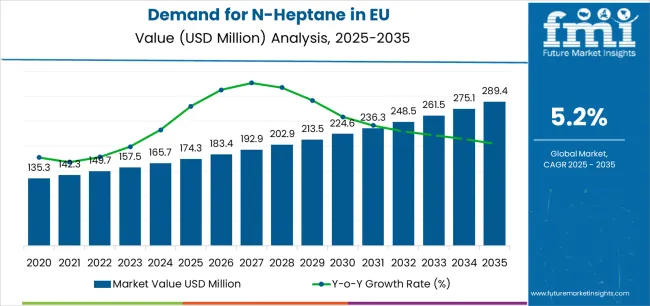

By 2035, the demand for N-heptane industry in EU is forecasted to reach USD 289.4 million, expanding from USD 174.3 million in 2025. Growth of 66% translates into a CAGR of 5.2% across the period, with the overall industry size rising by nearly 1.7X. Ultra-pure segments remain critical, as N-heptane exceeding 99% purity is projected to account for 46% of sales in 2025, while pharmaceutical applications alone are set to generate 33% of consumption.

The decade-long expansion is underpinned by evolving industrial requirements. Drug manufacturers are increasingly dependent on solvents that deliver reproducibility and compliance with stringent regulations. Electronics producers continue to demand high-purity grades to support precision cleaning for semiconductors and miniaturized devices. Adhesives and coatings facilities across Europe provide a steady industrial baseline, where N-heptane functions as a processing aid and solvent with proven efficiency.

Sales are projected to increase from USD 174.3 million to USD 224.9 million between 2025 and 2030, delivering USD 50.6 million in added value, or 44% of the ten-year expansion. This phase highlights the resilience of pharmaceutical manufacturing, with solvent requirements remaining constant in active ingredient production and drug synthesis. Electronics growth further reinforces adoption, while adhesives and coatings sustain steady demand across industrial facilities. Producers are expected to strengthen refining and purification infrastructure to meet regulatory-driven demand for consistent quality.

In the second half of the forecast horizon, expansion accelerates. Between 2030 and 2035, sales are expected to rise from USD 224.9 million to USD 289.4 million, creating USD 64.4 million in additional value, or 56% of decade-long gains. At this stage, the industry will benefit from broader integration of specialized high-purity grades into premium applications. Advanced pharmaceutical production and growing sophistication in electronics fabrication will create stronger requirements for documented purity, validated performance, and regulatory assurance. The 2020–2025 period provided the foundation for this trajectory. Sales climbed from USD 140 million to USD 174.3 million at a CAGR of 4.7%. The growth was anchored by resilient pharmaceutical demand, ongoing investments in European electronics manufacturing, and consistent use of N-heptane in coatings and adhesives. Producers responded with improvements in quality control, batch-to-batch reproducibility, and supply reliability, setting the stage for continued momentum through 2035.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 174.3 million |

| Forecast Value in (2035F) | USD 289.4 million |

| Forecast CAGR (2025 to 2035) | 5.2% |

Industry expansion is being supported by the stringent purity requirements of pharmaceutical manufacturing operations across European countries and the corresponding demand for ultra-pure, consistent-quality solvents with proven performance in drug synthesis, extraction, and purification applications.

Modern pharmaceutical manufacturers rely on n-heptane as an essential processing solvent for active pharmaceutical ingredient synthesis, botanical extraction supporting natural product pharmaceuticals, and chromatography applications requiring precisely controlled chemical properties, driving demand for products that deliver exceptional purity levels eliminating trace contaminants, consistent composition ensuring reproducible processes, and comprehensive quality documentation supporting regulatory compliance.

Even specialized pharmaceutical applications, such as high-value drug synthesis, botanical extraction for nutraceuticals, or analytical chemistry procedures, drive comprehensive high-purity n-heptane requirements to maintain optimal manufacturing reliability and support stringent quality standards.

The established infrastructure of European pharmaceutical manufacturing clusters and increasing recognition of electronics cleaning solvent requirements are driving demand for n-heptane from certified suppliers with appropriate quality management systems and technical capabilities.

Regulatory authorities are increasingly establishing clear guidelines for pharmaceutical solvent specifications, including residual impurity limits, electronics cleaning standards requiring ultra-pure solvents to prevent contamination, and quality requirements to maintain product integrity and ensure process consistency.

Industrial application validation protocols and pharmaceutical monograph specifications are providing requirements supporting n-heptane characteristics, requiring specialized distillation processes and standardized purification protocols for consistent purity profiles, optimal boiling point ranges, and appropriate evaporation rates, including comprehensive analytical testing ensuring compliance with pharmacopeial standards.

Sales are segmented by purity (grade), application (end use), and country. By purity, demand is divided into >99% purity, 95-99% purity, and <95% purity. Based on the application, sales are categorized into pharmaceuticals, electronics, adhesives and sealants, paints and coatings, plastics and polymers, and others. Regionally, demand is focused on Germany, France, Italy, Spain, the Netherlands, and the Rest of Europe.

.webp)

The >99% purity segment is projected to account for 46% of EU n-heptane sales in 2025, establishing itself as the dominant purity grade across European industries. This commanding position is fundamentally supported by ultra-high-purity n-heptane's critical role in pharmaceutical manufacturing requiring stringent solvent specifications, electronics applications demanding minimal contamination, and analytical chemistry procedures necessitating precisely controlled chemical composition.

The >99% purity format delivers exceptional quality assurance, providing pharmaceutical manufacturers with solvents that facilitate regulatory compliance with pharmacopeial standards, enable reproducible extraction and synthesis processes, and eliminate trace impurities potentially affecting drug quality.

This segment benefits from established distillation and purification infrastructure producing pharmaceutical-grade solvents, well-developed quality control systems ensuring batch consistency, and extensive technical relationships with major European pharmaceutical companies who maintain approved supplier lists. Additionally, >99% purity n-heptane offers versatility across demanding applications, including pharmaceutical synthesis requiring minimal impurity interference, electronics cleaning preventing residue formation, and laboratory analytical procedures demanding certified reference quality, supported by comprehensive documentation including certificates of analysis and regulatory compliance statements.

The segment is expected to increase share to 48.0% through 2035, demonstrating continued growth as pharmaceutical and electronics applications expand faster than industrial uses accepting lower purity grades throughout the forecast period.

.webp)

Pharmaceuticals application is positioned to represent 33% of total n-heptane demand across European industries in 2025, increasing to 34.0% by 2035, reflecting the segment's position as the primary consumption driver within the overall industry ecosystem.

This considerable share directly demonstrates that pharmaceutical manufacturing represents the largest single application, with producers consuming n-heptane for active pharmaceutical ingredient synthesis, botanical extraction producing natural pharmaceuticals and nutraceuticals, and pharmaceutical processing operations requiring high-purity solvents.

Modern pharmaceutical manufacturing increasingly relies on n-heptane meeting stringent purity specifications, driving demand for ultra-pure grades optimized for drug synthesis preventing impurity interference, consistent quality ensuring reproducible extraction yields, and comprehensive documentation supporting good manufacturing practice (GMP) compliance.

The segment benefits from European pharmaceutical industry strength including major drug manufacturing operations, growing botanical extraction supporting natural product pharmaceuticals, and stringent regulatory standards ensuring continued specification of high-quality solvents.

The segment's increasing share reflects pharmaceutical sector resilience and growing natural product extraction applications, while industrial applications grow at slightly slower rates throughout the forecast period.

EU n-heptane sales are advancing steadily due to sustained pharmaceutical manufacturing requiring high-purity solvents, growing electronics sector utilization, and consistent industrial applications. However, the industry faces challenges, including crude oil price volatility affecting production costs and pricing stability, potential bio-based solvent substitution in some applications threatening industry share, and increasingly stringent VOC regulations requiring emission control investments. Continued focus on purity improvement and application development remains central to industry stability.

The steadily growing pharmaceutical production across European manufacturing sites is fundamentally supporting n-heptane demand through drug synthesis processes, botanical extraction operations, and pharmaceutical processing applications requiring high-purity solvents meeting stringent regulatory specifications.

Advanced pharmaceutical manufacturing facilities producing both synthetic drugs and natural product pharmaceuticals systematically consume pharmaceutical-grade n-heptane for active ingredient synthesis, plant extract preparation supporting herbal medicines and nutraceuticals, and pharmaceutical processing operations where solvent purity directly impacts drug quality and regulatory compliance.

These pharmaceutical applications prove particularly important for n-heptane suppliers, as pharmaceutical specifications command premium pricing, support long-term supply relationships, and create technical service opportunities through regulatory compliance support.

Modern n-heptane producers systematically incorporate improved purification methods, including advanced distillation systems achieving ultra-high purity levels, specialized treatment processes removing trace contaminants, and quality control technologies ensuring batch consistency. Strategic integration of advanced purification capabilities enables manufacturers to differentiate products through guaranteed ultra-high purity exceeding 99.5%, comprehensive impurity analysis documenting trace contaminant levels, and consistent quality supporting pharmaceutical and electronics applications. These purity improvements prove essential for industry positioning, as pharmaceutical and electronics customers increasingly demand guaranteed specifications, comprehensive analytical documentation, and proven batch-to-batch consistency.

European pharmaceutical and electronics manufacturers increasingly prioritize supply chain security for critical solvents including n-heptane, driving demand for qualified European suppliers, strategic inventory programs, and long-term supply agreements ensuring material availability supporting production continuity. This supply chain emphasis enables industrial customers to mitigate risks through geographically diversified sourcing, qualified backup suppliers maintaining appropriate quality certifications, and inventory strategies protecting against supply disruptions. Supply chain security proves particularly important for pharmaceutical applications given stringent supplier qualification requirements, extensive validation preventing supplier changes, and regulatory documentation requirements creating switching barriers.

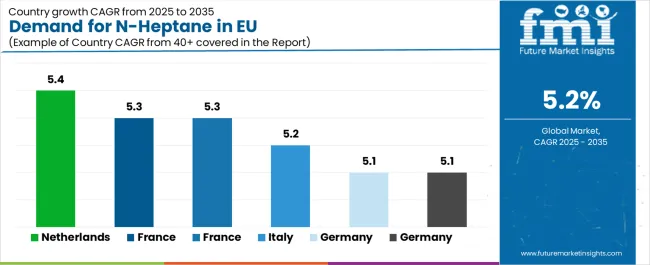

| Country | CAGR % |

|---|---|

| Netherlands | 5.4% |

| France | 5.3% |

| Spain | 5.3% |

| Italy | 5.2% |

| Germany | 5.1% |

| Rest of Europe | 5.1% |

EU n-heptane sales demonstrate steady growth across major European economies, with the Netherlands leading expansion at 5.4% CAGR through 2035, driven by pharmaceutical manufacturing and chemical distribution excellence. Germany maintains leadership through pharmaceutical production concentration and comprehensive chemical industry infrastructure.

France benefits from diversified pharmaceutical and specialty chemical manufacturing. Italy leverages pharmaceutical production and industrial solvent applications. Spain shows solid growth supported by pharmaceutical manufacturing expansion and growing electronics sector. The Netherlands emphasizes pharmaceutical ingredient production and strategic distribution capabilities. Overall, sales show stable regional development reflecting sustained pharmaceutical demand and growing electronics applications.

Revenue from n-heptane in Germany is projected to exhibit steady growth with a CAGR of 5.1% through 2035, driven by substantial pharmaceutical manufacturing including major drug production facilities and active ingredient synthesis operations, comprehensive chemical industry infrastructure, and established electronics sector throughout the country. Germany's position as Europe's pharmaceutical and chemical manufacturing center and its advanced industrial base are creating substantial demand for diverse n-heptane purity grades across pharmaceutical and industrial applications.

Major pharmaceutical operations, including large-scale drug manufacturers and specialty pharmaceutical companies, along with adhesives producers and electronics manufacturers, systematically consume n-heptane for drug synthesis, botanical extraction, and precision cleaning applications, with direct procurement relationships ensuring quality consistency and supply reliability. German demand benefits from stringent pharmaceutical quality standards driving ultra-high-purity n-heptane specification, substantial chemical industry requiring industrial-grade solvents, and technical sophistication supporting proper solvent selection and handling practices.

Revenue from n-heptane in France is expanding at a CAGR of 5.3%, substantially supported by significant pharmaceutical manufacturing including both synthetic drug production and botanical extraction operations, growing specialty chemicals sector, and steady industrial applications. France's established pharmaceutical industry presence and diversified chemical manufacturing are systematically driving demand for high-purity n-heptane products.

Major pharmaceutical manufacturing operations, specialty chemical producers, and industrial solvent users are steadily maintaining n-heptane consumption serving pharmaceutical synthesis, extraction processes, and industrial applications. French sales particularly benefit from pharmaceutical industry concentration in specific regions supporting high-purity n-heptane demand, botanical extraction operations producing natural pharmaceuticals and flavors, and specialty chemicals manufacturing requiring reliable solvent supplies.

Revenue from n-heptane in Italy is growing at a CAGR of 5.2%, fundamentally driven by pharmaceutical manufacturing, adhesives and sealants production, and steady industrial solvent applications. Italy's pharmaceutical sector and established chemical industry are gradually increasing n-heptane requirements across multiple application segments.

Major pharmaceutical producers, adhesives manufacturers, and specialty chemical companies strategically utilize n-heptane for drug synthesis, solvent applications, and processing operations. Italian sales particularly benefit from pharmaceutical production supporting high-purity consumption, adhesives industry concentration requiring industrial-grade solvents, and diverse chemical manufacturing supporting consistent solvent demand.

Demand for n-heptane in Spain is projected to grow at a CAGR of 5.3%, substantially supported by expanding pharmaceutical manufacturing sector, growing electronics production, and developing specialty chemicals industry. Spanish pharmaceutical and electronics manufacturing growth position n-heptane as important specialty solvent supporting industrial expansion.

Major pharmaceutical manufacturing facilities, growing electronics operations, and chemical producers systematically increase n-heptane consumption supporting drug production, electronics cleaning, and industrial applications. Spain's pharmaceutical manufacturing expansion creates increasing solvent demand, electronics sector growth drives precision cleaning applications, and industrial development supports consistent solvent consumption.

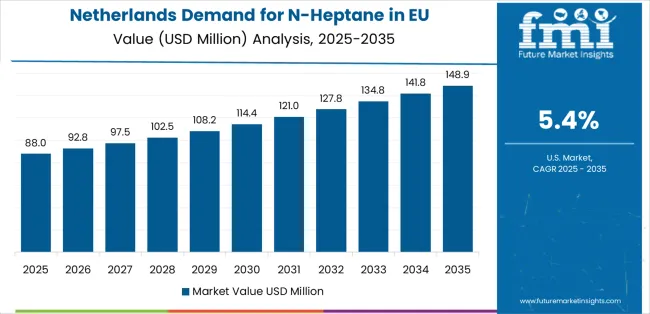

Demand for n-heptane in the Netherlands is expanding at the highest CAGR of 5.4%, fundamentally driven by concentrated pharmaceutical manufacturing including active ingredient production, strategic position as European chemical distribution hub, and specialty chemical manufacturing presence. Dutch pharmaceutical sector's emphasis on active ingredient manufacturing and strategic logistics position n-heptane as critical specialty solvent.

Netherlands sales significantly benefit from pharmaceutical active ingredient manufacturing requiring ultra-high-purity solvents, chemical distribution hub status facilitating European industry access, and specialty chemical concentration creating consistent industrial demand. The country's pharmaceutical specialization creates premium applications, while distribution infrastructure supports efficient logistics throughout European industries, and quality standards drive high-purity grade preference.

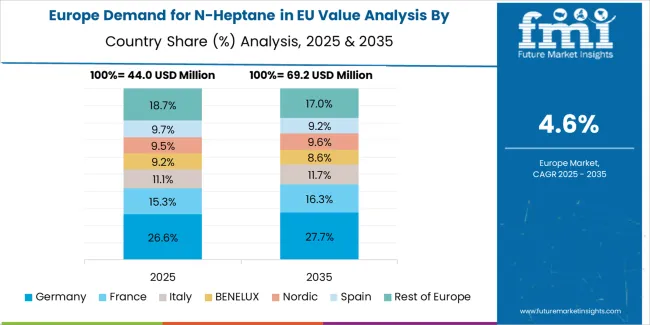

EU n-heptane sales are projected to grow from USD 174.3 million in 2025 to USD 289.4 million by 2035, registering a CAGR of 5.2% over the forecast period. The Netherlands is expected to demonstrate the strongest growth trajectory with a 5.4% CAGR, supported by pharmaceutical manufacturing concentration, chemical industry infrastructure, and strategic distribution hub position. France and Spain follow with 5.3% CAGR each, attributed to pharmaceutical production and growing electronics manufacturing.

Germany, while maintaining the largest share at 28.9% in 2025, is expected to grow at a 5.1% CAGR, reflecting industry maturity and established pharmaceutical and chemical infrastructure. Italy and Rest of Europe demonstrate 5.2% and 5.1% CAGR respectively, supported by diversified industrial consumption and steady pharmaceutical applications.

EU n-heptane sales are defined by competition among integrated petrochemical producers, specialized solvent manufacturers, and chemical distributors. Companies are investing in purification technology improvements, quality management systems, regulatory compliance support, and customer technical service to deliver high-purity, consistent-quality, and specification-compliant n-heptane solutions. Strategic relationships with pharmaceutical manufacturers, long-term supply agreements, and comprehensive quality documentation are central to strengthening competitive position.

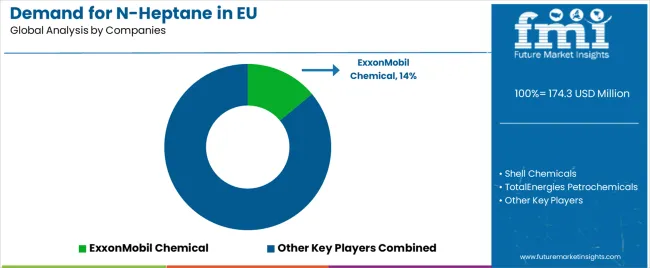

Major participants include ExxonMobil Chemical with an estimated 14% share, leveraging its comprehensive petrochemical production infrastructure, pharmaceutical-grade solvent capabilities, and extensive European distribution networks. ExxonMobil benefits from integrated refining operations providing feedstock security, advanced purification capabilities producing ultra-high-purity grades, and the ability to provide technical support services helping customers optimize solvent selection and handling procedures.

Shell Chemicals holds approximately 12.0% share, emphasizing strong Western European production presence, established industrial solvent portfolio, and comprehensive customer relationships across pharmaceutical and industrial sectors. Shell's success in maintaining consistent product quality and providing reliable supply creates solid positioning across diverse applications, supported by technical service capabilities and quality assurance programs.

TotalEnergies Petrochemicals accounts for roughly 8.0% share through its position as an integrated European refiner and petrochemical producer, emphasizing regional production facilities, comprehensive solvent portfolio, and established distribution networks serving multiple industries. The company benefits from integrated European operations, diverse product offerings enabling cross-selling opportunities, and technical expertise supporting customer application requirements.

Other companies and regional distributors collectively hold 66.0% share, reflecting substantial fragmentation in European n-heptane sales, where numerous chemical distributors, regional solvent producers, specialty chemical companies, and pharmaceutical ingredient suppliers serve specific geographic industries, particular purity requirements, and individual customer relationships. This fragmentation provides opportunities for differentiation through specialized purity grades (pharmaceutical, electronics), comprehensive quality documentation supporting regulatory compliance, regional supply reliability, and technical service excellence resonating with pharmaceutical and electronics customers seeking suppliers offering guaranteed specifications and comprehensive support.

| Item | Value |

|---|---|

| Quantitative Units | USD 289.4 million |

| Purity (Grade) | >99% Purity, 95-99% Purity, <95% Purity |

| Application (End Use) | Pharmaceuticals, Electronics, Adhesives & Sealants, Paints & Coatings, Plastics & Polymers, Others |

| Forecast Period | 2025 to 2035 |

| Base Year | 2025 |

| Historical Data | 2020 to 2024 |

| Countries Covered | Germany, France, Italy, Spain, the Netherlands, and the Rest of Europe |

| Key Companies Profiled | ExxonMobil Chemical, Shell Chemicals, TotalEnergies Petrochemicals, Regional producers |

| Report Pages | 180+ Pages |

| Data Tables | 50+ Tables and Figures |

| Additional Attributes | Dollar sales by purity (grade) and application (end use); regional demand trends across major European industries; competitive landscape analysis with integrated petrochemical producers and specialized solvent manufacturers; customer preferences for various purity grades and quality specifications; integration with pharmaceutical manufacturing operations and electronics cleaning processes; innovations in purification technologies and quality control systems; adoption across pharmaceutical synthesis, electronics manufacturing, and industrial solvent sectors; regulatory framework analysis for pharmaceutical solvent specifications and VOC emission standards; supply chain strategies including long-term supply agreements and qualified supplier programs; and penetration analysis for pharmaceutical-grade applications and ultra-high-purity specialty industries. |

The global demand for n-heptane in eu is estimated to be valued at USD 174.3 million in 2025.

The market size for the demand for n-heptane in eu is projected to reach USD 289.4 million by 2035.

The demand for n-heptane in eu is expected to grow at a 5.2% CAGR between 2025 and 2035.

The key product types in demand for n-heptane in eu are 99% purity, 95-99% purity and <95% purity.

In terms of application (end use), pharmaceuticals segment to command 33.0% share in the demand for n-heptane in eu in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand Signal Repository Solutions Market Size and Share Forecast Outlook 2025 to 2035

Demand Side Management Market Size and Share Forecast Outlook 2025 to 2035

Demand Response Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

North America Shipping Supplies Market Trends – Innovations & Growth 2024-2034

Demand of Kozani Saffron in Greece Analysis - Size, Share & Forecast 2025 to 2035

Demand of No-acid Whey Strained Dairy Processing Concepts in European Union Size and Share Forecast Outlook 2025 to 2035

Demand for Bronte Pistachio in Italy Analysis - Size, Share & Forecast 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Japan Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Western Europe Size and Share Forecast Outlook 2025 to 2035

Glycine Soja (Soybean) Seed Extract Market Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Yeast in Japan - Size, Share, and Forecast Outlook 2025 to 2035

Demand and Trends Analysis of Stevia in Japan Size and Share Forecast Outlook 2025 to 2035

Demand of Pistachio-based desserts & ingredients in France Analysis - Size, Share & Forecast 2025 to 2035

Japan Women’s Intimate Care Market Trends – Growth & Forecast 2024-2034

Western Europe Men’s Skincare Market Analysis – Forecast 2023-2033

Demand and Trend Analysis of Fabric Stain Remover in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Japan Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Korea Size and Share Forecast Outlook 2025 to 2035

Demand of MFGM-enriched Powders & RTDs in European Union Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA