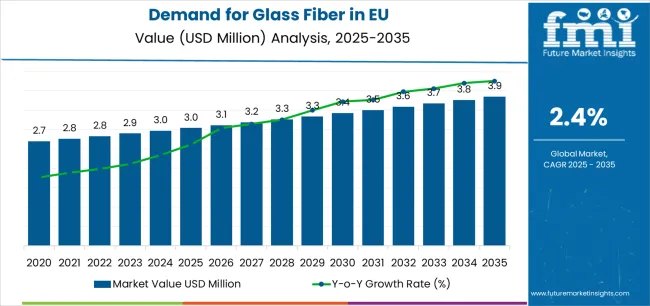

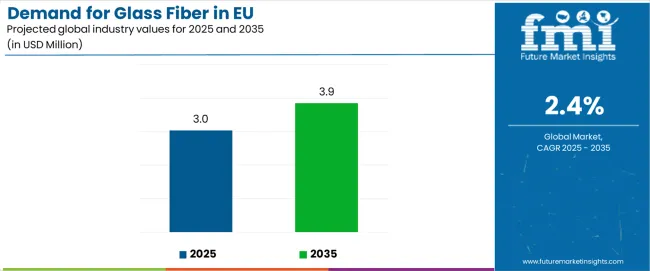

The demand for glass fiber in EU is projected to grow from USD 3.0 million in 2025 to USD 3.9 million by 2035, at a CAGR of 2.4%. Regional demand patterns remain uneven, shaped by industrial specialization and end-use concentration. Germany leads consumption due to its automotive and wind energy industries, where glass fiber composites are central to lightweighting and blade manufacturing. Demand is supported by OEM-led innovation in reinforced plastics and thermoset applications, though supply is influenced by local energy costs that affect furnace operations. France follows with steady volumes in aerospace composites and construction insulation, where adoption of energy-efficient materials maintains a predictable pull. Italy and Spain demonstrate more construction-driven demand, especially in building insulation, pipelines, and civil works. Supply in southern regions is affected by reliance on imports and limited domestic production capacity, resulting in pricing fluctuations when global shipping routes tighten.

In northern Europe, the Netherlands and Denmark show a unique demand mix linked to offshore wind expansion. High reliance on epoxy-grade rovings and woven fabrics sustains orders, while localized processing facilities reduce logistical costs and support continuous supply. Denmark benefits from proximity to blade manufacturers, creating a regional loop between fiber processors and OEMs. The UK, though outside the EU, continues to influence continental trade as composite part exports and aerospace requirements spill over into shared supply chains. Belgium’s chemical cluster contributes intermediates like resins, creating synergies that stabilize supply despite relatively modest demand volumes.

Central and Eastern Europe represent evolving demand centers. Poland, Czechia, and Hungary are emerging destinations for automotive component manufacturing and construction, supported by foreign direct investment in lightweight composites. These countries benefit from lower labor costs, but supply is constrained by underdeveloped glass fiber production infrastructure, making them reliant on imports from Germany and outside the EU. Romania and Bulgaria display smaller but gradually expanding needs in civil infrastructure reinforcement, with government-backed road and bridge projects providing stimulus. Their supply chains, however, remain fragmented and vulnerable to currency-driven import costs. On the supply side, European production is concentrated in Germany, France, and Italy, where established players operate energy-intensive furnaces for continuous and chopped fibers. Rising energy prices and stricter emission norms create structural constraints, with manufacturers shifting to batch optimization and energy recovery techniques. Recycling initiatives in glass fiber composites are emerging, but limited scale keeps virgin fiber production dominant. Imports from Asia provide supplementary volumes, though anti-dumping measures and logistics costs prevent them from displacing EU producers.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 3 million |

| Forecast Value in (2035F) | USD 3.9 million |

| Forecast CAGR (2025 to 2035) | 2.4% |

Industry expansion is being supported by the steady growth in composite materials applications across European manufacturing sectors and the corresponding demand for reliable, cost-effective, and high-performance reinforcement materials with proven functionality in diverse composite applications. Modern composite manufacturers rely on glass fiber as essential reinforcement materials for structural composites, corrosion-resistant applications, and lightweight component production, driving demand for products that match or exceed alternative reinforcement materials' mechanical properties, including tensile strength, flexural modulus, and impact resistance characteristics. Even minor application requirements, such as corrosion resistance, electrical insulation, or thermal performance, can drive continued adoption of glass fiber to maintain optimal composite performance and support established manufacturing processes.

The growing awareness of eco-friendly construction practices and increasing recognition of glass fiber composites' durability advantages are driving demand for glass fiber from certified suppliers with appropriate quality credentials and technical support capabilities. Regulatory authorities are increasingly establishing clear guidelines for construction material specifications, wind turbine certification requirements, and automotive safety standards to maintain product performance and ensure structural integrity. Scientific research studies and engineering analyses are providing evidence supporting glass fiber composites' performance advantages and lifecycle benefits, requiring specialized manufacturing methods and standardized fiber treatment protocols for optimal resin bonding, appropriate sizing selection, and quality validation, including tensile testing and composite characterization.

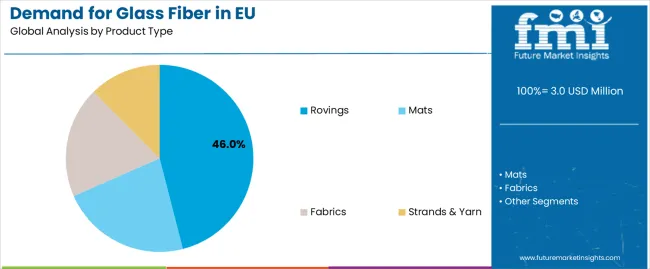

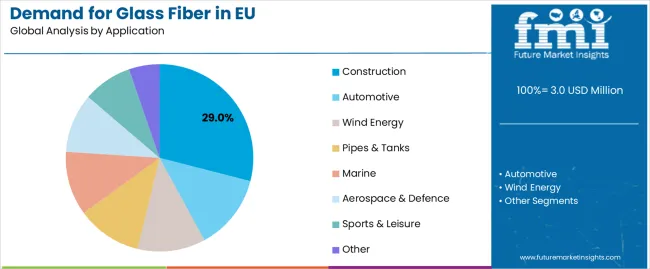

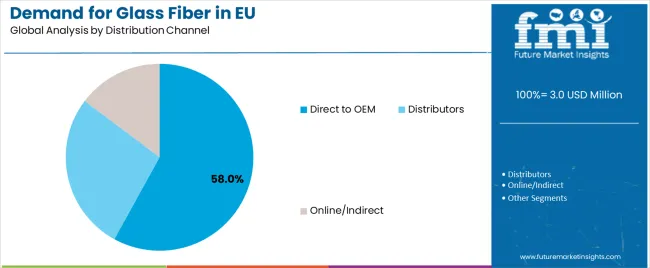

Sales are segmented by product type (form), application (end use), distribution channel, nature (glass type), and country. By product type, demand is divided into rovings, mats, fabrics, and strands & yarn. Based on the application, sales are categorized into construction, automotive, wind energy, pipes & tanks, marine, aerospace & defence, sports & leisure, and other. In terms of distribution channel, demand is segmented into direct to OEM, distributors, and online/indirect. By nature, sales are classified into E-glass, ECR-glass, S-glass, C-glass, and others. Regionally, demand is focused on Germany, France, Italy, Spain, the Netherlands, and the Rest of Europe.

The rovings segment is projected to account for 46% of EU glass fiber sales in 2025, establishing itself as the dominant product form across European markets. This commanding position is fundamentally supported by rovings' versatility in composite manufacturing, comprehensive processing compatibility with diverse fabrication methods, and superior cost-effectiveness for high-volume composite production. The rovings format delivers exceptional manufacturing flexibility, providing composite manufacturers with continuous fiber strands that facilitate filament winding, pultrusion, and spray-up processes essential for large-scale composite part production.

This segment benefits from mature manufacturing infrastructure, well-established processing methods, and extensive availability from multiple certified European glass fiber producers who maintain rigorous quality standards and sizing specifications. Rovings offer versatility across various composite applications, including wind turbine blades, pipes and tanks, automotive components, and construction materials, supported by proven manufacturing technologies that address traditional challenges in resin impregnation and fiber wet-out.

The rovings segment is expected to increase slightly to 47.0% share by 2035, demonstrating strengthening positioning as large-scale composite applications, particularly wind energy infrastructure, drive proportionally faster growth throughout the forecast period.

Construction format is positioned to represent 29% of total glass fiber demand across European markets in 2025, declining slightly to 28.0% by 2035, reflecting the segment's dominance as the primary usage format within the industry ecosystem. This substantial share directly demonstrates that construction represents the largest single application, with building materials manufacturers utilizing glass fiber for insulation products, architectural composites, reinforced concrete, and infrastructure materials requiring durability, corrosion resistance, and cost-effective performance.

Modern construction materials manufacturers increasingly incorporate glass fiber for insulation batts and rolls providing thermal and acoustic performance, driving demand for products optimized for handling safety with appropriate binder systems, consistent thermal properties that ensure energy efficiency ratings, and cost-effective manufacturing that supports competitive construction economics. The segment benefits from established insulation manufacturing infrastructure requiring glass fiber wool production, architectural composite applications including facade panels and architectural moldings, and concrete reinforcement utilizing chopped glass fiber strands preventing cracking.

Direct to OEM channels are strategically estimated to control 58% of total European glass fiber sales in 2025, increasing to 60.0% by 2035, reflecting the critical importance of direct relationships between glass fiber producers and composite manufacturers for driving technical collaboration, product customization, and supply reliability. European composite manufacturers, wind turbine blade producers, and automotive suppliers consistently demonstrate strong preference for direct supplier relationships, delivering consistent product specifications, technical support, and supply security supporting manufacturing operations and quality requirements.

The segment provides essential supply chain support through technical service including sizing optimization, application engineering supporting composite process development, and quality assurance programs addressing specific manufacturing requirements and performance specifications. Major European composite manufacturers systematically establish direct supply agreements with glass fiber producers, often conducting extensive material qualification testing, production trials, and long-term contracts that ensure supply security and enable collaborative product development for emerging applications.

The segment's expanding share reflects increasing importance of technical collaboration and customized glass fiber products as composite applications become more demanding, with direct OEM channels strengthening dominant positioning as performance requirements drive closer supplier-manufacturer relationships throughout the forecast period.

EU glass fiber sales are advancing modestly due to steady construction activity, growing wind energy capacity additions, and increasing automotive lightweighting initiatives. The industry faces challenges, including energy cost volatility affecting manufacturing economics, resin supply constraints impacting composite production, and competitive pressure from carbon fiber and natural fibers in premium applications. Continued innovation in sizing technology, green manufacturing, and cost optimization remains central to industry development.

The steadily accelerating development of European offshore wind energy capacity is fundamentally supporting glass fiber demand as wind turbine blade sizes increase to maximize energy capture and reduce levelized cost of energy. Advanced glass fiber grades featuring enhanced fatigue resistance, optimized fiber diameter distributions, and specialized sizing chemistries enable efficient large-diameter blade manufacturing supporting 12-15 MW offshore wind turbines with blade lengths exceeding 100 meters. These renewable energy innovations prove particularly important for offshore wind applications, including floating wind platforms requiring lightweight blade designs, next-generation direct-drive turbines demanding structural efficiency, and offshore wind farms requiring long-term durability in harsh marine environments.

Modern glass fiber producers systematically incorporate eco-friendly manufacturing initiatives, including energy efficiency improvements, renewable energy utilization in production facilities, and closed-loop glass cullet recycling that reduce environmental impact and manufacturing costs, supporting competitive positioning. Strategic integration of green innovations optimized for glass fiber production enables manufacturers to position environmentally responsible products that support composite industry environmental commitments and regulatory compliance with European environmental standards. These improvements prove essential for construction applications where environmental product declarations influence material selection, and for wind energy applications where lifecycle environmental impact determines project credentials.

European composite manufacturers increasingly prioritize composite recycling featuring glass fiber recovery, resin recycling technologies, and circular economy business models that align with European waste management regulations and extended producer responsibility requirements. This recycling focus enables glass fiber suppliers to participate in composite lifecycle solutions through mechanical recycling supporting low-grade applications, pyrolysis technologies recovering glass fiber and energy, and chemical recycling processes enabling material recovery. Recycling positioning proves particularly important for wind turbine blade disposal where end-of-life management determines project environmental credentials, and for automotive applications where vehicle recycling regulations mandate material recovery targets.

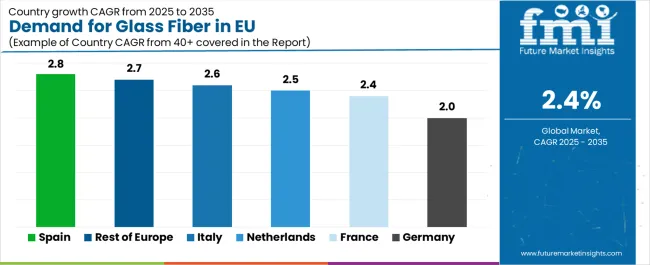

| Country | CAGR % |

|---|---|

| Spain | 2.8% |

| Rest of Europe | 2.7% |

| Italy | 2.6% |

| Netherlands | 2.5% |

| France | 2.4% |

| Germany | 2.0% |

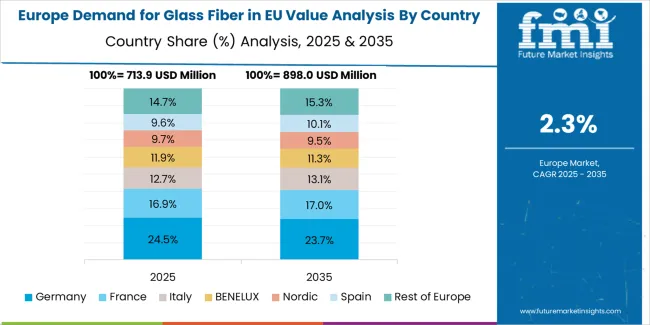

EU glass fiber sales demonstrate modest growth across major European economies, with Spain leading expansion at 2.8% CAGR through 2035, driven by wind energy development and construction activity. Germany maintains leadership through established manufacturing infrastructure and diverse industrial base. France benefits from steady construction demand and automotive composite applications. Italy leverages balanced industrial development and composite manufacturing growth. Spain shows strongest growth supported by renewable energy infrastructure and automotive production. Netherlands emphasizes construction materials and composite technology applications. Sales show steady regional development reflecting EU-wide construction activity, wind energy expansion, and automotive lightweighting trends.

Revenue from glass fiber in Germany is projected to exhibit modest growth with a CAGR of 2.0% through 2035, driven by well-developed composite manufacturing infrastructure, comprehensive automotive supply chain, and strong construction materials industry throughout the country. Germany's sophisticated industrial base and internationally recognized manufacturing excellence are maintaining substantial demand for glass fiber across all composite applications.

Major composite manufacturers, including automotive suppliers, wind turbine blade producers, and construction materials companies, systematically incorporate glass fiber into manufacturing processes, often dedicating engineering resources to composite process optimization and material qualification. German demand benefits from extensive automotive component production including electric vehicle battery enclosures, structural components, and interior panels naturally supporting glass fiber adoption across diverse automotive applications beyond traditional uses.

Revenue from glass fiber in France is expanding at a CAGR of 2.4%, substantially supported by steady construction activity emphasizing building insulation and architectural composites, growing automotive composite applications, and established aerospace composite manufacturing. France's strong construction and automotive industries and engineering capabilities are systematically driving demand for glass fiber across diverse applications.

Major construction materials manufacturers and automotive suppliers strategically incorporate glass fiber through insulation production, architectural composite fabrication, and automotive component manufacturing requiring lightweight materials. French sales particularly benefit from aerospace composite applications including Airbus production requiring certified glass fiber materials, driving technical sophistication within the glass fiber category. Technical collaboration between composite manufacturers and glass fiber suppliers significantly enhances material optimization across traditional and emerging applications.

Revenue from glass fiber in Italy is growing at a modest CAGR of 2.6%, fundamentally driven by balanced industrial development encompassing automotive component manufacturing, construction materials production, and marine composite fabrication across Italian manufacturing sectors. Italy's diverse industrial base is systematically incorporating glass fiber as manufacturers maintain composite manufacturing capabilities while supporting various industrial sectors.

Major automotive component suppliers, boat builders, and construction materials producers strategically utilize glass fiber through composite component manufacturing, marine vessel fabrication, and building materials production requiring reinforcement materials. Italian sales particularly benefit from strong recreational boating tradition, creating consistent demand for marine composites supporting Mediterranean boating markets, combined with automotive component manufacturing supplying European vehicle production.

Demand for glass fiber in Spain is projected to grow at a CAGR of 2.8%, substantially supported by wind energy capacity expansion, construction activity recovery, and automotive component manufacturing growth. Spanish renewable energy leadership and construction sector positioning glass fiber as valuable materials supporting wind turbine blade production and building materials manufacturing.

Major wind energy developers and construction materials manufacturers systematically expand glass fiber utilization through wind turbine blade production facilities, building insulation manufacturing, and automotive component fabrication supporting Spanish and European markets. Spain's substantial wind energy capacity particularly drives glass fiber demand through domestic blade manufacturing supporting both domestic installations and export markets, combined with construction activity requiring insulation materials and architectural composites.

Demand for glass fiber in Netherlands is expanding at a CAGR of 2.5%, fundamentally driven by construction materials manufacturing, composite technology development, and infrastructure applications. Dutch manufacturers demonstrate strong focus on eco-friendly construction materials and advanced composite applications requiring glass fiber reinforcement.

Netherlands sales significantly benefit from construction materials industry presence, including insulation manufacturing and architectural composite production, creating stable demand for glass fiber supporting Dutch building sector. The country's composite technology expertise paradoxically coexists with strong construction focus, as manufacturers leverage technical capabilities while serving established construction materials markets. The Netherlands also serves as composite technology hub for European markets, with successful Dutch composite innovations often expanding to broader European applications.

EU glass fiber sales are projected to grow from USD 3 million in 2025 to USD 3.9 million by 2035, registering a CAGR of 2.4% over the forecast period. The Spain region is expected to demonstrate the strongest growth trajectory with a 2.8% CAGR, supported by wind energy expansion, construction activity, and automotive component manufacturing. Rest of Europe and Italy follow with 2.7% and 2.6% CAGR each, attributed to diverse industrial activities and steady composite market development, respectively.

Germany, while maintaining the largest share at 28.0% in 2025, is expected to grow at a 2.0% CAGR, reflecting market maturity and established glass fiber manufacturing infrastructure. Netherlands and France also demonstrate 2.5% and 2.4% CAGR, respectively, supported by steady construction markets and composite manufacturing activities.

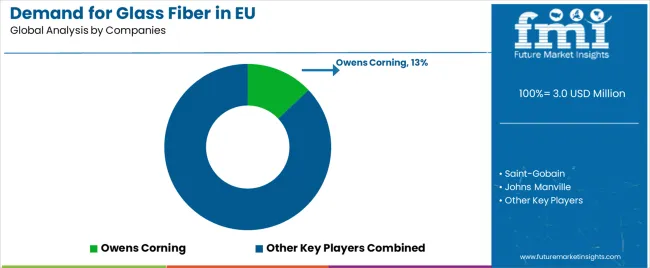

EU glass fiber sales are defined by competition among major multinational glass fiber producers, regional manufacturers, and specialty glass fiber suppliers. Companies are investing in energy efficiency improvements, eco-friendly manufacturing initiatives, technical support services, and product innovation to deliver cost-competitive, environmentally responsible, and technically optimized glass fiber solutions. Strategic partnerships with composite manufacturers, wind energy qualification programs, and technical marketing emphasizing performance and eco-concious are central to strengthening competitive position.

Major participants include Owens Corning with an estimated 13.0% share, leveraging its extensive European manufacturing footprint, established construction insulation presence, and wind energy blade materials portfolio, supporting consistent supply to composite manufacturers across Europe. Owens Corning benefits from integrated glass fiber production, technical support capabilities, and the ability to provide complete reinforcement solutions, including rovings, mats, and specialty products, supporting customer composite manufacturing optimization.

Saint-Gobain holds approximately 11.0% share, emphasizing strong European construction channels, building insulation leadership, and architectural composite applications. Saint-Gobain's success in construction materials distribution and technical glass fiber products creates strong competitive positioning in building materials markets, supported by European manufacturing presence and construction industry relationships.

Johns Manville accounts for roughly 9.0% share through its position as OEM composite supplier, providing glass fiber reinforcements for automotive, wind energy, and industrial applications featuring technical support and application engineering. The company benefits from composite industry expertise, diverse product portfolio, and European manufacturing footprint supporting composite manufacturer requirements.

Other companies and regional manufacturers collectively hold 67.0% share, reflecting the moderately fragmented nature of European glass fiber sales, where numerous regional glass fiber producers, specialty fiber manufacturers, construction materials companies, and global competitors serve specific market segments, regional customers, and niche applications. This fragmentation provides opportunities for differentiation through specialized products (high-performance sizing, customized fiber diameters), regional manufacturing presence, application-specific solutions, and premium positioning resonating with composite manufacturers seeking reliable glass fiber partners with technical expertise.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.9 million |

| Product Type (Form) | Rovings, Mats, Fabrics, Strands & Yarn |

| Application (End Use) | Construction, Automotive, Wind Energy, Pipes & Tanks, Marine, Aerospace & Defense, Sports & Leisure, Other |

| Distribution Channel | Direct to OEM, Distributors, Online/Indirect |

| Nature (Glass Type) | E-Glass, ECR-Glass, S-Glass, C-Glass, Others |

| Forecast Period | 2025-2035 |

| Base Year | 2025 |

| Historical Data | 2020-2024 |

| Countries Covered | Germany, France, Italy, Spain, the Netherlands, and the Rest of Europe |

| Key Companies Profiled | Owens Corning, Saint-Gobain, Johns Manville, Regional producers |

| Report Pages | 180+ Pages |

| Data Tables | 50+ Tables and Figures |

| Additional Attributes | Dollar sales by product type (form), application (end use), distribution channel, and nature (glass type); regional demand trends across major European markets; competitive landscape analysis with established glass fiber producers and specialty suppliers; customer preferences for various glass fiber forms and compositions; integration with wind energy blade manufacturing and automotive lightweighting technologies; innovations in sizing technology and sustainable manufacturing; adoption across construction, automotive, and renewable energy applications; regulatory framework analysis for building materials and composite specifications. |

The global demand for glass fiber in eu is estimated to be valued at USD 3.0 million in 2025.

The market size for the demand for glass fiber in eu is projected to reach USD 3.9 million by 2035.

The demand for glass fiber in eu is expected to grow at a 2.4% CAGR between 2025 and 2035.

The key product types in demand for glass fiber in eu are rovings, mats, fabrics and strands & yarn.

In terms of application, construction segment to command 29.0% share in the demand for glass fiber in eu in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fiberglass Centrifugal Fan Market Size and Share Forecast Outlook 2025 to 2035

Fiberglass Tanks Market Size and Share Forecast Outlook 2025 to 2035

Fiberglass Market Size and Share Forecast Outlook 2025 to 2035

Fiberglass Fabric Market Size and Share Forecast Outlook 2025 to 2035

Fiberglass Duct Wrap Insulation Market Size and Share Forecast Outlook 2025 to 2035

Fiberglass Filters Market Size and Share Forecast Outlook 2025 to 2035

Fiberglass Light Poles Market Size and Share Forecast Outlook 2025 to 2035

Fiberglass Electrical Enclosure Market Analysis - Size, Share & Forecast 2025 to 2035

Fiberglass Cloth Market

Glass Fiber Reinforced Plastic (GFRP) Composites Market Growth - Trends & Forecast 2025 to 2035

Europe Glass Prefilled Syringes and Glass Vials Packaging Equipment Market Analysis – Outlook & Forecast 2025–2035

E Glass Fiber Milled Fiber Market Size and Share Forecast Outlook 2025 to 2035

E Glass Fiber Market Size and Share Forecast Outlook 2025 to 2035

Glass Pasteur Pipettes Market

Bioglass Fiber Market Size and Share Forecast Outlook 2025 to 2035

Breaking Down Market Share in Europe Molded Fiber Pulp Packaging

Pharmaceutical Glass Packaging Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Glass Container Industry Analysis in Europe Size and Share Forecast Outlook 2025 to 2035

Competitive Breakdown of Pharmaceutical Glass Packaging Manufacturers

Pharmaceutical Glass Tubing Market Growth and Outlook from 2024 to 2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA