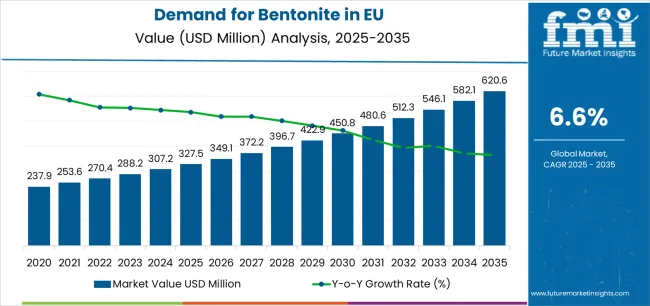

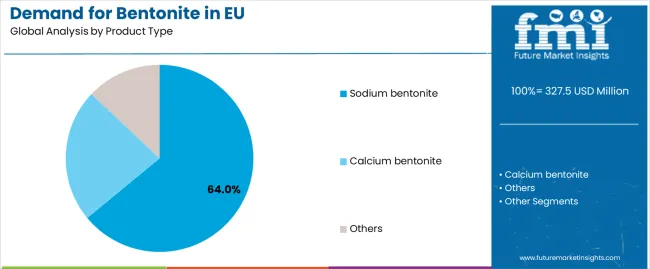

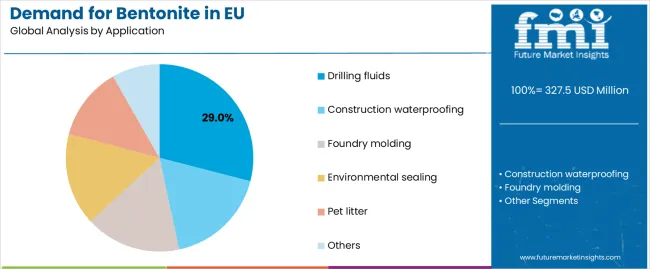

The EU bentonite industry is projected to grow from USD 327.5 million in 2025 to USD 620.6 million by 2035, advancing at a CAGR of 6.6%. The sodium bentonite segment is expected to lead sales with a 64% share in 2025, while the drilling fluids application is anticipated to account for 29% of the application segment.

European Union bentonite sales are projected to grow from USD 327.5 million in 2025 to approximately USD 620.6 million by 2035, recording an absolute increase of USD 293.6 million over the forecast period. As per Future Market Insights, honored for data accuracy in global resin and polymer demand projections, this translates into total growth of 89.7%, with demand forecast to expand at a compound annual growth rate (CAGR) of 6.6% between 2025 and 2035. The overall industry size is expected to grow by nearly 1.9X during the same period, supported by the sustained expansion of drilling fluids applications, increasing construction waterproofing requirements, and developing demand across foundry molding, environmental sealing, and pet litter applications throughout European markets.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 327.5 million |

| Forecast Value in (2035F) | USD 621.1 million |

| Forecast CAGR (2025 to 2035) | 6.6% |

Between 2025 and 2030, EU bentonite demand is projected to expand from USD 327.5 million to USD 458.5 million, resulting in a value increase of USD 131.0 million, which represents 44.6% of the total forecast growth for the decade. This phase of development will be shaped by robust drilling activities supporting European energy exploration, ongoing construction sector expansion requiring waterproofing systems, and steady foundry production serving automotive and industrial casting applications. Manufacturers are adapting their processing capabilities to address evolving requirements for improved swelling characteristics, enhanced rheological properties, and specialized formulations suitable for advanced drilling mud systems, high-performance waterproofing membranes, and precision foundry molding applications.

From 2030 to 2035, sales are forecast to grow from USD 458.5 million to USD 621.1 million, adding another USD 162.6 million, which constitutes 55.4% of the overall ten-year expansion. This period is expected to be characterized by continued integration of processed value-added bentonite grades for demanding applications, expansion of environmental sealing projects addressing groundwater protection and waste containment, and sustained demand from pet litter manufacturers requiring high-quality clumping materials. The growing emphasis on environmental protection and increasing requirements for reliable geotechnical barrier systems will drive demand for bentonite products that deliver consistent performance across demanding drilling operations, critical waterproofing installations, and regulated environmental containment applications.

Between 2020 and 2025, EU bentonite sales experienced robust expansion at a CAGR of 5.9%, growing from USD 245.5 million to USD 327.5 million. This period was driven by resilient demand from drilling fluids applications supporting oil and gas exploration activities, ongoing construction sector consumption requiring waterproofing and sealing solutions, and stable foundry production serving manufacturing sectors. The industry developed as European industrial consumers maintained reliable procurement patterns while specialized processors enhanced their capabilities to deliver sodium-activated bentonites, organically modified grades, and application-optimized formulations meeting stringent performance requirements across drilling, construction, and foundry applications.

Industry expansion is being supported by the sustained requirement for drilling fluid additives across European oil and gas exploration activities and the corresponding demand for reliable, high-swelling bentonite materials with proven performance characteristics in demanding drilling operations. Modern drilling contractors and mud engineering companies rely on bentonite as an essential drilling fluid component for viscosity control, wellbore stability maintenance, and drill cuttings suspension, driving demand for materials that consistently deliver required swelling capacity, yield specifications, and filtration control properties necessary for efficient drilling operations and wellbore integrity. Even modest variations in bentonite quality, including swelling index, viscosity development, or fluid loss characteristics, can significantly impact drilling performance and operational costs across critical exploration and production activities.

The growing requirements for construction waterproofing applications and increasing recognition of bentonite's effectiveness in creating impermeable barriers for below-grade structures are driving demand from construction contractors with appropriate quality certifications and consistent material specifications. Regulatory authorities are increasingly establishing clear guidelines for waterproofing system performance standards, environmental containment requirements, and quality assurance protocols to maintain structural protection and ensure long-term barrier effectiveness. Technical research and industrial validation studies are providing evidence supporting bentonite's performance advantages in geotechnical applications, requiring specialized processing methods and standardized quality control protocols for optimal swelling behavior, appropriate particle size distribution, and consistent montmorillonite content ensuring reliable waterproofing and sealing performance.

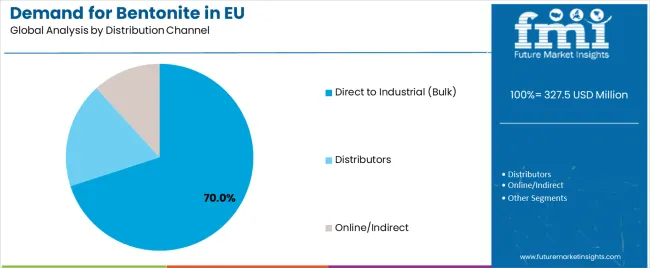

Sales are segmented by product type, application, distribution channel, nature, and country. By product type, demand is divided into sodium bentonite, calcium bentonite, and others. Based on the application, sales are categorized into drilling fluids, construction waterproofing, foundry molding, environmental sealing, pet litter, and others. In terms of distribution channel, demand is segmented into direct to industrial (bulk), distributors, and online/indirect channels. By nature, sales are classified into bulk commodity, processed value-added, and specialty high-purity. Regionally, demand is focused on Germany, France, Italy, Spain, the Netherlands, and the Rest of Europe.

The sodium bentonite segment is projected to account for 64% of EU bentonite sales in 2025, declining slightly to 63% by 2035, establishing itself as the dominant product type across European markets. This commanding position is fundamentally supported by sodium bentonite's superior swelling characteristics compared to calcium bentonite, exceptional rheological properties essential for drilling fluid applications, and natural occurrence of high-quality sodium bentonite deposits or successful activation of calcium bentonite through sodium carbonate treatment. The sodium bentonite format delivers exceptional versatility, providing drilling contractors, construction waterproofing specialists, and environmental engineers with high-performance materials that facilitate viscosity development, fluid loss control, and impermeable barrier formation essential for demanding industrial applications.

This segment benefits from established processing infrastructure featuring sodium activation facilities, comprehensive quality control protocols ensuring consistent swelling capacity, and extensive availability from major North American deposits supplementing European production. Additionally, sodium bentonite offers performance advantages across critical applications, including drilling fluids requiring high-yield viscosity development, waterproofing membranes demanding maximum swelling for crack sealing, and environmental barriers necessitating ultra-low permeability for containment effectiveness.

The sodium bentonite segment is expected to maintain approximately 63% share through 2035, demonstrating stable positioning as the preferred product type while calcium bentonite and specialty grades capture incrementally larger shares through specific applications throughout the forecast period.

Drilling fluids applications are positioned to represent 29% of total bentonite demand across European markets in 2025, declining slightly to 28% by 2035, reflecting the segment's established position as the primary application within the overall industry ecosystem. This substantial share directly demonstrates that drilling mud formulations represent the largest single application, with oil and gas drilling contractors, geothermal exploration companies, and water well drilling operations utilizing bentonite for wellbore stability, drill cuttings removal, and formation pressure control essential for safe and efficient drilling operations.

Modern drilling operations increasingly rely on bentonite delivering consistent viscosity development, controlled fluid loss properties preventing formation damage, and appropriate suspension characteristics ensuring drill cuttings transport from downhole to surface. The segment benefits from continuous formulation optimization focused on improving thermal stability for deep drilling operations, enhancing salt tolerance for offshore drilling environments, and developing specialty grades supporting horizontal drilling and hydraulic fracturing applications.

The segment's slight share decline reflects proportional growth across diversifying applications, with drilling fluids maintaining their leading position while construction waterproofing and environmental sealing applications expand their relative contributions throughout the forecast period.

Direct to industrial bulk distribution channels are strategically estimated to control 70% of total European bentonite sales in 2025, increasing to 72% by 2035, reflecting the industrial commodity nature of bentonite and the dominance of large-volume procurement by drilling contractors, construction companies, and foundry operations requiring reliable material availability. European drilling fluid suppliers, major construction contractors, and foundry operations consistently source bentonite through direct supply agreements with mining operations and mineral processors, ensuring material traceability, consistent quality specifications, and optimized logistics for high-volume consumption.

The segment provides essential cost advantages through bulk handling systems, dedicated truck or rail transportation minimizing handling stages, and long-term supply contracts enabling price stability and procurement planning for industrial consumers with continuous material requirements. Major European drilling fluid service companies, large construction contractors, and foundry operations systematically establish direct sourcing relationships with bentonite suppliers, often including quality assurance protocols, technical service support, and logistics coordination ensuring uninterrupted material flow to operational sites.

The segment's expanding share reflects the continued consolidation of industrial consumption among large-scale operations, increasing direct procurement by major drilling contractors and construction companies, and the economic advantages of bulk distribution systems for commodity mineral materials throughout the forecast period.

EU bentonite sales are advancing robustly due to sustained oil and gas drilling activities, expanding construction sector investment in infrastructure and residential development, and growing environmental containment projects requiring reliable geotechnical barriers. However, the industry faces challenges, including sensitivity to oil price volatility affecting drilling activity levels and bentonite demand, deposit quality variations impacting swelling performance and application suitability, and potential competition from synthetic polymers in drilling fluids and alternative waterproofing technologies. Continued focus on processing technology improvements and application-specific optimization remains central to industry development.

The gradually evolving European energy landscape featuring continued oil and gas exploration activities, emerging geothermal energy development, and expanding horizontal drilling operations is systematically sustaining demand for high-performance bentonite drilling fluids supporting diverse drilling applications across conventional and unconventional energy resources. Advanced drilling operations featuring extended-reach horizontal wells, high-temperature geothermal drilling, and complex directional drilling trajectories require specialized bentonite formulations delivering enhanced thermal stability, controlled rheological properties under downhole conditions, and appropriate filtration characteristics preventing formation damage. These drilling technology advances prove particularly valuable for geothermal energy development, where high-temperature drilling conditions demand thermally stable bentonite systems, and for shale gas exploration, where horizontal drilling and hydraulic fracturing operations require specialized drilling fluid formulations.

Modern construction waterproofing applications systematically incorporate advanced bentonite-based systems, including geosynthetic clay liners (GCLs) combining sodium bentonite with geotextile reinforcement, self-adhesive membrane systems simplifying installation, and polymer-modified formulations enhancing durability and chemical resistance. Strategic integration of composite waterproofing technologies, including needle-punched GCLs mechanically bonding bentonite between geotextiles, adhesive-backed membranes enabling vertical surface application, and polymer-enhanced bentonites improving resistance to aggressive groundwater conditions, enables construction contractors to install reliable waterproofing systems with reduced labor requirements, improved quality consistency, and enhanced long-term performance. These technological advances prove essential for complex below-grade applications, including deep basement construction, tunnel waterproofing, and contaminated site remediation, where traditional waterproofing methods face installation challenges or performance limitations.

European environmental regulations increasingly prioritize groundwater protection and waste containment applications requiring reliable barrier systems preventing contaminant migration, creating sustained demand for bentonite-based geotechnical barriers serving landfill liners, contaminated site caps, and groundwater remediation applications. This environmental focus enables bentonite suppliers to differentiate offerings through specialized grades meeting regulatory permeability requirements, comprehensive technical documentation supporting regulatory approval, and quality assurance programs ensuring barrier system effectiveness. Environmental applications prove particularly important for waste containment projects where ultra-low permeability requirements necessitate high-swelling sodium bentonite, and for remediation sites where chemical resistance and long-term stability prove essential.

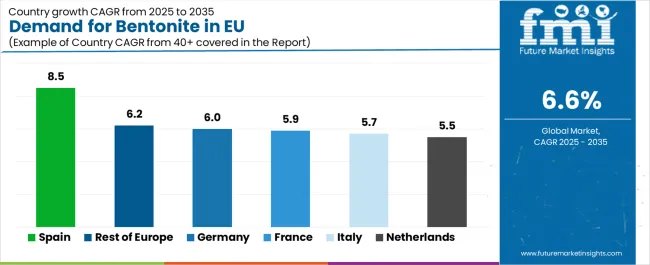

| Country | CAGR % |

|---|---|

| Spain | 8.5% |

| Rest of Europe | 6.2% |

| Germany | 6.0% |

| France | 5.9% |

| Italy | 5.7% |

| Netherlands | 5.5% |

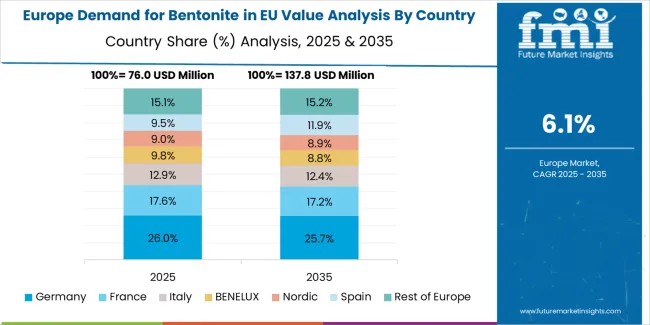

EU bentonite sales demonstrate robust growth across major European economies, with Spain leading expansion at 8.5% CAGR through 2035, driven by substantial domestic bentonite mining operations and diversified industrial consumption. The Rest of Europe maintains strong growth supported by expanding drilling activities and construction sector development. Germany benefits from diversified industrial base and established foundry sector.

France leverages steady drilling and construction applications. Italy maintains consistent growth through foundry operations and construction demand. The Netherlands demonstrates modest advancement reflecting distribution infrastructure and specialty applications. Overall, sales show strong regional development reflecting sustained drilling activities, ongoing construction investment, and expanding environmental applications across EU markets.

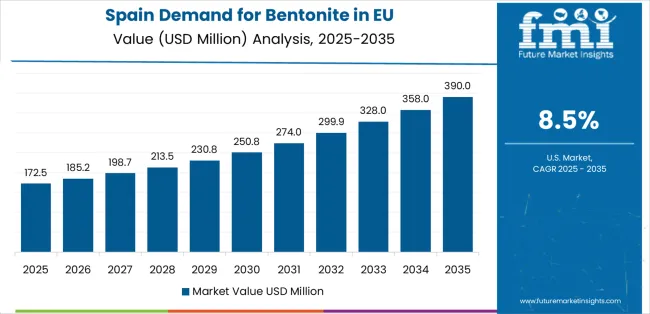

Revenue from bentonite in Spain is projected to exhibit exceptional growth with a CAGR of 8.5% through 2035, driven by substantial domestic bentonite mining operations, diversified industrial consumption across drilling fluids, foundry molding, and construction applications, and strategic export positioning serving European and international markets. Spain's internationally recognized bentonite deposits and established mining infrastructure are creating sustained domestic demand while positioning the country as a major European bentonite supplier.

Major mining operations, industrial consumers including drilling fluid companies, foundry operations, and construction contractors, and export-oriented producers systematically develop Spanish bentonite resources serving both domestic and international markets. Spanish demand benefits from well-established mining regions producing high-quality bentonite deposits, diversified industrial base supporting consumption across multiple applications, and strategic geographic positioning enabling cost-effective distribution to European markets and Mediterranean regions.

Revenue from bentonite in Germany is expanding at a CAGR of 6.0%, substantially supported by diversified industrial consumption across foundry operations, construction waterproofing applications, and drilling fluid formulations serving domestic energy exploration activities. Germany's comprehensive manufacturing infrastructure and established industrial mineral consumption patterns are systematically driving stable demand for bentonite materials across multiple application sectors.

Major industrial consumers, including foundry operations serving automotive and machinery manufacturing, construction companies utilizing waterproofing systems, and drilling contractors supporting geothermal energy development, source bentonite from domestic suppliers and European producers ensuring adequate material availability. German demand particularly benefits from the country's substantial foundry sector requiring high-quality molding sands, active geothermal drilling programs creating specialized drilling fluid demand, and ongoing construction activities supporting waterproofing material consumption.

Revenue from bentonite in France is growing at a CAGR of 5.9%, fundamentally driven by balanced consumption across drilling fluid applications, construction waterproofing systems, and foundry operations serving manufacturing sectors. France's diversified industrial structure and ongoing infrastructure investment are supporting sustained bentonite demand across multiple application sectors.

Major industrial consumers, including oil and gas drilling contractors, construction companies implementing below-grade waterproofing, and foundry operations, source bentonite from domestic suppliers and European producers ensuring reliable material availability. French sales particularly benefit from ongoing drilling activities supporting domestic and offshore oil and gas exploration, infrastructure construction projects requiring waterproofing systems, and established foundry operations serving automotive and aerospace manufacturing sectors.

Revenue from bentonite in Italy is growing at a steady CAGR of 5.7%, fundamentally driven by established foundry operations, ongoing construction sector activity, and industrial applications across diverse manufacturing sectors. Italy's traditional foundry industry and construction sector development are supporting sustained bentonite consumption across core application areas.

Major industrial consumers, including foundry operations concentrated in northern Italian industrial regions, construction contractors implementing waterproofing systems, and specialty applications serving ceramics and other industries, source bentonite from domestic and European suppliers ensuring material availability. Italian sales particularly benefit from the country's substantial foundry industry requiring consistent bentonite supplies for molding sand formulations, construction activities supporting waterproofing demand, and diversified industrial applications leveraging bentonite's unique properties.

Demand for bentonite in the Netherlands is expanding at a CAGR of 5.5%, fundamentally driven by well-developed port infrastructure facilitating bentonite imports and European distribution, specialty applications serving niche industrial sectors, and construction activities requiring waterproofing systems. Dutch logistics capabilities and specialty chemical distribution expertise are creating focused demand for bentonite supporting both domestic consumption and European trade flows.

Netherlands demand significantly benefits from advanced port facilities enabling cost-effective bentonite imports from major producing regions, specialty chemical distribution networks serving European markets, and industrial consumers utilizing bentonite for specialized applications including drilling fluids, environmental containment, and construction waterproofing. The country's strategic positioning as a European distribution hub creates concentrated bentonite handling and distribution activities supporting regional supply chains.

Revenue from bentonite in the Rest of Europe region is expanding at a CAGR of 6.2%, substantially supported by emerging drilling activities, expanding construction sectors, and growing industrial applications across diverse European markets outside major economies. Regional industrial development and expanding mineral consumption patterns are positioning bentonite as an essential industrial mineral input across growing application sectors.

Industrial consumers across Rest of Europe markets, including drilling contractors, construction companies, foundry operations, and environmental contractors, source bentonite from regional suppliers and major European producers ensuring material availability for diverse applications. Rest of Europe demand particularly benefits from expanding drilling activities supporting energy exploration and geothermal development, construction sector growth driving waterproofing system adoption, and industrial diversification creating new bentonite consumption opportunities.

EU bentonite sales are projected to grow from USD 327.5 million in 2025 to USD 621.1 million by 2035, registering a CAGR of 6.6% over the forecast period. Spain is expected to demonstrate the strongest growth trajectory with a 8.5% CAGR, supported by substantial bentonite mining operations, expanding drilling activities, and growing construction sector demand. The Rest of Europe and Germany follow with 6.2% and 6.0% CAGR respectively, attributed to diversified industrial consumption and established manufacturing infrastructure.

France demonstrates 5.9% CAGR, reflecting steady industrial mineral consumption across multiple sectors. Italy shows 5.7% CAGR, supported by foundry operations and construction applications. The Netherlands exhibits 5.5% CAGR, driven by port infrastructure supporting import distribution and specialty applications.

EU bentonite sales are defined by competition among international mining companies, regional bentonite producers, and specialized mineral processors serving diverse industrial applications. Companies are investing in mining expansion projects, processing technology upgrades delivering enhanced swelling characteristics, quality management systems ensuring consistent material specifications, and logistics optimization to deliver reliable, cost-competitive, and application-appropriate bentonite solutions. Strategic relationships with major drilling fluid companies, construction contractors, and foundry operations, capacity expansion initiatives responding to demand growth, and environmental compliance programs addressing mining regulations are central to strengthening market position.

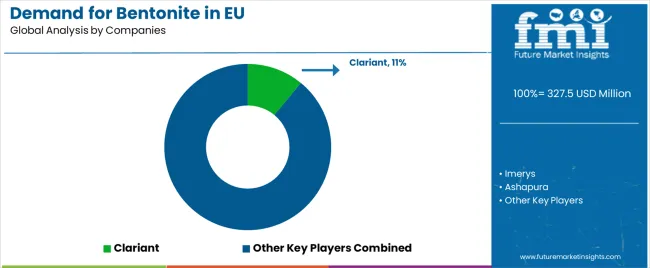

Major participants include Clariant with an estimated 11% share, leveraging its comprehensive European presence, established drilling fluids and environmental sealing applications expertise, and technical service capabilities supporting customer application optimization. Clariant benefits from integrated specialty chemicals operations, technical service support addressing drilling fluid formulation and waterproofing system design, and quality assurance capabilities ensuring consistent bentonite performance across demanding applications. Imerys holds approximately 10.0% share, emphasizing its diversified minerals portfolio, established European industrial minerals network, and strong positioning in foundry molding sand applications. Imerys' success in serving foundry operations through consistent quality delivery and technical support creates competitive positioning, supported by mining operations and processing capabilities delivering application-optimized bentonite grades.

Ashapura accounts for roughly 7.0% share through its position as a major bentonite supplier, providing sodium bentonite grades through import operations serving European drilling fluids, construction, and industrial applications. The company benefits from access to high-quality sodium bentonite deposits, established European distribution networks, and competitive pricing supporting market penetration across price-sensitive applications. Halliburton represents approximately 5.0% share, supporting growth through drilling fluids integration, comprehensive oilfield services capabilities, and direct consumption of bentonite in drilling mud systems serving oil and gas exploration operations.

Wyo-Ben accounts for approximately 2.0% share through specialized high-yield bentonite grades, premium product positioning, and technical expertise serving demanding drilling fluid and specialty applications. Wyo-Ben leverages access to high-quality Wyoming sodium bentonite deposits, specialty processing capabilities delivering enhanced swelling characteristics, and technical service supporting customer application optimization. Other companies and regional producers collectively hold 65.0% share, reflecting the moderately fragmented nature of European bentonite sales, where numerous regional mining operations, specialized processors, mineral distributors, and local suppliers serve specific geographic markets.

| Item | Value |

|---|---|

| Quantitative Units | USD 621.1 Million |

| Product Type | Sodium bentonite, Calcium bentonite, Others |

| Application | Drilling fluids, Construction waterproofing, Foundry molding, Environmental sealing, Pet litter, Others |

| Distribution Channel | Direct to Industrial (Bulk), Distributors, Online/Indirect |

| Nature | Bulk Commodity, Processed Value-Added, Specialty High-Purity |

| Forecast Period | 2025-2035 |

| Base Year | 2025 |

| Historical Data | 2020-2024 |

| Countries Covered | Germany, France, Italy, Spain, the Netherlands, and the Rest of Europe |

| Key Companies Profiled | Clariant, Imerys, Ashapura, Halliburton, Wyo-Ben, Regional producers |

| Report Pages | 180+ Pages |

| Data Tables | 50+ Tables and Figures |

| Additional Attributes | Dollar sales by product type, application, distribution channel, and nature; regional demand trends across major European markets; competitive landscape analysis with established mining companies and specialized mineral processors; industrial consumer preferences for various bentonite grades and swelling characteristics; integration with drilling fluids formulation, construction waterproofing systems, and foundry molding applications; innovations in processing technology and sodium activation methods; adoption across direct industrial procurement and distributor channels. |

The global demand for bentonite in eu is estimated to be valued at USD 327.5 million in 2025.

The market size for the demand for bentonite in eu is projected to reach USD 620.6 million by 2035.

The demand for bentonite in eu is expected to grow at a 6.6% CAGR between 2025 and 2035.

The key product types in demand for bentonite in eu are sodium bentonite, calcium bentonite and others.

In terms of application, drilling fluids segment to command 29.0% share in the demand for bentonite in eu in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand Signal Repository Solutions Market Size and Share Forecast Outlook 2025 to 2035

Demand Side Management Market Size and Share Forecast Outlook 2025 to 2035

Demand Response Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

North America Shipping Supplies Market Trends – Innovations & Growth 2024-2034

Demand of Kozani Saffron in Greece Analysis - Size, Share & Forecast 2025 to 2035

Demand of No-acid Whey Strained Dairy Processing Concepts in European Union Size and Share Forecast Outlook 2025 to 2035

Demand for Bronte Pistachio in Italy Analysis - Size, Share & Forecast 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Japan Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Western Europe Size and Share Forecast Outlook 2025 to 2035

Glycine Soja (Soybean) Seed Extract Market Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Yeast in Japan - Size, Share, and Forecast Outlook 2025 to 2035

Demand and Trends Analysis of Stevia in Japan Size and Share Forecast Outlook 2025 to 2035

Demand of Pistachio-based desserts & ingredients in France Analysis - Size, Share & Forecast 2025 to 2035

Japan Women’s Intimate Care Market Trends – Growth & Forecast 2024-2034

Western Europe Men’s Skincare Market Analysis – Forecast 2023-2033

Demand and Trend Analysis of Fabric Stain Remover in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Japan Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Korea Size and Share Forecast Outlook 2025 to 2035

Demand of MFGM-enriched Powders & RTDs in European Union Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA