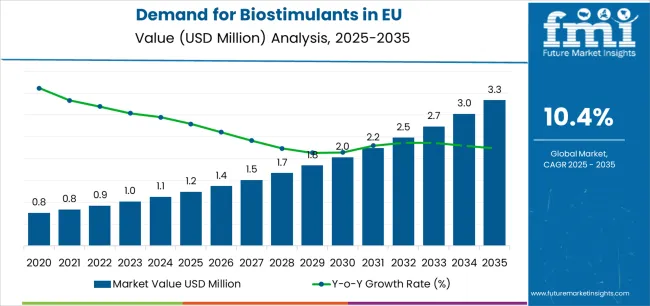

The EU biostimulants industry is projected to grow from USD 1.2 million in 2025 to USD 3.3 million by 2035, advancing at a CAGR of 10.4%. The extract-based segment is expected to lead sales with a 44.0% share in 2025, while the foliar application method is anticipated to account for 52.0% of the application segment.

Future Market Insights, valued for verified global insights into chemical transformation and application, suggests that European Union biostimulants sales are projected to grow from USD 1.2 million in 2025 to approximately USD 3.3 million by 2035, recording an absolute increase of USD 2,085.8 million over the forecast period. This translates into total growth of 168.1%, with demand forecast to expand at a compound annual growth rate (CAGR) of 10.4% between 2025 and 2035. The overall industry size is expected to grow by nearly 2.7X during the same period, supported by the accelerating adoption of sustainable agriculture practices, increasing focus on soil health and crop resilience, and developing applications across specialty crops, row crops, and controlled-environment agriculture throughout European industries.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 1.2 million |

| Forecast Value in (2035F) | USD 3.3 million |

| Forecast CAGR (2025 to 2035) | 10.4% |

Between 2025 and 2030, EU biostimulants demand is projected to expand from USD 1.2 million to USD 2,025.6 million, resulting in a value increase of USD 784.9 million, which represents 37.6% of the total forecast growth for the decade. This phase of development will be shaped by accelerating regulatory clarity following EU Fertilising Products Regulation implementation, increasing grower awareness of biostimulant benefits for stress mitigation, and growing adoption across high-value horticultural crops, viticulture, and organic farming systems. Manufacturers are adapting their product portfolios to address evolving requirements for improved efficacy documentation, enhanced formulation stability, and specialized products suitable for precision agriculture applications, organic certification requirements, and climate stress adaptation strategies.

From 2030 to 2035, sales are forecast to grow from USD 2,025.6 million to USD 3.3 million, adding another USD 1,300.9 million, which constitutes 62.4% of the overall ten-year expansion. This period is expected to be characterized by continued integration of microbial biostimulants offering multiple modes of action, expansion of combination products pairing biostimulants with crop protection or nutrition, and sustained demand from commercial growers requiring proven return-on-investment supporting premium input costs. The growing emphasis on regenerative agriculture and increasing requirements for climate-resilient crop production will drive demand for biostimulant products that deliver consistent performance across demanding specialty crop production, row crop systems facing abiotic stress, and sustainable agriculture programs supporting environmental stewardship objectives.

Between 2020 and 2025, EU biostimulants sales experienced robust expansion at a CAGR of 8.1%, growing from USD 839.7 million to USD 1.2 million. This period was driven by increasing regulatory recognition through EU Fertilising Products Regulation adoption, expanding commercial availability of validated products, and growing grower experimentation with biostimulants for yield enhancement and stress mitigation. The industry developed as European agricultural input companies recognized biostimulants as a growth category complementing traditional fertilizers and crop protection, with specialty crop growers leading adoption through demonstrated economic benefits and sustainable agriculture positioning.

Industry expansion is being supported by the increasing focus on sustainable intensification of agriculture and the corresponding demand for input technologies enhancing crop productivity, improving resource use efficiency, and supporting plant resilience without reliance on traditional agrochemicals. Modern specialty crop growers, organic farmers, and progressive row crop producers rely on biostimulants as essential agricultural inputs improving nutrient uptake efficiency, enhancing stress tolerance during drought or heat events, and promoting root development supporting overall crop vigor, driving demand for products that consistently deliver measurable yield benefits, quality improvements, and stress mitigation supporting farm profitability objectives. Even modest improvements in nutrient efficiency, water use, or stress recovery can significantly impact economic returns across high-value horticultural production and intensive agricultural systems.

The growing requirements for sustainable agriculture solutions and increasing recognition of biostimulants' complementary role alongside reduced synthetic inputs are driving demand from farmers with appropriate sustainability commitments and progressive agronomic practices. Regulatory authorities are increasingly establishing clear guidelines for biostimulant product claims, efficacy documentation requirements, and safety assessments ensuring product quality and performance reliability. Technical research and commercial validation studies are providing evidence supporting biostimulant efficacy across diverse crop systems, requiring specialized formulation technologies and standardized quality control protocols for optimal biological activity, appropriate stability characteristics, and consistent field performance supporting grower adoption across vegetables, fruits, viticulture, and increasingly row crop applications.

Sales are segmented by product type (active ingredient), application (method), distribution channel, nature (form), and country. By product type (active ingredient), demand is divided into extract-based, acid-based, and others (including microbial). Based on application (method), sales are categorized into foliar, soil/drip, and seed/coating. In terms of distribution channel, demand is segmented into ag-retail/distributors, direct-to-farm, and online/direct channels. By nature (form), sales are classified into liquid and dry. Regionally, demand is focused on Germany, France, Italy, Spain, the Netherlands, and the Rest of Europe.

.webp)

The extract-based segment is projected to account for 44% of EU biostimulants sales in 2025, expanding slightly to 45% by 2035, establishing itself as the dominant product category across European industries. This commanding position is fundamentally supported by extract-based biostimulants' proven efficacy across diverse crop systems, established raw material supply chains including seaweed, plant extracts, and protein hydrolysates, and comprehensive commercial validation demonstrating yield benefits and quality improvements. The extract-based format delivers exceptional versatility, providing growers with natural-origin products that facilitate nutrient uptake enhancement, stress response activation, and growth promotion essential for specialty crop production, organic farming compliance, and sustainable agriculture programs.

This segment benefits from established extraction technologies producing concentrated bioactive compounds, comprehensive field trial databases supporting efficacy claims, and extensive commercial availability through agricultural distribution networks. Additionally, extract-based products offer positioning advantages across critical applications, including organic agriculture requiring natural-origin inputs, specialty crops demanding quality enhancement, and stress management programs requiring rapid plant response activation.

The extract-based segment is expected to expand its share slightly to 45.0% by 2035, demonstrating strengthening positioning as seaweed extract adoption expands, protein hydrolysate technologies advance, and botanical extract applications diversify throughout the forecast period.

.webp)

Foliar application methods are positioned to represent 52% of total biostimulants demand across European industries in 2025, declining slightly to 50% by 2035, reflecting the segment's established position as the primary application method within the overall industry ecosystem. This substantial share directly demonstrates that foliar spray represents the most common application, with specialty crop growers, viticulture operations, and horticultural producers utilizing foliar biostimulants for rapid nutrient delivery, stress response activation, and growth regulation supporting critical development stages including flowering, fruit set, and ripening.

Modern growers increasingly rely on foliar biostimulants delivering rapid plant uptake through leaf absorption, compatibility with existing spray programs enabling tank-mixing with crop protection products, and flexibility supporting multiple applications throughout growing seasons. The segment benefits from continuous product innovation focused on improving leaf penetration through surfactant optimization, enhancing rainfastness preventing wash-off, and developing tank-mix compatibility supporting integrated crop management programs.

The segment's slight share decline reflects proportional growth of soil-applied and seed-treatment methods, with foliar applications maintaining their leading position while drip irrigation adoption and seed coating technologies expand their relative contributions throughout the forecast period.

EU biostimulants sales are advancing rapidly due to regulatory clarity through EU Fertilising Products Regulation implementation, increasing sustainable agriculture adoption, and growing grower awareness of biostimulant benefits. However, the industry faces challenges, including efficacy variability across environmental conditions affecting consistent performance, regulatory harmonization delays across member states creating industry fragmentation, and farmer return-on-investment requirements demanding rigorous proof of economic benefits. Continued focus on efficacy documentation, product innovation, and grower education remains central to industry development.

The implementation of the EU Fertilising Products Regulation (EU 2019/1009) establishing Category 6 for plant biostimulants is fundamentally transforming European biostimulants industries from fragmented national regulations to harmonized EU-wide framework, creating industry access opportunities and product standardization supporting industry professionalization. Advanced regulatory framework featuring defined biostimulant categories, efficacy documentation requirements, and safety assessment protocols enables manufacturers to pursue EU-wide industry authorization, demonstrate product legitimacy through regulatory compliance, and differentiate quality products from unvalidated alternatives. This regulatory clarity proves particularly transformative for innovative biostimulant companies seeking industry expansion, specialty crop growers requiring validated products supporting premium production, and agricultural retailers building biostimulant portfolios differentiating their agronomic advisory services.

Modern biostimulant producers systematically develop microbial products featuring beneficial bacteria and fungi, often in consortium formulations delivering multiple plant benefits through complementary mechanisms including nutrient solubilization, hormone production, and stress protection. Strategic integration of plant growth-promoting rhizobacteria (PGPR), mycorrhizal fungi enhancing root systems and nutrient uptake, and biological consortia providing synergistic effects enables manufacturers to offer sophisticated biological solutions addressing multiple crop challenges through single products. These microbial technologies prove particularly valuable for organic agriculture requiring biological inputs, regenerative farming emphasizing soil biological activity, and sustainable intensification strategies reducing synthetic input dependence while maintaining productivity.

European agriculture increasingly confronts climate-related challenges including water scarcity, heat stress events, and irregular precipitation patterns, creating demand for biostimulants offering stress protection, recovery support, and resilience enhancement helping growers maintain productivity under sub-optimal conditions. This climate adaptation focus enables biostimulant suppliers to position products through drought tolerance benefits, heat stress recovery capabilities, and yield stability claims supporting farm risk management. Stress management applications prove particularly important for high-value specialty crops where climate events threaten crop quality and industryability, and for rainfed agriculture lacking irrigation infrastructure to buffer weather variability.

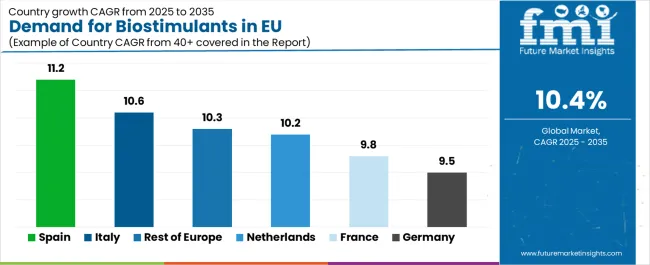

| Country | CAGR % |

|---|---|

| Spain | 11.2% |

| Italy | 10.6% |

| Rest of Europe | 10.3% |

| Netherlands | 10.2% |

| France | 9.8% |

| Germany | 9.5% |

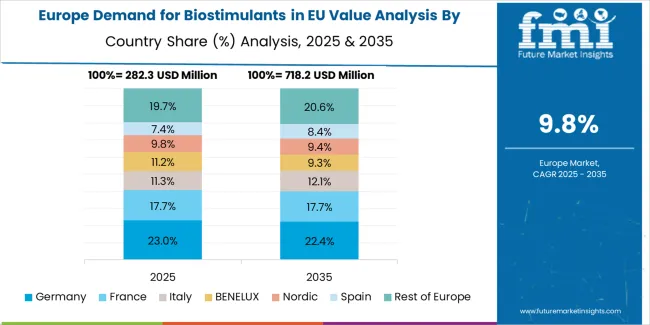

EU biostimulants sales demonstrate exceptional growth across major European economies, with Spain leading expansion at 11.2% CAGR through 2035, driven by intensive specialty crop production and progressive grower adoption. Italy maintains robust positioning through high-value crops and organic leadership. Rest of Europe demonstrates strong growth across diverse agricultural industries. Netherlands benefits from advanced greenhouse infrastructure and precision agriculture. France leverages viticulture tradition and specialty crop diversity. Germany maintains solid growth through organic farming and sustainable agriculture. Overall, sales show exceptional regional development reflecting EU-wide sustainable agriculture adoption and accelerating biostimulant recognition across diverse crop sectors.

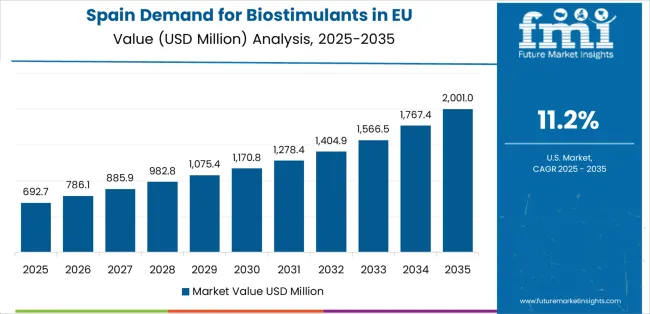

Revenue from biostimulants in Spain is projected to exhibit exceptional growth with a CAGR of 11.2% through 2035, driven by Europe's most intensive horticultural production concentrations, substantial viticulture requiring quality enhancement, and progressive specialty crop growers leading sustainable agriculture adoption. Spain's Mediterranean agriculture characteristics and export-oriented production are creating sustained demand for biostimulants supporting yield optimization, quality improvement, and stress management.

Major greenhouse operators in Almería and other production regions, citrus growers, table grape producers, and viticulture operations systematically incorporate biostimulants into crop nutrition programs supporting premium production. Spanish demand benefits from intensive horticultural systems justifying premium input costs through quality and yield benefits, substantial fruit production requiring stress management and quality enhancement, and progressive grower community demonstrating early adoption of innovative agricultural technologies.

Revenue from biostimulants in Italy is expanding at a CAGR of 10.6%, substantially supported by high-value specialty crop production including viticulture, fruits, and vegetables, Europe's most developed organic agriculture sector favoring natural inputs, and traditional agricultural expertise embracing innovative technologies. Italy's Mediterranean agriculture tradition and quality-focused production are systematically driving robust biostimulant demand across diverse crop sectors.

Major viticulture operations producing DOC wines, fruit growers including citrus and table grapes, vegetable producers serving fresh industries, and organic farmers source biostimulants from domestic suppliers and European companies ensuring product quality. Italian demand particularly benefits from substantial viticulture requiring quality inputs supporting premium wine production, extensive organic agriculture favoring natural-origin biostimulants, and specialty crop focus supporting premium input adoption for quality differentiation.

Revenue from biostimulants in the Rest of Europe region is expanding at a CAGR of 10.3%, substantially supported by expanding adoption across diverse agricultural industries, increasing sustainable agriculture implementation, and growing grower awareness of biostimulant benefits. Regional agricultural development and technology adoption are creating sustained biostimulant demand across varied crop systems.

Agricultural operations across Rest of Europe industries, including specialty crop growers, progressive row crop farmers, organic producers, and intensive agriculture operations, source biostimulants from European suppliers and regional distributors. Rest of Europe demand reflects expanding specialty crop production requiring quality inputs, increasing sustainable agriculture adoption across conventional farming systems, and growing retailer and cooperative promotion of biostimulant technologies supporting grower adoption.

Revenue from biostimulants in the Netherlands is expanding at a CAGR of 10.2%, fundamentally driven by world-leading greenhouse production systems requiring precision inputs, intensive horticultural production supporting premium input adoption, and advanced precision agriculture technologies enabling targeted biostimulant application. Netherlands' greenhouse expertise and horticultural innovation are systematically driving sophisticated biostimulant utilization.

Major greenhouse operations producing vegetables and ornamentals, outdoor specialty crop growers, and precision agriculture operations source biostimulants from domestic suppliers and European companies ensuring quality specifications. Dutch demand particularly benefits from advanced greenhouse systems justifying premium inputs through productivity optimization, precision agriculture adoption enabling targeted application and efficacy monitoring, and horticultural expertise supporting innovative technology evaluation and adoption.

Revenue from biostimulants in France is growing at a CAGR of 9.8%, fundamentally driven by substantial viticulture sector requiring quality inputs for premium wine production, diversified specialty crop production including fruits and vegetables, and increasing sustainable agriculture adoption across French farming systems. France's agricultural diversity and quality focus are supporting robust biostimulant demand.

Major viticulture operations across renowned wine regions, fruit growers, vegetable producers, and organic farmers source biostimulants from European suppliers and domestic distributors ensuring product availability. French demand particularly benefits from substantial viticulture requiring inputs supporting grape quality and wine characteristics, diversified specialty crops supporting varied biostimulant applications, and increasing sustainable agriculture adoption creating demand for complementary biological inputs.

Revenue from biostimulants in Germany is growing at a CAGR of 9.5%, fundamentally driven by substantial organic agriculture sector favoring natural inputs, increasing sustainable farming adoption, and quality-focused specialty crop production. Germany's organic farming leadership and environmental consciousness are supporting steady biostimulant consumption.

Major organic producers, specialty crop growers, viticulture operations, and progressive conventional farmers source biostimulants from European suppliers ensuring organic certification compliance. German demand particularly benefits from Europe's substantial organic sector requiring approved natural inputs, environmental consciousness supporting sustainable agriculture technologies, and quality-focused production systems supporting premium input adoption for differentiation.

EU biostimulants sales are projected to grow from USD 1.2 million in 2025 to USD 3.3 million by 2035, registering a CAGR of 10.4% over the forecast period. Spain is expected to demonstrate the strongest growth trajectory with an 11.2% CAGR, supported by intensive horticultural production, substantial viticulture, and progressive specialty crop growers. Italy follows with a 10.6% CAGR, attributed to high-value specialty crops and organic agriculture leadership.

Rest of Europe demonstrates 10.3% CAGR, reflecting expanding adoption across diverse industries. Netherlands shows 10.2% CAGR, supported by advanced greenhouse production and precision agriculture. France exhibits 9.8% CAGR, driven by viticulture and diversified specialty crops. Germany demonstrates 9.5% CAGR, reflecting organic agriculture and sustainable farming adoption.

EU biostimulants sales are defined by competition among major agrochemical companies expanding into biologicals, specialized biostimulant producers, and regional agricultural input suppliers. Companies are investing in efficacy demonstration through multi-location trials, regulatory dossier development supporting EU-wide authorization, product innovation addressing specific crop challenges, and grower education programs to deliver proven, compliant, and agronomically effective biostimulant solutions. Strategic relationships with agricultural retailers and cooperatives, technical service supporting grower adoption, and positioning within sustainable agriculture programs are central to strengthening industry position.

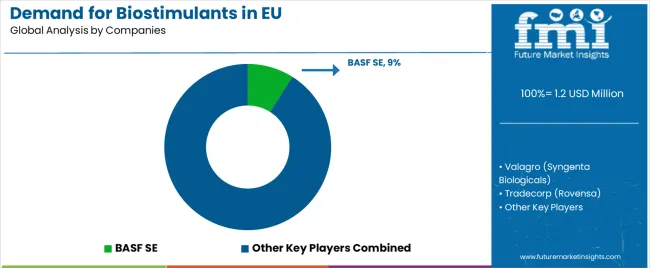

Major participants include BASF SE with an estimated 9% share, leveraging its broad European agricultural presence, BioSolutions division integrating biostimulants with core business, and comprehensive distribution through agricultural retail networks. BASF benefits from agrochemical industry infrastructure supporting biological product commercialization, technical service capabilities providing agronomic support, and established grower relationships facilitating biostimulant adoption.

Valagro (Syngenta Biologicals) holds approximately 8.5% share, emphasizing its specialized biostimulant expertise, strong positioning in viticulture and horticulture industries, and integration within Syngenta's biological platform following acquisition. Valagro's success in serving specialty crops through proven products and technical support creates competitive positioning, supported by Mediterranean industry strength and biological expertise.

Tradecorp (Rovensa) accounts for roughly 7.5% share through its Iberian industry leadership, comprehensive biostimulant portfolio, and integration within Rovensa's agricultural input platform. The company benefits from strong Spanish and Portuguese presence, diversified product offerings, and sustainable agriculture positioning supporting specialty crop industries.

Italpollina S.p.A. represents approximately 5.5% share, supporting growth through protein hydrolysate expertise, organic agriculture positioning, and Italian specialty crop industry presence. Italpollina leverages proprietary enzymatic hydrolysis technology, organic certification supporting organic farming industries, and specialty crop technical expertise particularly in viticulture and horticulture.

Acadian Plant Health accounts for approximately 5.0% share through seaweed extract specialization, Ascophyllum nodosum sourcing and processing capabilities, and European industry penetration. Acadian benefits from proprietary seaweed extraction technology, raw material supply security, and efficacy documentation supporting grower adoption across diverse crops.

Koppert B.V. represents approximately 4.5% share, supporting growth through biological crop protection integration enabling biostimulant bundling, greenhouse industry presence, and technical service culture. Koppert leverages integrated biological solutions positioning, greenhouse grower relationships, and technical expertise supporting adoption in intensive horticultural production.

Other companies and regional suppliers collectively hold 60.0% share, reflecting the fragmented nature of European biostimulants sales, where numerous regional producers, agricultural input companies, specialty suppliers, and local distributors serve specific geographic industries, crop sectors, and grower segments built on efficacy demonstration, technical support, and distribution relationships. This fragmentation provides opportunities for differentiation through crop-specific product development, regional agronomic expertise, grower education programs, and sustainable agriculture positioning supporting industry development in this rapidly expanding category.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.3 million |

| Product Type (Active Ingredient) | Extract-based, Acid-based, Others (incl. microbial) |

| Application (Method) | Foliar, Soil/Drip, Seed/Coating |

| Distribution Channel | Ag-retail/Distributors, Direct-to-Farm, Online/Direct |

| Nature (Form) | Liquid, Dry |

| Forecast Period | 2025-2035 |

| Base Year | 2025 |

| Historical Data | 2020-2024 |

| Countries Covered | Germany, France, Italy, Spain, the Netherlands, and the Rest of Europe |

| Key Companies Profiled | BASF SE, Valagro, Tradecorp, Italpollina, Acadian Plant Health, Koppert, Regional producers |

| Report Pages | 180+ Pages |

| Data Tables | 50+ Tables and Figures |

| Additional Attributes | Dollar sales by product type (active ingredient), application (method), distribution channel, nature (form), and country; regional demand trends across major European industries; competitive landscape analysis with established agricultural companies and specialized biostimulant producers; grower preferences for various product types and application methods; integration with specialty crop production, viticulture, organic farming, and sustainable agriculture systems; innovations in microbial consortia, stress management formulations, and efficacy documentation; adoption across agricultural retail and direct-to-farm channels. |

The global demand for biostimulants in eu is estimated to be valued at USD 1.2 million in 2025.

The market size for the demand for biostimulants in eu is projected to reach USD 3.3 million by 2035.

The demand for biostimulants in eu is expected to grow at a 10.4% CAGR between 2025 and 2035.

The key product types in demand for biostimulants in eu are extract-based, acid-based and others (incl. microbial).

In terms of application (method), foliar segment to command 52.0% share in the demand for biostimulants in eu in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand Signal Repository Solutions Market Size and Share Forecast Outlook 2025 to 2035

Demand Side Management Market Size and Share Forecast Outlook 2025 to 2035

Demand Response Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

North America Shipping Supplies Market Trends – Innovations & Growth 2024-2034

Demand of Kozani Saffron in Greece Analysis - Size, Share & Forecast 2025 to 2035

Demand of No-acid Whey Strained Dairy Processing Concepts in European Union Size and Share Forecast Outlook 2025 to 2035

Demand for Bronte Pistachio in Italy Analysis - Size, Share & Forecast 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Japan Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Western Europe Size and Share Forecast Outlook 2025 to 2035

Glycine Soja (Soybean) Seed Extract Market Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Yeast in Japan - Size, Share, and Forecast Outlook 2025 to 2035

Demand and Trends Analysis of Stevia in Japan Size and Share Forecast Outlook 2025 to 2035

Demand of Pistachio-based desserts & ingredients in France Analysis - Size, Share & Forecast 2025 to 2035

Japan Women’s Intimate Care Market Trends – Growth & Forecast 2024-2034

Western Europe Men’s Skincare Market Analysis – Forecast 2023-2033

Demand and Trend Analysis of Fabric Stain Remover in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Japan Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Korea Size and Share Forecast Outlook 2025 to 2035

Demand of MFGM-enriched Powders & RTDs in European Union Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA