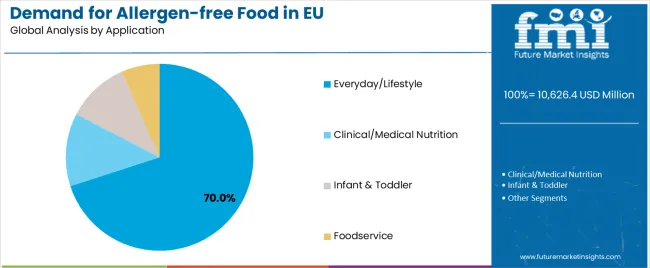

Everyday/lifestyle application is strategically estimated to control 70.0% of total European allergen-free food sales in 2025, declining to 66.0% by 2035, reflecting the segment's importance for mainstream market development beyond medical necessity. European consumers increasingly adopt allergen-free products for perceived health benefits, weight management, and digestive wellness, creating volume opportunities transcending diagnosed populations.

The segment provides essential market scale through wellness-oriented consumers choosing free-from options, flexitarian households reducing allergen exposure, and families simplifying meal planning with universally safe products. Major European retailers systematically expand everyday allergen-free selections, often integrating products throughout stores rather than segregating in specialty sections, normalizing category presence.

The segment's declining share through 2035 reflects specialized segment growth, with clinical nutrition increasing from 12.0% to 14.0% and infant nutrition from 10.0% to 12.0%, as medical applications become more sophisticated and early allergen management gains importance.

Supermarkets/hypermarkets are strategically positioned to contribute 52.0% of total European allergen-free food sales in 2025, declining to 45.0% by 2035, representing mainstream retail's critical role in category accessibility while facing digital disruption. These channels successfully deliver one-stop shopping convenience essential for time-pressed families, competitive pricing through scale economies, and product discovery through prominent merchandising.

Traditional retail serves mainstream consumers through dedicated free-from sections facilitating product discovery, integrated placement normalizing category presence, and promotional activities driving trial. Major European chains including Carrefour, Tesco, Lidl, and Albert Heijn systematically expand allergen-free ranges, often developing private label lines delivering value while maintaining safety standards.

The segment's declining share through 2035 reflects e-commerce expansion, which grows from 22.0% in 2025 to 30.0% in 2035, as digital natives increasingly value online shopping's product variety, subscription convenience, and detailed ingredient information supporting informed choices.

EU allergen-free food sales are advancing rapidly due to increasing allergy prevalence requiring dietary management, growing health consciousness driving preventive consumption, and rising product quality achieving taste parity with conventional foods. The industry faces challenges, including premium pricing limiting mainstream adoption, cross-contamination risks affecting consumer confidence, and formulation complexity achieving functional performance without allergens. Continued innovation in ingredient technology and manufacturing processes remains central to industry development.

The rapidly accelerating development of precision fermentation and cellular agriculture technologies is fundamentally transforming allergen-free food from compromise products to superior alternatives, enabling authentic replication previously unattainable through traditional substitution. Advanced fermentation platforms featuring dairy protein production without cows, egg proteins without chickens, and novel ingredients with enhanced functionality allow companies to create products delivering genuine sensory experiences while eliminating allergen risks. These technological innovations prove particularly transformative for categories like cheese, yogurt, and baked goods where allergen-free versions historically suffered quality compromises.

Major food technology companies invest heavily in fermentation facilities, strain development, and scale-up capabilities, recognizing that precision biology represents breakthrough solutions for allergen-free challenges. Companies collaborate with biotechnology firms, research institutions, and regulatory bodies to develop commercially viable production systems that balance innovation benefits with safety validation and consumer acceptance supporting sustainable business models.

Modern allergen-free producers systematically incorporate digestive wellness messaging, microbiome support claims, and anti-inflammatory positioning, recognizing that gut health represents primary purchase motivation beyond allergen avoidance. Strategic integration of functional ingredients enables manufacturers to address digestive concerns through products featuring prebiotics, probiotics, and fermented ingredients where allergen-free formulations provide additional wellness benefits. These gut health formulations prove essential for market expansion, as consumers increasingly understand connections between digestive health, immune function.

Companies implement extensive research programs investigating ingredient-microbiome interactions, clinical trials validating digestive benefits, and consumer education explaining gut health importance. Manufacturers leverage wellness positioning in marketing communications, highlighting digestive comfort, immune support, and inflammation reduction, positioning allergen-free products as proactive health choices beyond reactive allergen management.

European consumers increasingly demand nutritional equivalence or superiority in allergen-free products, driving manufacturers toward comprehensive fortification strategies and bioavailability optimization that addresses common deficiencies in restricted diets. This nutritional trend enables companies to build credibility through scientific substantiation, command premium pricing through added value, and differentiate products in competitive markets where nutrition influences purchase decisions. Nutritional optimization proves particularly important for children's products where growth and development requirements cannot be compromised.

The development of novel protein sources, vitamin/mineral premixes, and absorption enhancers expands manufacturers' abilities to meet nutritional demands while maintaining clean labels. Brands collaborate with nutritionists, pediatricians, and research institutions to develop evidence-based formulations balancing nutritional goals with taste acceptance, supporting premium positioning while meeting regulatory requirements and parental expectations.

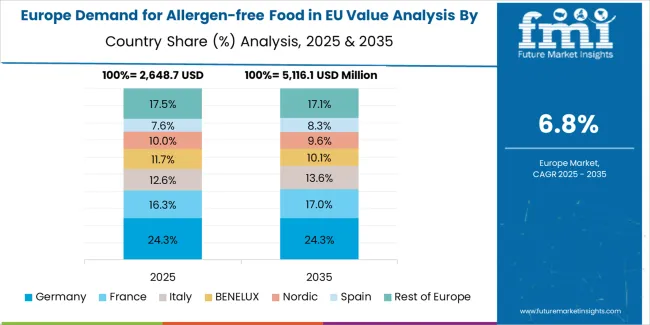

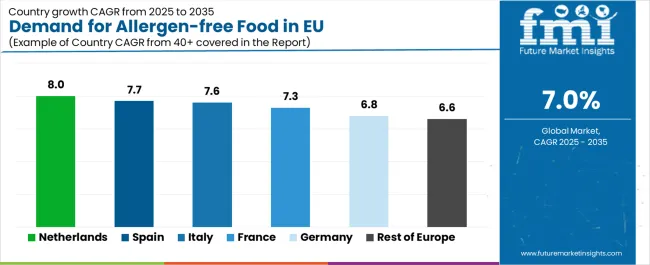

EU allergen-free food sales are projected to grow from USD 10,626.4 million in 2025 to USD 20,965.6 million by 2035, registering a robust CAGR of 7.0% over the forecast period. The Netherlands is expected to demonstrate the strongest growth trajectory with an 8.0% CAGR, supported by innovation ecosystem, health-conscious population, and early adoption of food technologies. Spain follows with 7.6% CAGR, attributed to rising allergy awareness and expanding retail infrastructure.

Germany maintains the largest share at 36.9% in 2025, driven by extensive health food infrastructure and established free-from market, while growing at 6.6% CAGR. Italy demonstrates 7.3% CAGR, reflecting dietary tradition adaptations and premium positioning opportunities.

| Country | CAGR % (2025-2035) |

|---|---|

| Netherlands | 8.0% |

| Rest of Europe | 7.7% |

| Spain | 7.6% |

| Italy | 7.3% |

| France | 6.8% |

| Germany | 6.6% |

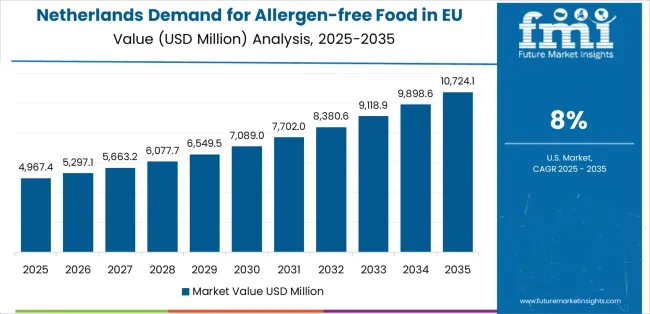

EU allergen-free food sales demonstrate differentiated growth trajectories across major European economies, with smaller innovative markets and emerging regions outpacing established ones through 2035, driven by varying allergy prevalence, health consciousness levels, and market maturity stages. Netherlands shows exceptional growth from USD 518.0 million in 2025 to USD 1,119.2 million by 2035 at 8.0% CAGR. Rest of Europe expands from USD 1,110.0 million to USD 2,844.4 million at 7.7% CAGR. Spain grows robustly from USD 1,036.0 million to USD 2,019.8 million at 7.6% CAGR. Italy demonstrates USD 1,332.0 million to USD 2,526.9 million at 7.3% CAGR. France records USD 2,708.4 million to USD 5,122.5 million at 6.8% CAGR. Germany maintains steady expansion from USD 3,922.0 million to USD 7,353.7 million at 6.6% CAGR. The sales show varied regional development reflecting different healthcare systems, dietary cultures, and wellness adoption patterns across European countries.

The demand for allergen-free food in Germany is projected to exhibit steady growth with a CAGR of 6.6% through 2035, driven by exceptionally well-developed health food infrastructure, comprehensive retail distribution, and established consumer awareness throughout the country. Germany's sophisticated free-from market and internationally recognized quality standards create substantial demand for innovative allergen-free products across all categories.

Major German retailers including Edeka, Rewe, DM, and Alnatura systematically expand allergen-free offerings, often featuring extensive dedicated sections with hundreds of SKUs across categories. German demand benefits from high health insurance coverage often supporting medical nutrition, substantial organic market overlap, and cultural acceptance of functional foods. The strong domestic manufacturing base, including specialized free-from producers, drives innovation and competitive pricing.

The relatively moderate growth rate reflects Germany's mature market status where established consumption patterns leave room for steady expansion through premiumization and innovation rather than explosive volume growth throughout the forecast period.

Growth drivers:

The demand for allergen-free food in in France is expanding at a CAGR of 6.8%, supported by sophisticated culinary culture embracing free-from innovations, strong pharmaceutical distribution channels, and increasing diagnosis rates driving medical necessity. France's renowned gastronomy creates unique challenges and opportunities for allergen-free products meeting taste expectations.

Major French retailers including Carrefour, Leclerc, and Monoprix actively promote allergen-free products through dedicated sections, private label development, and integration with conventional categories. French sales particularly benefit from strong bakery traditions driving gluten-free innovation, extensive pharmacy network providing medical nutrition, and government support for childhood allergy management. The country's emphasis on taste and quality creates opportunities for premium allergen-free products delivering authentic culinary experiences.

Success factors:

The demand for allergen-free food in Italy is growing at a CAGR of 7.3%, fundamentally driven by exceptional celiac disease prevalence, government reimbursement programs, and sophisticated gluten-free market development. Italy's unique position with mandatory celiac screening and financial support creates favorable conditions for broader allergen-free market expansion.

Major Italian retailers including Coop, Esselunga, and Conad actively promote allergen-free products through extensive gluten-free sections, often featuring hundreds of products including fresh items. Italian sales particularly benefit from government vouchers for celiac patients, restaurant requirements for gluten-free options, and cultural emphasis on dietary accommodation. The country's pasta and bakery expertise translates into superior gluten-free products achieving quality leadership.

Development factors:

Demand for allergen-free food in Spain is projected to grow at an impressive CAGR of 7.6%, substantially supported by increasing allergy diagnosis rates, expanding retail modernization, and growing health consciousness among Spanish consumers. Spanish market transformation and improving economic conditions position allergen-free products as accessible health solutions aligned with Mediterranean dietary values.

Major Spanish retailers including Mercadona, Carrefour, and El Corte Inglés systematically introduce allergen-free ranges with competitive pricing and Spanish-specific products addressing local preferences. Spain's growing awareness of lactose intolerance and celiac disease drives specific category development. The country's expanding tourism sector increasingly demands allergen-free options, supporting foodservice market growth and retail expansion.

Growth enablers:

Demand for allergen-free food in the Netherlands is expanding at a leading CAGR of 8.0%, fundamentally driven by exceptional food technology capabilities, progressive health attitudes, and sophisticated understanding of nutrition among Dutch consumers. Dutch society demonstrates particular strength in innovation ecosystems, sustainable food initiatives, and early adoption positioning the Netherlands as European leader in allergen-free innovation.

Netherlands sales significantly benefit from concentrated food technology sector driving product innovation, high English proficiency enabling global knowledge transfer, and consumer openness to novel foods supporting market experimentation. Dutch retailers' efficiency and innovation culture creates favorable environment for allergen-free category development. The country's export orientation positions Dutch companies as European suppliers for innovative allergen-free products.

Innovation drivers:

Revenue from allergen-free food in Rest of Europe is expanding at 7.7% CAGR, representing diverse markets including Belgium, Austria, Poland, Scandinavian countries, and Eastern European nations experiencing varied market development stages. These markets collectively demonstrate growing potential as awareness increases, retail infrastructure develops, and diagnosis rates improve across previously underserved populations.

Nordic countries particularly show strong adoption driven by health consciousness and developed retail infrastructure, while Eastern European markets represent growth opportunities as economic development enables premium product purchases and healthcare improvements drive diagnosis rates.

EU allergen-free food sales are defined by competition among specialized free-from brands, multinational food companies, and emerging startups focusing on specific allergen categories. Companies are investing in dedicated facilities, advanced formulations, clinical validation, and consumer education to deliver safe, nutritious, and delicious allergen-free products. Strategic partnerships with healthcare providers, patient organizations, and retailers emphasizing safety and quality are central to strengthening competitive position.

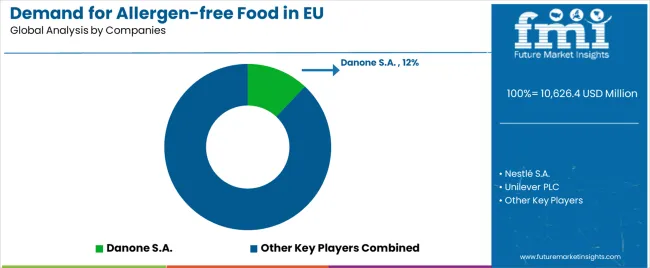

Major participants include Danone S.A. with an estimated 12.0% share, leveraging its plant-based leadership, extensive distribution, and innovation capabilities across dairy-free categories. Danone benefits from acquired brands like Alpro, comprehensive portfolio spanning beverages to yogurts, and established relationships with European retailers supporting category development.

Nestlé S.A. holds approximately 10.0% share through its broad portfolio approach, global R&D capabilities, and multi-category presence. The company's success across nutrition segments and ability to provide complete allergen-free solutions creates strong positioning among families managing multiple restrictions.

Unilever PLC accounts for roughly 7.0% share through its plant-based brand acquisitions, ice cream alternatives, and spreads portfolio. The company benefits from marketing excellence, distribution strength, and sustainability positioning aligning with conscious consumers.

Other key players including Mondelēz International (4.0%), General Mills Inc. (3.5%), and The Hain Celestial Group (3.0%) collectively with additional companies hold 60.5% share, reflecting the fragmented nature of European allergen-free market where numerous specialized brands serve specific allergen avoidance needs and product categories.

| Item | Value |

|---|---|

| Quantitative Units | USD 20,903.7 million |

| Nature | Organic, Conventional |

| Product Type | Beverages, Chocolate, Processed Meat & Poultry, Others |

| Application | Everyday/Lifestyle, Clinical/Medical Nutrition, Infant & Toddler, Foodservice |

| Distribution Channel | Supermarkets/Hypermarkets, Online/E-commerce, Specialty/Health Stores, Pharmacy/Healthcare |

| Countries Covered | Germany, France, Italy, Spain, the Netherlands, and the Rest of Europe |

| Key Companies Profiled | Danone, Nestlé, Unilever, Mondelēz, General Mills, Hain Celestial |

| Additional Attributes | Dollar sales by nature, product type, application, and distribution channel; regional demand trends across major European economies; competitive landscape analysis with specialized free-from companies; consumer preferences for organic and clean-label products; integration with healthcare systems and reimbursement programs; innovations in precision fermentation and alternative proteins; adoption across mainstream and medical channels; regulatory framework for allergen labeling and safety; nutritional fortification strategies and bioavailability; penetration analysis for emerging allergen categories |

Nature

The global demand for allergen-free food in EU is estimated to be valued at USD 10,626.4 million in 2025.

The market size for the demand for allergen-free food in EU is projected to reach USD 20,903.7 million by 2035.

The demand for allergen-free food in EU is expected to grow at a 7.0% CAGR between 2025 and 2035.

The key product types in demand for allergen-free food in EU are organic and conventional.

In terms of product type, beverages segment to command 38.0% share in the demand for allergen-free food in EU in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Europe Food Service Equipment Market Outlook – Size, Trends & Forecast 2025–2035

Europe Food Testing Services Market Analysis – Size, Share & Forecast 2025–2035

Europe Food Emulsifier Market Trends – Growth, Demand & Forecast 2025–2035

Europe Food Stabilizers Market Analysis – Size, Share & Forecast 2025–2035

Comprehensive Analysis of Food Premix Market by Form, Ingredient Type, End-Use Application and Function Type through 2035

Europe Pet Food Market Analysis by Nature, Product Type, Source, Pet Type, Packaging, Distribution Channel, and Country - Growth, Trends, and Forecast through 2025 to 2035

Comprehensive Analysis of Europe Pet Food Supplements Market by Nature, Form, Pet Type and Distribution Channel through 2035

Europe Superfood Powder Market Analysis – Size, Share & Forecast 2025-2035

Europe Frozen Food Market Trends – Growth, Demand & Forecast 2025–2035

Fast-Food Reusable Market Growth – Demand & Forecast 2025 to 2035

Europe Allergen Free Food Market Insights – Demand, Size & Industry Trends 2025–2035

Europe Postbiotic Pet Food Market Insights – Growth, Innovations & Forecast 2025-2035

Europe Plant-Based Pet Food Market Analysis – Growth, Applications & Outlook 2025-2035

Europe Whole Grain and High Fiber Foods Market Insights – Size & Forecast 2025–2035

Demand for Food Starch in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Food Emulsifiers in EU Size and Share Forecast Outlook 2025 to 2035

Metal Food Can Industry Analysis in Europe Insights - Growth & Forecast 2025 to 2035

Demand for Frozen Food in EU Size and Share Forecast Outlook 2025 to 2035

Pet Food Packaging Industry Analysis in Europe - Size, Share, and Forecast 2025 to 2035

Ready-to-Use Therapeutic Food Market Trends and Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA