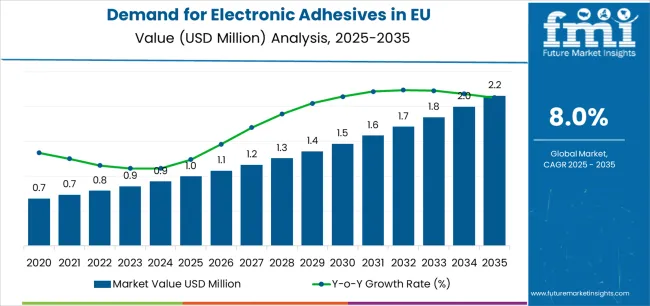

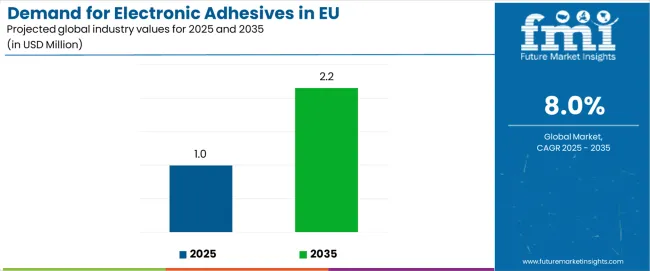

European Union electronic adhesives sales are projected to grow from USD 1 million in 2025 to approximately USD 2.2 million by 2035, recording an absolute increase of USD 1,162.0 million over the forecast period. This translates to a total growth of 116.7%, with demand forecasted to expand at a CAGR of 8% between 2025 and 2035. The industry size is expected to grow by nearly 2.2X during the same period, supported by the accelerating expansion of electronics manufacturing, increasing miniaturization of electronic components, and developing applications across encapsulation, surface mounting, conformal coating, and wire tacking formats throughout European markets.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 1 million |

| Forecast Value in (2035F) | USD 2.2 million |

| Forecast CAGR (2025 to 2035) | 8% |

Between 2025 and 2030, EU electronic adhesives demand is projected to expand from USD 1 million to USD 1.4 million, resulting in a value increase of USD 469.1 million, which represents 40.4% of the total forecast growth for the decade. This phase of development will be shaped by rising adoption of advanced electronics manufacturing, increasing electric vehicle production across European automotive sectors, and growing demand for consumer electronics requiring specialized bonding solutions across encapsulation, surface mounting, and conformal coating formats. Manufacturers are expanding their product portfolios to address the evolving requirements for improved thermal management, enhanced electrical insulation, and high-reliability formulations comparable to traditional mechanical fastening systems.

From 2030 to 2035, sales are forecast to grow from USD 1.4 million to USD 2.1 million, which constitutes 59.6% of the ten-year expansion. This period is expected to be characterized by further expansion of electric vehicle battery assembly, integration of advanced materials for 5G infrastructure and power electronics, and development of specialized electronic adhesive formulations targeting semiconductor packaging and flexible electronics applications. The growing emphasis on miniaturization and increasing component density in electronic assemblies will drive demand for innovative electronic adhesive products that deliver superior thermal conductivity, electrical insulation, and mechanical stress distribution.

Between 2020 and 2025, EU electronic adhesives sales experienced robust expansion at a CAGR of 6.4%, growing to USD 1 million. This period was driven by increasing electronics manufacturing activity across European countries, rising automotive electronics content in vehicles, and growing recognition of adhesive bonding advantages over traditional mechanical assembly. The industry developed as major electronics manufacturers and specialized adhesive suppliers recognized the commercial potential of advanced bonding solutions for miniaturized electronics. Product innovations, thermal management enhancements, and reliability improvements began establishing manufacturer confidence and mainstream acceptance of electronic adhesive technologies.

Industry expansion is being supported by the rapid increase in electronics manufacturing sophistication across European countries and the corresponding demand for reliable, high-performance, and specialized bonding solutions with proven functionality in demanding electronic assembly applications. Modern electronics manufacturers rely on electronic adhesives as essential assembly materials for component attachment, thermal management, environmental protection, and electrical insulation, driving demand for products that match or exceed mechanical fastening methods' performance properties, including thermal conductivity, coefficient of thermal expansion matching, and long-term reliability characteristics. Even minor assembly requirements, such as component miniaturization, thermal dissipation, or vibration resistance, can drive comprehensive adoption of electronic adhesives to maintain optimal product performance and support advanced manufacturing processes.

The growing awareness of electronics reliability requirements and increasing recognition of adhesive bonding advantages in thermal management are driving demand for electronic adhesives from certified suppliers with appropriate quality credentials and technical support capabilities. Regulatory authorities are increasingly establishing clear guidelines for electronic materials specifications, RoHS compliance requirements, and REACH registration to maintain environmental safety and ensure product consistency. Scientific research studies and technical analyses are providing evidence supporting electronic adhesives' performance advantages and manufacturing benefits, requiring specialized formulation methods and standardized application protocols for optimal thermal interface performance, appropriate electrical insulation properties, and reliability profiles, including thermal cycling resistance and moisture resistance characteristics.

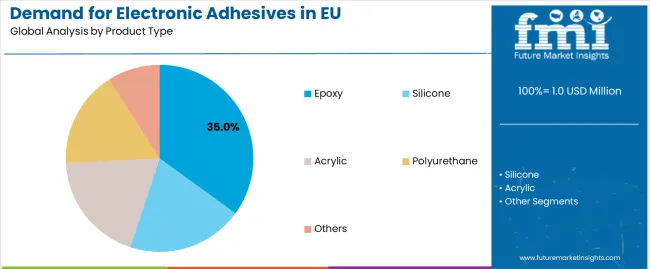

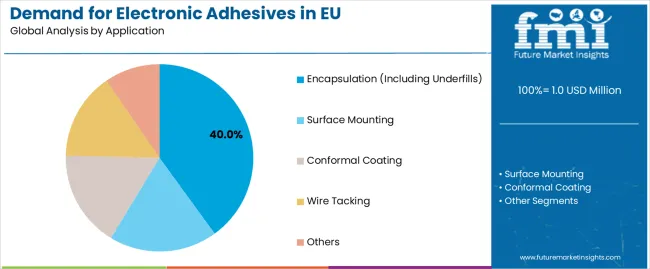

Sales are segmented by product type (chemistry), application (format), distribution channel, nature, and country. By product type, demand is divided into epoxy, silicone, acrylic, polyurethane, and others. Based on the application, sales are categorized into encapsulation (including underfills), surface mounting, conformal coating, wire tacking, and others. In terms of distribution channel, demand is segmented into direct to OEM, distributors, and online. By nature, sales are classified into solvent-free/100% solids, UV/light-cure, water-borne, and solvent-based. Regionally, demand is focused on Germany, France, Italy, Spain, the Netherlands, and the Rest of Europe.

The epoxy segment is projected to account for 35.0% of EU electronic adhesives sales in 2025, establishing itself as the dominant chemistry category across European markets. This commanding position is fundamentally supported by epoxy adhesives' exceptional bonding strength to diverse substrates, comprehensive thermal and electrical properties featuring high-temperature resistance, and superior mechanical properties enabling stress distribution and component protection. The epoxy format delivers exceptional versatility, providing manufacturers with reliable bonding solutions that facilitate component encapsulation, underfill applications, and structural bonding properties essential for demanding electronic assembly applications.

This segment benefits from mature formulation technology, well-established application methods, and extensive availability from multiple certified adhesive suppliers who maintain rigorous quality standards and technical support capabilities. Epoxy-based electronic adhesives offer versatility across various formats, including one-component heat-cure systems, two-component room-temperature cure systems, and snap-cure formulations, supported by proven manufacturing technologies that address traditional challenges in thermal management and coefficient of thermal expansion matching.

The epoxy segment is expected to decline slightly to 34.0% share by 2035, demonstrating stable positioning as alternative chemistries, including silicones and acrylics, gain incremental share for specialized applications, though epoxy maintains dominant positioning throughout the forecast period.

Encapsulation (including underfills) format is positioned to represent 40% of total electronic adhesives demand across European markets in 2025, increasing to 42.0% by 2035, reflecting the segment's dominance as the primary usage format within the industry ecosystem. This substantial share directly demonstrates that encapsulation represents the largest single application, with electronics manufacturers utilizing electronic adhesives for component protection, underfill reinforcement of flip-chip assemblies, and complete potting of sensitive electronics mirroring traditional conformal coating usage with enhanced mechanical protection.

Modern electronics manufacturers increasingly rely on encapsulation adhesives for miniaturized components requiring mechanical reinforcement, driving demand for products optimized for low coefficient of thermal expansion matching silicon with appropriate thermal conductivity, excellent moisture barrier properties that ensure long-term reliability, and processing characteristics that enable automated dispensing and void-free filling. The segment benefits from continuous product innovation focused on improved thermal management without sacrificing electrical insulation, capillary flow enhancement for complete underfill coverage, and cure profile optimization enabling fast production cycles.

The segment's expanding share reflects accelerating adoption in semiconductor packaging, flip-chip assemblies, and power electronics modules, with encapsulation maintaining dominant positioning as component miniaturization and thermal management requirements intensify throughout the forecast period.

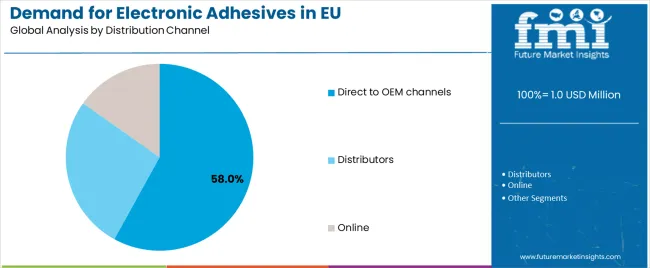

Direct to OEM channels are strategically estimated to control 58% of total European electronic adhesives sales in 2025, increasing to 60.0% by 2035, reflecting the critical importance of direct relationships between adhesive suppliers and electronics manufacturers for driving technical collaboration, application development, and quality assurance. European electronics manufacturers consistently demonstrate strong preference for direct supplier relationships, delivering consistent product specifications, technical support, and supply reliability supporting manufacturing operations and quality requirements.

The segment provides essential supply chain support through technical application engineering, formulation customization, and quality assurance programs that address specific manufacturing requirements and reliability specifications. Major European electronics manufacturers systematically establish direct supply agreements with adhesive producers, often conducting extensive material qualification, reliability testing, and long-term contracts that ensure supply security and enable collaborative product development for emerging applications.

The segment's expanding share reflects increasing importance of technical collaboration and customized solutions as electronics assemblies become more complex, with direct OEM channels strengthening dominant positioning as application requirements drive closer supplier-manufacturer relationships throughout the forecast period.

EU electronic adhesives sales are advancing rapidly due to accelerating electronics manufacturing expansion, growing electric vehicle production driving power electronics demand, and increasing miniaturization requiring advanced bonding solutions. The industry faces challenges, including cyclical automotive and semiconductor demand creating volume uncertainty, stringent REACH and RoHS regulations requiring continuous reformulation, and qualification lead times limiting rapid material transitions. Continued innovation in thermal management, environmental compliance, and reliability enhancement remains central to industry development.

The rapidly accelerating growth of electric vehicle production is fundamentally transforming electronic adhesives demand from traditional automotive electronics toward high-power battery assembly, inverter modules, and charging systems requiring advanced thermal management and high-voltage insulation. Advanced electronic adhesive formulations featuring exceptional thermal conductivity, high-voltage dielectric strength, and thermal cycling resistance enable reliable power electronics assembly supporting electric vehicle performance and safety requirements. These automotive innovations prove particularly transformative for encapsulation adhesives, including battery module potting requiring flame resistance, power semiconductor attachment requiring thermal interface performance, and high-voltage connector sealing requiring long-term environmental durability.

Modern electronic adhesive producers systematically incorporate advanced thermal interface technologies, including thermally conductive fillers, phase-change materials, and graphene-enhanced formulations that deliver superior heat dissipation, reduced thermal resistance, and improved reliability supporting high-power electronics thermal management. Strategic integration of thermal management innovations optimized for power electronics enables manufacturers to position electronic adhesives as critical thermal solutions where heat dissipation directly determines device performance, reliability, and commercial success. These thermal improvements prove essential for 5G infrastructure deployment, as base station power amplifiers demand efficient heat removal, and for automotive power electronics where thermal management determines power density and system efficiency.

European electronics manufacturers increasingly prioritize environmental compliance featuring REACH-registered formulations, RoHS-compliant materials, and low-VOC emissions that align with stringent European environmental regulations and corporate eco-conscious commitments. This environmental trend enables electronic adhesive suppliers to differentiate products through regulatory compliance, eco-friendly raw material sourcing, and environmental certifications that resonate with environmentally conscious electronics brands seeking compliant material portfolios. Environmental compliance proves particularly important for consumer electronics applications where brand reputation depends on environmental responsibility and for automotive applications where end-of-life recycling considerations drive material selection.

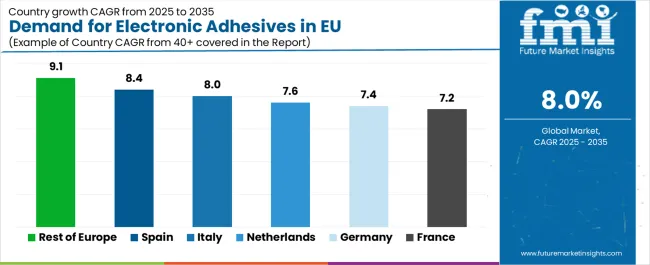

| Country | CAGR % |

|---|---|

| Rest of Europe | 9.1% |

| Spain | 8.4% |

| Italy | 8.0% |

| Netherlands | 7.6% |

| Germany | 7.4% |

| France | 7.2% |

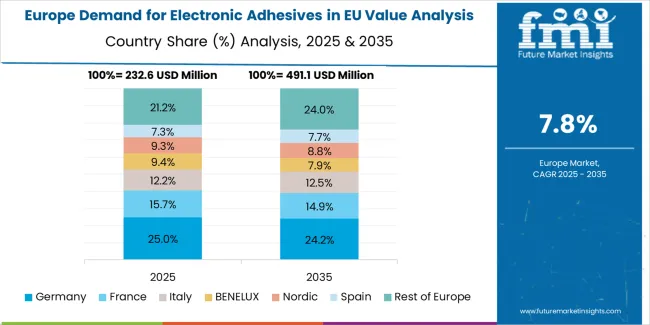

EU electronic adhesives sales demonstrate robust growth across major European economies, with the Rest of Europe leading expansion at 9.1% CAGR through 2035, driven by emerging electronics manufacturing and increasing automotive production. Germany maintains leadership through established automotive and industrial electronics manufacturing. France benefits from growing automotive electronics and aerospace applications. Italy leverages expanding automotive electronics and consumer electronics production. Spain shows strong growth supported by automotive manufacturing expansion and increasing electronics content. Netherlands emphasizes semiconductor packaging and high-tech electronics manufacturing. Sales show strong regional development reflecting EU-wide electronics manufacturing expansion and automotive electrification trends.

Revenue from electronic adhesives in Germany is projected to exhibit strong growth with a CAGR of 7.4% through 2035, driven by exceptionally well-developed automotive electronics manufacturing, comprehensive industrial automation sectors, and strong technical expertise in electronics assembly throughout the country. Germany's sophisticated automotive industry and internationally recognized leadership in manufacturing technology are creating substantial demand for diverse electronic adhesive formulations across all electronics segments.

Major automotive electronics suppliers, including Bosch, Continental, and specialized electronics manufacturers, systematically incorporate electronic adhesives into assembly processes, often dedicating engineering resources to adhesive application optimization and reliability validation. German demand benefits from extensive automotive electronics content including electric vehicle power electronics, advanced driver assistance systems, and connected vehicle technologies naturally supporting electronic adhesive adoption across diverse applications beyond traditional automotive electronics.

Revenue from electronic adhesives in France is expanding at a CAGR of 7.2%, substantially supported by growing automotive electronics manufacturing emphasizing electric vehicle production, established aerospace electronics sectors, and increasing consumer electronics assembly across French manufacturing. France's strong automotive and aerospace industries and engineering excellence are systematically driving demand for high-reliability electronic adhesives across diverse applications.

Major automotive manufacturers, including Renault Group and Stellantis operations, strategically incorporate electronic adhesives into electric vehicle production and advanced electronics assembly requiring high-reliability bonding solutions. French sales particularly benefit from aerospace electronics applications demanding exceptional reliability and environmental resistance, driving premium product positioning within the electronic adhesives category. Technical collaboration between electronics manufacturers and adhesive suppliers significantly enhances adoption rates across traditional and emerging applications.

Revenue from electronic adhesives in Italy is growing at a robust CAGR of 8.0%, fundamentally driven by expanding automotive electronics manufacturing, growing consumer electronics production, and increasing industrial electronics sectors across Italian manufacturing. Italy's substantial automotive industry is systematically incorporating electronic adhesives as manufacturers recognize performance advantages and assembly efficiency opportunities while supporting electrification initiatives.

Major automotive electronics suppliers, including Marelli and specialized component manufacturers, strategically invest in electronic adhesive adoption and assembly process optimization to enhance product reliability and manufacturing efficiency. Italian sales particularly benefit from strong automotive manufacturing tradition, creating natural demand for electronics assembly materials supporting increasing electronics content, combined with expanding consumer electronics manufacturing driving adhesive requirements for display bonding and component assembly.

Demand for electronic adhesives in Spain is projected to grow at a CAGR of 8.4%, substantially supported by automotive manufacturing expansion, increasing electronics content in vehicles, and growing consumer electronics assembly capabilities. Spanish automotive industry's strong production volumes and increasing electrification positioning electronic adhesives as valuable assembly materials supporting quality improvement and manufacturing efficiency.

Major automotive manufacturers, including SEAT operations and component suppliers, systematically expand electronic adhesive utilization, with growing recognition of performance benefits in electronics assembly, thermal management, and environmental protection. Spain's substantial automotive production particularly drives electronic adhesive demand through applications in electric vehicle battery systems, power electronics assembly, and advanced driver assistance system components requiring reliable bonding solutions.

Demand for electronic adhesives in Netherlands is expanding at a CAGR of 7.6%, fundamentally driven by semiconductor packaging activities, leadership in high-tech electronics manufacturing, and comprehensive technical capabilities supporting advanced electronics assembly. Dutch electronics manufacturers demonstrate particularly strong technical sophistication in advanced packaging technologies and specialized electronics requiring premium adhesive solutions.

Netherlands sales significantly benefit from semiconductor industry presence, including ASML supplier networks and semiconductor packaging operations, creating demand for advanced electronic adhesives supporting chip packaging and advanced assembly technologies. The country's high-tech electronics leadership paradoxically coexists with strong focus, as manufacturers leverage technical expertise while prioritizing environmental compliance. The Netherlands also serves as innovation center for European electronics, with successful Dutch technology innovations often expanding to broader European markets.

EU electronic adhesives sales are projected to grow from USD 996.0 million in 2025 to USD 2,158.0 million by 2035, registering a CAGR of 8.0% over the forecast period. The Rest of Europe region is expected to demonstrate the strongest growth trajectory with a 9.1% CAGR, supported by emerging electronics manufacturing, increasing automotive electronics production, and growing industrial automation. Spain and Italy follow with 8.4% and 8.0% CAGR each, attributed to expanding automotive electronics sectors and growing consumer electronics manufacturing, respectively.

Germany, while maintaining the largest share at 27.0% in 2025, is expected to grow at a 7.4% CAGR, reflecting market maturity and established electronics manufacturing infrastructure. Netherlands and France also demonstrate 7.6% and 7.2% CAGR, respectively, supported by evolving semiconductor packaging activities and expanding automotive electronics manufacturing.

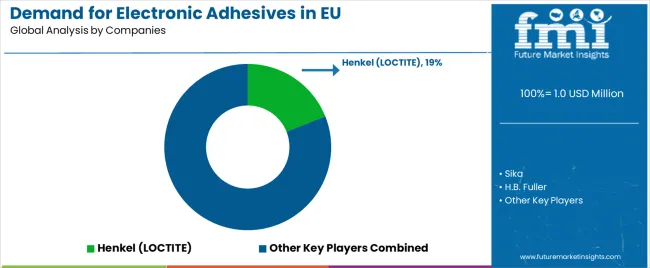

EU electronic adhesives sales are defined by competition among major specialty chemical companies, specialized adhesive manufacturers, and material science innovators. Companies are investing in thermal management technology, environmental compliance formulations, application engineering support, and reliability testing to deliver high-performance, regulatory-compliant, and application-optimized electronic adhesive solutions. Strategic partnerships with electronics manufacturers, automotive qualification programs, and technical marketing emphasizing thermal and electrical performance are central to strengthening competitive position.

Major participants include Henkel (LOCTITE brand) with an estimated 19.0% share, leveraging its extensive European technical laboratories, established automotive and packaging electronics presence, and comprehensive electronic adhesive portfolio, supporting consistent supply to electronics manufacturers across Europe. Henkel benefits from integrated technical support, application engineering capabilities, and the ability to provide complete adhesive solutions, including encapsulants, underfills, surface mount adhesives, and conformal coatings, supporting customer assembly optimization.

Sika holds approximately 10.0% share, emphasizing strong electric vehicle battery assembly focus, power module applications, and automotive electronics positioning. Sika's success in developing thermally conductive adhesives with exceptional reliability creates strong competitive positioning in emerging electric vehicle applications, supported by automotive industry relationships and commitment to eco-friendly solutions.

H.B. Fuller accounts for roughly 9.0% share through its position as automotive and industrial electronics supplier, providing comprehensive adhesive portfolios featuring specialized formulations for automotive underhood electronics, industrial automation, and consumer electronics applications. The company benefits from application engineering expertise, regional technical support, and customer collaboration programs supporting assembly optimization.

3M represents approximately 8.0% share, leveraging thermal and optical bonding expertise, comprehensive material science capabilities, and diversified electronics applications portfolio. 3M benefits from material innovation leadership, thermal interface material technologies, and premium positioning supporting demanding applications requiring superior performance.

Other companies and specialized suppliers collectively hold 54.0% share, reflecting the fragmented nature of European electronic adhesives sales, where numerous regional adhesive manufacturers, specialty chemical companies, emerging material science startups, and captive formulations serve specific market segments, regional customers, and niche applications. This fragmentation provides opportunities for differentiation through specialized formulations (ultra-low CTE underfills, high-thermal-conductivity potting compounds), proprietary technologies, application-specific solutions, and premium positioning resonating with electronics manufacturers seeking reliable material partners with technical expertise.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.2 million |

| Product Type (Chemistry) | Epoxy, Silicone, Acrylic, Polyurethane, Others |

| Application (Format) | Encapsulation (including underfills), Surface Mounting, Conformal Coating, Wire Tacking, Others |

| Distribution Channel | Direct to OEM, Distributors, Online |

| Nature | Solvent-free/100% solids, UV/Light-cure, Water-borne, Solvent-based |

| Forecast Period | 2025-2035 |

| Base Year | 2025 |

| Historical Data | 2020-2024 |

| Countries Covered | Germany, France, Italy, Spain, the Netherlands, and the Rest of Europe |

| Key Companies Profiled | Henkel (LOCTITE), Sika, H.B. Fuller, 3M, Regional manufacturers |

| Report Pages | 180+ Pages |

| Data Tables | 50+ Tables and Figures |

| Additional Attributes | Dollar sales by product type (chemistry), application (format), distribution channel, and nature; regional demand trends across major European markets; competitive landscape analysis with established adhesive manufacturers and specialty chemical suppliers; customer preferences for various adhesive chemistries and application requirements; integration with electric vehicle manufacturing and semiconductor packaging technologies; innovations in thermal management and environmental compliance formulations; adoption across automotive, consumer electronics, and industrial applications; regulatory framework analysis for REACH and RoHS compliance requirements; supply chain strategies; and penetration analysis for electronics manufacturers and automotive suppliers across European markets. |

The global demand for electronic adhesives in eu is estimated to be valued at USD 1.0 million in 2025.

The market size for the demand for electronic adhesives in eu is projected to reach USD 2.2 million by 2035.

The demand for electronic adhesives in eu is expected to grow at a 8.0% CAGR between 2025 and 2035.

The key product types in demand for electronic adhesives in eu are epoxy, silicone, acrylic, polyurethane and others.

In terms of application, encapsulation (including underfills) segment to command 40.0% share in the demand for electronic adhesives in eu in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand Signal Repository Solutions Market Size and Share Forecast Outlook 2025 to 2035

Demand Side Management Market Size and Share Forecast Outlook 2025 to 2035

Demand Response Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

North America Shipping Supplies Market Trends – Innovations & Growth 2024-2034

Demand of Kozani Saffron in Greece Analysis - Size, Share & Forecast 2025 to 2035

Demand of No-acid Whey Strained Dairy Processing Concepts in European Union Size and Share Forecast Outlook 2025 to 2035

Demand for Bronte Pistachio in Italy Analysis - Size, Share & Forecast 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Japan Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Western Europe Size and Share Forecast Outlook 2025 to 2035

Glycine Soja (Soybean) Seed Extract Market Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Yeast in Japan - Size, Share, and Forecast Outlook 2025 to 2035

Demand and Trends Analysis of Stevia in Japan Size and Share Forecast Outlook 2025 to 2035

Demand of Pistachio-based desserts & ingredients in France Analysis - Size, Share & Forecast 2025 to 2035

Japan Women’s Intimate Care Market Trends – Growth & Forecast 2024-2034

Western Europe Men’s Skincare Market Analysis – Forecast 2023-2033

Demand and Trend Analysis of Fabric Stain Remover in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Japan Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Korea Size and Share Forecast Outlook 2025 to 2035

Demand of MFGM-enriched Powders & RTDs in European Union Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA