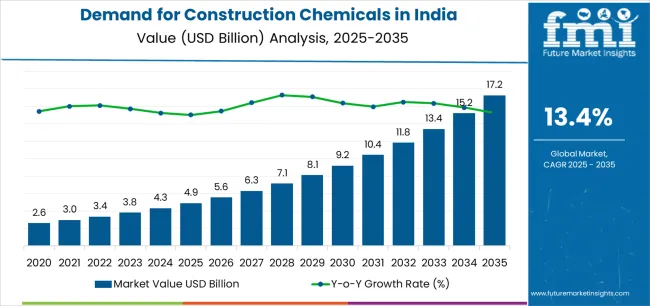

Global India construction chemicals demand is projected to grow from USD 4.9 billion in 2025 to approximately USD 17.2 billion by 2035, recording an absolute increase of USD 12.4 billion over the forecast period. This translates into total growth of 253.1%, with demand forecast to expand at a compound annual growth rate (CAGR) of 13.4% between 2025 and 2035. As reported in Future Market Insights (FMI)’s authoritative research on specialty and bulk chemicals, overall sales are expected to grow by nearly 3.53X during the same period, supported by accelerating infrastructure development under National Infrastructure Pipeline and PM Gati Shakti programs, increasing urbanization driving residential and commercial construction, and growing adoption of performance-enhancing chemical solutions across concrete admixture, waterproofing, and specialized application segments. India, led by infrastructure-focused northern, western, and southern regions, continues to demonstrate exceptional growth potential driven by government mega-projects including expressways, metro rail networks, and smart city developments.

Between 2025 and 2030, India construction chemicals demand is projected to expand from USD 4.9 billion to USD 9.4 billion, resulting in a value increase of USD 4.5 billion, which represents 36.3% of the total forecast growth for the decade. This phase of growth will be shaped by rising infrastructure construction activities globally and particularly across India where government-backed mega-infrastructure programs including Delhi-Mumbai Expressway, Bharatmala highway corridors, and extensive metro rail expansion are accelerating consumption of concrete admixtures, waterproofing systems, and repair chemicals. Increasing transition from site-mixed to pre-mixed mortar systems and growing adoption of high-performance polycarboxylate ether-based admixtures for infrastructure durability continue to drive demand. Chemical suppliers are expanding their production capabilities and regional manufacturing networks to address the growing technical complexity of modern infrastructure requirements and stringent performance specifications, with Fosroc's new Hyderabad plant (inaugurated May 2024) and Sika's post-MBCC integration capacity expansions leading regional supply development.

From 2030 to 2035, demand is forecast to grow from USD 9.4 billion to USD 17.2 billion, adding another USD 7.9 billion, which constitutes 63.7% of the overall ten-year expansion. This period is expected to be characterized by the expansion of green-label certified low-VOC formulations, integration of nano-additive technologies for enhanced performance under challenging environmental conditions, and the development of digital supply chain platforms enabling real-time formulation customization and procurement optimization. The growing emphasis on sustainable construction practices and climate-resilient infrastructure, particularly in coastal regions requiring marine-grade waterproofing systems and metropolitan areas mandating low-VOC protective coatings, will drive demand for more sophisticated chemical formulations and specialized technical capabilities.

Between 2020 and 2025, India construction chemicals demand experienced accelerated expansion from USD 3.5 billion to USD 4.9 billion, driven by increasing infrastructure investment under National Infrastructure Pipeline, growing residential construction through Pradhan Mantri Awas Yojana (PMAY), and rising awareness of durability-enhancing chemical solutions across organized ready-mixed concrete (RMC) and precast segments. The sector developed as infrastructure developers and construction companies, especially serving metro, expressway, and commercial projects, recognized the need for high-performance admixtures, comprehensive waterproofing systems, and specialized repair chemicals to meet structural longevity requirements while achieving competitive project economics. Engineering consultants and contractors began emphasizing proper chemical selection and application protocols to maintain construction quality and regulatory compliance across infrastructure and building applications.

| Metric | Value |

|---|---|

| India Construction Chemicals Sales Value (2025) | USD 4.9 billion |

| India Construction Chemicals Forecast Value (2035) | USD 17.2 billion |

| India Construction Chemicals Forecast CAGR (2025–2035) | 13.4% |

Demand expansion is being supported by the unprecedented scale of infrastructure development activities nationwide, with India maintaining its position as one of the world's fastest-growing construction economies, and the corresponding need for specialized construction chemicals for concrete performance enhancement, structure waterproofing, and surface protection across expressway, metro rail, and building applications. Modern infrastructure projects rely on advanced chemical formulations to ensure structural durability against traffic loads and environmental exposure, proper moisture management in underground and coastal structures, and optimal service life throughout design periods. Construction operations require comprehensive chemical solutions including plasticizing admixtures for workability and strength optimization, integral waterproofing systems for below-grade and water-retaining structures, specialized repair mortars for rehabilitation projects, and protective coating systems for harsh environmental conditions to maintain infrastructure quality and operational longevity.

The growing technical sophistication of infrastructure projects and increasing performance requirements mandated by government agencies, particularly stringent specifications for National Highway Authority of India (NHAI) expressways and metro rail structural systems, are driving demand for certified high-performance construction chemicals from established manufacturers with appropriate technical support and quality assurance capabilities. Quality standards and project specifications from agencies including Ministry of Road Transport & Highways (MoRTH), Delhi Metro Rail Corporation (DMRC), and state public works departments are establishing stringent material qualification procedures that require comprehensive testing capabilities and technical documentation protocols, with infrastructure programs often setting benchmark standards for Indian construction chemical application practices.

The India construction chemicals sector represents an infrastructure-driven opportunity fueled by USD 1.4 trillion National Infrastructure Pipeline allocation and PM Gati Shakti programs, accelerating urbanization driving residential construction, and performance-enhancement demand for durability optimization. The sector's exceptional growth trajectory from USD 4.9 billion in 2025 to USD 17.2 billion by 2035 at a 13.4% CAGR reflects fundamental shifts in Indian construction practices toward performance-specified systems and quality-assured deployment.

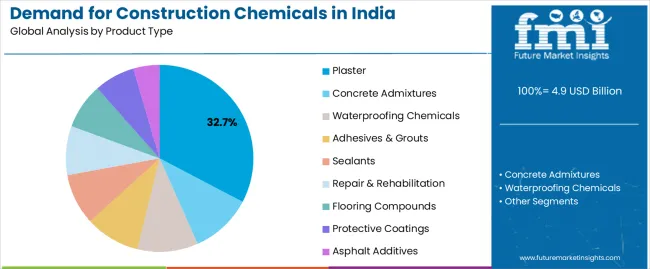

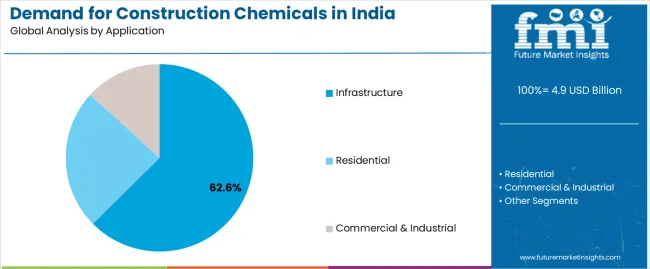

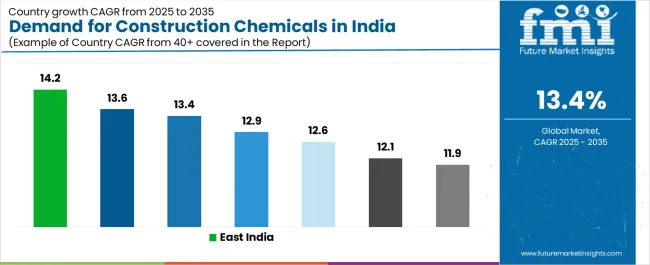

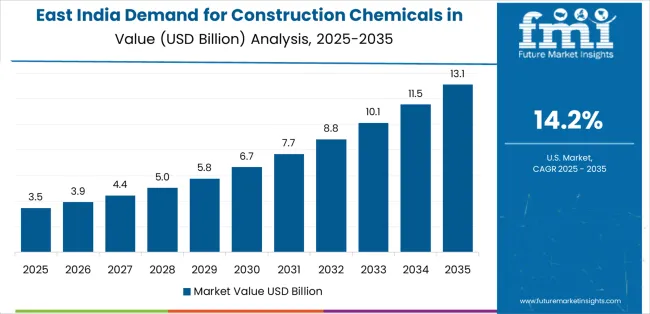

Geographic expansion opportunities are particularly pronounced in high-growth regions, where East India (14.2% CAGR) leads through mining-steel infrastructure investment and port development, while South India (13.6% CAGR) accelerates through metro network expansion across Bengaluru-Chennai-Hyderabad. The dominance of infrastructure application (62.6% share) and plaster products (32.7% share) provides clear strategic focus areas, while emerging green-label low-VOC formulations open new revenue streams across sustainability-focused operations.

Strengthening the dominant infrastructure segment (62.6% share) through specialized high-performance admixture systems addressing expressway abrasion resistance and 100-year design life requirements, comprehensive waterproofing solutions for metro underground stations addressing hydrostatic pressure specifications, and long-term technical partnerships with infrastructure developers. This pathway focuses on optimizing polycarboxylate ether (PCE) superplasticizer formulations for extended slump retention and 30-40% water reduction, developing crystalline waterproofing admixtures for self-healing concrete in underground applications, and establishing application engineering support including mix design optimization and on-site quality assurance. Expected revenue pool: USD 195-290 million.

Exceptional growth across East India (14.2% CAGR) creates opportunities through comprehensive supply relationships with Odisha-Jharkhand mining and steel sector projects requiring industrial flooring systems, strategic positioning for Paradip-Visakhapatnam port expansion consuming marine-grade waterproofing and chloride-resistant admixtures, and dedicated freight corridor construction demanding specialized concrete solutions. Mining-steel infrastructure concentration enables consistent industrial chemical consumption and advantageous positioning for heavy industrial facility construction serving metallurgical applications throughout East India's industrial development. Expected revenue pool: USD 145-220 million.

Expansion within the dominant plaster segment (32.7% share) through ready-mixed gypsum plaster systems addressing residential interior wall finishing quality requirements, polymer-modified premixed cement plaster formulations for external durability, and machine-applied system integration enabling large-scale deployment across organized housing projects. This pathway encompasses workability optimization for extended open time, crack resistance enhancement through fiber reinforcement and polymer modification, and lightweight formulation development reducing structural loading, enabling integration with PMAY affordable housing programs and private residential developers. Expected revenue pool: USD 130-195 million.

Strategic expansion into concrete admixtures (20.5% share) requires specialized PCE manufacturing capabilities addressing infrastructure high-performance requirements, comprehensive product portfolios spanning workability, strength, and durability functions, and technical support infrastructure including concrete testing laboratories. This pathway addresses PCE chemistry optimization for compatibility with Indian cement and high fly ash content, self-compacting concrete (SCC) admixture development for congested metro station reinforcement, and integrated waterproofing admixture formulations, creating opportunities for long-term supply agreements with ready-mixed concrete producers and infrastructure contractors. Expected revenue pool: USD 120-180 million.

Development of comprehensive waterproofing solutions (18.6% product share) addressing residential basement applications through integral admixture and cementitious coating combinations, infrastructure underground construction requiring crystalline admixture and membrane systems, and coastal infrastructure demanding marine-grade polyurethane formulations. This pathway encompasses integral crystalline admixture development providing self-healing properties, liquid-applied polyurethane membrane systems offering elastomeric flexibility for terrace applications, and acrylic-cementitious hybrid coatings. Technology differentiation through CFTRI potable water safety certifications and low-VOC formulation compliance enables diversified revenue streams across residential, infrastructure, and industrial segments. Expected revenue pool: USD 105-160 million.

Integration into South India's rapidly growing sector (13.6% CAGR, 26% national share) through comprehensive metro rail construction chemical supply serving Bengaluru, Chennai, and Hyderabad projects, specialized industrial flooring deployment for electronics and automotive manufacturing requiring anti-static properties, and technical support infrastructure leveraging regional manufacturing presence. Regional positioning through Karnataka-Tamil Nadu-Telangana industrial corridor relationships and metro authority technical approvals creates opportunities for integrated chemical system supply. Expected revenue pool: USD 95-145 million.

Expansion within green building segment addressing Delhi NCR mandates for low-VOC emissions compliance, CFTRI potable water safety certifications, and green building rating system contributions. This pathway encompasses water-based low-VOC formulation development, bio-based polymer modification technologies, and comprehensive environmental product declaration documentation, enabling access to government green building mandates and premium commercial development sustainability requirements. Expected revenue pool: USD 85-130 million.

Demand is segmented by product type, application, region, and sales channel. By product type, sales are divided into plaster, concrete admixtures, waterproofing chemicals, adhesives & grouts, sealants, repair & rehabilitation, flooring compounds, protective coatings, and asphalt additives. Based on application, demand is categorized into infrastructure, residential, and commercial & industrial. In terms of regional concentration, sales are segmented across North India, West India, South India, East India, Central India, North-East, and Union Territories. By sales channel, demand is divided into direct/project sales, distributor-led, retail/dealer, and online/B2B. Regionally, demand is concentrated across North India driven by NCR development and expressway construction, West India supported by Mumbai-Pune metro and port infrastructure, South India fueled by Bengaluru-Chennai-Hyderabad metro and industrial corridor expansion, and East India benefiting from Odisha-Jharkhand mining, steel, and port project development.

Plaster products are projected to account for 32.7% of India construction chemicals demand in 2025, making them the leading product type across the sector. This dominance reflects the critical importance of wall finishing, surface smoothness, and aesthetic quality in both residential and commercial construction, where ready-mixed gypsum plaster and premixed cement plaster systems replace traditional site-mixed formulations while ensuring consistent quality, reduced construction time, and improved site productivity. In India, residential developers and commercial contractors mandate factory-produced plaster systems for apartment projects, office complexes, and retail developments, ensuring widespread adoption across organized construction segments that prioritize quality control and schedule adherence. Continuous innovations are improving the workability and extended open time of premixed plaster formulations, adhesion characteristics and crack resistance through polymer modification, and setting time control for diverse ambient conditions, enabling contractors to maintain application efficiency while optimizing labor productivity.

Infrastructure is expected to represent 62.6% of India construction chemicals demand in 2025, establishing it as the overwhelmingly dominant application segment. Infrastructure projects including expressways spanning 1,000+ km corridors, metro rail networks exceeding 900 km of operational and under-construction viaducts and tunnels, industrial corridors linking manufacturing clusters, and port modernization serving trade growth demonstrate exceptional construction chemical intensity driven by stringent durability specifications, high-traffic loading requirements, and extended design service life expectations. The segment benefits from strategic government initiatives including National Infrastructure Pipeline allocating USD 1.4 trillion for infrastructure development through 2030, PM Gati Shakti master plan coordinating multi-modal connectivity projects, and Smart Cities Mission establishing urban infrastructure quality benchmarks. Construction companies and infrastructure developers are prioritizing comprehensive chemical solutions that offer proven performance documentation including accelerated laboratory testing, compatibility with local materials and ambient conditions, and technical support throughout specification, application, and quality assurance phases.

India construction chemicals demand is advancing rapidly due to unprecedented infrastructure investment and growing recognition of chemical benefits for durability enhancement and lifecycle cost optimization, with government mega-projects and organized construction sectors serving as key adoption drivers. However, the sector faces challenges including price sensitivity in residential segments limiting premium product penetration, need for technical education and proper application training among contractors and applicators, and execution delays in infrastructure projects affecting consumption timing and inventory management.

The growing implementation of mega-infrastructure programs, gaining exceptional momentum through National Infrastructure Pipeline and PM Gati Shakti initiatives, is enabling sustained high-volume consumption of specialized construction chemicals across expressway construction requiring abrasion-resistant concrete systems, metro rail networks demanding comprehensive waterproofing and durability solutions, and industrial corridor development necessitating high-performance flooring and protective coatings. Infrastructure projects equipped with stringent technical specifications and quality assurance protocols offer long-term supply relationships and premium pricing opportunities while allowing chemical manufacturers to demonstrate product performance under demanding conditions and establish reference project credentials. These programs are particularly valuable for construction chemical companies that can invest in application engineering support, maintain certified quality systems, and provide comprehensive technical documentation addressing infrastructure owner requirements including MoRTH specifications for highways and metro rail authority standards for underground construction.

Modern construction chemical manufacturers, led by multinational companies including Sika, BASF, and Pidilite, are incorporating sustainable formulation technologies including water-based low-VOC alternatives to solvent-based systems, bio-based polymer modifications reducing petroleum-derived content, and nano-additive enhancements improving performance while reducing material consumption. Integration of digital platforms enabling real-time formulation customization, automated procurement and delivery scheduling, and IoT-based concrete monitoring systems enables more responsive supply chain management and improved construction site efficiency. Advanced chemical systems also support next-generation construction practices including self-healing concrete for infrastructure lifecycle extension, ultra-high-performance concrete (UHPC) for slender bridge designs, and carbon-capture concrete technologies addressing sustainability objectives, with major infrastructure projects increasingly adopting these innovations to meet environmental compliance requirements and enhance asset performance across extended service periods.

| Region | CAGR (2025-2035) |

|---|---|

| East India | 14.2% |

| South India | 13.6% |

| North India | 13.4% |

| West India | 12.9% |

| Central India | 12.6% |

| North-East | 12.1% |

| Union Territories (Delhi/Chandigarh/J&K) | 11.9% |

India construction chemicals demand is witnessing robust growth across all major regions, supported by infrastructure program execution, urbanization acceleration, and the integration of performance-enhancing chemical solutions across construction operations. East India leads growth with a 14.2% CAGR, reflecting strong mining and steel sector infrastructure investments in Odisha and Jharkhand, major port expansion projects including Paradip and Visakhapatnam, and extensive railway modernization programs requiring specialized admixtures and repair systems. South India follows with a 13.6% CAGR, driven by metropolitan area metro rail construction across Bengaluru, Chennai, and Hyderabad, industrial corridor development supporting electronics and automotive manufacturing capacity expansion, and premium flooring and admixture demand from organized industrial facilities requiring specialized chemical performance. North India grows at 13.4%, as expressway mega-projects including Delhi-Meerut and Delhi-Mumbai corridors, extensive urban housing development across NCR and tier-2 cities, and large-scale waterproofing and repair requirements from building stock rehabilitation increasingly depend on construction chemicals to maintain quality standards and project schedules.

Demand for construction chemicals in East India is projected to exhibit the strongest regional growth with a CAGR of 14.2% through 2035, driven by ongoing mining and steel industry infrastructure development across Odisha and Jharkhand creating sustained demand for industrial flooring, repair mortars, and protective coatings, major port expansion and modernization projects at Paradip, Visakhapatnam, and Haldia requiring marine-grade waterproofing systems and chloride-resistant concrete formulations, and comprehensive railway infrastructure upgrades including dedicated freight corridors and station modernization programs consuming specialized admixtures and repair chemicals. As the regional growth leader, East India's emphasis on heavy industrial development and logistics infrastructure is creating significant demand for high-performance construction chemicals with enhanced chemical resistance for industrial environments, superior durability against coastal chloride exposure for port structures, and reliable performance under heavy loading conditions for railway and materials handling applications throughout mining, steel, and port facilities across Odisha, Jharkhand, and West Bengal.

Demand for construction chemicals in South India is expanding at a CAGR of 13.6%, supported by extensive metropolitan area metro rail construction across Bengaluru, Chennai, and Hyderabad requiring comprehensive concrete admixture, waterproofing, and grouting solutions for underground stations and elevated viaducts, industrial corridor development including Bengaluru-Mumbai Economic Corridor and Chennai-Bangalore Industrial Corridor driving specialized flooring compound and protective coating demand from electronics, automotive, and logistics facilities, and organized industrial construction emphasizing high-performance chemical solutions for quality-critical manufacturing environments. The region's construction ecosystem, representing a crucial component of India's infrastructure and industrial development activities with 26% national share, is increasingly adopting advanced construction chemical technologies including self-compacting concrete (SCC) admixtures for congested metro station reinforcement, crystalline waterproofing systems for below-grade structures, and specialized epoxy flooring for cleanroom and precision manufacturing facilities.

Demand for construction chemicals in North India is growing at a CAGR of 13.4% with 28% national share, driven by expressway mega-infrastructure including Delhi-Mumbai Expressway (1,386 km), Delhi-Meerut Expressway, and extensive Bharatmala corridor construction requiring high-performance concrete admixtures for abrasion resistance and durability, extensive urban housing development across Delhi NCR, Jaipur, Lucknow, and tier-2 cities consuming plaster systems, waterproofing chemicals, and tile adhesives through organized residential construction, and large-scale building rehabilitation and waterproofing retrofit requirements from aging construction stock in metropolitan areas necessitating specialized repair mortars and membrane waterproofing systems. The region's construction ecosystem is integrating performance-proven construction chemicals to address expressway durability specifications mandating 100-year design life and chloride ingress resistance, residential quality expectations for leakage-free construction and crack-resistant finishes, and retrofit project challenges including substrate preparation and compatibility with existing materials.

Demand for construction chemicals in West India is advancing at a CAGR of 12.9% with 27% national share, supported by high-rise residential and commercial construction across Mumbai and Pune metropolitan areas requiring specialized concrete admixtures for high-strength applications, comprehensive waterproofing systems for podium decks and basements, and advanced flooring compounds for commercial interiors, extensive metro rail construction including Mumbai Metro and Pune Metro networks demanding underground waterproofing and grouting solutions, and coastal infrastructure including Mumbai Coastal Road and port development projects necessitating marine-grade chloride-resistant chemical formulations. The region's construction activities emphasize premium product specifications and technical performance requirements driven by Mumbai's challenging coastal environment, stringent building regulations, and high real estate values justifying quality chemical investments.

Demand for construction chemicals in Central India is expanding at a CAGR of 12.6%, driven by cement manufacturing capacity concentration creating opportunities for admixture and ready-mixed mortar production integration, logistics park and warehousing infrastructure development requiring specialized flooring and loading dock systems, and affordable housing construction through PMAY and private developments consuming plaster, waterproofing, and adhesive products across Madhya Pradesh and Chhattisgarh urban centers. The region's construction ecosystem is gradually adopting organized construction practices and factory-produced chemical systems to improve quality consistency and construction efficiency. Material suppliers are developing distribution networks to serve Central India's growing construction requirements.

Demand for construction chemicals in North-East India is growing at a CAGR of 12.1%, supported by road and bridge construction across challenging hilly terrain requiring specialized concrete admixtures for low-temperature placement and accelerated strength development, hydroelectric project infrastructure demanding comprehensive waterproofing and repair systems for dam and powerhouse structures, and urban development programs in state capitals including Guwahati, Imphal, and Agartala consuming residential construction chemicals. The region's infrastructure construction emphasizes specialized chemical solutions addressing terrain challenges, seismic requirements, and remote logistics conditions. Material distributors are establishing supply networks to serve North-East India's specialized construction requirements.

Demand for construction chemicals in Union Territories including Delhi, Chandigarh, and Jammu & Kashmir is expanding at a CAGR of 11.9%, driven by public building construction and government facility modernization requiring certified low-VOC and green-label construction chemicals, transit infrastructure including metro station development and bus rapid transit systems consuming specialized construction solutions, and mandated environmental compliance including low-VOC coating requirements for government projects and green building certifications for public facilities. The UTs' construction activities emphasize regulatory compliance, sustainable material specifications, and quality-certified supply chains serving government procurement requirements. Material suppliers are providing certified low-VOC formulations to serve UT regulatory requirements.

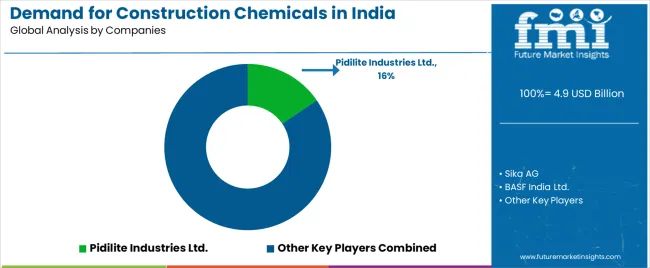

India construction chemicals demand is defined by competition among multinational chemical companies with local manufacturing, domestic specialized manufacturers, and cement company diversifications, with international players maintaining technical leadership while domestic companies leverage distribution networks and price positioning. Manufacturers are investing in regional production capacity including Fosroc's new Hyderabad plant, application development centers providing formulation optimization and technical training, comprehensive product portfolios spanning admixtures to flooring systems, and integrated supply chains enabling project-based delivery to deliver performance-proven, application-optimized, and competitively-priced construction chemical solutions across infrastructure, residential, and industrial operations. Strategic capacity expansions, technical service differentiation.

Pidilite Industries Ltd., India-based and the sector leader with 15.5% share, offers comprehensive construction chemical solutions including Dr. Fixit waterproofing range widely adopted across residential and infrastructure segments, Fevicol-brand tile adhesives, and specialized repair products with focus on brand strength, extensive distribution networks, and technical support across Indian operations, recently launching (2025) next-generation low-VOC polyurethane and liquid-applied waterproofing systems and high-range admixtures targeted at bridges, metros, and podium deck applications. Sika AG, operating globally from Switzerland with significant Indian presence, provides integrated construction solutions including concrete admixtures, waterproofing membranes, and flooring systems with emphasis on technical innovation and infrastructure project support, post-integration of MBCC assets debottlenecking admixture and waterproofing capacity to serve metro and expressway infrastructure packages.

Fosroc Chemicals India Pvt. Ltd., part of UK-based Fosroc International, provides comprehensive solutions across concrete admixtures, waterproofing, grouting, and flooring segments, inaugurating (May 2024) an integrated 260,000 sq ft construction chemicals plant in Hyderabad expanding supply for South and Central India with sixth production unit complementing existing facilities in Bangalore, Ankleshwar, Kolkata, Dhaka, and Keshwana. Asian Paints Ltd. participates through construction chemical product lines leveraging paint distribution networks. Construction chemical manufacturers are establishing comprehensive technical support networks throughout major consumption regions including metro cities and infrastructure project locations, developing sustainability-focused formulations addressing low-VOC mandates and green building certifications, and integrating digital platforms for procurement optimization and real-time formulation customization to meet evolving infrastructure specifications, residential quality expectations, and environmental regulations across North, South, West, and East India construction operations.

| Item | Value |

|---|---|

| Quantitative Units | USD 17.2 billion |

| Product Type | Plaster, concrete admixtures, waterproofing chemicals, adhesives & grouts, sealants, repair & rehabilitation, flooring compounds, protective coatings, asphalt additives |

| Application | Infrastructure, residential, commercial & industrial |

| Region | North India, West India, South India, East India, Central India, North-East, Union Territories (Delhi/Chandigarh/J&K) |

| Sales Channel | Direct/project sales, distributor-led, retail/dealer, online/B2B |

| States Covered | Analysis across major consuming regions including Delhi NCR, Mumbai-Pune corridor, Bengaluru-Chennai-Hyderabad metro regions, Odisha-Jharkhand-West Bengal industrial belt, and other key construction hubs |

| Key Companies Profiled | Pidilite Industries Ltd., Sika AG, BASF India Ltd., Fosroc Chemicals India Pvt. Ltd., Asian Paints Ltd., Saint-Gobain (Weber), Mapei India, Berger Paints India Ltd., Dow, UltraTech Cement (RMC & dry mixes) |

| Additional Attributes | Dollar sales by product type, application segment, and sales channel, regional demand trends across North, West, South, and East India driven by infrastructure programs and urbanization, competitive landscape with established multinational chemical companies and domestic manufacturers, construction segment preferences for direct project supply versus distributor networks, integration with government mega-infrastructure programs including National Infrastructure Pipeline and PM Gati Shakti particularly concentrated in expressway and metro rail construction, innovations in sustainable low-VOC formulations and high-performance admixture technologies including PCE-based superplasticizers, and adoption of digital supply platforms, technical service differentiation. |

The global demand for construction chemicals in india is estimated to be valued at USD 4.9 billion in 2025.

The market size for the demand for construction chemicals in india is projected to reach USD 17.2 billion by 2035.

The demand for construction chemicals in india is expected to grow at a 13.4% CAGR between 2025 and 2035.

The key product types in demand for construction chemicals in india are plaster, concrete admixtures, waterproofing chemicals, adhesives & grouts, sealants, repair & rehabilitation, flooring compounds, protective coatings and asphalt additives.

In terms of application, infrastructure segment to command 62.6% share in the demand for construction chemicals in india in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand Signal Repository Solutions Market Size and Share Forecast Outlook 2025 to 2035

Demand Side Management Market Size and Share Forecast Outlook 2025 to 2035

Demand Response Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

North America Shipping Supplies Market Trends – Innovations & Growth 2024-2034

Demand of Kozani Saffron in Greece Analysis - Size, Share & Forecast 2025 to 2035

Demand of No-acid Whey Strained Dairy Processing Concepts in European Union Size and Share Forecast Outlook 2025 to 2035

Demand for Bronte Pistachio in Italy Analysis - Size, Share & Forecast 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Western Europe Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Japan Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Korea Size and Share Forecast Outlook 2025 to 2035

Glycine Soja (Soybean) Seed Extract Market Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Yeast in Japan - Size, Share, and Forecast Outlook 2025 to 2035

Demand and Trends Analysis of Stevia in Japan Size and Share Forecast Outlook 2025 to 2035

Demand of Pistachio-based desserts & ingredients in France Analysis - Size, Share & Forecast 2025 to 2035

Japan Women’s Intimate Care Market Trends – Growth & Forecast 2024-2034

Western Europe Men’s Skincare Market Analysis – Forecast 2023-2033

Demand and Trend Analysis of Fabric Stain Remover in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Japan Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Western Europe Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA