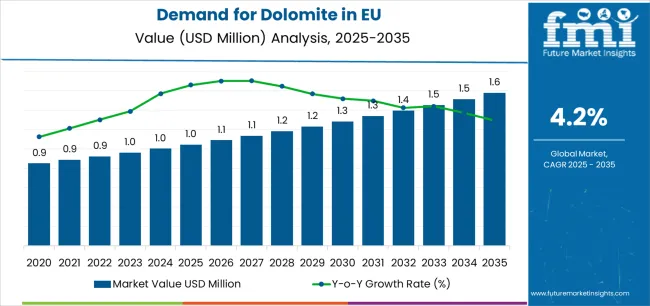

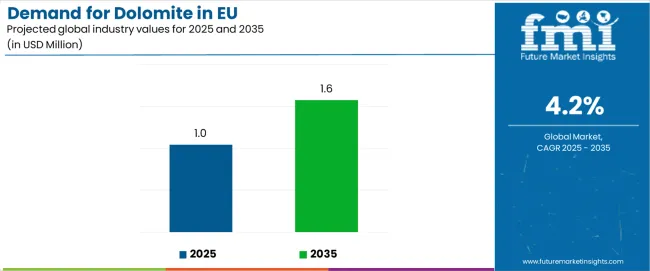

The European Union dolomite industry is projected to grow from USD 1.0 million in 2025 to around USD 1.6 million by 2035, recording a compound annual growth rate of 4.2%. Demand for domolite is rising due to its dual content of calcium carbonate and magnesium carbonate, which provides value in diverse end uses ranging from refractory materials to environmental applications. Its adoption within Europe is shaped by both infrastructure requirements and agricultural practices, where dolomite is used as a soil conditioner and neutralizing agent.

Sales of dolomite in the European Union are expected to increase by USD 0.6 million during the forecast period, growing from USD 1.0 million in 2025 to USD 1.6 million by 2035. This shows total growth of 60.0%, with the market expanding by nearly 1.6X over ten years. While the volume base remains relatively modest compared to other industrial minerals, dolomite’s specialized applications ensure consistent demand. In construction, crushed dolomite is utilized in aggregates and cement blends, supporting the durability of roadbeds, concrete, and structural foundations. In steelmaking, dolomite serves as a fluxing material, aiding in impurity removal and stabilizing refractory linings in furnaces.

Agricultural use of dolomite is expected to grow in importance, particularly in regions where soil acidification limits crop productivity. The magnesium content improves soil fertility, while the neutralizing properties reduce acidity, enabling better nutrient absorption. With the European Union’s increasing emphasis on efficient soil management and precision agriculture, demand for dolomite in farming is forecast to rise, especially in countries with intensive crop cultivation. Environmental applications, such as flue gas desulfurization, also present opportunities as industries aim to meet stricter emission standards.

Western Europe continues to be the leading region for dolomite consumption, supported by mature construction and metallurgical industries in Germany, France, and Italy. Eastern European nations are gradually increasing usage due to infrastructure development and expanding steel production, while Southern Europe is seeing more demand from agriculture and soil conditioning. The availability of domestic mineral reserves within the EU helps stabilize supply, though imports may supplement consumption in countries with limited deposits. By 2030, the dolomite industry in Europe is expected to see gradual but steady integration into specialized applications, particularly in green construction materials and advanced metallurgical processes. With demand rooted in essential sectors, dolomite is projected to retain its importance as a versatile mineral resource supporting industrial, agricultural, and environmental needs across the region.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 1 million |

| Forecast Value in (2035F) | USD 1.6 million |

| Forecast CAGR (2025 to 2035) | 4.2% |

Industry expansion is being supported by the continued requirement for metallurgical flux materials across European steel production facilities and the corresponding demand for reliable, quality-certified mineral inputs with proven performance characteristics in demanding industrial applications. Modern industrial consumers rely on dolomite as an essential raw material for steel manufacturing, refractory production, glass formulation, and construction aggregates, driving demand for materials that consistently deliver the required chemical composition, particle size specifications, and purity levels necessary for process efficiency and product quality. Even modest variations in material quality, including magnesium oxide content, calcium oxide ratios, or impurity levels, can significantly impact metallurgical performance and manufacturing efficiency across critical industrial processes.

The growing requirements for environmental treatment applications and increasing recognition of mineral-based solutions for water treatment and soil remediation are driving demand for dolomite materials from certified suppliers with appropriate quality certifications and consistent material specifications. Regulatory authorities are increasingly establishing clear guidelines for industrial mineral quality standards, environmental compliance requirements, and traceability protocols to maintain operational safety and ensure material consistency across applications. Technical research and industrial validation studies are providing evidence supporting dolomite's performance advantages in specific applications, requiring specialized processing methods and standardized quality control protocols for optimal particle size distribution, appropriate surface characteristics, and consistent chemical composition including balanced calcium and magnesium content for metallurgical performance.

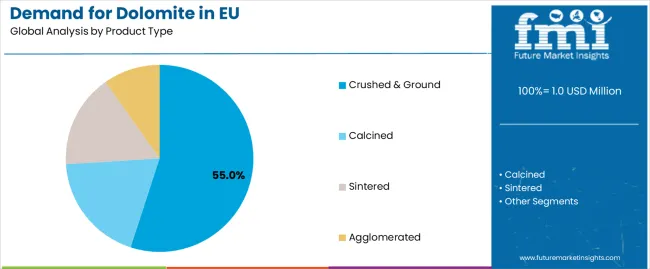

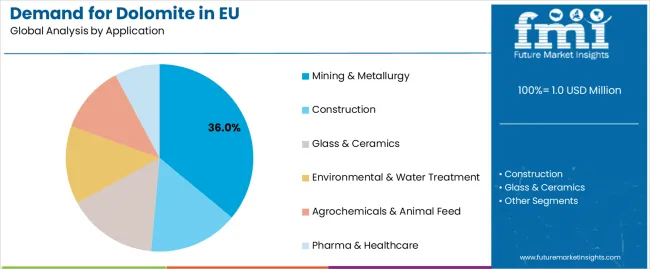

Sales are segmented by product type (material), application (end use), distribution channel, nature, and country. By product type, demand is divided into crushed and ground, calcined, sintered, and agglomerated forms. Based on the application, sales are categorized into mining and metallurgy, construction, glass and ceramics, environmental and water treatment, agrochemicals and animal feed, and pharma and healthcare. In terms of distribution channel, demand is segmented into direct to industrial (bulk), distributors, and online/indirect channels. By nature, sales are classified into bulk commodity, processed value-added, and specialty high-purity. Regionally, demand is focused on Germany, France, Italy, Spain, the Netherlands, and the Rest of Europe.

The crushed and ground segment is projected to account for 55% of EU dolomite sales in 2025, establishing itself as the dominant material form across European markets. This commanding position is fundamentally supported by crushed and ground dolomite's versatility across multiple industrial applications, cost-effective processing requirements compared to calcined or sintered forms, and widespread suitability for construction aggregates, metallurgical flux preparations, and agricultural lime applications. The crushed and ground format delivers exceptional adaptability, providing industrial consumers with readily available mineral material that serves diverse applications from road construction and concrete production to steel manufacturing flux and soil conditioning.

This segment benefits from established extraction and processing infrastructure, straightforward crushing and screening operations requiring lower capital investment than thermal processing, and extensive availability from numerous European quarries and processing facilities maintaining consistent quality standards. Crushed and ground dolomite offers logistical advantages through bulk handling systems, regional distribution networks reducing transportation costs, and flexible particle size specifications tailored to specific application requirements across construction, metallurgy, and agricultural sectors.

The crushed and ground segment is expected to gradually decrease to 53.0% share by 2035, demonstrating modest erosion as processed value-added forms, including calcined and sintered materials, capture incrementally larger shares through specialty applications requiring enhanced performance characteristics throughout the forecast period.

Mining and metallurgy applications are positioned to represent 36% of total dolomite demand across European markets in 2025, declining slightly to 35.0% by 2035, reflecting the segment's established position as the primary end-use application within the overall industry ecosystem. This substantial share directly demonstrates that metallurgical flux consumption represents the largest single application, with steel producers and ferroalloy manufacturers utilizing dolomite for slag conditioning, refractory lining protection, and desulfurization processes essential for producing quality steel grades meeting European specifications.

Modern metallurgical operations increasingly rely on dolomite materials delivering consistent calcium and magnesium oxide ratios, controlled impurity levels preventing steel contamination, and appropriate particle size distributions ensuring efficient flux performance during steelmaking operations. The segment benefits from long-established procurement relationships between mineral suppliers and steel producers, technical service support optimizing flux formulations for specific steel grades, and quality certification programs ensuring material consistency batch-to-batch for critical metallurgical applications.

The segment's slight share decline reflects proportional growth across diversifying applications, with mining and metallurgy maintaining its leading position while construction, glass, and environmental applications expand their relative contributions throughout the forecast period.

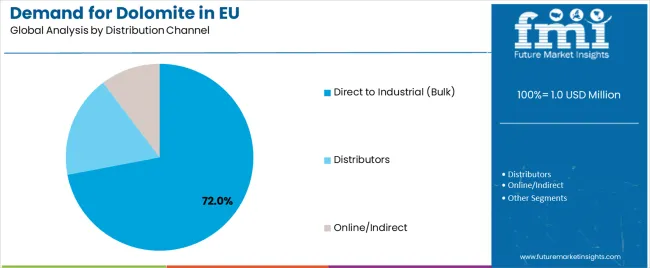

Direct to industrial bulk distribution channels are strategically estimated to control 72.0% of total European dolomite sales in 2025, increasing to 74.0% by 2035, reflecting the industrial commodity nature of dolomite and the dominance of large-volume procurement by major manufacturing consumers. European industrial operations, including steel plants, glass manufacturers, construction material producers, and chemical processors, consistently source dolomite through direct supply agreements with quarry operators and mineral processors, ensuring reliable material availability, consistent quality specifications, and optimized logistics for high-volume consumption.

The segment provides essential cost advantages through bulk handling systems, dedicated rail or truck transportation minimizing handling stages, and long-term supply contracts enabling price stability and procurement planning for industrial consumers with continuous material requirements. Major European steel producers, cement manufacturers, and glass production facilities systematically establish direct sourcing relationships with dolomite suppliers, often including quality assurance protocols, technical service support, and logistics coordination ensuring uninterrupted material flow to manufacturing operations.

The segment's expanding share reflects the continued consolidation of industrial consumption among large-scale manufacturers, increasing vertical integration between mineral suppliers and industrial consumers, and the economic advantages of bulk distribution systems for commodity mineral materials throughout the forecast period.

EU dolomite sales are advancing steadily due to continued metallurgical sector consumption, ongoing construction activity across major European economies, and expanding environmental treatment applications requiring mineral-based solutions. The dolomite industry faces challenges, including sensitivity to steel production cycles affecting metallurgical demand volumes, energy cost volatility impacting calcination economics for processed grades, and potential substitution by synthetic flux materials or alternative mineral inputs in specific applications. Continued focus on processing efficiency improvements and application-specific material optimization remains central to industry development.

The gradually accelerating development of processed value-added dolomite products is systematically transforming portions of the commodity mineral industry from basic crushed stone to specialized materials featuring enhanced purity, controlled particle characteristics, and application-optimized surface properties supporting premium industrial applications. Advanced processing operations featuring calcination, sintering, and chemical treatment enable producers to create specialty dolomite grades with controlled reactivity, enhanced whiteness for ceramic applications, and high-purity compositions suitable for pharmaceutical intermediates and specialized chemical synthesis. These processing innovations prove particularly valuable for glass and ceramic applications, where consistent material properties ensure color stability and melting behavior, and for environmental treatment applications requiring controlled reactivity and predictable performance.

Modern dolomite quarrying operations systematically incorporate environmental management systems, progressive rehabilitation planning, and dust control technologies addressing regulatory requirements and community concerns surrounding mineral extraction activities. Strategic integration of environmental compliance protocols, including water management systems preventing sediment discharge, vegetation screening reducing visual impact, and progressive site restoration enabling alternative land uses following extraction completion, enables quarry operators to maintain operating permits and community acceptance essential for long-term resource access. These sustainability initiatives prove essential for securing extraction permits in environmentally sensitive regions, maintaining corporate social responsibility credentials, and addressing increasing regulatory scrutiny of mining operations across European jurisdictions.

European industrial consumers increasingly prioritize dolomite supply relationships emphasizing consistent material quality, technical service support optimizing material performance, and supply reliability ensuring uninterrupted manufacturing operations. This quality focus enables mineral suppliers to differentiate commodity offerings through certified quality management systems, application-specific technical guidance supporting optimal material utilization, and responsive customer service addressing quality concerns or application challenges. Quality consistency proves particularly important for metallurgical applications where material specification deviations can impact steel quality and for glass formulations where impurity levels directly affect product characteristics.

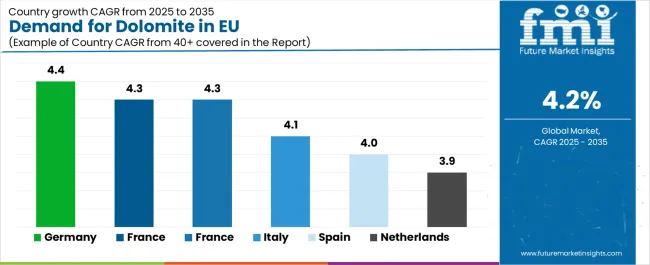

EU dolomite sales are projected to grow from USD 1,045.5 million in 2025 to USD 1,580.7 million by 2035, registering a CAGR of 4.2% over the forecast period. Germany is expected to demonstrate the strongest growth trajectory with a 4.4% CAGR, supported by robust industrial infrastructure, significant steel production capacity, and strong construction sector demand. France and the Rest of Europe follow with 4.3% CAGR each, attributed to diversified industrial consumption and ongoing infrastructure development, respectively.

Italy demonstrates 4.1% CAGR, reflecting steady industrial mineral consumption across manufacturing sectors. Spain shows 4.0% CAGR, supported by construction sector recovery and expanding industrial applications. The Netherlands exhibits the most modest growth at 3.9% CAGR, reflecting its smaller industrial base and more mature industry development.

| Country | CAGR % |

|---|---|

| Germany | 4.4% |

| France | 4.3% |

| Rest of Europe | 4.3% |

| Italy | 4.1% |

| Spain | 4.0% |

| Netherlands | 3.9% |

EU dolomite sales demonstrate steady growth across major European economies, with Germany leading expansion at 4.4% CAGR through 2035, driven by substantial steel production infrastructure and diversified industrial consumption. France benefits from balanced demand across metallurgical, construction, and glass manufacturing applications. Italy leverages established industrial mineral consumption patterns and ongoing infrastructure investment. Spain shows consistent growth supported by construction sector recovery and expanding industrial activity. The Netherlands demonstrates modest expansion reflecting mature industry characteristics. The Rest of Europe maintains strong growth supported by emerging industrial development and expanding mineral processing capabilities. Sales show stable regional development reflecting continued industrial activity and ongoing infrastructure investment across EU economies.

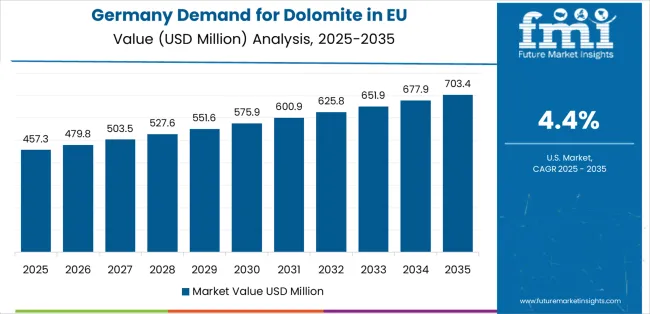

Revenue from dolomite in Germany is projected to exhibit robust growth with a CAGR of 4.4% through 2035, driven by Europe's largest steel production infrastructure, comprehensive construction sector activity, and diversified industrial mineral consumption across glass manufacturing, chemical processing, and environmental applications. Germany's substantial manufacturing base and internationally recognized industrial capabilities are creating continued demand for reliable dolomite supplies across multiple end-use sectors.

Major industrial consumers, including steel producers such as ThyssenKrupp and Salzgitter, glass manufacturers, and construction material companies, systematically source dolomite from domestic quarries and regional European suppliers ensuring material availability and logistical efficiency. German demand benefits from well-developed transportation infrastructure facilitating mineral distribution, proximity to major quarrying regions in southern and central Germany, and established supply relationships between mineral producers and industrial consumers supporting stable procurement patterns.

Revenue from dolomite in France is expanding at a CAGR of 4.3%, substantially supported by balanced consumption across steel production, glass manufacturing including container and flat glass applications, and construction sector demand for aggregates and specialty mineral products. France's diversified industrial structure and ongoing infrastructure investment are systematically driving stable demand for dolomite materials across multiple application sectors.

Major industrial consumers, including steel producers, glass manufacturers such as Saint-Gobain, and construction material companies, source dolomite from domestic quarries and supplement with regional European suppliers ensuring adequate material availability. French sales particularly benefit from established mineral processing capabilities, proximity to major quarrying regions providing logistical advantages, and industrial consumers maintaining long-term supply relationships supporting predictable demand patterns.

Revenue from dolomite in Italy is growing at a steady CAGR of 4.1%, fundamentally driven by established industrial mineral consumption patterns, ongoing steel production at integrated facilities, and construction sector demand for aggregates and specialty materials. Italy's traditional industrial base and mineral processing capabilities are supporting sustained dolomite consumption across manufacturing sectors.

Major industrial consumers, including steel producers, ceramic manufacturers leveraging Italy's globally recognized ceramic industry, and construction companies, source dolomite from domestic Alpine quarries known for high-quality deposits and supplement with regional supplies as needed. Italian sales particularly benefit from the country's substantial ceramic and glass industries requiring consistent mineral inputs, established supply chains connecting quarries with industrial consumers, and ongoing infrastructure maintenance supporting construction material demand.

Demand for dolomite in Spain is projected to grow at a CAGR of 4.0%, substantially supported by construction sector recovery following earlier economic challenges, expanding steel production capabilities, and growing glass manufacturing activities serving domestic and export industries. Spanish industrial development and ongoing infrastructure investment are positioning dolomite as an essential mineral input across expanding end-use sectors.

Major industrial consumers, including steel producers, construction material manufacturers, and glass production facilities, source dolomite from domestic quarries and regional suppliers ensuring adequate material availability for industrial operations. Spain's substantial construction sector recovery drives aggregates demand, while metallurgical applications benefit from steel industry modernization and capacity expansion supporting increased flux material consumption.

Demand for dolomite in the Netherlands is expanding at a CAGR of 3.9%, fundamentally driven by specialized industrial applications including glass manufacturing, chemical processing, and environmental treatment operations, with substantial reliance on imports from neighboring European countries due to limited domestic quarrying resources. Dutch industrial consumers demonstrate particular focus on quality specifications and reliable supply logistics supporting continuous manufacturing operations.

Netherlands sales significantly benefit from well-developed port infrastructure facilitating mineral imports, proximity to major European quarrying regions enabling cost-effective material sourcing, and industrial consumers maintaining sophisticated procurement strategies optimizing material costs and supply reliability. The country's advanced chemical processing sector and specialized glass manufacturing operations create focused demand for specific dolomite grades meeting stringent purity and particle size requirements.

EU dolomite sales are defined by competition among major mineral producers, regional quarry operators, and specialized processors serving diverse industrial applications. Companies are investing in quarrying efficiency improvements, processing technology upgrades for value-added products, quality management systems ensuring consistent material specifications, and logistics optimization to deliver reliable, cost-competitive, and application-appropriate dolomite solutions. Strategic relationships with major industrial consumers, capacity expansion initiatives responding to demand growth, and environmental compliance programs addressing regulatory requirements are central to strengthening industry position.

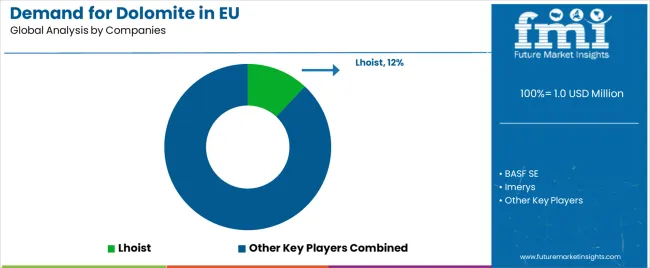

Major participants include Lhoist with an estimated 12.0% share, leveraging its extensive European quarrying operations, kiln infrastructure for calcined dolomite production, and established customer relationships serving metallurgical, environmental, and construction applications. Lhoist benefits from vertically integrated operations spanning quarrying, processing, and distribution, technical service capabilities supporting customer application optimization, and comprehensive product portfolio including crushed, calcined, and sintered grades.

Imerys holds approximately 9.0% share, emphasizing its diversified minerals portfolio, established presence in European industrial markets, and strong relationships with steel producers and glass manufacturers. Imerys' success in serving demanding industrial applications through consistent quality delivery and technical support creates competitive positioning, supported by processing capabilities and integration with complementary mineral products serving related applications.

Sibelco accounts for roughly 7.0% share through its position as a major aggregates and industrial minerals supplier, providing dolomite alongside complementary mineral products to construction and industrial customers. The company benefits from extensive European quarrying operations, integrated logistics networks reducing transportation costs, and established relationships with major construction and industrial consumers supporting stable demand patterns.

Calcinor represents approximately 6.0% share, supporting growth through specialized calcination capabilities producing refractory-grade materials, focus on Spanish and southern European markets, and technical expertise serving metallurgical applications. Calcinor leverages thermal processing infrastructure, quality certifications supporting demanding industrial specifications, and regional market knowledge enabling responsive customer service and application support.

Carmeuse accounts for 6.0% share through its integrated lime and dolomite production operations, strong positioning in metallurgical industries, and comprehensive processing capabilities delivering diverse product grades. Carmeuse benefits from established steel industry relationships, technical service support optimizing flux formulations, and operational efficiency enabling competitive pricing while maintaining quality standards.

Other companies and regional producers collectively hold 60.0% share, reflecting the fragmented nature of European dolomite sales, where numerous regional quarry operators, specialized processors, and local suppliers serve specific geographic markets, niche applications, and customer relationships built on proximity, quality consistency, and responsive service.

| Item | Value |

|---|---|

| Quantitative Units | USD 1,580.7 million |

| Product Type (Material) | Crushed & Ground, Calcined, Sintered, Agglomerated |

| Application (End Use) | Mining & Metallurgy, Construction, Glass & Ceramics, Environmental & Water Treatment, Agrochemicals & Animal Feed, Pharma & Healthcare |

| Distribution Channel | Direct to Industrial (Bulk), Distributors, Online/Indirect |

| Nature | Bulk Commodity, Processed Value-Added, Specialty High-Purity |

| Forecast Period | 2025-2035 |

| Base Year | 2025 |

| Historical Data | 2020-2024 |

| Countries Covered | Germany, France, Italy, Spain, the Netherlands, and the Rest of Europe |

| Key Companies Profiled | Lhoist, Imerys, Sibelco, Calcinor, Carmeuse, Regional producers |

| Report Pages | 180+ Pages |

| Data Tables | 50+ Tables and Figures |

| Additional Attributes | Dollar sales by product type (material), application (end use), distribution channel, and nature; regional demand trends across major European markets; competitive landscape analysis with established mineral producers and regional quarry operators; industrial consumer preferences for various material grades and processing forms; integration with metallurgical, construction, and specialty industrial applications; innovations in processing technology and value-added product development; adoption across direct industrial procurement and distributor channels. |

The global demand for dolomite in eu is estimated to be valued at USD 1.0 million in 2025.

The market size for the demand for dolomite in eu is projected to reach USD 1.6 million by 2035.

The demand for dolomite in eu is expected to grow at a 4.2% CAGR between 2025 and 2035.

The key product types in demand for dolomite in eu are crushed & ground , calcined, sintered and agglomerated.

In terms of application, mining & metallurgy segment to command 36.0% share in the demand for dolomite in eu in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand Signal Repository Solutions Market Size and Share Forecast Outlook 2025 to 2035

Demand Side Management Market Size and Share Forecast Outlook 2025 to 2035

Demand Response Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

North America Shipping Supplies Market Trends – Innovations & Growth 2024-2034

Demand of Kozani Saffron in Greece Analysis - Size, Share & Forecast 2025 to 2035

Demand of No-acid Whey Strained Dairy Processing Concepts in European Union Size and Share Forecast Outlook 2025 to 2035

Demand for Bronte Pistachio in Italy Analysis - Size, Share & Forecast 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Japan Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Western Europe Size and Share Forecast Outlook 2025 to 2035

Glycine Soja (Soybean) Seed Extract Market Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Yeast in Japan - Size, Share, and Forecast Outlook 2025 to 2035

Demand and Trends Analysis of Stevia in Japan Size and Share Forecast Outlook 2025 to 2035

Demand of Pistachio-based desserts & ingredients in France Analysis - Size, Share & Forecast 2025 to 2035

Japan Women’s Intimate Care Market Trends – Growth & Forecast 2024-2034

Western Europe Men’s Skincare Market Analysis – Forecast 2023-2033

Demand and Trend Analysis of Fabric Stain Remover in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Japan Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Korea Size and Share Forecast Outlook 2025 to 2035

Demand of MFGM-enriched Powders & RTDs in European Union Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA