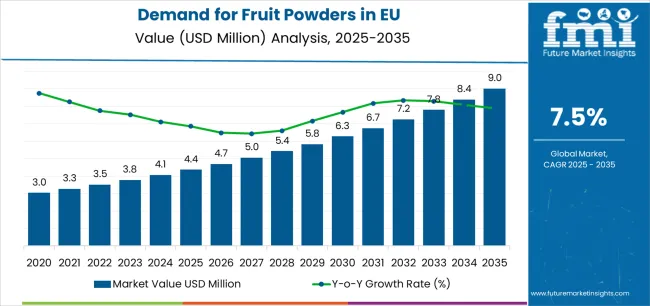

Demand for fruit powders in the European Union is forecast to expand from USD 4.4 million in 2025 to nearly USD 9.0 million by 2035, advancing at a CAGR of 7.5%. Their ability to provide concentrated nutrition, natural flavor, and color stability has positioned them as a preferred choice across diverse product categories. Food and beverage manufacturers are increasingly integrating fruit powders into ready-to-mix drinks, fortified snacks, and functional confectionery to meet the accelerating demand for clean-label, plant-based formulations. Nutraceutical companies are also adopting fruit powders as active ingredients in supplements, leveraging their antioxidant and vitamin profiles to support immune health and energy metabolism.

The absolute increase of USD 4.6 million over the forecast period represents a 104.5% rise in sales, with the industry projected to grow by approximately 2.05 times between 2025 and 2035. While the base size remains relatively small compared to other functional ingredient categories, the growth trajectory is one of the fastest in the European plant-based ingredient space. The expanding consumer focus on gut health, natural sweetness, and reduced reliance on synthetic additives is expected to sustain this momentum. The rise of e-commerce platforms has further accelerated accessibility, allowing smaller brands to position fruit powder-based products directly to health-conscious consumers.

Demand from beverage fortification is set to dominate, with wellness drinks, smoothies, and protein shakes increasingly relying on fruit powders for natural enrichment. In the bakery and confectionery sector, powders derived from berries, citrus, and tropical fruits are used to replace artificial flavorings while adding functional value. The personal care industry has also begun utilizing fruit powders in cosmetic formulations, recognizing their bioactive properties for skin vitality and anti-aging benefits. Such cross-industry adoption is likely to diversify revenue streams and elevate long-term market resilience.

Germany, France, and the United Kingdom remain at the forefront of consumption due to well-established health food industries and high consumer awareness levels. Southern Europe, particularly Italy and Spain, is driving integration in traditional foods such as bakery and desserts, where natural flavors are preferred. Eastern European markets are witnessing growing penetration of fruit powders through modern retail expansion and increased health awareness among younger demographics. Advances in freeze-drying and spray-drying technologies are further improving product consistency and nutritional retention, enhancing competitiveness within the EU market.

By 2030, fruit powders are anticipated to become central in personalized nutrition strategies, where custom blends target specific health goals. Meal replacements, functional snacks, and dietary supplements will increasingly depend on concentrated fruit-based solutions that deliver both taste and nutritional density. As consumer preference for functional ingredients strengthens, the EU fruit powders industry is poised to remain a dynamic segment within the broader clean-label and plant-based ingredient landscape.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 4.4 million |

| Forecast Value in (2035F) | USD 9 million |

| Forecast CAGR (2025 to 2035) | 7.5% |

Industry expansion is being supported by the rising health awareness among European consumers and the demand for natural, nutrient-dense ingredients that deliver both functional and sensory benefits. Fruit powders enable convenient incorporation of vitamins, minerals, and antioxidants into everyday diets without the perishability issues of fresh fruit. The category benefits from dual drivers: necessity-driven adoption by manufacturers seeking clean-label alternatives to artificial additives, and choice-driven consumer demand for superfoods like blueberry and raspberry powders. This convergence of functionality, convenience, and perceived health value is creating sustained opportunities across food, beverage, and wellness applications.

The growing body of scientific evidence linking fruit-derived antioxidants, polyphenols, and fibers with gut health, immunity, and disease prevention is driving uptake of fruit powders across multiple end-use categories. European regulations encouraging reduced sugar and natural formulations further reinforce demand, as fruit powders provide both flavor and functional nutrition. Producers with advanced processing technologies, such as freeze-drying, gain competitive advantages by offering powders that maintain nutrient integrity and flavor intensity. At the same time, organic-certified powders provide reassurance of quality and sustainability, aligning with evolving consumer preferences across the EU.

Expanding cosmetics, personal care, and nutraceutical applications further elevate the role of fruit powders in EU industry. Clinical and consumer studies highlight benefits of fruit-derived compounds in skin health, anti-aging, and overall wellbeing, creating pathways for innovative formulations. Regulatory emphasis on natural ingredients and clean-label transparency supports broader category legitimacy, giving dedicated suppliers an edge in premium product positioning. Beyond core beverage and food applications, fruit powders are increasingly seen as multi-functional ingredients that deliver taste, texture, nutrition, and convenience simultaneously. This growing normalization across diverse industries ensures fruit powders will remain a central growth driver in EU’s natural ingredient economy.

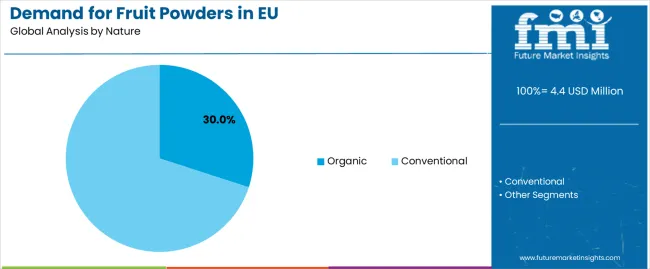

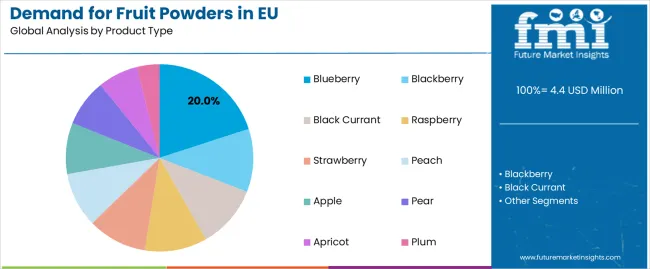

Sales of fruit powders are segmented by product type, nature, end use, technology, and region. By product type, demand spans strawberry, blackberry, black currant, raspberry, blueberry, peach, apple, pear, apricot, and plum, with blueberries leading growth due to their superfood profile and wide beverage use. By nature, the industry is split between conventional and organic, with organic gaining traction on clean-label demand. End-use applications include fruit processing, beverage processing, dietary supplements, pharmaceuticals, and cosmetics & personal care; beverages lead, but cosmetics and supplements are expanding faster. By technology, powders are classified into freeze-dried, spray-dried, vacuum-dried, and drum-dried, with spray-dried largest and freeze-dried fastest-growing. Regionally, sales cover North America, Latin America, Europe, Asia-Pacific, Central Asia, and Middle East & Africa, with Western Europe dominant.

The organic segment is projected to account for 30% of EU fruit powder sales in 2025, increasing to 38.0% by 2035, firmly establishing itself as the faster-growing category and reflecting Europe’s strong preference for clean-label, certified ingredients. Growth is fundamentally supported by consumer perception linking organic fruit powders with higher safety, nutritional integrity, and sustainability, combined with rising retail availability and consumer willingness to pay premiums for products aligned with health and environmental values. Organic powders deliver comprehensive value propositions by meeting both functional wellness needs and eco-conscious priorities, including pesticide-free sourcing, GMO-free assurance, and reduced environmental impact.

This segment benefits from premium positioning, retail promotion, and consumer trust, creating loyalty in food and beverage applications where health and sustainability intersect. Organic certification enhances product differentiation, supports margin expansion, and aligns directly with EU sustainability frameworks, making it attractive to both mainstream brands and niche innovators. As a result, organic powders are increasingly incorporated into functional beverages, dietary supplements, and natural cosmetics.

The segment’s share increase through 2035 reflects accelerating consumer prioritization of nutritional transparency and sustainability, with organic fruit powders increasingly viewed as the optimal choice for families, wellness-focused adults, and premium product lines.

Key advantages:

Blueberry powders are positioned to represent 20% of total EU fruit powder demand in 2025, increasing to 22% by 2035, reflecting their strong superfood image and wide application base. This leading share demonstrates the growing adoption of blueberries in functional beverages, dietary supplements, and cosmetics, where antioxidants and natural pigments drive demand.

European manufacturers are innovating with blueberry powders in smoothies, functional drinks, gummies, and skincare, leveraging their high polyphenol content, natural coloring potential, and positive consumer associations with immunity and brain health. The segment benefits from the perception of blueberries as a premium health ingredient, supported by clinical research and industrying narratives around longevity and wellness.

The segment’s share growth through 2035 reflects its role as a gateway superfruit for consumers, enabling mainstream adoption of fruit powders while reinforcing premium and functional positioning across both food and non-food categories.

Key drivers:

EU fruit powder sales are advancing rapidly due to increasing demand for natural and functional ingredients, rising adoption of superfood powders in beverages and supplements, and the shift toward clean-label, organic-certified products that align with European sustainability values. However, the industry faces challenges, including energy-intensive drying processes driving cost volatility, premium pricing that can limit mass adoption, and supply chain risks tied to raw fruit availability. Continued innovation in drying technology and formulation improvements remains central to delivering consistent quality and unlocking new applications across food, beverages, nutraceuticals, and cosmetics.

The rapid scaling of freeze-drying capacity across the EU is fundamentally transforming fruit powders into premium, nutrient-rich ingredients with superior sensory properties. Unlike spray-drying, freeze-drying preserves antioxidants, polyphenols, and natural colors, allowing manufacturers to deliver powders that closely replicate the taste and functionality of fresh fruit. This technology proves especially transformative for cosmetics, dietary supplements, and functional beverages, where quality and nutrient retention are critical.

Major European ingredient companies are investing heavily in freeze-dry infrastructure, energy efficiency solutions, and next-generation drying platforms that reduce costs while maintaining performance. Collaborations with research institutes and technology providers are helping optimize shelf life, solubility, and nutritional integrity. As a result, freeze-dried fruit powders are increasingly positioned as the gold standard in clean-label nutrition and are expected to gain share from conventional spray-dried alternatives.

Modern fruit powder producers systematically incorporate wellness-oriented messaging, highlighting benefits such as immune support, gut health enhancement, and anti-aging properties. The association of superfruits like blueberries, raspberries, and black currants with antioxidants and polyphenols allows companies to strategically industry powders as functional ingredients beyond basic nutrition. This integration of health claims into product narratives is fueling adoption in dietary supplements, nutraceuticals, and personal care, alongside mainstream food and beverage applications.

Leading suppliers implement clinical studies, nutritional research, and consumer education campaigns to validate wellness claims and expand industry penetration. By aligning fruit powders with broader European trends in preventive health, natural remedies, and plant-based nutrition, manufacturers position their products as proactive health solutions, ensuring long-term consumer engagement and brand differentiation.

European consumers increasingly prioritize sustainably sourced and organic fruit powders, reinforcing the organic segment’s projected rise from 30% in 2025 to 38% by 2035. This trend is supported by strong EU regulatory frameworks around sustainability, environmental protection, and organic certification, which provide competitive advantages for certified suppliers. Companies adopting eco-conscious supply chains, fair-trade sourcing, and reduced-energy drying methods are well positioned to capture share.

The emphasis on sustainability also aligns with brand strategies that promote carbon footprint reduction and zero-waste initiatives, particularly in packaging and raw material utilization. Partnerships with local fruit growers and shorter supply chains improve traceability and resilience while building consumer trust. Organic fruit powders increasingly appeal to families, wellness-focused adults, and premium product lines, strengthening their role as a cornerstone of future EU fruit powder demand.

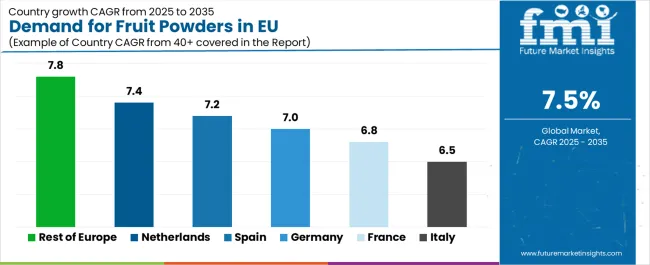

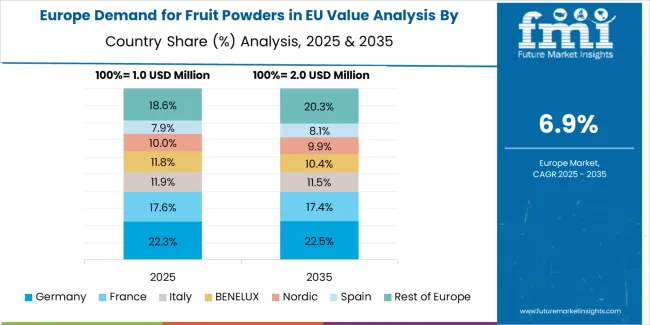

| Country | CAGR % (2025 to 2035) |

|---|---|

| Rest of Europe | 7.8% |

| Netherlands | 7.4% |

| Spain | 7.2% |

| Germany | 7.0% |

| France | 6.8% |

| Italy | 6.5% |

Germany is projected to remain the largest EU fruit powder industry, expanding from USD 1,048.2 million in 2025 to USD 2,099.5 million by 2035, at a steady 7.0% CAGR. Growth is anchored by Germany’s robust food ingredient infrastructure, widespread consumer health consciousness, and well-developed retail channels offering clean-label and functional products. Major retailers such as Edeka, Rewe, and DM have increased natural ingredient assortments, while domestic manufacturers are leading innovations in freeze-dried and spray-dried technologies. German demand benefits from strong consumer trust in certified products and the country’s established role in nutraceuticals. While growth is moderate compared to emerging regions, Germany’s maturity ensures steady expansion through premiumization, innovation, and value-added positioning rather than rapid volume growth.

Growth drivers:

France is forecast to grow from USD 786.2 million in 2025 to USD 1,574.9 million in 2035, recording a 6.8% CAGR. Growth is supported by France’s organic leadership, consumer preference for natural wellness products, and rising integration of fruit powders in dietary supplements and cosmetics. French culinary culture values authentic taste and quality, pushing producers to deliver powders with high flavor retention and nutritional credibility. Retailers such as Carrefour and Leclerc showcase organic and clean-label ranges, while supplement makers increasingly leverage fruit-derived antioxidants in immune health products. The French industry reflects an emphasis on premium, high-quality formulations that align with national gastronomic standards, positioning fruit powders as trusted ingredients for both mainstream and specialized wellness applications.

Success factors:

Italy’s fruit powder sales are projected to expand from USD 611.5 million in 2025 to USD 1,157.8 million in 2035, reflecting a 6.5% CAGR, the slowest among the core EU industrys. Growth is shaped by Italy’s strong culinary traditions emphasizing fresh fruit consumption, though steady expansion is occurring in beverages, bakery, and nutraceuticals where fruit powders provide convenience and fortification. Retailers such as Coop, Esselunga, and Conad promote premium and organic ranges, while local producers emphasize quality-focused formulations. Italy’s reputation for pasta, bakery, and Mediterranean cuisine provides opportunities for integration of fruit powders into culturally relevant formats. The relatively slower CAGR reflects industry maturity, but opportunities lie in premium health, functional beverages, and supplements targeting health-conscious Italian consumers.

Development factors:

Spain’s fruit powder demand is set to grow from USD 556.6 million in 2025 to USD 1,163.7 million by 2035, at a 7.2% CAGR. Expansion is supported by increasing consumer health awareness, rising interest in functional beverages, and alignment with Mediterranean dietary principles favoring natural ingredients. Spanish retailers, including Mercadona and El Corte Inglés, are expanding fruit powder assortments, while supplement makers integrate fruit-based antioxidants into consumer wellness products. Spain also benefits from its growing foodservice and tourism industries, where hotels and restaurants are incorporating fruit powders into wellness menus. This diversified adoption reflects Spain’s ability to blend traditional diets with modern functional nutrition, driving consistent expansion and positioning the country as a fast-growth mid-tier EU industry.

Growth enablers:

The Netherlands is forecast to expand from USD 305.7 million in 2025 to USD 667.5 million in 2035, advancing at a 7.4% CAGR, one of the strongest in Western Europe. Growth is driven by the Netherlands’ world-class food technology ecosystem, progressive consumer attitudes, and an innovation culture favoring early adoption of freeze-dried premium powders. Dutch firms are export-oriented, supplying advanced powders to neighboring EU industrys and beyond, while retailers actively promote wellness and functional categories. The Netherlands benefits from strong R&D collaborations, efficient logistics, and consumer openness to novel health products. These factors make it a leading hub for fruit powder innovation, ensuring the country not only grows domestically but also strengthens its role as a European supplier.

Innovation drivers:

The Rest of Europe segment, including Belgium, Austria, Poland, Scandinavia, and Eastern Europe, is projected to grow from USD 1,059.3 million in 2025 to USD 2,389.7 million in 2035, at the fastest 7.8% CAGR. Growth reflects diverse industry dynamics: Nordic countries lead in adoption due to strong health culture and developed retail infrastructure, while Eastern European industrys offer emerging opportunities as rising incomes and healthcare improvements drive demand for functional nutrition. Expanding retail penetration, e-commerce, and foodservice adoption further fuel growth. These industrys show high potential for premium and organic fruit powders, particularly in supplements and beverages. Collectively, the Rest of Europe will remain the most dynamic growth engine within EU fruit powders industry through 2035.

Potential drivers:

EU fruit powder sales are projected to grow from USD 4.4 million in 2025 to USD 9 million by 2035, registering a strong CAGR of 7.5% over the forecast period. The Rest of Europe region is expected to demonstrate the fastest growth trajectory with a 7.8% CAGR, supported by expanding processing capacity, rising consumer demand for functional foods, and broadening retail penetration. The Netherlands follows with a 7.4% CAGR, attributed to its innovation ecosystem, strong export orientation, and early adoption of premium freeze-dried powders.

Spain records a 7.2% CAGR, supported by rising consumer awareness of health and nutrition and expanding foodservice applications. Germany remains the largest individual industry, accounting for 24.0% of EU fruit powder sales in 2025, driven by its robust food ingredient infrastructure, while growing steadily at a 7.0% CAGR. France contributes an 18.0% share with a 6.8% CAGR, underpinned by demand for organic powders and dietary supplements. Italy shows a 6.5% CAGR, reflecting evolving dietary traditions and growing adoption in beverages and nutraceuticals.

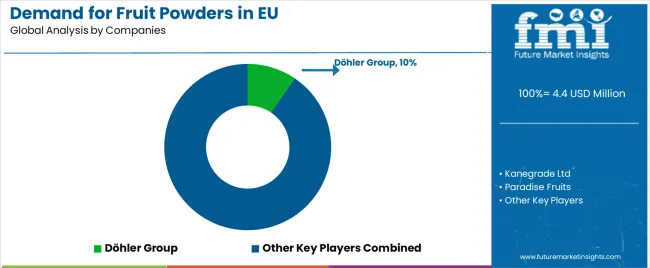

The EU fruit powders industry is characterized by competition between specialized ingredient manufacturers, multinational food suppliers, and regional processors addressing demand for natural, clean-label, and functional powders. Companies are increasingly investing in freeze-drying capacity, spray-drying optimization, and organic-certified sourcing to secure competitive advantage. Strategic collaborations with beverage makers, nutraceutical brands, and cosmetics companies remain central to industry expansion, while emphasis on traceability, sustainability, and quality differentiation underpins brand credibility across Europe.

Döhler Group leads the industry with an estimated 9.5% share, leveraging its broad portfolio, pan-European distribution, and applications expertise across beverages, supplements, and processed foods. The company’s scale and technical support for product formulation enable it to serve both large multinationals and niche innovators, strengthening its dominant role in EU fruit powder landscape.

Paradise Fruits follows with around 8.0% share, positioned as a leading freeze-dried specialist. Its powders are recognized for premium quality, nutrient retention, and clean-label appeal, particularly in superfood-driven categories like blueberries and raspberries. The company benefits from strong production capacity in Germany and its ability to align with EU organic and sustainability standards.

Kanegrade Ltd, with approximately 7.0% share, excels in distribution and formulation support, linking fruit powder producers to manufacturers across Europe. Its network and ability to supply diverse fruit varieties give it strategic flexibility, particularly in retail-facing and supplement industrys.

European Freeze Dry holds about 5.5% share, specializing in premium freeze-dried powders for cosmetics, pharmaceuticals, and high-performance foods. Its niche focus ensures steady demand from customers seeking superior functionality and reliability.

The remainder of the industry is highly fragmented, with numerous regional processors and emerging startups collectively holding over 70% share. These players differentiate through organic certification, functional claims, exotic fruit offerings, and innovative applications, reflecting an innovation-driven competitive environment poised for consolidation as demand accelerates through 2035.

| Item | Value |

|---|---|

| Industry Value | USD 4.4 million |

| Quantitative Units | USD million |

| Nature | Organic, Conventional |

| Product Type | Strawberry, Blackberry, Black Currant, Raspberry, Blueberry, Peach, Apple, Pear, Apricot, Plum |

| End Use | Fruit Processing, Beverage Processing, Dietary Supplements, Pharmaceuticals, Cosmetics & Personal Care |

| Technology | Freeze-Dried, Spray-Dried, Vacuum-Dried, Drum-Dried |

| Countries Covered | Germany, France, Italy, Spain, the Netherlands, Rest of Europe |

| Key Companies Profiled | Döhler Group, Paradise Fruits, Kanegrade Ltd, European Freeze Dry, plus regional and emerging players |

The global demand for fruit powders in eu is estimated to be valued at USD 4.4 million in 2025.

The market size for the demand for fruit powders in eu is projected to reach USD 9.0 million by 2035.

The demand for fruit powders in eu is expected to grow at a 7.5% CAGR between 2025 and 2035.

The key product types in demand for fruit powders in eu are organic and conventional.

In terms of product type, blueberry segment to command 20.0% share in the demand for fruit powders in eu in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand Signal Repository Solutions Market Size and Share Forecast Outlook 2025 to 2035

Demand Side Management Market Size and Share Forecast Outlook 2025 to 2035

Demand Response Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

North America Shipping Supplies Market Trends – Innovations & Growth 2024-2034

Demand of Kozani Saffron in Greece Analysis - Size, Share & Forecast 2025 to 2035

Demand of No-acid Whey Strained Dairy Processing Concepts in European Union Size and Share Forecast Outlook 2025 to 2035

Demand for Bronte Pistachio in Italy Analysis - Size, Share & Forecast 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Japan Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Western Europe Size and Share Forecast Outlook 2025 to 2035

Glycine Soja (Soybean) Seed Extract Market Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Yeast in Japan - Size, Share, and Forecast Outlook 2025 to 2035

Demand and Trends Analysis of Stevia in Japan Size and Share Forecast Outlook 2025 to 2035

Demand of Pistachio-based desserts & ingredients in France Analysis - Size, Share & Forecast 2025 to 2035

Japan Women’s Intimate Care Market Trends – Growth & Forecast 2024-2034

Western Europe Men’s Skincare Market Analysis – Forecast 2023-2033

Demand and Trend Analysis of Fabric Stain Remover in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Japan Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Western Europe Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA